December 5, 20240001410636false00014106362024-12-052024-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2024

American Water Works Company, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34028

| | | | | |

| Delaware | 51-0063696 |

(State or other jurisdiction

of incorporation) | (IRS Employer

Identification No.) |

1 Water Street

Camden, NJ 08102-1658

(Address of principal executive offices, including zip code)

(856) 955-4001

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share | | AWK | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Approval of Final Decision in California-American Water Company’s (“Cal Am”) General Rate Case

At a public meeting held on December 5, 2024, the California Public Utilities Commission (the “CPUC”) approved a final decision adopting the terms of a partial settlement agreement filed on November 17, 2023 in Cal Am’s general rate case originally filed on July 1, 2022. Incorporating the currently effective return on equity of 10.2%, as reflected in the attachments to the final decision, the decision provides incremental annualized water and wastewater revenues of $20.9 million in the 2024 test year, and an estimated $15.9 million in the 2025 escalation year and $15.9 million in the 2026 attrition year. New rates will be implemented retroactively to January 1, 2024. In addition, the CPUC denied Cal Am’s proposed Water Resources Sustainability Plan decoupling mechanism but approved continuation of its currently effective Annual Consumption Adjustment Mechanism. Cal Am intends to evaluate filing an application for rehearing of the CPUC’s denial of the proposed Water Resources Sustainability Plan decoupling mechanism. Cal Am is a wholly owned subsidiary of American Water Works Company, Inc. (the “Company”).

A copy of the press release issued by Cal Am on December 6, 2024, regarding the CPUC’s final decision has been filed as Exhibit 99.1 hereto and is incorporated herein by reference. References and links to websites and other information contained in this press release are not provided as active hyperlinks, and the information contained in or accessed through these hyperlinks shall not be incorporated into, or form a part of, this Current Report on Form 8-K. Cautionary Statement Concerning Forward-Looking Statements

Certain statements included in this Current Report on Form 8-K (or the exhibits thereto) are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could,” or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on the Company’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this Current Report on Form 8-K as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on February 14, 2024, and other filings with the SEC, and additional risks and uncertainties, including with respect to (1) the resolution by the CPUC of any issue as to which Cal Am files an application for rehearing; (2) the occurrence of benefits to Cal Am arising from the CPUC’s final decision; (3) unexpected costs, liabilities or delays associated with the resolution of any such application for rehearing filed by Cal Am; (4) regulatory, legislative, local, municipal or other actions adversely affecting Cal Am specifically or the water and wastewater industries generally, including with respect to the potential condemnation of Cal Am’s water system assets located on the Monterey peninsula; and (5) other economic, business and other factors. These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in the Company’s annual and quarterly reports as filed with the SEC, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date of this Current Report on Form 8-K. The Company does not have any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s or Cal Am’s business, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits to this Current Report have been provided herewith as noted below:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are included and formatted as Inline XBRL). |

| * Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | AMERICAN WATER WORKS COMPANY, INC. |

| | | | | |

| Dated: | December 6, 2024 | | By: | /s/ DAVID M. BOWLER |

| | | | | David M. Bowler |

| | | | | Executive Vice President and Chief Financial Officer |

California Public Utilities Commission Approves and Adopts Partial Settlement in California American Water’s General Rate Case

SACRAMENTO, Calif. – Dec. 6, 2024 – The California Public Utilities Commission (CPUC) approved and adopted a partial settlement agreement in California American Water’s General Rate Case at its meeting on December 5, 2024. The decision adopts a partial settlement between California American Water and the CPUC’s Public Advocates Office.

The decision provides incremental annualized water and wastewater revenues of approximately $20.9 million in test year 2024, approximately $15.9 million for escalation year 2025 and approximately $15.9 million for attrition year 2026. The Commission’s decision is retroactive to January 1, 2024. California American Water expects to implement new rates in February 2025.

The decision also authorizes $390 million in new infrastructure investment to maintain high-quality water and wastewater service. These investments include upgrades to distribution systems, treatment facilities, storage tanks and pump stations, and are necessary to maintain and improve water quality, reliability, fire protection as well as customer service for the communities served by California American Water.

In its application, California American Water proposed to continue full rate decoupling and sales adjustment mechanisms that promote affordability and conservation-oriented rate design.

The CPUC’s decision includes approval of an important sales adjustment mechanism, which reflects the understanding that water sales forecasting is difficult and should be adjusted annually to reflect current data. The decision does not recognize the importance of a decoupling mechanism in promoting affordable rates and conservation. Decoupling separates water revenue from water sales volume and is commonly used by energy utilities. In 2022, the Legislature passed SB 1469, which expressed a clear legislative intent in support of decoupling for CPUC regulated water utilities. In 2024, the California Supreme Court struck down the CPUC’s prohibition on the use of decoupling by water utilities. California American Water intends to evaluate filing an application for rehearing with the CPUC and is exploring other avenues to help ensure that customers can achieve the affordability and conservation benefits associated with decoupling and sales adjustments mechanisms.

“The CPUC's decision overlooks the importance of decoupling to allow California American Water to be a leader in ensuring affordable rates and promoting conservation for our customers," said California American Water President Kevin Tilden. "This mechanism, widely used by energy utilities and proven effective, has strong support

from state legislators.”

As part of the settlement, California American Water received adjustments strengthening its Customer Assistance Program. Discounts increased from 20 percent to 25 percent off the typical bill for qualified residential customers in Northern and Southern California and from 30 percent to 35 percent for qualified customers in Central California. Information about the Customer Assistance Program and customer applications as well as information about other assistance programs can be found at www.californiaamwater.com under Customer Service & Billing, Bill Paying Assistance.

Rate cases are proceedings used to address the capital investment needed for infrastructure, the costs of operating and maintaining the utility system and the allocation of those costs among customer classes. Large, regulated water utilities like California American Water are required by law to file a General Rate Case every three years with the CPUC to set revenues and rates.

Customers will receive specific information about rates in their bill in each of California American Water’s water and wastewater service areas, as well as information about customer assistance and conservation programs. Specific information will also be available on the company’s website at www.californiaamwater.com under Customer Service & Billing, Water and Wastewater Rates.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to, among other things, the outcome of California American Water’s application for rehearing and the effective date of new water and wastewater rates. These statements are based on the current expectations of management of California American Water. There are a number of risks and uncertainties that could cause actual results to differ materially from these forward-looking statements, including with respect to (1) the resolution by the CPUC of any issue as to which California American Water files an application for rehearing; (2) the occurrence of benefits to California American Water arising from the CPUC’s decision; (3) unexpected costs, liabilities or delays associated with the resolution of any such application for rehearing filed by California American Water; (4) regulatory, legislative, local, municipal or other actions adversely affecting California American Water specifically or the water and wastewater industries generally, including with respect to the potential condemnation of California American Water’s water system assets located on the Monterey peninsula; and (5) other economic, business and other factors.

About American Water

American Water (NYSE: AWK) is the largest regulated water and wastewater utility company in the United States. With a history dating back to 1886, We Keep Life Flowing® by providing safe, clean, reliable and affordable drinking water and wastewater services to more than 14 million people with regulated operations in 14 states and on 18 military installations. American Water’s 6,500 talented professionals leverage their significant expertise and the company’s national size and scale to achieve excellent outcomes for the benefit of customers, employees, investors and other stakeholders.

For more information, visit amwater.com and join American Water on LinkedIn, Facebook, X and Instagram.

About California American Water

California American Water, a subsidiary of American Water, provides high-quality and reliable water and wastewater services to approximately 700,000 people. For more information, visit www.californiaamwater.com and follow California American Water on LinkedIn, Facebook, X, and Instagram.

AWK-IR

MEDIA CONTACT:

Evan Jacobs

Sr. Director, Business Development & External Affairs

707-495-6135

evan.jacobs@amwater.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

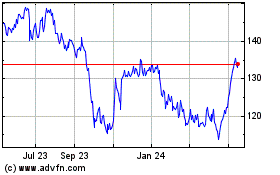

American Water Works (NYSE:AWK)

Historical Stock Chart

From Nov 2024 to Dec 2024

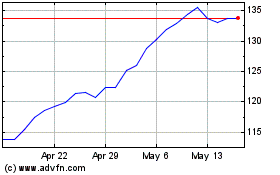

American Water Works (NYSE:AWK)

Historical Stock Chart

From Dec 2023 to Dec 2024