As filed with the Securities and Exchange Commission

on May 23, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Arbor Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

20-0057959 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

333 Earle Ovington Boulevard, Suite 900

Uniondale, New York 11553

(Address of principal executive offices, including

zip code)

ARBOR REALTY TRUST, INC. 2024 AMENDED

OMNIBUS STOCK INCENTIVE PLAN

(Full title of the plan)

Paul Elenio

Chief Financial Officer

Arbor Realty Trust, Inc.

333 Earle Ovington Boulevard, Suite 900

Uniondale, New York 11553

(516) 506-4200

(Name and address, including zip code, and telephone

number, including area code, of agent for service)

Copy

to:

David J. Goldschmidt, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

One Manhattan West

New York, New York 10001

(212) 735-3000

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ |

| Non-accelerated filer ¨ |

Smaller reporting company ¨ |

| |

Emerging growth company ¨ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY

NOTE

This Registration Statement on Form S-8 is being filed by Arbor

Realty Trust, Inc., a Maryland corporation (the “Company” or the “Registrant”), to register 6,217,547 shares

of the Company’s common stock, par value $0.01 per share (the “Common Stock”), that may be issued and sold under the

Arbor Realty Trust, Inc. 2024 Amended Omnibus Stock Incentive Plan (the “Plan”), which was approved by the Company’s

stockholders on May 22, 2024, none of which have been issued as of the date of this Registration Statement.

PART I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

* The documents containing the information specified in Part I

of Form S-8 will be sent or given to employees as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended

(the “Securities Act”). Such documents need not be filed with the Securities and Exchange Commission (the “SEC”)

either as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities

Act. These documents and the documents incorporated by reference in this registration statement pursuant to Item 3 of Part II of

this registration statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities

Act.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents the Company has previously filed with the SEC

are incorporated by reference in this registration statement (other than information deemed furnished and not filed in accordance with

SEC rules, including Items 2.02 and 7.01 of Form 8-K):

| (c) | the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 3, 2024; |

All other reports and documents subsequently filed

by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), (other than information deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K)

on or after the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement

which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed

to be incorporated by reference in this registration statement and to be a part hereof from the date of the filing of such reports and

documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference in this registration statement shall be deemed to be modified or superseded for purposes of

this registration statement to the extent that a statement contained in this registration statement, or in any other subsequently filed

document that also is or is deemed to be incorporated by reference in this registration statement, modifies or supersedes such prior statement.

Any statement contained in this registration statement shall be deemed to be modified or superseded to the extent that a statement contained

in a subsequently filed document that is or is deemed to be incorporated by reference in this registration statement modifies or supersedes

such prior statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Maryland law permits a Maryland corporation to

include in its charter a provision eliminating the liability of its directors and officers to the corporation and its stockholders for

money damages, except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services

or (b) active and deliberate dishonesty established by a final judgment and which is material to the cause of action. The Company’s

charter contains such a provision which eliminates directors’ and officers’ liability to the maximum extent permitted by Maryland

law.

The charter authorizes the Company to obligate

itself and the bylaws obligate the Company, to the maximum extent permitted by Maryland law, to indemnify any present or former director

or officer of the Company or any individual who, while a director or officer of the Company and at the request of the Company, serves

or has served another corporation, real estate investment trust, partnership, joint venture, trust, employee benefit plan or other enterprise

as a director, officer, partner or trustee, from and against any claim or liability to which that person may become subject or which that

person may incur by reason of his or her status in any of the foregoing capacities and to pay or reimburse their reasonable expenses in

advance of final disposition of a proceeding. The charter and bylaws also permit the Company to indemnify and advance expenses to any

person who served a predecessor of the Company in any of the capacities described above and to any employee or agent of the Company or

a predecessor of the Company.

Maryland law requires a Maryland corporation (unless

its charter provides otherwise, which the Company’s charter does not) to indemnify a director or officer who has been successful,

on the merits or otherwise, in the defense of any proceeding to which he or she is made a party by reason of his service in that capacity.

Maryland law permits a Maryland corporation to indemnify its present and former directors and officers, among others, against judgments,

penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be

made or threatened to be made a party by reason of their service in those or other capacities unless it is established that (a) the

act or omission of the director or officer was material to the matter giving rise to the proceeding and (i) was committed in bad

faith or (ii) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper

personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable

cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse

judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that personal benefit was improperly

received, unless in either case a court orders indemnification and then only for expenses. In addition, Maryland law permits a Maryland

corporation to advance reasonable expenses to a director or officer upon the corporation’s receipt of (a) a written affirmation

by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification

by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by

the corporation if it is ultimately determined that the standard of conduct was not met.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions,

the registrant has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act and is therefore unenforceable.

The Company has also entered into agreements to

indemnify its directors and executive officers to the maximum extent permitted by Maryland law and pay such persons’ expenses in

defending any civil or criminal proceeding in advance of final disposition of such proceeding.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

*Incorporated

by reference to the Registrant’s Registration Statement on Form S-11 (Registration No. 333-110472), as amended. Such

Registration Statement was originally filed with the SEC on December 31, 2003.

**Filed herewith.

Item 9. Undertakings.

The undersigned registrant hereby undertakes:

| (1) | To file, during any period in which offers or sales are being

made, a post-effective amendment to this registration statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Filing Fee” table in the effective registration statement; and |

| (iii) | to include any material information with respect to the plan of distribution not previously disclosed in this registration statement

or any material change to such information in this registration statement; |

Provided,

however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13

or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement;

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof; and

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

The undersigned registrant hereby undertakes that,

for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Sections

13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant

to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions,

or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed

in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in City of Uniondale,

State of New York, on May 23, 2024.

| |

ARBOR REALTY TRUST, INC. |

| |

|

| |

By: |

/s/ Paul Elenio |

| |

|

Name: Paul Elenio |

| |

|

Title: Chief Financial Officer |

POWER

OF ATTORNEY

Each of the undersigned officers and directors

of Arbor Realty Trust, Inc., a Maryland corporation, hereby constitutes and appoints Paul Elenio and Maysa Vahidi and each of them,

severally, as his or her true and lawful attorney-in-fact and agent, each acting along with full power of substitution and resubstitution,

for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective

amendments) and exhibits to this Registration Statement and any and all applications and other documents relating thereto, with the SEC,

with full power and authority to perform and do any and all acts and things whatsoever which any such attorney or substitute may deem

necessary or advisable to be performed or done in connection with any or all of the above-described matters, as fully as each of the undersigned

could do if personally present and acting; and each of the undersigned hereby ratifies and approves all acts of any such attorney or substitute.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Ivan Kaufman |

|

Chairman of the Board of Directors, Chief Executive Officer and President |

|

May 23, 2024 |

| Ivan Kaufman |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Paul Elenio |

|

Chief Financial Officer |

|

May 23, 2024 |

| Paul Elenio |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Kenneth J. Bacon |

|

Director |

|

May 23, 2024 |

| Kenneth J. Bacon |

|

|

|

|

| |

|

|

|

|

| /s/ Caryn Effron |

|

Director |

|

May 23, 2024 |

| Caryn Effron |

|

|

|

|

| |

|

|

|

|

| /s/ Edward Farrell |

|

Director |

|

May 23, 2024 |

| Edward Farrell |

|

|

|

|

| |

|

|

|

|

| /s/ William C. Green |

|

Director |

|

May 23, 2024 |

| William C. Green |

|

|

|

|

| |

|

|

|

|

| /s/ Melvin F. Lazar |

|

Director |

|

May 23, 2024 |

| Melvin F. Lazar |

|

|

|

|

| |

|

|

|

|

| /s/ Joseph Martello |

|

Director |

|

May 23, 2024 |

| Joseph Martello |

|

|

|

|

| |

|

|

|

|

| /s/ Elliot Schwartz |

|

Director |

|

May 23, 2024 |

| Elliot Schwartz |

|

|

|

|

| |

|

|

|

|

| /s/ Carrie Wilkens |

|

Director |

|

May 23, 2024 |

| Carrie Wilkens |

|

|

|

|

Exhibit 5.1

May 23, 2024

Arbor Realty Trust, Inc.

333 Earle Ovington Boulevard, Suite 900

Uniondale, NY 11553

Re: Registration Statement

on Form S-8

Ladies and Gentlemen:

We have served as Maryland counsel to Arbor Realty

Trust, Inc., a Maryland corporation (the “Company”), in connection with certain matters of Maryland law arising out of the

registration by the Company of 6,217,547 shares (the “Shares”) of common stock, $0.01 par value per share (the “Common

Stock”), of the Company, covered by the above-referenced Registration Statement, and all amendments related thereto (the “Registration

Statement”), filed by the Company with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Act”). The Shares are to be issued by the Company from time to time in accordance with the Arbor

Realty Trust, Inc. 2024 Amended Omnibus Stock Incentive Plan (the “Plan”).

In connection with our representation of the

Company, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified

to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1. The Registration

Statement, in the form transmitted to the Commission under the Act;

2. The charter

of the Company (the “Charter”), certified by the State Department of Assessments and Taxation of Maryland (the “SDAT”);

3. The Bylaws

of the Company, certified as of the date hereof by an officer of the Company;

4. A certificate

of the SDAT as to the good standing of the Company, dated as of a recent date;

5. Resolutions

adopted by the Board of Directors of the Company (the “Resolutions”) relating to, among other matters, the approval of the

Plan and the registration and issuance of the Shares, certified as of the date hereof by an officer of the Company;

6. The Plan,

certified as of the date hereof by an officer of the Company;

Arbor Realty Trust, Inc.

May 23, 2024

Page 2

7. A certificate

executed by an officer of the Company, dated as of the date hereof; and

8. Such

other documents and matters as we have deemed necessary or appropriate to express the opinion set forth below, subject to the assumptions,

limitations and qualifications stated herein.

In expressing the opinion set forth below, we have

assumed the following:

1. Each

individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so.

2. Each

individual executing any of the Documents on behalf of a party (other than the Company) is duly authorized to do so.

3. Each

of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents

to which such party is a signatory, and such party’s obligations set forth therein are legal, valid and binding and are enforceable

in accordance with all stated terms.

4. All Documents

submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not differ in

any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted to

us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records

reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained

in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there

has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

5. The Shares

will not be issued or transferred in violation of any restriction or limitation contained in Article VII of the Charter or in the Plan.

6. Upon

the issuance of any Shares, the total number of shares of Common Stock issued and outstanding will not exceed the total number of shares

of Common Stock that the Company is then authorized to issue under the Charter.

7. Each

award that provides for the potential issuance of a Share pursuant to the Plan (each, an “Award”) will be duly authorized

and validly granted in accordance with the Plan.

Arbor Realty Trust, Inc.

May 23, 2024

Page 3

Based upon the foregoing, and subject to the assumptions,

limitations and qualifications stated herein, it is our opinion that:

1. The Company

is a corporation duly incorporated and existing under and by virtue of the laws of the State of Maryland and is in good standing with

the SDAT.

2. The issuance

of the Shares has been duly authorized and, when and if issued and delivered in accordance with the Registration Statement, the Resolutions

and the Plan, the Shares will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the laws of the

State of Maryland and we do not express any opinion herein concerning federal law or any other state law. We express no opinion as to

the applicability or effect of federal or state securities laws, including the securities laws of the State of Maryland, federal or state

laws regarding fraudulent transfers or the laws, codes or regulations of any municipality or other jurisdiction. To the extent that any

matter as to which our opinion is expressed herein would be governed by the laws of any jurisdiction other than the State of Maryland,

we do not express any opinion on such matter. The opinion expressed herein is subject to the effect of any judicial decision which may

permit the introduction of parol evidence to modify the terms or the interpretation of agreements.

The opinion expressed herein is limited to the matters

specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We assume no obligation to supplement

this opinion if any applicable law changes after the date hereof or if we become aware of any fact that might change the opinion expressed

herein after the date hereof.

This opinion is being furnished

to you for submission to the Commission as an exhibit to the Registration Statement. We hereby consent to the filing of this opinion as

an exhibit to the Registration Statement and to the use of the name of our firm therein. In giving this consent, we do not admit that

we are within the category of persons whose consent is required by Section 7 of the Act.

| |

Very truly yours, |

| |

|

| |

/s/ Venable LLP |

Exhibit 10.1

ARBOR REALTY TRUST, INC.

2024 AMENDED OMNIBUS STOCK INCENTIVE PLAN

Approved by the Company's Stockholders on May 22,

2024

Section 1. General

Purpose of Plan; Definitions.

The name of this plan is

the Arbor Realty Trust, Inc. 2024 Amended Omnibus Stock Incentive Plan (the "Plan"). The Plan is an amendment and restatement

of the Arbor Realty Trust, Inc. 2020 Amended Omnibus Stock Incentive Plan (inclusive of the predecessor plans to such plan, the

"Predecessor Plans").

The purpose of the Plan is

to enable the Company to attract and retain highly qualified personnel who will contribute to the Company's success and to provide incentives

to Participants (defined below) that are linked directly to stockholder value and will therefore inure to the benefit of all stockholders

of the Company.

For purposes of the Plan, the following terms

shall be defined as set forth below:

"ACM" means

Arbor Commercial Mortgage, LLC, a New York limited liability company, or any successor.

"Administrator" means the Board, or if and to the extent the Board delegates the administration of the Plan to the Committee,

such Committee in accordance with Section 2 below.

"Award"

means any award under the Plan.

"Award Agreement" means, with respect to each Award, the agreement, which may be an electronic agreement, between the

Company and the Participant setting forth the terms and conditions of the Award.

"Board"

means the Board of Directors of the Company.

"Code"

means the Internal Revenue Code of 1986, as amended from time to time, or any successor thereto.

"Committee" means a committee of the Board, which shall consist of two or more individuals, each of whom shall

qualify as (i) a “nonemployee director” within the meaning of Rule 16b-3 and (ii) an “independent director”

within the meaning of the New York Stock Exchange Listed Company Manual. If at any time or to any extent the Board shall delegate the

administration of the Plan to the Committee, then the functions of the Board specified in the Plan shall be exercised by the Committee.

"Common Stock" means the common stock, par value $0.01 per share, of the Company.

"Company"

means Arbor Realty Trust, Inc., a Maryland corporation (or any successor corporation).

"Disability" means the inability of a Participant to perform substantially his or her duties and responsibilities to

the Company or to any Parent or Subsidiary by reason of a physical or mental disability or infirmity (i) for a continuous period

of six months, or (ii) at such earlier time as the Participant submits medical evidence satisfactory to the Administrator that the

Participant has a physical or mental disability or infirmity that will likely prevent the Participant from returning to the performance

of the Participant's work duties for six months or longer. The date of such Disability shall be the last day of such six-month period

or the day on which the Participant submits such satisfactory medical evidence, as the case may be.

"Eligible

Recipient" means an officer, director, employee, consultant (including employees of ACM who

provide services to the Company) or advisor of the Company or of any Parent or Subsidiary.

"Exercise Price" means the per share price, if any, at which a holder of an Option may purchase the Shares issuable

upon exercise of the Option.

"Fair Market Value" as of a particular date shall mean the fair market value of a share of Common Stock as determined

by the Administrator in its sole discretion in accordance with Section 409A of the Code; provided, however, that (i) if

the Common Stock is admitted to trading on a national securities exchange, fair market value of a share of Common Stock on any date shall

be the average of the open and closing sale prices reported for such share on such exchange on such date or, if no sale was reported

on such date, on the last date preceding such date on which a sale was reported, (ii) if the Common Stock is admitted to quotation

on the National Association of Securities Dealers Automated Quotation ("Nasdaq") System or other comparable quotation system

and has been designated as a National Market System ("NMS") security, fair market value of a share of Common Stock on any date

shall be the average of the open and closing sale prices reported for such share on such system on such date or, if no sale was reported

on such date, on the last date preceding such date on which a sale was reported, or (iii) if the Common Stock is admitted to quotation

on the Nasdaq System but has not been designated as an NMS security, fair market value of a share of Common Stock on any date shall be

the average of the highest bid and lowest asked prices of such share on such system on such date or, if no bid and ask prices were reported

on such date, on the last date preceding such date on which both bid and ask prices were reported.

"Incentive Stock

Option" means any Option intended to be designated as an "incentive stock option"

within the meaning of Section 422 of the Code.

"Nonqualified Stock

Option" means any Option that is not an Incentive Stock Option, including any Option

that provides (as of the time such Option is granted) that it will not be treated as an Incentive Stock Option.

"Option"

means an option to purchase Shares granted pursuant to Section 6 below.

"Parent"

means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations

in the chain (other than the Company) owns stock possessing 50% or more of the combined voting power of all classes of stock in one of

the other corporations in the chain.

"Participant" means any Eligible Recipient selected by the Administrator, pursuant to the Administrator's authority

in Section 2 below, to receive grants of Options and/or awards of Restricted Stock.

"Restricted Stock" means Shares subject to certain restrictions granted pursuant to Section 7 below.

“Restricted Stock

Unit” means a contractual right to receive Shares (or its then Fair Market Value in cash) in the future, subject to the satisfaction

of vesting conditions.

"Shares"

means shares of Common Stock reserved for issuance under the Plan, as adjusted pursuant to Sections 3 and 4, and any successor security.

"Subsidiary" means any corporation (other than the Company) in an unbroken chain of corporations beginning with the

Company, if each of the corporations (other than the last corporation) in the unbroken chain owns stock possessing 50% or more of the

total combined voting power of all classes of stock in one of the other corporations in the chain.

Section 2. Administration.

The Plan shall be administered

by the Board or, at the Board's sole discretion, by the Committee, which shall be appointed by the Board, and which shall serve at the

pleasure of the Board. Pursuant to the terms of the Plan, the Administrator shall have the power and authority:

to

select those Eligible Recipients who shall be Participants;

to determine whether and

to what extent Options or awards of Restricted Stock or Restricted Stock Units are to be granted hereunder to Participants;

to determine the number of

Shares to be covered by each Award granted hereunder;

to determine the terms and

conditions, not inconsistent with the terms of the Plan, of each Award granted hereunder; and

to determine the terms and

conditions, not inconsistent with the terms of the Plan, which shall govern all written instruments evidencing Options or awards of Restricted

Stock or Restricted Stock Units granted hereunder.

The Administrator shall have

the authority, in its sole discretion, to adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan

as it shall from time to time deem advisable; to interpret the terms and provisions of the Plan and any Award issued under the Plan (and

any Award Agreement relating thereto); and to otherwise supervise the administration of the Plan.

All decisions made by the

Administrator pursuant to the provisions of the Plan shall be final, conclusive and binding on all persons, including the Company and

the Participants.

Section 3. Shares

Subject to Plan.

The total number of shares

of Common Stock reserved and available for issuance under the Plan (net of shares of Common Stock issued pursuant to awards made under

the Predecessor Plans and shares of Common Stock subject to Awards outstanding under the Predecessor Plans as of the Effective Date (as

defined Section 11)) shall be 17,000,000 shares, all of which may be granted in respect of Incentive Stock Options. Such shares

may consist, in whole or in part, of authorized and unissued shares or treasury shares.

To the extent that (i) any

Option terminates or expires without exercise of the Option, or (ii) any Award of Restricted Stock or Restricted Stock Units is

forfeited, cancelled or otherwise fails to vest (including any Option or Award of Restricted Stock or Restricted Stock Units made under

the Predecessor Plans), the Shares subject to such terminated, expired or forfeited Award shall again be available for issuance in connection

with future Awards granted under the Plan.

Section 4. Corporate

Transactions.

In the event of any merger,

reorganization, consolidation, recapitalization, spin-off, combination, stock repurchase, stock split, reverse stock split, stock dividend,

extraordinary dividend, or other change in corporate structure affecting the Common Stock, an equitable substitution or proportionate

adjustment shall be made in (i) the aggregate number of Shares reserved for issuance under the Plan, (ii) the kind, number

and Exercise Price (if applicable) of Shares subject to outstanding Options or Restricted Stock Units granted under the Plan, (iii) the

kind, number and purchase price of Shares subject to outstanding awards of Restricted Stock granted under the Plan and (iv) the

limitation set forth in Section 6(i), in each case as may be determined by the Administrator, in its sole discretion. Such other

substitutions or adjustments shall be made as may be determined by the Administrator, in its sole discretion. In connection with any

event described in this paragraph, the Administrator may provide, in its sole discretion, for the cancellation of any outstanding awards

and payment in cash or other property therefor.

Section 5. Eligibility.

Eligible Recipients may be

granted Options and/or awards of Restricted Stock or Restricted Stock Units. The Participants under the Plan shall be selected from time

to time by the Administrator, in its sole discretion, from among the Eligible Recipients.

The Administrator shall have

the authority to grant to any Eligible Recipient who is an employee of the Company or of any Parent or Subsidiary (including directors

who are also officers of the Company) Incentive Stock Options, Nonqualified Stock Options, or both types of Options, and/or Restricted

Stock or Restricted Stock Units. Non-employee Directors of the Company or of any Parent or Subsidiary, consultants (including employees

of ACM) or advisors who are not also employees of the Company or of any Parent or Subsidiary may only be granted Options that are Nonqualified

Stock Options and/or Restricted Stock or Restricted Stock Units.

Section 6. Options.

Options may be granted alone

or in addition to other awards of Restricted Stock or Restricted Stock Units granted under the Plan. Any Option granted under the Plan

shall be in such form as the Administrator may from time to time approve, and the provisions of each Option need not be the same with

respect to each Participant. Participants who are granted Options shall enter into an Award Agreement with the Company, in such form

as the Administrator shall determine, which Award Agreement shall set forth, among other things, the Exercise Price of the Option, the

term of the Option and provisions regarding exercisability of the Option granted thereunder.

The Options granted under

the Plan may be of two types: (i) Incentive Stock Options and (ii) Nonqualified Stock Options. To the extent that any Option

does not qualify as an Incentive Stock Option, it shall constitute a separate Nonqualified Stock Option. More than one Option may be

granted to the same Participant and be outstanding concurrently hereunder.

Options granted under the

Plan shall be subject to the following terms and conditions and shall contain such additional terms and conditions, not inconsistent

with the terms of the Plan, as the Administrator shall deem desirable:

Option

Exercise Price. The per share Exercise Price of Shares purchasable under an Option shall be determined by the Administrator

in its sole discretion at the time of grant but shall not, (i) in the case of Incentive Stock Options, be less than 100% of the

Fair Market Value of the Common Stock on such date (110% of the Fair Market Value per Share on such date if, on such date, the Eligible

Recipient owns (or is deemed to own under Section 424(d) of the Code) stock possessing more than ten percent of the total combined

voting power of all classes of stock of the Company, or any Parent or Subsidiary), and (ii) in the case of Nonqualified Stock Options,

be less than 100% of the Fair Market Value of the Common Stock on such date.

Option

Term. The term of each Option shall be fixed by the Administrator, but no Option shall be exercisable more than ten years

after the date such Option is granted; provided, however, that if an employee owns or is deemed to own (by reason of the

attribution rules of Section 424(d) of the Code) more than 10% of the combined voting power of all classes of stock of

the Company or of any Parent or Subsidiary and an Incentive Stock Option is granted to such employee, the term of such Incentive Stock

Option (to the extent required by the Code at the time of grant) shall be no more than five years from the date of grant.

Exercisability.

Options shall be exercisable at such time or times and subject to such terms and conditions as shall be determined by the Administrator

at or after the time of grant. The Administrator may also provide that any Option shall be exercisable only in installments, and the

Administrator may waive such installment exercise provisions at any time, in whole or in part, based on such factors as the Administrator

may determine, in its sole discretion.

Method

of Exercise. Subject to Section 6(c), Options may be exercised in whole or in part at any time during the Option period,

by giving written notice of exercise to the Company specifying the number of Shares to be purchased, accompanied by (i) payment

in full of the aggregate Exercise Price of the Shares so purchased in cash, (ii) delivery of outstanding shares of Common Stock

with a Fair Market Value on the date of exercise equal to the aggregate Exercise Price payable with respect to the Options' exercise;

(iii) simultaneous sale through a broker reasonably acceptable to the Administrator of Shares acquired on exercise, as permitted

under Regulation T of the Federal Reserve Board or (iv) payment of the Exercise Price through such other method as the Administrator

may authorize from time to time in its sole discretion.

In the event a grantee elects

to pay the Exercise Price payable with respect to an Option pursuant to clause (ii) above: (A) only a whole number of share(s) of

Common Stock (and not fractional shares of Common Stock) may be tendered in payment, (B) such grantee must present evidence acceptable

to the Company that he or she has owned any such shares of Common Stock tendered in payment of the Exercise Price (and that such tendered

shares of Common Stock have not been subject to any substantial risk of forfeiture) for at least six months prior to the date of exercise,

and (C) Common Stock must be delivered to the Company. Delivery for this purpose may, at the election of the grantee, be made either

by (i) physical delivery of the certificate(s) for all such shares of Common Stock tendered in payment of the Exercise Price,

accompanied by duly executed instruments of transfer in a form acceptable to the Company, or (ii) direction to the grantee's broker

to transfer, by book entry, of such shares of Common Stock from a brokerage account of the grantee to a brokerage account specified by

the Company. When payment of the Exercise Price is made by delivery of Common Stock, the difference, if any, between the aggregate Exercise

Price payable with respect to the Option being exercised and the Fair Market Value of the shares of Common Stock tendered in payment

(plus any applicable taxes) shall be paid in cash. No grantee may tender shares of Common Stock having a Fair Market Value exceeding

the aggregate Exercise Price payable with respect to the Option being exercised (plus any applicable taxes).

Non-Transferability

of Options. Except as otherwise provided by the Administrator or in the Award Agreement, Options may not be sold, pledged,

assigned, hypothecated, transferred, or disposed of in any manner other than by will or by the laws of descent or distribution.

Termination

of Employment or Service. The rights of Participants granted Options upon termination of employment or service as a director,

consultant or advisor to the Company or to any Parent or Subsidiary for any reason prior to the exercise of such Options shall be set

forth in the Award Agreement governing such Options.

Annual

Limit on Incentive Stock Options. To the extent that the aggregate Fair Market Value (determined as of the date the Incentive

Stock Option is granted) of Shares with respect to which Incentive Stock Options granted to a Participant under this Plan and all other

option plans of the Company or of any Parent or Subsidiary become exercisable for the first time by the Participant during any calendar

year exceeds $100,000 (as determined in accordance with Section 422(d) of the Code), the portion of such Incentive Stock Options

in excess of $100,000 shall be treated as Nonqualified Stock Options.

Rights

as Stockholder. An Optionee shall have no rights to dividends or any other rights of a stockholder with respect to the Shares

subject to the Option until the Optionee has given written notice of exercise, has paid in full for such Shares, has satisfied the requirements

of Section 10(d) hereof and, if requested, has given the representation described in Section 10(b) hereof.

Annual

Limitation. No Eligible Recipient will be granted Options for more than 250,000 shares of Common Stock during any single calendar

year.

No

Repricing. Other than with respect to an adjustment described in Section 4, in no event shall the Exercise Price of an

Option be reduced following the grant of an Option, nor shall an Option be cancelled in exchange for a replacement Option with a lower

exercise price or in exchange for another type of Award or cash payment without approval of the Company's stockholders.

Section 7. Restricted

Stock; Unrestricted Stock; Restricted Stock Units.

Awards of Restricted Stock

may be issued either alone or in addition to Options or Restricted Stock Units granted under the Plan. The Administrator shall determine

the Eligible Recipients to whom, and the time or times at which, awards of Restricted Stock shall be made; the number of Shares to be

awarded; the price, if any, to be paid by the Participant for the acquisition of Restricted Stock; and the Restricted Period (as defined

in Section 7(b)), if any, applicable to awards of Restricted Stock. The Administrator may also condition the grant of the award

of Restricted Stock upon the exercise of Options or upon such other criteria as the Administrator may determine, in its sole discretion.

The provisions of the awards of Restricted Stock need not be the same with respect to each Participant.

Awards

and Certificates. The prospective recipient of awards of Restricted Stock shall not have any rights with respect to any such

Award, unless and until such recipient has executed an Award Agreement evidencing the Award (a "Restricted Stock Award Agreement")

and delivered a fully executed copy thereof to the Company, which may be delivered electronically, within a period of sixty days (or

such other period as the Administrator may specify) after the award date. Except as otherwise provided below in Section 7(b), each

Participant who is granted an award of Restricted Stock shall be issued a stock certificate in respect of such shares of Restricted Stock,

which certificate shall be registered in the name of the Participant and shall bear an appropriate legend referring to the terms, conditions,

and restrictions applicable to any such Award. Awards may also be documented via book entry, in which case the applicable restrictions

will be indicated with respect to such book entry.

The

Company may require that the stock certificates evidencing Restricted Stock granted hereunder, if any, be held in the custody of the

Company until the restrictions thereon shall have lapsed, and that, as a condition of any award of Restricted Stock, the Participant

shall have delivered a stock power, endorsed in blank, relating to the Shares covered by such Award.

Restrictions

and Conditions. The awards of Restricted Stock granted pursuant to this Section 7 shall be subject to the following restrictions

and conditions:

Subject to the provisions

of the Plan and the Restricted Stock Award Agreement governing any such Award, during such period, if any, as may be set by the Administrator

commencing on the date of grant (the "Restricted Period"), the Participant shall not be permitted to sell, transfer, pledge

or assign shares of Restricted Stock awarded under the Plan; provided, however, that the Administrator may, in its sole

discretion, provide for the lapse of such restrictions in installments and may accelerate or waive such restrictions in whole or in part

based on such factors and such circumstances as the Administrator may determine, in its sole discretion.

Except as provided in Section 7(b)(i),

the Participant shall generally have the rights of a stockholder of the Company with respect to Restricted Stock during the Restricted

Period. Certificates for unrestricted Shares shall be delivered to the Participant promptly after, and only after, the Restricted Period

shall expire without forfeiture in respect of such awards of Restricted Stock except as the Administrator, in its sole discretion, shall

otherwise determine.

The rights of Participants

granted awards of Restricted Stock upon termination of employment or service as a director, consultant or advisor to the Company or to

any Parent or Subsidiary for any reason during the Restricted Period shall be set forth in the Restricted Stock Award Agreement governing

such Awards.

Unrestricted

Shares. Awards of unrestricted (fully vested) Shares may also be made under the Plan, in the discretion of the Administrator.

Restricted

Stock Units. The Administrator shall have the authority to determine the Eligible Recipients to whom Restricted Stock Units

shall be granted, the number of Restricted Stock Units to be granted to each such Participant, the conditions under which the Restricted

Stock Units may become vested or forfeited and such other terms and conditions, as the Administrator may determine, that are not inconsistent

with the provisions of the Plan. Payment with respect to Restricted Stock Units shall be made in cash, in Shares, or in a combination

of cash and Shares, as determined by the Administrator. A Participant shall have no rights to dividends or any other rights of a stockholder

with respect to the Shares subject to Restricted Stock Units until the Shares subject thereto have been issued to the Participant.

Section 8. Amendment

and Termination.

The Board may amend, alter

or discontinue the Plan, but no amendment, alteration, or discontinuation shall be made that would impair the rights of a Participant

under any Award theretofore granted without such Participant's consent. The Board shall obtain approval of the Company's stockholders

for an amendment to the extent such approval is required in order to comply with applicable law or stock exchange listing requirement.

The Administrator may amend

the terms of any Award theretofore granted, prospectively or retroactively, but, subject to Section 4 of the Plan, no such amendment

shall impair the rights of any Participant without his or her consent.

Section 9. Unfunded

Status of Plan.

The Plan is intended to constitute

an "unfunded" plan for incentive compensation. With respect to any payments not yet made to a Participant by the Company, nothing

contained herein shall give any such Participant any rights that are greater than those of a general creditor of the Company.

Section 10. General

Provisions.

Shares

shall not be issued pursuant to any Award granted hereunder unless such Award and the issuance and delivery of such Shares pursuant thereto

shall comply with all relevant provisions of law, including, without limitation, the Securities Act of 1933, as amended, the Securities

Exchange Act of 1934, as amended, and the requirements of any stock exchange upon which the Common Stock may then be listed, and shall

be further subject to the approval of counsel for the Company with respect to such compliance.

The Administrator may require

each person acquiring Shares to represent to and agree with the Company in writing that such person is acquiring the Shares without a

view to distribution thereof. The certificates for such Shares may include any legend which the Administrator deems appropriate to reflect

any restrictions on transfer.

All certificates for Shares

delivered under the Plan shall be subject to such stock-transfer orders and other restrictions as the Administrator may deem advisable

under the rules, regulations, and other requirements of the Securities and Exchange Commission, any stock exchange upon which the Common

Stock is then listed, and any applicable Federal or state securities law, and the Administrator may cause a legend or legends to be placed

on any such certificates to make appropriate reference to such restrictions. Corresponding restrictions may be applied to Shares evidenced

via book entry.

Nothing contained in the

Plan shall prevent the Board from adopting other or additional compensation arrangements, subject to stockholder approval, if such approval

is required; and such arrangements may be either generally applicable or applicable only in specific cases. The adoption of the Plan

shall not confer upon any Eligible Recipient any right to continued employment or service with the Company or any Parent or Subsidiary,

as the case may be, nor shall it interfere in any way with the right of the Company or any Parent or Subsidiary to terminate the employment

or service of any of its Eligible Recipients at any time.

Any delivery of Shares hereunder

shall be subject to the satisfaction by the Participant of applicable withholding requirements. Unless otherwise determined by the Administrator,

a Participant may elect to deliver shares of Common Stock (or have the Company withhold shares) to satisfy, in whole or in part, the

amount the Company is required to withhold for taxes in connection with the exercise of an Option or the delivery of Restricted Stock

or Restricted Stock Units upon grant or vesting, as the case may be. Once made, the election shall be irrevocable. The fair market value

of the Shares to be withheld or delivered will be the Fair Market Value as of the date the amount of tax to be withheld is determined.

In the event a Participant elects to deliver Shares of Common Stock pursuant to this Section 10(d), such delivery must be made subject

to the conditions and pursuant to the procedures set forth in Section 6(d) with respect to the delivery of Common Stock in

payment of the Exercise Price of Options.

No member of the Board or

the Administrator, nor any officer or employee of the Company acting on behalf of the Board or the Administrator, shall be personally

liable for any action, determination, or interpretation taken or made in good faith with respect to the Plan, and all members of the

Board or the Administrator and each and any officer or employee of the Company acting on their behalf shall, to the extent permitted

by law, be fully indemnified and protected by the Company in respect of any such action, determination or interpretation.

Awards made under the Plan

shall be subject to the Arbor Realty Trust, Inc. Clawback Policy (the “Clawback Policy”), as in effect from time to

time and recipients of Awards shall be deemed to have consented and agreed to the application of the Clawback Policy.

Section 11. Effective

Date of Plan.

The Plan has been adopted

and approved by the Board and shall become effective as of May 22, 2024 (the "Effective Date"), subject to the approval

of the stockholders of the Company.

Section 12. Term

of Plan.

No Award shall be granted

pursuant to the Plan on or after the tenth anniversary of the Effective Date, but Awards theretofore granted may extend beyond that date.

Section 13. Governing

Law.

This Plan and all questions

relating to its validity, interpretation, performance and enforcement shall be governed by and construed, interpreted and enforced in

accordance with the laws of the State of New York, notwithstanding any New York or other conflict-of-law provisions to the contrary.

Exhibit 23.1

Consent

of Independent Registered Public Accounting Firm

We

consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2024

Amended Omnibus Stock Incentive Plan of Arbor Realty Trust, Inc. of our reports dated February 20, 2024, with respect to the

consolidated financial statements and schedule of Arbor Realty Trust, Inc. and Subsidiaries and the effectiveness of internal control

over financial reporting of Arbor Realty Trust, Inc. and Subsidiaries included in its Annual Report (Form 10-K) for the year

ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/

Ernst & Young LLP

New

York, New York

May 23,

2024

Exhibit 23.2

Consent

of Independent Registered Public Accounting Firm

We

consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2024 Amended Omnibus Stock Incentive

Plan of Arbor Realty Trust, Inc. of our report dated February 14, 2022, with respect to the consolidated financial statements

of Wakefield Investment Holdings LLC for the year ended December 31, 2021, which is included in the Annual Report (Form 10-K)

of Arbor Realty Trust, Inc. and Subsidiaries for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/

Richey, May & Co. LLP

Englewood,

Colorado

May 23,

2024

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Arbor Realty Trust, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security

Type |

Security

Class

Title |

Fee

Calculation

Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee

Rate |

Amount of

Registration

Fee |

|

Equity |

Common stock, par value $0.01 per share |

457(c); 457(h) |

6,217,547 |

$13.63(2) |

$84,745,165.61 |

0.0001476 |

$12,508.39 |

|

Total Offering Amounts |

|

$84,745,165.61 |

|

$12,508.39 |

|

Total Fee Offsets(3) |

|

|

|

- |

|

Net Fee Due |

|

|

|

$12,508.39 |

|

(1) |

Represents the number of shares of common stock, par value $0.01 per

share (“Common Stock”) of Arbor Realty Trust, Inc. (the “Company”), available for future issuance under the Arbor

Realty Trust, Inc. 2024 Amended Omnibus Stock Incentive Plan (the “Plan”). Pursuant to Rule 416(a) promulgated under the Securities

Act of 1933, as amended (the “Securities Act”), this registration statement also covers additional shares that may become

issuable under the Plan by reason of certain corporate transactions or events, including any stock dividend, stock split, recapitalization

or any other similar transaction effected without the receipt of consideration which results in an increase in the number of the Company’s

outstanding shares of Common Stock. |

|

(2) |

Determined on the basis of the average of the high and low prices per

share of Common Stock as reported on the New York Stock Exchange on May 22, 2024, a date within five business days prior to the filing

of this registration statement, of $13.78 and $13.48, respectively, solely for the purpose of calculating the registration fee pursuant

to Rules 457(c) and 457(h) under the Securities Act. |

|

(3) |

The Company does not have any fee offsets. |

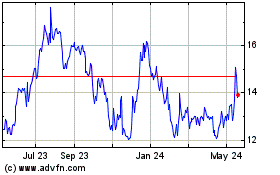

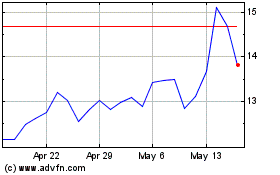

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Nov 2023 to Nov 2024