Xcel Energy Inc. (NASDAQ: XEL) (Xcel Energy) announced today the

early results of its previously announced offers to purchase for

cash (the Tender Offers) in the order of priority set forth in the

table below up to $110,000,000 aggregate principal amount (the

Aggregate Tender Cap) of certain outstanding first mortgage bonds

issued by Northern States Power Company, a Minnesota corporation

(NSPM), a wholly owned subsidiary of Xcel Energy (the Bonds),

pursuant to an Offer to Purchase, dated December 2, 2024 (the Offer

to Purchase). Xcel Energy also announced that it anticipates

increasing the Aggregate Tender Cap depending on the bid-side price

of the applicable “U.S. Treasury Reference Security” to be

determined at 10:00 a.m., New York City time, later today, December

16, 2024. Even if Xcel Energy increases the Aggregate Tender Cap,

Xcel Energy does not expect to accept for purchase Bonds of any

series other than the 2051 Bonds (as defined below). The terms and

conditions of the Tender Offers are described in the Offer to

Purchase and remain unchanged, except as described in this press

release.

The table below summarizes certain information regarding the

Bonds and the Tender Offers according to information provided by

D.F. King & Co., Inc.:

Title of Security

CUSIP Number

Issuer

Principal Amount

Outstanding

Acceptance Priority

Level(1)

Principal Amount

Tendered

2.60% First Mortgage Bonds,

Series due June 1, 2051

(the 2051 Bonds)

665772 CS6

Northern States Power Company

(a Minnesota corporation)

$700,000,000

1

$440,456,000

2.90% First Mortgage Bonds,

Series due March 1, 2050

665772 CR8

Northern States Power Company

(a Minnesota corporation)

$600,000,000

2

(2)

3.20% First Mortgage Bonds,

Series due April 1, 2052

665772 CU1

Northern States Power Company

(a Minnesota corporation)

$425,000,000

3

3.60% First Mortgage Bonds,

Series due September 15, 2047

665772 CQ0

Northern States Power Company

(a Minnesota corporation)

$600,000,000

4

3.600% First Mortgage Bonds,

Series due May 15, 2046

665772 CP2

Northern States Power Company

(a Minnesota corporation)

$350,000,000

5

_______________

(1)

The Tender Offers with respect to the

Bonds are subject to the Aggregate Tender Cap.

(2)

Even if Xcel Energy increases the

Aggregate Tender Cap, Xcel Energy does not expect to accept for

purchase Bonds of any series other than the 2051 Bonds.

The amount of Bonds accepted for purchase will be determined

pursuant to the terms and conditions of the Tender Offers as set

forth in the Offer to Purchase. Bonds not accepted for purchase

will be promptly credited to the account of the registered holder

of such Bonds with The Depository Trust Company and otherwise

returned in accordance with the Offer to Purchase.

Holders of Bonds that were validly tendered and not validly

withdrawn on or prior to the Early Tender Date and that are

accepted for purchase are eligible to receive the Total

Consideration, which includes an early tender payment of $30 per

$1,000 principal amount of Bonds validly tendered and not validly

withdrawn by such holders and accepted for purchase by Xcel Energy

(the Early Tender Payment). The Total Consideration offered per

$1,000 principal amount of Bonds validly tendered and accepted for

purchase pursuant to the Tender Offers will be determined in the

manner described in the Offer to Purchase by reference to the fixed

spread for such Bonds specified in the table above plus the yield

to maturity based on the bid-side price of the U.S. Treasury

Reference Security as quoted on the page on the Bloomberg Bond

Trader PX1 page at 10:00 a.m., New York City time, today. Accrued

and unpaid interest up to, but not including, the settlement date

will be paid in cash on all validly tendered Bonds accepted and

purchased by Xcel Energy in the Tender Offers. Xcel Energy expects

to issue a press release today, December 16, 2024, to announce the

Reference Yield that will be used in determining the Total

Consideration payable in connection with the Tender Offers as well

as the final principal amount accepted and the final upsize amount,

if applicable. The settlement date for the Bonds accepted for

purchase by Xcel Energy in connection with the Early Tender Date is

expected to be December 18, 2024. In accordance with the terms of

the Tender Offers, the withdrawal date was 5:00 p.m., New York City

time, on December 13, 2024. As a result, tendered Bonds may no

longer be withdrawn, except in certain limited circumstances where

additional withdrawal rights are required by law.

The Tender Offers will expire at 5:00 p.m., New York City time,

on December 31, 2024, or any other date and time to which Xcel

Energy extends such Tender Offers, unless earlier terminated. Even

if Xcel Energy increases the Aggregate Tender Cap, Xcel Energy does

not expect to accept for purchase any tender of Bonds after the

Early Tender Date because the amount of Bonds validly tendered and

not validly withdrawn at or prior to the Early Tender Date exceeds

the Aggregate Tender Cap.

Xcel Energy or its affiliates (including NSPM) may from time to

time, after completion of the applicable Tender Offers, purchase

additional Bonds in the open market, in privately negotiated

transactions, through one or more additional tender or exchange

offers, or otherwise, or NSPM may redeem Bonds that it is permitted

to redeem pursuant to their terms. In addition, from time to time,

including during the Tender Offers, Xcel Energy or its affiliates

(including NSPM) may purchase certain of NSPM's first mortgage

bonds that are not subject to the Tender Offers in the open market,

in privately negotiated transactions, through tender or exchange

offers, or otherwise, or NSPM may redeem such first mortgage bonds

that it is permitted to redeem pursuant to their terms. Any future

purchases by Xcel Energy or its affiliates (including NSPM) will

depend on various factors existing at that time.

Xcel Energy’s obligation to accept for purchase and to pay for

the Bonds in the Tender Offers is subject to the satisfaction or

waiver of a number of conditions described in the Offer to

Purchase. Xcel Energy reserves the right, subject to applicable

law, to (i) waive any and all conditions to any of the Tender

Offers, (ii) extend or terminate any of the Tender Offers, (iii)

increase or decrease the Aggregate Tender Cap, or (iv) otherwise

amend any of the Tender Offers in any respect.

Information Relating to the Tender Offer

U.S. Bancorp Investments, Inc. is serving as Dealer Manager in

connection with the Tender Offers. D.F. King & Co., Inc. is

serving as Tender and Information Agent in connection with the

Tender Offers. Copies of the Offer to Purchase or any other

documents are available by contacting D.F. King & Co., Inc. via

email at Xcel@dfking.com or by phone at (800) 769-7666 (toll-free)

or (212) 269-5550 (banks and brokers). Questions regarding the

Tender Offers should be directed to U.S. Bancorp Investments, Inc.,

Liability Management Group at (917) 558-2756 (collect) or (800)

479-3441 (toll-free).

None of Xcel Energy, its affiliates, the Dealer Manager, D.F.

King & Co., Inc. or the trustee with respect to any series of

Bonds makes any recommendation to any holder whether to tender or

refrain from tendering any or all of such holder’s Bonds or how

much they should tender, and none of them has authorized any person

to make any such recommendation. Holders are urged to evaluate

carefully all information in the Offer to Purchase, consult their

own investment and tax advisors and make their own decisions with

respect to the Tender Offers.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities. The Tender Offers

are being made only pursuant to the Offer to Purchase and only in

such jurisdictions as is permitted under applicable law.

The full details of the Tender Offers, including complete

instruction on how to tender Bonds, are included in the Offer to

Purchase. The Offer to Purchase contains important information that

should be read by holders of Bonds before making a decision to

tender any Bonds. The Offer to Purchase may be obtained from D.F.

King & Co., Inc., free of charge, by calling (800) 769-7666

(toll-free) or (212) 269-5550 (banks and brokers), or emailing at

Xcel@dfking.com.

About Xcel Energy

Xcel Energy (NASDAQ: XEL) provides the energy that powers

millions of homes and businesses across eight Western and

Midwestern states. Headquartered in Minneapolis, the company is an

industry leader in responsibly reducing carbon emissions and

producing and delivering clean energy solutions from a variety of

renewable sources at competitive prices.

This press release contains forward-looking statements

regarding, among other things, Xcel Energy’s expectations regarding

the Tender Offers. Xcel Energy cannot be sure that it will complete

the Tender Offers or, if it does, on what terms it will complete

the Tender Offers. Forward-looking statements are based on current

beliefs and expectations and are subject to inherent risks and

uncertainties, including those discussed under the caption

“Forward-Looking Statements” in the Offer to Purchase. The

forward-looking statements speak only as of the date of release,

and Xcel Energy is under no obligation to, and expressly disclaims

any such obligation to update or alter its forward-looking

statements, whether as the result of new information, future events

or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216097890/en/

For more information, contact: Paul Johnson, Vice President,

Treasury & Investor Relations (612) 215-4535 Roopesh Aggarwal,

Senior Director - Investor Relations (303) 571-2855

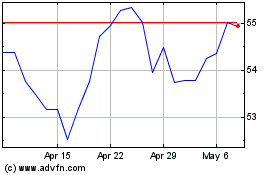

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Dec 2023 to Dec 2024