false

0001037676

0001037676

2024-10-14

2024-10-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT

OF 1934

Date of Report (Date of earliest event reported):

October 14, 2024

Arch

Resources, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-13105 |

|

43-0921172 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

CityPlace

One

One

CityPlace Drive, Suite 300

St.

Louis, Missouri

63141

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including

area code:

(314) 994-2700

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, $.01 par value |

|

ARCH |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On October 14, 2024,

Arch Resources, Inc., a Delaware corporation (“Arch”), and CONSOL Energy Inc., a Delaware corporation (“CONSOL”),

issued a joint press release announcing that the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended,

in relation to the pending combination of CONSOL and Arch expired at 11:59 p.m. Eastern Time on October 11, 2024. A copy of

the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Cautionary Statement Regarding Forward-Looking

Information

This report contains certain

“forward-looking statements” within the meaning of federal securities laws. Forward-looking statements may be identified by

words such as “anticipates,” “believes,” “could,” “continue,” “estimate,”

“expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,”

“project,” “would” and similar expressions. Forward-looking statements are not statements of historical fact and

reflect CONSOL’s and Arch’s current views about future events. Such forward-looking statements include, without limitation,

statements about the benefits of the proposed transaction involving CONSOL and Arch, including future financial and operating results,

CONSOL’s and Arch’s plans, objectives, expectations and intentions, the expected timing and likelihood of completion of the

proposed transaction, and other statements that are not historical facts, including estimates of coal reserves, estimates of future production,

assumptions regarding future coal pricing, planned delivery of coal to markets and the associated costs, future results of operations,

projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given

that the forward-looking statements contained in this report will occur as projected, and actual results may differ materially from those

projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and

uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without

limitation, the ability to obtain the requisite CONSOL and Arch stockholder approvals; the risk that CONSOL or Arch may be unable to obtain

governmental and regulatory approvals required for the proposed transaction (and the risk that such approvals may result in the imposition

of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the risk that an

event, change or other circumstance could give rise to the termination of the proposed transaction; the risk that a condition to closing

of the proposed transaction may not be satisfied; the risk of delays in completing the proposed transaction; the risk that the businesses

will not be integrated successfully; the risk that the cost savings and any other synergies from the proposed transaction may not be fully

realized or may take longer to realize than expected; the risk that any announcement relating to the proposed transaction could have adverse

effects on the market price of CONSOL’s common stock or Arch’s common stock; the risk of litigation related to the proposed

transaction; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect;

the diversion of management time from ongoing business operations and opportunities as a result of the proposed transaction; the risk

of adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of

the proposed transaction; the dilution caused by CONSOL’s issuance of additional shares of its capital stock in connection with

the proposed transaction; changes in coal prices, which may be caused by numerous factors, including changes in the domestic and foreign

supply of and demand for coal and the domestic and foreign demand for steel and electricity; the volatility in commodity and capital equipment

prices for coal mining operations; the presence or recoverability of estimated reserves; the ability to replace reserves; environmental

and geological risks; mining and operating risks; the risks related to the availability, reliability and cost-effectiveness of transportation

facilities and fluctuations in transportation costs; foreign currency, competition, government regulation or other actions; the ability

of management to execute its plans to meet its goals; risks associated with the evolving legal, regulatory and tax regimes; changes in

economic, financial, political and regulatory conditions; natural and man-made disasters; civil unrest, pandemics, and conditions that

may result from legislative, regulatory, trade and policy changes; and other risks inherent in CONSOL’s and Arch’s businesses.

All such factors are difficult

to predict, are beyond CONSOL’s and Arch’s control, and are subject to additional risks and uncertainties, including those

detailed in CONSOL’s annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q,

and current reports on Form 8-K that are available on its website at https://investors.consolenergy.com/sec-filings and on the SEC’s

website at http://www.sec.gov, and those detailed in Arch’s annual report on Form 10-K for the year ended December 31,

2023, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Arch’s website at https://investor.archrsc.com/sec-filings/

and on the SEC’s website at http://www.sec.gov.

Forward-looking statements

are based on the estimates and opinions of management at the time the statements are made. Neither CONSOL nor Arch undertakes any obligation

to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required

by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

No Offer or Solicitation

This report is not intended

to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed

transaction, CONSOL filed with the SEC on October 1, 2024 a registration statement on Form S-4 that includes a preliminary joint

proxy statement of Arch and CONSOL and that also constitutes a prospectus of CONSOL. Each of Arch and CONSOL may also file other relevant

documents with the SEC regarding the proposed transaction. This document is not a substitute for the definitive joint proxy statement/prospectus

or registration statement or any other document that Arch or CONSOL may file with the SEC. The definitive joint proxy statement/prospectus

(if and when available) will be mailed to stockholders of Arch and CONSOL. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT ARCH, CONSOL AND THE PROPOSED TRANSACTION.

Investors and security holders

will be able to obtain free copies of the registration statement, preliminary joint proxy statement/prospectus and definitive joint proxy

statement/prospectus (if and when available) and other documents containing important information about Arch, CONSOL and the proposed

transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the

registration statement and preliminary joint proxy statement/prospectus, definitive joint proxy statement/prospectus (if and when available)

and other documents filed with the SEC by Arch may be obtained free of charge on Arch’s website at https://investor.archrsc.com/sec-filings/

or, alternatively, by directing a request by mail to Arch’s Corporate Secretary at One CityPlace Drive, Suite 300, St. Louis,

Missouri, 63141. Copies of the registration statement preliminary joint proxy statement/prospectus and definitive joint proxy statement/prospectus

(if and when available) and other documents filed with the SEC by CONSOL may be obtained free of charge on CONSOL’s website at https://investors.consolenergy.com/sec-filings

or, alternatively, by directing a request by mail to CONSOL’s Corporate Secretary at 275 Technology Drive, Suite 101, Canonsburg,

Pennsylvania 15317.

Participants in the Solicitation

Arch, CONSOL and certain of

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of Arch, including a description of their direct or indirect interests,

by security holdings or otherwise, is set forth in Arch’s proxy statement for its 2024 Annual Meeting of Stockholders, which was

filed with the SEC on March 27, 2024, including under the headings “Executive Compensation,” “Director Compensation,”

“Equity Compensation Plan Information,” and “Security Ownership of Directors and Executive Officers.” To the extent

holdings of Arch common stock by the directors and executive officers of Arch have changed from the amounts of Arch common stock held

by such persons as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities

on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or

Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with

the SEC, including: the Form 3 filed by George John Schuller on March 19, 2024; and the Forms 4 filed by Pamela Butcher on March 13,

2024, March 18, 2024, June 17, 2024 and September 16, 2024, James Chapman on March 11, 2024, Paul Demzik on March 5,

2024, John Eaves on March 8, 2024, Patrick Kriegshauser on March 18, 2024, June 17, 2024 and September 16, 2024, Holly

Koeppel on March 18, 2024, June 17, 2024 and September 16, 2024, Richard Navarre on March 18, 2024, June 17,

2024 and September 16, 2024, George John Schuller on March 21, 2024, Peifang Zhang on March 18, 2024, June 17, 2024

and September 16, 2024 and John Ziegler on March 8, 2024. Information about the directors and executive officers of CONSOL,

including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in CONSOL’s proxy

statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 1, 2024, including under the headings

“Board of Directors and Compensation Information,” “Executive Compensation Information” and “Beneficial

Ownership of Securities.” To the extent holdings of CONSOL common stock by the directors and executive officers of CONSOL have changed

from the amounts of CONSOL common stock held by such persons as reflected therein, such changes have been or will be reflected on Forms

3, Forms 4 or Forms 5, in each case filed with the SEC, including: the Forms 4 filed by James Brock on May 24, 2024 and July 1,

2024, John Mills on May 9, 2024, Cassandra Chia-Wei Pan on May 9, 2024, Valli Perera on May 9, 2024, Joseph Platt on May 9,

2024 and John Rothka on March 8, 2024. Other information regarding the participants in the proxy solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and joint proxy

statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become

available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein

from Arch or CONSOL using the sources indicated above.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Arch Resources, Inc. |

| |

|

|

| Date: October 15, 2024 |

By: |

/s/ Rosemary L. Klein |

| |

Name: |

Rosemary L. Klein |

| |

Title: |

Senior Vice President – Law, General Counsel and Secretary |

Exhibit 99.1

Arch Resources and CONSOL Energy Announce Expiration

of Hart-Scott-Rodino Act Waiting Period in Respect of Pending Merger

ST.

LOUIS and CANONSBURG, Pa. – October 14, 2024 – Arch Resources, Inc. (“Arch”) (NYSE: ARCH)

and CONSOL Energy Inc. (“CONSOL”) (NYSE: CEIX) today announced that the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended (the “HSR Act”), in relation to the pending combination of CONSOL and Arch expired at

11:59 p.m. Eastern Time on October 11, 2024. The expiration of the waiting period under the HSR Act is one of the conditions

to the closing of the pending combination. Completion of the transaction is subject to the satisfaction of the remaining customary closing

conditions, including approval by both companies’ stockholders.

About Arch Resources, Inc.

Arch Resources is a premier producer of high-quality metallurgical

products for the global steel industry. The company operates large, modern and highly efficient mines that consistently set the industry

standard for both mine safety and environmental stewardship. Arch Resources from time to time utilizes its website – www.archrsc.com

– as a channel of distribution for material company information. To learn more about us and our premium metallurgical products,

go to www.archrsc.com.

About CONSOL Energy Inc.

CONSOL Energy Inc. (NYSE: CEIX) is a Canonsburg, Pennsylvania-based

producer and exporter of high-Btu bituminous thermal coal and metallurgical coal. It owns and operates some of the most productive longwall

mining operations in the Northern Appalachian Basin. CONSOL’s flagship operation is the Pennsylvania Mining Complex, which has the

capacity to produce approximately 28.5 million tons of coal per year and is comprised of 3 large-scale underground mines: Bailey Mine,

Enlow Fork Mine, and Harvey Mine. CONSOL recently developed the Itmann Mine in the Central Appalachian Basin, which has the capacity when

fully operational to produce roughly 900 thousand tons per annum of premium, low-vol metallurgical coking coal. The company also owns

and operates the CONSOL Marine Terminal, which is located in the port of Baltimore and has a throughput capacity of approximately 20 million

tons per year. In addition to the ~584 million reserve tons associated with the Pennsylvania Mining Complex and the ~28 million reserve

tons associated with the Itmann Mining Complex, the company controls approximately 1.3 billion tons of greenfield thermal and metallurgical

coal reserves and resources located in the major coal-producing basins of the eastern United States. Additional information regarding

CONSOL Energy may be found at www.consolenergy.com.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains certain “forward-looking

statements” within the meaning of federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “could,” “continue,” “estimate,” “expects,” “intends,”

“will,” “should,” “may,” “plan,” “predict,” “project,” “would”

and similar expressions. Forward-looking statements are not statements of historical fact and reflect CONSOL’s and Arch’s

current views about future events. Such forward-looking statements include, without limitation, statements about the benefits of the proposed

transaction involving CONSOL and Arch, including future financial and operating results, CONSOL’s and Arch’s plans, objectives,

expectations and intentions, the expected timing and likelihood of completion of the proposed transaction, and other statements that are

not historical facts, including estimates of coal reserves, estimates of future production, assumptions regarding future coal pricing,

planned delivery of coal to markets and the associated costs, future results of operations, projected cash flow and liquidity, business

strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained

in this communication will occur as projected, and actual results may differ materially from those projected. Forward-looking statements

are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual

results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the

requisite CONSOL and Arch stockholder approvals; the risk that CONSOL or Arch may be unable to obtain governmental and regulatory approvals

required for the proposed transaction (and the risk that such approvals may result in the imposition of conditions that could adversely

affect the combined company or the expected benefits of the proposed transaction); the risk that an event, change or other circumstance

could give rise to the termination of the proposed transaction; the risk that a condition to closing of the proposed transaction may not

be satisfied; the risk of delays in completing the proposed transaction; the risk that the businesses will not be integrated successfully;

the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize

than expected; the risk that any announcement relating to the proposed transaction could have adverse effects on the market price of CONSOL’s

common stock or Arch’s common stock; the risk of litigation related to the proposed transaction; the risk that the credit ratings

of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing

business operations and opportunities as a result of the proposed transaction; the risk of adverse reactions or changes to business or

employee relationships, including those resulting from the announcement or completion of the proposed transaction; the dilution caused

by CONSOL’s issuance of additional shares of its capital stock in connection with the proposed transaction; changes in coal prices,

which may be caused by numerous factors, including changes in the domestic and foreign supply of and demand for coal and the domestic

and foreign demand for steel and electricity; the volatility in commodity and capital equipment prices for coal mining operations; the

presence or recoverability of estimated reserves; the ability to replace reserves; environmental and geological risks; mining and operating

risks; the risks related to the availability, reliability and cost-effectiveness of transportation facilities and fluctuations in transportation

costs; foreign currency, competition, government regulation or other actions; the ability of management to execute its plans to meet its

goals; risks associated with the evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory

conditions; natural and man-made disasters; civil unrest, pandemics, and conditions that may result from legislative, regulatory, trade

and policy changes; and other risks inherent in CONSOL’s and Arch’s businesses.

All such factors are difficult to predict, are

beyond CONSOL’s and Arch’s control, and are subject to additional risks and uncertainties, including those detailed in CONSOL’s

annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q, and current reports on

Form 8-K that are available on its website at https://investors.consolenergy.com/sec-filings and on the SEC’s website at http://www.sec.gov,

and those detailed in Arch’s annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q

and current reports on Form 8-K that are available on Arch’s website at https://investor.archrsc.com/sec-filings/ and on the

SEC’s website at http://www.sec.gov.

Forward-looking statements are based on the estimates

and opinions of management at the time the statements are made. Neither CONSOL nor Arch undertakes any obligation to publicly update any

forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers are

cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

No Offer or Solicitation

This communication is not intended to be, and

shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any

vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed transaction, CONSOL

filed with the SEC on October 1, 2024 a registration statement on Form S-4 that includes a preliminary joint proxy statement

of Arch and CONSOL and that also constitutes a prospectus of CONSOL. Each of Arch and CONSOL may also file other relevant documents with

the SEC regarding the proposed transaction. This document is not a substitute for the definitive joint proxy statement/prospectus or registration

statement or any other document that Arch or CONSOL may file with the SEC. The definitive joint proxy statement/prospectus (if and when

available) will be mailed to stockholders of Arch and CONSOL. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT,

JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT ARCH, CONSOL AND THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the registration statement, preliminary joint proxy statement/prospectus and definitive joint proxy statement/prospectus

(if and when available) and other documents containing important information about Arch, CONSOL and the proposed transaction, once such

documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the registration statement

and preliminary joint proxy statement/prospectus, definitive joint proxy statement/prospectus (if and when available) and other documents

filed with the SEC by Arch may be obtained free of charge on Arch’s website at https://investor.archrsc.com/sec-filings/ or, alternatively,

by directing a request by mail to Arch’s Corporate Secretary at One CityPlace Drive, Suite 300, St. Louis, Missouri, 63141.

Copies of the registration statement, preliminary joint proxy statement/prospectus and definitive joint proxy statement/prospectus (if

and when available) and other documents filed with the SEC by CONSOL may be obtained free of charge on CONSOL’s website at https://investors.consolenergy.com/sec-filings

or, alternatively, by directing a request by mail to CONSOL’s Corporate Secretary at 275 Technology Drive, Suite 101, Canonsburg,

Pennsylvania 15317.

Participants in the Solicitation

Arch, CONSOL and certain of their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information

about the directors and executive officers of Arch, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in Arch’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on

March 27, 2024, including under the headings “Executive Compensation,” “Director Compensation,” “Equity

Compensation Plan Information,” and “Security Ownership of Directors and Executive Officers.” To the extent holdings

of Arch common stock by the directors and executive officers of Arch have changed from the amounts of Arch common stock held by such persons

as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3

(“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements

of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with the SEC, including:

the Form 3 filed by George John Schuller on March 19, 2024; and the Forms 4 filed by Pamela Butcher on March 13, 2024,

March 18, 2024, June 17, 2024 and September 16, 2024, James Chapman on March 11, 2024, Paul Demzik on March 5,

2024, John Eaves on March 8, 2024, Patrick Kriegshauser on March 18, 2024, June 17, 2024 and September 16, 2024, Holly

Koeppel on March 18, 2024, June 17, 2024 and September 16, 2024, Richard Navarre on March 18, 2024, June 17,

2024 and September 16, 2024, George John Schuller on March 21, 2024, Peifang Zhang on March 18, 2024, June 17, 2024

and September 16, 2024 and John Ziegler on March 8, 2024. Information about the directors and executive officers of CONSOL,

including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in CONSOL’s proxy

statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 1, 2024, including under the headings

“Board of Directors and Compensation Information,” “Executive Compensation Information” and “Beneficial

Ownership of Securities.” To the extent holdings of CONSOL common stock by the directors and executive officers of CONSOL have changed

from the amounts of CONSOL common stock held by such persons as reflected therein, such changes have been or will be reflected on Forms

3, Forms 4 or Forms 5, in each case filed with the SEC, including: the Forms 4 filed by James Brock on May 24, 2024 and July 1,

2024, John Mills on May 9, 2024, Cassandra Chia-Wei Pan on May 9, 2024, Valli Perera on May 9, 2024, Joseph Platt on May 9,

2024 and John Rothka on March 8, 2024. Other information regarding the participants in the proxy solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and joint proxy

statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become

available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein

from Arch or CONSOL using the sources indicated above.

|

Arch Resources Contacts

Investors

Deck Slone

314-994-2766

dslone@archrsc.com

Media

Andrew Siegel / Aaron Palash / Spencer Hoffman

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

|

CONSOL Energy Contacts

Investors

Nathan Tucker

724-416-8336

nathantucker@consolenergy.com

Media

Erica Fisher

724-416-8292

ericafisher@consolenergy.com

OR

Barrett Golden / Adam Pollack / Kara Grimaldi

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

|

v3.24.3

Cover

|

Oct. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 14, 2024

|

| Entity File Number |

1-13105

|

| Entity Registrant Name |

Arch

Resources, Inc.

|

| Entity Central Index Key |

0001037676

|

| Entity Tax Identification Number |

43-0921172

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

CityPlace

One

|

| Entity Address, Address Line Two |

One

CityPlace Drive, Suite 300

|

| Entity Address, City or Town |

St.

Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63141

|

| City Area Code |

314

|

| Local Phone Number |

994-2700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $.01 par value

|

| Trading Symbol |

ARCH

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

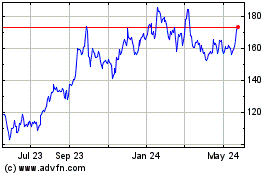

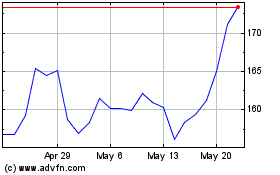

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Nov 2023 to Nov 2024