false

0001083301

0001083301

2024-12-23

2024-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 23, 2024

TERAWULF INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-41163 |

87-1909475 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

9 Federal Street

Easton, Maryland 21601

(Address of principal executive offices and zip code)

(410) 770-9500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $0.001 par value per share |

|

WULF |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 23, 2024, TeraWulf Inc. (the “Company”) held a

conference call with investors, analysts and others to discuss the Company’s partnership with Core42, a G42 company specializing

in sovereign cloud, AI infrastructure and digital services. A copy of the call transcript is filed as Exhibit 99.1.

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report

on Form 8-K about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical

facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements relating to the completion, size and timing of the offering, the anticipated

use of any proceeds from the offering, and the terms of the notes. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will,” “would,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including uncertainties related to market conditions and the completion of the offering on the anticipated terms or at all, the other

factors discussed in the “Risk Factors” section of TeraWulf’s Annual Report on Form 10-K filed with the U.S. Securities

and Exchange Commission (the “SEC”) on March 20, 2024, the “Risk Factors” section of TeraWulf’s Quarterly

Reports on Form 10-Q and the risks described in other filings that TeraWulf may make from time to time with the SEC. Any forward-looking

statements contained in this Current Report on Form 8-K speak only as of the date hereof, and TeraWulf specifically disclaims any obligation

to update any forward-looking statement, whether as a result of new information, future events, or otherwise, except to the extent required

by applicable law.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 26, 2024 |

TERAWULF, INC. |

|

| |

|

|

|

|

| |

By: |

/s/ Patrick A. Fleury |

|

| |

Name: |

Patrick A. Fleury |

|

| |

Title: |

Chief Financial Officer |

|

EXHIBIT 99.1

| FINAL TRANSCRIPT |

2024-12-23 |

| Terawulf Inc (WULF US Equity) |

|

TeraWulf to Deliver over 70 MW of Data Center Infrastructure for G42s

US Operations

Company Participants

| · | John Larkin, Director, Investor Relations |

| · | Kerri Langlais, Chief Strategy Officer |

| · | Nazar Khan, Co-Founder, Chief Operating Officer & Chief

Technology Officer |

| · | Patrick Fleury, Chief Financial Officer |

| · | Paul Prager, Co-Founder, Chairman and Chief Executive Officer |

Presentation

Operator

Greetings, and welcome to the TeraWulf Investor Update Call. At this

time, all participants are in listen-only mode. A fireside chat session will follow introductory remarks, and as a reminder, this call

is being recorded.

It is now my pleasure to introduce your host, John Larkin, TeraWulf's

Director of Investor Relations. Thank you. You may begin.

John Larkin {BIO 1491210 <GO>}

Thank you, and welcome to the TeraWulf investor update call. Before

we get started, I'd like to remind everyone that our prepared remarks may contain forward-looking statements, which are subject to risks

and uncertainties, and we may make additional forward-looking statements, during the Q&A session.

When used on this call, the words anticipate, could, enable, estimate,

intend, expect, potential, believe, will, should, project, and similar expressions as they relate to TeraWulf are such forward-looking

statements. Investors are cautioned that results may differ materially from those anticipated by TeraWulf, at this time.

In addition, other risks are more fully described in our public

filings with the U.S. Securities and Exchange Commission, which may be viewed at sec.gov, and

in the Investor section of our corporate website at terawulf.com.

Finally, please note that today's call will refer to certain non-GAAP

financial measures. Please refer to our company's periodic reports on Form 10-K and 10-Q, and our website for full reconciliation of these

non-GAAP performance measures to the most comparable GAAP financial measures. We'll begin today's call with introductory remarks from

Paul and Nazar, and then we'll proceed to the Q&A portion of the call.

It's now my pleasure to turn the call over to TeraWulf's CEO, Paul

Prager. Paul?

Paul Prager {BIO 3957382 <GO>}

Thanks, John. Good morning, everyone, and thank you for joining us

today. At TeraWulf, our mission has always been clear. Maximize the value of our scalable and

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 1 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

sustainable digital infrastructure. We began by delivering low-cost,

predominantly zero-carbon Bitcoin mining, a strategy that has served us exceptionally well. Today, we are proud to announce the next step

in our evolution, our strategic expansion into high-performance compute to meet surging market demand.

Over the past nine months, we've been disciplined and deliberate.

We've engaged with nearly 25 counterparties, conducted exhaustive due diligence, and prioritized certainty and execution over speed. For

us, this is not about signaling potential, it is about delivering results, underpinned by finalized and tangible agreements. Today marks

a milestone for TeraWulf, our first HPC hosting agreement with Core42.

The Core42 lease covers 72.5 megawatts of gross capacity, the equivalent

of 60 megawatts of critical IT load, with an option to expand by another 135 megawatts of gross capacity, or 108 megawatts of critical

IT load. The data center lease is executed through La Lupa, a newly formed and wholly-owned TeraWulf entity, created to support the strategic

expansion into high-performance compute.

As a quick aside, the name La Lupa carries special significance.

Inspired by the mythological she-wolf, who nurtured Romulus & Remus. La Lupa represents strength, resilience, and the foundation for

greatness. Just as she enabled the creation of Rome, this data center lease with Core42 marks the cornerstone of a significant extension

of our digital infrastructure at TeraWulf, one powered by AI-driven compute infrastructure.

Why Core42 and TeraWulf? Well, the collaboration between Core42 and

TeraWulf represents a powerful alignment of strengths, expertise, and vision. Core42, a wholly-owned subsidiary of G42, is a leader in

the global digital transformation and compute markets, actively working to build a worldwide footprint of AI compute capacity.

The data center lease with Core42 is backed by a parent guarantee

from G42, further strengthening our financing strategy. To ensure we have this right, we partnered early with top-tier advisors, Milbank

as legal counsel, and JP Morgan and Morgan Stanley as financial advisors.

At TeraWulf, we sought a long-term tenant that we can grow with,

one that shares our vision for innovation, sustainability, and scalability. Equally important, our alignment on operational priorities

and growth potential makes this strategic relationship a natural-fit. The opportunity for expansion is a key driver behind this agreement.

Beginning with a 72.5 megawatt deployment, which represents 60 megawatts

of critical IT load, the data center lease allows for significant scaling potential of up to 135 megawatts of additional growth capacity,

or 108 megawatts of critical IT load.

After an exhaustive review of sites across the United States, Core42

selected TeraWulf for two critical reasons. Our future-ready, purpose-built infrastructure, and our proven ability to deliver and operate

large-scale, high-performance projects.

To that end, over the past year, our team has collaborated extensively

with NVIDIA, Dell, and Hewlett-Packard Enterprise to design future-proof data centers, capable of supporting next-generation GPU clusters.

This announcement highlights the strength of that work, and our commitment to providing state-of-the-art digital infrastructure that evolves

with our tenants' needs.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 2 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

With that, I'll turn it over to Nazar Khan, my partner, and TeraWulf's

Chief Technology Officer, to walk you through the details of the data center lease. Naz?

Nazar Khan {BIO 22616427 <GO>}

Thank you, Paul. Let me outline the key components of the data center

lease. Under the terms of the deal, TeraWulf will deliver 72.5 megawatts of gross capacity, equivalent to 60 megawatts of critical IT

capacity, of state-of-the-art data center infrastructure at our flagship Lake Mariner facility in New York. The rollout will occur over

the first three quarters of 2025.

Under this data center lease, TeraWulf will provide low-cost, predominantly

zero-carbon power, and operate and maintain purpose-built infrastructure. Core42 will supply GPUs and associated equipment, including

servers, networking, and compute equipment. This agreement marks a major milestone in G42's U.S. expansion. Our role is to maintain a

secure facility, operate the data center infrastructure, and pass-through all power costs directly to the tenant.

I'll now walk through the economics of the deal. From an economic

perspective, the fundamentals of the data center lease are very compelling. Key highlights include a 10-year initial term with two five-year

extensions, 60 megawatts of critical IT load, which is equivalent to 72.5 megawatts gross, assuming an approximate PUE of 1.25.

Revenues of $125 per kilowatt-month, which equates to $1.5 million

per megawatt per year, with a 3% annual escalator. And finally, a 12-month revenue prepayment credited back through a 50% net reduction

until fully repaid. Additionally, Core42 has the option to expand their footprint by up to 135 megawatts gross, or 108 megawatts of critical

IT load at market rates. This option also includes a 12-month revenue prepayment.

When you look at the return profile, this data center lease becomes

even more compelling. With $1.5 million of revenue per megawatt annually on approximately $6 million per megawatt build cost at a 70%

EBITDA margin, we estimate a 17% to 18% unlevered yield with an extremely well-capitalized, high-quality tenant. These metrics underscore

the tremendous value unlocked from our infrastructure and highlight our disciplined capital deployment strategy.

With that, I'll turn it back over to John.

Questions And Answers

Operator

(Question And Answer)

A - John Larkin {BIO 1491210 <GO>}

Thank you, Nazar. So, in addition to Paul and Nazar, we're also joined

by our CFO, Patrick Fleury; and our Chief Strategy Officer, Kerri Langlais. So, I have a number of questions that have come into the team

over the past month, specifically on the HPC/AI compute business from the investment community. Also, as we referenced in our press release,

we're receiving questions at info@terawulf.com. So, I'll be mixing these questions in today.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 3 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

Paul, I'm going to start with you. Can you tell us more about Core42

and G42 and their focus on AI?

A - Paul Prager {BIO 3957382 <GO>}

Sure. G42 is a global leader in AI and digital infrastructure. And

Core42, their wholly-owned subsidiary, is a key enabler of AI compute infrastructure. G42 is committed to cutting-edge infrastructure

globally with a focus on sustainability and scalability. Both G42 and Core42 view this lease as a key milestone in their mission to empower

nations and enterprises with AI solutions.

A - John Larkin {BIO 1491210 <GO>}

Patrick, could you discuss the economics of the first 72.5 megawatts

from the TeraWulf perspective?

A - Patrick Fleury {BIO 17188291 <GO>}

Yes, of course. Nazar just touched on it, but I'll revisit. But based

on our current budget, the numbers are broadly consistent with what we've been discussing, since putting our Slide 16 in our investor

deck in May of 2024. And it's the slide we've repeated each quarter. And the focus is on that middle column, co-location. And so, just

to repeat, it's $5 million of CapEx per gross megawatt, excuse me, then adjusting for a 1.2 PUE drives CapEx of $6 million per megawatt

of critical IT load. $1.5 million of revenue per megawatt at a 70% EBITDA margin is $1.05 million per megawatt of EBITDA.

So, as Nazar mentioned, we think about everything in yield. So, when

you think of those figures, it's $1.05 million of EBITDA per megawatt divided by $6 million of CapEx per megawatt of critical IT load.

And that's effectively a 17% to 18% unlevered return. And just as a reminder, that the 12-month revenue prepayment is recorded as deferred

revenue, and that'll be credited back to Core42 over approximately two years.

A - John Larkin {BIO 1491210 <GO>}

Nazar, we've gotten this question many times over the past month.

Were there any specific sticking points in the negotiations?

A - Nazar Khan {BIO 22616427 <GO>}

Thanks, John. There were no specific sticking points. Discussions

were more focused on coordination of various design elements, operational parameters, and delivery timelines.

The lease document is a fairly complex agreement. Each line in the

document represents economic value, both for our shareholders as well as the Core42 stakeholders as well. And so, it takes time to work

through this agreement, and let's not forget this is a 10 to 20-year agreement. So, every line in that agreement was diligently reviewed

and analyzed by both sides.

A - John Larkin {BIO 1491210 <GO>}

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 4 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

Okay. Kerri, we have an email question about what happened to the

other parties given how many conversations TeraWulf had over the past nine months? Where do those broader conversations stand given that

one customer spoke for all the initial capacity?

A - Kerri Langlais {BIO 22616294 <GO>}

Thanks, John. So, as Paul mentioned in his introductory remarks,

we started this process nine months ago with more than 2,000 parties. And over the course of our diligence had sort of whittled that down

to a less than a handful of people at the very end. So, we did have other counterparties, who were very close to the finish line here

on this initial 72.5 megawatts.

And while we opted for one customer to take that full amount of 72.5

megawatts, we do remain in dialogue with the other parties. These discussions are ongoing, and we're actively exploring opportunities

for them to become tenants at Lake Mariner, or potentially other sites that we are currently evaluating.

A - John Larkin {BIO 1491210 <GO>}

Nazar, we have a few questions focused on the option for additional

megawatts. So, maybe if I can just dial out and ask higher level, could you just talk to the specifics on the option for additional power?

A - Nazar Khan {BIO 22616427 <GO>}

Sure. The -- as was noted earlier, the agreement reflects an option

for 135 megawatts of gross incremental capacity, 108 megawatts of net critical IT load. This option reflects a balance between Core42's

potential near-term scaling needs and capacity that we can deliver over the next 12 to 15 months.

Given, the supply-demand balance in the market, most compute customers

want to option as much capacity as possible, but our focus has really been on delivering tangible capacity. And so, we really focused

on, where we could get to over the next 12 to 15 months as well as, where Core42 thought their business would lead them.

In terms of pricing, as Patrick mentioned, we think about these agreements

in terms of the yield, we're spending CapEx to put a building up, and we're earning a fixed revenue over a long period of time from a

high-quality tenant on the back end. So, our initial deal as well as all future capacity will be targeting that similar high-teens unlevered

yield.

A - John Larkin {BIO 1491210 <GO>}

Paul, a timing and capital allocation question, if I could. Can you

share your thoughts on the deployment timing on the remaining megawatts that are allocated to the AI compute business? And then maybe

at a higher level, can you share your thoughts with everyone on capital allocation between Bitcoin mining and AI compute?

A - Paul Prager {BIO 3957382 <GO>}

Sure. Sure. And I think of the deployment of the 500 megawatts that

we've currently circled for AI compute, and that is not all of our development pipeline. But I think that

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 5 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

takes 3 to 3.5 years, so, I think it's safe to assume 100 megawatts

to 150 megawatts a year.

Everybody is in a race to power right now, and the question really

is, is it a 100-meter race, a 400-meter race, 1,600-meter race? We've been in infrastructure for 30 years. Infrastructure is not a 100-meter

race, though what seems to be a driver for the customer today is immediately available power.

Regarding the megawatts that we currently use for Bitcoin mining,

or the 250 megawatts that we've told the world that we've allocated to it. We expect at some point there's going to be a natural fork

in the road for us. We think it's probably going to be the next halving, where given the required substantial CapEx upgrades, we would,

if the market is then as it is today, we would likely shift those megawatts over to high-performance compute.

But in the meantime, the 250 megawatts will generate a ton of free

cash flow for us. And as you know, John, we've just recently upgraded our machines, so, we're state-of-the-art, and I think we're at 18

joules per terahash in terms of efficiency. In the meantime, I think it's very helpful to have the flexible load of Bitcoin mining alongside

the less flexible load of AI compute as we ramp this business, and I know that has given some comfort to the grid operator.

A - John Larkin {BIO 1491210 <GO>}

Thank you. So, we fielded many questions on the two big variables

in the AI compute model, specifically PUE and gross margin, so, I'm going to split those in two. Patrick, maybe you can go first. Can

you talk to TeraWulf's PUE guidance of 1.25, and then specifically why this first slug of capacity is coming in very slightly better than

that?

A - Patrick Fleury {BIO 17188291 <GO>}

Yes. Sure. So, as mentioned, this is coming in at 1.2, and the reason

for that is we're through the design stage. We've got a very good sense at this point on how the design will use power, and how much power

will actually make it to the GPU. So, I think as folks know, this is one of the very few operational data centers, call it in the first

half of next year, with this type of power density, liquid cooling, and the designs and layouts can be different by each client, so, it's

really difficult to predict the PUE with any precision.

But look, I think there'll be a lot of discovery over the first 12

months by us and our customers. And I think remember, relative to other locations, Lake Mariner is really blessed with a very favorable

ambient temperature environment, cool on the shores of Lake Ontario, that really helps. We've had no 100-degree days ever recorded at

the site in over 40 years. And then just for folks that are, looking further out, just note that our PUE guidance on the option and future

capacity remains at 1.25, because we don't yet know the specific design specs for that additional capacity.

A - John Larkin {BIO 1491210 <GO>}

And then, Kerri, could you talk to how investors should think about

gross margin guidance of 70%, given that investors are very aware that another signed deal has been guided to 80%. And so, if you could

break down the major drivers, the cost

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 6 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

structure to help investors think through the gross margin structure

of our AI compute business?

A - Kerri Langlais {BIO 22616294 <GO>}

Sure, John. And I think this largely dovetails with the question

that was just fielded by Patrick in terms of our guidance on PUE. I mean, the reality is, is there are no legacy data center designs that

are applicable here, right? We're building the data centers of tomorrow. And there are very few, if any, facilities operating at this

power density with liquid cooling.

So, given, how advanced these data centers are and the lack of sort

of a track record for operating them, we are guiding on the very conservative end of gross margin. And it's driven by really two key buckets

of costs. There's the people costs, obviously, that includes site labor, maintenance, the repair, security, both in terms of cyber and

physical security, and technical support. And then there's sort of the bucket for other costs, and that's things like insurance, audit

and compliance, lease expense, and fiber or water costs.

And so, when we think about all of that together, and relative to

our guidance of 70%, I mean, we're very confident in our ability to execute there. And I think over time, we expect that we will likely

be ahead of that. But I think at this point in time, and where we are in the development and construction and rollout of our facilities,

that's where we're comfortable guiding our investors.

A - John Larkin {BIO 1491210 <GO>}

Paul, I know you fielded this question many times, but I think it's

an important one. How sustainable do you think the $1.5 million per megawatt revenue number is going forward?

A - Paul Prager {BIO 3957382 <GO>}

I think it's entirely sustainable. I remember a dinner, I think at

the Cantor Conference, where everyone in the space was around the table and they asked if the Cores deal was a unicorn. And I think, I

was in the minority and I said, no, that deal is doable again, if not at better terms, and we're here now.

I think the market's gotten tighter over the last few months. Specifically,

we continue to hear from potential customers, who need near-term access to power. And we, as you know, have the access to power with infrastructure,

land, and water.

Our site's in a zone with an oversupply of power. It's also 91% green

power generated in that zone. And our power costs are typically below market averages of about $0.045. So, given our power cost advantage,

our cost to build advantage is given our existing infrastructure, I'm certain that this is sustainable given the demand outlook that we

currently see.

I mean, at the end of the day, revenue per megawatt is not the primary

focus, as it entirely depends on build costs. As Nazar has said, Patrick has said, Kerri just said, we're focused on yield. We will continue

to focus on achieving a high-teens, unlevered yield on our data center developments.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 7 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

A - John Larkin {BIO 1491210 <GO>}

So, that's a good segue. Nazar, we have a question coming in regarding

build costs. So, can you just talk about how confident do you feel about the $6 million to $8 million per megawatt estimated build costs

going forward?

A - Nazar Khan {BIO 22616427 <GO>}

Sure. There's the current cost, and we've guided to deliver capacity

in the first and second quarter of next year. And so, the budgets for CB1 and CB2 are fairly well-defined. And so, we are pretty confident

in that range for the existing capacity.

As we look out, there are certain long lead time items that are a

significant component of the overall construction cost. And so, as Paul mentioned, the markets are getting tighter. And so, we're seeing

some pressure on those things. So, depending upon when we would go back to market to lock-in pricing for those things, we may see some

increases.

But generally, we're pretty confident that being able to deliver

on that $6 million to $8 million per megawatt for buildings beyond CB2 is possible, again, if we're kind of back in the market here within

the next three, four months or so.

And it's important to remember that, part of this is also kind of

we have a fairly dynamic market with respect to the CPUs and equipment that we'll be hosting. We're going from Hopper to Blackwell to

Rubin on the NVIDIA roadmap. And the designs that we have are flexible enough to kind of roll with those upcoming changes. And NVIDIA

as you know kind of out there saying that, every six to eight months they're going to come out with a new design.

So, again, as you know, everyone's mentioned our focus is really

delivering a high-teens unlevered yield on cost. And again, where we sit today, and the work that we've done on CB1 and CB2 gives us comfort

that we'll be able to maintain that general CapEx target.

A - John Larkin {BIO 1491210 <GO>}

Kerri, could you take this one investor asking, if we could discuss

TeraWulf's development pipeline, and how actively the team explores new opportunities?

A - Kerri Langlais {BIO 22616294 <GO>}

Sure. We are constantly evaluating opportunities for additional sites.

Our management team has decades of experience in developing, financing, buying, operating, selling power projects. So, we're capable of

evaluating a lot of different opportunities and sussing out pretty quickly whether they're appropriate for TeraWulf.

So, many of these sites come with complicating factors. It's actually

sort of our bailiwick in terms of being able to work through potential site issues. Maybe it's a site that was a former power plant that's

been retired, or maybe it was a former paper mill, things of that nature that take time to evaluate and sort of work through. But where

-- that's where our skill set really sets us apart. So, that expertise allows us to

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 8 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

identify and pursue projects that align with our strategic goals

and ensure that we maximize both value and efficiency and additional scaling of our platform.

A - John Larkin {BIO 1491210 <GO>}

Patrick, we have a few questions regarding the TeraWulf deal versus

another announced deal, I'll say. So, I'll paraphrase a bit. And as Paul mentioned, many people thought the Core Sci, CoreWeave deal from

an economic perspective was a one-off, your thoughts on how the deals compare?

A - Patrick Fleury {BIO 17188291 <GO>}

Yes. Look, I'm going to focus on our deal, but which I think as folks

hopefully can see, we got great terms on our deal. It's very consistent with what we've been disclosing to the market since May. But it's

also a very different structure and we've been steadfast about that since we started talking about this earlier this year, and that is

that we funded the CapEx on our construction.

But look, we think it's a fabulous deal for Wulf and Wulf shareholders.

I think that last point, though, is a very -- I just want to drill in a little bit more there. So, we sold an asset, right, in our Nautilus

facility, reinvested that at Lake Mariner, and then we also executed on a convertible financing in October. And those two things allowed

us to fully equity fund Wulf Den, CB-1 and CB-2.

And now, given we have this lease, we will look to project finance,

in other words, take ourselves out of that equity in the future with debt. And then we will also look to project finance future projects,

so, that we do not need to use that equity funding in the future.

And I think, if folks remember, on Page 13 of our last quarter investor

deck, we showed, if we accomplish that, we have over $380 million of unallocated cash available next year to fund returns to shareholders.

So, I think that is a very big difference that, again, we have been steadfast on since we first started talking about entering this business.

There's other aspects of the deal that I think are maybe viewed as

minor, but are really quite a big deal for us. For example, we have a 3% annual escalator. When you compound that over 10 to 20 years,

that's a big deal. And I think our counterparty quality is extremely high. We have a corporate guarantee from G42, which is backed by

a sovereign government with a credit rating and CDS that trades virtually on top of the U.S. government CDS.

Moreover, G42 is a beneficiary of a very large investment from Microsoft,

alongside some of the most successful and largest fund managers in the world. So, we feel very strong about the credit quality here about

Core42, G42, and the sovereign that supports them.

And just to be clear, John, I know, I just thought we got a couple

of comments here. Sorry. But we, and then to be even more clear, we do not need any additional financing for this first 72.5 megawatts,

again that was equity funded. And now that we have a lease, our intent is to actually get finance ourselves out of that equity funding,

just to be really clear.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 9 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

And we think, look, it's early days, but we think that cost in the

beginning, and it depends on, frankly, whether we go to the typical bank project finance market, or term loan B financing markets. But

we expect that, will be single-digit cost of capital and amortizing around within sort of the life of the loan. But remember, we do have

two five-year extensions beyond the initial 10-year term. So, I would expect that the term of that debt is maybe 10 to 15 years.

A - John Larkin {BIO 1491210 <GO>}

Great. And then any thoughts on timing on the first financing kick-off?

A - Patrick Fleury {BIO 17188291 <GO>}

Yes. Look, we're like we said, we've hired Morgan Stanley and JP

Morgan. And we expect to begin working on that in Q1. But I think the execution of that will likely be mid-year.

A - John Larkin {BIO 1491210 <GO>}

Got it. Nazar, I think a very good question that we received this

morning. Will the next lease be easier, because TeraWulf has this one under the belt, but for Core42, and also if it happens to be a different

tenant?

A - Nazar Khan {BIO 22616427 <GO>}

Yes. The simple answer is, yes. With Core42, we have an option embedded

within the lease agreements, the 108 megawatts that we've talked about. A couple of questions have come in around timing of that. Again,

that's geared towards the end of the year, first quarter of 2026, end of 2025, early 2026 in terms of the delivery of that. So, yes, with

the existing tenant, it's -- there's an option there. It's fairly straightforward.

And with others, it's also, we've been now through a very detailed

negotiation on every single parameter that comes up with respect to these agreements, the service level credits, the operational parameters,

what these customers care about in terms of humidity, temperature, and efficiency.

And so, all of those things have been negotiated in a very detailed

document. And so, yes, on this next go-around to the extent that there are other customers that we bring in at this site or others, we've

got a pretty good framework to start working from.

A - John Larkin {BIO 1491210 <GO>}

Kerri, we haven't really talked much about the power source in New

York Zone A. Do you think investors and/or customers appreciate the value of the green power source?

A - Kerri Langlais {BIO 22616294 <GO>}

Thanks, John. I think right now, candidly, I don't think, we're being

fully rewarded for the value of our access to clean power. As Paul mentioned, and it's kind of been reiterated throughout responses to

a number of the questions, time to power is universally right now, the biggest challenge for our customers and tenants. And so,

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 10 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

as they prioritize immediate access to infrastructure, I think, sustainability

may not be the number one deciding factor.

However, as enterprises increasingly scrutinize the power that they're

consuming, and align that with their own environmental goals. I expect the value, and importance of our access to what is predominantly

zero-carbon power to become a much more significant determining factor for capacity going forward. So, in short, I don't think, we're

getting full credit for it today, but I do think it's going to be an elemental piece of the puzzle going forward.

A - John Larkin {BIO 1491210 <GO>}

Thanks, Kerri. Paul, I'm going to direct this one to you. Why do

you like the high-performance compute -- AI compute business so much?

A - Paul Prager {BIO 3957382 <GO>}

Listen, we've been in energy infrastructure for almost 30 years,

and this team's been together for the vast majority of that time. And so, in the power business, what we used to do was we used to find

an offtaker for electricity. We'd want them to be a good credit, and we'd find a fuel supplier. We'd capture a spread. We would build

the plant. We'd operate the plant. We'd finance that in the most efficient manner. And then we had predictable revenue for 15, 20 years,

that's what this business is.

And in this case, we've got a long-term offtaker, who's a phenomenal

credit. Core42 is backed by G42, both top-tier customers of NVIDIA, both partners with Dell, G42 backed by, a sovereign wealth fund, a

tremendous reputation. So, we've got a longterm offtaker of phenomenal credibility, approved, if you will, by our financial advisors,

JP Morgan and Morgan Stanley. We've got the site. We've got long-term supply of electricity, and we are building and operating.

So, Patrick will get to work on a project financing, so, we could

wash, rinse, and repeat. I mean, this represents really just about 10% of our capability and capacity over the next three to five years.

So, we've got a lot of work to do, but the revenues are tremendous. The credit and the partnerships are tremendous, and it's just like

what we did in the power space for two decades.

A - John Larkin {BIO 1491210 <GO>}

That's helpful. Thanks, Paul. Patrick, this has been a recurring

question that we've gotten. Can you give us your thoughts on TeraWulf's ability to become a REIT down the road?

A - Paul Prager {BIO 3957382 <GO>}

Yes. Sure. So, that is something that we will most certainly explore.

We've already begun implementing from a structuring perspective, but just to note, it's really important that folks realize that the optimal

time to convert to a REIT is when the business is moving from a non-taxpayer to a taxpayer, given that when you convert to a REIT you

have to purge the company of retained earnings to become a REIT.

We have a pretty significant amount of NOLs, and we're also poised

to generate a pretty significant amount of free cash flow over the next three to four years. So, given our NOLs, and then that earnings

profile, I think, just very roughly the timing could

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 11 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

line up pretty well with the next halving. So, yes, we have explored

that on a preliminary basis, nothing precluding us from becoming a REIT, and I think we'll expect to explore that in more details once

we reach operational scale.

A - John Larkin {BIO 1491210 <GO>}

Okay. To finish off we have a few what I call micro questions that

have come in. So, we'll have a bit of a speed round of sorts. Answers can be brief. So, here goes. Nazar, when will GPUs and servers begin

arriving at the facility?

A - Nazar Khan {BIO 22616427 <GO>}

As early as January. So, we'll start to receive equipment in January.

Again we've been guiding that initial building will come online towards the end of the first quarter of the year, and so equipment will

be arriving on site shortly. And then over the course of the first two quarters of next year, there's going to be over $2 billion of hardware

that's going to show up at our site that's going to populate the 60 megawatts of critical IT load.

A - John Larkin {BIO 1491210 <GO>}

Kerri, what are the benefits to being in one site?

A - Kerri Langlais {BIO 22616294 <GO>}

Thanks, John. Listen, there are several operational benefits to being

at one site. We are blessed to be in a single state ISO. We can leverage our operational synergies across the site, which streamlines

our processes and reduces complexity. I think, importantly, and we've talked about this before, the people who operate the Lake Mariner

data center facilities are many of the same individuals who worked at the site when it was a 700 megawatt coal plant.

And so that knowledge, that inherent knowledge of our infrastructure,

how our facilities integrate with the grid, how to manage significant loads is really invaluable as we scale that business. So, that I

think is something that can't be replicated. We know every risk at the site and how to address it. We've had many, many years of doing

just that at this location.

So, the other thing, I think, that kind of dovetails with this is,

as we have been through these conversations with our tenants over the last several months, we're also seeing value in zonal deployment

of HPC data centers. So, nearby data centers can share computing resources.

For instance, tasks that might require less immediate processing

time can be routed to less congested partner facilities, if you will, in the same regional zone. And so, that also plays into our thinking

if we think about, or evaluate potential additional sites that we might be able to bring into the TeraWulf platform to further expand

and optimize our footprint in that region.

A - John Larkin {BIO 1491210 <GO>}

Nazar, I have a couple of questions. They're maybe too closely related,

basically about the integrators. And so, how closely did onsite TeraWulf team work with the

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 12 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

OEMs, the integrators, and potential customers during the design

stage? And how many site visits were there?

A - Nazar Khan {BIO 22616427 <GO>}

We worked extremely closely with those folks. Members of the NVIDIA

team have been on our site multiple times. In the press release, you'll see there's a quote from the Dell team. Dell is the system integrator

for part of the deployment that Core42 will be doing here. And so, Dell's been again, multiple visits to the site. We've got a very large

working group between Core42, the Dell team and our team in rolling out the capacity here over the next couple quarters.

So, again, this has been a -- I'd say, a very coordinated and iterative

process with both the OEM as well as the integrators to make sure the whole chain works. And so, I think as Kerri mentioned earlier, these

are data centers of the future. The rack densities that we're building to are different than where the market has been going back three,

four, five years. And so, each component, each phase has been heavily reviewed, discussed, and kind of we're working together on that.

And that being said, as we go along that intimate discussion is going

to need to continue, kind of bringing up the capacity that we're talking about. And as mentioned earlier, over $2 billion of hardware

will be at our site. This is going to require very close coordination with all those parties to ensure that Core42 is getting the most

out of the equipment they have, and they're also getting the most out of the design that we have for the infrastructure that we've built.

A - John Larkin {BIO 1491210 <GO>}

Got you. And the next part was about how long will they be on site,

when the data centers come online, it sounds like quite a bit.

A - Nazar Khan {BIO 22616427 <GO>}

Yes. It's going to probably, over a couple months. And so, just again,

kind of tuning once all of the GPUs are installed. Again, CB-1 we've outlined, 16 megawatt critical IT load facility. It'll probably take,

eight to nine weeks to fully tune all of those GPUs to ensure that Core42 is getting the most out of that.

A - John Larkin {BIO 1491210 <GO>}

Paul, you've talked about feedback received from potential customers

after visiting our site. Can you elaborate on what was the feedback?

A - Paul Prager {BIO 3957382 <GO>}

Sure. I mean, it all comes down to our team led by Naz and Sean Farrell

working with the customers alongside the OEMs and the integrators to get to a custom solution. We had a couple of dozen site visits, and

there was not one party that visited the site that then did not approach us to enter into an arrangement with us.

We entered into the deal with Core42 because, again, we said all

along, there were three things we were looking for. First-class quality credit, and again, Core42 backed by G42, supported by a sovereign

wealth fund. That's all you could ever ask for.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 13 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

Two, we wanted people we could scale with. Core42

did a tremendous amount of diligence relative to -- some of the hyperscalers are out and about and they're really trying to option space.

Core42 really dug into design, brought Dell and NVIDIA into the picture early on to work on diligencing the site, what we were capable

of there. I mean, they were really all over it, and so, culturally, we really -- we really liked them a lot, because of their intense

focus on our site and what was capable there. So, we're highly confident we're going to be able to work with them.

And of course, the third thing that we focused on was yield. We liked

the Core42 sense of commerciality because they recognize the availability of immediate power, and so, we were able to strike a commercial

arrangement with them where, it made sense for both parties and we thought we were going to get a premium return. And so, that's how we

ended up here.

A - John Larkin {BIO 1491210 <GO>}

Thanks, Paul. Patrick, a question on exactly when does TeraWulf start

earning revenues? Is it when the servers are installed, or is there another specific data milestone?

A - Patrick Fleury {BIO 17188291 <GO>}

Yes. Hey, John. So, yes, when the building is ready, TeraWulf delivers

a commissioning report to our tenant ahead of, certain agreed upon dates, and that's when revenues begin. So, and I just want to go back

to, I think Paul just mentioned something, I just want to put an exclamation point on. The yield that we're talking about is unlevered

yield.

So, then when you add in typical project financing debt at reasonable

rates and at reasonable term, you're talking about a yield, levered yield, that's in the mid-to-high 20s. And that's where, I think this

gets really exciting for us and TeraWulf shareholders.

A - John Larkin {BIO 1491210 <GO>}

Thank you. Hopefully this has been helpful to investors. And with

that, I'm going to turn it back over to Paul for a closing comment.

A - Paul Prager {BIO 3957382 <GO>}

Thanks, John. Today's announcement further reinforces our core expertise,

the ability to deliver high-quality digital infrastructure. This data center leases positions Wulf at the center of two of the most impactful

uses of sustainable digital infrastructure, Bitcoin mining and AI-driven compute workloads.

As significant equity holders, we approach this process with patience

and precision to deliver maximum value. The outcome speaks for itself. And I'm particularly proud to share this milestone as we close

out the year. And yes, finally, it's beginning to look a lot like Christmas. Thank you for your continued trust and support. We look forward

to an exciting and prosperous 2025.

Operator

Today's conference has concluded. You may now disconnect your lines

at this time.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 14 of 15 |  |

| FINAL TRANSCRIPT | 2024-12-23 |

| Terawulf Inc (WULF US Equity) | |

This transcript may not be 100 percent accurate and may contain

misspellings and other inaccuracies. This transcript is provided "as is", without express or implied warranties of any kind.

Bloomberg retains all rights to this transcript and provides it solely for your personal, non-commercial use. Bloomberg, its suppliers

and third-party agents shall have no liability for errors in this transcript or for lost profits, losses, or direct, indirect, incidental,

consequential, special or punitive damages in connection with the furnishing, performance or use of such transcript. Neither the information

nor any opinion expressed in this transcript constitutes a solicitation of the purchase or sale of securities or commodities. Any opinion

expressed in the transcript does not necessarily reflect the views of Bloomberg LP. © COPYRIGHT 2024, BLOOMBERG LP. All rights reserved.

Any reproduction, redistribution or retransmission is expressly prohibited.

© COPYRIGHT 2024, BLOOMBERG LP. All rights reserved. Any reproduction, redistribution or retransmission is expressly prohibited. Printed on 12-24-2024 Page 15 of 15 |  |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

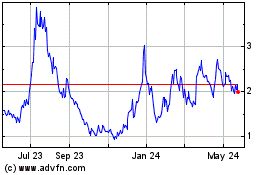

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Dec 2024 to Jan 2025

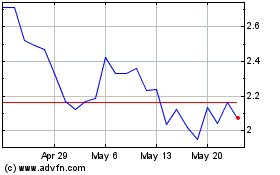

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Jan 2024 to Jan 2025