Accel Entertainment, Inc. (NYSE: ACEL) today announced certain

financial and operating results for the third quarter ended

September 30, 2024.

Highlights:

- Ended Q3 2024 with 4,014 locations; an increase of 2.8%

compared to Q3 2023

- Ended Q3 2024 with 25,729 gaming terminals; an increase of 4.1%

compared to Q3 2023

- Record revenues of $302.2 million for Q3 2024; an increase of

5.1% compared to Q3 2023

- Net income of $4.9 million for Q3 2024; a decrease of 53.2%

compared to Q3 2023 partially attributable to a higher loss on the

change in fair value of the contingent earnout shares

- Adjusted EBITDA of $45.9 million for Q3 2024; an increase of

3.9% compared to Q3 2023

- Q3 2024 ended with $289 million of net debt; an increase of

2.4% compared to Q3 2023

- Repurchased approximately $6.2 million of Accel Class A-1

common stock in Q3 2024

- Acquisition of a distributed gaming operator in the state of

Louisiana expected to close in Q4 2024

- Acquisition of the FanDuel Sportsbook & Horse Racing in

Collinsville, Illinois, expected to close in Q4 2024

Accel CEO Andy Rubenstein commented, “I am happy to report that

we delivered another strong quarter and are making substantial

progress closing our acquisition of FanDuel Sportsbook & Horse

Racing, a natural extension of our convenient, local gaming

platform. We continue to outperform casinos in our largest market,

Illinois, and posted significant revenue increases in our fastest

growing market, Nebraska. By strengthening our core and expanding

our offerings, we believe we can continue to generate attractive

low-teens returns on capital and improve our trading multiples,

making Accel a compelling investment opportunity.”

Condensed Consolidated Statements of

Operations and Other Data

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in thousands)

2024

2023

2024

2023

Total net revenues

$

302,227

$

287,497

$

913,457

$

873,352

Operating income

21,845

25,120

70,087

81,956

Income before income tax expense

8,464

15,080

39,166

46,347

Net income

4,895

10,450

26,897

29,615

Other Financial Data:

Adjusted EBITDA(1)

45,880

44,138

141,792

136,869

Adjusted net income (2)

18,350

19,067

59,238

60,566

(1)

Adjusted EBITDA is a non-GAAP metric. See "Non-GAAP Financial

Measures" for a reconciliation to GAAP.

(2)

Adjusted net income is a non-GAAP metric. See "Non-GAAP

Financial Measures" for a reconciliation to GAAP.

Net Revenues

(in thousands)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenues by state:

Illinois

$

223,338

$

212,113

$

675,294

$

647,903

Montana

39,648

39,362

120,372

115,088

Nevada

28,350

28,003

86,881

87,833

Nebraska

6,538

4,802

18,621

13,213

Other

4,353

3,217

12,289

9,315

Total net revenues

$

302,227

$

287,497

$

913,457

$

873,352

Key Business Metrics

Locations (1)

As of September 30,

Increase / (Decrease)

2024

2023

Change

Change (%)

Illinois

2,791

2,724

67

2.5%

Montana

615

611

4

0.7%

Nevada

356

352

4

1.1%

Nebraska

252

219

33

15.1%

Total locations

4,014

3,906

108

2.8%

Gaming terminals (1)

As of September 30,

Increase / (Decrease)

2024

2023

Change

Change (%)

Illinois

15,714

15,020

694

4.6

%

Montana

6,448

6,252

196

3.1

%

Nevada

2,685

2,744

(59

)

(2.2

)%

Nebraska

882

688

194

28.2

%

Total gaming terminals

25,729

24,704

1,025

4.1

%

Location hold-per-day (2)

Three Months Ended September

30,

Increase / (Decrease)

2024

2023

Change ($)

Change (%)

Illinois

$

839

$

825

$

14

1.7

%

Montana

613

591

22

3.7

%

Nevada

802

802

—

—

%

Nebraska

257

220

37

16.8

%

Nine Months Ended

September 30,

Increase / (Decrease)

2024

2023

Change ($)

Change (%)

Illinois

$

859

$

854

$

5

0.6

%

Montana

608

579

29

5.1

%

Nevada

835

849

(14

)

(1.6

)%

Nebraska

244

228

16

7.0

%

(1)

Based on a combination of third-party portal data and data from

our internal systems. This metric is utilized by Accel to

continually monitor growth from existing locations, organic

openings, acquired locations, and competitor conversions.

(2)

Location hold-per-day is calculated by dividing net gaming

revenue in the period by the average number of locations. We then

divide the calculated amount by the number of operational days. We

utilize this metric to compare market and location performance on a

normalized basis. The percent change in location hold-per-day is

the underlying metric used to determine the change in same-store

sales.

Condensed Consolidated Statements of

Cash Flows Data

Nine Months Ended

September 30,

Increase / (Decrease)

(in thousands)

2024

2023

Change ($)

Change (%)

Net cash provided by operating

activities

$

107,665

$

92,007

$

15,658

17.0

%

Net cash used in investing activities

(90,224

)

(35,404

)

(54,820

)

(154.8

)%

Net cash used in financing activities

(13,967

)

(50,328

)

36,361

72.2

%

Non-GAAP Financial

Measures

Adjusted net income is defined as net income plus:

- Amortization of intangible assets and route and customer

acquisition costs

- Stock-based compensation expense

- Loss from unconsolidated affiliates

- Loss on change in fair value of contingent earnout shares

- Other expenses, net which consists of (i) non-cash expenses

including the remeasurement of contingent consideration

liabilities, (ii) non-recurring lobbying and legal expenses related

to distributed gaming expansion in current or prospective markets,

and (iii) other non-recurring expenses

- Tax effect of adjustments

Adjusted EBITDA is defined as net income plus:

- Amortization of intangible assets and route and customer

acquisition costs

- Stock-based compensation expense

- Loss from unconsolidated affiliates

- Loss on change in fair value of contingent earnout shares

- Other expenses, net

- Tax effect of adjustments

- Depreciation and amortization of property and equipment

- Interest expense, net

- Emerging markets, which reflects the results, on an Adjusted

EBITDA basis, for non-core jurisdictions where our operations are

developing

- Markets are no longer considered emerging when we have

installed or acquired at least 500 gaming terminals in the

jurisdiction, or when 24 months have elapsed from the date we first

install or acquire gaming terminals in the jurisdiction, whichever

occurs first

- We currently view Pennsylvania as an emerging market

- Prior to January 2024, Iowa was considered an emerging

market

- Prior to April 2023, Nebraska was considered an emerging

market

- Income tax expense

Net debt is defined as debt, net of current maturities

plus:

- Current maturities of debt

- less Cash and cash equivalents

Adjusted net income and Adjusted EBITDA

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in thousands)

2024

2023

2024

2023

Net income

$

4,895

$

10,450

$

26,897

$

29,615

Adjustments:

Amortization of intangible assets and

route and customer acquisition costs

5,781

5,299

16,808

15,825

Stock-based compensation expense

3,342

2,718

8,927

6,973

Loss from unconsolidated affiliates

1

—

1

—

Loss on change in fair value of contingent

earnout shares

4,216

1,625

4,190

11,063

Other expenses, net

3,867

1,682

13,620

5,006

Tax effect of adjustments

(3,752

)

(2,707

)

(11,205

)

(7,916

)

Adjusted net income

18,350

19,067

59,238

60,566

Depreciation and amortization of property

and equipment

11,001

9,405

32,229

27,914

Interest expense, net

9,164

8,415

26,730

24,546

Emerging markets

43

(86

)

121

(805

)

Income tax expense

7,322

7,337

23,474

24,648

Adjusted EBITDA

$

45,880

$

44,138

$

141,792

$

136,869

Net Debt

As of September 30,

(in thousands)

2024

2023

Debt, net of current maturities

$

525,572

$

484,004

Plus: Current maturities of debt

28,490

28,479

Less: Cash and cash equivalents

(265,085

)

(230,388

)

Net debt

$

288,977

$

282,095

Conference Call

Accel will host an investor conference call on October 30, 2024

at 4:30 p.m. Central time (5:30 p.m. Eastern time) to discuss these

financial and operating results. Interested parties may join the

live webcast by registering at

https://www.netroadshow.com/events/login?show=a8e678a0&confId=71436

or accessing the webcast via the company’s investor relations

website: ir.accelentertainment.com. Following completion of the

call, a replay of the webcast will be posted on Accel’s investor

relations website.

About Accel

Accel is a leading distributed gaming operator in the United

States and a preferred partner for local business owners in the

markets it serves. Accel offers turnkey full-service gaming

solutions to authorized non-casino locations such as bars,

restaurants, convenience stores, truck stops, and fraternal and

veteran establishments across the country. Accel installs,

maintains, operates and services gaming terminals and related

equipment for its location partners as well as redemption devices,

stand-alone ATMs and amusement devices, including jukeboxes,

dartboards, pool tables, and other entertainment related equipment.

Accel also designs and manufactures gaming terminals and related

equipment.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact,

contained in this press release are forward-looking statements,

including, but not limited to, any statements regarding our

estimates of number of gaming terminals, locations, revenues,

Adjusted EBITDA and capital expenditures, our ability to continue

to generate returns on capital and improve our trading multiples,

and our proposed acquisition of Fairmount Holdings, Inc. The words

“predict,” “estimated,” “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,”

“continue,” and similar expressions or the negatives thereof are

intended to identify forward-looking statements. These

forward-looking statements represent our current reasonable

expectations and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance and

achievements, or industry results, to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements. We cannot guarantee the

accuracy of the forward-looking statements, and you should be aware

that results and events could differ materially and adversely from

those contained in the forward-looking statements due to a number

of factors including, but not limited to: Accel’s ability to

operate in existing markets or expand into new jurisdictions;

Accel’s ability to offer new and innovative products and services

that fulfill the needs of location partners and create strong and

sustained player appeal; Accel’s dependence on relationships with

key manufacturers, developers and third parties to obtain gaming

terminals, amusement machines, and related supplies, programs, and

technologies for its business on acceptable terms; the negative

impact on Accel’s future results of operations by the slow growth

in demand for gaming terminals and by the slow growth of new gaming

jurisdictions; Accel’s heavy dependency on its ability to win,

maintain and renew contracts with location partners; the parties'

ability to satisfy the conditions to the consummation of the

proposed acquisition of Fairmount Holdings, Inc. and the risk that

the proposed acquisition may not be completed in a timely manner or

at all; unfavorable macroeconomic conditions or decreased

discretionary spending due to other factors such as interest rate

volatility, persistent inflation, actual or perceived instability

in the U.S. and global banking systems, high fuel rates,

recessions, epidemics or other public health issues, terrorist

activity or threat thereof, civil unrest or other macroeconomic or

political uncertainties, that could adversely affect Accel’s

business, results of operations, cash flows and financial

conditions and other risks and uncertainties indicated from time to

time in documents filed or to be filed with the Securities and

Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any

projections or analysis, should not be viewed as factual and should

not be relied upon as an accurate prediction of future results. The

forward-looking statements contained in this press release are

based on our current expectations and beliefs concerning future

developments and their potential effects on Accel. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control), or other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described in the section entitled “Risk

Factors” in the Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 filed by Accel with the SEC on February 28,

2024 (the "Form 10-K"), as well as Accel’s other filings with the

SEC. Except as required by law, we do not undertake publicly to

update or revise these statements, even if experience or future

changes make it clear that any projected results expressed in this

or other press releases or future quarterly reports, or company

statements will not be realized. In addition, the inclusion of any

statement in this press release does not constitute an admission by

us that the events or circumstances described in such statement are

material. We qualify all of our forward-looking statements by these

cautionary statements. In addition, the industry in which we

operate is subject to a high degree of uncertainty and risk due to

a variety of factors including those described in the section

entitled “Risk Factors” in the Form 10-K, as well as Accel’s other

filings with the SEC. These and other factors could cause our

results to differ materially from those expressed in this press

release.

Industry and Market Data

Unless otherwise indicated, information contained in this press

release concerning our industry and the markets in which we

operate, including our general expectations and market position,

market opportunity, and market size, is based on information from

various sources, on assumptions that we have made that are based on

those data and other similar sources, and on our knowledge of the

markets for our services. This information includes a number of

assumptions and limitations, and you are cautioned not to give

undue weight to such information. In addition, projections,

assumptions, and estimates of our future performance and the future

performance of the industry in which we operate are necessarily

subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the Annual Report on Form

10-K filed by Accel with the SEC, as well as Accel's other filings

with the SEC. These and other factors could cause results to differ

materially from those expressed in the estimates made by third

parties and by us.

Non-GAAP Financial Information

This press release includes certain financial information not

prepared in accordance with Generally Accepted Accounting

Principles in the United States (“GAAP”), including Adjusted

EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA,

Adjusted net income, and Net Debt are non-GAAP financial measures

and are key metrics used to monitor ongoing core operations.

Management of Accel believes Adjusted EBITDA, Adjusted net income,

and Net Debt enhance the understanding of Accel’s underlying

drivers of profitability and trends in Accel’s business and

facilitates company-to-company and period-to-period comparisons,

because these non-GAAP financial measures exclude the effects of

certain non-cash items, represents certain nonrecurring items that

are unrelated to core performance, or excludes non-core operations.

Management of Accel also believes that these non-GAAP financial

measures are used by investors, analysts and other interested

parties as measures of financial performance.

ACCEL ENTERTAINMENT,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenues:

Net gaming

$

289,923

$

274,123

$

871,300

$

831,054

Amusement

5,104

5,411

16,772

17,839

Manufacturing

1,705

3,334

9,122

9,886

ATM fees and other

5,495

4,629

16,263

14,573

Total net revenues

302,227

287,497

913,457

873,352

Operating expenses:

Cost of revenue (exclusive of depreciation

and amortization expense shown below)

210,841

198,743

633,325

604,603

Cost of manufacturing goods sold

(exclusive of depreciation and amortization expense shown

below)

962

2,065

5,283

5,627

General and administrative

47,930

45,183

142,105

132,421

Depreciation and amortization of property

and equipment

11,001

9,405

32,229

27,914

Amortization of intangible assets and

route and customer acquisition costs

5,781

5,299

16,808

15,825

Other expenses, net

3,867

1,682

13,620

5,006

Total operating expenses

280,382

262,377

843,370

791,396

Operating income

21,845

25,120

70,087

81,956

Interest expense, net

9,164

8,415

26,730

24,546

Loss from unconsolidated affiliates

1

—

1

—

Loss on change in fair value of contingent

earnout shares

4,216

1,625

4,190

11,063

Income before income tax

expense

8,464

15,080

39,166

46,347

Income tax expense

3,569

4,630

12,269

16,732

Net income

$

4,895

$

10,450

$

26,897

$

29,615

Earnings per common share:

Basic

$

0.06

$

0.12

$

0.32

$

0.34

Diluted

0.06

0.12

0.32

0.34

Weighted average number of common

shares outstanding:

Basic

82,952

85,865

83,718

86,305

Diluted

84,322

87,114

84,890

87,022

ACCEL ENTERTAINMENT,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except par value and share

amounts)

September 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

265,085

$

261,611

Accounts receivable, net

7,830

13,467

Prepaid expenses

8,168

6,287

Inventories

9,090

7,681

Interest rate caplets

5,510

8,140

Deposits

18,293

6,555

Other current assets

9,347

8,853

Total current assets

323,323

312,594

Property and equipment, net

281,917

260,813

Noncurrent assets:

Route and customer acquisition costs,

net

23,725

19,188

Location contracts acquired, net

176,793

176,311

Goodwill

102,151

101,554

Other intangible assets, net

18,715

20,542

Interest rate caplets, net of current

1,176

4,871

Other assets

22,406

17,020

Total noncurrent assets

344,966

339,486

Total assets

$

950,206

$

912,893

Liabilities and Stockholders’

Equity

Current liabilities:

Current maturities of debt

$

28,490

$

28,483

Current portion of route and customer

acquisition costs payable

2,122

1,505

Accrued location gaming expense

8,921

9,350

Accrued state gaming expense

30,503

18,364

Accounts payable and other accrued

expenses

36,462

36,012

Accrued compensation and related

expenses

10,108

12,648

Current portion of consideration

payable

2,766

3,288

Total current liabilities

119,372

109,650

Long-term liabilities:

Debt, net of current maturities

525,572

514,091

Route and customer acquisition costs

payable, less current portion

7,306

4,955

Consideration payable, less current

portion

10,882

4,201

Contingent earnout share liability

36,017

31,827

Other long-term liabilities

6,188

7,015

Deferred income tax liability, net

38,150

42,750

Total long-term liabilities

624,115

604,839

Stockholders’ equity:

Preferred Stock, par value of $0.0001;

1,000,000 shares authorized; 0 shares issued and outstanding at

September 30, 2024 and December 31, 2023

—

—

Class A-1 Common Stock, par value $0.0001;

250,000,000 shares authorized; 95,409,648 shares issued and

82,430,205 shares outstanding at September 30, 2024; 95,016,960

shares issued and 84,123,385 shares outstanding at December 31,

2023

8

8

Additional paid-in capital

210,225

203,046

Treasury stock, at cost

(133,760

)

(112,070

)

Accumulated other comprehensive income

3,865

7,936

Accumulated earnings

126,381

99,484

Total stockholders' equity

206,719

198,404

Total liabilities and stockholders'

equity

$

950,206

$

912,893

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030476384/en/

Media: Eric Bonach H/Advisors Abernathy 212-371-5999

eric.bonach@h-advisors.global

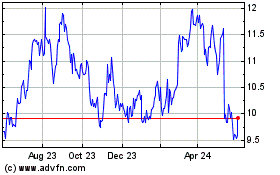

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

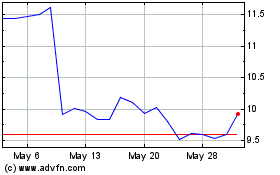

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Nov 2023 to Nov 2024