0000818479false00008184792024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

October 24, 2024

Date of Report (Date of earliest event reported)

DENTSPLY SIRONA Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 0-16211 | 39-1434669 | |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

13320 Ballantyne Corporate Place, | Charlotte | North Carolina | 28277-3607 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(844) 848-0137

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | XRAY | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition

On October 24, 2024, DENTSPLY SIRONA Inc. (the “Company”) issued a press release announcing that as a precautionary measure, the Company is suspending the sale and marketing of its Byte Aligner System and Impression Kits, as described in Item 8.01 herein. The press release also includes select preliminary unaudited financial results for the third quarter ended September 30, 2024 (the “third quarter 2024”). Based on preliminary financial information, the Company expects to report third quarter 2024 net sales of approximately $951 million and preliminary adjusted earnings per share (“EPS”) between $0.49 and $0.51. For the third quarter 2024, the Company expects to report year-over-year net sales growth in Essential Dental Solutions, partially offset by declines in Orthodontic and Implant Solutions and Connected Technology Solutions segments. Wellspect Healthcare net sales are expected to be approximately flat due to timing with a large U.S. distributor. Net sales and adjusted EPS were favorably impacted by a shift in the timing of distributor orders for Essential Dental Solutions products from the fourth quarter into the third quarter of approximately $20 million. The Company does not provide forward-looking or preliminary estimates of adjusted EPS on a GAAP basis as it is not able to reconcile this measure without unreasonable effort because the adjusting items will not be finalized until the completion of the Company’s quarter-end closing procedures and could be significant. A description of the adjustments typically made to compute adjusted EPS can be found in Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on July 31, 2024.

In addition, in connection with the preparation of the Company’s financial statements for the third quarter 2024, the Company concluded that it expects to record non-cash charges for the impairment of goodwill within the range of $450 - $550 million, net of tax, pertaining to two of its reporting units, Orthodontic Aligner Solutions and Implant & Prosthetic Solutions, which together comprise its Orthodontic and Implant Solutions segment. The decline in fair value for the Orthodontic Aligner Solutions reporting unit is driven primarily by adverse impacts from recent state regulatory trends pertaining to the Company’s direct-to-consumer aligner business, while the decline in fair value for the Implant & Prosthetic Solutions reporting unit is driven by weakened demand in conjunction with competitive pricing pressures and adverse impacts of ongoing global conflicts in certain markets, as well as lower long-term expectations for volumes of lab materials. These factors contributed to reductions to forecasted revenues, lower operating margins, and expectations for lower future cash flows in the near term, resulting in an impairment during the third quarter for the aforementioned reporting units.

The Company will evaluate and assess the appropriate next steps, with the goal of continuing to provide access to quality oral care to underserved populations. In connection with this assessment, the Company may incur additional impairments and write-offs regarding its Byte business, which may be material in the current and future periods.

The preliminary estimates above are based solely upon information available to management as of the date of this Current Report on Form 8-K and are subject to change. The Company’s actual results may differ from these estimates due to the completion of its quarter-end closing procedures, final adjustments and developments that may arise or information that may become available between now and the time the Company’s financial results are finalized and included in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

The Company will provide further updates on the business and its performance including an update to its 2024 full year outlook during its third quarter 2024 earnings call, which has been scheduled for November 7, 2024.

The information furnished pursuant to Item 2.02 in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 8.01 Other Events

On October 24, 2024, the Company issued a press release announcing that as a precautionary measure, the Company is voluntarily suspending the sale and marketing of its Byte Aligner System and Impression Kits while the Company conducts a review of certain regulatory requirements related to these products. The Company’s decision was made in consultation with the U.S. Food and Drug Administration (the “FDA”).

In connection with this review, and Dentsply Sirona’s proactive efforts to continuously improve its processes, the Company has suspended shipment and processing of new and recently placed orders for Byte aligners and impression kits.

The Company expects this suspension of sales to have a material impact on the Company’s results of operations. The sales of Byte Aligner Systems and Impression Kits represent approximately 5% of the Company’s annual revenue. Failure to promptly resolve these issues or to comply with the U.S. medical device regulatory requirements in general could result in regulatory action being initiated by the FDA that would have a material adverse impact on the Company’s financial status and results of operations. FDA actions could include, among other things, fines, injunctions, consent decrees, civil money penalties, repairs, replacements, refunds, recalls or seizures of products, total or partial suspension of production, the FDA’s refusal to grant future premarket approvals and criminal prosecution.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| (d) Exhibits: |

| | |

| | DENTSPLY SIRONA Inc. Press Release issued October 24, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| | |

Forward Looking Statements

All statements in this Current Report on Form 8-K that do not directly and exclusively relate to historical facts, including statements relating to the Company’s preliminary unaudited financial results for the third quarter 2024, the Company’s plans to terminate certain activities and the anticipated impact on the Company’s business, financial condition and results of operations, constitute “forward-looking statements.” These statements represent current expectations and beliefs and no assurance can be given that the results described in such statements will be achieved. Such statements are subject to numerous assumptions, risks, uncertainties and other factors, including those described in the section titled “Risk Factors” in the Company’s most recent Form 10-K, including any amendments thereto, and in other documents that we file with the Securities and Exchange Commission. No assurance can be given that any expectation, belief, goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. The Company does not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this Current Report on Form 8-K or to reflect the occurrence of unanticipated events.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

DENTSPLY SIRONA Inc.

| | | | | | | | |

| By: | /s/ Richard C. Rosenzweig | |

| Richard C. Rosenzweig | |

| Executive Vice President, Corporate Development, | |

| General Counsel and Secretary | |

Date: October 24, 2024

Dentsply Sirona Provides Update on Byte Aligner Products Voluntarily Suspends Sales and Marketing of Byte Aligners and Impression Kits Provides Select Preliminary Third Quarter 2024 Results CHARLOTTE, N.C., -- Oct. 24, 2024 -- DENTSPLY SIRONA Inc. (“Dentsply Sirona” or the "Company") (Nasdaq: XRAY), today announced the voluntary suspension of sales and marketing of its Byte Aligners and Impression Kits while the Company conducts a review of certain regulatory requirements related to these products. The Company’s decision was made in consultation with the U.S. Food and Drug Administration (FDA). In connection with this review, and Dentsply Sirona’s proactive efforts to continuously improve its processes, the Company has suspended shipment and processing of new and recently placed orders for Byte Aligners and Impression Kits. The Company holds itself to the highest standards of quality and compliance with patient safety at the center of everything we do. To that end, we will continue to work closely with the FDA and other regulatory authorities, while communicating with treating dentists and their patients to support their continued care as appropriate. Independent of the above matter, the state regulatory environment has adversely impacted our Byte Aligner business model, resulting in declining conversion rates, and new documentation, records and additional requirements (such as evidence of visits to a dentist or patient x-rays). As a result, we had begun to assess our resources at Byte to leverage and/or redeploy infrastructure, talent, and capability elsewhere in our business. Examples include augmenting resources to improve other software platforms, accelerating DS Core functionality, and enhancing the patient experience. Additional details regarding today’s announcement can be found in the Company’s Form 8-K that was filed today with the Securities and Exchange Commission (SEC). Select Preliminary Third Quarter 2024 Results Dentsply Sirona is also announcing select preliminary financial results for the three months ended September 30, 2024 (“third quarter 2024”). The Company expects to report third quarter 2024 net sales of approximately $951 million and adjusted EPS is expected to be between $0.49 and $0.51. For the third quarter 2024, the Company expects to report year-over-year net sales growth in Essential Dental Solutions, partially offset by declines in Orthodontic and Implant Solutions and Connected Technology Solutions segments. Wellspect Healthcare net sales are expected to be approximately flat due to timing with a large US distributor. Net sales and adjusted EPS were favorably impacted by a shift in the timing of distributor orders for Essential Dental Solutions products from the fourth quarter into the third quarter of approximately $20 million associated with the Company’s planned fourth quarter ERP implementation in North America. The Company does not provide preliminary estimates of EPS on a GAAP basis as certain information needed to prepare adjustments is not yet available and cannot be reasonably estimated. A description of the adjustments typically made to compute adjusted EPS can be found in Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on July 31, 2024. The Company expects to record non-cash charges for the impairment of goodwill within the range of $450 - $550 million, net of tax, pertaining to two of its reporting units, Orthodontic Aligner Solutions and Implants & Prosthetic Solutions, which together comprise the Orthodontic and Implant Solutions segment. The decline in fair value for the Orthodontic Aligner Solutions reporting unit is driven primarily by adverse impacts from state regulatory trends pertaining to the Company’s Byte Aligner business, while the decline in fair value for the Implants & Prosthetic Solutions reporting unit is driven by weakened demand in conjunction with competitive pricing pressures and adverse impacts of ongoing global conflicts in certain markets, as well as lower long-term expectations for volumes of lab materials. These factors contributed to reductions to forecasted revenues, lower operating margins, and expectations for lower future cash flows in the near term, resulting in an impairment during the third quarter for the aforementioned reporting units.

The Company will evaluate and assess the appropriate next steps for Byte, with the goal of continuing to provide access to quality oral care to underserved populations. In connection with this assessment, the Company may incur additional impairments and write-offs regarding this business, which may be material in the current and future periods. The preliminary estimates above are based solely upon information available to management as of the date of this press release and are subject to change. The Company’s actual results may differ materially from these estimates due to the completion of its quarter-end closing procedures, final adjustments and developments that may arise or information that may become available between now and the time the Company’s financial results are finalized and included in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. Dentsply Sirona will provide further updates on the business and its performance including an update to its 2024 full year outlook during its third quarter 2024 earnings call, which has been scheduled for November 7, 2024. About Dentsply Sirona Dentsply Sirona is the world’s largest manufacturer of professional dental products and technologies, with over a century of innovation and service to the dental industry and patients worldwide. Dentsply Sirona develops, manufactures, and markets a comprehensive solutions offering including dental and oral health products as well as other consumable medical devices under a strong portfolio of world class brands. Dentsply Sirona’s products provide innovative, high-quality and effective solutions to advance patient care and deliver better and safer dental care. Dentsply Sirona’s headquarters is located in Charlotte, North Carolina. The Company’s shares are listed in the United States on Nasdaq under the symbol XRAY. Visit www.dentsplysirona.com for more information about Dentsply Sirona and its products. Forward-Looking Statements and Associated Risks All statements in this Press Release that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control, including those described in Part I, Item 1A, “Risk Factors” of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the "2023 Form 10-K"), and other factors which may be described in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). No assurance can be given that any expectation, belief, goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this Press Release or to reflect the occurrence of unanticipated events. Investors should understand it is not possible to predict or identify all such factors or risks. As such, you should not consider the risks identified in the Company’s SEC filings to be a complete discussion of all potential risks or uncertainties associated with an investment in the Company. Contact Information Investors: Andrea Daley Vice President, Investor Relations +1-704-591-8631 InvestorRelations@dentsplysirona.com Press: Marion Par-Weixlberger Vice President, Public Relations & Corporate Communications +43 676 848414588 Marion.Par-Weixlberger@dentsplysirona.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

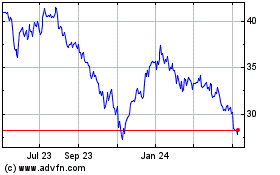

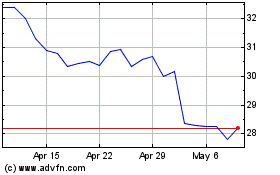

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Dec 2023 to Dec 2024