0001734342false00017343422025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 22, 2025

Amerant Bancorp Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Florida | | 001-38534 | | 65-0032379 |

(State or other jurisdiction

of incorporation | | (Commission

file number) | | (IRS Employer

Identification Number) |

| | | | | | | | |

| | |

| | |

| 220 Alhambra Circle | | |

Coral Gables, Florida | | 33134 |

| (Address of principal executive offices) | | (Zip Code) |

(305) 460-8728 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of exchange on which registered |

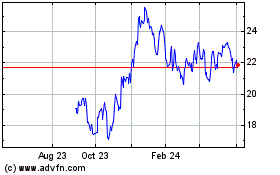

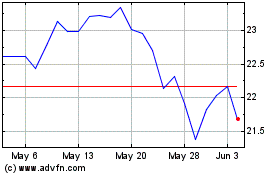

| Class A Common Stock | AMTB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 22, 2025, Amerant Bancorp Inc. (the "Company") issued a press release to report the Company’s financial results for the fiscal quarter and year ended December 31, 2024. The release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference to this Item 2.02.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On January 23, 2025, the Company will hold a live audio webcast to discuss its financial results for the fiscal quarter and year ended December 31, 2024. In connection with the webcast, the Company is furnishing to the U.S. Securities and Exchange Commission the earnings slide presentation attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference to this Item 7.01.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 attached hereto, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits | | | | | |

Number | Exhibit |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: January 22, 2024 | | Amerant Bancorp Inc. |

| | | | |

| | | By: | | /s/ Julio V. Pena |

| | | | | Name: Julio V. Pena |

| | | | | Title: Senior Vice President,

Securities Counsel and Corporate Secretary |

| | | | | | | | |

| | CONTACTS: |

| | Investors |

| | Laura Rossi |

| | InvestorRelations@amerantbank.com |

| | (305) 460-8728 |

| | |

| | Media |

| | Alexis Dominguez |

| | MediaRelations@amerantbank.com |

| | (305) 441-8414 |

AMERANT REPORTS FOURTH QUARTER 2024 AND FULL-YEAR 2024 RESULTS

CORAL GABLES, FLORIDA, January 22, 2025. Amerant Bancorp Inc. (NYSE: AMTB) (the “Company” or “Amerant”) today reported a net income attributable to the Company of $16.9 million in the fourth quarter of 2024, or $0.40 per diluted share, compared to a net loss of $48.2 million, or $1.43 loss per diluted share, in the third quarter of 2024. Net loss attributable to the Company was $15.8 million for the full-year 2024, or $0.44 per diluted share, compared to net income of $32.5 million, or $0.96 per diluted share, for the full-year 2023.

“Our fourth quarter results show significant improvement in a number of areas,” stated Jerry Plush, Chairman and CEO. “Net interest income increased over 8% while provision for credit losses declined 48%, quarter over quarter. While our asset size declined primarily from the sale of our Houston Franchise in the fourth quarter, our loan pipeline is robust heading into 2025, and we expect to be back well over $10 billion in assets in the first quarter of 2025. This past year we focused on completing our transformation toward becoming the bank of choice in Florida – in 2025, our focus now is executing on our growth plan.”

Fourth Quarter Financial Highlights and Quarter-over-Quarter Changes:

•Total assets were $9.9 billion, down $455.4 million, or 4.40%, compared to $10.4 billion as of 3Q24.

•Total gross loans were $7.27 billion, a decrease of $294.7 million, or 3.90%, compared to $7.56 billion in 3Q24.

•Cash and cash equivalents were $590.4 million, down $81.5 million, or 12.13%, compared to $671.8 million as of 3Q24.

•Total deposits were $7.9 billion, down $256.9 million, or 3.17%, compared to $8.1 billion in 3Q24.

•Total advances from Federal Home Loan Bank (“FHLB”) were $745.0 million, down $170.0 million, or 18.6%, compared to $915.0 million as of 3Q24. The Bank had an aggregate borrowing capacity of $2.5 billion from the FED and FHLB as of December 31, 2024.

•Average yield on loans was 7.00%, down compared to 7.08% in 3Q24.

•Total non-performing assets were $122.2 million, down $7.3 million, or 5.6%, compared to $129.4 million as of 3Q24.

•Classified loans were $125.7 million, up by $11.5 million compared to $114.2 million as of 3Q24, while non-performing loans declined by $10.8 million to $104.1 million as of 4Q24 from $114.9 million as of 3Q24. Special mention loans also declined by $71.0 million to $5.4 million as of 4Q24 from $76.4 million as of 3Q24.

•The allowance for credit losses ("ACL") was $85.0 million, an increase of $5.1 million, or 6.3%, compared to $79.9 million as of 3Q24.

•Core deposits, which consist of total deposits excluding all time deposits, were $5.6 billion, down $87.7 million, or 1.5%, compared to $5.7 billion as of 3Q24.

•Average cost of total deposits was 2.77% compared to 2.99% in 3Q24.

•Loan to deposit ratio was 92.5% compared to 93.2% in 3Q24.

•Assets Under Management and custody (“AUM”) totaled $2.9 billion as of 4Q24, an increase of $339.5 million, or 13.3%, compared to $2.6 billion as of 3Q24.

•Pre-provision net revenue (“PPNR”)(1) was $27.9 million in 4Q24, an increase of $70.8 million, or 165.1%, compared to negative $42.9 million in 3Q24. Excluding non-routine items, PPNR(2) in 4Q24 was $37.2 million, up $6.0 million, or 19.0%, compared to $31.3 million in 3Q24.

•Net Interest Margin (“NIM”) was 3.75%, up compared to 3.49% in 3Q24.

•Net Interest Income (“NII”) was $87.6 million, up $6.6 million, or 8.2%, compared to $81.0 million in 3Q24.

•Provision for credit losses was $9.9 million, down $9.1 million, or 47.8%, compared to $19.0 million in 3Q24.

•Non-interest income was $23.7 million, an increase of $71.4 million, or 149.7%, compared to negative $47.7 million in 3Q24. Excluding non-routine items, non-interest income(2) was $17.8 million, a decrease of $3.0 million, or 14.3%, compared to $20.8 million in 3Q24.

•Non-interest expense was $83.4 million, up $7.2 million, or 9.4%, compared to $76.2 million in 3Q24. Excluding non-routine items, non-interest expense(2) was $68.2 million, a decrease of $2.3 million, or 3.3%, compared to $70.5 million in 3Q24.

•The efficiency ratio was 74.91% in 4Q24, down compared to 228.74% in 3Q24. Excluding non-routine items, efficiency ratio(2) was 64.71%, down compared to 69.29% in 3Q24.

•Return on average assets (“ROA”) was 0.67% in 4Q24 compared to negative 1.92% in 3Q24. Excluding non-routine items, ROA(2) was 0.83% compared to 0.37% in 3Q24.

•Return on average equity (“ROE”) was 7.38% in 4Q24 compared to negative 24.98% in 3Q24. Excluding non-routine items, ROE(2) was 9.25% compared to 4.80% in 3Q24.

•The Company’s Board of Directors declared a cash dividend of $0.09 per share of common stock on January 22, 2025. The dividend is payable on February 28, 2025, to shareholders of record on February 14, 2025.

Full-year Financial Highlights and Year-on-Year Changes:

•Total assets were $9.9 billion, up $0.2 billion, or 1.9%, compared to $9.7 billion as of 4Q23.

•Total gross loans were $7.27 billion, an increase of $2.4 million, or 0.03%, compared to $7.26 billion in 4Q23.

•Cash and cash equivalents were $590.4 million, up $268.5 million, or 83%, compared to $321.9 million as of 4Q23.

•Total deposits were $7.9 billion, down $40.8 million, or 0.5%, compared to $7.9 billion in 4Q23.

•Total advances from Federal Home Loan Bank (“FHLB”) were $745.0 million, up $100.0 million, or 15.5%, compared to $645.0 million as of 4Q23.

•Average yield on loans was 7.00%, down compared to 7.09% in 4Q23. Average yield on loans for the full-year 2024 was 7.06%, up compared to 6.78% for the full-year 2023.

•Total non-performing assets were $122.2 million, up $67.6 million or 123.8%, compared to $54.6 million to 4Q23.

•Classified loans were $125.7 million, up by $96.0 million compared to $29.7 million as of 4Q23 and non-performing loans increased by $69.7 million to $104.1 million as of 4Q24 from $34.4 million as of 4Q23, while special mention loans declined by $40.6 million to $5.4 million as of 4Q24 from $46.0 million as of 4Q23.

•The allowance for credit losses ("ACL") was $85.0 million, a decrease of $10.5 million, or 11.0%, compared to $95.5 million in 4Q23.

•Core deposits, which consist of total deposits excluding all time deposits, were $5.62 billion, up $21.9 million, or 0.4%, compared to $5.60 billion as of 4Q23.

•Average cost of total deposits was 2.77% compared to 2.88% in 4Q23. Average cost of total deposits for the full-year 2024 was 2.94% compared to 2.47% for the full-year 2023.

•Loan to deposit ratio was 92.53% compared to 92.02% in 4Q23.

•Assets Under Management and custody (“AUM”) totaled $2.9 billion as of 4Q24, an increase of $600.9 million, or 26.3%, compared to $2.3 billion in 4Q23.

•Pre-provision net revenue (“PPNR”)(1) was $27.9 million in 4Q24, an increase of $35.5 million, or 467.8%, compared to negative $7.6 million in 4Q23. PPNR was $36.4 million

for the full-year 2024, a decrease of $67.9 million, or 65.1%, compared to $104.3 million for the full-year 2023. Excluding non-routine items, PPNR(2) for the full-year 2024 was $125.6 million, down $16.4 million, or 11.6%, compared to $142.0 million for the full-year 2023.

•Net Interest Margin (“NIM”) was 3.75%, up compared to 3.72% in 4Q23. NIM was 3.58% for the full-year 2024, down compared to 3.76% for the full-year 2023.

•Net Interest Income (“NII”) was $87.6 million, up $6.0 million, or 7.3%, compared to $81.7 million in 4Q23. NII was $326.0 million for the full-year 2024, down $0.5 million, or 0.16%, compared to $326.5 million for the full-year 2023.

•Provision for credit losses was $9.9 million, down compared to $12.5 million in 4Q23. Provision for credit losses was $60.5 million for the full-year 2024, compared to $61.3 million in the full-year 2023.

•Non-interest income was $23.7 million, an increase of $4.1 million, or 20.76%, compared to $19.6 million in 4Q23. Non-interest income was $9.9 million for the full-year 2024, a decrease of $77.6 million, or 88.7%, compared to $87.5 million for the full-year 2023. Excluding non-routine items, non-interest income(2) in 4Q24 was $17.8 million, an increase of $3.9 million, or 28.0%, compared to $13.9 million in 4Q23. For the full-year 2024, non-interest income(2) was $72.7 million, an increase of $13.7 million, or 23.2%, compared to $59.0 million for the full-year 2023.

•Non-interest expense was $83.4 million, down $26.3 million, or 24.0%, compared to $109.7 million in 4Q23. Non-interest expense was $299.5 million for the full-year 2024, down $11.9 million or 3.8%, compared to $311.4 million for the full-year 2023. Excluding non-routine items, non-interest expense(2) in 4Q24 was $68.2 million, an increase of $1.6 million, or 2.4%, compared to $66.6 million in 4Q23, while for the full-year 2024, non-interest expense(2) was $273.1 million, an increase of $27.9 million, or 11.38%, compared to $245.2 million for the full-year 2023.

•The efficiency ratio was 74.91% in 4Q24, down compared to 108.30% in 4Q23. The efficiency ratio was 89.17% for the full-year 2024 compared to 75.21% for the full-year 2023. Excluding non-routine items, efficiency ratio(2) in 4Q24 was 64.71%, down compared to 69.67% in 4Q23, while for the full-year 2024, the efficiency ratio(2) was 68.51%, up compared to 63.61% for the full-year 2023.

•Return on average assets (“ROA”) was 0.67% in 4Q24 compared to negative 0.71% in 4Q23. ROA was negative 0.16% for the full-year 2024 compared to 0.34% for the full-year 2023. Excluding non-routine items, ROA(2) in 4Q24 was 0.83% compared to 0.64% in 4Q23, while for the full-year 2024, ROA(2) was 0.51% compared to 0.69% for the full-year 2023.

•Return on average equity (“ROE”) was 7.38% in 4Q24 compared to negative 9.22% in 4Q23. ROE was negative 1.99% for the full-year 2024 compared to 4.39% for the full-year 2023. Excluding non-routine items, ROE(2) was 9.25% in 4Q24 compared to 8.23% in 4Q23, while for the full-year 2024, ROE(2) was 6.37% compared to 8.79% for the full-year 2023.

Additional details on fourth quarter and full-year 2024 results can be found in the Exhibits to this earnings release, and the earnings presentation available under the Investor Relations section of the Company’s website at https://investor.amerantbank.com.

1 Non-GAAP measure, see “Non-GAAP Financial Measures” for more information and Exhibit 2 for a reconciliation to GAAP.

2 Represents core PPNR, core noninterest income, core noninterest expense, core efficiency ratio, core ROA or Core ROE, as applicable, which are Non-GAAP measures. See “Non-GAAP Financial Measures” for more information and Exhibit 2 for a reconciliation to GAAP measures.

Fourth Quarter and Full Year 2024 Earnings Conference Call

The Company will hold an earnings conference call on Thursday, January 23, 2025 at 9:00 a.m. (Eastern Time) to discuss its fourth quarter and full-year 2024 results. The conference call and presentation materials can be accessed via webcast by logging on from the Investor Relations section of the Company’s website at https://investor.amerantbank.com. The online replay will remain available for approximately one month following the call through the above link.

About Amerant Bancorp Inc. (NYSE: AMTB)

Amerant Bancorp Inc. is a bank holding company headquartered in Coral Gables, Florida since 1979. The Company operates through its main subsidiary, Amerant Bank, N.A. (the “Bank”), as well as its other subsidiaries: Amerant Investments, Inc., and Amerant Mortgage, LLC. The Company provides individuals and businesses with deposit, credit and wealth management services. The Bank, which has operated for over 40 years, is headquartered in Florida and operates 19 banking centers – 18 in South Florida and 1 in Tampa, Florida. For more information, visit investor.amerantbank.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our securities repositioning and loan recoveries, reaching effective resolutions on problem loans, or significantly reducing special mention and/or non-performing loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future.

Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2023 filed on March 7, 2024 (the “Form 10-K”), our quarterly report on Form 10-Q for the quarter ended March 31, 2024 filed on May 3, 2024, our quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2024 filed on

November 4, 2024, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov.

Interim Financial Information

Unaudited financial information as of and for interim periods, including the three month periods ended September 30, 2024, June 30, 2024, March 31, 2024, and the three and twelve month periods ended December 31, 2024, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2024, or any other period of time or date.

Non-GAAP Financial Measures

The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, “tangible stockholders’ equity (book value) per common share”, “tangible common equity ratio, adjusted for net unrealized accumulated losses on debt securities held to maturity”, and “tangible stockholders' equity (book value) per common share, adjusted for net unrealized accumulated losses on debt securities held to maturity”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein.

We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2024, including the effect of non-core banking activities such as the sale of loans and securities (including the investment portfolio repositioning initiated in the third quarter of 2024) and other repossessed assets, the sale of our Houston franchise, the valuation of securities, derivatives, loans held for sale and other real estate owned, impairment of investments, the early repayment of FHLB advances, Bank owned life insurance restructure, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

Exhibit 2 reconciles these non-GAAP financial measures to GAAP reported results.

Exhibit 1- Selected Financial Information

The following table sets forth selected financial information derived from our unaudited and audited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 |

| Consolidated Balance Sheets | | | | | | | | | (audited) |

| Total assets | $ | 9,897,691 | | | $ | 10,353,127 | | | $ | 9,747,738 | | | $ | 9,817,772 | | | $ | 9,716,327 | |

| Total investments | 1,497,925 | | | 1,542,544 | | | 1,547,864 | | | 1,578,568 | | | 1,496,975 | |

| | | | | | | | | |

Total gross loans (1)(2) | 7,267,279 | | | 7,561,963 | | | 7,322,911 | | | 7,006,383 | | | 7,264,912 | |

| Allowance for credit losses | 84,963 | | | 79,890 | | | 94,400 | | | 96,050 | | | 95,504 | |

| Total deposits | 7,854,069 | | | 8,110,944 | | | 7,816,011 | | | 7,878,243 | | | 7,894,863 | |

Core deposits (1) | 5,619,624 | | | 5,707,366 | | | 5,505,349 | | | 5,633,165 | | | 5,597,766 | |

| Advances from the Federal Home Loan Bank | 745,000 | | | 915,000 | | | 765,000 | | | 715,000 | | | 645,000 | |

| Senior notes | 59,843 | | | 59,764 | | | 59,685 | | | 59,605 | | | 59,526 | |

| Subordinated notes | 29,624 | | | 29,582 | | | 29,539 | | | 29,497 | | | 29,454 | |

| Junior subordinated debentures | 64,178 | | | 64,178 | | | 64,178 | | | 64,178 | | | 64,178 | |

Stockholders' equity (3)(4)(5) | 890,467 | | | 902,888 | | | 734,342 | | | 738,085 | | | 736,068 | |

Assets under management and custody (1) | 2,890,048 | | | 2,550,541 | | | 2,451,854 | | | 2,357,621 | | | 2,289,135 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended December 31, |

(in thousands, except percentages, share data and per share amounts) | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | |

Consolidated Results of Operations | | | | | | | | | | | | |

|

| Net interest income | $ | 87,635 | | $ | 80,999 | | $ | 79,355 | | $ | 77,968 | | $ | 81,677 | | $ | 325,957 | | $ | 326,464 |

Provision for credit losses (6) | 9,910 | | 19,000 | | 19,150 | | 12,400 | | 12,500 | | 60,460 | | 61,277 |

| Noninterest income | 23,684 | | (47,683) | | 19,420 | | 14,488 | | 19,613 | | 9,909 | | 87,496 |

| Noninterest expense | 83,386 | | 76,208 | | 73,302 | | 66,594 | | 109,702 | | 299,490 | | 311,355 |

Net income (loss) attributable to Amerant Bancorp Inc. (7) | 16,881 | | (48,164) | | 4,963 | | 10,568 | | (17,123) | | (15,752) | | 32,490 |

| Effective income tax rate | 6.34 | % | | 22.18 | % | | 21.51 | % | | 21.50 | % | | 14.21 | % | | 34.60 | % | | 25.50 | % |

| | | | | | | | | | | | | |

Common Share Data | | | | | | | | | | | | | |

| Stockholders' book value per common share | $ | 21.14 | | $ | 21.44 | | $ | 21.88 | | $ | 21.90 | | $ | 21.90 | | $ | 21.14 | | $ | 21.90 |

Tangible stockholders' equity (book value) per common share (8) | $ | 20.56 | | $ | 20.87 | | $ | 21.15 | | $ | 21.16 | | $ | 21.16 | | $ | 20.56 | | $ | 21.16 |

Tangible stockholders’ equity (book value) per common share, adjusted for net unrealized accumulated losses on debt securities held to maturity (8) | $ | 20.56 | | $ | 20.87 | | $ | 20.54 | | $ | 20.60 | | $ | 20.68 | | $ | 20.56 | | $ | 20.68 |

| Basic earnings (loss) per common share | $ | 0.40 | | $ | (1.43) | | $ | 0.15 | | $ | 0.32 | | $ | (0.51) | | $ | (0.44) | | $ | 0.97 |

Diluted earnings (loss) per common share (9) | $ | 0.40 | | $ | (1.43) | | $ | 0.15 | | $ | 0.31 | | $ | (0.51) | | $ | (0.44) | | $ | 0.96 |

| Basic weighted average shares outstanding | 42,069,098 | | 33,784,999 | | 33,581,604 | | 33,538,069 | | 33,432,871 | | 35,755,375 | | 33,511,321 |

Diluted weighted average shares outstanding (9) | 42,273,778 | | 33,784,999 | | 33,780,666 | | 33,821,562 | | 33,432,871 | | 35,755,375 | | 33,675,388 |

Cash dividend declared per common share (4) | $ | 0.09 | | | $ | 0.09 | | | $ | 0.09 | | | $ | 0.09 | | | $ | 0.09 | | | $ | 0.36 | | | $ | 0.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended December 31, |

| December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | 2024 | | 2023 |

Other Financial and Operating Data (12) | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| Profitability Indicators (%) | | | | | | | | | | | | | |

Net interest income / Average total interest earning assets (NIM) (1) | 3.75 | % | | 3.49 | % | | 3.56 | % | | 3.51 | % | | 3.72 | % | | 3.58 | % | | 3.76 | % |

Net income (loss) / Average total assets (ROA) (1) | 0.67 | % | | (1.92) | % | | 0.21 | % | | 0.44 | % | | (0.71) | % | | (0.16) | % | | 0.34 | % |

Net income(loss) / Average stockholders' equity (ROE) (1) | 7.38 | % | | (24.98) | % | | 2.68 | % | | 5.69 | % | | (9.22) | % | | (1.99) | % | | 4.39 | % |

Noninterest income / Total revenue (1) | 21.28 | % | | (143.12) | % | | 19.66 | % | | 15.67 | % | | 19.36 | % | | 2.95 | % | | 21.14 | % |

| | | | | | | | | | | | | |

| Capital Indicators (%) | | | | | | | | | | | | | |

Total capital ratio (1) | 13.43 | % | | 12.72 | % | | 11.88 | % | | 12.49 | % | | 12.13 | % | | 13.43 | % | | 12.13 | % |

Tier 1 capital ratio (1) | 11.95 | % | | 11.36 | % | | 10.34 | % | | 10.87 | % | | 10.55 | % | | 11.95 | % | | 10.55 | % |

Tier 1 leverage ratio (1) | 9.66 | % | | 9.56 | % | | 8.74 | % | | 8.73 | % | | 8.84 | % | | 9.66 | % | | 8.84 | % |

Common equity tier 1 capital ratio (CET1) (1) | 11.21 | % | | 10.65 | % | | 9.60 | % | | 10.10 | % | | 9.79 | % | | 11.21 | % | | 9.79 | % |

Tangible common equity ratio (1)(8) | 8.77 | % | | 8.51 | % | | 7.30 | % | | 7.28 | % | | 7.34 | % | | 8.77 | % | | 7.34 | % |

Tangible common equity ratio, adjusted for net unrealized accumulated losses on debt securities held to maturity (1)(8) | 8.77 | % | | 8.51 | % | | 7.11 | % | | 7.10 | % | | 7.18 | % | | 8.77 | % | | 7.18 | % |

| | | | | | | | | | | | | |

| Liquidity Ratios (%) | | | | | | | | | | | | | |

Loans to Deposits (1) | 92.53 | % | | 93.23 | % | | 93.69 | % | | 88.93 | % | | 92.02 | % | | 92.53 | % | | 92.02 | % |

| | | | | | | | | | | | | |

| Asset Quality Indicators (%) | | | | | | | | | | | | | |

Non-performing assets / Total assets (1) | 1.23 | % | | 1.25 | % | | 1.24 | % | | 0.51 | % | | 0.56 | % | | 1.23 | % | | 0.56 | % |

Non-performing loans / Total loans (1) | 1.43 | % | | 1.52 | % | | 1.38 | % | | 0.43 | % | | 0.47 | % | | 1.43 | % | | 0.47 | % |

| Allowance for credit losses / Total non-performing loans | 81.62 | % | | 69.51 | % | | 93.51 | % | | 317.01 | % | | 278.02 | % | | 81.62 | % | | 278.02 | % |

| Allowance for credit losses / Total loans held for investment | 1.18 | % | | 1.15 | % | | 1.41 | % | | 1.38 | % | | 1.39 | % | | 1.18 | % | | 1.39 | % |

Net charge-offs / Average total loans held for investment (1)(10) | 0.26 | % | | 1.90 | % | | 1.13 | % | | 0.69 | % | | 0.85 | % | | 0.99 | % | | 0.69 | % |

| | | | | | | | | | | | | |

| Efficiency Indicators (% except FTE) | | | | | | | | | | | | | |

| Noninterest expense / Average total assets | 3.29 | % | | 3.04 | % | | 3.03 | % | | 2.75 | % | | 4.57 | % | | 3.03 | % | | 3.29 | % |

| Salaries and employee benefits / Average total assets | 1.39 | % | | 1.39 | % | | 1.40 | % | | 1.36 | % | | 1.38 | % | | 1.39 | % | | 1.41 | % |

Other operating expenses/ Average total assets (1) | 1.90 | % | | 1.64 | % | | 1.63 | % | | 1.39 | % | | 3.20 | % | | 1.64 | % | | 1.88 | % |

Efficiency ratio (1) | 74.91 | % | | 228.74 | % | | 74.21 | % | | 72.03 | % | | 108.30 | % | | 89.17 | % | | 75.21 | % |

Full-Time-Equivalent Employees (FTEs) (11) | 698 | | 735 | | 720 | | 696 | | 682 | | 698 | | 682 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended December 31, |

(in thousands, except percentages and per share amounts) | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | 2024 | | 2023 |

Core Selected Consolidated Results of Operations and Other Data (8) | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| Pre-provision net revenue (PPNR) | $ | 27,933 | | | $ | (42,892) | | | $ | 25,473 | | | $ | 25,862 | | | $ | (7,595) | | | $ | 36,376 | | $ | 104,306 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Core pre-provision net revenue (Core PPNR) | $ | 37,217 | | | $ | 31,264 | | | $ | 31,007 | | | $ | 26,068 | | | $ | 29,811 | | | $ | 125,556 | | $ | 141,990 |

| Core net income | $ | 21,160 | | | $ | 9,249 | | | $ | 9,307 | | | $ | 10,730 | | | $ | 15,272 | | | $ | 50,446 | | $ | 65,104 |

| Core basic earnings per common share | 0.50 | | | 0.27 | | | 0.28 | | | 0.32 | | | 0.46 | | | 1.41 | | 1.94 |

Core earnings per diluted common share (9) | 0.50 | | | 0.27 | | | 0.28 | | | 0.32 | | | 0.46 | | | 1.41 | | 1.93 |

Core net income / Average total assets (Core ROA) (1) | 0.83 | % | | 0.37 | % | | 0.38 | % | | 0.44 | % | | 0.64 | % | | 0.51% | | 0.69% |

Core net income / Average stockholders' equity (Core ROE)(1) | 9.25 | % | | 4.80 | % | | 5.03 | % | | 5.78 | % | | 8.23 | % | | 6.37% | | 8.79% |

Core efficiency ratio | 64.71 | % | | 69.29 | % | | 68.60 | % | | 71.87 | % | | 69.67 | % | | 68.51% | | 63.61% |

__________________

(1) See Glossary of Terms and Definitions for definitions of financial terms.

(2) All periods include mortgage loans held for sale carried at fair value, while September 30, 2024, June 30, 2024 and December 31 2023 also include loans held for sale carried at the lower of estimated cost or fair value. As of December 31, 2024, there were no loans carried at the lower cost or fair value.

(3) In the fourth quarter of 2022, the Company announced that the Board of Directors authorized a new repurchase program pursuant to which the Company may purchase, from time to time, up to an aggregate amount of $25 million of its shares of Class A common stock (the “2023 Class A Common Stock Repurchase Program”). There were no repurchases of Class A common stock in the fourth quarter of 2024. For repurchases during all other periods, see September 30, 2024 Form 10-Q, June 30, 2024 Form 10-Q, March 31, 2024 Form 10-Q and 2023 Form 10-K.

(4) For the three months ended December 31, 2024, the Company’s Board of Directors declared cash dividends of $0.09 per share of the Company’s common stock and paid an aggregate amount of $3.8 million in connection with these dividends. For all other periods shown, the Company paid $3.0 million per quarter in connection with these dividends. The dividend declared in the fourth quarter of 2024 was paid on November 29, 2024 to shareholders of record at the close of business on November 14, 2024. See September 30, 2024 Form 10-Q, June 30, 2024 Form 10-Q, and 2023 Form 10-K for more information on dividend payments during the previous quarters.

(5) On September 27, 2024, the Company completed a public offering of 8,684,210 shares of its Class A common stock, at a price to the public of $19.00 per share.

(6) In the fourth, third, second and first quarter of 2024 and in the fourth quarter of 2023, includes $9.7 million, $17.9 million, $17.7 million, $12.4 million and $12.0 million of provision for credit losses on loans. Provision for unfunded commitments (contingencies) in the fourth, third and second quarter of 2024 and in the fourth quarter of 2023, were $0.2 million, $1.1 million, $1.5 million and $0.5 million, respectively, while there was none in the first quarter of 2024. The Provision for Loan Losses was $60.5 million and $61.3 million for the years ended December 31, 2024 and 2023, respectively. These amounts include the Provision for Losses on Loans of $57.7 million and $60.1 million in the years ended December 31, 2024 and 2023, respectively, and the Provision for unfunded commitments (contingencies) of $2.8 million and $1.2 million as of December 31, 2024 and 2023, respectively.

(7) In the three months ended December 31, 2023, net income excludes losses of $0.8 million, attributable to a minority interest in Amerant Mortgage LLC. In the fourth quarter of 2023, the Company increased its ownership interest in Amerant Mortgage to 100% from 80% at September 30, 2023. This transaction had no material impact to the Company’s results of operations in the three months ended December 31, 2023. In connection with the change in ownership interest, which brought the minority interest share to zero, the Company derecognized the equity attributable to noncontrolling interest of $3.8 million at December 31, 2023, with a corresponding reduction to additional paid-in capital.

(8) This presentation contains adjusted financial information determined by methods other than GAAP. This adjusted financial information is reconciled to GAAP in Exhibit 2 - Non-GAAP Financial Measures Reconciliation.

(9) See 2023 Form 10-K for more information on potential dilutive instruments and its impact on diluted earnings per share computation.

(10) See September 30, 2024 Form 10-Q, June 30, 2024 Form 10-Q, March 31, 2024 Form 10-Q and 2023 Form 10-K, for more details on charge-offs for all previous periods.

(11) As of December 31, 2024, September 30, 2024, June 30, 2024, March 31, 2034 and December 31, 2023, includes 80, 81, 83, 65 and 67 FTEs for Amerant Mortgage, respectively.

(12) Operating data for the periods presented have been annualized.

Exhibit 2- Non-GAAP Financial Measures Reconciliation

The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, enhancement of the bank owned life insurance and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | Years Ended December 31, | | | | |

(in thousands) | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | December 31, 2023 | | 2024 | 2023

| | | | |

| | | | | | | | | | | | |

| Net income (loss) attributable to Amerant Bancorp Inc. | $ | 16,881 | | $ | (48,164) | | $ | 4,963 | | $ | 10,568 | | $ | (17,123) | | | $ | (15,752) | | $ | 32,490 | | | | | |

Plus: provision for credit losses (1) | 9,910 | | 19,000 | | 19,150 | | 12,400 | | 12,500 | | | 60,460 | | 61,277 | | | | | |

| Plus: provision for income tax (benefit) expense | 1,142 | | (13,728) | | 1,360 | | 2,894 | | (2,972) | | | (8,332) | | 10,539 | | | | | |

| Pre-provision net revenue (PPNR) | 27,933 | | (42,892) | | 25,473 | | 25,862 | | (7,595) | | | 36,376 | | 104,306 | | | | | |

| Plus: non-routine noninterest expense items | 15,148 | | 5,672 | | 5,562 | | — | | 43,094 | | | 26,382 | | 66,152 | | | | | |

(Less) plus: non-routine noninterest income items | (5,864) | | 68,484 | | (28) | | 206 | | (5,688) | | | 62,798 | | (28,468) | | | | | |

| Core pre-provision net revenue (Core PPNR) | $ | 37,217 | | $ | 31,264 | | $ | 31,007 | | $ | 26,068 | | $ | 29,811 | | | $ | 125,556 | | $ | 141,990 | | | | | |

| | | | | | | | | | | | |

| Total noninterest income | $ | 23,684 | | $ | (47,683) | | $ | 19,420 | | $ | 14,488 | | $ | 19,613 | | | $ | 9,909 | | $ | 87,496 | | | | | |

| Less: Non-routine noninterest income items: | | | | | | | | | | | | |

| Derivative (losses) gains, net | — | | — | | (44) | | (152) | | (151) | | | (196) | | 28 | | | | | |

Securities (losses) gains, net (2) | (8,200) | | (68,484) | | (117) | | (54) | | 33 | | | (76,855) | | (10,989) | | | | | |

Bank owned life insurance charge (3) | — | | — | | — | | — | | (655) | | | — | | (655) | | | | | |

| | | | | | | | | | | | |

Gain on sale of Houston Franchise (11) | 12,636 | | — | | — | | — | | — | | | 12,636 | | — | | | | | |

| Gains on early extinguishment of FHLB advances, net | 1,428 | | — | | 189 | | — | | 6,461 | | | 1,617 | | 40,084 | | | | | |

| | | | | | | | | | | | |

| Total non-routine noninterest income items | $ | 5,864 | | $ | (68,484) | | $ | 28 | | $ | (206) | | $ | 5,688 | | | $ | (62,798) | | $ | 28,468 | | | | | |

| Core noninterest income | $ | 17,820 | | $ | 20,801 | | $ | 19,392 | | $ | 14,694 | | $ | 13,925 | | | $ | 72,707 | | $ | 59,028 | | | | | |

| | | | | | | | | | | | |

| Total noninterest expenses | $ | 83,386 | | $ | 76,208 | | $ | 73,302 | | $ | 66,594 | | $ | 109,702 | | | $ | 299,490 | | $ | 311,355 | | | | | |

| Less: non-routine noninterest expense items | | | | | | | | | | | | |

Restructuring costs (4) | | | | | | | | | | | | |

Staff reduction costs (5) | — | | — | | — | | — | | 1,120 | | | — | | 4,006 | | | | | |

| | | | | | | | | | | | |

Contract termination costs (6) | — | | — | | — | | — | | — | | | — | | 1,550 | | | | | |

Consulting and other professional fees and software expenses (7) | — | | — | | — | | — | | 1,629 | | | — | | 6,379 | | | | | |

| | | | | | | | | | | | |

Disposition of fixed assets (8) | — | | — | | — | | — | | — | | | — | | 1,419 | | | | | |

Branch closure and related charges (9) | — | | — | | — | | — | | — | | | — | | 2,279 | | | | | |

| Total restructuring costs | $ | — | | $ | — | | $ | — | | $ | — | | $ | 2,749 | | | $ | — | | $ | 15,633 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other non-routine noninterest expense items: | | | | | | | | | | | | |

Losses on loans held for sale carried at the lower cost or fair value (10)(11) | 12,642 | | — | | 1,258 | | — | | 37,495 | | | 13,900 | | 43,057 | | | | | |

Other real estate owned valuation expense(12) | — | | 5,672 | | — | | — | | — | | | 5,672 | | 2,649 | | | | | |

Goodwill and intangible assets impairment (11) | — | | — | | 300 | | — | | 1,713 | | | 300 | | 1,713 | | | | | |

Fixed assets impairment (11)(13) | — | | — | | 3,443 | | — | | — | | | 3,443 | | — | | | | | |

Legal, broker fees, and other costs (11) | 2,506 | | — | | 561 | | — | | — | | | 3,067 | | — | | | | | |

Bank owned life insurance enhancement costs (3) | — | | — | | — | | — | | 1,137 | | | — | | 1,137 | | | | | |

| Impairment charge on investment carried at cost | — | | — | | — | | — | | — | | | — | | 1,963 | | | | | |

| Total non-routine noninterest expense items | $ | 15,148 | | $ | 5,672 | | $ | 5,562 | | $ | — | | $ | 43,094 | | | $ | 26,382 | | $ | 66,152 | | | | | |

| Core noninterest expenses | $ | 68,238 | | $ | 70,536 | | $ | 67,740 | | $ | 66,594 | | $ | 66,608 | | | $ | 273,108 | | $ | 245,203 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | Years Ended December 31, | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(in thousands, except percentages and per share data) | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | December 31, 2023 | | 2024 | 2023

| | | | |

| Net income (loss) attributable to Amerant Bancorp Inc. | $ | 16,881 | | $ | (48,164) | | $ | 4,963 | | $ | 10,568 | | $ | (17,123) | | | $ | (15,752) | | $ | 32,490 | | | | | |

| Plus after-tax non-routine items in noninterest expense: | | | | | | | | | | | | |

| Non-routine items in noninterest expense before income tax effect | 15,148 | | 5,672 | | 5,562 | | — | | 43,094 | | | 26,382 | | 66,152 | | | | | |

Income tax effect (14) | (3,409) | | (1,332) | | (1,196) | | — | | (8,887) | | | (5,937) | | (13,892) | | | | | |

| Total after-tax non-routine items in noninterest expense | 11,739 | | 4,340 | | 4,366 | | — | | 34,207 | | | 20,445 | | 52,260 | | | | | |

(Less) plus: before-tax non-routine items in noninterest income: | | | | | | | | | | | | |

| Non-routine items in noninterest income before income tax effect | (5,864) | | 68,484 | | (28) | | 206 | | (5,688) | | | 62,798 | | (28,468) | | | | | |

Income tax effect (14) | (1,596) | | (15,411) | | 6 | | (44) | | 1,032 | | | (17,045) | | 5,978 | | | | | |

| Total after-tax non-routine items in noninterest income | (7,460) | | 53,073 | | (22) | | 162 | | (4,656) | | | 45,753 | | (22,490) | | | | | |

BOLI enhancement tax impact (3) | — | | — | | — | | — | | 2,844 | | | — | | 2,844 | | | | | |

| Core net income | $ | 21,160 | | $ | 9,249 | | $ | 9,307 | | $ | 10,730 | | $ | 15,272 | | | $ | 50,446 | | $ | 65,104 | | | | | |

| | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | 0.40 | | $ | (1.43) | | $ | 0.15 | | $ | 0.32 | | $ | (0.51) | | | $ | (0.44) | | $ | 0.97 | | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (15) | 0.28 | | 0.13 | | 0.13 | | — | | 1.11 | | | 0.57 | | 1.64 | | | | | |

(Less) plus: after tax impact of non-routine items in noninterest income | (0.18) | | 1.57 | | — | | — | | (0.14) | | | 1.28 | | (0.67) | | | | | |

| Total core basic earnings per common share | $ | 0.50 | | $ | 0.27 | | $ | 0.28 | | $ | 0.32 | | $ | 0.46 | | | $ | 1.41 | | $ | 1.94 | | | | | |

| | | | | | | | | | | | |

Diluted earnings (loss) per share (16) | $ | 0.40 | | $ | (1.43) | | $ | 0.15 | | $ | 0.31 | | $ | (0.51) | | | $ | (0.44) | | $ | 0.96 | | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (15) | 0.28 | | 0.13 | | 0.13 | | — | | 1.11 | | | 0.57 | | 1.63 | | | | | |

(Less) plus: after tax impact of non-routine items in noninterest income | (0.18) | | 1.57 | | — | | 0.01 | | (0.14) | | | 1.28 | | (0.66) | | | | | |

| Total core diluted earnings per common share | $ | 0.50 | | $ | 0.27 | | $ | 0.28 | | $ | 0.32 | | $ | 0.46 | | | $ | 1.41 | | $ | 1.93 | | | | | |

| | | | | | | | | | | | |

| Net income (loss) / Average total assets (ROA) | 0.67 | % | (1.92) | % | 0.21 | % | 0.44 | % | (0.71) | % | | (0.16) | % | 0.34 | % | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (15) | 0.46 | % | 0.18 | % | 0.17 | % | — | % | 1.55 | % | | 0.21 | % | 0.58 | % | | | | |

(Less) plus: after tax impact of non-routine items in noninterest income | (0.30) | % | 2.11 | % | — | % | — | % | (0.20) | % | | 0.46 | % | (0.23) | % | | | | |

| Core net income / Average total assets (Core ROA) | 0.83 | % | 0.37 | % | 0.38 | % | 0.44 | % | 0.64 | % | | 0.51 | % | 0.69 | % | | | | |

| | | | | | | | | | | | |

| Net income (loss) / Average stockholders' equity (ROE) | 7.38 | % | (24.98) | % | 2.68 | % | 5.69 | % | (9.22) | % | | (1.99) | % | 4.39 | % | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (15) | 5.13 | % | 2.25 | % | 2.36 | % | — | % | 19.96 | % | | 2.58 | % | 7.44 | % | | | | |

(Less) plus: after tax impact of non-routine items in noninterest income | (3.26) | % | 27.53 | % | (0.01) | % | 0.09 | % | (2.51) | % | | 5.78 | % | (3.04) | % | | | | |

| Core net income / Average stockholders' equity (Core ROE) | 9.25 | % | 4.80 | % | 5.03 | % | 5.78 | % | 8.23 | % | | 6.37 | % | 8.79 | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Efficiency ratio | 74.91 | % | 228.74 | % | 74.21 | % | 72.03 | % | 108.30 | % | | 89.17 | % | 75.21 | % | | | | |

(Less): impact of non-routine items in noninterest expense and noninterest income | (10.20) | % | (159.45) | % | (5.61) | % | (0.16) | % | (38.63) | % | | (20.66) | % | (11.60) | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Core efficiency ratio | 64.71 | % | 69.29 | % | 68.60 | % | 71.87 | % | 69.67 | % | | 68.51 | % | 63.61 | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | Years Ended December 31, | | | | |

(in thousands, except percentages, share data and per share data) | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | December 31, 2023 | | 2024 | 2023

| | | | |

| Stockholders' equity | $ | 890,467 | | $ | 902,888 | | $ | 734,342 | | $ | 738,085 | | $ | 736,068 | | | $ | 890,467 | | $ | 736,068 | | | | | |

Less: goodwill and other intangibles (17) | (24,314) | | (24,366) | | (24,581) | | (24,935) | | (25,029) | | | (24,314) | | (25,029) | | | | | |

| Tangible common stockholders' equity | $ | 866,153 | | $ | 878,522 | | $ | 709,761 | | $ | 713,150 | | $ | 711,039 | | | $ | 866,153 | | $ | 711,039 | | | | | |

| Total assets | 9,897,691 | | 10,353,127 | | 9,747,738 | | 9,817,772 | | 9,716,327 | | | 9,897,691 | | 9,716,327 | | | | | |

Less: goodwill and other intangibles (17) | (24,314) | | (24,366) | | (24,581) | | (24,935) | | (25,029) | | | (24,314) | | (25,029) | | | | | |

| Tangible assets | $ | 9,873,377 | | $ | 10,328,761 | | $ | 9,723,157 | | $ | 9,792,837 | | $ | 9,691,298 | | | $ | 9,873,377 | | $ | 9,691,298 | | | | | |

| Common shares outstanding | 42,127,316 | | 42,103,623 | | 33,562,756 | | 33,709,395 | | 33,603,242 | | | 42,127,316 | | 33,603,242 | | | | | |

| Tangible common equity ratio | 8.77 | % | 8.51 | % | 7.30 | % | 7.28 | % | 7.34 | % | | 8.77 | % | 7.34 | % | | | | |

| Stockholders' book value per common share | $ | 21.14 | | $ | 21.44 | | $ | 21.88 | | $ | 21.90 | | $ | 21.90 | | | $ | 21.14 | | $ | 21.90 | | | | | |

| Tangible stockholders' book value per common share | $ | 20.56 | | $ | 20.87 | | $ | 21.15 | | $ | 21.16 | | $ | 21.16 | | | $ | 20.56 | | $ | 21.16 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Tangible common stockholders' equity | $ | 866,153 | | $ | 878,522 | $ | 709,761 | $ | 713,150 | $ | 711,039 | | $ | 866,153 | | $ | 711,039 | | | | |

Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (18) | — | | — | (20,304) | (18,729) | (16,197) | | — | | (16,197) | | | | |

| Tangible common stockholders' equity, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 866,153 | | $ | 878,522 | $ | 689,457 | $ | 694,421 | $ | 694,842 | | $ | 866,153 | | $ | 694,842 | | | | |

| Tangible assets | $ | 9,873,377 | | $ | 10,328,761 | $ | 9,723,157 | $ | 9,792,837 | $ | 9,691,298 | | $ | 9,873,377 | | $ | 9,691,298 | | | | |

Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (18) | — | | — | (20,304) | (18,729) | (16,197) | | — | | (16,197) | | | | | |

| Tangible assets, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 9,873,377 | | $ | 10,328,761 | $ | 9,702,853 | $ | 9,774,108 | $ | 9,675,101 | | $ | 9,873,377 | | $ | 9,675,101 | | | | |

| Common shares outstanding | 42,127,316 | | 42,103,623 | 33,562,756,000 | 33,709,395,000 | 33,603,242 | | 42,127,316 | | 33,603,242 | | | | |

| | | | | | | | | | | | |

| Tangible common equity ratio, adjusted for net unrealized accumulated losses on debt securities held to maturity | 8.77 | % | 8.51 | % | 7.11 | % | 7.10 | % | 7.18 | % | | 8.77 | % | 7.18 | % | | | | |

| Tangible stockholders' book value per common share, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 20.56 | $ | 20.87 | $ | 20.54 | $ | 20.60 | $ | 20.68 | | $ | 20.56 | $ | 20.68 | | | | |

| | | | | | | | | | | | |

____________(1) Includes provision for credit losses on loans and provision for loan contingencies. See Footnote 6 in Exhibit 1 - Selected Financial Information for more details.

(2) In the third quarter of 2024, the Company executed an investment portfolio repositioning which resulted in a total pre-tax net loss of $68.5 million during the same period. The investment portfolio repositioning was completed in early October 2024 resulting in an additional $8.1 million in losses in the fourth quarter of 2024.

(3) In the fourth quarter of 2023, the Company completed a restructuring of its bank-owned life insurance (“BOLI”) program. This was executed through a combination of a 1035 exchange and a surrender and reinvestment into higher-yielding general account with a new investment grade insurance carrier. This transaction allowed for higher team member participation through an enhanced split-dollar plan. Estimated improved yields resulting from the enhancement have an earn-back period of approximately 2 years. In the fourth quarter of 2023, we recorded total additional expenses and charges of $4.6 million in connection with this transaction, including: (i) a reduction of $0.7 million to the cash surrender value of BOLI; (ii) transaction costs of $1.1 million, and (iii) income tax expense of $2.8 million.

(4) Expenses incurred for actions designed to implement the Company’s business strategy. These actions include, but are not limited to reductions in workforce, streamlining operational processes, promoting the Amerant brand, implementation of new technology system applications, decommissioning of legacy technologies, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities.

(5) Staff reduction costs consist of severance expenses related to organizational rationalization.

(6) Contract termination and related costs associated with third party vendors resulting from the Company’s engagement of FIS.

(7) In the three months and year ended December 31, 2023, includes an aggregate of $1.6 million and $6.4 million, respectively, of nonrecurrent expenses in connection with the engagement of FIS and, to a lesser extent, software expenses related to legacy applications running in parallel to new core banking applications. The transition to FIS was completed in 2023, therefore, there were no significant nonrecurrent expenses in connection with engagement of FIS in all the other periods shown.

(8) Includes expenses in connection with the disposition of fixed assets due to the write-off of in-development software in the year ended December 31, 2023.

(9) In the year ended December 31, 2023, includes expenses of $0.3 million in connection with the closure of a branch in Houston, Texas in 2023. In addition, in the year ended December 31, 2023, includes $0.9 million of accelerated amortization of leasehold

improvements and $0.6 million of right-of-use, or ROU asset impairment, associated with the closure of a branch in Miami, Florida in 2023. Also, in the year ended December 31, 2023, includes $0.5 million of ROU asset impairment associated with the closure of a branch in Houston, Texas in 2023.

(10) In the three months and year ended December 31, 2024, includes loss on sale of $12.6 million, including transaction costs, related to the sale of a portfolio of 323 business-purpose, investment property, residential mortgage loans with a balance of approximately $71.4 million. In each of the three months and year ended December 31, 2023, includes: (i) a fair value adjustment of $35.5 million related to an aggregate of $401 million in Houston-based CRE loans held for sale which are carried at the lower of fair value or cost, and (ii) a loss on sale of $2.0 million related to a New York-based CRE loan previously carried at the lower of fair value or cost. In the year ended December 31, 2023, includes a fair value adjustment of $5.6 million related to a New York-based CRE loan held for sale carried at the lower of fair value or cost.

(11) In the three months and year ended December 31, 2024, amounts shown are in connection with the Houston Transaction.

(12) In the year ended December 31, 2023, amount represents the loss on sale of repossessed assets in connection with our equipment-financing activities.

(13) Related to Houston branches and included as part of occupancy and equipment expenses. See Exhibit 5 for additional information.

(14) In the year ended December 31, 2024, income tax effect amounts on nonroutine items of noninterest income and expense were calculated using estimated tax rates of 27.14% and 22.50%, respectively. In the year ended December 31, 2023, amounts were calculated using an estimated tax rate of 21.00%. In the three months ended March 31, 2024, amounts were calculated based upon the effective tax rate for the period of 21.50%. For all of the other periods shown, amounts represent the difference between the current and prior period year-to-date tax effect.

(15) In the three months and year ended December 31, 2023, per share amounts and percentages were calculated using the after-tax impact of non-routine items in noninterest expense of $34.2 million and $52.3 million, respectively, and BOLI tax impact of $2.8 million in each period. In all other periods shown, per share amounts and percentages were calculated using the after tax impact of non-routine items in noninterest expense.

(16) See 2023 Form 10-K for more information on potential dilutive instruments and its impact on diluted earnings per share computation.

(17) At December 31, 2024, September 30, 2024, June 30, 2024, March 31, 2024 and December 31, 2023, other intangible assets primarily consist of naming rights of $2.0 million, $2.1 million, $2.3 million, $2.4 million and $2.5 million, respectively, and mortgage servicing rights (“MSRs”) of $1.5 million, $1.4 million, $1.5 million, $1.4 million and $1.4 million, respectively. Other intangible assets are included in other assets in the Company’s consolidated balance sheets.

(18) There were no debt securities held to maturity at December 31, 2024 and September 30, 2024. As of June 30, 2024, March 31, 2024 and December 31, 2023, amounts were calculated based upon the fair value of debt securities held to maturity, and assuming a tax rate of 25.38%, 25.40% and 25.36%, respectively.

Exhibit 3 - Average Balance Sheet, Interest and Yield/Rate Analysis

The following tables present average balance sheet information, interest income, interest expense and the corresponding average yields earned and rates paid for the periods presented. The average balances for loans include both performing and nonperforming balances. Interest income on loans includes the effects of discount accretion and the amortization of non-refundable loan origination fees, net of direct loan origination costs, as well as premiums paid on purchased loans, accounted for as yield adjustments. Average balances represent the daily average balances for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | |

December 31, 2023 |

| | | | | | | | | | | | | |

| (in thousands, except percentages) | Average

Balances | | Income/

Expense | | Yield/

Rates | | Average Balances | | Income/ Expense | | Yield/ Rates | | Average

Balances | | Income/

Expense | | Yield/

Rates |

| Interest-earning assets: | | | | | | | | | | | | | | | | | |

| Loan portfolio, net (1)(2) | $ | 7,322,613 | | | $ | 128,910 | | | 7.00 | % | | $ | 7,291,632 | | | $ | 129,752 | | | 7.08 | % | | $ | 7,107,222 | | | $ | 127,090 | | | 7.09 | % |

| Debt securities available for sale (3)(4) | 1,346,108 | | | 16,069 | | | 4.75 | % | | 1,313,366 | | | 14,273 | | | 4.32 | % | | 1,060,113 | | | 11,603 | | | 4.34 | % |

| Debt securities held to maturity (5) | — | | | — | | | — | % | | 205,958 | | | 1,752 | | | 3.38 | % | | 227,765 | | | 1,951 | | | 3.40 | % |

| Debt securities held for trading | — | | | — | | | — | % | | — | | | — | | | — | % | | — | | | — | | | — | % |

| Equity securities with readily determinable fair value not held for trading | 2,509 | | | 19 | | | 3.01 | % | | 2,525 | | | 19 | | | 2.99 | % | | 2,450 | | | 12 | | | 1.94 | % |

| Federal Reserve Bank and FHLB stock | 58,861 | | | 1,035 | | | 7.00 | % | | 61,147 | | | 1,083 | | | 7.05 | % | | 49,741 | | | 894 | | | 7.13 | % |

| Deposits with banks | 560,323 | | | 6,811 | | | 4.84 | % | | 344,469 | | | 4,670 | | | 5.39 | % | | 265,657 | | | 3,940 | | | 5.88 | % |

| Other short-term investments | 6,380 | | | 74 | | | 4.61 | % | | 6,677 | | | 88 | | | 5.24 | % | | 5,928 | | | 79 | | | 5.29 | % |

| Total interest-earning assets | 9,296,794 | | | 152,918 | | | 6.54 | % | | 9,225,774 | | | 151,637 | | | 6.54 | % | | 8,718,876 | | | 145,569 | | | 6.62 | % |

| Total non-interest-earning assets (6) | 798,113 | | | | | | | 760,198 | | | | | | | 794,844 | | | | | |

| Total assets | $ | 10,094,907 | | | | | | | $ | 9,985,972 | | | | | | | $ | 9,513,720 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | |

December 31, 2023 |

| | | | | | | | | | | | | |

| (in thousands, except percentages) | Average

Balances | | Income/

Expense | | Yield/

Rates | | Average Balances | | Income/ Expense | | Yield/ Rates | | Average

Balances | | Income/

Expense | | Yield/

Rates |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Checking and saving accounts - | | | | | | | | | | | | | | | | | |

| Interest bearing DDA | $ | 2,233,157 | | $ | 12,859 | | | 2.29 | % | | $ | 2,294,323 | | $ | 15,345 | | | 2.66 | % | | $ | 2,435,871 | | $ | 16,350 | | | 2.66 | % |

| Money market | 1,622,240 | | 15,696 | | | 3.85 | % | | 1,541,987 | | 16,804 | | | 4.34 | % | | 1,259,859 | | 13,917 | | | 4.38 | % |

| Savings | 242,589 | | 24 | | | 0.04 | % | | 247,903 | | 26 | | | 0.04 | % | | 271,307 | | 30 | | | 0.04 | % |

| Total checking and saving accounts | 4,097,986 | | 28,579 | | | 2.77 | % | | 4,084,213 | | 32,175 | | | 3.13 | % | | 3,967,037 | | 30,297 | | | 3.03 | % |

| Time deposits | 2,336,324 | | 26,427 | | | 4.50 | % | | 2,324,694 | | 27,260 | | | 4.67 | % | | 2,276,720 | | 24,985 | | | 4.35 | % |

| Total deposits | 6,434,310 | | 55,006 | | | 3.40 | % | | 6,408,907 | | 59,435 | | | 3.69 | % | | 6,243,757 | | 55,282 | | | 3.51 | % |

| Securities sold under agreements to repurchase | 115 | | 1 | | | 3.46 | % | | — | | | — | | | — | % | | 106 | | 2 | | | 7.49 | % |

| Advances from the FHLB (7) | 782,242 | | 7,946 | | | 4.04 | % | | 863,913 | | 8,833 | | | 4.07 | % | | 635,272 | | 6,225 | | | 3.89 | % |

| Senior notes | 59,804 | | 941 | | | 6.26 | % | | 59,725 | | 942 | | | 6.27 | % | | 59,488 | | 941 | | | 6.28 | % |

| Subordinated notes | 29,604 | | 361 | | | 4.85 | % | | 29,561 | | 361 | | | 4.86 | % | | 29,433 | | 361 | | | 4.87 | % |

| Junior subordinated debentures | 64,178 | | 1,030 | | | 6.38 | % | | 64,178 | | 1,067 | | | 6.61 | % | | 64,178 | | 1,081 | | | 6.68 | % |

| Total interest-bearing liabilities | 7,370,253 | | 65,285 | | | 3.52 | % | | 7,426,284 | | 70,638 | | | 3.78 | % | | 7,032,234 | | 63,892 | | | 3.60 | % |

| Non-interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Non-interest bearing demand deposits | 1,469,726 | | | | | | 1,491,406 | | | | | | 1,381,157 | | | | |

| Accounts payable, accrued liabilities and other liabilities | 344,770 | | | | | | 301,373 | | | | | | 363,711 | | | | |

| Total non-interest-bearing liabilities | 1,814,496 | | | | | | 1,792,779 | | | | | | 1,744,868 | | | | |

| Total liabilities | 9,184,749 | | | | | | 9,219,063 | | | | | | 8,777,102 | | | | |

| Stockholders’ equity | 910,158 | | | | | | 766,909 | | | | | | 736,618 | | | | |

| Total liabilities and stockholders' equity | $ | 10,094,907 | | | | | | $ | 9,985,972 | | | | | | $ | 9,513,720 | | | | |

| Excess of average interest-earning assets over average interest-bearing liabilities | $ | 1,926,541 | | | | | | $ | 1,799,490 | | | | | | $ | 1,686,642 | | | | |

| Net interest income | | | $ | 87,633 | | | | | | | $ | 80,999 | | | | | | | $ | 81,677 | | | |

| Net interest rate spread | | | | | 3.02 | % | | | | | | 2.76 | % | | | | | | 3.02 | % |

| Net interest margin (7) | | | | | 3.75 | % | | | | | | 3.49 | % | | | | | | 3.72 | % |

| Cost of total deposits (7) | | | | | 2.77 | % | | | | | | 2.99 | % | | | | | | 2.88 | % |

| Ratio of average interest-earning assets to average interest-bearing liabilities | 126.14 | % | | | | | | 124.23 | % | | | | | | 123.98 | % | | | | |

| Average non-performing loans/ Average total loans | 1.36 | % | | | | | | 1.54 | % | | | | | | 0.49 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | |

2023 (audited) |

| (in thousands, except percentages) | Average

Balances | | Income/

Expense | | Yield/

Rates | | Average Balances | | Income/ Expense | | Yield/ Rates |

| Interest-earning assets: | | | | | | | | | | | |

| Loan portfolio, net (1)(2) | $ | 7,157,991 | | $ | 505,484 | | | 7.06 | % | | $ | 7,006,919 | | $ | 475,405 | | | 6.78 | % |

| Debt securities available for sale (3)(4) | 1,291,974 | | 57,631 | | | 4.46 | % | | 1,053,034 | | 43,096 | | | 4.09 | % |

| Debt securities held to maturity (5) | 162,657 | | 5,597 | | | 3.44 | % | | 234,168 | | 7,997 | | | 3.42 | % |

| Debt securities held for trading | — | | — | | | — | % | | 586 | | 7 | | | 1.19 | % |

| Equity securities with readily determinable fair value not held for trading | 2,495 | | 106 | | | 4.25 | % | | 2,454 | | 33 | | | 1.34 | % |

| Federal Reserve Bank and FHLB stock | 56,234 | | 3,957 | | | 7.04 | % | | 53,608 | | 3,727 | | | 6.95 | % |

| Deposits with banks | 423,185 | | 22,492 | | | 5.31 | % | | 322,853 | | 18,212 | | | 5.64 | % |

| Other short-term investments | 6,348 | | 322 | | | 5.07 | % | | 2,115 | | 102 | | | 4.80 | % |

| Total interest-earning assets | 9,100,884 | | 595,589 | | | 6.54 | % | | 8,675,737 | | 548,579 | | | 6.32 | % |

| Total non-interest-earning assets (6) | 790,919 | | | | | | 776,484 | | | | |

| Total assets | $ | 9,891,803 | | | | | | $ | 9,452,221 | | | | |

| | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Checking and saving accounts | | | | | | | | | | | |

| Interest bearing DDA | $ | 2,345,193 | | $ | 62,719 | | | 2.67 | % | | $ | 2,486,190 | | $ | 62,551 | | | 2.52 | % |

| Money market | 1,502,304 | | 62,307 | | | 4.15 | % | | 1,226,311 | | 42,212 | | | 3.44 | % |

| Savings | 251,626 | | 103 | | | 0.04 | % | | 284,510 | | 144 | | | 0.05 | % |

| Total checking and saving accounts | 4,099,123 | | 125,129 | | | 3.05 | % | | 3,997,011 | | 104,907 | | | 2.62 | % |

| Time deposits | 2,302,798 | | 105,780 | | | 4.59 | % | | 2,074,549 | | 78,829 | | | 3.80 | % |

| Total deposits | 6,401,921 | | 230,909 | | | 3.61 | % | | 6,071,560 | | 183,736 | | | 3.03 | % |

| Securities sold under agreements to repurchase | 60 | | 3 | | | 5.00 | % | | 124 | | 7 | | | 5.65 | % |

Advances from the FHLB (7) | 757,502 | | 29,303 | | | 3.87 | % | | 805,084 | | 28,816 | | | 3.58 | % |

| Senior notes | 59,686 | | 3,767 | | | 6.31 | % | | 59,370 | | 3,766 | | | 6.34 | % |

| Subordinated notes | 29,540 | | 1,444 | | | 4.89 | % | | 29,370 | | 1,445 | | | 4.92 | % |

| Junior subordinated debentures | 64,178 | | 4,206 | | | 6.55 | % | | 64,178 | | 4,345 | | | 6.77 | % |

| Total interest-bearing liabilities | 7,312,887 | | 269,632 | | | 3.69 | % | | 7,029,686 | | 222,115 | | | 3.16 | % |

| Non-interest-bearing liabilities: | | | | | | | | | | | |

| Non-interest bearing demand deposits | 1,461,940 | | | | | | 1,356,538 | | | | |

| Accounts payable, accrued liabilities and other liabilities | 324,932 | | | | | | 325,367 | | | | |

| Total non-interest-bearing liabilities | 1,786,872 | | | | | | 1,681,905 | | | | |

| Total liabilities | 9,099,759 | | | | | | 8,711,591 | | | | |

| Stockholders’ equity | 792,044 | | | | | | 740,630 | | | | |

| Total liabilities and stockholders' equity | $ | 9,891,803 | | | | | | $ | 9,452,221 | | | | |

| Excess of average interest-earning assets over average interest-bearing liabilities | $ | 1,787,997 | | | | | | $ | 1,646,051 | | | | |

| Net interest income | | | $ | 325,957 | | | | | | | $ | 326,464 | | | |

| Net interest rate spread | | | | | 2.85 | % | | | | | | 3.16 | % |

| Net interest margin (7) | | | | | 3.58 | % | | | | | | 3.76 | % |

| Cost of total deposits (7) | | | | | 2.94 | % | | | | | | 2.47 | % |

| Ratio of average interest-earning assets to average interest-bearing liabilities | 124.45 | % | | | | | | 123.42 | % | | | | |

| Average non-performing loans/ Average total loans | 1.03 | % | | | | | | 0.48 | % | | | | |

_______________

(1) Includes loans held for investment, net of the allowance for credit losses, and loans held for sale. The average balance of the allowance for credit losses was $80.5 million, $92.1 million and $92.7 million in the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $90.0 million and $90.0 million in the years ended December 31, 2024 and 2023, respectively. The average balance of total loans held for sale was $357.2 million, $612.9 million and $100.7 million in the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $353.9 million and $77.8 million in the years ended December 31, 2024 and 2023, respectively.

(2) Includes average non-performing loans of $101.0 million, $113.5 million and $35.1 million for the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $74.9 million and $34.3 million for the years ended December 31, 2024 and 2023, respectively.

(3) Includes the average balance of net unrealized gains and losses in the fair value of debt securities available for sale. The average balance includes average net unrealized losses of $31.7 million, $89.4 million and $142.1 million in the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $84.5 million and $118.5 million in the years ended December 31, 2024 and 2023, respectively.

(4) Includes nontaxable securities with average balances of $60.4 million, $19.9 million and $17.8 million for the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $29.4 million and $17.8 million in the years ended December 31, 2024 and 2023, respectively. The tax equivalent yield for these nontaxable securities was 4.39%, 4.33% and 4.78% for the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and 4.45% and 4.83% for the years ended December 31, 2024 and 2023, respectively. In 2024 and 2023, the tax equivalent yields were calculated by assuming a 21% tax rate and dividing the actual yield by 0.79.

(5) Includes nontaxable securities with average balances of $44.5 million and $48.9 million for the three months ended September 30, 2024 and December 31, 2023, respectively. We had no average held to maturity balances at December 31, 2024. We had average balances of $35.2 million and $49.8 million in the years ended December 31, 2024 and 2023, respectively. The tax equivalent yield for these nontaxable securities was 4.43% and 4.26% for the quarter ended September 30, 2024 and December 31, 2023, respectively, and 4.29% and 4.22% for the years ended December 31, 2024 and 2023, respectively. In 2024 and 2023, the tax equivalent yields were calculated assuming a 21% tax rate and dividing the actual yield by 0.79.

(6) Excludes the allowance for credit losses.

(7) See Glossary of Terms and Definitions for definitions of financial terms.

Exhibit 4 - Noninterest Income

This table shows the amounts of each of the categories of noninterest income for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, |

| December 31, 2024 | | September 30, 2024 | | | | | | | December 31, 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | | | | | | | | (audited) |

| (in thousands, except percentages) | Amount | % | | Amount | % | | | | | | | | | | | Amount | % | | Amount | % | | Amount | % |

| | | | | | | |

| Deposits and service fees | $ | 5,501 | | 23.2 | % | | $ | 5,046 | | 10.6 | % | | | | | | | | | | | $ | 4,424 | | 22.5 | % | | $ | 20,153 | | 203.4 | % | | $ | 19,376 | | 22.1 | % |

| Brokerage, advisory and fiduciary activities | 4,653 | | 19.7 | % | | 4,466 | | 9.4 | % | | | | | | | | | | | 4,249 | | 21.7 | % | | 17,984 | | 181.5 | % | | 17,057 | | 19.5 | % |

Change in cash surrender value of bank owned life insurance (“BOLI”)(1) | 2,364 | | 10.0 | % | | 2,332 | | 4.9 | % | | | | | | | | | | | 849 | | 4.3 | % | | 9,280 | | 93.7 | % | | 5,173 | | 5.9 | % |

| Cards and trade finance servicing fees | 1,533 | | 6.5 | % | | 1,430 | | 3.0 | % | | | | | | | | | | | 1,238 | | 6.3 | % | | 5,517 | | 55.7 | % | | 3,067 | | 3.5 | % |

| Gain (loss) on early extinguishment of FHLB advances, net | 1,428 | | 6.0 | % | | — | | — | % | | | | | | | | | | | 6,461 | | 32.9 | % | | 1,617 | | 16.3 | % | | 40,084 | | 45.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Securities (losses) gains, net (2) | (8,200) | | (34.6) | % | | (68,484) | | (143.6) | % | | | | | | | | | | | 33 | | 0.2 | % | | (76,855) | | (775.6) | % | | (10,989) | | (12.6) | % |

Derivative (losses) gains, net (3) | — | | — | % | | — | | — | % | | | | | | | | | | | (151) | | (0.8) | % | | (196) | | (2.0) | % | | 28 | | — | % |

Loan-level derivative income (4) | 706 | | 3.0 | % | | 3,515 | | 7.4 | % | | | | | | | | | | | 837 | | 4.3 | % | | 7,044 | | 71.1 | % | | 4,580 | | 5.2 | % |

Gain on sale of Houston Franchise | 12,636 | | 53.4 | % | | — | | — | % | | | | | | | | | | | — | | — | % | | 12,636 | | 127.5 | % | | — | | — | % |

Other noninterest income (5) | 3,063 | | 12.8 | % | | 4,012 | | 8.3 | % | | | | | | | | | | | 1,673 | | 8.5 | % | | 12,729 | | 128.4 | % | | 9,120 | | 10.6 | % |

| Total noninterest income | $ | 23,684 | | 100.0 | % | | $ | (47,683) | | (100.0) | % | | | | | | | | | | | $ | 19,613 | | 100.0 | % | | $ | 9,909 | | 100.0 | % | | $ | 87,496 | | 100.0 | % |

__________________(1) Changes in cash surrender value of BOLI are not taxable. In the three months and year ended December 31, 2023, includes a charge of $0.7 million in connection with the enhancement/restructuring of BOLI in the fourth quarter of 2023.

(2) Amounts are primarily in connection with losses and gains on the sale of debt securities available for sale. In the three months ended December 31, 2024 and September 30, 2024, includes a total net loss of $8.1 million and $68.5 million, respectively, as a result of the investment portfolio repositioning. In the year ended December 31, 2024, includes $76.7 million as a result of the investment portfolio repositioning.

(3) Net unrealized gains and losses related to uncovered interest rate caps with clients.

(4) Income from interest rate swaps and other derivative transactions with customers. The Company incurs expenses related to derivative transactions with customers which are included as part of noninterest expenses under loan-level derivative expense. See Exhibit 5 for more details.

(5) Includes mortgage banking income of $1.1 million, $2.8 million and $0.6 million in the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $6.9 million and $4.5 million in the years ended December 31, 2024 and 2023, respectively, primarily consisting of net gains on sale, valuation and derivative transactions associated with mortgage loans held for sale activity, and other smaller sources of income related to the operations of Amerant Mortgage. In addition, includes $0.5 million BOLI death benefits received in the year ended December 31, 2024. Other sources of income in the periods shown include foreign currency exchange transactions with customers and valuation income on the investment balances held in the non-qualified deferred compensation plan.

Exhibit 5 - Noninterest Expense

This table shows the amounts of each of the categories of noninterest expense for the periods presented. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, |

| December 31, 2024 | | September 30, 2024 | | | | | | December 31, 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | | | | | | | (audited) |

| (in thousands, except percentages) | Amount | % | | Amount | % | | | | | | | | | | Amount | % | | Amount | % | | Amount | % |

| | | | | | | |

Salaries and employee benefits (1) | $ | 35,284 | | 42.3 | % | | $ | 34,979 | | 45.9 | % | | | | | | | | | | $ | 33,049 | | 30.1 | % | | $ | 137,078 | | 45.8 | % | | $ | 133,506 | | 42.9 | % |

Occupancy and equipment (2) | 5,719 | | 6.9 | % | | 5,891 | | 7.7 | % | | | | | | | | | | 7,015 | | 6.4 | % | | 27,127 | | 9.1 | % | | 27,843 | | 8.9 | % |

Professional and other services fees (3) | 14,308 | | 17.2 | % | | 13,711 | | 18.0 | % | | | | | | | | | | 14,201 | | 12.9 | % | | 51,092 | | 17.1 | % | | 34,569 | | 11.1 | % |