0001698991false00016989912024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

ACCEL ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-38136 | 98-1350261 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

|

| 140 Tower Drive | |

| Burr Ridge | , | Illinois | 60527 |

| (Address of principal executive offices) | (Zip Code) |

(630) 972-2235

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A-1 common stock, par value $0.0001 per share | ACEL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2024, Accel Entertainment, Inc. (the "Company") issued a press release announcing its financial and operating results for the third quarter ended September 30, 2024. Copies of the Company’s press release and investor presentation are attached and furnished herewith as Exhibits 99.1 and 99.2 to this Form 8-K and are incorporated herein by reference.

Information in this report (including Exhibits 99.1 and 99.2) furnished pursuant to Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section.

The Company announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, and the Company’s investor relations website (https:// ir.accelentertainment.com) as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ACCEL ENTERTAINMENT, INC. |

| | | |

Date: October 30, 2024 | By: | | /s/ Mathew Ellis |

| | | Mathew Ellis |

| | | Chief Financial Officer |

Accel Entertainment Announces Q3 2024 Operating Results

Chicago, IL – October 30, 2024 – Accel Entertainment, Inc. (NYSE: ACEL) today announced certain financial and operating results for the third quarter ended September 30, 2024.

Highlights:

•Ended Q3 2024 with 4,014 locations; an increase of 2.8% compared to Q3 2023

•Ended Q3 2024 with 25,729 gaming terminals; an increase of 4.1% compared to Q3 2023

•Record revenues of $302.2 million for Q3 2024; an increase of 5.1% compared to Q3 2023

•Net income of $4.9 million for Q3 2024; a decrease of 53.2% compared to Q3 2023 partially attributable to a higher loss on the change in fair value of the contingent earnout shares

•Adjusted EBITDA of $45.9 million for Q3 2024; an increase of 3.9% compared to Q3 2023

•Q3 2024 ended with $289 million of net debt; an increase of 2.4% compared to Q3 2023

•Repurchased approximately $6.2 million of Accel Class A-1 common stock in Q3 2024

•Acquisition of a distributed gaming operator in the state of Louisiana expected to close in Q4 2024

•Acquisition of the FanDuel Sportsbook & Horse Racing in Collinsville, Illinois, expected to close in Q4 2024

Accel CEO Andy Rubenstein commented, “I am happy to report that we delivered another strong quarter and are making substantial progress closing our acquisition of FanDuel Sportsbook & Horse Racing, a natural extension of our convenient, local gaming platform. We continue to outperform casinos in our largest market, Illinois, and posted significant revenue increases in our fastest growing market, Nebraska. By strengthening our core and expanding our offerings, we believe we can continue to generate attractive low-teens returns on capital and improve our trading multiples, making Accel a compelling investment opportunity.”

Condensed Consolidated Statements of Operations and Other Data

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

Total net revenues | $ | 302,227 | | | $ | 287,497 | | | $ | 913,457 | | | $ | 873,352 | |

| Operating income | 21,845 | | | 25,120 | | | 70,087 | | | 81,956 | |

| Income before income tax expense | 8,464 | | | 15,080 | | | 39,166 | | | 46,347 | |

| Net income | 4,895 | | | 10,450 | | | 26,897 | | | 29,615 | |

| Other Financial Data: | | | | | | | |

Adjusted EBITDA(1) | 45,880 | | | 44,138 | | | 141,792 | | | 136,869 | |

Adjusted net income (2) | 18,350 | | | 19,067 | | | 59,238 | | | 60,566 | |

(1)Adjusted EBITDA is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to GAAP.

(2)Adjusted net income is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to GAAP.

Net Revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Three Months Ended

September 30, | | | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Net revenues by state: | | | | | | | | | | | |

| Illinois | $ | 223,338 | | | $ | 212,113 | | | | | | | $ | 675,294 | | | $ | 647,903 | |

| Montana | 39,648 | | | 39,362 | | | | | | | 120,372 | | | 115,088 | |

| Nevada | 28,350 | | | 28,003 | | | | | | | 86,881 | | | 87,833 | |

| Nebraska | 6,538 | | | 4,802 | | | | | | | 18,621 | | | 13,213 | |

| Other | 4,353 | | | 3,217 | | | | | | | 12,289 | | | 9,315 | |

| Total net revenues | $ | 302,227 | | | $ | 287,497 | | | | | | | $ | 913,457 | | | $ | 873,352 | |

Key Business Metrics

| | | | | | | | | | | | | | | | | | | | | | | |

Locations (1) | As of September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | Change | | Change (%) |

| Illinois | 2,791 | | | 2,724 | | | 67 | | | 2.5 | % |

| Montana | 615 | | | 611 | | | 4 | | | 0.7 | % |

| Nevada | 356 | | | 352 | | | 4 | | | 1.1 | % |

| Nebraska | 252 | | | 219 | | | 33 | | | 15.1 | % |

| Total locations | 4,014 | | | 3,906 | | | 108 | | | 2.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Gaming terminals (1) | As of September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | Change | | Change (%) |

| Illinois | 15,714 | | | 15,020 | | | 694 | | | 4.6 | % |

| Montana | 6,448 | | | 6,252 | | | 196 | | | 3.1 | % |

| Nevada | 2,685 | | | 2,744 | | | (59) | | | (2.2) | % |

| Nebraska | 882 | | | 688 | | | 194 | | | 28.2 | % |

| Total gaming terminals | 25,729 | | | 24,704 | | | 1,025 | | | 4.1 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Location hold-per-day (2) | Three Months Ended September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | Change ($) | | Change (%) |

| Illinois | $ | 839 | | | $ | 825 | | | $ | 14 | | | 1.7 | % |

| Montana | 613 | | | 591 | | | 22 | | | 3.7 | % |

| Nevada | 802 | | | 802 | | | — | | | — | % |

| Nebraska | 257 | | | 220 | | | 37 | | | 16.8 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | Change ($) | | Change (%) |

| Illinois | $ | 859 | | | $ | 854 | | | $ | 5 | | | 0.6 | % |

| Montana | 608 | | | 579 | | | 29 | | | 5.1 | % |

| Nevada | 835 | | | 849 | | | (14) | | | (1.6) | % |

| Nebraska | 244 | | | 228 | | | 16 | | | 7.0 | % |

| | | | | | | |

(1)Based on a combination of third-party portal data and data from our internal systems. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions.

(2)Location hold-per-day is calculated by dividing net gaming revenue in the period by the average number of locations. We then divide the calculated amount by the number of operational days. We utilize this metric to compare market and location performance on a normalized basis. The percent change in location hold-per-day is the underlying metric used to determine the change in same-store sales.

Condensed Consolidated Statements of Cash Flows Data

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, | | Increase / (Decrease) |

| (in thousands) | 2024 | | 2023 | | Change ($) | | Change (%) |

| Net cash provided by operating activities | $ | 107,665 | | | $ | 92,007 | | | $ | 15,658 | | | 17.0 | % |

| Net cash used in investing activities | (90,224) | | (35,404) | | (54,820) | | (154.8) | % |

| Net cash used in financing activities | (13,967) | | (50,328) | | 36,361 | | 72.2 | % |

Non-GAAP Financial Measures

Adjusted net income is defined as net income plus:

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•Loss from unconsolidated affiliates

•Loss on change in fair value of contingent earnout shares

•Other expenses, net which consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses

•Tax effect of adjustments

Adjusted EBITDA is defined as net income plus:

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•Loss from unconsolidated affiliates

•Loss on change in fair value of contingent earnout shares

•Other expenses, net

•Tax effect of adjustments

•Depreciation and amortization of property and equipment

•Interest expense, net

•Emerging markets, which reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing

◦Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first

◦We currently view Pennsylvania as an emerging market

◦Prior to January 2024, Iowa was considered an emerging market

◦Prior to April 2023, Nebraska was considered an emerging market

•Income tax expense

Net debt is defined as debt, net of current maturities plus:

•Current maturities of debt

•less Cash and cash equivalents

Adjusted net income and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | | Nine Months Ended

September 30, |

| (in thousands) | 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Net income | $ | 4,895 | | | $ | 10,450 | | | | | | | $ | 26,897 | | | $ | 29,615 | |

| Adjustments: | | | | | | | | | | | |

Amortization of intangible assets and route and customer acquisition costs | 5,781 | | | 5,299 | | | | | | | 16,808 | | | 15,825 | |

Stock-based compensation expense | 3,342 | | | 2,718 | | | | | | | 8,927 | | | 6,973 | |

| Loss from unconsolidated affiliates | 1 | | | — | | | | | | | 1 | | | — | |

Loss on change in fair value of contingent earnout shares | 4,216 | | | 1,625 | | | | | | | 4,190 | | | 11,063 | |

| | | | | | | | | | | |

Other expenses, net | 3,867 | | | 1,682 | | | | | | | 13,620 | | | 5,006 | |

Tax effect of adjustments | (3,752) | | | (2,707) | | | | | | | (11,205) | | | (7,916) | |

| Adjusted net income | 18,350 | | | 19,067 | | | | | | | 59,238 | | | 60,566 | |

| Depreciation and amortization of property and equipment | 11,001 | | | 9,405 | | | | | | | 32,229 | | | 27,914 | |

| Interest expense, net | 9,164 | | | 8,415 | | | | | | | 26,730 | | | 24,546 | |

Emerging markets | 43 | | | (86) | | | | | | | 121 | | | (805) | |

| Income tax expense | 7,322 | | | 7,337 | | | | | | | 23,474 | | | 24,648 | |

| Adjusted EBITDA | $ | 45,880 | | | $ | 44,138 | | | | | | | $ | 141,792 | | | $ | 136,869 | |

Net Debt

| | | | | | | | | | | |

| As of September 30, |

| (in thousands) | 2024 | | 2023 |

| Debt, net of current maturities | $ | 525,572 | | | $ | 484,004 | |

| Plus: Current maturities of debt | 28,490 | | | 28,479 | |

| Less: Cash and cash equivalents | (265,085) | | | (230,388) | |

| Net debt | $ | 288,977 | | | $ | 282,095 | |

Conference Call

Accel will host an investor conference call on October 30, 2024 at 4:30 p.m. Central time (5:30 p.m. Eastern time) to discuss these financial and operating results. Interested parties may join the live webcast by registering at https://www.netroadshow.com/events/login?show=a8e678a0&confId=71436 or accessing the webcast via the company’s investor relations website: ir.accelentertainment.com. Following completion of the call, a replay of the webcast will be posted on Accel’s investor relations website.

About Accel

Accel is a leading distributed gaming operator in the United States and a preferred partner for local business owners in the markets it serves. Accel offers turnkey full-service gaming solutions to authorized non-casino locations such as bars, restaurants, convenience stores, truck stops, and fraternal and veteran establishments across the country. Accel installs, maintains, operates and services gaming terminals and related equipment for its location partners as well as redemption devices, stand-alone ATMs and amusement devices, including jukeboxes, dartboards, pool tables, and other entertainment related equipment. Accel also designs and manufactures gaming terminals and related equipment.

Media Contact:

Eric Bonach

H/Advisors Abernathy

212-371-5999

eric.bonach@h-advisors.global

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA and capital expenditures, our ability to continue to generate returns on capital and improve our trading multiples, and our proposed acquisition of Fairmount Holdings, Inc. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; the parties' ability to satisfy the conditions to the consummation of the proposed acquisition of Fairmount Holdings, Inc. and the risk that the proposed acquisition may not be completed in a timely

manner or at all; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed by Accel with the SEC on February 28, 2024 (the "Form 10-K"), as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other press releases or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this press release does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this press release.

Industry and Market Data

Unless otherwise indicated, information contained in this press release concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel's other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

Non-GAAP Financial Information

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA, Adjusted net income, and Net Debt are non-GAAP financial measures and are key metrics used to monitor ongoing core operations. Management of Accel believes Adjusted EBITDA, Adjusted net income, and Net Debt enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitates company-to-company and period-to-period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items, represents certain nonrecurring items that are unrelated to core performance, or excludes non-core operations. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance.

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands, except per share amounts) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues: | | | | | | | |

| Net gaming | $ | 289,923 | | | $ | 274,123 | | | $ | 871,300 | | | $ | 831,054 | |

| Amusement | 5,104 | | | 5,411 | | | 16,772 | | | 17,839 | |

| Manufacturing | 1,705 | | | 3,334 | | | 9,122 | | | 9,886 | |

| ATM fees and other | 5,495 | | | 4,629 | | | 16,263 | | | 14,573 | |

| Total net revenues | 302,227 | | | 287,497 | | | 913,457 | | | 873,352 | |

| Operating expenses: | | | | | | | |

| Cost of revenue (exclusive of depreciation and amortization expense shown below) | 210,841 | | | 198,743 | | | 633,325 | | | 604,603 | |

| Cost of manufacturing goods sold (exclusive of depreciation and amortization expense shown below) | 962 | | | 2,065 | | | 5,283 | | | 5,627 | |

| General and administrative | 47,930 | | | 45,183 | | | 142,105 | | | 132,421 | |

| Depreciation and amortization of property and equipment | 11,001 | | | 9,405 | | | 32,229 | | | 27,914 | |

| Amortization of intangible assets and route and customer acquisition costs | 5,781 | | | 5,299 | | | 16,808 | | | 15,825 | |

| Other expenses, net | 3,867 | | | 1,682 | | | 13,620 | | | 5,006 | |

| Total operating expenses | 280,382 | | | 262,377 | | | 843,370 | | | 791,396 | |

| Operating income | 21,845 | | | 25,120 | | | 70,087 | | | 81,956 | |

| Interest expense, net | 9,164 | | | 8,415 | | | 26,730 | | | 24,546 | |

| Loss from unconsolidated affiliates | 1 | | | — | | | 1 | | | — | |

| Loss on change in fair value of contingent earnout shares | 4,216 | | | 1,625 | | | 4,190 | | | 11,063 | |

| | | | | | | |

| Income before income tax expense | 8,464 | | | 15,080 | | | 39,166 | | | 46,347 | |

| Income tax expense | 3,569 | | | 4,630 | | | 12,269 | | | 16,732 | |

| Net income | $ | 4,895 | | | $ | 10,450 | | | $ | 26,897 | | | $ | 29,615 | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 0.06 | | | $ | 0.12 | | | $ | 0.32 | | | $ | 0.34 | |

| Diluted | 0.06 | | | 0.12 | | | 0.32 | | | 0.34 | |

| Weighted average number of common shares outstanding: | | | | | | | |

| Basic | 82,952 | | | 85,865 | | | 83,718 | | | 86,305 | |

| Diluted | 84,322 | | | 87,114 | | | 84,890 | | | 87,022 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

(In thousands, except par value and share amounts) | September 30, | | December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 265,085 | | | $ | 261,611 | |

| Accounts receivable, net | 7,830 | | | 13,467 | |

| Prepaid expenses | 8,168 | | | 6,287 | |

| Inventories | 9,090 | | | 7,681 | |

| | | |

| Interest rate caplets | 5,510 | | | 8,140 | |

| | | |

Deposits | 18,293 | | | 6,555 | |

| Other current assets | 9,347 | | | 8,853 | |

| Total current assets | 323,323 | | | 312,594 | |

| Property and equipment, net | 281,917 | | | 260,813 | |

| Noncurrent assets: | | | |

| Route and customer acquisition costs, net | 23,725 | | | 19,188 | |

| Location contracts acquired, net | 176,793 | | | 176,311 | |

| Goodwill | 102,151 | | | 101,554 | |

| Other intangible assets, net | 18,715 | | | 20,542 | |

| Interest rate caplets, net of current | 1,176 | | | 4,871 | |

| | | |

| Other assets | 22,406 | | | 17,020 | |

| Total noncurrent assets | 344,966 | | | 339,486 | |

| Total assets | $ | 950,206 | | | $ | 912,893 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Current maturities of debt | $ | 28,490 | | | $ | 28,483 | |

| | | |

| Current portion of route and customer acquisition costs payable | 2,122 | | | 1,505 | |

| Accrued location gaming expense | 8,921 | | | 9,350 | |

| Accrued state gaming expense | 30,503 | | | 18,364 | |

| Accounts payable and other accrued expenses | 36,462 | | | 36,012 | |

| Accrued compensation and related expenses | 10,108 | | | 12,648 | |

| Current portion of consideration payable | 2,766 | | | 3,288 | |

| Total current liabilities | 119,372 | | | 109,650 | |

| Long-term liabilities: | | | |

| Debt, net of current maturities | 525,572 | | | 514,091 | |

| Route and customer acquisition costs payable, less current portion | 7,306 | | | 4,955 | |

| Consideration payable, less current portion | 10,882 | | | 4,201 | |

| Contingent earnout share liability | 36,017 | | | 31,827 | |

| Other long-term liabilities | 6,188 | | | 7,015 | |

| Deferred income tax liability, net | 38,150 | | | 42,750 | |

| Total long-term liabilities | 624,115 | | | 604,839 | |

| Stockholders’ equity: | | | |

Preferred Stock, par value of $0.0001; 1,000,000 shares authorized; 0 shares issued and outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Class A-1 Common Stock, par value $0.0001; 250,000,000 shares authorized; 95,409,648 shares issued and 82,430,205 shares outstanding at September 30, 2024; 95,016,960 shares issued and 84,123,385 shares outstanding at December 31, 2023 | 8 | | | 8 | |

| | | |

| Additional paid-in capital | 210,225 | | | 203,046 | |

| Treasury stock, at cost | (133,760) | | | (112,070) | |

| Accumulated other comprehensive income | 3,865 | | | 7,936 | |

| Accumulated earnings | 126,381 | | | 99,484 | |

| Total stockholders' equity | 206,719 | | | 198,404 | |

| Total liabilities and stockholders' equity | $ | 950,206 | | | $ | 912,893 | |

Third Quarter 2024 Earnings Presentation October 2024

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA, capital expenditures, and our proposed acquisition of Fairmount Holdings, Inc. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward- looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; the parties' ability to satisfy the conditions to the consummation of the proposed acquisition of Fairmount Holdings Inc. and the risk that that the proposed acquisition may not be completed in a timely manner or at all; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial condit ions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed by Accel with the SEC on February 28, 2024 (the "Form 10-K"), as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other presentations or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this presentation. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted net income, Adjusted EBITDA, EBIT, Capex, and Net Debt. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. For definitions of non-GAAP financial measures and reconciliations of non-GAAP financial measures to the most directly comparable GAAP measure, please see the Appendix to this presentation. 2

Accel at a Glance 1. Calculated as Net Gaming Revenue in the period divided by the number of operational days. There were 217 and approximately 347 operational days for the years ended December 31, 2020 and 2021, respectively. 2. Calculated as of September 30, 2024. Net Debt is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” 3. On November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of September 30, 2024, the Company has purchased a total of 13,495,065 shares under the plan at a cost of $139.5 million. Strong Track Record of Growth Disciplined Stewards of Capital As of September 30, 2024, Accel owned and operated 25,729 gaming terminals across 4,014 locations in Illinois, Montana, Nevada and Nebraska Average Daily Net Gaming Revenue(1) ($ in thousands) Long, recurring agreements Continued strong customer engagement Firm backlog of contracted locations waiting to go-live High Quality Service Company in Gaming Vertical Contracted, Recurring Revenue 3 Balance sheet strength Conservative net leverage $289 million of Net Debt(2) Completed approximately 70% of the $200 million share repurchase program(3) $658 $882 $1,125 $1,383 $2,030 $2,534 $3,051 $3,180 2017 2018 2019 2020 2021 2022 2023 2024 YTD

Q3 2024 Highlights • Strong revenue of $302 million for Q3 2024, an increase of 5% compared to Q3 2023 • Q3 2024 net income of $5 million, a decrease of 53% compared to Q3 2023 − Partially attributable to a higher loss on the change in fair value of the contingent earnout shares • Adjusted EBITDA(1) of $46 million for Q3 2024, an increase of 4% compared to Q3 2023 • Repurchased $6 million of Accel Class A-1 Common Stock in Q3 2024, and $140 million since the repurchase program was announced in November 2021(2) • Acquisition of a distributed gaming operator in the state of Louisiana expected to close in Q4 2024 • Announced acquisition of Fairmount Holdings, owner of the FanDuel Sportsbook & Horse Racing, which is expected to close in Q4 2024 4 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to our non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” 2. On November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of September 30, 2024, the Company has purchased a total of 13,495,065 shares under the plan at a cost of $139.5 million.

$46 $47 $44 $45$46 $50 $46 Q1 Q2 Q3 Q4 2023 2024 $293 $293 $287 $297$302 $309 $302 Q1 Q2 Q3 Q4 2023 2024 Accel Quarterly KPIs 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” Locations (#) Terminals (#) Revenue ($ in millions) Adjusted EBITDA(1) ($ in millions) 5 2,663 2,690 2,724 2,762 620 610 611 609 345 355 352 352 165 197 219 238 2,786 2,816 2,791 609 620 615 355 359 356 237 239 252 3,793 3,987 3,852 4,034 3,906 4,014 3,961 Q1 Q2 Q3 Q4 2023 IL 2023 MT 2023 NV 2023 NE 2024 IL 2024 MT 2024 NV 2024 NE 14,546 14,767 15,020 15,276 6,247 6,210 6,252 6,276 2,704 2,782 2,744 2,704 488 609 688 827 15,494 15,743 15,714 6,280 6,435 6,448 2,714 2,735 2,685 833 844 882 23,985 25,321 24,368 25,757 24,704 25,729 25,083 Q1 Q2 Q3 Q4 2023 IL 2023 MT 2023 NV 2023 NE 2024 IL 2024 MT 2024 NV 2024 NE

2024 Results 6 Note: Numbers may not total due to rounding. Percent change may not recalculate due to rounding. $ in millions, except %s Q3 2023 Q3 2024 % Change YTD 2023 YTD 2024 % Change Locations 3,906 4,014 3% 3,906 4,014 3% Terminals 24,704 25,729 4% 24,704 25,729 4% Revenue $287 $302 5% $873 $913 5% Adj EBITDA $44 $46 4% $137 $142 4% CapEx $19 $17 -9% $60 $55 -9% Net Debt $282 $289 2% $282 $289 2%

Historical Financial Summary 7 $ in millions Note: Numbers may not total due to rounding. Q3 YTD YoY YoY 2020 2021 2022 2023 2023 2024 Growth 2023 2024 Growth No. of Locations 2,435 2,584 3,741 3,961 3,906 4,014 3% 3,906 4,014 3% No. of Terminals 12,247 13,639 23,541 25,083 24,704 25,729 4% 24,704 25,729 4% Net Gaming Revenue 301 706 925 1,114 274 290 6% 831 871 5% Other Revenue 16 29 45 57 13 12 (8%) 42 42 (0%) Gross Revenues 316 735 970 1,170 287 302 5% 873 913 5% % YoY Growth (26%) 132% 32% 21% 5% 5% Less: Cost of revenue (exclusive of amortization and depreciation expense show n below ) (211) (494) (671) (817) (201) (212) 5% (610) (639) 5% Gross Profit 105 241 299 353 87 90 4% 263 275 4% % Margin 33% 33% 31% 30% 30% 30% 30% 30% Less: G&A Expenses (77) (111) (146) (180) (45) (48) 6% (132) (142) 7% EBITDA 28 130 153 173 42 42 2% 131 133 2% Adjusted EBITDA 34 140 162 181 44 46 4% 137 142 4% % Margin 11% 19% 17% 16% 15% 15% 16% 16% % YoY Growth (57%) 312% 16% 12% 4% 4% Less: Depreciation & amortization of property & equipment (21) (25) (29) (38) (9) (11) (28) (32) Less: Amortization of intangible assets and route and customer acquisition costs (23) (22) (17) (21) (5) (6) (16) (17) EBIT (16) 83 106 114 27 26 87 84 Less: Other expenses, net (9) (13) (9) (6) (2) (4) (5) (14) Less: Interest expense, net (14) (13) (22) (33) (8) (9) (25) (27) Less: Income tax benefit (expense) 17 (15) (21) (20) (5) (4) (17) (12) Less: Loss from unconsolidated aff iliates -- -- -- -- -- (0) -- (0) Less: Loss (gain) on change in fair value of contingent earnout shares 8 (10) 20 (9) (2) (4) (11) (4) Less: Loss (gain) on change in fair value of w arrants 13 -- -- -- -- -- -- -- Less: Loss on debt extinguishment -- (1) -- -- -- -- -- -- Reported Net Income (Loss) (0) 32 74 46 10 5 30 27 Adjusted Net Income 6 71 80 83 19 18 61 59 Twelve Months Ended Three Months Ended Nine Months Ended December 31, September 30, September 30,

Accel Balance Sheet 8 Note: Numbers may not total due to rounding. $ in millions December 31, 2023 September 30, 2024 Assets Current Assets: Cash and cash equivalents $262 $265 Other current assets 51 58 Total current assets $313 $323 Property and equipment, net 261 282 Route and customer acquisition costs, net 19 24 Location contracts acquired, net 176 177 Goodwill 102 102 Other assets 42 42 Total assets $913 $950 Liabilities and Stockholders' Equity Current liab ilities: Short term debt and current maturities $28 $28 Accrued state and location gaming expense 28 39 Other current liabilities 53 51 Total current liabilities $110 $119 Long-term liab ilities: Long-term debt $514 $526 Contingent earnout share liability 32 36 Other liabilities 59 63 Total liabilities $714 $743 Total stockholders' equity $198 $207 Total liabilities and stockholders' equity $913 $950

Definition of Non-GAAP Financial Measures Adjusted net income is defined as net income plus: • Amortization of intangible assets and route and customer acquisition costs • Stock-based compensation expense • Loss from unconsolidated affiliates • Loss (gain) on change in fair value of contingent earnout shares • Loss (gain) on change in fair value of warrants • Other expenses, net – consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses • Tax effect of adjustments Adjusted EBITDA is defined as net income plus: • Amortization of intangible assets and route and customer acquisition costs • Stock-based compensation expense • Loss from unconsolidated affiliates • Loss (gain) on change in fair value of contingent earnout shares • Loss (gain) on change in fair value of warrants • Other expenses, net • Tax effect of adjustments • Depreciation and amortization of property and equipment • Interest expense, net • Emerging markets – reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing − Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first − We currently view Pennsylvania as an emerging market − Prior to January 2024, Iowa was considered an emerging market − Prior to April 2023, Nebraska was considered an emerging market • Income tax expense • Loss on debt extinguishment 9 Accel uses non-GAAP measures as a key performance measure of the results of operations for purposes of evaluating performance internally. Management believes these non-GAAP financial measures enhance the understanding of our underlying drivers of profitability, trends in our business, and facilitate company-to-company and period-to-period comparisons. Management also believes that these non- GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate our ability to fund capital expenditures, service debt obligations and meet working capital requirements. EBIT is defined as EBITDA less: • Depreciation and amortization of property and equipment • Amortization of intangible assets and route and customer acquisition costs Capex is defined as purchases of property and equipment, net of proceeds from sales Net debt is defined as debt, net of current maturities plus: • Current maturities of debt less cash and cash equivalents

Non-GAAP to GAAP Reconciliation 10 Note: Numbers may not total due to rounding. $ in millions 2020 2021 2022 2023 2023 2024 2023 2024 Reported Net Income (Loss) (0) 32 74 46 10 5 30 27 (+) Amortization of intangible assets and route and customer acquisition costs 23 22 17 21 5 6 16 17 (+) Stock-based compensation expense 6 6 7 9 3 3 7 9 (+) Loss from unconsolidated aff iliates – – – – – 0 – 0 (+) Loss (gain) on change in fair value of contingent earnout shares (8) 10 (20) 9 2 4 11 4 (+) Loss (gain) on change in fair value of w arrants (13) – – – – – – – (+) Other expenses, net 9 13 9 6 2 4 5 14 (+) Tax effect of adjustments (10) (11) (8) (9) (3) (4) (8) (11) Adjusted Net Income 6 71 80 83 19 18 61 59 (+) Depreciation and amortization of property & equipment 21 25 29 38 9 11 28 32 (+) Interest expense, net 14 13 22 33 8 9 25 27 (+) Emerging markets 1 3 3 (1) (0) 0 (1) 0 (+) Income tax (benefit) expense (7) 26 29 29 7 7 25 23 (+) Loss on debt extinguishment – 1 – – – – – – Adjusted EBITDA 34 140 162 181 44 46 137 142 Twelve Months Ended Three Months Ended Nine Months Ended December 31, September 30, September 30, March 31, June 30, Sep. 30, Dec. 31, March 31, June 30, Sep. 30, 2023 2023 2023 2023 2024 2024 2024 Reported Net Income 9 10 10 16 7 15 5 (+) Amortization of intangible assets and route and customer acquisition costs 5 5 5 5 5 6 6 (+) Stock-based compensation expense 2 3 3 2 2 3 3 (+) Loss from unconsolidated aff iliates – – – – – – 0 (+) Loss (gain) on change in fair value of contingent earnout shares 5 5 2 (3) 5 (5) 4 (+) Other expenses, net 3 0 2 1 2 7 4 (+) Depreciation & amortization of property & equipment 9 9 9 10 10 11 11 (+) Interest expense, net 8 8 8 9 9 9 9 (+) Emerging markets (1) 0 (0) (0) 0 0 0 (+) Income tax expense 6 6 5 3 5 4 4 Adjusted EBITDA 46 47 44 45 46 50 46 Three Months Ended Three Months Ended September 30, 2023 2024 Debt, net of current maturities 484 526 (+) Current maturities of debt 28 28 (-) Cash and cash equivalents (230) (265) Net Debt 282 289

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

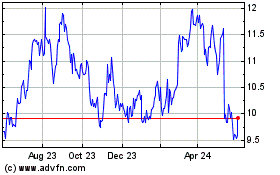

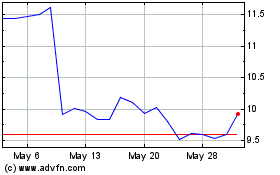

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Nov 2023 to Nov 2024