Following Years of Challenges, Small Business

Owners Project A Bright Outlook Even Amid Economic Hurdles

Small business owners and decision makers are optimistic about

the economic outlook for the year ahead, with 60% expecting a

slight or significant increase in revenue, according to a new

survey conducted by WSFS Bank, the primary subsidiary of WSFS

Financial Corporation (Nasdaq: WSFS). The survey polled 597 small

business decision makers to gauge their feelings on the state of

their business and financing needs in the current economy. For

purposes of this data, small business owners are identified as

those at businesses with annual revenues of up to $5 million and a

minimum of two employees.

While respondents’ views of the past two years mainly reflect

economic challenges encountered, many plan to seek financing to

invest in key business needs in 2025, signaling an optimistic

shift. Additionally, these owners are confident in their ability to

secure that financing. The most common planned investments include

purchasing equipment (26%), obtaining working capital (25%), and

funding expansions (24%).

“Small businesses have demonstrated remarkable adaptability in

an environment where uncertainty has become the norm,” said Candice

Caruso, Senior Vice President, Chief Business Banking Officer, WSFS

Bank. “Many small business owners are planning ahead and

transforming their businesses by embracing technology, refining

operational efficiencies, and seeking new ways to serve their

customers. We are proud of the role that WSFS plays in helping to

propel these investments and keeping small businesses at the heart

of the communities they serve.”

Challenges Facing Small Businesses Despite a more

optimistic outlook for the future, the past two years have

presented many hurdles for small business owners. For those who

believe the past two years have had a negative impact on their

business, the rising inflation rate (59%) is seen as the primary

factor, followed by the cost of living crisis (45%) and the looming

threat of a recession (31%). More than a quarter also pointed to

reduced consumer spending (27%), while over a fifth mentioned

supply chain disruptions (23%) and economic uncertainty surrounding

the recent election (22%).

In response to these challenges, more than half (54%) of

respondents have cut back on non-essential spending, with many

opting for more affordable suppliers (27%). Additionally,

one-quarter of respondents have chosen to delay non-essential

investments.

“As small businesses navigate an evolving economic landscape,

it’s more important than ever to closely examine areas like debt

management, strengthening vendor relationships, and exploring

strategic financing options to fuel growth,” said Jeremy

Shackleford, Senior Vice President, Director of Small Business

Sales for WSFS Bank. “Additionally, businesses should continue to

monitor and build their credit profiles, as well as work with

trusted partners, like their banker and accountant, to identify

opportunities for cost savings. By taking these steps, small

businesses can not only weather current challenges but better

position themselves for the future.”

Banking Expectations and Preferences When selecting a

banking partner, the majority (53%) report banking with a large

national bank, while nearly three in ten (29%) report using a

smaller regional bank. Small community banks are the least common,

with 16% using these as their banking partner.

When it comes to expectations from their banking partner, small

business owners most frequently seek assistance with obtaining

business credit cards, with over half (53%) relying on their

banking partner for this. Cash flow management (38%) and capital

for growth (36%) are also common expectations. Additionally,

one-third (33%) of small business owners expect payment solutions

and merchant services from their banking partner.

About half of respondents report their banker is proactive in

helping with loans and lending solutions as well as providing tools

and resources (both 51%). However, less than half feel their bank

is proactive in helping them navigate economic uncertainty (46%)

and with business planning (47%).

“The last several years have taught us to expect the unexpected.

As a regional bank, we work to form strong partnerships with our

small business Clients to best serve their needs with intimate

knowledge of the communities where they operate and the local

decision-making capabilities to help them reach their goals,”

Caruso explained. “It’s key at the onset of your banking

relationship to establish expectations and reevaluate those

regularly. When it comes to preparing for economic headwinds and

long-term planning, proactive support from a banking partner is a

must.”

When it comes to meeting with their banker in person versus face

to face, small business leaders are fairly split between what they

prefer within specific circumstances. For example, small business

owners are equally split between preferring in-person meetings

(35%), preferring virtual meetings (32%), and being impartial (34%)

for obtaining business credit cards. However, when it comes to more

nuanced services – such as customized business planning and

lending, the majority prefer to be in person (66% and 62%,

respectively).

Deep Dive: Read the full report on survey results.

Survey Methodology The survey was conducted by market

research and insights agency Opinium. The sample includes a survey

of 597 small business owners/decision makers, with 351 respondents

from the Mid-Atlantic and 246 from the broader U.S. All respondents

were over the age of 18. The online survey was conducted from

November 18 – December 2, 2024. It has a margin of error of +/- 4

percent.

About Opinium, Inc. Opinium is an award-winning strategic

insight agency built on the belief that in a world of uncertainty

and complexity, success depends on the ability to stay on pulse of

what people think, feel and do. Creative and inquisitive, we are

passionate about empowering our clients to make the decisions that

matter. We work with organizations to define and overcome strategic

challenges – helping them to get to grips with the world in which

their brands operate. We use the right approach and methodology to

deliver robust insights, strategic counsel and targeted

recommendations that generate change and positive outcomes.

About WSFS Financial Corporation WSFS Financial

Corporation is a multibillion-dollar financial services company.

Its primary subsidiary, WSFS Bank, is the oldest and largest

locally headquartered bank and trust company in the Greater

Philadelphia and Delaware region. As of September 30, 2024, WSFS

Financial Corporation had $20.9 billion in assets on its balance

sheet and $87.2 billion in assets under management and

administration. WSFS operates from 114 offices, 88 of which are

banking offices, located in Pennsylvania (57), Delaware (39), New

Jersey (14), Florida (2), Nevada (1) and Virginia (1) and provides

comprehensive financial services including commercial banking,

consumer banking, treasury management and trust and wealth

management. Other subsidiaries or divisions include Arrow Land

Transfer, Bryn Mawr Capital Management, LLC, Bryn Mawr Trust®, The

Bryn Mawr Trust Company of Delaware, Cash Connect®, NewLane

Finance®, Powdermill® Financial Solutions, WSFS Institutional

Services®, WSFS Mortgage®, and WSFS Wealth® Investments. Serving

the Greater Delaware Valley since 1832, WSFS Bank is one of the ten

oldest banks in the United States continuously operating under the

same name. For more information, please visit www.wsfsbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121251376/en/

Media Contact: Andrew Davison (215) 309-1064

adavison@wsfsbank.com

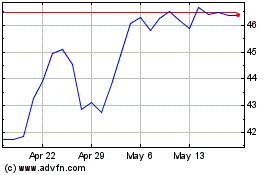

WSFS Financial (NASDAQ:WSFS)

Historical Stock Chart

From Jan 2025 to Feb 2025

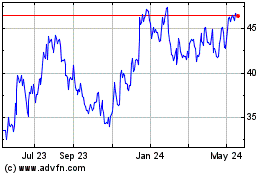

WSFS Financial (NASDAQ:WSFS)

Historical Stock Chart

From Feb 2024 to Feb 2025