Washington Federal, Inc. and Luther Burbank Corporation Announce Receipt of Shareholder Approval for Merger

May 05 2023 - 4:00PM

Washington Federal, Inc. (NASDAQ: WAFD, “Washington Federal”), the

parent company of Washington Federal Bank (“WaFd Bank”), and Luther

Burbank Corporation (NASDAQ: LBC, “Luther Burbank”), the parent

company of Luther Burbank Savings, jointly announced today that, at

special meetings of their respective shareholders held on May 4,

2023, Washington Federal shareholders approved the issuance of

shares of Washington Federal’s common stock to the shareholders of

Luther Burbank pursuant to that certain Agreement and Plan of

Reorganization, dated as of November 13, 2022 (the “Merger

Agreement”), by and between Washington Federal and Luther Burbank,

and Luther Burbank’s shareholders approved the Merger Agreement,

the merger of Luther Burbank with and into Washington Federal, with

Washington Federal as the surviving corporation (the “Merger”), and

the compensation payable to the named executive officers of Luther

Burbank in connection with the Merger. The final results on the

proposals voted on at the special meetings of each company’s

shareholders held on May 4, 2023 will be set forth in the

companies’ separate Form 8-Ks to be filed with the U.S. Securities

and Exchange Commission after certification by each company’s

inspector of election.

The consummation of the Merger remains subject

to customary closing conditions, including receipt of required

regulatory approvals.

Brent Beardall, President and Chief Executive

Officer of Washington Federal, commented, “We are pleased to have

received approval of our shareholders and Luther Burbank’s

shareholders in connection with our pending acquisition of Luther

Burbank. These voting results affirm our belief that the

combination of Washington Federal and Luther Burbank will create

significant opportunities to enhance the banking experience for our

customers and drive increased long-term value for our shareholders.

Upon receipt of regulatory approval, we will be prepared to

efficiently execute on our integration plan and begin extending our

diversified banking products and services into our new communities

in California.”

Simone Lagomarsino, President and Chief

Executive Officer of Luther Burbank, commented, “We are very

pleased to have received shareholder approval in connection with

the merger. We continue to firmly believe that combining with

Washington Federal is in the best interests of all of our

stakeholders, including our shareholders and the communities we

serve. We are working collaboratively with Washington Federal on

expeditiously pursuing regulatory approval so that we can begin

executing on our closing and integration processes.”

About Washington Federal,

Inc.

Washington Federal is headquartered in Seattle,

Washington, and has 199 branches in eight western states. As of

March 31, 2023, Washington Federal had total assets of $22.3

billion, total loans of $17.3 billion and total deposits of $15.9

billion. Washington Federal conducts its business primarily through

its wholly-owned subsidiary, WaFd Bank.

To find out more about Washington Federal,

please visit its website www.wafdbank.com. Washington Federal uses

its website to distribute financial and other material information

about the Company.

About Luther Burbank

Corporation

Luther Burbank is headquartered in Santa Rosa,

California, and operates 10 full service branches in California, 1

full service branch in Washington, and several loan production

offices located throughout California. As of March 31, 2023, Luther

Burbank had total assets of $8.3 billion, total loans of $7.0

billion and total deposits of $5.6 billion. It operates primarily

through its wholly-owned subsidiary, Luther Burbank Savings, an

FDIC insured, California-chartered bank. Luther Burbank Savings

executes on its mission to improve the financial future of

customers, employees and shareholders by providing superior,

human-centered personal banking and business banking services.

To find out more about Luther Burbank, please

visit its website www.lutherburbanksavings.com. Luther Burbank uses

its website to distribute financial and other material information

about the Company.

Investor Relations Contacts:

| Washington Federal, Inc.Brad GoodeChief

Marketing Officer(206) 626-8178Brad.Goode@wafd.com |

|

Luther Burbank CorporationBradley

SatenbergInvestor Relations(844)

446-8201investorrelations@lbsavings.com |

| |

|

|

Forward Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 regarding the financial condition, results of

operations, business plans and the future performance of Washington

Federal and Luther Burbank. Words such as “anticipates,”

“believes,” “estimates,” “expects,” “forecasts,” “intends,”

“plans,” “projects,” “could,” “may,” “should,” “will” or other

similar words and expressions are intended to identify these

forward-looking statements. These forward-looking statements are

based on Washington Federal’s and Luther Burbank’s current

expectations and assumptions regarding Washington Federal’s and

Luther Burbank’s businesses, the economy, and other future

conditions. Because forward-looking statements relate to future

results and occurrences, they are subject to inherent

uncertainties, risks, and changes in circumstances that are

difficult to predict. Many possible events or factors could affect

Washington Federal’s or Luther Burbank’s future financial results

and performance and could cause actual results or performance to

differ materially from anticipated results or performance. Such

risks and uncertainties include, among others: the occurrence of

any event, change or other circumstances that could give rise to

the right of one or both of the parties to terminate the Merger

Agreement, the outcome of any legal proceedings that may be

instituted against Washington Federal or Luther Burbank, delays in

completing the Merger, the failure to obtain necessary regulatory

approvals (and the risk that such approvals may result in the

imposition of conditions that could adversely affect the combined

company or the expected benefits of the Merger Agreement) or to

satisfy any of the other conditions to the Merger on a timely basis

or at all, the possibility that the anticipated benefits of the

Merger are not realized when expected or at all, including as a

result of the impact of, or problems arising from, the integration

of the two companies or as a result of the strength of the economy

and competitive factors in the areas where Washington Federal and

Luther Burbank do business, the possibility that the Merger may be

more expensive to complete than anticipated, including as a result

of unexpected factors or events, diversion of management’s

attention from ongoing business operations and opportunities,

potential adverse reactions or changes to business or employee

relationships, including those resulting from the announcement or

completion of the Merger, the ability to complete the Merger and

integration of Washington Federal and Luther Burbank successfully,

and the dilution caused by Washington Federal’s issuance of

additional shares of its capital stock in connection with the

Merger. Except to the extent required by applicable law or

regulation, each of Washington Federal and Luther Burbank

specifically disclaims any obligation to update such factors or to

publicly announce the results of any revisions to any of the

forward-looking statements included herein to reflect future events

or developments. Further information regarding Washington Federal,

Luther Burbank and factors which could affect the forward-looking

statements contained herein can be found in Washington Federal’s

Annual Report on Form 10-K for the fiscal year ended September 30,

2022 and its other filings with the SEC and in Luther Burbank’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022 and its other filings with the SEC.

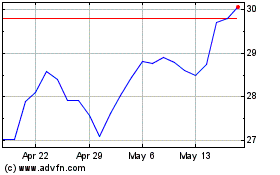

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Nov 2024 to Dec 2024

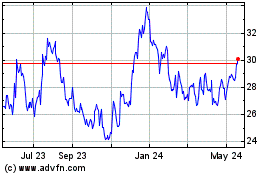

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Dec 2023 to Dec 2024