Amprius Technologies, Inc. (“Amprius” or the

“Company”) (NYSE: AMPX), a leader in next-generation

lithium-ion batteries with its Silicon Anode Platform, today

announced a temporary offer allowing its public and private

warrants to be exercised for cash at a reduced price.

The offer applies to holders of the Company’s outstanding public

warrants to purchase up to 29,268,236 shares of the Company’s

common stock, $0.0001 par value per share (the “Common Stock”), and

private warrants to purchase up to 16,400,000 shares of Common

Stock (together with the public warrants, the “Offering Warrants”).

Holders of the Offering Warrants, exercisable for one share of

Common Stock at an exercise price of $11.50 per Offering Warrant,

will have the opportunity to exercise their Offering Warrants at a

temporarily reduced cash exercise price of $1.10 per Offering

Warrant.

The offer is contingent upon the terms set forth in the Offer to

Exercise Warrants to Purchase Common Stock of Amprius Technologies,

Inc., dated May 13, 2024 (together with any amendments or

supplements thereto, the “Offer to Exercise”), filed as an exhibit

to the Company’s Schedule TO filed with the U.S. Securities and

Exchange Comission (the “SEC”).

The Company’s outstanding private placement warrants (the “PIPE

Warrants”), which are exercisable at a price of $12.50 per PIPE

Warrant, are not eligible to be exercised at the reduced exercise

price.

To participate in the Offer to Exercise and exercise the

Offering Warrants at the reduced cash exercise price, holders will

be required to tender their Offering Warrants prior to the

expiration of the Offer to Exercise at 5:00 p.m. Eastern Time on

June 11, 2024, which may be extended by Amprius in its sole

discretion.

The purpose of the Offer to Exercise is to encourage the cash

exercise of the Offering Warrants by temporarily reducing the

exercise price. Net proceeds received from any such exercises will

provide funds to Amprius for working capital, including to

partially fund the Company’s development plans, and general

corporate purposes. If all of the outstanding Offering Warrants

subject to the Offer to Exercise are exercised at this temporarily

reduced cash exercise price, Amprius would receive gross proceeds

of approximately $50 million from such exercises.

For additional information or assistance, please contact D.F.

King & Co., Inc., which is acting as Information Agent for the

Offer to Exercise. The Information Agent may be reached at:

D.F. King & Co., Inc. 48 Wall Street, 22nd Floor New York,

NY 10005 Banks and Brokers Call: (212) 434-0035 Call Toll-Free:

(866) 342-4883 Email: ampx@dfking.com

No Offer or Solicitation

This announcement is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended.

Additional Information

The discussion of the Offer to Exercise contained in this press

release is for informational purposes only and is neither an offer

to buy nor a solicitation of an offer to sell securities. Holders

of the Offering Warrants should read the Schedule TO filed with the

SEC and the exhibits attached thereto carefully because they

contain important information, including the various terms and

conditions of the Offer to Exercise. The Schedule TO, including the

Offer to Exercise and other related materials, will also be

available to Offering Warrant holders at no charge on the SEC’s

website at www.sec.gov or from D.F. King & Co., Inc., the

Company’s information agent for the offering. Holders of the

Offering Warrants are urged to read those materials carefully prior

to making any decisions with respect to the Offer to Exercise.

The Company has filed with the SEC registration statements that,

each as supplemented by the applicable prospectus supplement,

collectively register, among other things, the offer and sale of

the shares of Common Stock issuable upon exercise of Offering

Warrants at the temporarily reduced offering price available under

the Offer to Exercise. Copies of the prospectus supplements

relating to the exercise of the Offering Warrants, together with

the accompanying base prospectuses included in the registration

statements, may be obtained from the SEC at http://www.sec.gov, or

by contacting D.F. King & Co., Inc. at 48 Wall Street, 22nd

Floor, New York, NY 10005; Bankers and Brokers Call: (212)

434-0035; Toll-Free Call: (866) 342-4883, or via email at

AMPX@dfking.com.

About Amprius Technologies, Inc.

Amprius Technologies, Inc. is a leading manufacturer of

high-energy and high-power lithium-ion batteries producing the

industry’s highest known energy density cells. The Company’s

commercially available SiMaxx™ batteries deliver up to 450 Wh/kg

and 1,150 Wh/L, with third-party validation of 500Wh/kg and 1,300

Wh/L. The Company’s corporate headquarters is in Fremont,

California, where it maintains an R&D lab and a MWh scale

manufacturing facility for the fabrication of silicon anodes and

cells. To serve customer demand, Amprius entered into a lease

agreement for an approximately 774,000 square foot facility in

Brighton, Colorado and expanded its product portfolio to include

the SiCore™ platform.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, each as

amended. Forward-looking statements may be identified by the use of

words such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “anticipate,” “believe,” “seek” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding Amprius’ plans related to the tender offer,

including the expiration date of the Offer to Exercise and the use

of proceeds. These forward-looking statements are subject to a

number of risks and uncertainties, including whether holders of the

Offering Warrants participate in the Offer to Exercise, the

Company’s ability to complete the tender offer and changes in the

Company’s strategy due to unforeseen events or changed business

conditions. For more information on these and other risks and

uncertainties that may impact the operations and projections

discussed herein can be found in the documents Amprius files from

time to time with the Securities and Exchange Commission (the

“SEC”), all of which are available on the SEC’s website at

www.sec.gov. There may be additional risks that Amprius does not

presently know or that Amprius currently believes are immaterial

that could also cause actual results to differ from those contained

in the forward-looking statements. In addition, forward-looking

statements reflect Amprius’ expectations, plans or forecasts of

future events and views as of the date of this press release. These

forward-looking statements should not be relied upon as

representing Amprius’ assessments as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements. Except as required

by law, Amprius specifically disclaims any obligation to update any

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513588209/en/

Investors Tom Colton, Chris Adusei-Poku Gateway Group,

Inc. 949-574-3860 IR@amprius.com

Media Zach Kadletz, Brenlyn Motlagh Gateway Group, Inc.

949-574-3860 Amprius@Gateway-grp.com

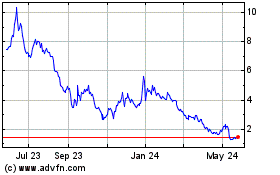

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From Apr 2024 to May 2024

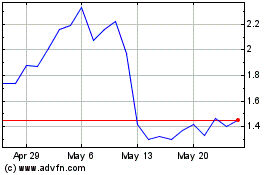

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From May 2023 to May 2024