Apollo (NYSE: APO) and Bridge Investment Group Holdings Inc. (NYSE:

BRDG) (“Bridge” or the “Company”) today announced they have entered

into a definitive agreement for Apollo to acquire Bridge in an

all-stock transaction with an equity value of approximately $1.5

billion.

Founded in 2009, Bridge is an established leader

in residential and industrial real estate as well as other

specialized real estate asset classes. Led by an experienced senior

leadership team and over 300 dedicated investment professionals

with significant real estate investment and operating expertise,

Bridge’s forward-integrated model, nationwide operating platform

and data-driven approach have fostered organic growth and

consistently produced desirable outcomes across asset classes.

Bridge will provide Apollo with immediate scale

to its real estate equity platform and enhance Apollo’s origination

capabilities in both real estate equity and credit, which is

expected to benefit Apollo’s growing suite of hybrid and real

estate product offerings. Bridge manages approximately $50 billion

of high-quality AUM in real estate products targeting both

institutional and wealth clients and is expected to be highly

synergistic with Apollo’s existing real estate equity strategies

and leading real estate credit platform. The transaction is

expected to be immediately accretive to Apollo’s fee-related

earnings upon closing.

Apollo Partner and Co-Head of Equity David

Sambur said, “We are pleased to announce this transaction with

Bridge, which is highly aligned with Apollo’s strategic focus on

expanding our origination base in areas of our business that are

growing but not yet at scale. Led by a respected real estate team

including Executive Chairman Bob Morse and CEO Jonathan Slager,

Bridge brings a seasoned team with deep expertise and a strong

track record in their sectors. Their business will complement and

further augment our existing real estate capabilities, and we

believe we can help scale Bridge’s products by leveraging the

breadth of our integrated platform. We look forward to working with

Bob and the talented Bridge team as we seek to achieve the

strategic objectives we laid out at our recent Investor Day.”

Bridge Executive Chairman Bob Morse said, “We

are proud to be joining Apollo and its industry-leading team, who

share our commitment to performance and excellence. This

transaction will allow the Bridge and Apollo teams to grow on the

strong foundation that Bridge has built since 2009 as we work to

pursue meaningful value and impact for our investors and

communities. With Apollo’s global integrated platform, resources,

innovation and established expertise, we are confident that Bridge

will be positioned for the next phase of growth amid growing demand

across the alternative investments space.”

Transaction DetailsUnder the

terms of the transaction, Bridge stockholders and Bridge OpCo

unitholders will receive, at closing, 0.07081 shares of Apollo

stock for each share of Bridge Class A common stock and each Bridge

OpCo Class A common unit, respectively, valued by the parties at

$11.50 per each share of Bridge Class A common stock and Bridge

OpCo Class A common unit, respectively.

Upon the closing of the transaction, Bridge will

operate as a standalone platform within Apollo’s asset management

business, retaining its existing brand, management team and

dedicated capital formation team. Bob Morse will become an Apollo

Partner and lead Apollo’s real estate equity franchise.

A special committee of independent directors for

Bridge (the “Special Committee”), advised by its own independent

legal and financial advisors, reviewed, negotiated and unanimously

recommended approval of the merger agreement by the Bridge Board of

Directors, determining that it was in the best interests of Bridge

and its stockholders not affiliated with Bridge management and

directors. Acting upon the recommendation of the Special Committee,

the Bridge Board of Directors approved the merger agreement. The

transaction is expected to close in the third quarter of 2025,

subject to customary closing conditions for transactions of this

nature, including approval by a majority of the Class A common

stock and Class B common stock of Bridge, voting together and the

receipt of regulatory approvals. Certain members of Bridge

management and their affiliates, collectively owning approximately

51.4% of the outstanding voting power of the Class A common stock

and Class B common stock of Bridge, have entered into voting

agreements in connection with the transaction and have agreed to

vote in favor of the transaction in accordance with the terms

therein. Subject to and upon completion of the transaction, shares

of Bridge common stock will no longer be listed on the New York

Stock Exchange and Bridge will become a privately held company.

Further information regarding terms and

conditions contained in the definitive merger agreement will be

made available in Bridge’s Current Report on Form 8-K, which will

be filed in connection with this transaction.

Bridge Fourth Quarter and Full-Year 2024

EarningsBridge will no longer be holding its fourth

quarter and full-year 2024 earnings conference call and webcast

scheduled for February 25, 2025, due to the pending

transaction.

AdvisorsBofA Securities, Citi,

Goldman, Sachs & Co. LLC, Morgan Stanley & Co. LLC and

Newmark Group are acting as financial advisors, Paul, Weiss,

Rifkind, Wharton & Garrison LLP is acting as legal counsel and

Sidley Austin LLP is acting as insurance regulatory counsel to

Apollo. J.P. Morgan Securities LLC is serving as financial advisor

to Bridge and Latham & Watkins LLP is acting as legal counsel.

Lazard is serving as financial advisor to the special committee of

the Bridge Board of Directors and Cravath, Swaine & Moore LLP

is acting as legal counsel.

Statement Regarding Forward-Looking

Information

This press release contains statements regarding

Apollo, Bridge, the proposed transactions and other matters that

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended.

Such forward-looking statements include, but are not limited to,

discussions related to the proposed transaction between Apollo and

the Company, including statements regarding the benefits of the

proposed transaction and the anticipated timing and likelihood of

completion of the proposed transaction, and information regarding

the businesses of Apollo and the Company, including Apollo’s and

the Company’s objectives, plans and strategies for future

operations, statements that contain projections of results of

operations or of financial condition and all other statements other

than statements of historical fact that address activities, events

or developments that Apollo and the Company intends, expects,

projects, believes or anticipates will or may occur in the future.

Such statements are based on management’s beliefs and assumptions

made based on information currently available to management. All

statements in this communication, other than statements of

historical fact, are forward-looking statements that may be

identified by the use of the words “outlook,” “indicator,” “may,”

“will,” “should,” “expects,” “plans,” “seek,” “anticipates,”

“plan,” “forecasts,” “could,” “intends,” “targets,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or

“continue” or the negative of these terms or other similar

expressions, but not all forward- looking statements include such

words. These forward-looking statements are subject to certain

risks, uncertainties and assumptions, many of which are beyond the

control of Apollo and the Company, that could cause actual results

and performance to differ materially from those expressed in such

forward-looking statements. Factors and risks that may impact

future results and performance include, but are not limited to,

those factors and risks described under the section entitled “Risk

Factors” in Apollo’s and the Company’s most recent Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q and such reports that

are subsequently filed with the Securities and Exchange Commission

(the “SEC”).

The forward-looking statements are subject to

certain risks, uncertainties and assumptions, which include, but

are not limited to, and in each case as a possible result of the

proposed transaction on each of Apollo and the Company: the

ultimate outcome of the proposed transaction between Apollo and the

Company, including the possibility that the Company’s stockholders

will not adopt the merger agreement in respect of the proposed

transaction; the effect of the announcement of the proposed

transaction; the ability to operate Apollo’s and the Company’s

respective businesses, including business disruptions; difficulties

in retaining and hiring key personnel and employees; the ability to

maintain favorable business relationships with customers and other

business partners; the terms and timing of the proposed

transaction; the occurrence of any event, change or other

circumstance that could give rise to the termination of the merger

agreement and the proposed transaction; the anticipated or actual

tax treatment of the proposed transaction; the ability to satisfy

closing conditions to the completion of the proposed transaction

(including the adoption of the merger agreement in respect of the

proposed transaction by the Company’s stockholders); other risks

related to the completion of the proposed transaction and actions

related thereto; the ability of Apollo and the Company to integrate

the businesses successfully and to achieve anticipated synergies

and value creation from the proposed transaction; global market,

political and economic conditions, including in the markets in

which Apollo and the Company operate; the ability to secure

government regulatory approvals on the terms expected, at all or in

a timely manner; the global macro-economic environment, including

headwinds caused by inflation, rising interest rates, unfavorable

currency exchange rates, and potential recessionary or

depressionary conditions; cyber-attacks, information security and

data privacy; the impact of public health crises, such as pandemics

and epidemics and any related company or government policies and

actions to protect the health and safety of individuals or

government policies or actions to maintain the functioning of

national or global economies and markets; litigation and regulatory

proceedings, including any proceedings that may be instituted

against Apollo or the Company related to the proposed transaction;

and disruptions of Apollo’s or the Company’s information technology

systems.

These risks, as well as other risks related to

the proposed transaction, will be included in the Registration

Statement (as defined below) and Joint Proxy Statement/Prospectus

(as defined below) that will be filed with the SEC in connection

with the proposed transaction. While the list of factors presented

here is, and the list of factors to be presented in the

Registration Statement and Joint Proxy Statement/Prospectus are

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties.

Other unknown or unpredictable factors also could have a material

adverse effect on Apollo’s and the Company’s business, financial

condition, results of operations and prospects. Accordingly,

readers should not place undue reliance on these forward-looking

statements. These forward-looking statements are inherently subject

to uncertainties, risks and changes in circumstances that are

difficult to predict. Except as required by applicable law or

regulation, neither Apollo nor the Company undertakes (and each of

Apollo and the Company expressly disclaim) any obligation and do

not intend to publicly update or review any of these

forward-looking statements, whether as a result of new information,

future events or otherwise.

No Offer or Solicitation

This press release is not intended to and does

not constitute an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for

any securities or the solicitation of any vote in any jurisdiction

pursuant to the proposed transactions or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act. Subject to certain exceptions to

be approved by the relevant regulators or certain facts to be

ascertained, the public offer will not be made directly or

indirectly, in or into any jurisdiction where to do so would

constitute a violation of the laws of such jurisdiction, or by use

of the mails or by any means or instrumentality (including without

limitation, facsimile transmission, telephone and the internet) of

interstate or foreign commerce, or any facility of a national

securities exchange, of any such jurisdiction.

Additional Information Regarding the

Transaction and Where to Find It

This press release is being made in respect of

the proposed transaction between Apollo and the Company. In

connection with the proposed transaction, Apollo intends to file

with the SEC a registration statement on Form S-4, which will

constitute a prospectus of Apollo for the issuance of Apollo common

stock (the “Registration Statement”) and which will also include a

proxy statement of the Company for the Company stockholder meeting

(together with any amendments or supplements thereto, and together

with the Registration Statement, the “Joint Proxy

Statement/Prospectus”). Each of Apollo and the Company may also

file other relevant documents with the SEC regarding the proposed

transaction. This document is not a substitute for the Registration

Statement or Joint Proxy Statement/Prospectus or any other document

that Apollo or the Company may file with the SEC. The definitive

Joint Proxy Statement/Prospectus (if and when available) will be

mailed to stockholders of the Company.

INVESTORS ARE URGED TO READ IN THEIR ENTIRETY

THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS

AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION. Investors will be able to obtain free copies

of the Registration Statement and Joint Proxy Statement/Prospectus

(if and when available) and other documents containing important

information about Apollo, the Company and the proposed transaction,

once such documents are filed with the SEC through the website

maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with, or furnished to, the SEC by Apollo will be

available free of charge by accessing the Investor Relations

section of Apollo’s website at https://ir.apollo.com. Copies of the

documents filed with, or furnished to, the SEC by the Company will

be available free of charge by accessing the Investor Relations

section of the Company’s website at https://www.bridgeig.com. The

information included on, or accessible through, Apollo’s or the

Company’s website is not incorporated by reference into this

communication.

Participants in the

Solicitation

Apollo, the Company, and certain of their

respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from the Company’s

stockholders in respect of the proposed transaction. Information

about the directors and executive officers of Apollo, including a

description of their direct or indirect interests, by security

holdings or otherwise, is contained in its Proxy Statement on

Schedule 14A, dated April 26, 2024 (the “Apollo Annual Meeting

Proxy Statement”), which is filed with the SEC. Any changes in the

holdings of Apollo’s securities by Apollo’s directors or executive

officers from the amounts described in the Apollo Annual Meeting

Proxy Statement have been or will be reflected in Initial

Statements of Beneficial Ownership of Securities

on Form 3 (“Form 3”), Statements of Changes in

Beneficial Ownership on Form 4 (“Form 4”) or Annual

Statements of Changes in Beneficial Ownership of Securities on

Form 5 (“Form 5”) subsequently filed with the SEC and

available at the SEC’s website at www.sec.gov. Information about

the directors and executive officers of the Company, including a

description of their direct or indirect interests, by security

holdings or otherwise, is contained in its Proxy Statement on

Schedule 14A, dated March 21, 2024 (the “Company Annual Meeting

Proxy Statement”), which is filed with the SEC. Any changes in the

holdings of the Company’s securities by the Company’s directors or

executive officers from the amounts described in the Company Annual

Meeting Proxy Statement have been or will be reflected on Forms 3,

Forms 4 or Forms 5, subsequently filed with the SEC and available

at the SEC’s website at www.sec.gov. Other information regarding

the participants in the proxy solicitation and a description of

their direct and indirect interests, by security holdings or

otherwise, will be contained in the Registration Statement and the

Joint Proxy Statement/Prospectus and other relevant materials to be

filed with the SEC regarding the proposed transaction when such

materials become available. Investors should read the Registration

Statement and the Joint Proxy Statement/Prospectus carefully when

available before making any voting or investment decisions.

About ApolloApollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade credit to private

equity. For more than three decades, our investing expertise across

our fully integrated platform has served the financial return needs

of our clients and provided businesses with innovative capital

solutions for growth. Through Athene, our retirement services

business, we specialize in helping clients achieve financial

security by providing a suite of retirement savings products and

acting as a solutions provider to institutions. Our patient,

creative, and knowledgeable approach to investing aligns our

clients, businesses we invest in, our employees, and the

communities we impact, to expand opportunity and achieve positive

outcomes. As of December 31, 2024, Apollo had approximately $751

billion of assets under management. To learn more, please visit

www.apollo.com.

About Bridge Investment GroupBridge is a

leading alternative investment manager, diversified across

specialized asset classes, with approximately $50 billion of assets

under management as of December 31, 2024. Bridge combines its

nationwide operating platform with dedicated teams of investment

professionals focused on select verticals across real estate,

credit, renewable energy and secondaries strategies.

Contacts

For Apollo:

Noah GunnGlobal Head of Investor RelationsApollo Global

Management, Inc.212-822-0540ir@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.212-822-0491communications@apollo.com

For Bridge:

Shareholder Relations:Bonni Rosen SalisburyBridge Investment

Group Holdings Inc.shareholderrelations@bridgeig.com

Media:Charlotte MorseBridge Investment Group Holdings Inc.(877)

866-4540charlotte.morse@bridgeig.com

H/Advisors AbernathyEric Bonach / Dan Scorpio(917) 710-7973 /

(646) 899-8118eric.bonach@h-advisors.global /

dan.scorpio@h-advisors.global

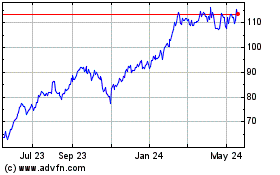

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2025 to Feb 2025

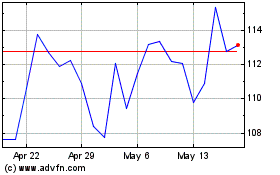

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Feb 2024 to Feb 2025