Belden Inc. (NYSE: BDC) (“Belden” or the “Company”), a leading

global supplier of complete connection solutions, today reported

fiscal fourth quarter and full year results for the period ended

December 31, 2024.

Fourth Quarter 2024 Highlights

- Revenues of $666 million, up 21% y/y and up 14% y/y

organically

- GAAP EPS of $1.42, up 56% y/y

- Adjusted EPS of $1.92, up 32% y/y

- Repurchased 0.5 million shares for $55 million during the

quarter

Full Year 2024 Highlights

- Revenues of $2,461 million, down 2% y/y and down 6% y/y

organically

- GAAP EPS of $4.80, down 15% y/y

- Adjusted EPS of $6.36, down 7% y/y

- Free Cash Flow of $223 million, up 3% y/y

- Repurchased 1.3 million shares for $133 million during the

year

“I am proud of our team for delivering an excellent quarter and

ending the year on a high note,” said Ashish Chand, President and

CEO of Belden. “Demand continues to remain steady, with sequential

orders up modestly for the quarter and increasing 9% for the year.

Performance during the quarter was strong, marked by 21%

year-over-year revenue growth with expanding margins. As business

conditions continue to improve, I am pleased to report that our

revenues grew organically in the fourth quarter by 14% with

strength in both segments. Free cash flow for the year reached $223

million, providing the business with ample capital to allocate

towards compelling acquisition opportunities while also returning

capital to shareholders through share repurchases when

appropriate.”

Fourth Quarter 2024

Revenues for the quarter increased $115 million, or 21%, to $666

million from $551 million in the year-ago period. Revenues

increased 14% organically, with Automation Solutions and Smart

Infrastructure Solutions both up 14%. Net income was $58 million,

compared to $39 million in the year-ago period. Net income as a

percentage of revenues was 8.8%, compared to 7.0% in the year-ago

period. EPS totaled $1.42 for the quarter, compared to $0.91 in the

year-ago period.

Adjusted EBITDA was $114 million, up $26 million, or 29%,

compared to $88 million in the year-ago period. Adjusted EBITDA

margin was 17.1%, up 110 bps, compared to 16.0% in the year-ago

period. Adjusted EPS was $1.92, increasing 32% compared to $1.46 in

the year-ago period. Relative to our prior guidance, Adjusted EPS

benefited in the fourth quarter by $0.17 from a lower-than-expected

tax rate. Adjusted results are non-GAAP measures, and a non-GAAP

reconciliation table is provided as an appendix to this

release.

Full Year 2024

Revenues for the year decreased $51 million, or 2%, to $2,461

million from $2,512 million in the prior year. Revenues were down

6% organically, with Automation Solutions down 6% and Smart

Infrastructure Solutions down 5%. Net income was $198 million,

compared to $243 million in the prior year. Net income as a

percentage of revenues was 8.1%, compared to 9.7% in the prior

year. EPS totaled $4.80 for the year, compared to $5.66 in the

prior year.

Adjusted EBITDA was $411 million, down $27 million, or 6%,

compared to $438 million in the prior year. Adjusted EBITDA margin

was 16.7%, down 70 bps, compared to 17.4% in the prior year.

Adjusted EPS was $6.36, decreasing 7% compared to $6.83 in the

prior year. Adjusted results are non-GAAP measures, and a non-GAAP

reconciliation table is provided as an appendix to this

release.

Outlook

“As we continue to drive our solutions transformation, we

anticipate first quarter performance to reflect typical seasonality

and stable demand,” said Dr. Chand. “Our customers are managing

through short-term uncertainties, and we expect further clarity as

the quarter progresses. We are confident in the long-term growth

potential of our key markets, our team’s ability to execute

effectively, and our capacity to allocate capital strategically to

maximize shareholder returns while driving sustained growth and

compounding value for the business over time.”

For the first quarter, we anticipate order patterns to align

with typical seasonality and expect our customers to remain in a

neutral posture as they navigate this dynamic environment. Revenues

are expected to be in the range of $605 million to $620 million,

representing a 13% to 16% increase over the prior-year quarter.

GAAP EPS is expected to be in the range of $1.03 to $1.13,

representing a 14% to 26% increase over the prior-year quarter.

Adjusted EPS is expected to be in the range of $1.43 to $1.53,

representing a 15% to 23% increase over the prior-year quarter.

First quarter guidance includes a currency exchange headwind of

approximately $15 million in revenues and $0.05 of EPS.

First Quarter

2025:

Guidance

Revenues (million)

$605 - $620

GAAP EPS

$1.03 - $1.13

Adjusted EPS

$1.43 - $1.53

Earnings Conference Call

Management will host a conference call today at 8:30 am ET to

discuss the results. The listen-only audio of the conference call

will be broadcast live online at https://investor.belden.com. The

dial-in number for participants is 1-866-575-6539 with confirmation

code 7220743. A replay of this conference call will remain

accessible in the investor relations section of the Company’s

website for a limited time.

Earnings per Share (EPS) and Organic Growth

All references to EPS within this earnings release refer to net

income per diluted share attributable to Belden stockholders.

Organic growth is calculated as the change in revenues excluding

the impacts from currency exchange rates, copper prices,

acquisitions, and divestitures.

BELDEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(In thousands, except per

share data)

Revenues

$

666,042

$

551,243

$

2,460,979

$

2,512,084

Cost of sales

(416,226

)

(344,878

)

(1,538,757

)

(1,557,118

)

Gross profit

249,816

206,365

922,222

954,966

Selling, general and administrative

expenses

(137,362

)

(126,414

)

(494,603

)

(492,702

)

Research and development expenses

(28,968

)

(25,883

)

(112,365

)

(116,427

)

Amortization of intangibles

(14,307

)

(10,113

)

(48,794

)

(40,375

)

Gain on sale of assets

—

—

—

12,056

Operating income

69,179

43,955

266,460

317,518

Interest expense, net

(10,849

)

(8,032

)

(38,303

)

(33,625

)

Non-operating pension benefit (cost)

(962

)

401

(215

)

1,863

Income before taxes

57,368

36,324

227,942

285,756

Income tax benefit (expense)

1,014

2,185

(29,528

)

(43,200

)

Net income

58,382

38,509

198,414

242,556

Less: Net income (loss) attributable to

noncontrolling interest

(2

)

42

(19

)

(203

)

Net income attributable to Belden

stockholders

$

58,384

$

38,467

$

198,433

$

242,759

Weighted average number of common shares

and equivalents:

Basic

40,312

41,565

40,694

42,237

Diluted

41,087

42,046

41,299

42,859

Basic income per share attributable to

Belden stockholders:

$

1.45

$

0.93

$

4.88

$

5.75

Diluted income per share attributable to

Belden stockholders:

$

1.42

$

0.91

$

4.80

$

5.66

Common stock dividends declared per

share

$

0.05

$

0.05

$

0.20

$

0.20

BELDEN INC.

OPERATING SEGMENT INFORMATION

(Unaudited)

Smart

Infrastructure

Solutions

Automation Solutions

(In thousands, except

percentages)

For the three

months ended December 31, 2024

Segment Revenues

$

319,581

$

346,461

Segment EBITDA

42,401

71,465

Segment EBITDA margin

13.3

%

20.6

%

Depreciation expense

6,954

7,732

Amortization of intangibles

9,163

5,144

Amortization of software development

intangible assets

12

2,697

Severance, restructuring, and acquisition

integration costs

6,647

2,699

Adjustments related to acquisitions and

divestitures

3,309

298

For the three

months ended December 31, 2023

Segment Revenues

$

251,054

$

300,189

Segment EBITDA

30,253

57,666

Segment EBITDA margin

12.1

%

19.2

%

Depreciation expense

6,164

6,737

Amortization of intangibles

4,914

5,199

Amortization of software development

intangible assets

—

2,457

Severance, restructuring, and acquisition

integration costs

6,074

7,232

Adjustments related to acquisitions and

divestitures

4,837

298

For the twelve

months ended December 31, 2024

Segment Revenues

$

1,143,790

$

1,317,189

Segment EBITDA

140,092

269,766

Segment EBITDA margin

12.2

%

20.5

%

Depreciation expense

26,231

30,152

Amortization of intangibles

28,642

20,152

Amortization of software development

intangible assets

12

10,552

Severance, restructuring, and acquisition

integration costs

15,165

7,649

Adjustments related to acquisitions and

divestitures

3,572

1,192

For the twelve

months ended December 31, 2023

Segment Revenues

$

1,122,831

$

1,389,253

Segment EBITDA

149,107

287,328

Segment EBITDA margin

13.3

%

20.7

%

Depreciation expense

24,943

26,436

Amortization of intangibles

20,085

20,290

Amortization of software development

intangible assets

—

7,692

Severance, restructuring, and acquisition

integration costs

11,221

13,931

Adjustments related to acquisitions and

divestitures

5,359

818

BELDEN INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

December 31, 2024

December 31, 2023

(Unaudited)

(In thousands)

ASSETS

Current assets:

Cash and cash equivalents

$

370,302

$

597,044

Receivables, net

409,711

413,806

Inventories, net

343,099

366,987

Other current assets

73,117

79,142

Total current assets

1,196,229

1,456,979

Property, plant and equipment, less

accumulated depreciation

495,625

451,069

Operating lease right-of-use assets

118,551

89,686

Goodwill

1,018,677

907,331

Intangible assets, less accumulated

amortization

419,074

269,144

Deferred income taxes

16,353

15,739

Other long-lived assets

63,429

50,243

$

3,327,938

$

3,240,191

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

315,724

$

343,215

Accrued liabilities

306,980

290,289

Total current liabilities

622,704

633,504

Long-term debt

1,130,101

1,204,211

Postretirement benefits

63,260

74,573

Deferred income taxes

77,333

49,472

Long-term operating lease liabilities

100,049

74,941

Other long-term liabilities

39,755

37,188

Stockholders’ equity:

Common stock

503

503

Additional paid-in capital

839,755

818,663

Retained earnings

1,176,036

985,807

Accumulated other comprehensive loss

(3,532

)

(41,279

)

Treasury stock

(718,026

)

(597,437

)

Total Belden stockholders’ equity

1,294,736

1,166,257

Noncontrolling interests

—

45

Total stockholders’ equity

1,294,736

1,166,302

$

3,327,938

$

3,240,191

BELDEN INC.

CONDENSED CONSOLIDATED CASH FLOW

STATEMENTS

(Unaudited)

Twelve Months Ended

December 31, 2024

December 31, 2023

(In thousands)

Cash flows from operating activities:

Net income

$

198,414

$

242,556

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization

115,741

99,446

Share-based compensation

27,532

21,024

Deferred income tax benefit

(15,954

)

(12,957

)

Gain on sale of assets

—

(12,056

)

Changes in operating assets and

liabilities, net of the effects of currency exchange rate changes,

acquired businesses and disposals:

Receivables

18,861

24,527

Inventories

24,318

(15,331

)

Accounts payable

(29,001

)

(8,175

)

Accrued liabilities

11,354

(16,292

)

Income taxes

6,639

(3,668

)

Other assets

(6,689

)

(9,314

)

Other liabilities

(6,416

)

9,878

Net cash provided by operating

activities

344,799

319,638

Cash flows from investing activities:

Cash used for business acquisitions, net

of cash acquired

(296,452

)

(106,712

)

Capital expenditures

(121,823

)

(116,731

)

Cash from (used for) disposal of

businesses, net of cash sold

(1,316

)

9,300

Proceeds from disposal of tangible

assets

113

13,785

Net cash used for investing activities

(419,478

)

(200,358

)

Cash flows from financing activities:

Payments under share repurchase program

including excise tax

(134,308

)

(192,135

)

Withholding tax payments for share-based

payment awards

(9,659

)

(17,444

)

Cash dividends paid

(8,195

)

(8,498

)

Payments under financing lease

obligations

(1,134

)

(423

)

Payments to noncontrolling interest

holders

(67

)

—

Other

728

—

Proceeds from issuance of common stock

8,917

6,568

Net cash used for financing activities

(143,718

)

(211,932

)

Effect of foreign currency exchange rate

changes on cash and cash equivalents

(8,345

)

2,020

Net decrease in cash and cash

equivalents

(226,742

)

(90,632

)

Cash and cash equivalents, beginning of

period

597,044

687,676

Cash and cash equivalents, end of

period

$

370,302

$

597,044

BELDEN INC. RECONCILIATION OF NON-GAAP MEASURES

(Unaudited)

In addition to reporting financial results in accordance with

accounting principles generally accepted in the United States, we

provide non-GAAP operating results adjusted for certain items,

including: asset impairments; accelerated depreciation expense due

to plant consolidation activities; purchase accounting effects

related to acquisitions, such as the adjustment of acquired

inventory to fair value, and transaction costs; severance,

restructuring, and acquisition integration costs; gains (losses)

recognized on the disposal of businesses and assets; amortization

of intangible assets; gains (losses) on debt extinguishment;

certain gains (losses) from patent settlements; discontinued

operations; and other costs. We adjust for the items listed above

in all periods presented, unless the impact is clearly immaterial

to our financial statements. When we calculate the tax effect of

the adjustments, we include all current and deferred income tax

expense commensurate with the adjusted measure of pre-tax

profitability.

We utilize the adjusted results to review our ongoing operations

without the effect of these adjustments and for comparison to

budgeted operating results. We believe the adjusted results are

useful to investors because they help them compare our results to

previous periods and provide important insights into underlying

trends in the business and how management oversees our business

operations on a day-to-day basis. As an example, we adjust for

acquisition-related expenses, such as amortization of intangibles

and impacts of fair value adjustments because they generally are

not related to the acquired business' core business performance. As

an additional example, we exclude the costs of restructuring

programs, which can occur from time to time for our current

businesses and/or recently acquired businesses. We exclude the

costs in calculating adjusted results to allow us and investors to

evaluate the performance of the business based upon its expected

ongoing operating structure. We believe the adjusted measures,

accompanied by the disclosure of the costs of these programs,

provides valuable insight.

Adjusted results should be considered only in conjunction with

results reported according to accounting principles generally

accepted in the United States.

Three Months Ended

Twelve Months Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(In thousands, except

percentages and per share amounts)

Revenues

$

666,042

$

551,243

$

2,460,979

$

2,512,084

GAAP gross profit

$

249,816

$

206,365

$

922,222

$

954,966

Amortization of software development

intangible assets

2,709

2,457

10,564

7,692

Severance, restructuring, and acquisition

integration costs

1,196

2,088

4,395

3,488

Adjustments related to acquisitions and

divestitures

—

(270

)

263

252

Adjusted gross profit

$

253,721

$

210,640

$

937,444

$

966,398

GAAP gross profit margin

37.5

%

37.4

%

37.5

%

38.0

%

Adjusted gross profit margin

38.1

%

38.2

%

38.1

%

38.5

%

GAAP selling, general and administrative

expenses

$

(137,362

)

$

(126,414

)

(494,603

)

(492,702

)

Severance, restructuring, and acquisition

integration costs

8,270

9,637

18,257

20,039

Adjustments related to acquisitions and

divestitures

3,607

5,405

4,501

5,925

Adjusted selling, general and

administrative expenses

$

(125,485

)

$

(111,372

)

$

(471,845

)

$

(466,738

)

GAAP research and development expenses

$

(28,968

)

$

(25,883

)

$

(112,365

)

$

(116,427

)

Severance, restructuring, and acquisition

integration costs

(120

)

1,581

162

1,625

Adjusted research and development

expenses

$

(29,088

)

$

(24,302

)

$

(112,203

)

$

(114,802

)

GAAP net income

$

58,382

$

38,509

$

198,414

$

242,556

Income tax expense (benefit)

(1,014

)

(2,185

)

29,528

43,200

Interest expense, net

10,849

8,032

38,303

33,625

Non-operating pension settlement loss

1,208

—

1,208

—

Total non-operating adjustments

11,043

5,847

69,039

76,825

Amortization of intangible assets

14,307

10,113

48,794

40,375

Severance, restructuring, and acquisition

integration costs

9,346

13,306

22,814

25,152

Amortization of software development

intangible assets

2,709

2,457

10,564

7,692

Adjustments related to acquisitions and

divestitures

3,607

5,135

4,764

6,177

Gain on sale of assets

—

—

—

(12,056

)

Total operating income adjustments

29,969

31,011

86,936

67,340

Depreciation expense

14,686

12,901

56,383

51,379

Adjusted EBITDA

$

114,080

$

88,268

$

410,772

$

438,100

GAAP income margin

8.8

%

7.0

%

8.1

%

9.7

%

Adjusted EBITDA margin

17.1

%

16.0

%

16.7

%

17.4

%

GAAP net income

$

58,382

$

38,509

$

198,414

$

242,556

Less: Net income (loss) attributable to

noncontrolling interest

(2

)

42

(19

)

(203

)

GAAP net income attributable to Belden

stockholders

$

58,384

$

38,467

$

198,433

$

242,759

GAAP net income

$

58,382

$

38,509

$

198,414

$

242,556

Plus: Operating income adjustments from

above

29,969

31,011

86,936

67,340

Plus: Non-operating pension settlement

loss

1,208

—

1,208

—

Less: Net income (loss) attributable to

noncontrolling interest

(2

)

42

(19

)

(203

)

Less: Tax effect of adjustments above

10,859

8,108

23,834

17,310

Adjusted net income attributable to Belden

stockholders

$

78,702

$

61,370

$

262,743

$

292,789

GAAP net income per diluted share

attributable to Belden stockholders (EPS)

$

1.42

$

0.91

$

4.80

$

5.66

Adjusted net income per diluted share

attributable to Belden stockholders (Adjusted EPS)

$

1.92

$

1.46

$

6.36

$

6.83

GAAP and adjusted diluted weighted average

shares

41,087

42,046

41,299

42,859

BELDEN INC. RECONCILIATION OF NON-GAAP MEASURES

(Unaudited)

We define free cash flow, which is a non-GAAP financial measure,

as net cash from operating activities adjusted for capital

expenditures net of the proceeds from the disposal of tangible

assets. We believe free cash flow provides useful information to

investors regarding our ability to generate cash from business

operations that is available for acquisitions and other

investments, service of debt principal, dividends and share

repurchases. We use free cash flow, as defined, as one financial

measure to monitor and evaluate performance and liquidity. Non-GAAP

financial measures should be considered only in conjunction with

financial measures reported according to accounting principles

generally accepted in the United States. Our definition of free

cash flow may differ from definitions used by other companies.

Three Months Ended

Twelve Months Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(In thousands)

GAAP net cash provided by operating

activities

$

167,442

$

159,645

$

344,799

$

319,638

Capital expenditures

(51,064

)

(54,861

)

(121,823

)

(116,731

)

Proceeds from disposal of assets

7

—

113

13,785

Non-GAAP free cash flow

$

116,385

$

104,784

$

223,089

$

216,692

BELDEN INC. RECONCILIATION OF NON-GAAP MEASURES

2025 Guidance

Three Months Ended

March 30, 2025

GAAP income from continuing operations per

diluted share attributable to Belden common stockholders

$1.03 - $1.13

Amortization of intangible assets

0.30

Severance, restructuring, and acquisition

integration costs

0.09

Adjustments related to acquisitions and

divestitures

0.01

Adjusted income from continuing operations

per diluted share attributable to Belden common stockholders

$1.43 - $1.53

Our guidance is based upon information currently available

regarding events and conditions that will impact our future

operating results. In particular, our results are subject to the

factors listed under "Forward-Looking Statements" in this release.

In addition, our actual results are likely to be impacted by other

additional events for which information is not available, such as

asset impairments, adjustments related to acquisitions and

divestitures, severance, restructuring, and acquisition integration

costs, gains (losses) recognized on the disposal of assets, gains

(losses) on debt extinguishment, discontinued operations, and other

gains (losses) related to events or conditions that are not yet

known.

Forward-Looking Statements

This release contains, and any statements made by us concerning

the subject matter of this release may contain, forward-looking

statements, including our outlook for the first quarter of 2025 and

beyond. Forward-looking statements also include any statements

regarding future financial performance (including revenues, growth,

expenses, earnings, margins, cash flows, dividends, capital

expenditures and financial condition), plans and objectives, and

related assumptions. In some cases these statements are

identifiable through the use of words such as “anticipate,”

“believe,” “estimate,” “forecast,” “guide,” “expect,” “intend,”

“plan,” “project,” “target,” “can,” “could,” “may,” “should,”

“will,” “would” and similar expressions. Forward-looking statements

reflect management’s current beliefs and expectations and are not

guarantees of future performance. Actual results may differ

materially from those suggested by any forward-looking statements

for a number of reasons, including, without limitation: the impact

of a challenging global economy, including the impact of inflation,

or a downturn in served markets; volatility in credit and foreign

exchange markets; the competitiveness of the global markets in

which we operate; the inability of the Company to develop and

introduce new products; competitive responses to our products; the

inability to execute and realize the expected benefits from

strategic initiatives (including revenue growth, cost control, and

productivity improvement programs); difficulty in forecasting

revenues due to the unpredictable timing of orders related to

customer projects as well as the impacts of channel inventory;

foreign and domestic political, economic and other uncertainties,

including changes in currency exchange rates; the impact of

disruptions in the global supply chain, including the inability to

timely obtain raw materials and components in sufficient quantities

on commercially reasonable terms; the inability to achieve our

strategic priorities in emerging markets; the impact of changes in

global tariffs and trade agreements; the presence of substitute

products in the marketplace; disruptions in the Company’s

information systems including due to cyber-attacks; inflation and

changes in the price and availability of raw materials leading to

higher input and labor costs; the possibility of future epidemics

or pandemics; changes in tax laws and variability in the Company’s

quarterly and annual effective tax rates; the increased prevalence

of cloud computing; the inability to successfully complete and

integrate acquisitions, in furtherance of the Company’s strategic

plan, as well as the inability to accurately forecast the financial

impacts of acquisitions; the inability to retain key employees;

disruption of, or changes in, the Company’s key distribution

channels; the presence of activists proposing certain actions by

the Company; perceived or actual product failures; the impact of

regulatory requirements and other legal compliance issues;

inability to satisfy the increasing expectations with respect to

environmental, social and governance matters; assertions that the

Company violates the intellectual property of others and the

ownership of intellectual property by competitors and others that

prevents the use of that intellectual property by the Company;

risks related to the use of open source software; the impairment of

goodwill and other intangible assets and the resulting impact on

financial performance; disruptions and increased costs attendant to

collective bargaining groups and other labor matters; and other

factors.

For a more complete discussion of risk factors, please see our

Annual Report on Form 10-K for the period ended December 31, 2023,

filed with the SEC on February 13, 2024. Although the content of

this release represents our best judgment as of the date of this

report based on information currently available and reasonable

assumptions, we give no assurances that the expectations will prove

to be accurate. Deviations from the expectations may be material.

For these reasons, Belden cautions readers to not place undue

reliance on these forward-looking statements, which speak only as

of the date made. Belden disclaims any duty to update any

forward-looking statements as a result of new information, future

developments, or otherwise, except as required by law.

About Belden

Belden Inc. delivers complete connection solutions that unlock

untold possibilities for our customers, their customers and the

world. We advance ideas and technologies that enable a safer,

smarter and more prosperous future. Throughout our 120+ year

history we have evolved as a company, but our purpose remains –

making connections. By connecting people, information and ideas, we

make it possible. We are headquartered in St. Louis and have

manufacturing capabilities in North America, Europe, Asia and

Africa. For more information, visit us at www.belden.com; follow us

on Facebook, LinkedIn and X/Twitter.

BDC-Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206350956/en/

Belden Investor Relations Aaron Reddington, CFA

(317) 219-9359 Investor.Relations@Belden.com

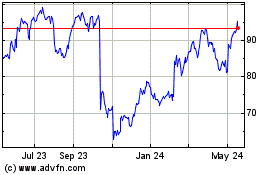

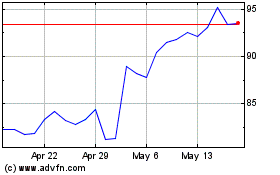

Belden (NYSE:BDC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Belden (NYSE:BDC)

Historical Stock Chart

From Feb 2024 to Feb 2025