Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

May 22 2024 - 3:02PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 433

Registration Statement Nos. 333-272449, 333-272449-01,

333-272449-02,

333-272449-03, 333-272449-04 and 333-272449-05

Amcor UK Finance plc

€500,000,000

3.950% Guaranteed Senior Notes due 2032

With full and unconditional guarantees

as to payment of principal and

interest by each of

Amcor plc

Amcor Finance (USA), Inc.

Amcor Group Finance plc

Amcor Pty Ltd

Amcor Flexibles North America, Inc.

Pricing Term Sheet – May

22, 2024

| Issuer: |

Amcor UK Finance plc |

| Guarantors: |

Amcor plc, Amcor Finance (USA), Inc., Amcor Group Finance plc, Amcor Pty Ltd and Amcor Flexibles North America, Inc. |

| Expected Ratings*: |

Baa2 (Negative) (Moody’s) / BBB (Stable) (S&P) |

| Principal Amount: |

€500,000,000 |

| Ranking: |

Senior Unsecured |

| Format: |

SEC Registered Global Notes |

| Trade Date: |

May 22, 2024 |

| Settlement Date**: |

May 29, 2024 |

| Maturity Date: |

May 29, 2032 |

| Benchmark Bund: |

DBR 0% due February 15, 2032 |

| Benchmark Bund Price and Yield: |

82.790 / 2.473% |

| Spread to Benchmark Bund: |

+160.3 bps |

| Coupon: |

3.950% per annum |

| Re-Offer Yield: |

4.076% |

| Re-Offer Price: |

99.154% |

| Mid-Swap Yield: |

2.796% |

| Spread to Mid-Swap Yield: |

+128 bps |

| Fees: |

35 basis points |

| |

|

| All-in Price: |

98.804% |

| |

|

| Redemption Amount: |

100% of face value at Maturity Date

|

| |

|

| Interest Payment Dates: |

Payable annually in arrears on May 29 of each year, commencing May 29, 2025 and ending on the Maturity Date |

| |

|

| Optional Redemption: |

Make-Whole

Call: Comparable government bond + 25 bps at any time before February 29, 2032 Par call at any time on or after February 29,

2032

In the event that the Issuer has redeemed or purchased and

cancelled Notes equal to or greater than 75% of the aggregate principal amount of the Notes initially issued, the Issuer may redeem, in

whole, but not in part, the remaining Notes at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, together

with accrued and unpaid interest on those Notes to, but excluding, the date fixed for redemption.

|

| Day Count Convention: |

Actual / Actual (ICMA) |

| |

|

| Listing: |

We intend to apply to list the Notes on the New York Stock Exchange (the “NYSE”). The listing application will be subject to approval by the NYSE. We expect trading in the Notes on the NYSE to begin within 30 days after the original issue date of the Notes. If such listing is obtained, we will have no obligation to maintain such listing, and we may delist any Notes at any time. |

| |

|

| Target Market/PRIIPs: |

Manufacturer target market (MiFID II product governance) is

eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared

as not available to retail in the European Economic Area (the “EEA”).

Manufacturer target market (UK MIFIR product governance) is

eligible counterparties and professional clients only (all distribution channels). No UK PRIIPs key information document (KID) has been

prepared as not available to retail in the United Kingdom (the “UK”). |

| |

|

| ISIN / Common Code / CUSIP: |

XS2821714735 / 282171473 / 0234EVAB7 |

| |

|

| Settlement and Trading: |

Through the facilities of Euroclear and Clearstream |

| |

|

| Denominations: |

Minimum of €100,000 with increments of €1,000 thereafter |

| |

|

| Governing Law: |

New York |

| |

|

| Global Coordinators: |

Citigroup Global Markets Limited

Wells Fargo Securities International Limited |

| |

|

| Joint Book-Running Managers: |

BNP Paribas

HSBC Bank plc

Merrill Lynch International

Banco Bilbao Vizcaya Argentaria, S.A.

ING Bank N.V.

J.P. Morgan Securities plc |

| |

|

| Concurrent Offering: |

Concurrently with this offering, Amcor Group Finance plc is offering $500,000,000 aggregate principal amount of 5.450% Notes due 2029 (the “Concurrent Offering”). The Concurrent Offering is being made by means of a separate prospectus supplement and not by means of the prospectus supplement to which this pricing term sheet relates. This communication is not an offer to sell or a solicitation of an offer to buy any securities being offered in the concurrent offering. The closing of this offering and the Concurrent Offering are not conditioned on each other. |

*Note: A securities rating is not a

recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Credit ratings in respect of

Amcor UK Finance plc may be made available only to a person (x) who is not a “retail client” within the meaning of section

761G of the Corporations Act and is also a sophisticated investor, professional investor or other investor in respect of whom disclosure

is not required under Part 6D.2 or 7.9 of the Corporations Act, and (y) who is otherwise permitted to receive credit ratings in accordance

with applicable law in any jurisdiction in which the person may be located.

**Note: It is expected that delivery

of the Notes will be made to investors on or about May 29, 2024, which will be the fifth business day following the date of pricing of

the Notes (such settlement being referred to as “T+5”). Under Rule 15c6-1 of the U.S. Securities Exchange Act of 1934, as

amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade Notes prior to two business days before the date of delivery will be required,

by virtue of the fact that the Securities initially will settle in T+5, to specify an alternate settlement cycle at the time of any such

trade to prevent a failed settlement. Purchasers of the Notes who wish to trade Notes prior to two business days before the date of delivery

should consult their own advisor.

This communication is intended for the

sole use of the person to whom it is provided by the sender. This document may not be reproduced, distributed or published by any recipient

for any purpose. This document has been prepared for information purposes only and does not take into account the specific requirements,

investment objectives or financial circumstances of any recipient. The recipient should seek independent financial, legal, tax and other

relevant advice and should independently verify the accuracy of the information contained in this document.

MIFID II professionals / ECPs only

/ No PRIIPs KID – No PRIIPs key information document (KID) has been prepared as not available to retail in the EEA. Manufacturer

target market (MiFID II product governance) is eligible counterparties and professional clients only (all distribution channels).

UK MIFIR professionals / ECPs only

/ No PRIIPs KID – No UK PRIIPs key information documents (KID) has been prepared as not available to retail in the UK. Manufacturer

target market (UK MIFIR product governance) is eligible counterparties and professional clients only (all distribution channels).

The Issuer has filed a registration

statement (including a prospectus), as amended, with the SEC for the offering to which this communication relates. The information in

this pricing term sheet supplements the Issuer’s preliminary prospectus supplement, dated May 22, 2024 (the “Preliminary Prospectus”)

and supersedes the information in the Preliminary Prospectus to the extent inconsistent with the information in the Preliminary Prospectus.

Before you invest, you should read the Preliminary Prospectus, together with the prospectus in that registration statement and other documents

each of the Issuer and Amcor plc has filed with the SEC for more complete information about the Issuer, Amcor plc and this offering. You

may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any

dealer participating in the offering will arrange to send you the Preliminary Prospectus if you request it by calling Citigroup Global

Markets Limited toll-free at +1 800 831 9146 or Wells Fargo Securities International Limited at +44 20 3942 8530.

The information in this pricing term

sheet supplements the Preliminary Prospectus and supersedes the information in the Preliminary Prospectus to the extent inconsistent with

the information in the Preliminary Prospectus. This pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus.

Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus.

If this document has been distributed

by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could

be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability

for any errors or omissions in the contents of this document, which may arise as a result of electronic transmission.

ANY DISCLAIMERS OR OTHER NOTICES THAT

MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY

GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

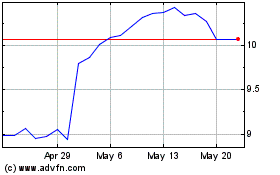

Amcor (NYSE:AMCR)

Historical Stock Chart

From May 2024 to Jun 2024

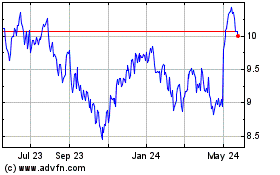

Amcor (NYSE:AMCR)

Historical Stock Chart

From Jun 2023 to Jun 2024