Redding Ridge Asset Management to Acquire Irradiant Partners

February 21 2025 - 3:30PM

Redding Ridge Asset Management (RRAM), an independently managed

affiliate of Apollo (NYSE: APO), today announced it has agreed to

acquire Irradiant Partners, an alternative investment manager

specializing in liquid credit, private credit and renewables. As a

result of the acquisition, RRAM will add $10.7 billion of CLO AUM,

further scaling the business and creating a top five CLO manager

with approximately $38 billion of AUM. In addition, Apollo will add

$2.2 billion of private credit and renewables AUM from Irradiant.

Irradiant was established in 2021 and was founded by Michael

Levitt, John Eanes and Jon Levinson. Following close of the

acquisition and achieving all regulatory approvals, Eanes will be

named Chief Investment Officer of RRAM US and Levitt and Levinson

will join Apollo.

Bret Leas, RRAM Board Member and Apollo Partner and Co-Head of

ABF, said: “We are in a market where scale and operating leverage

are critical to portfolio management as well as the business

model. This acquisition of Irradiant creates one of the best

capitalized global CLO managers with over $38 billion of AUM. The

addition of their leadership team, including John Eanes as RRAM US

CIO, will strengthen our franchise and solidify Redding as one of

the most recognized and trusted issuers.”

John Eanes, Co-CEO of Irradiant and incoming Chief Investment

Officer of RRAM US, said: “With my partners Mike and Jon and our

dedicated team, we are proud to have built Irradiant into a leading

alternative credit business. As part of Redding, we will benefit

from additional scale, resources and a like-minded investment

philosophy. I look forward to leading the US business, working with

the teams at Redding and Apollo to serve an expanded investor base

and continue our growth journey.”

Redding Ridge Asset Management was founded in 2016 as an

independently managed affiliate of Apollo, and in less than a

decade has grown to become one of the largest collateral managers

for CLO transactions and related warehouse facilities in the US and

Europe. RRAM is in two principal businesses of CLO management and

partnership investments, and it maintains a credit-first,

disciplined investment strategy to serve its investors.

The acquisition is subject to regulatory approval; a first close

of a majority of the business, including liquid and private credit,

is expected in Q2 2025. RRAM will fund the acquisition with cash on

its balance sheet. Financial terms of the acquisition are not

disclosed. RRAM and Apollo expect to retain a majority of

Irradiant’s employees, which will provide continuity of management

for Irradiant’s existing funds as well as expand RRAM’s US

portfolio management team and provide complementary operations and

support capabilities to help drive RRAM’s continued growth.

Sidley Austin is serving as legal counsel and Greensledge

Capital Markets is serving as financial advisor to RRAM and Apollo.

Weil, Gotshal & Manges is serving as legal counsel and Piper

Sandler is serving as financial advisor to Irradiant Partners.

Leadership Biographies

John Eanes, incoming CIO for RRAM US, is currently co-CEO and

head of liquid investments at Irradiant. Previously, Eanes spent

more than a decade at Ares and started his career at Lehman

Brothers. Eanes is a graduate of the University of

Pennsylvania.

Jon Levinson is currently co-CEO and head of private investments

at Irradiant. Previously, he was a Partner at TPG-Axon Capital

Management and began his career in private equity at TPG Capital.

Levinson is a graduate of Yale University.

Michael Levitt is currently the Chairman of Irradiant. He

previously founded Stone Tower Capital in 2001 and grew it into a

$17 billion AUM platform before its acquisition by Apollo in 2011.

He began his career in banking and private equity and holds a BBA

and JD from the University of Michigan.

About Redding Ridge Asset ManagementRedding

Ridge Asset Management is an independently managed affiliate of

Apollo specializing in structured credit, with over $27 billion in

AUM and two principal businesses: CLO Management and Partnership

Investments. Our credit-first philosophy, disciplined investment

strategy and strategic relationships help to set us apart in the

industry. For more information about Redding Ridge, please visit

www.rram.com

About Irradiant PartnersIrradiant Partners is

an employee-owned alternative asset manager focused on liquid

credit, opportunistic credit, and renewable private equity and

credit. Irradiant manages nearly $13 billion primarily for

institutional investors including public and corporate pensions,

endowments, foundations, and insurance companies. For more

information, please visit www.irradiantpartners.com.

About Apollo Apollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade credit to private

equity. For more than three decades, our investing expertise across

our fully integrated platform has served the financial return needs

of our clients and provided businesses with innovative capital

solutions for growth. Through Athene, our retirement services

business, we specialize in helping clients achieve financial

security by providing a suite of retirement savings products and

acting as a solutions provider to institutions. Our patient,

creative, and knowledgeable approach to investing aligns our

clients, businesses we invest in, our employees, and the

communities we impact, to expand opportunity and achieve positive

outcomes. As of December 31, 2024, Apollo had approximately $751

billion of assets under management. To learn more, please visit

www.apollo.com.

Contacts

Redding Ridge ContactErik GobboHead of Investor

RelationsRedding Ridge Asset

Management646-969-2593egobbo@apollo.com

Irradiant Partners ContactZach Axelrod,

Managing Director, Head of Investor Relations424 222

8380info@irradiantpartners.com

Apollo ContactsNoah GunnGlobal Head of Investor

RelationsApollo Global Management, Inc.(212)

822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

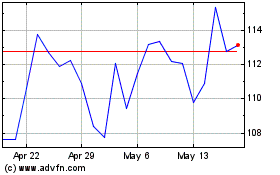

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2025 to Feb 2025

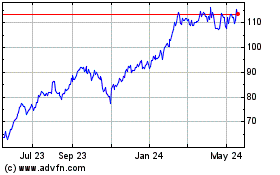

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Feb 2024 to Feb 2025