Comparable Sales Declined 2.9%

GAAP Diluted EPS Increased 4% to

$1.26

Non-GAAP Diluted EPS Decreased 2% to

$1.26

Best Buy Co., Inc. (NYSE: BBY) today announced results for the

13-week third quarter ended November 2, 2024 (“Q3 FY25”), as

compared to the 13-week third quarter ended October 28, 2023 (“Q3

FY24”).

Q3 FY25

Q3 FY24

Revenue ($ in millions)

Enterprise

$

9,445

$

9,756

Domestic segment

$

8,697

$

8,996

International segment

$

748

$

760

Enterprise comparable sales % change1

(2.9

)%

(6.9

)%

Domestic comparable sales % change1

(2.8

)%

(7.3

)%

Domestic comparable online sales %

change1

(1.0

)%

(9.3

)%

International comparable sales %

change1

(3.7

)%

(1.9

)%

Operating Income

GAAP operating income as a % of

revenue

3.7

%

3.6

%

Non-GAAP operating income as a % of

revenue

3.7

%

3.8

%

Diluted Earnings per Share

("EPS")

GAAP diluted EPS

$

1.26

$

1.21

Non-GAAP diluted EPS

$

1.26

$

1.29

For GAAP to non-GAAP reconciliations of the measures referred to

in the above table, please refer to the attached supporting

schedule.

“In the third quarter, our teams delivered an in-line non-GAAP

operating income rate on sales that were a little softer than

expected,” said Corie Barry, Best Buy CEO. “During the second half

of the quarter, a combination of the ongoing macro uncertainty,

customers waiting for deals and sales events, and distraction

during the run-up to the election, particularly in non-essential

categories, led to softer-than-expected demand. In the first few

weeks of Q4, as holiday sales have begun and the election is behind

us, we have seen customer demand increase again.”

“We are excited and feel well-positioned for the holiday season

with compelling deals, inspirational in-store and digital

merchandising and competitive fulfillment options,” Barry

continued. “We continue to see a consumer who is seeking value and

sales events, and one who is also willing to spend on high

price-point products when they need to or when there is new,

compelling technology. Thus, we are balancing our optimism in both

the industry and our unique positioning with a pragmatic approach

to likely uneven customer behavior going forward.”

FY25 Financial Guidance

“We are adjusting our full year comparable sales guidance to a

decline in the range of 2.5% to 3.5%,” said Matt Bilunas, Best Buy

CFO. “At the same time, we are maintaining our full year non-GAAP

operating income rate of 4.1% to 4.2%, which represents slight

expansion compared to FY24 on a 52-week basis.”

Bilunas continued, “For Q4 FY25, we expect comparable sales

versus last year to be flat to down 3% and our non-GAAP operating

income rate to be in the range of 4.6% to 4.8%.”

Best Buy’s updated guidance for FY25 is the following:

- Revenue of $41.1 billion to $41.5 billion, which compares to

prior guidance of $41.3 billion to $41.9 billion

- Comparable sales1 of (3.5%) to (2.5%), which compares to prior

guidance of (3.0%) to (1.5%)

- Enterprise non-GAAP operating income rate2 of 4.1% to 4.2%,

which is unchanged

- Non-GAAP effective income tax rate2 of approximately 23.5%,

which compares to prior guidance of approximately 24.0%

- Non-GAAP diluted EPS2 of $6.10 to $6.25, which compares to

prior guidance of $6.10 to $6.35

- Capital expenditures of approximately $750 million, which is

unchanged

Note: FY25 has 52 weeks compared to 53 weeks in FY24. The

company estimates the impact of the extra week in Q4 FY24 added

approximately $735 million in revenue, approximately 15 basis

points of non-GAAP operating income rate and approximately $0.30 of

non-GAAP diluted EPS to the full-year results.

Domestic Segment Q3 FY25

Results

Domestic Revenue

Domestic revenue of $8.70 billion decreased 3.3% versus last

year primarily driven by a comparable sales decline of 2.8%.

From a merchandising perspective, the largest drivers of the

comparable sales decline on a weighted basis were appliances, home

theater and gaming. These drivers were partially offset by growth

in the computing, tablets and services categories.

Domestic online revenue of $2.73 billion decreased 1.0% on a

comparable basis, and as a percentage of total Domestic revenue,

online revenue was 31.4% versus 30.6% last year.

Domestic Gross Profit Rate

Domestic gross profit rate was 23.6% versus 22.9% last year. The

higher gross profit rate was primarily due to improved financial

performance from the company’s services category, including its

membership offerings, which was partially offset by lower

profit-sharing revenue from the company’s private label and

co-branded credit card arrangement and lower product margin

rates.

Domestic Selling, General and Administrative Expenses

(“SG&A”)

Domestic GAAP SG&A expenses were $1.72 billion, or 19.7% of

revenue, versus $1.73 billion, or 19.2% of revenue, last year. On a

non-GAAP basis, SG&A expenses were $1.71 billion, or 19.7% of

revenue, versus $1.71 billion, or 19.0% of revenue, last year. GAAP

SG&A decreased $11 million, which included lower intangible

asset amortization of approximately $10 million. Both GAAP and

non-GAAP SG&A included higher advertising expense, which was

partially offset by lower incentive compensation.

International Segment Q3 FY25

Results

International Revenue

International revenue of $748 million decreased 1.6% versus last

year primarily driven by a comparable sales decline of 3.7% and the

negative impact from foreign exchange rates, which were partially

offset by revenue from Best Buy Express locations that have opened

in Canada during FY25.

International Gross Profit Rate

International gross profit rate was 22.5% versus 22.1% last

year. The higher gross profit rate was primarily due to growth in

the higher margin services category.

International SG&A

International SG&A expenses were $155 million, or 20.7% of

revenue, versus $151 million, or 19.9% of revenue, last year. The

higher SG&A expense was primarily driven by expenses associated

with new Best Buy Express locations.

Share Repurchases and

Dividends

In Q3 FY25, the company returned a total of $339 million to

shareholders through dividends of $202 million and share

repurchases of $137 million. On a year-to-date basis, the company

has returned a total of $892 million to shareholders through

dividends of $607 million and share repurchases of $285 million.

The company still expects to spend approximately $500 million on

share repurchases during FY25.

Today, the company announced that its board of directors has

authorized the payment of a regular quarterly cash dividend of

$0.94 per common share. The quarterly dividend is payable on

January 7, 2025, to shareholders of record as of the close of

business on December 17, 2024.

Conference Call

Best Buy is scheduled to conduct an earnings conference call at

8:00 a.m. Eastern Time (7:00 a.m. Central Time) on November 26,

2024. A webcast of the call is expected to be available at

www.investors.bestbuy.com, both live and after the call.

Notes:

(1) The method of calculating comparable sales varies across the

retail industry. As a result, our method of calculating comparable

sales may not be the same as other retailers’ methods. For

additional information on comparable sales, please see our most

recent Annual Report on Form 10-K, and our subsequent Quarterly

Reports on Form 10-Q, filed with the Securities and Exchange

Commission (“SEC”), and available at www.investors.bestbuy.com.

(2) A reconciliation of the projected non-GAAP operating income

rate, non-GAAP effective income tax rate, and non-GAAP diluted EPS,

which are forward-looking non-GAAP financial measures, to the most

directly comparable GAAP financial measures, is not provided

because the company is unable to provide such reconciliation

without unreasonable effort. The inability to provide a

reconciliation is due to the uncertainty and inherent difficulty

predicting the occurrence, the financial impact and the periods in

which the non-GAAP adjustments may be recognized. These GAAP

measures may include the impact of such items as restructuring

charges; price-fixing settlements; goodwill and intangible asset

impairments; gains and losses on sales of subsidiaries and certain

investments; intangible asset amortization; certain

acquisition-related costs; and the tax effect of all such items.

Historically, the company has excluded these items from non-GAAP

financial measures. The company currently expects to continue to

exclude these items in future disclosures of non-GAAP financial

measures and may also exclude other items that may arise

(collectively, “non-GAAP adjustments”). The decisions and events

that typically lead to the recognition of non-GAAP adjustments,

such as a decision to exit part of the business or reaching

settlement of a legal dispute, are inherently unpredictable as to

if or when they may occur. For the same reasons, the company is

unable to address the probable significance of the unavailable

information, which could be material to future results.

Forward-Looking and Cautionary Statements:

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 as

contained in Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. You can identify these

statements by the fact that they use words such as "anticipate,"

“appear,” “approximate,” "assume," "believe," “continue,” “could,”

"estimate," "expect," “foresee,” "guidance," "intend," “may,”

“might,” "outlook," "plan," “possible,” "project" “seek,” “should,”

“would,” and other words and terms of similar meaning or the

negatives thereof. Such statements reflect our current views and

estimates with respect to future market conditions, company

performance and financial results, operational investments,

business prospects, our operating model, new strategies and growth

initiatives, the competitive environment, consumer behavior and

other events. These statements involve a number of judgments and

are subject to certain risks and uncertainties, many of which are

outside the control of the Company, that could cause actual results

to differ materially from the potential results discussed in such

forward-looking statements. Readers should review Item 1A, Risk

Factors, of our most recent Annual Report on Form 10-K, and any

updated information in subsequent Quarterly Reports on Form 10-Q,

for a description of important factors that could cause our actual

results to differ materially from those contemplated by the

forward-looking statements made in this release. Among the factors

that could cause actual results and outcomes to differ materially

from those contained in such forward-looking statements are the

following: macroeconomic pressures in the markets in which we

operate (including but not limited to recession, inflation rates,

fluctuations in foreign currency exchange rates, limitations on a

government’s ability to borrow and/or spend capital, fluctuations

in housing prices, energy markets, jobless rates and effects

related to the conflicts in Eastern Europe and the Middle East or

other geopolitical events); catastrophic events, health crises and

pandemics; susceptibility of the products we sell to technological

advancements, product life cycle fluctuations and changes in

consumer preferences; competition (including from multi-channel

retailers, e-commerce business, technology service providers,

traditional store-based retailers, vendors and mobile network

carriers and in the provision of delivery speed and options); our

ability to attract and retain qualified employees; changes in

market compensation rates; our expansion into health and new

products, services and technologies; our focus on services as a

strategic priority; our reliance on key vendors and mobile network

carriers (including product availability); our ability to maintain

positive brand perception and recognition; our ability to

effectively manage strategic ventures, alliances or acquisitions;

our ability to effectively manage our real estate portfolio;

inability of vendors or service providers to perform components of

our supply chain (impacting our stores or other aspects of our

operations) and other various functions of our business; risks

arising from and potentially unique to our exclusive brands

products; risks associated with vendors that source products

outside the U.S.; our reliance on our information technology

systems, internet and telecommunications access and capabilities;

our ability to prevent or effectively respond to a cyber-attack,

privacy or security breach; product safety and quality concerns;

changes to labor or employment laws or regulations; risks arising

from statutory, regulatory and legal developments (including

statutes and/or regulations related to tax or privacy); evolving

corporate governance and public disclosure regulations and

expectations (including, but not limited to, cybersecurity and

environmental, social and governance matters); risks arising from

our international activities (including fluctuations in foreign

currency exchange rates) and those of our vendors; failure to

effectively manage our costs; our dependence on cash flows and net

earnings generated during the fourth fiscal quarter; pricing

investments and promotional activity; economic or regulatory

developments that might affect our ability to provide attractive

promotional financing; constraints in the capital markets; changes

to our vendor credit terms; changes in our credit ratings; and

failure to meet financial-performance guidance or other

forward-looking statements. We caution that the foregoing list of

important factors is not complete. Any forward-looking statements

speak only as of the date they are made and we assume no obligation

to update any forward-looking statement that we may make.

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

($ and shares in millions, except

per share amounts)

(Unaudited and subject to

reclassification)

Three Months Ended

Nine Months Ended

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Revenue

$

9,445

$

9,756

$

27,580

$

28,806

Cost of sales

7,228

7,524

21,113

22,204

Gross profit

2,217

2,232

6,467

6,602

Gross profit %

23.5

%

22.9

%

23.4

%

22.9

%

Selling, general and administrative

expenses1,871

1,878

5,418

5,605

SG&A %

19.8

%

19.2

%

19.6

%

19.5

%

Restructuring charges

(4

)

-

4

(16

)

Operating income

350

354

1,045

1,013

Operating income %

3.7

%

3.6

%

3.8

%

3.5

%

Other income (expense):

Gain on sale of subsidiary, net

-

-

-

21

Investment income and other

19

8

65

41

Interest expense

(13

)

(14

)

(38

)

(38

)

Earnings before income tax expense and

equity in income of affiliates

356

348

1,072

1,037

Income tax expense

85

86

266

257

Effective tax rate

23.9

%

24.7

%

24.8

%

24.8

%

Equity in income of affiliates

2

1

4

1

Net earnings

$

273

$

263

$

810

$

781

Basic earnings per share

$

1.27

$

1.21

$

3.76

$

3.58

Diluted earnings per share

$

1.26

$

1.21

$

3.73

$

3.57

Weighted-average common shares

outstanding:

Basic

214.8

217.8

215.7

218.4

Diluted

216.7

218.3

217.2

219.1

BEST BUY CO., INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

($ in millions)

(Unaudited and subject to

reclassification)

November 2, 2024

October 28, 2023

Assets

Current assets:

Cash and cash equivalents

$

643

$

636

Receivables, net

932

901

Merchandise inventories

7,806

7,562

Other current assets

574

766

Total current assets

9,955

9,865

Property and equipment, net

2,196

2,313

Operating lease assets

2,842

2,827

Goodwill

1,383

1,383

Other assets

642

494

Total assets

$

17,018

$

16,882

Liabilities and equity

Current liabilities:

Accounts payable

$

7,145

$

7,133

Unredeemed gift card liabilities

246

245

Deferred revenue

878

934

Accrued compensation and related

expenses

361

309

Accrued liabilities

690

760

Current portion of operating lease

liabilities

616

614

Current portion of long-term debt

12

15

Total current liabilities

9,948

10,010

Long-term operating lease liabilities

2,293

2,270

Long-term debt

1,144

1,130

Long-term liabilities

551

660

Equity

3,082

2,812

Total liabilities and equity

$

17,018

$

16,882

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited and subject to

reclassification)

Nine Months Ended

November 2, 2024

October 28, 2023

Operating activities

Net earnings

$

810

$

781

Adjustments to reconcile net

earnings to total cash provided by operating activities:

Depreciation and amortization

650

702

Restructuring charges

4

(16

)

Stock-based compensation

108

110

Gain on sale of subsidiary, net

-

(21

)

Other, net

3

7

Changes in operating assets and

liabilities:

Receivables

4

240

Merchandise inventories

(2,869

)

(2,444

)

Other assets

(16

)

(17

)

Accounts payable

2,483

1,468

Income taxes

(219

)

(200

)

Other liabilities

(397

)

(320

)

Total cash provided by operating

activities

561

290

Investing activities

Additions to property and equipment

(528

)

(612

)

Net proceeds from sale of subsidiary

-

14

Other, net

6

(2

)

Total cash used in investing

activities

(522

)

(600

)

Financing activities

Repurchase of common stock

(285

)

(270

)

Dividends paid

(607

)

(603

)

Other, net

-

1

Total cash used in financing

activities

(892

)

(872

)

Effect of exchange rate changes on cash

and cash equivalents

(2

)

(12

)

Decrease in cash, cash equivalents and

restricted cash

(855

)

(1,194

)

Cash, cash equivalents and restricted

cash at beginning of period

1,793

2,253

Cash, cash equivalents and restricted

cash at end of period

$

938

$

1,059

BEST BUY CO., INC.

SEGMENT INFORMATION

($ in millions)

(Unaudited and subject to

reclassification)

Three Months Ended

Nine Months Ended

Domestic Segment Results

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Revenue

$

8,697

$

8,996

$

25,523

$

26,687

Comparable sales % change

(2.8

)%

(7.3

)%

(3.8

)%

(8.0

)%

Comparable online sales % change

(1.0

)%

(9.3

)%

(2.9

)%

(9.5

)%

Gross profit

$

2,049

$

2,064

$

5,993

$

6,108

Gross profit as a % of revenue

23.6

%

22.9

%

23.5

%

22.9

%

SG&A

$

1,716

$

1,727

$

4,982

$

5,167

SG&A as a % of revenue

19.7

%

19.2

%

19.5

%

19.4

%

Operating income

$

337

$

336

$

1,007

$

955

Operating income as a % of revenue

3.9

%

3.7

%

3.9

%

3.6

%

Domestic Segment Non-GAAP

Results1

Gross profit

$

2,049

$

2,064

$

5,993

$

6,108

Gross profit as a % of revenue

23.6

%

22.9

%

23.5

%

22.9

%

SG&A

$

1,711

$

1,712

$

4,966

$

5,111

SG&A as a % of revenue

19.7

%

19.0

%

19.5

%

19.2

%

Operating income

$

338

$

352

$

1,027

$

997

Operating income as a % of revenue

3.9

%

3.9

%

4.0

%

3.7

%

Three Months Ended

Nine Months Ended

International Segment Results

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Revenue

$

748

$

760

$

2,057

$

2,119

Comparable sales % change

(3.7

)%

(1.9

)%

(3.0

)%

(4.2

)%

Gross profit

$

168

$

168

$

474

$

494

Gross profit as a % of revenue

22.5

%

22.1

%

23.0

%

23.3

%

SG&A

$

155

$

151

$

436

$

438

SG&A as a % of revenue

20.7

%

19.9

%

21.2

%

20.7

%

Operating income

$

13

$

18

$

38

$

58

Operating income as a % of revenue

1.7

%

2.4

%

1.8

%

2.7

%

International Segment Non-GAAP

Results1

Gross profit

$

168

$

168

$

474

$

494

Gross profit as a % of revenue

22.5

%

22.1

%

23.0

%

23.3

%

SG&A

$

155

$

151

$

436

$

438

SG&A as a % of revenue

20.7

%

19.9

%

21.2

%

20.7

%

Operating income

$

13

$

17

$

38

$

56

Operating income as a % of revenue

1.7

%

2.2

%

1.8

%

2.6

%

(1) For GAAP to non-GAAP reconciliations,

please refer to the attached supporting schedule titled

Reconciliation of Non-GAAP Financial Measures.

BEST BUY CO., INC.

REVENUE CATEGORY

SUMMARY

(Unaudited and subject to

reclassification)

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

Domestic Segment

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Computing and Mobile Phones

47

%

44

%

3.8

%

(8.3

)%

Consumer Electronics

28

%

29

%

(5.8

)%

(9.5

)%

Appliances

12

%

14

%

(14.7

)%

(15.1

)%

Entertainment

5

%

6

%

(18.8

)%

20.6

%

Services

7

%

6

%

6.0

%

6.9

%

Other

1

%

1

%

12.9

%

4.7

%

Total

100

%

100

%

(2.8

)%

(7.3

)%

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

International Segment

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Computing and Mobile Phones

52

%

50

%

(0.1

)%

(1.0

)%

Consumer Electronics

26

%

26

%

(6.1

)%

(8.4

)%

Appliances

9

%

10

%

(8.1

)%

4.0

%

Entertainment

6

%

7

%

(18.7

)%

18.6

%

Services

6

%

6

%

4.0

%

2.4

%

Other

1

%

1

%

(12.7

)%

(37.5

)%

Total

100

%

100

%

(3.7

)%

(1.9

)%

BEST BUY CO., INC. RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES ($ in millions, except per share

amounts) (Unaudited and subject to reclassification)

The following information provides reconciliations of the most

comparable financial measures presented in accordance with

accounting principles generally accepted in the U.S. (GAAP

financial measures) to presented non-GAAP financial measures. The

company believes that non-GAAP financial measures, when reviewed in

conjunction with GAAP financial measures, can provide more

information to assist investors in evaluating current period

performance and in assessing future performance. For these reasons,

internal management reporting also includes non-GAAP financial

measures. Generally, presented non-GAAP financial measures include

adjustments for items such as restructuring charges, goodwill and

intangible asset impairments, price-fixing settlements, gains and

losses on subsidiaries and certain investments, intangible asset

amortization, certain acquisition-related costs and the tax effect

of all such items. In addition, certain other items may be excluded

from non-GAAP financial measures when the company believes this

provides greater clarity to management and investors. These

non-GAAP financial measures should be considered in addition to,

and not superior to or as a substitute for, the GAAP financial

measures presented in this earnings release and the company’s

financial statements and other publicly filed reports. Non-GAAP

financial measures as presented herein may not be comparable to

similarly titled measures used by other companies.

Three Months Ended

Three Months Ended

November 2, 2024

October 28, 2023

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

1,716

$

155

$

1,871

$

1,727

$

151

$

1,878

% of revenue

19.7

%

20.7

%

19.8

%

19.2

%

19.9

%

19.2

%

Intangible asset amortization1

(5

)

-

(5

)

(15

)

-

(15

)

Non-GAAP SG&A

$

1,711

$

155

$

1,866

$

1,712

$

151

$

1,863

% of revenue

19.7

%

20.7

%

19.8

%

19.0

%

19.9

%

19.1

%

Operating income

$

337

$

13

$

350

$

336

$

18

$

354

% of revenue

3.9

%

1.7

%

3.7

%

3.7

%

2.4

%

3.6

%

Intangible asset amortization1

5

-

5

15

-

15

Restructuring charges2

(4

)

-

(4

)

1

(1

)

-

Non-GAAP operating income

$

338

$

13

$

351

$

352

$

17

$

369

% of revenue

3.9

%

1.7

%

3.7

%

3.9

%

2.2

%

3.8

%

Effective tax rate

23.9

%

24.7

%

Intangible asset amortization1

(0.1

)%

-

%

Non-GAAP effective tax rate

23.8

%

24.7

%

Three Months Ended

Three Months Ended

November 2, 2024

October 28, 2023

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

1.26

$

1.21

Intangible asset amortization1

$

5

$

4

0.01

$

15

$

7

0.03

Restructuring charges2

(4

)

(3

)

(0.01

)

-

2

0.01

Loss on investments

-

-

-

9

9

0.04

Non-GAAP diluted EPS

$

1.26

$

1.29

Nine Months Ended

Nine Months Ended

November 2, 2024

October 28, 2023

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

4,982

$

436

$

5,418

$

5,167

$

438

$

5,605

% of revenue

19.5

%

21.2

%

19.6

%

19.4

%

20.7

%

19.5

%

Intangible asset amortization1

(16

)

-

(16

)

(56

)

-

(56

)

Non-GAAP SG&A

$

4,966

$

436

$

5,402

$

5,111

$

438

$

5,549

% of revenue

19.5

%

21.2

%

19.6

%

19.2

%

20.7

%

19.3

%

Operating income

$

1,007

$

38

$

1,045

$

955

$

58

$

1,013

% of revenue

3.9

%

1.8

%

3.8

%

3.6

%

2.7

%

3.5

%

Intangible asset amortization1

16

-

16

56

-

56

Restructuring charges2

4

-

4

(14

)

(2

)

(16

)

Non-GAAP operating income

$

1,027

$

38

$

1,065

$

997

$

56

$

1,053

% of revenue

4.0

%

1.8

%

3.9

%

3.7

%

2.6

%

3.7

%

Effective tax rate

24.8

%

24.8

%

Intangible asset amortization1

-

%

0.2

%

Restructuring charges2

-

%

(0.1

)%

Non-GAAP effective tax rate

24.8

%

24.9

%

Nine Months Ended

Nine Months Ended

November 2, 2024

October 28, 2023

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

3.73

$

3.57

Intangible asset amortization1

$

16

$

12

0.05

$

56

$

43

0.20

Restructuring charges2

4

3

0.02

(16

)

(12

)

(0.06

)

Loss on investments

-

-

-

11

11

0.05

Gain on sale of subsidiary, net3

-

-

-

(21

)

(21

)

(0.10

)

Non-GAAP diluted EPS

$

3.80

$

3.66

(1) Represents the non-cash amortization

of definite-lived intangible assets associated with acquisitions,

including customer relationships, tradenames and developed

technology assets.

(2) Represents charges related to employee

termination benefits and subsequent adjustments from

higher-than-expected employee retention associated with

enterprise-wide restructuring initiatives.

(3) Represents the gain on sale of a

Mexico subsidiary subsequent to our exit from operations in

Mexico.

(4) The non-GAAP adjustments primarily

relate to the U.S. and Mexico. As such, the forecasted annual

income tax charge on a portion of the U.S. non-GAAP adjustments is

calculated using the statutory tax rate of 24.5%. There is no

forecasted annual income tax for Mexico non-GAAP items and a

portion of U.S. non-GAAP items, as there is no forecasted annual

tax benefit/expense on the income/expenses in the calculation of

GAAP income tax expense.

Return on Assets and

Non-GAAP Return on Investment

The tables below provide calculations of return on assets

("ROA") (GAAP financial measure) and non-GAAP return on investment

(“ROI”) (non-GAAP financial measure) for the periods presented. The

company believes ROA is the most directly comparable financial

measure to ROI. Non-GAAP ROI is defined as non-GAAP adjusted

operating income after tax divided by average invested operating

assets. All periods presented below apply this methodology

consistently. The company believes non-GAAP ROI is a meaningful

metric for investors to evaluate capital efficiency because it

measures how key assets are deployed by adjusting operating income

and total assets for the items noted below. This method of

determining non-GAAP ROI may differ from other companies' methods

and therefore may not be comparable to those used by other

companies.

Return on Assets ("ROA")

November 2, 20241

October 28, 20231

Net earnings

$

1,270

$

1,276

Total assets

16,042

16,069

ROA

7.9

%

7.9

%

Non-GAAP Return on Investment

("ROI")

November 2, 20241

October 28, 20231

Numerator

Operating income

$

1,606

$

1,610

Add: Non-GAAP operating income

adjustments2

194

147

Add: Operating lease interest3

115

114

Less: Income taxes4

(469

)

(458

)

Add: Depreciation

850

865

Add: Operating lease amortization5

663

666

Adjusted operating income after

tax

$

2,959

$

2,944

Denominator

Total assets

$

16,042

$

16,069

Less: Excess cash6

(403

)

(318

)

Add: Accumulated depreciation and

amortization7

5,237

5,055

Less: Adjusted current liabilities8

(8,395

)

(8,632

)

Average invested operating

assets

$

12,481

$

12,174

Non-GAAP ROI

23.7

%

24.2

%

(1) Income statement accounts represent

the activity for the trailing 12 months ended as of each of the

balance sheet dates. Balance sheet accounts represent the average

account balances for the trailing 12 months ended as of each of the

balance sheet dates.

(2) Non-GAAP operating income adjustments

include continuing operations adjustments for restructuring charges

and intangible asset amortization. Additional details regarding

these adjustments are included in the Reconciliation of Non-GAAP

Financial Measures schedule within the company’s earnings

releases.

(3) Operating lease interest represents

the add-back to operating income to approximate the total interest

expense that the company would incur if its operating leases were

owned and financed by debt. The add-back is approximated by

multiplying average operating lease assets by 4%, which

approximates the interest rate on the company’s operating lease

liabilities.

(4) Income taxes are approximated by using

a blended statutory rate at the Enterprise level based on statutory

rates from the countries in which the company does business, which

primarily consists of the U.S. with a statutory rate of 24.5% for

the periods presented.

(5) Operating lease amortization

represents operating lease cost less operating lease interest.

Operating lease cost includes short-term leases, which are

immaterial, and excludes variable lease costs as these costs are

not included in the operating lease asset balance.

(6) Excess cash represents the amount of

cash, cash equivalents and short-term investments greater than $1

billion, which approximates the amount of cash the company believes

is necessary to run the business and may fluctuate over time.

(7) Accumulated depreciation and

amortization represents accumulated depreciation related to

property and equipment and accumulated amortization related to

definite-lived intangible assets.

(8) Adjusted current liabilities represent

total current liabilities less short-term debt and the current

portions of operating lease liabilities and long-term debt.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125324856/en/

Investor Contact: Mollie O'Brien

mollie.obrien@bestbuy.com Media Contact: Carly Charlson

carly.charlson@bestbuy.com

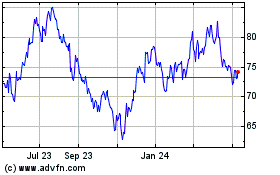

Best Buy (NYSE:BBY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Mar 2025