0001130464false00011304642025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): Feb. 5, 2025 |

Black Hills Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

South Dakota |

001-31303 |

46-0458824 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

7001 Mount Rushmore Road |

|

Rapid City, South Dakota |

|

57702 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 605 721-1700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock of $1.00 par value |

|

BKH |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On Feb. 5, 2025, Black Hills Corporation ("the Company") issued a press release announcing financial results for the fourth quarter of 2024.

The press release is attached as Exhibit 99 to this Form 8-K. This information is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BLACK HILLS CORPORATION |

|

|

|

|

Date: |

Feb. 5, 2025 |

By: |

/s/ Kimberly F. Nooney |

|

|

|

Kimberly F. Nooney

Senior Vice President

and Chief Financial Officer |

Black Hills Corp. Reports 2024 Fourth-Quarter and Full-Year Results and Initiates 2025 Earnings Guidance

•Delivered 2024 EPS of $3.91, or 4.3% growth from the midpoint of 2023 earnings guidance

•Increasing five-year capital forecast by 10% to $4.7 billion for 2025 through 2029, including $1.0 billion for 2025

•Projecting total data center load exceeding one gigawatt from existing customers

•Increased quarterly dividend by 4%, extending track record of annual dividend increases to 55 consecutive years

•Initiating 2025 earnings guidance range at $4.00 to $4.20 per share

RAPID CITY, S.D. — Feb. 5, 2025 — Black Hills Corp. (NYSE: BKH) today announced financial results for the fourth quarter and full year ending Dec. 31, 2024. Operating income, net income available for common stock and earnings per share for the three and twelve months ended Dec. 31, 2024, compared to the three and twelve months ended Dec. 31, 2023, were:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Dec. 31, |

|

|

Twelve Months Ended Dec. 31, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

(in millions, except per share amounts) |

|

Operating Income |

$ |

163.3 |

|

$ |

136.5 |

|

|

$ |

503.1 |

|

$ |

472.7 |

|

Net income available for common stock |

$ |

98.1 |

|

$ |

79.6 |

|

|

$ |

273.1 |

|

$ |

262.2 |

|

Earnings per share, Diluted |

$ |

1.37 |

|

$ |

1.17 |

|

|

$ |

3.91 |

|

$ |

3.91 |

|

Earnings of $3.91 per share for 2024 benefited from $0.82 per share of new rates, rider recovery, and customer growth. Significant expense management measures offset the impacts of mild weather, unplanned generation outages and higher insurance expense.

“We advanced our regulatory and growth initiatives and delivered strong earnings,” said Linn Evans, president and CEO of Black Hills Corp. “I’m proud of our team’s execution and our relentless commitment to providing safe, reliable, and cost-effective service. We reached constructive settlements for our natural gas rate reviews in Arkansas and Iowa. We also maintained our solid financial position and credit ratings, achieving our long-term capitalization target during the year. On behalf of our customers, we invested approximately $800 million in our electric and gas infrastructure. This included energizing the first phase of our Ready Wyoming transmission expansion, the largest transmission project in our company’s history.

“As we roll forward our five-year plan, I’m confident in our 4% to 6% long-term EPS growth target given our customer-focused capital outlook and growth opportunities. We increased our capital forecast by 10% through 2029 to $4.7 billion. We have a pipeline of data center demand exceeding one gigawatt from existing customers within the next 10 years. Approximately 500 megawatts of that demand is expected to be served by the end of 2029 through our innovative tariff that requires minimal capital. We expect this demand to more than double EPS contribution to greater than 10% by year-end 2029. Additionally, upside potential from data centers and other organic growth in our service territories is expected to drive future transmission and generation investment opportunities above and beyond our current five-year plan,” concluded Evans.

FOURTH-QUARTER AND FULL-YEAR 2024 HIGHLIGHTS AND RECENT UPDATES

Electric Utilities

•On Jan. 20, 2025, Wyoming Electric set a new all-time peak load of 318 megawatts for the nineteenth consecutive year, surpassing the previous winter and all-time peak on Jan. 11, 2024, of 314 megawatts. Prior to 2024, the previous winter peak was 301 megawatts in December 2023 and the all-time peak was 312 megawatts in July 2023.

•On Dec. 19, Wyoming Electric placed in service the initial phase of its approximately 260-mile, $350-million Ready Wyoming electric transmission expansion project. The first 12-mile transmission line segment and two substations near Cheyenne, Wyoming, were completed and energized, adding approximately $40 million of rate base being recovered through the transmission rider. Construction is on schedule for the two major lines heading northeast and northwest from Cheyenne, with both lines interconnecting with the South Dakota Electric system. The project is being constructed in multiple segments and is expected to be completed and in service by year-end 2025.

•During the fourth quarter, Colorado Electric received final approval of its Clean Energy Plan from the Colorado Public Utilities Commission for 350 megawatts of new renewable generation resources. The decision includes a 100-megawatt utility-owned solar project, 50-megawatt utility-owned battery storage project and a 200-megawatt solar power purchase agreement.

•During the fourth quarter, South Dakota Electric continued to pursue the addition of 99 megawatts of utility-owned, dispatchable natural gas resources by the second half of 2026. During the first quarter of 2025, the company expects to request a certificate of public convenience and necessity (CPCN) in Wyoming.

•On July 11, Wyoming Electric announced its partnership with Meta to provide power for its newest AI data center to be constructed in Cheyenne, Wyoming. The company will serve Meta under its Large Power Contract Service tariff and procure customized energy resources essential to Meta's operations and sustainability objectives.

•On June 14, Colorado Electric filed a rate review request with the Colorado Public Utilities Commission seeking the recovery of significant infrastructure investments in its 3,200-mile electric distribution and 600-mile electric transmission systems. The company expects a final decision on the request from the CPUC in the first quarter or early second quarter of 2025. Timing and implementation of new rates will be subject to a final decision.

Gas Utilities

•On Feb. 3, 2025, Kansas Gas filed a rate review request with the Kansas Corporation Commission seeking approval to recover approximately $118 million of system investments and inflationary impacts on expenses to serve customers. The rate review requested $17 million of new annual revenue based on a capital structure of approximately 50% equity and 50% debt and a return on equity of 10.5%. New rates are requested in the second half of 2025.

•On Jan. 1, 2025, new final rates were effective for Iowa Gas resulting from an approved settlement agreement for its rate review request filed May 1, 2024. The approved black box settlement provides $15 million of new annual revenue based on a weighted average cost of capital of 7.21%.

•On Oct. 1, new rates were effective for Arkansas Gas resulting from an approved settlement agreement for its rate review request filed in December 2023. The settlement provides $25 million of new annual revenue based on a capital structure of 46% equity and 54% debt and a return on equity of 9.85%.

•On Feb. 13, new rates were effective for Colorado Gas resulting from an approved settlement agreement for its rate review request filed in May 2023. The settlement provides for $20 million in new annual revenue based on a capital structure of 51% equity and 49% debt and a return on equity of 9.3%.

•On Feb. 1, 2024, new rates were effective for Wyoming Gas resulting from an approved settlement agreement for its rate review request filed in May 2023. The settlement provides for $14 million in new annual revenue based on a capital structure of 51% equity and 49% debt and a return on equity of 9.9%. The agreement also provides for a four-year renewal of the company's integrity investment rider.

•On Jan. 31, 2024, Black Hills Energy Renewable Resources, a non-regulated subsidiary of Black Hills Corp., acquired a renewable natural gas (RNG) production facility at a landfill in Dubuque, Iowa. The purchase includes producing biogas wells and rights to production, including the ability to drill additional wells. The acquisition represents the company’s first entry into the production of RNG.

Corporate and Other

•On Jan. 24, 2025, Black Hills’ board of directors approved a quarterly dividend of $0.676 per share payable on March 1, 2025, to common shareholders of record at the close of business on Feb. 18, 2025. The dividend represents an increase in the quarterly dividend of $0.026 per share, or 4.0%. On an annualized rate, the dividend represents 55 consecutive years of increases, the second-longest track record in the electric and natural gas industry.

•During 2024, the company issued a total of 3.3 million shares of new common stock for net proceeds of $182 million.

•On May 31, Black Hills amended and restated its revolving credit facility with similar terms as the former facility, maintaining total commitments of $750 million and extending the term through May 31, 2029.

•On May 16, Black Hills completed a public debt offering of $450 million, 6.00% senior unsecured notes due Jan. 15, 2035. Proceeds were used for general corporate purposes and, along with available cash or short-term borrowings under the company's existing facilities, to repay the $600 million notes which were due Aug. 23, 2024.

•Black Hills maintained its solid investment-grade credit ratings by rating agencies covering the company.

oOn Jan. 17, 2025, Fitch affirmed Black Hills’ long-term issuer rating at BBB+ with a negative outlook. Following the affirmation, the parties jointly withdrew the rating.

oOn Jan. 8, 2025, Moody's Investor Service affirmed Black Hills' long-term issuer rating at Baa2 with a stable outlook.

oOn May 9, 2024, S&P Global Ratings affirmed Black Hills’ issuer credit rating at BBB+ with a stable outlook.

2025 EARNINGS GUIDANCE INITIATED

Black Hills initiates its guidance for 2025 earnings per share available for common stock to be in the range of $4.00 to $4.20, based on the following assumptions:

•Normal weather conditions within our utility service territories;

•Constructive and timely outcomes of utility regulatory dockets;

•Excludes mark-to-market adjustments;

•No unplanned outages at our generation facilities;

•Compounded annual growth rate of approximately 3.5% for operations and maintenance expense (excludes depreciation and amortization and taxes other than income taxes) off 2023 of $552 million

•Equity issuance between $215 million and $235 million; and

•An effective tax rate of approximately 13% for the full year.

BLACK HILLS CORPORATION

CONSOLIDATED FINANCIAL RESULTS

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Dec. 31, |

|

|

Twelve Months Ended Dec. 31, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

(in millions) |

|

Revenue |

$ |

597.1 |

|

$ |

591.7 |

|

|

$ |

2,127.7 |

|

$ |

2,331.3 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Fuel, purchased power, and cost of natural gas sold |

|

212.1 |

|

|

233.1 |

|

|

|

730.3 |

|

|

982.9 |

|

Operations and maintenance |

|

136.2 |

|

|

139.5 |

|

|

|

557.0 |

|

|

552.0 |

|

Depreciation and amortization |

|

68.3 |

|

|

65.6 |

|

|

|

270.1 |

|

|

256.8 |

|

Taxes other than income taxes |

|

17.2 |

|

|

17.0 |

|

|

|

67.2 |

|

|

66.9 |

|

Total operating expenses |

|

433.8 |

|

|

455.2 |

|

|

|

1,624.6 |

|

|

1,858.6 |

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

163.3 |

|

|

136.5 |

|

|

|

503.1 |

|

|

472.7 |

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(49.7 |

) |

|

(41.9 |

) |

|

|

(181.7 |

) |

|

(167.9 |

) |

Other income (expense), net |

|

0.1 |

|

|

(1.8 |

) |

|

|

(1.4 |

) |

|

(3.2 |

) |

Income tax (expense) |

|

(12.7 |

) |

|

(9.6 |

) |

|

|

(36.3 |

) |

|

(25.6 |

) |

Net income |

|

101.0 |

|

|

83.2 |

|

|

|

283.7 |

|

|

276.0 |

|

Net income attributable to non-controlling interest |

|

(2.9 |

) |

|

(3.6 |

) |

|

|

(10.6 |

) |

|

(13.8 |

) |

Net income available for common stock |

$ |

98.1 |

|

$ |

79.6 |

|

|

$ |

273.1 |

|

$ |

262.2 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions): |

|

|

|

|

|

|

Basic |

|

71.4 |

|

|

67.9 |

|

|

|

69.8 |

|

|

67.0 |

|

Diluted |

|

71.6 |

|

|

68.0 |

|

|

|

69.9 |

|

|

67.1 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

Earnings per share, Basic |

$ |

1.37 |

|

$ |

1.17 |

|

|

$ |

3.91 |

|

$ |

3.91 |

|

Earnings per share, Diluted |

$ |

1.37 |

|

$ |

1.17 |

|

|

$ |

3.91 |

|

$ |

3.91 |

|

CONSOLIDATING INCOME STATEMENTS -- FOURTH QUARTER

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement |

|

Three Months Ended Dec. 31, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

216.3 |

|

$ |

385.2 |

|

$ |

(4.4 |

) |

$ |

597.1 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

50.7 |

|

|

161.4 |

|

|

- |

|

|

212.1 |

|

Operations and maintenance |

|

62.2 |

|

|

78.0 |

|

|

(4.0 |

) |

|

136.2 |

|

Depreciation and amortization |

|

36.5 |

|

|

31.8 |

|

|

- |

|

|

68.3 |

|

Taxes other than income taxes |

|

10.0 |

|

|

7.2 |

|

|

- |

|

|

17.2 |

|

Operating income |

$ |

56.9 |

|

$ |

106.8 |

|

$ |

(0.4 |

) |

$ |

163.3 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(49.7 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

0.1 |

|

Income tax benefit (expense) |

|

|

|

|

|

|

|

(12.7 |

) |

Net income |

|

|

|

|

|

|

|

101.0 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(2.9 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

98.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement |

|

Three Months Ended Dec. 31, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

215.9 |

|

$ |

380.3 |

|

$ |

(4.5 |

) |

$ |

591.7 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

52.9 |

|

|

180.4 |

|

|

(0.2 |

) |

|

233.1 |

|

Operations and maintenance |

|

59.4 |

|

|

81.9 |

|

|

(1.8 |

) |

|

139.5 |

|

Depreciation and amortization |

|

35.9 |

|

|

29.6 |

|

|

0.1 |

|

|

65.6 |

|

Taxes other than income taxes |

|

9.6 |

|

|

7.4 |

|

|

- |

|

|

17.0 |

|

Operating income |

$ |

58.1 |

|

$ |

81.0 |

|

$ |

(2.6 |

) |

$ |

136.5 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(41.9 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(1.8 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(9.6 |

) |

Net income |

|

|

|

|

|

|

|

83.2 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(3.6 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

79.6 |

|

Three Months Ended Dec. 31, 2024, Compared to the Three Months Ended Dec. 31, 2023

•Electric Utilities’ operating income decreased $1.2 million primarily due to higher insurance expense and lower off-system excess energy sales partially offset by new rates and rider recovery;

•Gas Utilities’ operating income increased $25.8 million primarily due to new rates and rider recovery driven by the Arkansas Gas, Colorado Gas, Iowa Gas and Wyoming Gas rate reviews and lower employee-related expenses;

•Corporate and other operating loss decreased $2.2 million due to lower unallocated outside services expenses;

•Net interest expense increased $7.8 million primarily due to lower interest income on lower cash balances and higher interest expense due to higher rates; and

•Income tax (expense) increased $3.1 million primarily driven by higher pre-tax income.

CONSOLIDATING INCOME STATEMENTS -- YEAR-TO-DATE

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement |

|

Twelve Months Ended Dec. 31, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

876.1 |

|

$ |

1,269.4 |

|

$ |

(17.8 |

) |

$ |

2,127.7 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

206.4 |

|

|

524.3 |

|

|

(0.4 |

) |

|

730.3 |

|

Operations and maintenance |

|

252.6 |

|

|

320.7 |

|

|

(16.3 |

) |

|

557.0 |

|

Depreciation and amortization |

|

145.3 |

|

|

124.7 |

|

|

0.1 |

|

|

270.1 |

|

Taxes other than income taxes |

|

38.8 |

|

|

28.4 |

|

|

- |

|

|

67.2 |

|

Operating income |

$ |

233.0 |

|

$ |

271.3 |

|

$ |

(1.2 |

) |

$ |

503.1 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(181.7 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(1.4 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(36.3 |

) |

Net income |

|

|

|

|

|

|

|

283.7 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(10.6 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

273.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement |

|

Twelve Months Ended Dec. 31, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

865.0 |

|

$ |

1,484.2 |

|

$ |

(17.9 |

) |

$ |

2,331.3 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

200.1 |

|

|

783.2 |

|

|

(0.4 |

) |

|

982.9 |

|

Operations and maintenance |

|

236.2 |

|

|

328.7 |

|

|

(12.9 |

) |

|

552.0 |

|

Depreciation and amortization |

|

142.6 |

|

|

113.9 |

|

|

0.3 |

|

|

256.8 |

|

Taxes other than income taxes |

|

37.3 |

|

|

29.6 |

|

|

- |

|

|

66.9 |

|

Operating income |

$ |

248.8 |

|

$ |

228.8 |

|

$ |

(4.9 |

) |

$ |

472.7 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(167.9 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(3.2 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(25.6 |

) |

Net income |

|

|

|

|

|

|

|

276.0 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(13.8 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

262.2 |

|

Twelve Months Ended Dec. 31, 2024, Compared to the Twelve Months Ended Dec. 31, 2023

•Electric Utilities’ operating income decreased $15.8 million primarily due to unfavorable impacts from unplanned generation outages in 2024, lower off-system excess energy sales, higher insurance expense, and one-time benefits in 2023 from a gain on the sale of Northern Iowa Windpower assets, a gain on sale of land to support data center growth and a recovery from our business interruption insurance. These unfavorable variances were partially offset by new rates and rider recovery and retail customer growth and usage;

•Gas Utilities’ operating income increased $42.5 million primarily due to new rates and rider recovery driven by the Colorado Gas, Iowa Gas, Rocky Mountain Natural Gas and Wyoming Gas rate reviews, retail customer growth and usage, favorable mark-to-market on commodity contracts, and lower employee-related expenses partially offset by unfavorable weather and higher depreciation driven by capital expenditures;

•Corporate and other operating loss decreased $3.7 million due to lower unallocated operating expenses;

•Net interest expense increased $13.8 million primarily due to higher interest rates partially offset by increased interest income and increased allowance for funds used during construction (AFUDC) debt driven by higher construction work-in-progress balances;

•Other (expense), net decreased $1.8 million primarily due to higher AFUDC equity driven by higher construction work-in-progress balances;

•Income tax (expense) increased $10.7 million driven by higher pre-tax income and a higher effective tax rate primarily due to an $8.2 million tax benefit in 2023 from a Nebraska income tax rate decrease; and

•Net income attributable to non-controlling interest decreased $3.2 million due to lower net income from Colorado IPP primarily driven by unplanned generation outages.

OPERATING STATISTICS

Electric Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in millions) |

|

Quantities Sold (GWh) |

|

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

By customer class |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Residential |

$ |

55.5 |

|

$ |

54.7 |

|

$ |

234.8 |

|

$ |

224.5 |

|

|

348.5 |

|

|

347.9 |

|

|

1,471.9 |

|

|

1,438.5 |

|

Commercial |

|

63.7 |

|

|

63.8 |

|

|

263.6 |

|

|

254.5 |

|

|

500.8 |

|

|

498.2 |

|

|

2,091.4 |

|

|

2,074.4 |

|

Industrial |

|

42.0 |

|

|

42.4 |

|

|

168.9 |

|

|

157.3 |

|

|

526.4 |

|

|

583.2 |

|

|

2,169.8 |

|

|

2,094.8 |

|

Municipal |

|

4.3 |

|

|

4.3 |

|

|

17.0 |

|

|

17.5 |

|

|

35.4 |

|

|

34.8 |

|

|

147.1 |

|

|

150.9 |

|

Other Retail |

|

3.9 |

|

|

3.0 |

|

|

14.3 |

|

|

12.3 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Subtotal Retail Revenue - Electric |

|

169.4 |

|

|

168.2 |

|

|

698.6 |

|

|

666.1 |

|

|

1,411.1 |

|

|

1,464.1 |

|

|

5,880.2 |

|

|

5,758.6 |

|

Wholesale |

|

5.6 |

|

|

9.6 |

|

|

26.8 |

|

|

34.2 |

|

|

130.3 |

|

|

193.5 |

|

|

589.4 |

|

|

699.7 |

|

Market - off-system sales |

|

12.0 |

|

|

13.4 |

|

|

34.8 |

|

|

50.9 |

|

|

258.8 |

|

|

219.4 |

|

|

765.6 |

|

|

737.9 |

|

Transmission |

|

13.1 |

|

|

11.2 |

|

|

52.2 |

|

|

47.1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Other (a) |

|

16.2 |

|

|

13.5 |

|

|

63.7 |

|

|

66.7 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total Revenue and Quantities Sold |

$ |

216.3 |

|

$ |

215.9 |

|

$ |

876.1 |

|

$ |

865.0 |

|

|

1,800.2 |

|

|

1,877.0 |

|

|

7,235.2 |

|

|

7,196.2 |

|

Other Uses, Losses, or Generation, net (b) |

|

|

|

|

|

|

|

|

|

152.7 |

|

|

117.9 |

|

|

390.3 |

|

|

463.5 |

|

Total Energy |

|

|

|

|

|

|

|

|

|

1,952.9 |

|

|

1,994.9 |

|

|

7,625.5 |

|

|

7,659.7 |

|

(a)Primarily related to Integrated Generation, inter-segment rent, and non-regulated services to our retail customers under the Service Guard Comfort Plan and Tech Services.

(b)Includes company uses and line losses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in millions) |

|

Quantities Sold (GWh) |

|

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

By business unit |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Colorado Electric |

$ |

68.2 |

|

$ |

68.8 |

|

$ |

276.9 |

|

$ |

285.7 |

|

|

575.9 |

|

|

602.7 |

|

|

2,392.7 |

|

|

2,397.2 |

|

South Dakota Electric |

|

79.5 |

|

|

80.5 |

|

|

322.0 |

|

|

321.1 |

|

|

674.2 |

|

|

677.6 |

|

|

2,556.5 |

|

|

2,554.3 |

|

Wyoming Electric |

|

57.6 |

|

|

57.2 |

|

|

234.3 |

|

|

212.2 |

|

|

528.3 |

|

|

578.7 |

|

|

2,190.1 |

|

|

2,124.1 |

|

Integrated Generation |

|

11.0 |

|

|

9.4 |

|

|

42.9 |

|

|

46.0 |

|

|

21.8 |

|

|

18.0 |

|

|

95.9 |

|

|

120.6 |

|

Total Revenue and Quantities Sold |

$ |

216.3 |

|

$ |

215.9 |

|

$ |

876.1 |

|

$ |

865.0 |

|

|

1,800.2 |

|

|

1,877.0 |

|

|

7,235.2 |

|

|

7,196.2 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Dec. 31, |

Twelve Months Ended Dec. 31, |

|

2024 |

2023 |

2024 |

2023 |

Degree Days |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Heating Degree Days: |

|

|

|

|

|

|

|

|

Colorado Electric |

1,876 |

(8)% |

1,965 |

(5)% |

4,926 |

(8)% |

5,330 |

1% |

South Dakota Electric |

2,231 |

(15)% |

2,348 |

(13)% |

6,311 |

(13)% |

6,969 |

(4)% |

Wyoming Electric |

2,137 |

(13)% |

2,249 |

(10)% |

6,272 |

(10)% |

6,783 |

(1)% |

Combined (a) |

2,052 |

(12)% |

2,154 |

(9)% |

5,676 |

(10)% |

6,185 |

(1)% |

|

|

|

|

|

|

|

|

|

Cooling Degree Days: |

|

|

|

|

|

|

|

|

Colorado Electric |

22 |

210% |

6 |

(10)% |

1,269 |

11% |

1,046 |

(10)% |

South Dakota Electric |

10 |

376% |

1 |

(38)% |

913 |

49% |

497 |

(21)% |

Wyoming Electric |

5 |

-- |

-- |

-- |

491 |

7% |

329 |

(30)% |

Combined (a) |

14 |

265% |

3 |

(15)% |

989 |

20% |

713 |

(15)% |

(a)Degree days are calculated based on a weighted average of total customers by state.

|

|

|

|

|

|

Three Months Ended Dec. 31, |

Twelve Months Ended Dec. 31, |

Contracted generating facilities Availability(a) by fuel type |

2024 |

2023 |

2024 |

2023 |

Coal (b) |

97.2% |

93.8% |

89.8% |

93.7% |

Natural gas and diesel oil (b) |

85.5% |

86.2% |

92.9% |

92.1% |

Wind |

87.6% |

89.8% |

90.6% |

92.5% |

Total Availability |

88.2% |

88.9% |

91.7% |

92.6% |

|

|

|

|

|

Wind Capacity Factor (a) |

38.0% |

35.8% |

36.7% |

37.4% |

(a)Availability and Wind Capacity Factor are calculated using a weighted average based on capacity of our generating fleet.

(b)2024 included unplanned outages at Wygen I and Pueblo Airport Generation #4-5.

OPERATING STATISTICS (continued)

Gas Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

(in millions) |

|

Quantities Sold and Transported

(Dth in millions) |

|

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

By customer class |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Retail Revenue - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

$ |

215.4 |

|

$ |

215.1 |

|

$ |

691.9 |

|

$ |

830.3 |

|

|

18.4 |

|

|

19.0 |

|

|

56.7 |

|

|

60.1 |

|

Commercial |

|

82.4 |

|

|

83.6 |

|

|

266.3 |

|

|

337.3 |

|

|

9.1 |

|

|

8.9 |

|

|

28.4 |

|

|

29.4 |

|

Industrial |

|

5.4 |

|

|

7.0 |

|

|

23.7 |

|

|

33.1 |

|

|

0.9 |

|

|

1.2 |

|

|

6.0 |

|

|

5.7 |

|

Other Retail (a) |

|

11.8 |

|

|

12.0 |

|

|

40.7 |

|

|

48.1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Subtotal Retail Revenue - Gas |

|

315.0 |

|

|

317.7 |

|

|

1,022.6 |

|

|

1,248.8 |

|

|

28.4 |

|

|

29.1 |

|

|

91.1 |

|

|

95.2 |

|

Transportation |

|

47.3 |

|

|

45.4 |

|

|

178.2 |

|

|

176.8 |

|

|

42.2 |

|

|

41.6 |

|

|

159.2 |

|

|

159.8 |

|

Other (b) |

|

22.9 |

|

|

17.2 |

|

|

68.6 |

|

|

58.6 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total Revenue and Quantities Sold |

$ |

385.2 |

|

$ |

380.3 |

|

$ |

1,269.4 |

|

$ |

1,484.2 |

|

|

70.6 |

|

|

70.7 |

|

|

250.3 |

|

|

255.0 |

|

(a)Includes Black Hills Energy Services revenue under the Choice Gas Program.

(b)Includes inter-segment rent and non-regulated services under the Service Guard Comfort Plan, Tech Services, and HomeServe.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

(in millions) |

|

Quantities Sold and Transported

(Dth in millions) |

|

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

Three Months Ended Dec. 31, |

|

Twelve Months Ended Dec. 31, |

|

By business unit |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Arkansas Gas |

$ |

81.6 |

|

$ |

79.8 |

|

$ |

248.8 |

|

$ |

268.9 |

|

|

8.4 |

|

|

9.1 |

|

|

29.9 |

|

|

30.2 |

|

Colorado Gas |

|

87.3 |

|

|

85.8 |

|

|

278.8 |

|

|

313.6 |

|

|

9.7 |

|

|

9.5 |

|

|

31.0 |

|

|

32.8 |

|

Iowa Gas |

|

51.9 |

|

|

45.4 |

|

|

162.3 |

|

|

213.6 |

|

|

10.9 |

|

|

10.8 |

|

|

37.3 |

|

|

37.9 |

|

Kansas Gas |

|

39.6 |

|

|

37.1 |

|

|

130.4 |

|

|

155.6 |

|

|

8.7 |

|

|

8.1 |

|

|

34.8 |

|

|

35.5 |

|

Nebraska Gas |

|

85.6 |

|

|

88.3 |

|

|

304.5 |

|

|

366.1 |

|

|

22.1 |

|

|

22.4 |

|

|

80.3 |

|

|

82.2 |

|

Wyoming Gas |

|

39.2 |

|

|

43.9 |

|

|

144.6 |

|

|

166.4 |

|

|

10.8 |

|

|

10.8 |

|

|

37.0 |

|

|

36.4 |

|

Total Revenue and Quantities Sold |

$ |

385.2 |

|

$ |

380.3 |

|

$ |

1,269.4 |

|

$ |

1,484.2 |

|

|

70.6 |

|

|

70.7 |

|

|

250.3 |

|

|

255.0 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Dec. 31, |

Twelve Months Ended Dec. 31, |

|

2024 |

2023 |

2024 |

2023 |

Heating Degree Days |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Arkansas Gas (a) |

1,073 |

(24)% |

1,253 |

(14)% |

2,998 |

(20)% |

3,197 |

(17)% |

Colorado Gas |

2,049 |

(10)% |

1,838 |

(21)% |

5,662 |

(7)% |

5,916 |

(4)% |

Iowa Gas |

2,093 |

(11)% |

2,054 |

(16)% |

5,543 |

(16)% |

5,921 |

(12)% |

Kansas Gas (a) |

1,516 |

(14)% |

1,638 |

(10)% |

4,092 |

(12)% |

4,387 |

(8)% |

Nebraska Gas |

1,891 |

(15)% |

1,988 |

(13)% |

5,172 |

(13)% |

5,579 |

(8)% |

Wyoming Gas |

2,257 |

(15)% |

2,432 |

(3)% |

6,641 |

(10)% |

7,385 |

8% |

Combined (b) |

2,015 |

(12)% |

2,080 |

(11)% |

5,517 |

(11)% |

6,006 |

(4)% |

(a)Arkansas Gas and Kansas Gas have weather normalization mechanisms that mitigate the weather impact on gross margins.

(b)The combined heating degree days are calculated based on a weighted average of total customers by state excluding Kansas Gas due to its weather normalization mechanism. Arkansas Gas is partially excluded based on the weather normalization mechanism in effect from November through April.

CONFERENCE CALL AND WEBCAST

Black Hills will host a live conference call and webcast at 11 a.m. EST on Thursday, Feb. 6, 2025, to discuss its financial and operating performance.

To access the live webcast and download a copy of the investor presentation, go to the “Investor Relations” section of the Black Hills website at www.blackhillscorp.com and click on “News and Events” and then “Events & Presentation.” The presentation will be posted on the website before the webcast. Listeners should allow at least five minutes for registering and accessing the presentation. For those unable to listen to the live broadcast, a replay will be available on the company’s website.

To ask a question during the live broadcast, users can access dial-in information and a personal identification number by registering for the event at https://register.vevent.com/register/BI8f4c7bc439534ef89a7c45967b67c281.

A listen-only webcast player and presentation slides can be accessed live at https://edge.media-server.com/mmc/p/hq33dood with a replay of the event available for up to one year.

ABOUT BLACK HILLS CORP.

Black Hills Corp. (NYSE: BKH) is a customer-focused, growth-oriented utility company with a tradition of improving life with energy and a vision to be the energy partner of choice. Based in Rapid City, South Dakota, the company serves 1.35 million natural gas and electric utility customers in eight states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. More information is available at www.blackhillscorp.com, www.blackhillscorp.com/corporateresponsibility and www.blackhillsenergy.com.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” as defined by the Securities and Exchange Commission. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. This includes, without limitations, our 2025 earnings guidance and long-term growth target. These forward-looking statements are based on assumptions which we believe are reasonable based on current expectations and projections about future events and industry conditions and trends affecting our business. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks and uncertainties that, among other things, could cause actual results to differ materially from those contained in the forward-looking statements, including without limitation, the risk factors described in Item 1A of Part I of our 2023 Annual Report on Form 10-K and other reports that we file with the SEC from time to time, and the following:

•The accuracy of our assumptions on which our earnings guidance and long-term growth target is based;

•Our ability to obtain adequate cost recovery for our utility operations through regulatory proceedings and favorable rulings on periodic applications to recover costs for capital additions, plant retirements and decommissioning, fuel, transmission, purchased power, and other operating costs and the timing in which new rates would go into effect;

•Our ability to complete our capital program in a cost-effective and timely manner;

•Our ability to execute on our strategy;

•Our ability to successfully execute our financing plans;

•The effects of changing interest rates;

•Our ability to achieve our greenhouse gas emissions intensity reduction goals;

•Board of Directors’ approval of any future quarterly dividends;

•The impact of future governmental regulation;

•Our ability to overcome the impacts of supply chain disruptions on availability and cost of materials;

•The effects of inflation and volatile energy prices;

•Our ability to obtain sufficient insurance coverage at reasonable costs and whether such coverage will protect us against significant losses; and

•Other factors discussed from time to time in our filings with the SEC.

New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time-to-time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. We assume no obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

Investor Relations: |

|

Sal Diaz |

|

Phone |

605-399-5079 |

Email |

investorrelations@blackhillscorp.com |

|

|

Media Contact: |

|

24-hour Media Assistance |

888-242-3969 |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

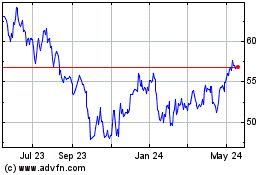

Black Hills (NYSE:BKH)

Historical Stock Chart

From Jan 2025 to Feb 2025

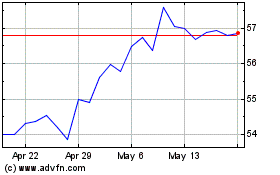

Black Hills (NYSE:BKH)

Historical Stock Chart

From Feb 2024 to Feb 2025