false

0001347858

0001347858

2024-09-05

2024-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2024

22nd Century Group, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

001-36338 |

98-0468420 |

(State or Other Jurisdiction

of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

|

321 Farmington Road, Mocksville, North Carolina

(Address of Principal Executive Office) |

27028

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 270-1523

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading symbol |

Name

of each exchange on which registered |

| Common Stock, $0.00001 par value |

XXII |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

NCSU Payment Agreement

On

September 5, 2024, (the “Effective Date”) the Company entered into a Payment Agreement (the “Agreement”)

with North Carolina State University (“NCSU”) to satisfy outstanding payments due under existing License Agreements with NCSU

and to prepay license fees and minimum royalty payments related to sponsored research for the Company’s intellectual property program

through the end of 2025. The total amount of $1,220,438.34 is payable in cash or through the issuance of Company common stock (the “Shares”),

at the Company’s election. The payments shall be issued in three separate installments commencing on or before September 15,

2024 and ending on or before January 15, 2025.

The

Shares, if issued at the Company’s election, will be issued in a private placement and were exempt from registration under the Securities

Act of 1933, as amended, in reliance on Section 4(a)(2) thereof as a transaction not involving a public offering and/or Rule 506

of Regulation D promulgated thereunder. Shares issued pursuant the Agreement shall be issued at an effective price per share equal to

the 5-day closing price of the Company’s common stock ending the day prior to the applicable issuance date. The total amount of

Shares issued under the Agreement shall not exceed 19.99% of the Company’s total outstanding shares on the Effective Date.

The

Company has agreed to file a registration statement on Form S-3 (or other appropriate form if the Company is not then S-3 eligible)

providing for the resale by NCSU of the Shares issued within three business days of each Share issuance installment under the Agreement.

A

copy of the Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The information set forth

under Item 1.01 with respect to the shares of common stock issuable by the Company to NCSU under the Payment Agreement is incorporated

herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

NCSU Payment Agreement

On

September 9, 2024, the Company issued a press release regarding the Payment Agreement. A copy of the press release is attached hereto

as Exhibit 99.1.

Investor Presentation

On

September 9, 2024, the Company issued an updated investor presentation. A copy of the investor presentation is attached hereto as Exhibit

99.2.

| Item 9.01(d): |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

22nd Century Group, Inc. |

| |

|

| |

/s/ Lawrence

Firestone |

| Date: September 9, 2024 |

Lawrence Firestone |

| |

Chief Executive Officer |

Exhibit 10.1

[***] = Pursuant to Item 601(b)(10) of

Regulation S-K, portions of this exhibit have been omitted as the registrant has determined certain confidential information contained

in this document, marked by brackets, is (i) not material and (ii) would be competitively harmful if publicly disclosed.

PAYMENT AGREEMENT

This Payment Agreement (the

“Payment Agreement”) is by and between North Carolina State University (“NCSU”), and 22nd Century Group, Inc.,

and its subsidiaries (collectively, the “Company”), effective as of the date of the signature below (the “Effective

Date”).

Recitals

WHEREAS,

NCSU and the Company are party to numerous agreements related to the research and development of certain low nicotine tobacco strains,

including that certain License Agreement No. 141421MA dated August 27, 2014, as amended, that certain License Agreement No. 2023-1087

dated November 1, 2023, that certain License Agreement No. 160829MA dated December 8, 2015, as amended, and that certain

Sponsored Research Agreement NCSU Radar Number 2014-1405, as amended and modified (collectively the “R&D Agreements”);

and

WHEREAS,

Company has outstanding payments due to NCSU under the R&D Agreements for patent maintenance, royalties, license fees and

sponsored research, plus certain payments that will become due through the end of 2025 as more fully set forth on Exhibit A

hereto (collectively, the “Obligations”); and

WHEREAS,

the Company wishes to fully satisfy the Obligations through the issuance of common shares of the Company (the “Settlement Shares”).

NOW,

THEREFORE, IN CONSIDERATION for entering into this Payment Agreement, and for the representations, promises, covenants

and releases contained in this Payment Agreement, and for other good and valuable consideration, including but not limited to payment

of the Settlement Shares, the receipt and adequacy of which are hereby acknowledged, the Company and NCSU agree as follow:

1. Recitals.

Each party agrees that the Recitals are true and correct and are incorporated into this Payment Agreement as part of this agreement.

2. Payment.

The Company hereby agrees to pay NCSU the sum of $1,220,438.34 (the “Total Settlement Amount”) in the form of Company common

shares payable in three installments, whereby the number of shares issued (the “Settlement Shares”) on each installment date

shall equal the Installment Amount, identified below, divided by the 5-day average closing price of Company common stock the day prior

to the Payment Date. The Settlement Shares shall satisfy in full the Obligations including all liability, interest, and penalties.

| Installment Amount |

Payment Date |

| $400,000 |

On or before September 15, 2024 |

| $400,000 |

Between November 1, 2024 and November 15, 2024 |

| $420,438.34 |

Between January 1, 2025 and January 15, 2025 |

[***] = Pursuant to Item 601(b)(10) of

Regulation S-K, portions of this exhibit have been omitted as the registrant has determined certain confidential information contained

in this document, marked by brackets, is (i) not material and (ii) would be competitively harmful if publicly disclosed.

3. Timing.

The Settlement Shares will be issued on the dates above and after the Company’s receipt from NCSU of an executed original of this

Payment Agreement. The Settlement Shares will initially be issued as unregistered shares with a restrictive legend. The Company shall

make commercially reasonable efforts to file a Registration Statement for the Settlement Shares on Form S-3 within three (3) business

days following the issuance of each installment of Settlement Shares. Within one (1) business day following notice of effectiveness

by the Securities and Exchange Commission (“SEC”) of each Registration Statement, the Company will instruct its’ Transfer

Agent to remove the restrictive legend from the Settlement Shares. Modification of the Payment Date provided above can only occur upon

the mutual written consent of the parties.

4. NCSU

Covenants. NCSU covenants and agrees that if on a given trading day, the VWAP of the common stock is more than 20% below the per share

issuance price (appropriately adjusted for stock splits, reverse stock splits, share combinations, stock dividends and similar transactions),

NCSU will (in the aggregate), on that trading day, sell no more than a maximum of 5% of the Settlement Shares issued to it for that particular

Installment Amount on that trading day.

5. 19.99%

Ownership Limitation. Notwithstanding anything to the contrary set forth in this Payment Agreement, the total amount of common shares

issued under this Agreement may not exceed 2,665,170 shares. If the Company is unable to issue shares on a Payment Date due to the aforementioned

limitation, the parties shall meet and confer regarding alternative payment methods and/or an extension to the applicable Payment Date.

NCSU may terminate this Agreement if the parties cannot agree to a resolution after a 20 day meet and confer period and such termination

will void any and all representations, promises, covenants and releases provided by NCSU to Company under this Payment Agreement. In

the case that all of the Installment Amounts are not made, the Obligations will be reduced by any timely payment of Installment Amounts

with such amounts applied in order starting with the oldest Obligation.

6. Beneficial

Ownership Limitation. At no time may the Company issue to NCSU any common shares to the extent that after giving effect to such issuance

NCSU (together with NCSU’s affiliates), would beneficially own in excess of 19.9% of the number of shares of the Company’s

common stock outstanding immediately after giving effect to the applicable issuance of shares of common stock pursuant to this Payment

Agreement held by NCSU. For purposes of this section, beneficial ownership shall be calculated in accordance with Section 13(d) of

the Exchange Act and the rules and regulations promulgated thereunder. To the extent that the limitation contained in this section

applies, the determination of whether shares of common stock may be issued pursuant to this Payment Agreement (in relation to other securities

owned by NCSU together with any affiliates) shall be in the sole discretion of NCSU. To ensure compliance with this restriction, NCSU

will be deemed to represent to the Company each time it receives common shares under this Payment Agreement according to the dates above,

that such receipt has not violated the restrictions set forth in this section and the Company shall have no obligation to verify or confirm

the accuracy of such determination.

7. Extension

of Deadline for Field Trials. The deadline to commence field trials pursuant to Appendix E (Development and Commercialization Schedule)

to the License Agreement dated November 1, 2023 is extended to June 1, 2026. The deadline to initiate and/or test pursuant

to paragraph 2 of Appendix E is extended to June 1, 2027.

[***] = Pursuant to Item 601(b)(10) of

Regulation S-K, portions of this exhibit have been omitted as the registrant has determined certain confidential information contained

in this document, marked by brackets, is (i) not material and (ii) would be competitively harmful if publicly disclosed.

8. Release

of Claims.

| a. | NCSU. Upon receipt by NCSU of total Settlement Shares from Company, equaling the Total Settlement

Amount, and removal of any type restrictive legend from all the Settlement Shares in accordance with this Payment Agreement, NCSU, for

itself and its affiliates, subsidiaries, heirs, executors, administrators and assigns (collectively, the “Releasors”)

forever waive, release and discharge the Company and each of its subsidiaries and affiliates, and its and their respective managers, directors,

officers, members, stockholders, subsidiary companies, insurance carriers and the officers, members, directors, agents, servants, employees

of each of the foregoing and the predecessors, successors and assigns of each of the foregoing (collectively, the “Releasees”),

from any and all actions, causes of action, claims, fees, commissions, payments, referral fees, expenses (inclusive of attorney’s

fees), demands or suits of any kind or nature whatsoever, whether known or unknown, and from all consequential, punitive and exemplary

damages arising out of or relating to the Obligations (“Release”). |

| b. | Company. Upon payment to NCSU of total Settlement Shares, equaling the Total Settlement Amount,

Company, for itself and its respective managers, directors, officers, members, stockholders, subsidiary companies, insurance carriers

and the officers, members, directors, agents, servants, employees of each of the foregoing and the predecessors, successors and assigns

of each of the foregoing (collectively, the “Releasors”) forever waive, release and discharge NCSU and each of its

affiliates, subsidiaries, heirs, executors, administrators and assigns (collectively, the “Releasees”), from any and all actions,

causes of action, claims, fees, commissions, payments, referral fees, expenses (inclusive of attorney’s fees), demands or suits

of any kind or nature whatsoever, whether known or unknown, and from all consequential, punitive and exemplary damages arising out of

or relating to the Obligations (“Release”). |

| c. | Reservation of Rights. Notwithstanding anything to the contrary in this Payment Agreement, neither

party waives, and each party expressly reserves, its claims, causes of action, rights, obligations, liabilities and remedies available

to a party related to a breach of this Payment Agreement. |

9. Termination.

The failure by Company to issue to NCSU Settlement Shares in accordance with the Payment Date provided in Section 2 and to instruct

its Transfer Agent to remove the restrictive legend from the Settlement Shares within ten (10) business days from Company issuing

to NCSU Settlement Shares, which issuance is not cured within five (5) business days, or any agreed upon modifications thereof, of

this Payment Agreement will result in this Payment Agreement’s automatic termination and will void any and all representations,

promises, covenants and releases provided by NCSU to Company under this Payment Agreement; provided that, if the delay is caused by the

SEC’s review of an S-3 Registration Statement, the cure period will be extended by the number of days by which the SEC completes

its review and declares the applicable Registration Statement effective, up to a period of 30 days. In the case that all of the Installment

Amounts are not made, the Obligations will be reduced by any timely payment of Installment Amounts with such amounts applied in order

starting with the oldest Obligation.

10. Miscellaneous.

This Payment Agreement contains the entire agreement between NCSU and the Company as to the subject matter hereof. NCSU hereby represents

and warrants that it has carefully read the foregoing, and know and understand the contents and meaning thereof, and are executing this

Payment Agreement voluntarily. This Payment Agreement shall be governed by the laws of the state of North Carolina without giving effect

to its conflict of laws principles. The parties hereto expressly designate any Releasee as a third party beneficiary to this Payment

Agreement, with the right to enforce the terms of such Payment Agreement.

[***] = Pursuant to Item 601(b)(10) of

Regulation S-K, portions of this exhibit have been omitted as the registrant has determined certain confidential information contained

in this document, marked by brackets, is (i) not material and (ii) would be competitively harmful if publicly disclosed.

IN

WITNESS WHEREOF, and intending to be legally bound, the undersigned hereunto sets its signature as of September 5, 2024.

| 22nd Century Group, Inc. |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

| North Carolina State University |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

[***] = Pursuant to Item 601(b)(10) of

Regulation S-K, portions of this exhibit have been omitted as the registrant has determined certain confidential information contained

in this document, marked by brackets, is (i) not material and (ii) would be competitively harmful if publicly disclosed.

Exhibit A

[***]

Exhibit 99.1

22nd Century Satisfies IP Licensing and Sponsored

Research Obligations to NCSU through 2025 in an Equity Transaction

MOCKSVILLE,

N.C., September 9, 2024 — 22nd Century Group, Inc. (Nasdaq: XXII), a tobacco products company leading the fight against

nicotine addiction with its FDA authorized 95% less nicotine brand VLN®, today announced an agreement to fund all intellectual property,

licensing and sponsored research payments to North Carolina State University through 2025 in equity as part of a deal valued at over $1.2

million. The payments will occur over the course of three tranches, in equity or cash, at the company’s election. The transaction

covers all expenses related to patent maintenance, royalty, license and sponsored research from the fourth quarter of 2023 through the

end of 2025. Additionally, the Company has extended its field trial activity to 2025.

Said Larry Firestone, Chairman and CEO: “We

recently secured our relationship with NCSU in November of 2023, bringing on additional IP to enhance our reduced nicotine content tobacco

capabilities. This latest agreement further aligns NCSU with our continued success at 22nd Century.”

About 22nd Century Group, Inc.

22nd Century Group is the pioneering nicotine harm reduction company

in the tobacco industry enabling smokers to take control of their nicotine consumption.

We created our flagship product, the VLN® cigarette, to give traditional

cigarette smokers an authentic and familiar alternative that helps them smoke less. VLN® is the world’s first and only combustible

cigarette to receive a Modified Risk Tobacco Product designation from the FDA, which the FDA has mandated be described as a product that

Helps You Smoke Less®. VLN® cigarettes have 95% less nicotine than the traditional cigarette and have been proven

to greatly reduce nicotine consumption. Instead of offering new ways of delivering nicotine to addicted smokers, we offer smokers

the option to take control of their nicotine consumption and make informed and more productive choices, including the choice to avoid

addictive levels of nicotine altogether.

Our wholly owned subsidiaries include a leading cigarette manufacturer

that produces all VLN® products and provides turnkey contract manufacturing for other tobacco brands both domestically and internationally.

The 60,000 square foot facility in Mocksville, North Carolina has the capacity to produce more than 45,000,000 cartons of combusted tobacco

products annually with additional space for expansion.

Our proprietary reduced nicotine tobacco blends are made possible by

comprehensive and patented technologies that regulate nicotine biosynthesis activities in the tobacco plant, resulting in full flavor

and high yield with 95% less nicotine. Our extensive patent portfolio has been developed to ensure we have the only low nicotine combustible

cigarette in the United States and critical international markets. Our mission is to sell the last cigarette before the 22nd Century.

VLN® and Helps You Smoke Less® are registered trademarks of

22nd Century Limited LLC

Learn

more at xxiicentury.com, on X (formerly Twitter),

on LinkedIn, and on YouTube.

Learn

more about VLN® at tryvln.com.

Cautionary Note Regarding

Forward-Looking Statements

Except for historical

information, all of the statements, expectations, and assumptions contained in this press release are forward-looking statements, including

but not limited to our full year business outlook. Forward-looking statements typically contain terms such as “anticipate,”

“believe,” “consider,” “continue,” “could,” “estimate,” “expect,”

“explore,” “foresee,” “goal,” “guidance,” “intend,” “likely,”

“may,” “plan,” “potential,” “predict,” “preliminary,” “probable,”

“project,” “promising,” “seek,” “should,” “will,” “would,” and

similar expressions. Forward-looking statements include, but are not limited to, statements regarding (i) our strategic alternatives and

cost reduction initiatives, (ii) our expectations regarding regulatory enforcement, including our ability to receive an exemption from

new regulations, (iii) our financial and operating performance and (iv) our expectations for our business interruption insurance claim.

Actual results might differ materially from those explicit or implicit in forward-looking statements. Important factors that could cause

actual results to differ materially are set forth in “Risk Factors” in the Company’s Annual Report on Form 10-K filed

on March 28, 2024 and Quarterly Reports on Form 10-Q filed on May 15, 2024 and August 13, 2024. All information provided in this release

is as of the date hereof, and the Company assumes no obligation to and does not intend to update these forward-looking statements, except

as required by law.

Investor

Relations & Media Contact

Matt Kreps

Investor Relations

22nd Century Group

mkreps@xxiicentury.com

214-597-8200

Exhibit 99.2

XXII Investor Presentation September 2024

VLN - Helps You Smoke Less ® Except for historical information, all of the statements, expectations, and assumptions contained in this presentation are forward - looking statements, including but not limited to our business outlook Forward - looking statements typically contain terms such as “anticipate,” “believe,” “consider,” “continue,” “could,” “drive to” “estimate,” “expect,” “explore,” “foresee,” “goal,” “guidance,” “intend,” “likely,” “may,” “plan,” “potential,” “predict,” “preliminary,” “probable,” “project,” “promising,” “seek,” “should,” “will,” “would,” and similar expressions. Actual results might differ materially from those explicit or implicit in forward - looking statements. Important factors that could cause actual results to differ materially are set forth in “Risk Factors” in the Company’s Annual Report on Form 10 - K filed on March 28, 2024 and Quarterly Reports filed on May 15, 2024 and August 13, 2024. All information provided in this presentation is as of the date hereof, and the Company assumes no obligation to and does not intend to update these forward - looking statements, except as required by law. Safe Harbor & Forward - looking Statement

At a Glance ▪ NASDAQ – XXII – Headquartered in Mocksville, NC ▪ Pure Play Tobacco Company with a 26 - year MISSION focused on Nicotine Harm Reduction with our branded VLN® Low Nicotine cigarette – The only Low Nicotine Cigarette ▪ NASCO Private Label Contract Manufacturing for others ▪ Supports company operations ▪ Reduces our cost ▪ Fund the growth business of VLN® ▪ Targeting Breakeven Profitability in Q1 2025 ▪ WE ARE HERE TO SOLVE A PROBLEM VLN - Helps You Smoke Less ®

XXII Mission: Lead the Nicotine Harm Reduction Movement Nicotine = Addiction ▪ Our Nicotine Harm Reduction Mission Started at XXII in 1998 – We were the Pioneer $ Billions are being spent on Nicotine Harm awareness campaigns and governance: ▪ TV commercials – Undo.org, CDC, American Heart Assoc, others ▪ Radio ▪ Associations/Societies ▪ Conferences ▪ Healthcare restrictions (surgery, medications, pregnancy) ▪ FDA ▪ Court ordered warnings ▪ Others ▪ WE HAVE THE SOLUTION with VLN – The Lowest Nicotine Cigarette in America VLN - Helps You Smoke Less ®

VLN® VLN® - Helps You Smoke Less ®

VLN® is the only one - Low Nicotine cigarette with 95% less Nicotine - FDA authorized ▪ Goal ▪ Recognition for VLN ® and create a separate category – Health related products seen as a better option for you ▪ Decaf Coffee ▪ Light Beer ▪ Diet Soda ▪ Strategy to create CMO flanker brands to join our Original VLN® in the category: ▪ Ranger VLN ® to Ranger ▪ Pinnacle VLN ® to Pinnacle ▪ Possible license opportunity to other brands ▪ VLN Branding extensions ▪ VLN® is synonymous with addressing smoker health and smoker choice: Helps You Smoke Less ® VLN® Strategy VLN - Helps You Smoke Less ®

VLN® - The Math ▪ 1 pack of VLN ® 95% less Nicotine Cigarettes = 1 standard cigarette for nicotine content ▪ The math is why it helps you smoke less For the Customer: ▪ The Original VLN® Cartons needed to breakeven – 223,000 (2.9% of NASCO Capacity) ▪ Current distribution 5,100 stores ▪ Cartons/year needed per store – 44 ▪ Cartons/ wk - .85 or 9pks/week avg. per store ▪ We've had stores that have sold 3.5 cartons/week over an extended period of time For XXII: VLN - Helps You Smoke Less ® For the Retailer: ▪ Answer to the Nicotine warning on the door ▪ Wholesaler Realignment ▪ New category in the store with active distribution support o Digital Marketing o Website update o Social Media

VLN® The Gift from Big Tobacco VLN - Helps You Smoke Less ® This sign is required by every retailer that sells tobacco in the US Simply Put – The Problem – The Solution – VLN® The Problem The Solution

VLN® Distribution VLN - Helps You Smoke Less ® Diverse List of U.S., Retail Locations Carry VLN® Products Across Broad Geography Current Distribution: ▪ More than 5,100 retail stores across 26 states, including three largest state markets of Texas, California and Florida ▪ Secured distribution with top national and regional retail distributors for tobacco related products, registrations in additional states for continued expansion Target US Distribution – The Opportunity: • More than 274,000 total resellers of tobacco products in the US among the top 4 classes of trade • We are less than 2% of the way to the target • There is shelf space in every store for THE answer to Nicotine from cigarettes

Art Company Lorem ipsum Dolor VLN® - Outlook ▪ Current owned Inventory Position: ▪ $4.4 million in finished VLN® product ▪ Tobacco to support approx. 1.2 million cartons Original VLN® ▪ Tobacco to support approx. 250,000 carton of custom blend VLN® ▪ Product Strategy – Build out the Category: ▪ Original VLN® ▪ VLN® Flanker Brands ▪ VLN® New Branding – Future Sku’s ▪ Marketing Campaign – Consumer awareness – Emotional connection ▪ Expanded Distribution ▪ Increased Sell - through ▪ Driving Growth in VLN®

Contract Manufacturing and Operations

Leading Provider of Manufacturing Solutions to the Tobacco Industry CMO Strategy ▪ Services include: ▪ High Quality Private Label Production Services ▪ Turnkey or Consigned ▪ Leverage our Machine Capacity ▪ Supply Chain Management ▪ MSA Cigarette Producer ▪ Low - Cost advantage ▪ We handle the Front End; They handle the "Go - to - Market"

Goal: Drive the Factory output to full capacity – VLN® + CMO Operations Strategy ▪ Agnostic to the end product – Cigarettes or Filtered Cigars ▪ 35,000 cartons per day on one shift depending on mix ▪ Running at Full Capacity will drop DLOH per carton across the board ▪ Current capacity can be grown by: ▪ Additional shifts ▪ Additional production lines ▪ In - line automation ▪ Full consumption of current 1 shift capacity with CMO business can cover the Company’s overhead ▪ The goal is to fill the capacity with CMO business and fund VLN® growth ▪ Substantial revenue stream at full capacity ▪ Growth in revenue and lower DLOH = Good margin and cash flow

Research & Development

Goal: To ensure company IP assets are positioned to provide ongoing commercial value where viable, along with continuing to develop further advancement in tobacco. R&D ▪ Key Areas Of Focus: ▪ Partnership with NCSU on various low nicotine tobacco improvements ▪ Low Nicotine Tobacco disease resistance ▪ Other Low Nicotine tobacco strain development for future VLN ® blends ▪ Domestic ▪ International ▪ Patent Strategy ▪ File new patents to extend low nicotine tobacco protection and block competitors ▪ International - pursue patents in select countries with large customer base

Financial

TTM Quarterly P&L (in 000’s) – Q2 2024 Please refer to our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and Form 8 - K earnings release for a full presentation of the statement of operations and comprehensive loss, and reconciliation of GAAP to Non - GAAP measures. Q2 2024 Q1 2023 Q4 2023 Q3 2023 Continuing Operations 7,947 $ 6,469 $ 7,357 $ 7,871 $ Revenues, net 3,869 4,213 11,565 3,920 Cost of goods sold 3,508 3,385 3,621 3,873 Excise taxes + fees on products 570 (1,129) (7,829) 78 Gross (loss) profit 2,617 3,305 6,403 8,328 Total operating expenses (2,047) (4,434) (14,232) (8,250) Operating loss (141) (1,016) (7,834) 171 Total other income (expense) (2,188) (5,450) (22,067) (8,080) Loss before income taxes 26 - 1 - Provision for income taxes (2,214) $ (5,450) $ (22,067) $ (8,080) $ Net loss from continuing operations (0.30) $ (1.72) $ (0.66) $ (0.41) $ Basic & diluted EPS (1,461) $ (4,168) $ (14,927) $ (6,569) $ EBITDA Q2 2024 earnings reflect improved trends in P&L including: ▪ Shifting product mix to improve gross margin profitability ▪ Significant reduction in operating expenses ▪ Restructured the JGB/Omnia debt to substantially reduce interest expense and cash payments

The presentation contains certain financial information that is not presented in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), including earnings before interest, taxes, depreciation and amortization (EBITDA) and EBITDA further adjusted for certain non - cash and/or non - operating expenses, including equity - based employee compensation expense, restructuring and restructuring - related charges such as impairment, acquisition and transaction costs, and other unusual or infrequently occurring items, if applicable, such as inventory reserves and adjustments, gains or losses on disposal of property, plant and equipment, and gains or losses on investments (Adjusted EBITDA). We believe that the presentation of EBITDA and Adjusted EBITDA are important financial measures that supplement discussion and analysis of its financial condition and results of operations and enhances an understanding of its operating performance. While management considers EBITDA and Adjusted EBITDA to be important, these financial performance measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating (loss) income, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. Non GAAP Financial Information

Summary ▪ VLN® Strategy solidified and started ▪ Positive Cash Flow from Sales of Current VLN Inventory ▪ Increased Gross Profit through: ▪ VLN® volume and new placements ▪ Higher margin CMO volume and further DLOH absorption ▪ Price increases to negative margin customers or exit ▪ Significant reduction in operating expenses ▪ Major Balance Sheet Improvements ▪ Continued Development of Low Nicotine Strains Key Initiatives & The Road Ahead:

Thank You Questions + Answers Q A

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

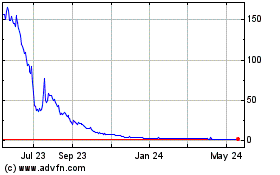

22nd Century (NASDAQ:XXII)

Historical Stock Chart

From Feb 2025 to Mar 2025

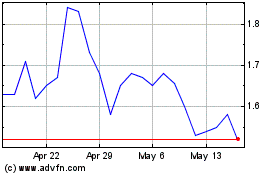

22nd Century (NASDAQ:XXII)

Historical Stock Chart

From Mar 2024 to Mar 2025