UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number: 001-35783

Alamos Gold Inc.

(Translation of registrant’s name into English)

Brookfield Place, 181 Bay Street, Suite 3910

Toronto, Ontario, Canada

M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

EXHIBIT INDEX

| | | | | | | | |

EXHIBIT NO. | | DESCRIPTION |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | Alamos Gold Inc. |

Date: May 28, 2024 | | | |

| | | | By: | | /s/ Nils F. Engelstad |

| | | | Name: | | Nils F. Engelstad |

| | | | Title: | | Senior Vice President, General Counsel |

AMENDMENT NO. 1 TO ARRANGEMENT AGREEMENT

THIS AMENDMENT NO. 1 TO ARRANGEMENT AGREEMENT (this “Agreement”) made as of the 24th day of May, 2024 (the “Amendment Date”)

BETWEEN:

ALAMOS GOLD INC., a corporation amalgamated under the laws of Ontario,

(hereinafter referred to as “Alamos”)

- and -

ARGONAUT GOLD INC., a corporation incorporated under the laws of Ontario,

(hereinafter referred to as “Argonaut”, and together with Alamos, the “Parties” and each, a “Party”)

WITNESSES THAT:

WHEREAS Alamos and Argonaut have entered into an arrangement agreement dated March 27, 2024 (the “Arrangement Agreement”) to implement (i) the acquisition by Alamos of all the issued and outstanding Argonaut Shares and (ii) in conjunction with and prior to such acquisition, the distribution by Argonaut of part of the business of Argonaut (by way of a distribution of New Argonaut Shares) to the holders of Argonaut Shares;

AND WHEREAS Alamos and Argonaut wish to amend the terms of the Arrangement Agreement in the manner set forth herein;

NOW THEREFORE in consideration of the mutual covenants and agreements herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties hereto hereby covenant and agree as follows:

1.1 Capitalized Terms

All capitalized terms not defined herein shall have the meaning given to such terms in the Arrangement Agreement, unless the context requires otherwise.

1.2 Amendments

Effective upon the Amendment Date, pursuant to Section 7.1 of the Arrangement Agreement, the terms of the Arrangement Agreement shall be amended as follows:

(a) all references to “June 21, 2024” in Section 4.1(a)(iii) and Section 7.2(e) of the Arrangement Agreement are hereby replaced with references to “July 5, 2024”;

(b) the reference to “June 28, 2024” in Section 1.1(www) of the Arrangement Agreement is hereby replaced with a reference to “July 12, 2024”; and

(c) the Plan of Arrangement attached as Schedule “A” to the Arrangement Agreement is hereby deleted in its entirety and replaced with the Plan of Arrangement attached as Schedule “A” to this Agreement.

1.3 Amendment of Arrangement Agreement

The Arrangement Agreement will be deemed to be amended hereby with all necessary changes being made to incorporate and give effect to the provisions hereof. Save as amended hereby, the parties acknowledge that the Arrangement Agreement is unamended, and that, as amended hereby, the Arrangement Agreement is in full force and effect, in accordance with its terms.

1.4 Further Assurances

Each Party hereto shall, from time to time, and at all times hereafter, at the request of the other of them, but without further consideration, do, or cause to be done, all such other acts and execute and deliver, or cause to be executed and delivered, all such further agreements, transfers, assurances, instruments or documents as shall be reasonably required in order to fully perform and carry out the terms and intent hereof, all in accordance with the terms and conditions hereof.

1.5 Governing Law

This Agreement shall be governed by, and be construed in accordance with, the laws of the Province of Ontario and the federal laws of Canada applicable therein but the reference to such laws shall not, by conflict of laws rules or otherwise, require the application of the law of any jurisdiction other than the Province of Ontario.

1.6 Execution in Counterparts

This Agreement may be executed in one or more counterparts, each of which shall conclusively be deemed to be an original and all such counterparts collectively shall be conclusively deemed to be one and the same. Delivery of an executed counterpart of the signature page to this Agreement by electronic mail or facsimile shall be effective as delivery of a manually executed counterpart of this Agreement.

1.7 Enurement and Assignment

This Agreement shall not be assigned by any Party hereto without the prior written consent of the other Party hereto. This Agreement shall enure to the benefit of the Parties and their respective successors and permitted assigns and shall be binding upon the Parties and their respective successors.

<Remainder of Page Intentionally Left Blank>

IN WITNESS WHEREOF the Parties hereto have executed this Agreement as of the date first above written.

| | | | | | | | | | | | | | |

| | ALAMOS GOLD INC. |

| | | By: | (signed) “Greg Fisher” |

|

|

|

| Name: Greg Fisher Title: Chief Financial Officer |

| | | | | | | | | | | | | | |

| | ARGONAUT GOLD INC. |

| | | By: | (signed) “Richard Young” |

|

|

|

| Name: Richard Young Title: Chief Executive Officer |

[Signature Page – Amendment No. 1 to Arrangement Agreement]

SCHEDULE A

PLAN OF ARRANGEMENT

See attached.

PLAN OF ARRANGEMENT

respecting

ARGONAUT GOLD INC.

made pursuant to

Section 182 of the Business Corporations Act (Ontario)

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Plan of Arrangement, the following terms shall have the respective meanings set out below and grammatical variations of such terms shall have corresponding meanings:

“3(a)(10) Securities” means, one or more of, as applicable, the Argonaut Class A Shares, the New Argonaut Shares, the Alamos Shares, the Argonaut Class A Options, the New Argonaut Options and the Alamos Replacement Options, in each case issuable to Argonaut Securityholders pursuant to the Arrangement;

“Alamos” means Alamos Gold Inc., a company existing under the OBCA;

“Alamos Exchange Ratio” means 0.0185;

“Alamos Replacement Option” shall have the meaning ascribed thereto in Section 2.3(l);

“Alamos Shares” means the Class A common shares in the capital of Alamos, as currently constituted;

“Argonaut” means Argonaut Gold Inc., a company existing under the OBCA;

“Argonaut Circular” means the notice of the Argonaut Meeting to be sent to Argonaut Shareholders and the management information circular to be prepared in connection with the Argonaut Meeting, together with any amendments thereto or supplements thereof, and any other information circular or proxy statement which may be prepared in connection with the Argonaut Meeting;

“Argonaut Class A Option” shall have the meaning ascribed thereto in Section 2.3(h)(i);

“Argonaut Class A Shares” means the Class A common shares in the capital of Argonaut to be created in accordance with this Plan of Arrangement, which shall have attached thereto the right to vote at all meetings of Argonaut Shareholders, the right to dividends as and when declared by the Argonaut Board and the right to participate in the

remaining assets of Argonaut upon a winding-up of Argonaut, all as more specifically set out in Schedule “A” to this Plan of Arrangement;

“Argonaut Contributed Assets” shall have the meaning ascribed thereto in the New Argonaut Contribution Agreement;

“Argonaut DSUs” means deferred share units granted under, or governed by, the Argonaut Incentive Plan;

“Argonaut Incentive Plan” means the amended and restated share incentive plan of Argonaut, most recently approved by the Argonaut Shareholders on May 5, 2023;

“Argonaut Meeting” means the special meeting, including any adjournments or postponements thereof, of the Argonaut Shareholders to be held to consider, among other things, and, if deemed advisable, to approve, the Arrangement Resolution;

“Argonaut Option” means a stock option issued pursuant to, or governed by, the Argonaut Incentive Plan, each of which entitles the holder to purchase one (1) Argonaut Share;

“Argonaut Portion” means the quotient obtained when (i) the Fair Market Value of an Argonaut Class A Share, is divided by (ii) the Fair Market Value of an Argonaut Share;

“Argonaut PSUs” means performance share units granted under, or governed by, the Argonaut Incentive Plan;

“Argonaut RSUs” means restricted share units granted under, or governed by, the Argonaut Incentive Plan;

“Argonaut Securities” means, collectively, the Argonaut Shares, Argonaut Options, Argonaut DSUs, Argonaut PSUs and Argonaut RSUs;

“Argonaut Securityholders” means, at any particular time, the holders of Argonaut Securities at such time;

“Argonaut Shareholders” means, at any particular time, the holders of Argonaut Shares at such time;

“Argonaut Shares” means the common shares in the capital of Argonaut, as constituted immediately prior to the Effective Time;

“Arrangement” means the arrangement under section 182 of the OBCA on the terms and subject to the conditions set out in this Plan of Arrangement, subject to any amendments or variations thereto made (i) in accordance with the Arrangement Agreement or Article 5; (ii) at the direction of the Court either in the Interim Order or the Final Order (with the consent of both of Alamos and Argonaut, each acting reasonably); or (iii) with the consent of both Alamos and Argonaut, each acting reasonably;

“Arrangement Agreement” means the arrangement agreement dated as of March 27, 2024 between Alamos and Argonaut, together with the schedules attached thereto, as amended, amended and restated or supplemented from time to time in accordance therewith prior to the Effective Date, providing for, among other things, the Arrangement;

“Arrangement Resolution” means the special resolution of the Argonaut Shareholders approving this Plan of Arrangement substantially in the form attached as a Schedule to the Arrangement Agreement;

“Articles of Arrangement” means the articles of arrangement of Argonaut in respect of the Arrangement, required by the OBCA to be sent to the Director after the Final Order is made, which shall be in form and substance satisfactory to Alamos and Argonaut, each acting reasonably;

“Business Day” means any day, other than a Saturday, a Sunday or a statutory holiday in Toronto, Ontario or New York City, New York;

“CBCA” means the Canada Business Corporations Act, as amended;

“Certificate of Arrangement” means the certificate of arrangement giving effect to the Arrangement, issued pursuant to subsection 183(2) of the OBCA after the Articles of Arrangement have been filed;

“Consideration” means the consideration which holders of Argonaut Shares (including, for greater certainty, Argonaut Shares issued to holders of Argonaut DSUs and Argonaut RSUs pursuant to Section 2.3), but excluding any Argonaut Shares held by Dissenting Shareholders that are transferred to Argonaut pursuant to Section 2.3(a), are ultimately entitled to receive pursuant to this Plan of Arrangement;

“Court” means the Ontario Superior Court of Justice (Commercial List);

“Depositary” means any trust company, bank or other financial institution agreed to in writing by Alamos and Argonaut for the purpose of, among other things, exchanging certificates representing Argonaut Shares for the Consideration in connection with the Arrangement;

“Director” means the Director appointed pursuant to section 278 of the OBCA;

“Dissent Notice” shall have the meaning ascribed thereto in Section 3.1;

“Dissent Rights” means the rights of dissent in respect of the Arrangement described in Article 3;

“Dissenting Shareholder” means a registered holder of Argonaut Shares who has validly exercised Dissent Rights and has not withdrawn or been deemed to have withdrawn such

exercise of Dissent Rights as of the Effective Time, but only in respect of the Argonaut Shares in respect of which Dissent Rights are validly exercised by such holder;

“DRS Advice” means a Direct Registration System (DRS) advice;

“Effective Date” means the date upon which the Arrangement becomes effective, as established by the date shown on the Certificate of Arrangement;

“Effective Time” means 3:01 a.m. (Toronto time) on the Effective Date, or such other time on the Effective Date as the Parties agree to in writing before the Effective Date;

“Fair Market Value” with reference to:

(a) an Alamos Share, means the closing price of the Alamos Shares on the TSX on the last trading day immediately prior to the Effective Date;

(b) an Argonaut Share, means the closing price of the Argonaut Shares on the TSX on the last trading day immediately prior to the Effective Date;

(c) an Argonaut Class A Share, means the amount obtained when (i) the Fair Market Value of an Alamos Share, is multiplied by (ii) the Alamos Exchange Ratio; and

(d) a New Argonaut Share, means the quotient obtained when (i) the amount by which (A) the Fair Market Value of an Argonaut Share, exceeds (B) the Fair Market Value of an Argonaut Class A Share, is divided by (ii) the New Argonaut Exchange Ratio;

“Final Order” means the final order made after application to the Court, and after being informed of the intention to rely upon the exemption from registration pursuant to the Section 3(a)(10) Exemption in connection with the issuance of 3(a)(10) Securities in the United States, to approve the Arrangement, as such order may be amended by the Court at any time prior to the Effective Date (with the consent of both Alamos and Argonaut, each acting reasonably) or, if appealed, then unless such appeal is withdrawn or denied, as affirmed or as amended (with the consent of both Alamos and Argonaut, each acting reasonably) on appeal;

“Fractional Alamos Share” means a portion of an Alamos Share equal to the quotient obtained when the Fair Market Value of an Argonaut Share is divided by the Fair Market Value of an Alamos Share;

“Fractional New Argonaut Share” means a portion of a New Argonaut Share equal to the New Argonaut Exchange Ratio;

“Governmental Entity” means (i) any international, multinational, national, federal, provincial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, board, bureau,

ministry, agency or instrumentality, domestic or foreign, (ii) any subdivision or authority of any of the above, (iii) any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing or (iv) any stock exchange, including, but not limited to, the Toronto Stock Exchange, the New York Stock Exchange or the TSX Venture Exchange;

“Interim Order” means the interim order made after application to the Court, containing declarations and directions in respect of the notice to be given in respect of, and the conduct of, the Argonaut Meeting and the Arrangement, as such order may be amended, supplemented or varied by the Court (with the consent of both Alamos and Argonaut, each acting reasonably);

“In-the-Money Amount” means in respect of an option at any time, the amount, if any, by which the aggregate Fair Market Value, at that time, of the shares subject to the option exceeds the aggregate exercise price under the option;

“Law” means, with respect to any Person, any and all applicable law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, judgment, decree, ruling or other similar requirement, whether domestic or foreign, enacted, adopted, promulgated or applied by a Governmental Entity that is binding upon or applicable to such Person or its business, undertaking, property or securities, and to the extent that they have the force of law, policies, guidelines, notices and protocols of any Governmental Entity, as amended;

“Letter of Transmittal” means the Letter of Transmittal for use by Argonaut Shareholders, in the form accompanying the Argonaut Circular;

“Liens” means any hypothecs, mortgages, pledges, assignments, liens, charges, security interests, encumbrances and adverse rights or claims, other third person interest or encumbrance of any kind, whether contingent or absolute, and any agreement, option, right or privilege (whether by law, contract or otherwise) capable of becoming any of the foregoing;

“Merger Subsidiaries” means, collectively, the following wholly-owned subsidiaries of Argonaut: Alio Gold Inc., Castle Gold Corporation, Pediment Gold Corp. and San Anton Resource Corporation, and “Merger Subsidiary” means any one of them;

“New Argonaut” means the entity to be formed on the merger of the Merger Subsidiaries, to be renamed Florida Canyon Gold Inc. or such other name determined by Argonaut prior to the Effective Time;

“New Argonaut Board Nominees” means such individuals as may be determined and confirmed in writing by Argonaut prior to the Effective Date;

“New Argonaut Consideration Shares” shall have the meaning ascribed thereto in the New Argonaut Contribution Agreement;

“New Argonaut Contribution Agreement” shall have the meaning ascribed thereto in the Arrangement Agreement;

“New Argonaut Exchange Ratio” means one-tenth (0.1) of a New Argonaut Share for each Argonaut Share;

“New Argonaut Incentive Plan” means the share incentive plan of New Argonaut providing for, among other things, the issuance of New Argonaut Options, in form and substance satisfactory to Argonaut, New Argonaut and Alamos, acting reasonably, and in compliance with all applicable Laws, which shall be considered and approved by the Argonaut Shareholders at the Argonaut Meeting;

“New Argonaut Option” shall have the meaning ascribed thereto in Section 2.3(h)(ii);

“New Argonaut Portion” means the amount by which (i) one, exceeds (ii) the Argonaut Portion;

“New Argonaut Shares” means the common shares in the capital of New Argonaut;

“OBCA” means the Business Corporations Act (Ontario);

“paid-up capital” shall have the meaning ascribed thereto in subsection 89(1) of the Tax Act;

“Party” means Alamos or Argonaut, as applicable herein;

“Person” means an individual, partnership, association, body corporate, trustee, executor, administrator, legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status;

“Plan of Arrangement” means this plan of arrangement proposed under section 182 of the OBCA, and any amendments or variations thereto made: (i) in accordance with the Arrangement Agreement or Article 5; (ii) at the direction of the Court either in the Interim Order or the Final Order (with the consent of both of Alamos and Argonaut, each acting reasonably); or (iii) with the consent of both Alamos and Argonaut, each acting reasonably;

“Tax Act” means the Income Tax Act (Canada) and the regulations made thereunder, as now in effect and as they may be promulgated or amended from time to time; and

“U.S. Securities Act” means the United States Securities Act of 1933, as amended, and the rules and regulations promulgated from time to time thereunder.

Any capitalized terms used but not defined herein shall have the meaning ascribed to such terms in the Arrangement Agreement.

1.2 Sections and Headings

The division of this Plan of Arrangement into sections and the insertion of headings are for reference purposes only and shall not affect the interpretation of this Plan of Arrangement. Unless otherwise indicated, any reference in this Plan of Arrangement to a Section or a Schedule refers to the specified section of, or schedule to, this Plan of Arrangement.

1.3 Number and Gender

In this Plan of Arrangement, unless the context otherwise requires, words importing the singular only shall include the plural and vice versa, words importing the use of either gender shall include both genders and neuter.

1.4 Date for any Action

If the date on which any action is required to be taken hereunder by any Party hereto is not a Business Day, such action shall be required to be taken on the next succeeding day that is a Business Day.

1.5 Time

Time shall be of the essence in every matter or action contemplated hereunder. All times expressed herein or in any letter of transmittal contemplated herein are local time (Toronto, Ontario) unless otherwise stipulated herein or therein.

1.6 Statutory Reference

Any reference in this Plan of Arrangement to a statute includes all regulations and rules made thereunder, all amendments to such statute or regulation in force from time to time and any statute or regulation that supplements or supersedes such statute or regulation.

1.7 Currency

Unless otherwise stated, all references in this Plan of Arrangement to amounts of money are expressed in lawful money of Canada.

ARTICLE 2

ARRANGEMENT

2.1 Binding Effect

This Plan of Arrangement is made pursuant to the provisions of the Arrangement Agreement and constitutes an arrangement as referred to in section 182 of the OBCA. The Arrangement will become effective at, and be binding at and after, the Effective Time on: (i) Alamos; (ii) Argonaut; (iii) New Argonaut; (iv) all holders of Argonaut Securities; (v) all holders of any security into which the Argonaut Securities may be exercised, exchanged or otherwise converted, whether directly or indirectly, pursuant to

Section 2.3, including Alamos Replacement Options and New Argonaut Options; and (vii) the Depositary.

2.2 Preliminary Steps Prior to the Arrangement

Prior to the Effective Time, Argonaut shall have taken all necessary steps to cause, and shall have caused:

(a) the Merger Subsidiaries to be merged by way of an amalgamation under the CBCA to form New Argonaut; and

(b) the number of issued and outstanding New Argonaut Shares immediately prior to the Effective Time, together with the number of New Argonaut Consideration Shares to be issued by New Argonaut to Argonaut pursuant to the New Argonaut Contribution Agreement, to be equal to the aggregate number of New Argonaut Shares to be issued to the holders of Argonaut Shares pursuant to Section 2.3(i).

2.3 Arrangement

Commencing at the Effective Time, the following steps or transactions shall, unless specifically provided otherwise in this Section 2.3, occur and shall be deemed to occur in the following order as set out below without any further authorization, act or formality, in each case at one-minute intervals starting at the Effective Time:

(a) each Argonaut Share held by a Dissenting Shareholder shall be, and shall be deemed to be, transferred (free and clear of all Liens) by the holder thereof, without any further act or formality on its part, to Argonaut for cancellation, and in consideration therefor such Dissenting Shareholder shall have a debt-claim to be paid the aggregate fair value of such Argonaut Shares as determined pursuant to Section 3.1, and, in respect of the Argonaut Shares so transferred:

(i) each such Dissenting Shareholder shall cease to be the holder of such Argonaut Shares and to have any rights as Argonaut Shareholders other than the right to be paid the fair value for such Argonaut Shares as set out in Section 3.1;

(ii) the name of each such Dissenting Shareholder shall be removed as an Argonaut Shareholder from the registers of Argonaut Shareholders maintained by or on behalf of Argonaut;

(iii) each such Dissenting Shareholder shall have been deemed to have executed and delivered all consents, releases, assignments and waivers, statutory or otherwise, required to transfer and assign such Argonaut Shares to Argonaut;

(iv) such Argonaut Shares so transferred to Argonaut shall thereupon be cancelled by Argonaut and the registers of Argonaut Shareholders maintained by or on behalf of Argonaut shall be revised accordingly; and

(v) the stated capital account maintained by Argonaut in respect of the Argonaut Shares shall be reduced by an amount equal to the product obtained when (i) the amount of the stated capital account in respect of the Argonaut Shares immediate prior to the Effective Time, is multiplied by (ii) a fraction, the numerator of which is the number of Argonaut Shares transferred and cancelled pursuant to this Section 2.3(a) and the denominator of which is the number of Argonaut Shares outstanding immediately prior to the Effective Time;

(b) the transactions contemplated by the New Argonaut Contribution Agreement shall become effective, and pursuant thereto Argonaut shall transfer, assign and convey to New Argonaut the Argonaut Contributed Assets and New Argonaut shall accept and assume the New Argonaut Liabilities and issue to Argonaut the New Argonaut Consideration Shares, and Argonaut shall be entered into the register of New Argonaut Shares maintained by or on behalf of New Argonaut as the registered owner of such New Argonaut Consideration Shares;

(c) each outstanding Argonaut RSU that has vested prior to the Effective Time shall be redeemed and cancelled, and in consideration Argonaut shall allot and issue from treasury to the holders of such redeemed Argonaut RSUs such number of fully-paid Argonaut Shares as are due to such holders under the terms of the Argonaut Incentive Plan (less any amounts withheld in accordance with this Plan of Arrangement);

(d) each holder of an Argonaut DSU shall resign from, and shall be deemed to have immediately resigned from, the Argonaut Board and the board of directors of any affiliate of Argonaut;

(e) following the resignation of the holders of Argonaut DSUs in accordance with Section 2.3(d), all of the issued and outstanding Argonaut DSUs shall immediately vest, and upon such vesting shall immediately be redeemed and cancelled, and in consideration Argonaut shall allot and issue from treasury to each holder of Argonaut DSUs such number of fully-paid Argonaut Shares as are due to such holder under the terms of the Argonaut Incentive Plan (less any amounts withheld in accordance with this Plan of Arrangement);

(f) the authorized share capital of Argonaut shall be amended, as more particularly described in Schedule “A” to this Plan of Arrangement, by the creation of Argonaut Class A Shares, of which an unlimited number of shares may be issued, and the articles of Argonaut shall be deemed to be amended accordingly;

(g) the New Argonaut Incentive Plan shall come into force;

(h) each holder of an issued and outstanding Argonaut Option shall simultaneously:

(i) dispose of, and be deemed to have disposed of, the Argonaut Portion of such Argonaut Option to Argonaut (free and clear of all Liens), and as the sole consideration therefor Argonaut will grant to such holder an option to purchase one (1) Argonaut Class A Share (an “Argonaut Class A Option”), which Argonaut Class A Option will (A) have an exercise price equal to the product obtained when the exercise price payable to acquire an Argonaut Share under such Argonaut Option is multiplied by the Argonaut Portion (provided that the aggregate exercise price payable on any particular exercise of Argonaut Class A Options shall be rounded up to the nearest whole cent), and (B) otherwise shall have the same terms and conditions, including with respect to expiry and manner of exercising, as such Argonaut Option (except that the term to expiry of any Argonaut Class A Option shall not be affected by a holder thereof ceasing to be an employee, consultant, officer or director of Argonaut), and any document evidencing such Argonaut Option shall thereafter evidence and be deemed to evidence such Argonaut Class A Option; and

(ii) dispose of, and be deemed to have disposed of, the New Argonaut Portion of such Argonaut Option to New Argonaut (free and clear of all Liens), and as the sole consideration therefor New Argonaut will grant to such holder an option, pursuant to the New Argonaut Incentive Plan, to purchase a Fractional New Argonaut Share (a “New Argonaut Option”), which New Argonaut Option will (A) have an exercise price for such Fractional New Argonaut Share equal to the product obtained when the exercise price payable to acquire an Argonaut Share under such Argonaut Option is multiplied by the New Argonaut Portion (provided that the aggregate exercise price payable on any particular exercise of Argonaut Class A Options shall be rounded up to the nearest whole cent), (B) have the same expiry date as the expiry date of such Argonaut Option, and (C) otherwise be subject to the terms and conditions, including with respect to manner of exercising, set out in the New Argonaut Incentive Plan (except that the term to expiry of any New Argonaut Option shall not be affected by a holder thereof ceasing to be an employee, consultant, officer or director of New Argonaut).

It is intended that subsection 7(1.4) of the Tax Act apply to the disposition and exchange of Argonaut Options pursuant to this Section 2.3(h). Accordingly, and notwithstanding clauses (i) and (ii) above, the exercise price of an Argonaut Class A Option or a New Argonaut Option, as the case may be, shall be adjusted as necessary to ensure that the aggregate In-the-Money Amount of the Argonaut Class A Option and New Argonaut Option immediately after the exchange does not exceed the In-the-Money Amount of the Argonaut Option immediately before the exchange;

(i) Argonaut shall undertake a reorganization of capital within the meaning of section 86 of the Tax Act, pursuant to which each outstanding Argonaut Share (including, for the avoidance of doubt, any Argonaut Shares issued to holders of Argonaut RSUs and Argonaut DSUs pursuant to Section 2.3, but excluding any Argonaut Shares that are cancelled pursuant to Section 2.3(a)) shall be, and shall be deemed to be, transferred to Argonaut (free and clear of any Liens) in exchange for one (1) Argonaut Class A Share and a Fractional New Argonaut Share, and such Argonaut Shares shall thereupon be cancelled, and:

(i) the holders of such Argonaut Shares shall cease to be the holders thereof and to have any rights or privileges as holders of such Argonaut Shares;

(ii) such holders’ names shall be removed from the register of the Argonaut Shares maintained by or on behalf of Argonaut;

(iii) each Argonaut Shareholder shall be deemed to be the holder of the Argonaut Class A Shares and New Argonaut Shares (in each case, free and clear of any Liens) received in exchange for their Argonaut Shares and shall be entered in the register of Argonaut or New Argonaut, as the case may be, as the registered holder thereof; and

(iv) the stated capital account maintained by Argonaut in respect of the Argonaut Shares shall be reduced to nil, and there shall be added to the stated capital account maintained by Argonaut in respect of the Argonaut Class A Shares, the amount by which (A) the paid-up capital in respect of the Argonaut Shares immediately prior to the exchange in this Section 2.3(i) exceeds the Fair Market Value of the New Argonaut Shares distributed by Argonaut to the Argonaut Shareholders on such exchange;

(j) concurrently with the transfer of Argonaut Shares under Section 2.3(i), the New Argonaut Board Nominees shall be appointed to, and shall comprise, the board of directors of New Argonaut and, concurrently with such appointment, any individuals other than the New Argonaut Board Nominees who are directors of New Argonaut immediately prior to such time shall, and shall be deemed to, resign as directors of New Argonaut;

(k) each outstanding Argonaut Class A Share (other than Argonaut Class A Shares held by Alamos or any affiliate thereof) shall, without further act or formality by or on behalf of a holder of Argonaut Class A Shares, be irrevocably assigned and transferred by the holder thereof to Alamos (free and clear of all Liens) in exchange for 0.0185 of an Alamos Share for each Argonaut Class A Share held, and:

(i) the holders of such Argonaut Class A Shares shall cease to be the holders thereof and to have any rights as holders of such Argonaut Class A Shares other than the right to receive 0.0185 of an Alamos Share per Argonaut Class A Share in accordance with this Plan of Arrangement;

(ii) such holders’ name shall be removed from the register of the Argonaut Class A Shares maintained by or on behalf of Argonaut;

(iii) Alamos shall be deemed to be the transferee and the legal and beneficial holder of such Argonaut Class A Shares (free and clear of all Liens) and shall be entered as the registered holder of such Argonaut Class A Shares in the register of the Argonaut Class A Shares maintained by or on behalf of Argonaut; and

(iv) each former holder of such exchanged Argonaut Class A Shares shall be entered in the register of the Alamos Shares maintained by or on behalf of Alamos as the registered holder of the Alamos Shares which such holder is entitled to receive pursuant to this Section 2.3(k);

(l) each holder of an Argonaut Class A Option shall dispose of, and be deemed to have disposed of, such Argonaut Class A Option to Alamos (free and clear of all Liens), and as the sole consideration therefor Alamos will grant to such holder an option (each, an “Alamos Replacement Option”) to purchase from Alamos 0.0185 of an Alamos Share (provided that if the foregoing would result in the issuance of a fraction of an Alamos Share on any particular exercise of Alamos Replacement Options in the aggregate, then the number of Alamos Shares otherwise issuable shall be rounded down to the nearest whole number of Alamos Shares). Such Alamos Replacement Option shall provide for an exercise price per whole Alamos Share (rounded up to the nearest whole cent) equal to the quotient obtained when (i) the exercise price that would otherwise be payable to acquire an Argonaut Class A Share pursuant to the Argonaut Class A Option it replaces, is divided by (ii) the Alamos Exchange Ratio (provided that the aggregate exercise price payable on any particular exercise of Alamos Replacement Options shall be rounded up to the nearest whole cent). All terms and conditions of an Alamos Replacement Option, including the term to expiry, conditions to and manner of exercising, will be the same as the Argonaut Class A Option for which it was exchanged (except that the term to expiry of any Alamos Replacement Option shall not be affected by a holder of Alamos Replacement Options not becoming, or ceasing to be, an employee, consultant, officer or director of Argonaut or Alamos, as the case may be), and any document evidencing an Argonaut Class A Option shall thereafter evidence and be deemed to evidence such Alamos Replacement Option. It is intended that subsection 7(1.4) of the Tax Act apply to such exchange of options. Accordingly, and notwithstanding the foregoing, the exercise price of an Alamos Replacement Option shall be adjusted as necessary to ensure that the In-the-Money Amount of the Alamos Replacement Option immediately after the exchange does not exceed the In-the-Money Amount of the Argonaut Class A Option immediately before the exchange;

(m) each outstanding Argonaut RSU that has not vested prior to the Effective Time shall (i) be adjusted, and be deemed to have been adjusted, pursuant to the

Argonaut Incentive Plan, so that on or after the Vesting Date (as defined in the Argonaut Incentive Plan) of such Argonaut RSU the holder of such Argonaut RSU shall be entitled to receive – in lieu of Argonaut Shares, cash, securities or other property or a combination thereof equal in value to an Argonaut Share – a fraction of an Alamos Share, cash, securities or other property or a combination thereof equal in value to a Fractional Alamos Share, (ii) remain outstanding on the same terms as it had immediately prior to the Effective Time, apart from the adjustment referred to in (i) of this Section 2.3(m), and (iii) continue to be subject to and governed by the Argonaut Incentive Plan; and

(n) except in relation to holders of unvested Argonaut RSUs, the Argonaut Incentive Plan will terminate and none of (i) the former holders of Argonaut Options, Argonaut Class A Options, Argonaut PSUs or Argonaut DSUs, (ii) the former holders of Argonaut RSUs that have vested prior to the Effective Time, (iii) the Parties or (iv) any of the respective successors or assigns of any of the foregoing (including, for the avoidance of doubt, New Argonaut with respect to the New Argonaut Portion of an Argonaut Option disposed of pursuant to Section 2.3(h)(ii)) shall have any rights, liabilities or obligations in respect of the Argonaut Incentive Plan.

Each of the events listed in this Section 2.3 will be, without affecting the timing set out herein, mutually conditional, such that no event may occur without all steps occurring, and those events will affect the integrated transaction which constitutes the Arrangement.

2.4 U.S. Securities Laws

Notwithstanding any provision herein to the contrary, each of the parties to the Arrangement agree that the Arrangement will be carried out with the intention that 3(a)(10) Securities to be issued in the United States in connection with the Arrangement shall be exempt pursuant to the exemption from the registration requirements of the U.S. Securities Act pursuant to Section 3(a)(10) thereunder and applicable state securities laws.

2.5 Effect of Transfer of New Argonaut Property and Assumption of New Argonaut Liabilities

Upon completion of the merger contemplated in Section 2.2(a) and the associated formation of New Argonaut and the transfer, assignment and conveyance of the Argonaut Contributed Assets by Argonaut to New Argonaut and the assumption by New Argonaut of the New Argonaut Liabilities pursuant to Section 2.3(b), Argonaut will, except as otherwise provided in the New Argonaut Contribution Agreement, the Arrangement Agreement or any document or agreement referred to therein, be released from all debts, liabilities, commitments and obligations of any nature or kind whatsoever (whether matured or unmatured, accrued, fixed, contingent or otherwise) in respect of the New Argonaut Property and the New Argonaut Liabilities.

2.6 Transfers Free and Clear

Any exchange or transfer of securities pursuant to this Plan of Arrangement shall free and clear of any Liens or other claims of third parties of any kind.

2.7 Fully-Paid Shares

All Argonaut Shares, Argonaut Class A Shares, New Argonaut Shares and Alamos Shares issued pursuant to this Plan of Arrangement shall be fully paid and non-assessable and each of Argonaut, New Argonaut and Alamos, as applicable, shall be deemed to have received the full consideration therefor and all non-cash consideration shall have a value that is not less in value than the fair equivalent of the money that Argonaut, New Argonaut and Alamos, as applicable, would have received had such shares been issued for money.

2.8 Articles of Arrangement

Notwithstanding anything to the contrary in the Arrangement Agreement, this Plan of Arrangement or the OBCA, (i) the articles of arrangement in respect of the Arrangement filed by Argonaut, which articles of arrangement shall be in form and substance satisfactory to Alamos and Argonaut, each acting reasonably, shall be deemed to be the Articles of Arrangement of Argonaut for all purposes, including for purposes of the Arrangement Agreement, this Plan of Arrangement, the Arrangement and the OBCA, and (ii) Alamos shall not be required to file any articles of arrangement to give effect to the Arrangement.

ARTICLE 3

RIGHTS OF DISSENT

3.1 Rights of Dissent for Argonaut Shareholders

Argonaut Shareholders may exercise rights of dissent with respect to the Argonaut Shares pursuant to and in the manner set forth in section 185 of the OBCA and this Section 3.1 in connection with the Arrangement Resolution; provided that, notwithstanding subsection 185(6) of the OBCA, the written objection to the Arrangement Resolution referred to in subsection 185(6) of the OBCA (a “Dissent Notice”) must be received by Argonaut not later than 5:00 p.m. (Toronto time) on the Business Day immediately preceding the Argonaut Meeting. Argonaut Shareholders who duly and properly exercise such rights of dissent and who:

(a) are ultimately entitled to be paid fair value for their Argonaut Shares (i) shall be deemed to have transferred the Argonaut Shares with respect to which such Argonaut Shareholders exercised rights of dissent to Argonaut in accordance with Section 2.3(a), and (ii) shall be entitled to be paid by Argonaut such fair value and will not be entitled to any other payment or consideration to which such Argonaut Shareholders would have been entitled under the Arrangement had such Argonaut Shareholders not exercised dissent rights in respect of Argonaut Shares; or

(b) are ultimately not entitled, for any reason, to be paid fair value for their Argonaut Shares shall be deemed to have participated in the Arrangement on the same basis as a non-dissenting holder of Argonaut Shares,

but in no case shall Argonaut or any other Person be required to recognize such Argonaut Shareholders as holders of Argonaut Shares after the Effective Time, and the names of such Argonaut Shareholders shall be removed from the register of holders of Argonaut Shares at the Effective Time.

ARTICLE 4

CERTIFICATES AND PAYMENTS

4.1 Letter of Transmittal

The Depositary shall forward to each former registered Argonaut Shareholder, at the address of such former Argonaut Shareholder as it appears on the former register for the Argonaut Shares, a Letter of Transmittal and instructions for obtaining delivery of the certificates, DRS Advices or other evidence of ownership representing the Alamos Shares and the New Argonaut Shares that will be transferred to such former Argonaut Shareholder pursuant to the Arrangement.

4.2 Delivery of Alamos Shares and New Argonaut Shares to Depositary

Following the receipt of the Final Order and prior to the Effective Date, Alamos and New Argonaut shall deliver or arrange to be delivered to the Depositary certificates (or electronic deposit) representing the Alamos Shares and the New Argonaut Shares to be issued to former Argonaut Shareholders in accordance with the provisions of Section 2.3, which shares shall be held by the Depositary as agent and nominee for such former Argonaut Shareholders for distribution to such former Argonaut Shareholders in accordance with the provisions of this Article 4.

4.3 Argonaut Share Certificates or DRS Advices

Argonaut shall not issue share certificates or DRS Advices representing the Argonaut Class A Shares in replacement for outstanding share certificates or DRS Advices representing the Argonaut Shares, and each certificate or DRS Advice representing the outstanding Argonaut Shares shall (i) following the exchange of Argonaut Shares pursuant to Section 2.3(i) and the exchange of Argonaut Class A Shares pursuant to Section 2.3(k), represent a right to receive the number of New Argonaut Shares and Alamos Shares that the holder of the Argonaut Shares represented by such share certificate or DRS Advice is entitled to receive pursuant to Section 2.3.

4.4 Payment of Consideration

(a) Upon surrender to the Depositary for cancellation of a certificate or DRS Advice that immediately prior to the Effective Time represented one or more outstanding Argonaut Shares (other than Argonaut Shares in respect of which the holder validly exercised Dissent Rights) that were exchanged pursuant to Section 2.3,

together with such other documents and instruments as would have been required to effect the transfer of the Argonaut Shares formerly represented by such certificate or DRS Advice under the OBCA and the articles of Argonaut and such additional documents and instruments as the Depositary may reasonably require, the holder of such surrendered certificate or DRS Advice shall be entitled to receive in exchange therefor, and the Depositary shall deliver to such holder following the Effective Time, or make available for pick up at its offices during normal business hours, (i) a certificate or DRS Advice representing that number (rounded down or up to the nearest whole number in accordance with Section 4.6) of Alamos Shares that the holder is entitled to receive pursuant to Section 2.3, (ii) a certificate or DRS Advice representing that number (rounded down or up to the nearest whole number in accordance with Section 4.6) of New Argonaut Shares that the holder is entitled to receive pursuant to Section 2.3, and (iii) any dividends or distributions, if any, with respect to such Alamos Shares and New Argonaut Shares pursuant to Section 4.5).

(b) After the Effective Time and until surrendered as contemplated by this Section 4.4, each certificate or DRS Advice which immediately prior to the Effective Time represented Argonaut Shares that were exchanged pursuant to Section 2.3 (other than Argonaut Shares in respect of which the holder validly exercised Dissent Rights) shall be deemed at all times after the completion of the Arrangement steps in Section 2.3 to represent only the right to receive upon such surrender (i) the certificates or DRS Advices representing Alamos Shares and New Argonaut Shares as contemplated by this Section 4.4, and (ii) any dividends or distributions with a record date after the Effective Time theretofore paid or payable with respect to such Alamos Shares and New Argonaut Shares as contemplated by Section 4.5.

(c) In the event of a transfer of ownership of Argonaut Shares that is not registered in the transfer records of Argonaut, certificates or DRS Advices representing the proper number of Alamos Shares and New Argonaut Shares may be issued to the transferee if the certificate or DRS Advice representing such Argonaut Shares is presented to the Depositary, accompanied by all documents required to evidence and effect such transfer.

(d) No holder of Argonaut Shares, Argonaut Class A Shares, Argonaut Options, Argonaut DSUs, Argonaut PSUs or Argonaut RSUs shall be entitled to receive any consideration with respect to such Argonaut Shares, Argonaut Class A Shares, Argonaut Options, Argonaut DSUs, Argonaut PSUs or Argonaut RSUs, other than any consideration to which such holder is entitled to receive in accordance with Section 2.3 and this Section 4.4 and, for greater certainty, no such holder shall be entitled to receive any interest, dividends, premium or other payment in connection therewith, other than any declared but unpaid dividends.

4.5 Distributions with Respect to Unsurrendered Certificates or DRS Advices

No dividends or other distributions declared or made after the Effective Time with respect to Alamos Shares or New Argonaut Shares with a record date after the Effective Time shall be paid to the holder of any unsurrendered certificate or DRS Advice which, immediately prior to the Effective Time, represented outstanding Argonaut Shares, unless and until the holder of record of such certificate or DRS Advice shall surrender such certificate or DRS Advice in accordance with Section 4.1. Subject to applicable Law, at the time of such surrender of any such certificate or DRS Advice, there shall be paid to the holder of record of the certificates or DRS Advices representing Argonaut Shares, without interest, (i) the amount of dividends or other distributions with a record date after the Effective Time theretofore paid with respect to the Alamos Shares and New Argonaut Shares that the holder of such Argonaut Shares is ultimately entitled to receive in accordance with Section 2.3, and (ii) on the appropriate payment date, the amount of dividends or other distributions with a record date after the Effective Time but prior to surrender and a payment date subsequent to surrender payable with respect to such Alamos Share and New Argonaut Shares.

4.6 No Fractional Shares

No certificates or scrip or DRS Advices representing fractional Alamos Shares or fractional New Argonaut Shares shall be issued upon the surrender for exchange of certificates or DRS Advices pursuant to Section 4.4, and no dividend, stock split or other change in the capital structure of Alamos or New Argonaut, as applicable, shall relate to any such fractional security and such fractional interests shall not entitle the owner thereof to exercise any rights as a securityholder of Alamos or New Argonaut, as applicable. The aggregate number of Alamos Shares and aggregate number of New Argonaut Shares, as applicable, to be issued to any Person pursuant to this Plan of Arrangement shall, in each case, be rounded to the nearest whole number of Alamos Shares or New Argonaut Shares, as applicable. For greater certainty, (i) where such fractional interest is greater than or equal to 0.5, the number of Alamos Shares or New Argonaut Shares, as applicable, to be issued will be rounded up to the nearest whole number and, (ii) where such fractional interest is less than 0.5, the number of Alamos Shares or New Argonaut Shares, as applicable, will be rounded down to the nearest whole number. In calculating such fractional interests, all Alamos Shares or New Argonaut Shares, as applicable, registered in the name of, or beneficially held by, a holder of Alamos Shares or New Argonaut Shares, as applicable, or their respective nominee, shall be aggregated.

4.7 Lost Certificates

In the event any certificate which immediately prior to the Effective Time represented one or more outstanding Argonaut Shares shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such certificate to be lost, stolen or destroyed, the Depositary will issue in exchange for such lost, stolen or destroyed certificate, one or more certificates or DRS Advices representing the Alamos

Shares and New Argonaut Shares (and any dividends or distributions with respect thereto pursuant to Section 4.5) to which the holder thereof is entitled to pursuant to Section 2.3, deliverable in accordance with such holder’s Letter of Transmittal. When authorizing such payment in exchange for any lost, stolen or destroyed certificate, the Person to whom certificates or DRS Advices representing Alamos Shares or New Argonaut Shares, as applicable, are to be issued shall, as a condition precedent to the issuance thereof, give a bond satisfactory to the Depositary and to Alamos or New Argonaut, as applicable, in such sum as Alamos or New Argonaut, as applicable, may direct or otherwise indemnify Alamos, New Argonaut and the Depositary in a manner satisfactory to Alamos, New Argonaut and the Depositary against any claim that may be made against them with respect to the certificate alleged to have been lost, stolen or destroyed.

4.8 Extinction of Rights

Any certificate or DRS Advice which immediately prior to the Effective Time represented outstanding Argonaut Shares and not deposited with all other instruments required by Section 4.4 on or prior to the sixth (6th) anniversary of the Effective Date, shall cease to represent a claim or interest of any kind or nature as a securityholder of Alamos or New Argonaut. On such date, the Alamos Shares and New Argonaut Shares to which the former holder of the certificate or DRS Advice referred to in the preceding sentence was ultimately entitled, shall be deemed to have been surrendered (i) in the case of Alamos Shares, to Alamos, and (ii) in the case of New Argonaut Shares, to New Argonaut, in each case together with all entitlements to dividends, distributions and interest thereon held for such former registered holder. None of Alamos, Argonaut, New Argonaut or the Depositary shall be liable to any Person in respect of any Alamos Shares or New Argonaut Shares (or dividends, distributions and interest in respect thereof) delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law.

4.9 Withholding Rights

Any Person making a payment pursuant to or in accordance with this Plan of Arrangement (a “Payor”) shall be entitled to deduct or withhold from any amount otherwise payable to any other Person (a “Recipient”) as contemplated under this Plan of Arrangement (including, without limitation, any amounts payable pursuant to Section 3.1) or the Arrangement Agreement such amounts as the Payor determines, acting reasonably, is required, or reasonably believes is required, or is permitted to be deducted or withheld with respect to such payment under the Tax Act or any provision of provincial, state, local or foreign Law, in each case as amended. To the extent that amounts are so deducted or withheld, such deducted or withheld amounts shall be treated for all purposes hereof as having been paid to the Recipient in respect of which such deduction or withholding was made, provided that such deducted or withheld amounts are actually remitted to the appropriate Governmental Entity. The Parties, New Argonaut and the Depositary are hereby authorized to withhold and sell, or otherwise require a Recipient to irrevocably direct the sale through a broker and irrevocably direct the broker

to pay the proceeds of such sale of, such portion of any share or other security otherwise issuable to the Recipient as is necessary to provide sufficient funds to the Payor to enable it to comply with such deduction or withholding requirement and the Payor shall notify the Recipient and remit the applicable portion of the net proceeds of such sale to the appropriate taxing authority. None of the Parties, New Argonaut or the Depositary shall be liable for any loss arising out of any such sale. Notwithstanding the foregoing, the Parties, New Argonaut and the Depositary shall not withhold securities where the Recipient has made arrangements to timely satisfy any such amounts required or permitted to be deducted or withheld, in advance, to the satisfaction of the Payor.

4.10 Calculations

All amounts of consideration to be received under this Plan of Arrangement will be calculated to the nearest cent ($0.01) or to the nearest hundredth of one percent (0.01%), as applicable. All calculations and determinations by Alamos, Argonaut, New Argonaut or the Depositary, as applicable, for the purposes of this Plan of Arrangement shall be conclusive, final and binding.

ARTICLE 5

AMENDMENTS

5.1 Amendments to Plan of Arrangement

(a) Alamos and Argonaut may amend, modify and/or supplement this Plan of Arrangement at any time and from time to time prior to the Effective Time, provided that each such amendment, modification and/or supplement must be (i) set out in writing, (ii) approved by Alamos and Argonaut in writing, (iii) filed with the Court and, if made following the Argonaut Meeting, approved by the Court and (iv) communicated to Argonaut Shareholders if and as required by the Court.

(b) Any amendment, modification or supplement to this Plan of Arrangement may be proposed by Alamos or Argonaut at any time prior to the Argonaut Meeting (provided that the other Party shall have consented thereto in writing) with or without any other prior notice or communication, and if so proposed and accepted by the Argonaut Shareholders voting at the Argonaut Meeting (other than as may be required under the Interim Order), shall become part of this Plan of Arrangement for all purposes.

(c) Any amendment, modification or supplement to this Plan of Arrangement that is approved or directed by the Court following the Argonaut Meeting shall be effective only if (i) it is consented to in writing by each of Alamos and Argonaut (in each case, acting reasonably), and (ii) if required by the Court, it is consented to by Argonaut Shareholders voting in the manner directed by the Court.

(d) Any amendment, modification or supplement to this Plan of Arrangement may be made following the Effective Date unilaterally by Alamos, provided that it concerns a matter which, in the reasonable opinion of Alamos, is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement and is not adverse to the economic interest of any former holder of Argonaut Securities, or their successors or assigns.

(e) This Plan of Arrangement may be withdrawn prior to the Effective Time in accordance with the terms of the Arrangement Agreement.

ARTICLE 6

FURTHER ASSURANCES

6.1 Further Assurances

Notwithstanding that the transactions and events set out herein shall occur and shall be deemed to occur in the order set out in this Plan of Arrangement without any further act or formality, each of the Parties to the Arrangement Agreement shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements, transfers, assurances, instruments or documents as may reasonably be required by either of them in order further to document or evidence any of the transactions or events set out herein.

6.2 Paramountcy

From and after the Effective Time:

(a) this Plan of Arrangement shall take precedence and priority over any and all rights related to Argonaut Securities (including pursuant to investor rights agreements);

(b) the rights and obligations of the holders of Argonaut Securities, and any trustee and transfer agent therefor, shall be solely as provided for in this Plan of Arrangement; and

(c) all actions, causes of action, claims or proceedings (actual or contingent, and whether or not previously asserted) based on or in any away relating to Argonaut Securities shall be deemed to have been settled, compromised, released and determined without any liability except as set forth herein.

6.3 Termination

This Plan of Arrangement may be withdrawn prior to the Effective Time in accordance with the terms of the Arrangement Agreement. Upon the termination of this Plan of Arrangement pursuant to the Arrangement Agreement, no Party shall have any liability or further obligation to any other Party hereunder other than as set out in the Arrangement Agreement.

SCHEDULE “A”

ARTICLE 1

INTERPRETATION

1.1 References to “Act”

In these provisions, as from time to time amended, unless there is something in the context inconsistent herewith, “Act” means the Business Corporations Act (Ontario), or the successor thereof, as amended from time to time. These provisions shall be governed by and are subject to the applicable provisions of the Act and, except as otherwise expressly provided herein, all words and terms used herein that are defined in the Act shall have the respective meanings ascribed thereto in the Act.

1.2 Headings, Gender and Number

These provisions, as from time to time amended, shall be read without regard to article or section headings, which are included for ease of reference only and shall not affect the construction or interpretation hereof, and with all changes in gender and number required by the context.

ARTICLE 2

COMMON SHARES

The common shares have attached thereto the following rights, privileges, restrictions and conditions:

2.1 Voting Rights

The holders of common shares are entitled to receive notice of, attend and vote at all meetings of the shareholders of the Corporation, except where holders of another class or series are entitled to vote separately as a class or series as provided in the Act. Each holder of common shares is entitled, voting together with the holders of shares of all other classes of shares, or series thereof, of the Corporation, if any, entitled to vote at such meetings, to one (1) vote for each common share held on all votes taken at such meetings.

2.2 Dividends

The holders of the common shares are entitled to receive any dividend as the directors of the Corporation may declare from time to time on the common shares, in their absolute discretion, in accordance with the Act. Any such dividends are payable by the Corporation as and when determined by the directors of the Corporation, in their sole and absolute discretion. For greater certainty, the directors of the Corporation may declare dividends on the common shares without declaring dividends on any other class of shares.

2.3 Liquidation, Dissolution or Winding-Up

In the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or other distribution of the property and assets of the Corporation for the purpose of winding- up the affairs of the Corporation, the holders of common shares shall be entitled to receive, equally on a share for share basis with the holders of the Class A common shares, the remaining property and assets of the Corporation.

ARTICLE 3

CLASS A COMMON SHARES

The Class A common shares have attached thereto the following rights, privileges, restrictions and conditions:

3.1 Voting Rights

The holders of Class A common shares are entitled to receive notice of, attend, and vote at all meetings of the shareholders of the Corporation, except where holders of another class or series are entitled to vote separately as a class or series as provided in the Act. Each holder of Class A common shares is entitled, voting together with the holders of shares of all other classes of shares, or series thereof, of the Corporation, if any, entitled to vote at such meetings, to two (2) votes for each Class A common share held on all votes taken at such meetings.

3.2 Dividends

The holders of the Class A common shares are entitled to receive any dividend as the directors of the Corporation may declare from time to time on the Class A common shares, in their absolute discretion, in accordance with the Act. Any such dividends are payable by the Corporation as and when determined by the directors of the Corporation, in their sole and absolute discretion. For greater certainty, the directors of the Corporation may declare dividends on the Class A common shares without declaring dividends on any other class of shares.

3.3 Liquidation, Dissolution or Winding-Up

In the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or other distribution of the property and assets of the Corporation for the purpose of winding- up the affairs of the Corporation, the holders of Class A common shares shall be entitled to receive, equally on a share for share basis with the holders of the common shares, the remaining property and assets of the Corporation.

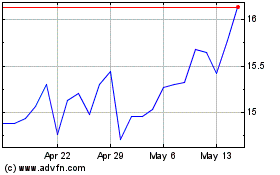

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From May 2024 to Jun 2024

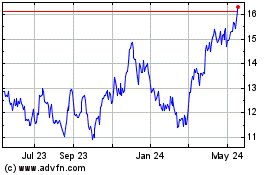

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jun 2023 to Jun 2024