Xcel Energy Announces Closing of Common Stock Offering with a Forward Component

November 05 2024 - 9:43AM

Business Wire

Xcel Energy Inc. (NASDAQ: XEL) (Xcel Energy) announced today the

closing of its registered underwritten offering of 18,320,610

shares of its common stock in connection with the forward sale

agreements described below. Barclays and BofA Securities acted as

joint lead book-running managers for the offering. Citigroup and

Wells Fargo Securities acted as joint book-running managers for the

offering.

The closing will result in approximately $1.18 billion of net

proceeds, before expenses (assuming each forward sale agreement is

physically settled based on the initial forward sale price per

share of $64.4356, as described more fully below).

In connection with the offering, Xcel Energy entered into

separate forward sale agreements with each of Barclays Bank PLC and

Bank of America, N.A. (in such capacity, the forward purchasers)

under which Xcel Energy agreed to issue and sell to the forward

purchasers an aggregate of 18,320,610 shares of its common stock at

the initial forward sale price of $64.4356. In addition, the

underwriters of the offering have been granted a 30-day option to

purchase up to an additional 2,748,091 shares of Xcel Energy’s

common stock upon the same terms. If the underwriters exercise

their option, Xcel Energy may elect to enter into additional

forward sale agreements with the forward purchasers with respect to

the additional shares or to issue and sell such shares directly to

the underwriters.

Settlement of the forward sale agreements is expected to occur

on or prior to June 30, 2026. Upon any physical settlement of each

forward sale agreement, Xcel Energy will issue and deliver to the

relevant forward purchaser shares of Xcel Energy’s common stock in

exchange for cash proceeds per share, based on the initial forward

sale price of $64.4356. The initial forward sale price will be

subject to certain adjustments as provided in the relevant forward

sale agreement. Xcel Energy may, subject to certain conditions,

elect cash settlement or net share settlement for all or a portion

of its rights or obligations under either of the forward sale

agreements.

In connection with the forward sale agreements, the forward

purchasers borrowed from third-party lenders and sold to the

underwriters 18,320,610 shares of Xcel Energy’s common stock at the

close of the offering.

If Xcel Energy elects physical settlement of either of the

forward sale agreements, it presently expects to use the net

proceeds for general corporate purposes, which may include capital

contributions to its utility subsidiaries, acquisitions, and/or

repayment of short-term debt.

The offering was made pursuant to Xcel Energy’s effective shelf

registration statement filed with the Securities and Exchange

Commission (SEC). The prospectus supplement and the accompanying

prospectus related to the offering are available on the SEC’s

website at www.sec.gov. Copies of the prospectus supplement and the

accompanying prospectus relating to the offering may be obtained

from the joint lead book-running managers for the offering:

Barclays Capital Inc. c/o Broadridge Financial Solutions 1155

Long Island Avenue Edgewood, NY 11717

Barclaysprospectus@broadridge.com (888) 603-5847

BofA Securities NC1-022-02-25 201 North Tryon Street Charlotte,

NC 28255-0001 Attn: Prospectus Department| Email:

dg.prospectus_requests@bofa.com

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any jurisdiction in which the

offer, solicitation or sale of these securities would be unlawful

prior to registration or qualification under the securities laws of

any jurisdiction. The offering of these securities will be made

only by means of a prospectus and a related prospectus supplement

meeting the requirements of Section 10 of the Securities Act of

1933, as amended.

About Xcel Energy

Xcel Energy (NASDAQ: XEL) provides the energy that powers

millions of homes and businesses across eight Western and

Midwestern states. Headquartered in Minneapolis, the company is an

industry leader in responsibly reducing carbon emissions and

producing and delivering clean energy solutions from a variety of

renewable sources at competitive prices.

This press release contains forward-looking statements

regarding, among other things, Xcel Energy’s expectations regarding

its offer and sale of common stock and the use of the net proceeds

therefrom. Forward-looking statements are based on current beliefs

and expectations and are subject to inherent risks and

uncertainties, including those discussed under the caption “Special

Note Regarding Forward-Looking Statements” in the prospectus

supplement. In addition, Xcel Energy management retains broad

discretion with respect to the allocation of net proceeds of the

offering. The forward-looking statements speak only as the date of

release, and Xcel Energy is under no obligation to, and expressly

disclaims any such obligation to update or alter its

forward-looking statements, whether as the result of new

information, future events or otherwise, except as may be required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105608233/en/

For more information, contact: Paul Johnson, Vice President,

Treasury & Investor Relations (612) 215-4535 Roopesh Aggarwal,

Senior Director - Investor Relations (303) 571-2855

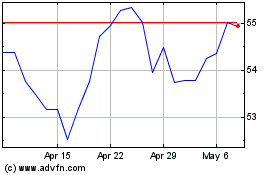

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Dec 2023 to Dec 2024