Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) has released its

annual Environmental, Social, and Governance (ESG) Report (“ESG

Report”), which outlines the Company’s progress on its ESG

performance in 2023 across its operations, projects and offices.

“During 2023 our Alamos Gold team had the

opportunity to reflect on two decades as a Company, and I am proud

to say that our dedication to responsible mining has been

foundational to achieving one of the best growth profiles in the

sector,” said President & CEO John McCluskey. “I am proud that

the Alamos team is willing to go above and beyond with our

sustainability initiatives that will allow us to make progress in

both the near and longer term.”

Alamos’ 2023 ESG Report, available

at https://esg2023.alamosgold.com, highlights the Company’s

significant sustainability efforts and the resulting achievements

which include:

-

An 8% reduction in total Scope 1 and 2 greenhouse gas

emissions;

-

A 5% reduction in the Company’s Total Recordable Injury Frequency

Rate;

-

$2.2 million invested in local community initiatives including

donations, sponsorships, community programs and

infrastructure;

-

Zero significant environmental incidents during the year, including

zero reportable tailings-related incidents;

-

Continued collaboration with impacted Indigenous communities in

Canada, including the finalization of one new formal participation

agreement during the year;

-

Over 87,000 hours of training delivered to employees, including

22,000 hours of health, safety and emergency response

training;

-

99% of procurement spent with in-country suppliers;

-

The Mulatos mine’s second consecutive year receiving the Silver

Helmet Award from the Mining Chamber of Mexico (CAMIMEX) in

recognition of outstanding health and safety performance; and

-

Four years of compliance with the World Gold

Council’s Responsible Gold Mining

Principles (RGMPs).

The 2023 ESG Report is guided by

the Sustainability Accounting Standards Board

(SASB) Metals & Mining Industry Standard, the

recommendations of the Task Force on Climate-Related Financial

Disclosures (TCFD), and the Global Reporting Initiative

Standards (GRI) for sustainability reporting “Core”

requirements. It focuses on economic, environmental, social and

governance topics and indicators that are of the greatest interest

to Alamos’ stakeholders.

Since 2013, Alamos has published an annual

Sustainability Report to provide transparency on its sustainability

initiatives and results from its operating mines. Since 2019, the

Company has branded this publication as an ESG Report to reflect

the depth of its content and the standards to which it now

aligns.

About Alamos

Alamos is a Canadian-based intermediate gold

producer with diversified production from three operations in North

America. This includes the Young-Davidson mine and Island Gold

District in northern Ontario, Canada and the Mulatos District in

Sonora State, Mexico. Additionally, the Company has a strong

portfolio of growth projects, including the Phase 3+ Expansion at

Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos

employs more than 2,400 people and is committed to the highest

standards of sustainable development. The Company’s shares are

traded on the TSX and NYSE under the symbol “AGI”.

Investor ContactScott K. ParsonsSenior Vice

President, Investor Relations(416) 368-9932 x 5439

ir@alamosgold.com

Media ContactRebecca ThompsonVice President,

Public Affairs(416) 368-9932 x 5448 media@alamosgold.com

The TSX and NYSE have not reviewed and do not

accept responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained

herein.

Cautionary Note

This News Release and Alamos’ 2023 ESG Report

that is the subject matter of this News Release, contain

forward-looking statements that constitute forward-looking

information as defined under applicable Canadian and U.S.

securities laws. All statements, other than statements of

historical fact, which address events, results, outcomes or

developments that Alamos expects to occur are, or may be deemed to

be, “forward-looking statements”. Forward-looking statements are

generally, but not always, identified by the use of forward-looking

terminology such as "expect", “assume”, “inferred”, “schedule”,

"estimate", "budget", “continue”, “potential”, “outlook”,

“trending”, “plan”, “target” or variations of such words and

phrases and similar expressions or statements that certain actions,

events or results “may", "could”, “would", "might" or "will" be

taken, occur or be achieved or the negative connotation of such

terms.

Forward looking statements in this News Release

may include statements and information as to the strategy, plans,

expectations or future financial or operating performance of the

Company. Cautionary Notes with respect to the forward-looking

information contained in the 2023 ESG Report can be found in that

report under “Cautionary Statements”.

Alamos cautions that forward-looking statements

are necessarily based upon several factors and assumptions that,

while considered reasonable by Alamos at the time of making such

statements, are inherently subject to significant business,

economic, technical, legal, political and competitive uncertainties

and contingencies. Known and unknown factors could cause actual

results to differ materially from those projected in the

forward-looking statements, and undue reliance should not be placed

on such statements and information.

Such factors and assumptions include, but

are not limited to: changes to current estimates of mineral

reserves and resources; changes to production estimates (which

assume accuracy of projected ore grade, mining rates, recovery

timing and recovery rate estimates and may be impacted by

unscheduled maintenance; weather issues, labour and contractor

availability and other operating or technical difficulties);

operations may be exposed to new illnesses, diseases, epidemics and

pandemics, and associated impact on the broader market and the

trading price of the Company's shares; provincial and federal

orders or mandates (including with respect to mining operations

generally or auxiliary businesses or services required for the

Company’s operations); the duration of any regulatory responses to

any widespread illnesses, diseases, epidemics or pandemics and

government and the Company’s attempts to reduce their spread, which

may affect many aspects of the Company's operations including the

ability to transport personnel to and from site, contractor and

supply availability and the ability to sell or deliver gold doré

bars; fluctuations in the price of gold or certain other

commodities such as, diesel fuel, natural gas, and electricity;

changes in foreign exchange rates; the impact of inflation; changes

in the Company’s credit rating; any decision to declare a quarterly

dividend; employee and community relations; litigation and

administrative proceedings; disruptions affecting operations;

availability of and increased costs associated with mining inputs

and labour; risks associated with the startup of new mines; delays

in or with the Phase 3+ Expansion Project at the Island Gold mine,

construction decisions and any development of the Lynn Lake Gold

Project; the risk that the Company’s mines may not perform as

planned; uncertainty with the Company’s ability to secure

additional capital to execute its business plans; the speculative

nature of mineral exploration and development, including the risks

of obtaining and maintaining necessary licenses and permits,

including the necessary licenses, permits, authorizations and/or

approvals from the appropriate regulatory authorities for the

Company’s development stage and operating assets; labour and

contractor availability (and being able to secure the same on

favourable terms); contests over title to properties; expropriation

or nationalization of property; inherent risks and hazards

associated with mining and mineral processing including

environmental hazards, industrial hazards and accidents, unusual or

unexpected formations, pressures and cave-ins; changes in national

and local government legislation, controls or regulations in

jurisdictions in which the Company does or may carry on business in

the future; increased costs and risks related to the potential

impact of climate change and other climate-related risks such as

warm spells, cold spells, heavy precipitation, storms, wildfires,

floods, drought, which may have an effect on mine permitting,

operations, ore extraction, mine closure or impact on employee

safety and the local environment; failure to comply with

environmental and health and safety laws and regulations;

disruptions in the maintenance or provision of required

infrastructure and information technology systems; risk of loss due

to sabotage, protests and other civil disturbances; the impact of

global liquidity and credit availability and the values of assets

and liabilities based on projected future cash flows; risks arising

from holding derivative instruments; and business opportunities

that may be pursued by the Company.

For a more detailed discussion of such risks and

other factors that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this News Release and the 2023 ESG Report, see the Company’s

latest 40-F/Annual Information Form and Management’s Discussion and

Analysis each under the heading “Risk Factors”, available on SEDAR+

at www.sedarplus.ca or on EDGAR at www.sec.gov. The

foregoing should be reviewed in conjunction with the information,

risk factors, and assumptions found in this News Release and the

2023 ESG Report.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

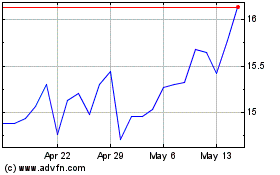

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

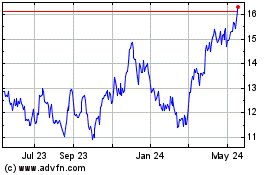

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Nov 2023 to Nov 2024