WaFd, Inc. (NASDAQ: WaFd), the parent company of Washington

Federal Bank (“WaFd Bank”), and Luther Burbank Corporation (NASDAQ:

LBC, “Luther Burbank”), the parent company of Luther Burbank

Savings, jointly announced today that they received the required

regulatory approvals from the Federal Deposit Insurance Corporation

and the Washington State Department of Financial Institutions for

Luther Burbank Savings to be merged with and into Washington

Federal Bank, and from the Board of Governors of the Federal

Reserve System for Luther Burbank to be merged with and into WaFd,

Inc., on the terms and subject to the conditions of the Agreement

and Plan of Reorganization, dated as of November 13, 2022, by and

between Luther Burbank and WaFd (the “Merger Agreement”). This

merger will expand WaFd Bank’s footprint to nine western states

with the addition of ten California branches of Luther Burbank.

“Regulatory approval of this merger with Luther Burbank affirms

WaFd Bank’s position as an important financial resource for the

communities we serve,” said Brent Beardall, President, and Chief

Executive Officer of WaFd Bank. “A lot has transpired in the

fourteen months since we announced this combination, but the more

we have worked with the Luther Burbank team, the more convinced we

are our combined bank will create significant opportunities for

current and future customers and shareholders.”

The merger is expected to be completed by February 29, 2024,

subject to the satisfaction or waiver of the remaining closing

conditions set forth in the Merger Agreement. System and brand

integration efforts are expected to be completed in the first week

of March 2024 so that Luther Burbank customers can quickly and

efficiently access the WaFd Bank platform and service

offerings.

As previously announced, WaFd will be welcoming two directors

from Luther Burbank to join the WaFd, Inc. and WaFd Bank Boards of

Directors. Mr. Brad Shuster and Mr. Max Yzaguirre will join the

Boards following the closing. Mr. Stephen Graham, Chairman of WaFd,

said “We are pleased to have the opportunity to welcome Mr. Shuster

and Mr. Yzaguirre to our Boards; their depth of knowledge and

industry experience is outstanding.”

“Our core strength has been our deep commitment to acting with

integrity,” said Simone Lagomarsino, President and Chief Executive

Officer of Luther Burbank Savings. “We believe we have found a

long-term partner in WaFd whose values align with ours, can offer

our customers a wider range of technology-enabled financial

solutions and expanded geographic footprint that will help our

customers thrive.”

About WaFd, Inc.

WaFd, Inc. is the parent company of Washington Federal Bank, a

federally insured Washington state chartered commercial bank doing

business as WaFd Bank and operating in Washington, Oregon, Idaho,

Utah, Nevada, Arizona, Texas and New Mexico. Established in 1917,

the bank provides consumer and commercial deposit accounts,

financing for small to middle-market businesses, commercial real

estate, and residential real estate, including consumer mortgages,

home equity loans and lines and insurance products through a

subsidiary. As of December 31, 2023, the Company operated 198

branches and reported $22.6 billion in assets, $16.0 billion in

deposits and $2.5 billion in shareholders’ equity. For more

information, please visit www.wafdbank.com.

About Luther Burbank Corporation

Luther Burbank is headquartered in Santa Rosa, California, and

through its subsidiary, Luther Burbank Savings, operates 10

full-service branches in California, one full-service branch in

Washington, and several loan production offices located throughout

California. As of December 31, 2023, Luther Burbank had total

assets of $8.2 billion, total loans of $6.8 billion and total

deposits of $5.8 billion. Luther Burbank Savings, an FDIC insured,

California chartered bank, executes on its mission to improve the

financial future of customers, employees and shareholders by

providing superior, human-centered personal banking and business

banking services. To find out more about Luther Burbank, please

visit its website www.lutherburbanksavings.com. Luther Burbank uses

its website to distribute financial and other material information

about the Company.

This press release contains certain forward-looking statements,

including but not limited to, certain plans, expectations, goals,

projections and statements about the benefits of the merger, the

plans, objectives, expectations and intentions of WaFd and Luther

Burbank, the expected timing of completion of the merger, and other

statements that are not historical facts. Such statements are

subject to numerous assumptions, risks, and uncertainties. All

statements other than statements of historical fact, including

statements about beliefs and expectations, are forward-looking

statements. Forward-looking statements may be identified by words

such as “expect,” “anticipate,” “believe,” “intend,” “estimate,”

“plan,” “target,” “goal,” or similar expressions, or future or

conditional verbs such as “will,” “may,” “might,” “should,”

“would,” “could,” or similar variations. The forward-looking

statements are intended to be subject to the safe harbor provided

by Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

based on WaFd’s and Luther Burbank’s current expectations and

assumptions regarding WaFd’s and Luther Burbank’s businesses, the

economy and other future conditions. Because forward-looking

statements relate to future results and occurrences, they are

subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict. Many possible events

or factors could affect WaFd’s and Luther Burbank’s future

financial results and performance and could cause actual results or

performance to differ materially from anticipated results or

performance. Such risks and uncertainties include, among others,

those identified in the joint proxy statement/prospectus relating

to the merger, initially filed with the U.S. Securities and

Exchange Commission (the “SEC”) on March 1, 2023 and declared

effective by the SEC on March 28, 2023. Except to the extent

required by applicable law or regulation, each of WaFd and Luther

Burbank disclaims any obligation to update such factors or to

publicly announce the results of any revisions to any of the

forward-looking statements included herein to reflect future events

or developments. Further information regarding WaFd, Luther Burbank

and factors which could affect the forward-looking statements

contained herein can be found in WaFd’s Annual Report on Form 10-K

for the fiscal year ended September 30, 2023 and its other filings

with the SEC and Luther Burbank’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240130316432/en/

Investor Relations Contacts: WaFd, Inc. Brad Goode Chief

Marketing Officer Investor Relations (206) 626-8178

brad.goode@wafd.com or Luther Burbank Corporation Bradley Satenberg

Investor Relations (844) 446-8201

investorrelations@lbsavings.com

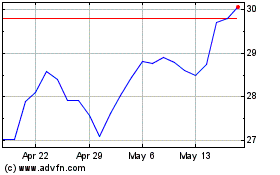

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

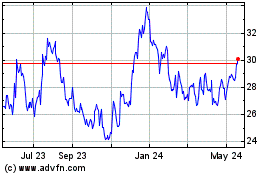

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Nov 2023 to Nov 2024