UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 20)1

AGCO CORPORATION

(Name

of Issuer)

Common Stock

(Title of Class of Securities)

001084102

(CUSIP Number)

Andrew M. Freedman

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

Dennis Hranitzky

Quinn Emanuel Urquhart & Sullivan LLP

51 Madison Avenue, 22nd Floor

New York, New York 10010

(212) 849-7000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

November 22, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Tractors and Farm Equipment Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,150,152 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,150,152 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,150,152 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☒ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

16.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

TAFE Motors and Tractors Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,262,321 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,262,321 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,262,321 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☒ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.4% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Mallika Srinivasan |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

23,713 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,150,152 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

23,713 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,150,152 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,173,865 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

16.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The Schedule 13D originally

filed with the Securities and Exchange Commission (the “SEC”) with respect to the Issuer on April 9, 2013, as amended by Amendment

Nos. 1 through 19 (the “Schedule 13D”), is hereby further amended and supplemented to include the information set forth herein.

This amended Statement on Schedule 13D/A constitutes Amendment No. 20 to the Schedule 13D. Capitalized terms used but not defined herein

have the meanings given to such terms in the Schedule 13D.

Item 1. Security

and Issuer

This Schedule 13D relates

to shares of the common stock (the “Common Stock”) of AGCO Corporation (“AGCO” or the “Issuer”), the

principal executive offices of which are located at 4205 River Green Parkway, Duluth, Georgia 30096.

Item 3. Source and

Amount of Funds or Other Consideration

Except for the 23,713 shares

that Ms. Srinivasan (together with the Companies (as defined below), the “Reporting Persons”) holds directly and that were

awarded to her under the AGCO Corporation 2006 Long-Term Incentive Plan for her services as a director of the Issuer, the source of the

funds used by the Reporting Persons to purchase the reported shares, pursuant to the Purchase Plans, was the working capital of Tractors

and Farm Equipment Limited (“TAFE”) or of TAFE Motors and Tractors Limited (“TAFE Motors and Tractors” and, together

with TAFE, the “Companies”). The Reporting Persons paid a total of $585,803,125.51 (exclusive of brokers’ commissions

and other administrative costs) to purchase the reported shares. Ms. Srinivasan did not pay for the shares that were awarded to her under

the AGCO Corporation 2006 Long-Term Incentive Plan.

Item 4. Purpose of

Transaction.

Item 4 of the Schedule 13D

is hereby further amended and supplemented by adding the following:

Dating back to 2020, TAFE has privately and

publicly raised its concerns with the Issuer’s niche, short-sighted strategy, declining financial performance, weakening competitive

position in key markets, capital allocation missteps and governance shortcomings. TAFE believes the Issuer’s disappointing third

quarter 2024 earnings and revised full-year 2024 guidance, which were disclosed earlier this month, further substantiate the governance

and strategy changes TAFE has been calling for.

As TAFE warned previously, the Issuer

was not well-positioned for the industry downcycle. The consequences of such unpreparedness have been significant, as evidenced by

the Issuer’s consecutive earnings per share misses and five successive quarters of weaker than expected sales. After being

unable to foresee the extent of the cyclical downturn, the Issuer appears to have responded to it in a purely tactical manner, with

an emphasis on cutting costs. TAFE believes this is too little, too late. ‘Controlling the things we can manage’ is not

a viable long-term strategy and fails to satisfy shareholders’ desire for sustainable growth.

In particular, TAFE remains concerned that

the Issuer lacks a clear vision for realizing value with PTx Trimble, the Issuer’s largest acquisition to date. TAFE believes that

the Issuer’s strategy regarding PTx Trimble lacks clarity. Developing and successfully executing on the PTx Trimble strategy will

be crucial to realizing the full value of the joint venture in the medium- and long-term. Failing to do this will expose shareholders

to significant risk of value destruction. Accordingly, TAFE believes it is imperative for the Issuer to successfully integrate PTx Trimble,

which requires a sense of urgency from the Board of Directors (the “Board”) and management team.

During the past four years, the Issuer has

disregarded much of TAFE’s feedback regarding the Issuer’s operational performance, strategy, execution, capital allocation

and Board oversight. While TAFE continues to assess the changes that it believes are necessary to drive long-term value for all shareholders,

it is clear to TAFE that enhancing the Issuer’s governance structures are central to achieving this objective. Therefore, TAFE has

taken the opportunity to submit a 14a-8 shareholder proposal for consideration at the Issuer’s 2025 Annual Meeting of Shareholders

requesting that the Issuer adopt a policy to require that the Chair of the Board be an independent director. TAFE believes that requiring

the Chair of the Board to be an independent director and separating the roles of CEO and Chair, both of which are currently held by Eric

Hansotia, will help enhance the Board’s oversight of management and increase accountability within the leadership structure. A copy

of the proposal is attached hereto as Exhibit I and incorporated herein by reference.

Item 5. Interest in Securities

of the Issuer

(a) The aggregate percentage

of shares reported owned on this Schedule 13D is based on 74,645,281 shares of Common Stock outstanding as of November 1, 2024, which

is the total number of shares of Common Stock outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the

SEC on November 7, 2024. As of the date hereof (i) TAFE beneficially owned 12,150,152 shares of Common Stock, which constituted approximately

16.3% of the Common Stock outstanding; (ii) TAFE Motors and Tractors beneficially owned 3,263,321 shares of Common Stock, which constituted

approximately 4.4% of the Common Stock outstanding; and (iii) Ms. Srinivasan beneficially owned 12,173,865 shares of Common Stock,

which constituted approximately 16.3% of the Common Stock outstanding, including the 23,713 shares she holds in her individual capacity.

Ms. Srinivasan disclaims beneficial ownership of the Common Stock beneficially owned by each of the Companies, and this report shall not

be deemed an admission that Ms. Srinivasan is a beneficial owner of such shares for the purposes of Section 13(d) or 13(g) of the Securities

Exchange Act of 1934 or for any other purpose. Each of the Companies disclaims beneficial ownership of the 23,713 shares of Common Stock

owned directly by Ms. Srinivasan in her individual capacity, and this report shall not be deemed an admission that either of the Companies

is a beneficial owner of such shares for the purposes of Section 13(d) or 13(g) of the Securities Exchange Act of 1934 or for any other

purpose. TAFE Motors and Tractors disclaims beneficial ownership of the 8,886,831 shares of Common Stock purchased on behalf of TAFE under

the Purchase Plans, and this report shall not be deemed an admission that TAFE Motors and Tractors is a beneficial owner of such shares

for the purposes of Section 13(d) or 13(g) of the Securities Exchange Act of 1934 or for any other purpose.

(b) For each person listed,

the following table indicates the number of shares of Common Stock as to which there is sole power to vote or to direct the vote, shared

power to vote or to direct the vote, sole power to dispose or to direct the disposition and shared power to dispose or to direct the disposition:

| Reporting Person | |

Sole Voting Power | |

Shared Voting Power | |

Sole Dispositive Power | |

Shared Dispositive Power |

| TAFE | |

| 0 | | |

| 12,150,152 | | |

| 0 | | |

| 12,150,152 | |

| TAFE Motors and Tractors | |

| 0 | | |

| 3,263,321 | | |

| 0 | | |

| 3,263,321 | |

| Mallika Srinivasan | |

| 23,713 | | |

| 12,173,865 | | |

| 23,713 | | |

| 12,173,865 | |

(c) See Annex A hereto.

(d) Not applicable.

(e) Not applicable.

Item 7. Material to Be

Filed as Exhibits

| Exhibit A* | Persons through whom Amalgamations Private Limited (“Amalgamations”)

may be deemed to control the Companies |

| Exhibit B* | Directors and Executive Officers of the Companies |

| Exhibit C* | Directors and Executive Officers of Amalgamations |

| Exhibit D** | Amended and Restated Letter Agreement, dated April 24, 2019, between Tractors

and Farm Equipment Limited and AGCO Corporation |

| Exhibit E*** | Limited Power of Attorney, dated as of July 24, 2024 |

| Exhibit F**** | Joint Filing Agreement, dated as of April 3, 2013 |

| Exhibit G***** | Amendment No. 1 to the Amended and Restated Letter Agreement, effective

April 24, 2024, between Tractors and Farm Equipment Limited and AGCO Corporation |

| Exhibit H****** | September

30 Letter |

| Exhibit I | 14a-8 Shareholder Proposal Letter, dated November 22, 2024 |

| * | Included by reference to Amendment No. 17 to this Schedule 13D, filed with the SEC on April 27, 2024. |

| ** | Included by reference to Amendment No. 10 to this Schedule 13D, filed with the SEC on April 26, 2019. |

| *** | Included by reference to Amendment No. 18 to this Schedule 13D, filed with the SEC on August 6, 2024. |

| **** | Included by reference to the initial filing of this Schedule 13D, filed with the SEC on April 9, 2013. |

| ***** | Included by reference to Exhibit 10.1 to Issuer’s Form 8-K, filed with the SEC on April 16, 2024. |

| ****** | Included by reference to Amendment No. 19 to this Schedule 13D, filed with the SEC on September 30, 2024. |

SIGNATURE

After reasonable inquiry

and to the best of his or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: November 25, 2024

| |

TRACTORS AND FARM EQUIPMENT LIMITED |

| |

|

| |

By: |

/s/ Andrew M. Freedman |

| |

|

Name: Andrew M. Freedman, |

| |

|

attorney-in-fact* |

| |

TAFE MOTORS AND TRACTORS

LIMITED |

| |

|

| |

By: |

/s/ Andrew M. Freedman |

| |

|

Name: Andrew M. Freedman, |

| |

|

attorney-in-fact* |

| |

/s/ Andrew M. Freedman |

| |

Andrew M. Freedman, attorney-in-fact for Mallika Srinivasan* |

* This Amendment No. 20 to Statement on Schedule 13D

was executed by Andrew M. Freedman as Attorney-In-Fact for Tractors and Farm Equipment Limited, TAFE Motors and Tractors Limited and Mallika

Srinivasan, pursuant to the Limited Power of Attorney granted by them.

ANNEX A

Transactions by TAFE during the last 60

days: None.

Transactions by TAFE Motors and Tractors

during the last 60 days: None.

Transactions by Ms. Srinivasan in her individual

capacity during the last 60 days: None.

TRACTORS

AND FARM EQUIPMENT LIMITED

No. 35 Nungambakkam High Road

Chennai, India 600034

November 22, 2024

BY EMAIL, HAND DELIVERY AND OVERNIGHT MAIL

AGCO Corporation

4205 River Green Parkway

Duluth, Georgia 30096

| Attn: |

Roger N. Batkin |

| |

Senior Vice President, General

Counsel, Chief ESG Officer, and Corporate Secretary |

Re: Submission of Proposal pursuant

to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, for the 2025 Annual Meeting of Stockholders of AGCO Corporation

Dear Mr. Batkin:

Tractors and Farm Equipment

Limited, a corporation organized under the laws of the Republic of India (“TAFE”), is submitting the proposal attached

hereto as Exhibit A (the “Proposal”) pursuant to Rule 14a-8 (“Rule 14a-8”) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), to be included in the proxy statement of AGCO Corporation, a

Delaware corporation (the “Company”), for its 2025 annual meeting of stockholders (including any postponements, adjournments,

continuations or reschedulings thereof, or any other meeting held in lieu thereof, the “2025 Annual Meeting”).

As of the date hereof, TAFE

is the beneficial owner of 12,150,152 shares of the Company’s common stock, par value $0.01 per share (the “Shares”)

and has full power and authority to submit the Proposal. As of the date hereof, TAFE confirms that it (i) has continuously held at least

$25,000 in market value of the Shares which are entitled to be voted on the Proposal for at least one year, as evidenced by TAFE’s

Schedule 13D and the amendments thereto filed by TAFE and certain affiliates1, which

are attached hereto as Exhibit B, pursuant to Rule 14a-8(b)(2)(ii)(B), and (ii) intends to and will continue to hold at least $25,000

in market value in Shares which are entitled to be voted on the Proposal through the date of the 2025 Annual Meeting.

_______________

1

TAFE’s original Schedule 13D filed with the SEC on April 9, 2013 reporting its beneficial ownership position in the Company is also

available at:

https://www.sec.gov/Archives/edgar/data/1525527/000095015713000143/sc13d.htm.

TAFE also intends to file an amendment to the Schedule 13D disclosing TAFE’s submission of the Proposal. However, such amendment

will not be filed until after the submission of such Proposal. Accordingly, a copy of such Schedule 13D amendment is not attached to this

letter, but can be viewed at www.sec.gov once it is filed with the SEC.

TAFE hereby confirms that

its representatives are available to meet with the Company via teleconference no less than ten (10) calendar days, nor more than thirty

(30) calendar days, after submission of the Proposal.

Representatives of TAFE will

be available to meet with the Company to discuss the Proposal on the following dates and at the following times:

| |

· December

9, 2024, between 9:00 a.m. and 11:00 a.m. EST |

| |

· December

12, 2024, between 9:00 a.m. and 11:00 a.m. EST |

| |

· December

16, 2024, between 9:00 a.m. and 11:00 a.m. EST |

| |

· December

18, 2024, between 9:00 a.m. and 11:00 a.m. EST |

Should these times or dates

not work for the Company, TAFE is prepared to meet with the Company when it is available, and requests that the Company send dates and

times it is available to meet, as necessary.

Mr. P Krishnamurthy, a representative

of TAFE, can be reached by email at [personal information redacted] to schedule a meeting. TAFE would appreciate that copies of all written

notices and other written or electronic communications (which shall not constitute notice) be sent to Mr. P Krishnamurthy at the above

email address.

TAFE’s representatives

will appear in person or by proxy to present the Proposal at the 2025 Annual Meeting.

*

* *

This notice

is submitted in accordance with Rule 14a-8 under the Exchange Act. TAFE will assume the Proposal will be included in the Company’s

proxy material for the 2025 Annual Meeting unless advised otherwise in writing (with a copy to its counsel, Olshan Frome Wolosky LLP,

1325 Avenue of the Americas, New York, New York 10019, Attention: Andrew Freedman, Esq., telephone (212) 451-2250, email: AFreedman@olshanlaw.com,

facsimile (212) 451-2222).

| |

Sincerely, |

| |

|

| |

TRACTORS AND FARM EQUIPMENT LIMITED |

| |

|

| |

By: |

/s/ C.P. Sounderarajan |

| |

|

Name: |

C.P. Sounderarajan |

| |

|

Title: |

Company Secretary |

cc: Andrew Freedman, Olshan Frome Wolosky LLP

Exhibit A

(Proposal)

Shareholder Proposal for an Independent Board

Chair

RESOLVED: Shareholders request that AGCO’s

Board of Directors adopt a policy, and amend the governing document as necessary, to require that the Chair of the Board be an independent

director whenever possible. The policy may provide that (i) if a Chair at any time ceases to be independent, the Board shall replace the

Chair with a new, independent, Chair within a reasonable time, and (ii) the policy shall apply prospectively so as not to violate any

contractual obligation existing at its adoption.

Supporting Statement:

The CEO of AGCO is also the Board Chair. While

this structure may be effective for some companies, we believe that, at AGCO, the combined role of CEO and Chair has failed to serve

the best interest of shareholders and resulted in inadequate oversight of management and the Company, leading to suboptimal strategic

and capital allocation decisions and underperformance, as evidenced by the following:

| • |

Weak Strategy and Performance: AGCO has delivered weaker than expected sales for five successive

quarters. The Company’s revenue growth and margin improvement have trailed peers since 2021, and its operating margin continues

to be the lowest among its competitors. Management’s consistent financial outlook cuts reflect its inability to foresee the

cyclical downturn or respond in the face of reduced demand. |

| |

|

| • |

Unsuccessful Acquisitions: AGCO has been overly dependent on acquisitions that have failed

to deliver returns or growth. Management’s inability to integrate acquisitions has led to significant write-offs, including

AGCO’s sale of the majority of its Grain & Protein business (resulting in losses amounting to at least $670.6 million).2 |

| |

|

| • |

Missed Market Opportunities: AGCO has consistently lost market share in key markets that are core to its current strategy

and its niche strategy has proven ineffective across industry cycles, demonstrating inadequate oversight from the Board. Given the

critical importance of successfully executing on PTx Trimble, AGCO’s largest investment, enhanced Board oversight to ensure

management accountability is crucial. |

| |

|

| • |

Ineffective Governance Structure: It is clear to us that AGCO’s current governance structure has stifled accountability

and strategic rigour, with the individual responsible for evolving and executing AGCO’s strategy also leading governance and

oversight. The Company’s Lead Director has been no substitute for an independent Board Chair, and, in our view, the combined

Chair and CEO structure has exaggerated poor decision-making and hindered strategic execution, leaving shareholders stunted by poor

capital allocation, weakened competitive positioning and a lack of operational expertise to weather the impacts of the commodity

cycle. |

An independent Chair would help ensure the Board

provides robust oversight and strategic guidance, enabling AGCO to respond effectively to competitive pressures, capitalize on strategic

opportunities and better navigate future market cycles.

We urge shareholders to vote FOR this proposal

to enhance Board accountability and protect shareholder value by requiring the Chair of the Board to be an independent director.

___________

2 Company SEC filings

Exhibit B

(Ownership Evidence)

TAFE’s Schedule 13D/A, filed with the

SEC on March 2, 2021, and each subsequent amendment

[Omitted.]

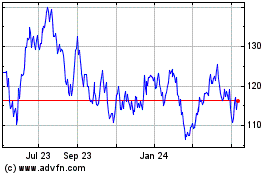

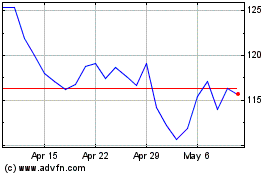

AGCO (NYSE:AGCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

AGCO (NYSE:AGCO)

Historical Stock Chart

From Nov 2023 to Nov 2024