false000143757800014375782024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 4, 2024

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35780 | | 80-0188269 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | | | | | | | |

| 2 Wells Avenue | | | | |

Newton, Massachusetts | | | | 02459 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (617) 673-8000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | BFAM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On November 4, 2024, Bright Horizons Family Solutions Inc. issued a press release announcing its financial results for the fiscal quarter ended September 30, 2024 and updated financial guidance for the year 2024. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information contained in this Item, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| BRIGHT HORIZONS FAMILY SOLUTIONS INC. |

| Date: | November 4, 2024 | By: | /s/ Elizabeth Boland |

| | | Elizabeth Boland |

| | | Chief Financial Officer |

Exhibit 99.1

Bright Horizons Family Solutions Reports Financial Results for Third Quarter of 2024

NEWTON, MA - (BUSINESS WIRE) - November 4, 2024 - Bright Horizons Family Solutions® Inc. (NYSE: BFAM), a leading provider of high-quality early education and child care, family care solutions, and workforce education services designed to support working families and client employees across life and career stages, today announced financial results for the third quarter of 2024 and updated financial guidance for 2024.

Third Quarter 2024 Highlights (compared to Third Quarter 2023):

•Revenue of $719 million (increase of 11%)

•Income from operations of $89 million (increase of 34%)

•Net income of $55 million and diluted earnings per common share of $0.94 (increases of 37% and 36%, respectively)

Non-GAAP financial measures

•Adjusted EBITDA* of $121 million (increase of 20%)

•Adjusted income from operations* of $89 million (increase of 34%)

•Adjusted net income* of $65 million and diluted adjusted earnings per common share* of $1.11 (increases of 27% and 26%, respectively)

“I am pleased to report solid financial results for the third quarter,” said Stephen Kramer, Chief Executive Officer. “Total revenue increased 11% with 26% adjusted EPS growth. Enrollment levels continued to expand year-over-year with 9% revenue growth in our Full Service segment, while our Back-Up Care segment delivered another exceptional quarter with stronger-than-expected use driving 18% revenue growth.”

“I am also proud of our employees working and living in the areas hit hard by Hurricanes Helene and Milton,” Kramer continued. “Not only have they been able to support each other through this difficult time, but they have also been able to provide our clients and the families we serve with critical child care services in Florida, Georgia and North Carolina, allowing employers and their employees to provide the services their communities desperately need.”

Third Quarter 2024 Results

Revenue increased by $73.3 million, or 11%, in the third quarter of 2024 from the third quarter of 2023, due to enrollment gains and tuition price increases at our centers, as well as increased utilization of back-up care services.

Income from operations was $89.4 million for the third quarter of 2024 compared to $66.8 million for the third quarter of 2023, an increase of 34%. The increase in income from operations is primarily related to incremental gross profit contributions resulting from higher utilization of services in our back-up care segment, as well as enrollment growth and improving operating leverage in our full service center-based child care segment. These contributions were partially offset by a decrease of approximately $9 million in funding received from pandemic-related government support programs and incremental overhead costs to support expanded service delivery. Net income was $54.9 million for the third quarter of 2024 compared to $40.0 million for the third quarter of 2023, an increase of 37%, due to the increase in income from operations noted above, partially offset by a higher effective tax rate. Diluted earnings per common share was $0.94 for the third quarter of 2024 compared to $0.69 for the third quarter of 2023.

In the third quarter of 2024, adjusted EBITDA* increased by $19.8 million, or 20%, to $121.0 million, and adjusted income from operations* increased by $22.6 million, or 34%, to $89.4 million from the third quarter of 2023, due to increased contributions from both the back-up care segment and full service center-based child care segment. Adjusted net income* increased by $13.8 million, or 27%, to $64.9 million, as a result of the increase in adjusted income from operations and a lower tax rate. Diluted adjusted earnings per common share* was $1.11 for the third quarter of 2024 compared to $0.88 for the third quarter of 2023.

As of September 30, 2024, the Company operated 1,028 early education and child care centers with the capacity to serve approximately 115,000 children.

*Adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share are financial measures that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), which are commonly referred to as “non-GAAP financial measures.” Adjusted EBITDA represents EBITDA (which is net income, as determined in accordance with GAAP, before interest expense, income tax expense, depreciation, and amortization) adjusted to exclude stock-based compensation expense and non-recurring costs, such as value-added tax expense related to prior periods and at times, other non-recurring costs, such as transaction costs and impairment costs. Adjusted income from operations represents income from operations, as determined in accordance with GAAP, adjusted to exclude non-recurring costs, such as value-added tax expense related to prior periods and at times, other non-recurring costs, such as transaction costs and impairment costs. Adjusted net income represents net income, as determined in accordance with GAAP, adjusted to exclude amortization, stock-based compensation expense, and non-recurring costs, such as value-added tax expense related to prior periods, interest on deferred consideration, and the income tax provision (benefit) thereon, and at times, other non-recurring costs, such as transaction costs and impairment costs. Diluted adjusted earnings per common share is calculated using adjusted net income. These non-GAAP financial measures are more fully described and are reconciled from the respective measures determined under GAAP in “Presentation of Non-GAAP Financial Measures” and the attached table “Bright Horizons Family Solutions Inc. Non-GAAP Reconciliations,” respectively.

Balance Sheet and Liquidity

At September 30, 2024, the Company had $109.9 million of cash and cash equivalents and $389.8 million available for borrowing under our revolving credit facility. In the nine months ended September 30, 2024, we generated $216.8 million of cash from operations, compared to $161.0 million for the same period in 2023, and made net investments totaling $92.7 million, compared to $92.0 million for the same period in the prior year. Additionally, during the nine months ended September 30, 2024, the Company paid deferred and contingent consideration related to acquisitions, including $106.5 million related to its 2022 acquisition of Only About Children, a child care operator in Australia.

2024 Outlook

Based on current trends and expectations, we currently expect fiscal year 2024 revenue to be approximately $2.675 billion and diluted adjusted earnings per common share to be in the range of $3.37 to $3.42. The Company will provide additional information on its outlook during its earnings conference call.

Conference Call

Bright Horizons Family Solutions will host an investor conference call today at 5:00 pm ET to discuss the results for the third quarter of 2024, as well as the Company’s updated business outlook, strategy and operating expectations. Interested parties are invited to listen to the conference call by dialing 1-877-407-9039, or for international callers, 1-201-689-8470, and asking for the Bright Horizons Family Solutions conference call moderated by Chief Executive Officer Stephen Kramer. Replays of the entire call will be available through November 18, 2024 at 1-844-512-2921, or for international callers, at 1-412-317-6671, conference ID #13744697. A link to the audio webcast of the conference call and a copy of this press release are also available through the Investor Relations section of the Company’s web site, www.brighthorizons.com.

Forward-Looking Statements

This press release includes forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company’s actual results may vary significantly from the results anticipated in these forward-looking statements, which can generally be identified by the use of forward-looking terminology, including the terms “believes,” “expects,” “may,” “will,” “should,” “seeks,” “projects,” “approximately,” “intends,” “plans,” “estimates” or “anticipates,” or, in each case, their negatives or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts, including statements regarding the Company’s intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, operating expectations, execution and delivery of our services and solutions, business trends, our future growth opportunities, enrollment levels, back-up care use, long-term growth strategy, estimated effective tax rate, tax expense, our future business and financial performance, and our 2024 financial guidance. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. The Company believes that these risks and uncertainties include, but are not limited to, changes in the demand for child care, dependent care and other workplace solutions, including variations in enrollment trends and lower than expected demand from employer sponsor clients as well as variations in workforce demographics and work environments; the constrained labor market for teachers and staff and ability to hire and retain talent, including the impact of increased compensation and labor costs; the availability or lack of government support and impact of government child care benefit programs; our ability to respond to changing client and customer needs; the possibility that acquisitions may disrupt our operations and expose us to additional risk; our ability to pass on our increased costs; our indebtedness and the terms of such indebtedness; our ability to withstand seasonal fluctuations in the demand for our services; our ability to implement our growth strategies successfully; changes in general economic, political, business and financial market conditions, including the impact of inflation and interest rate fluctuations; fluctuations in currency exchange rates; the effects of a cyber-attack, data breach or other security incident on our information technology system or software or those of our third party vendors; changes in tax rates or policies; impacts to our brand or reputation; and other risks and uncertainties more fully described in the “Risk Factors” section of our Annual Report on Form 10-K filed on February 27, 2024, and other factors disclosed from time to time in our other filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with GAAP throughout this press release, the Company has provided certain non-GAAP financial measures that present operating results on a basis adjusted for certain items. The Company uses these non-GAAP financial measures as key performance indicators for the purpose of evaluating performance internally, and in connection with determining incentive compensation for Company management, including executive officers. Adjusted EBITDA is also used in connection with the determination of certain ratio requirements under our credit agreement. We believe that these non-GAAP financial measures provide investors with useful information with respect to our historical operations. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of our financial results in accordance with GAAP. The use of the terms adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures.

With respect to our outlook for diluted adjusted earnings per common share, we do not provide the most directly comparable GAAP financial measure or corresponding reconciliation to such GAAP financial measure on a forward-looking basis. We are unable to predict with reasonable certainty and without unreasonable effort certain items such as the timing and amount of net excess income tax benefits, future impairments, transaction costs, and other non-recurring costs, as well as gains or losses from the early retirement of debt and the outcome from legal proceedings. These items are uncertain, depend on various factors outside our management’s control, and could significantly impact, either individually or in the aggregate, our future period earnings per common share as calculated and presented in accordance with GAAP.

For more information regarding adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share, refer to the reconciliation of GAAP financial measures to the non-GAAP financial measures in the attached table “Bright Horizons Family Solutions Inc. Non-GAAP Reconciliations.”

About Bright Horizons Family Solutions Inc.

Bright Horizons® is a leading global provider of high-quality early education and child care, back-up care, and workforce education services. For more than 35 years, we have partnered with employers to support workforces by providing services that help working families and employees thrive personally and professionally. Bright Horizons operates more than 1,000 early education and child care centers in the United States, the United Kingdom, the Netherlands, Australia and India, and serves more than 1,450 of the world’s leading employers. Bright Horizons’ early education and child care centers, back-up child and elder care, and workforce education programs help employees succeed at each life and career stage. For more information, go to www.brighthorizons.com.

Contacts:

| | | | | |

| Investors: |

| Elizabeth Boland |

| Chief Financial Officer - Bright Horizons |

| eboland@brighthorizons.com |

| 617-673-8125 |

| |

| Michael Flanagan |

| Vice President - Investor Relations - Bright Horizons |

| michael.flanagan@brighthorizons.com |

| 617-673-8720 |

| |

| Media: |

| Ilene Serpa |

| Vice President - Communications - Bright Horizons |

| iserpa@brighthorizons.com |

| 617-673-8044 |

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2024 | | % | | 2023 | | % |

| Revenue | $ | 719,099 | | | 100.0 | % | | $ | 645,787 | | | 100.0 | % |

| Cost of services | 537,564 | | | 74.8 | % | | 488,142 | | | 75.6 | % |

| Gross profit | 181,535 | | | 25.2 | % | | 157,645 | | | 24.4 | % |

| Selling, general and administrative expenses | 89,499 | | | 12.4 | % | | 83,253 | | | 12.9 | % |

| Amortization of intangible assets | 2,640 | | | 0.4 | % | | 7,568 | | | 1.2 | % |

| Income from operations | 89,396 | | | 12.4 | % | | 66,824 | | | 10.3 | % |

| Interest expense — net | (11,613) | | | (1.6) | % | | (12,222) | | | (1.8) | % |

| Income before income tax | 77,783 | | | 10.8 | % | | 54,602 | | | 8.5 | % |

| Income tax expense | (22,878) | | | (3.2) | % | | (14,623) | | | (2.3) | % |

| Net income | $ | 54,905 | | | 7.6 | % | | $ | 39,979 | | | 6.2 | % |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Common stock — basic | $ | 0.95 | | | | | $ | 0.69 | | | |

| Common stock — diluted | $ | 0.94 | | | | | $ | 0.69 | | | |

| | | | | | | |

Weighted average common shares outstanding: | | | | | | | |

| Common stock — basic | 58,062,009 | | | | | 57,765,332 | | | |

| Common stock — diluted | 58,701,618 | | | | | 58,045,137 | | | |

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | % | | 2023 | | % |

| Revenue | $ | 2,011,867 | | | 100.0 | % | | $ | 1,802,609 | | | 100.0 | % |

| Cost of services | 1,532,792 | | | 76.2 | % | | 1,386,787 | | | 76.9 | % |

| Gross profit | 479,075 | | | 23.8 | % | | 415,822 | | | 23.1 | % |

| Selling, general and administrative expenses | 264,544 | | | 13.1 | % | | 247,923 | | | 13.8 | % |

| Amortization of intangible assets | 16,139 | | | 0.8 | % | | 24,898 | | | 1.4 | % |

| Income from operations | 198,392 | | | 9.9 | % | | 143,001 | | | 7.9 | % |

| | | | | | | |

| Interest expense — net | (37,307) | | | (1.9) | % | | (37,357) | | | (2.0) | % |

| Income before income tax | 161,085 | | | 8.0 | % | | 105,644 | | | 5.9 | % |

| Income tax expense | (50,017) | | | (2.5) | % | | (36,945) | | | (2.1) | % |

| Net income | $ | 111,068 | | | 5.5 | % | | $ | 68,699 | | | 3.8 | % |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Common stock — basic | $ | 1.92 | | | | | $ | 1.19 | | | |

| Common stock — diluted | $ | 1.90 | | | | | $ | 1.18 | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Common stock — basic | 57,970,587 | | | | | 57,692,254 | | | |

| Common stock — diluted | 58,483,404 | | | | | 57,886,823 | | | |

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 109,933 | | | $ | 71,568 | |

| Accounts receivable — net | 231,535 | | | 281,710 | |

| Prepaid expenses and other current assets | 62,548 | | | 93,621 | |

| Total current assets | 404,016 | | | 446,899 | |

| Fixed assets — net | 597,202 | | | 579,296 | |

| Goodwill | 1,827,935 | | | 1,786,405 | |

| Other intangible assets — net | 203,046 | | | 216,576 | |

| Operating lease right-of-use assets | 773,613 | | | 774,703 | |

| Other assets | 109,001 | | | 92,265 | |

| Total assets | $ | 3,914,813 | | | $ | 3,896,144 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 26,000 | | | $ | 18,500 | |

| | | |

| Accounts payable and accrued expenses | 278,659 | | | 259,077 | |

| Current portion of operating lease liabilities | 104,664 | | | 100,387 | |

| Deferred revenue | 222,213 | | | 272,891 | |

| Other current liabilities | 35,358 | | | 148,578 | |

| Total current liabilities | 666,894 | | | 799,433 | |

| Long-term debt — net | 925,653 | | | 944,264 | |

| Operating lease liabilities | 787,095 | | | 796,701 | |

| Other long-term liabilities | 112,733 | | | 109,915 | |

| Deferred income taxes | 23,247 | | | 33,155 | |

| Total liabilities | 2,515,622 | | | 2,683,468 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total stockholders’ equity | 1,399,191 | | | 1,212,676 | |

| Total liabilities and stockholders’ equity | $ | 3,914,813 | | | $ | 3,896,144 | |

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 111,068 | | | $ | 68,699 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 75,601 | | | 82,732 | |

| Stock-based compensation expense | 24,607 | | | 21,154 | |

| | | |

| Deferred income taxes | (6,844) | | | (3,688) | |

| Non-cash interest and other — net | 10,464 | | | 8,867 | |

| Changes in assets and liabilities | 1,917 | | | (16,793) | |

| Net cash provided by operating activities | 216,813 | | | 160,971 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of fixed assets — net | (65,254) | | | (60,225) | |

| Purchases of debt securities and other investments | (43,049) | | | (9,463) | |

| Proceeds from the maturity of debt securities and sale of other investments | 23,908 | | | 15,451 | |

| Payments and settlements for acquisitions — net of cash acquired | (8,267) | | | (37,772) | |

| | | |

| Net cash used in investing activities | (92,662) | | | (92,009) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| Revolving credit facility — net | — | | | (54,600) | |

| Principal payments of long-term debt | (12,000) | | | (12,000) | |

| | | |

| Proceeds from issuance of common stock upon exercise of options | 24,808 | | | 8,764 | |

| | | |

| Taxes paid related to the net share settlement of stock options and restricted stock | (4,758) | | | (2,396) | |

| | | |

| Payments of deferred and contingent consideration for acquisitions | (103,872) | | | (225) | |

| Net cash used in financing activities | (95,822) | | | (60,457) | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | 1,307 | | | (1,280) | |

| Net increase in cash, cash equivalents and restricted cash | 29,636 | | | 7,225 | |

| Cash, cash equivalents and restricted cash — beginning of period | 89,451 | | | 51,894 | |

| Cash, cash equivalents and restricted cash — end of period | $ | 119,087 | | | $ | 59,119 | |

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Full service

center-based

child care | | Back-up care | | Educational

advisory services | | Total |

| Three Months Ended September 30, 2024 | | | | | | | |

| Revenue | $ | 486,567 | | | $ | 201,783 | | | $ | 30,749 | | | $ | 719,099 | |

| Income from operations | 12,465 | | | 70,487 | | | 6,444 | | | 89,396 | |

| Adjusted income from operations | 12,465 | | | 70,487 | | | 6,444 | | | 89,396 | |

| As a percentage of revenue | 3 | % | | 35 | % | | 21 | % | | 12 | % |

| | | | | | | |

| Three Months Ended September 30, 2023 | | | | | | | |

| Revenue | $ | 444,747 | | | $ | 171,423 | | | $ | 29,617 | | | $ | 645,787 | |

| Income from operations | 6,990 | | | 52,257 | | | 7,577 | | | 66,824 | |

| Adjusted income from operations | 6,990 | | | 52,257 | | | 7,577 | | | 66,824 | |

| As a percentage of revenue | 2 | % | | 30 | % | | 26 | % | | 10 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Full service

center-based

child care | | Back-up care | | Educational

advisory services | | Total |

| Nine Months Ended September 30, 2024 | | | | | | | |

| Revenue | $ | 1,477,284 | | | $ | 452,945 | | | $ | 81,638 | | | $ | 2,011,867 | |

| Income from operations | 66,553 | | | 118,063 | | | 13,776 | | | 198,392 | |

| Adjusted income from operations | 66,553 | | | 118,063 | | | 13,776 | | | 198,392 | |

| As a percentage of revenue | 5 | % | | 26 | % | | 17 | % | | 10 | % |

| | | | | | | |

| Nine Months Ended September 30, 2023 | | | | | | | |

| Revenue | $ | 1,333,469 | | | $ | 389,391 | | | $ | 79,749 | | | $ | 1,802,609 | |

| Income from operations | 28,493 | | | 97,500 | | | 17,008 | | | 143,001 | |

Adjusted income from operations (1) | 30,237 | | | 101,796 | | | 17,008 | | | 149,041 | |

| As a percentage of revenue | 2 | % | | 26 | % | | 21 | % | | 8 | % |

(1)For the nine months ended September 30, 2023, adjusted income from operations represents income from operations excluding value-added-tax expense of $6.0 million related to prior periods, of which $4.3 million was associated with the back-up care segment and $1.7 million was associated with the full service center-based child care segment.

BRIGHT HORIZONS FAMILY SOLUTIONS INC.

NON-GAAP RECONCILIATIONS

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 54,905 | | $ | 39,979 | | $ | 111,068 | | $ | 68,699 |

| Interest expense — net | 11,613 | | 12,222 | | 37,307 | | 37,357 |

| Income tax expense | 22,878 | | 14,623 | | 50,017 | | 36,945 |

| Depreciation | 19,862 | | 18,935 | | 59,462 | | 57,834 |

Amortization of intangible assets (a) | 2,640 | | 7,568 | | 16,139 | | 24,898 |

| EBITDA | 111,898 | | 93,327 | | 273,993 | | 225,733 |

| As a percentage of revenue | 16% | | 14% | | 14% | | 13% |

| Additional adjustments: | | | | | | | |

Stock-based compensation expense (b) | 9,091 | | 7,841 | | 24,607 | | 21,154 |

| | | | | | | |

Other costs (c) | — | | — | | — | | 6,040 |

| | | | | | | |

| Total adjustments | 9,091 | | 7,841 | | 24,607 | | 27,194 |

| Adjusted EBITDA | $ | 120,989 | | $ | 101,168 | | $ | 298,600 | | $ | 252,927 |

| As a percentage of revenue | 17 | % | | 16 | % | | 15 | % | | 14 | % |

| | | | | | | |

| Income from operations | $ | 89,396 | | $ | 66,824 | | $ | 198,392 | | $ | 143,001 |

Other costs (c) | — | | — | | — | | 6,040 |

| Adjusted income from operations | $ | 89,396 | | $ | 66,824 | | $ | 198,392 | | $ | 149,041 |

| As a percentage of revenue | 12 | % | | 10 | % | | 10 | % | | 8 | % |

| | | | | | | |

| Net income | $ | 54,905 | | $ | 39,979 | | $ | 111,068 | | $ | 68,699 |

| Income tax expense | 22,878 | | 14,623 | | 50,017 | | 36,945 |

| Income before income tax | 77,783 | | 54,602 | | 161,085 | | 105,644 |

Amortization of intangible assets (a) | 2,640 | | 7,568 | | 16,139 | | 24,898 |

Stock-based compensation expense (b) | 9,091 | | 7,841 | | 24,607 | | 21,154 |

| | | | | | | |

Other costs (c) | — | | — | | — | | 6,040 |

| | | | | | | |

Interest on deferred consideration (d) | — | | 1,487 | | — | | 4,412 |

| Adjusted income before income tax | 89,514 | | 71,498 | | 201,831 | | 162,148 |

Adjusted income tax expense (e) | (24,613) | | (20,377) | | (56,008) | | (45,913) |

| Adjusted net income | $ | 64,901 | | $ | 51,121 | | $ | 145,823 | | $ | 116,235 |

| As a percentage of revenue | 9 | % | | 8 | % | | 7 | % | | 6 | % |

| | | | | | | |

| Weighted average common shares outstanding — diluted | 58,701,618 | | 58,045,137 | | 58,483,404 | | 57,886,823 |

| Diluted adjusted earnings per common share | $ | 1.11 | | $ | 0.88 | | $ | 2.49 | | $ | 2.01 |

(a)Amortization of intangible assets represents amortization expense, including amortization expense of $0.1 million and $5.0 million for the three months ended September 30, 2024 and 2023, respectively, and of $8.4 million and $15.0 million for the nine months ended September 30, 2024 and 2023, respectively, associated with intangible assets recorded in connection with our going private transaction in May 2008.

(b)Stock-based compensation expense represents non-cash stock-based compensation expense in accordance with Accounting Standards Codification Topic 718, Compensation-Stock Compensation.

(c)Other costs in the nine months ended September 30, 2023 consist of value-added tax expense of $6.0 million related to prior periods, of which $4.3 million was associated with the back-up care segment and $1.7 million was associated with the full service center-based child care segment.

(d)Interest on deferred consideration represents the imputed interest on the deferred consideration issued in connection with the July 1, 2022 acquisition of Only About Children, a child care operator in Australia. The deferred consideration was paid in January 2024.

(e)Adjusted income tax expense represents income tax expense calculated on adjusted income before income tax at an effective tax rate of approximately 28% and 29% for the three months ended September 30, 2024 and 2023, respectively, and at an effective tax rate of approximately 28% for the nine months ended September 30, 2024 and 2023. The jurisdictional mix of the expected adjusted income before income tax for the full year will affect the estimated effective tax rate for the year.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

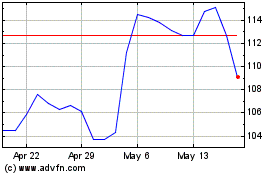

Bright Horizons Family S... (NYSE:BFAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bright Horizons Family S... (NYSE:BFAM)

Historical Stock Chart

From Nov 2023 to Nov 2024