BankUnited, Inc. (the “Company”) (NYSE: BKU) today announced

financial results for the quarter and year ended December 31,

2024.

"We are very excited about the momentum we've generated and the

improvement we've seen in the funding base and profitability

profile of the Company over the course of 2024," said Rajinder

Singh, Chairman, President and Chief Executive Officer.

For the quarter ended December 31, 2024, the Company reported

net income of $69.3 million, or $0.91 per diluted share, compared

to $61.5 million, or $0.81 per diluted share, for the immediately

preceding quarter ended September 30, 2024 and $20.8 million, or

$0.27 per diluted share, for the quarter ended December 31, 2023.

For the year ended December 31, 2024, the Company reported net

income of $232.5 million, or $3.08 per diluted share, compared to

$178.7 million, or $2.38 per diluted share, for the year ended

December 31, 2023. Results for the quarter and year ended December

31, 2023 were negatively impacted by a $35.4 million FDIC special

assessment, pre-tax. This item reduced net income by $26.2 million

and EPS by $0.35 for the quarter and year ended December 31,

2023.

Quarterly Highlights

We continue to execute on strategic priorities focused on

improving core profitability. EPS, the net interest margin, ROAA

and ROAE have improved notably since the fourth quarter of 2023, as

well as for the year ended December 31, 2024 compared to the year

ended December 31, 2023.

- The net interest margin, calculated on a tax-equivalent basis,

expanded by 0.06% to 2.84% for the quarter ended December 31, 2024

from 2.78% for the immediately preceding quarter and by 0.24% from

2.60% for the comparable quarter of the prior year. Average

non-interest bearing demand deposits ("NIDDA") for the quarter

ended December 31, 2024 exceeded our expectations and we made

outstanding progress reducing the cost of interest bearing

deposits. For the year ended December 31, 2024, the net interest

margin improved to 2.73% from 2.56% for the year ended December 31,

2023.

- The average cost of total deposits declined by 0.34% to 2.72%

for the quarter ended December 31, 2024 from 3.06% for the

immediately preceding quarter ended September 30, 2024, while the

average cost of interest bearing deposits declined by 0.45% to

3.75% from 4.20% for those same comparable periods. The spot APY of

total deposits declined to 2.63% at December 31, 2024 from 2.93% at

September 30, 2024 while the spot APY of interest bearing deposits

declined to 3.58% at December 31, 2024 from 4.01% at September 30,

2024.

- Average NIDDA grew by $173 million for the quarter ended

December 31, 2024 compared to the immediately preceding quarter and

by $648 million compared to the fourth quarter of 2023. On a

point-to-point basis, NIDDA grew by $781 million for the year ended

December 31, 2024 and was relatively flat, declining by only $19

million in spite of seasonal headwinds, for the fourth quarter of

2024. At December 31, 2024, NIDDA was 27% of total deposits.

- Wholesale funding, including FHLB advances and brokered

deposits, declined by $346 million for the quarter ended December

31, 2024. For the year ended December 31, 2024, wholesale funding

declined by $2.3 billion.

- Total deposits was relatively flat quarter over quarter,

growing by $9.5 million for the quarter ended December 31, 2024.

For the year ended December 31, 2024, total deposits grew by $1.3

billion; non-brokered deposits grew by $1.4 billion.

- Total loans declined by $101 million for the quarter ended

December 31, 2024. The core CRE and C&I segments grew by $185

million and mortgage warehouse grew by $14 million. Consistent with

our balance sheet strategy, the residential, franchise, equipment

and municipal finance portfolios declined by a combined $299

million. For the year ended December 31, 2024, the core CRE and

C&I segments grew by $470 million, mortgage warehouse grew by

$153 million and the residential, franchise, equipment and

municipal finance portfolios declined by a combined $959 million.

The pace of C&I growth over the course of 2024 was impacted by

an increased level of payoffs and rationalization of

non-relationship credits.

- The loan to deposit ratio declined to 87.2% at December 31,

2024, from 87.6% at September 30, 2024 and 92.8% at December 31,

2023.

- Total criticized and classified commercial loans declined by

$75.1 million for the quarter ended December 31, 2024, however,

non-performing loans increased by $26.2 million, primarily related

to one CRE office loan. The NPA ratio was 0.73%, including 0.10%

related to the guaranteed portion of non-accrual SBA loans, at

December 31, 2024 compared to 0.64%, including 0.10% related to the

guaranteed portion of non-accrual SBA loans at September 30, 2024.

The net charge-off ratio for the year ended December 31, 2024 was

0.16%.

- The ratio of the ACL to total loans was 0.92% at December 31,

2024; the ratio of the ACL to non-performing loans was 89.01%. The

ACL to loans ratio for commercial portfolio sub-segments including

C&I, CRE, franchise finance and equipment finance was 1.37% at

December 31, 2024 and the ACL to loans ratio for CRE office loans

was 2.30%.

- Our commercial real estate exposure totaled 26% of loans and

169% of the Bank's total risk based capital at December 31, 2024.

By comparison, based on call report data as of September 30, 2024

(the most recent date available) for banks with between $10 billion

and $100 billion in assets, the median level of CRE to total loans

was 35% and the median level of CRE to total risk based capital was

222%.

- At December 31, 2024, the weighted average LTV of the CRE

portfolio was 55.0%, the weighted average DSCR was 1.76, 54% of the

portfolio was collateralized by properties located in Florida and

25% was collateralized by properties located in the New York

tri-state area. For the office sub-segment, the weighted average

LTV was 65.2%, the weighted average DSCR was 1.57, 57% was

collateralized by properties in Florida, substantially all of which

was suburban, and 23% was collateralized by properties located in

the New York tri-state area.

- Our capital position is robust. At December 31, 2024, CET1 was

12.0% at a consolidated level. Pro-forma CET1, including

accumulated other comprehensive income, was 10.9% at December 31,

2024. The ratio of tangible common equity to tangible assets

increased to 7.8% at December 31, 2024.

- Book value and tangible book value per common share continued

to grow, to $37.65 and $36.61, respectively, at December 31, 2024,

compared to $37.56 and $36.52, respectively, at September 30, 2024,

and $34.66 and $33.62, respectively at December 31, 2023.

Loans

Loan portfolio composition at the dates indicated follows

(dollars in thousands):

December 31, 2024

September 30, 2024

December 31, 2023

Core C&I and CRE sub-segments:

Non-owner occupied commercial real

estate

$

5,652,203

23.3

%

$

5,488,884

22.5

%

$

5,323,241

21.6

%

Construction and land

561,989

2.3

%

497,928

2.0

%

495,992

2.0

%

Owner occupied commercial real estate

1,941,004

8.0

%

1,999,515

8.2

%

1,935,743

7.9

%

Commercial and industrial

7,042,222

28.9

%

7,026,412

28.9

%

6,971,981

28.3

%

15,197,418

62.5

%

15,012,739

61.6

%

14,726,957

59.8

%

Franchise and equipment finance

213,477

0.9

%

277,704

1.1

%

380,347

1.5

%

Pinnacle - municipal finance

720,661

3.0

%

749,035

3.1

%

884,690

3.6

%

Mortgage warehouse lending ("MWL")

585,610

2.4

%

571,783

2.3

%

432,663

1.8

%

Residential

7,580,814

31.2

%

7,787,442

31.9

%

8,209,027

33.3

%

$

24,297,980

100.0

%

$

24,398,703

100.0

%

$

24,633,684

100.0

%

For the quarter ended December 31, 2024, total loans declined by

$101 million. The CRE portfolio grew by $227 million and MWL grew

by $14 million while the C&I portfolio declined by $43 million.

Consistent with our balance sheet strategy, residential loans

declined by $207 million; the franchise, equipment, and municipal

finance portfolios declined by an aggregate $93 million.

Asset Quality and the

ACL

The following table presents information about the ACL at the

dates indicated as well as net charge-off rates for the periods

ended December 31, 2024, September 30, 2024 and December 31, 2023

(dollars in thousands):

ACL

ACL to Total Loans

Commercial ACL to Commercial

Loans(2)

ACL to Non- Performing

Loans

Net Charge-offs to Average

Loans (1)

December 31, 2023

$

202,689

0.82

%

1.29

%

159.54

%

0.09

%

September 30, 2024

$

228,249

0.94

%

1.41

%

101.68

%

0.12

%

December 31, 2024

$

223,153

0.92

%

1.37

%

89.01

%

0.16

___________________________

(1)

Annualized for the nine months ended

September 30, 2024; ratios for December 31, 2024 and 2023 are

annual net charge-off rates.

(2)

For purposes of this ratio, commercial

loans includes the core C&I and CRE sub-segments as presented

in the table above as well as franchise and equipment finance. Due

to their unique risk profiles, MWL and municipal finance are

excluded from this ratio.

The decline in the ACL coverage ratios at December 31, 2024 as

compared to the prior quarter-end is related to C&I charge-offs

during the quarter, the majority of which were previously reserved

for.

The ACL at December 31, 2024 represents management's estimate of

lifetime expected credit losses given an assessment of historical

data, current conditions, and a reasonable and supportable economic

forecast as of the balance sheet date. For the quarter ended

December 31, 2024, the provision for credit losses, including both

funded and unfunded loan commitments, was $11.0 million, compared

to $9.2 million for the immediately preceding quarter ended

September 30, 2024 and $19.3 million for the quarter ended December

31, 2023. The most significant factor leading to the decrease in

ACL for the quarter was net charge offs; this reduction was

partially offset by increases in specific reserves, the impact of

the economic forecast and an increase in qualitative overlays.

Three C&I loans accounted for substantially all of the

charge-offs for the quarter.

The following table summarizes the activity in the ACL for the

periods indicated (in thousands):

Three Months Ended

Years Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Beginning balance

$

228,249

$

225,698

$

196,063

$

202,689

$

147,946

Impact of adoption of new accounting

pronouncement (ASU 2022-02)

N/A

N/A

N/A

N/A

(1,794

)

Balance after impact of adoption of ASU

2022-02

228,249

225,698

196,063

202,689

146,152

Provision

12,267

9,091

16,257

58,986

78,924

Net charge-offs

(17,363

)

(6,540

)

(9,631

)

(38,522

)

(22,387

)

Ending balance

$

223,153

$

228,249

$

202,689

$

223,153

$

202,689

As detailed in the following table, criticized and classified

commercial loans declined by $75.1 million for the quarter ended

December 31, 2024 (in thousands):

December 31, 2024

September 30, 2024

December 31, 2023

CRE

Total Commercial

CRE

Total Commercial

CRE

Total Commercial

Special mention

$

58,771

$

262,387

$

145,338

$

323,326

$

97,552

$

319,905

Substandard - accruing

633,614

894,754

587,097

932,746

390,724

711,266

Substandard - non-accruing

95,378

219,758

70,860

186,565

13,727

86,903

Doubtful

—

6,856

—

16,265

—

19,035

Total

$

787,763

$

1,383,755

$

803,295

$

1,458,902

$

502,003

$

1,137,109

Non-performing loans totaled $250.7 million or 1.03% of total

loans at December 31, 2024, compared to $224.5 million or 0.92% of

total loans at September 30, 2024. The increase in non-performing

loans for the quarter ended December 31, 2024 related primarily to

one CRE office loan. Non-performing loans included $34.3 million

and $35.1 million of the guaranteed portion of SBA loans on

non-accrual status, representing 0.14% of total loans at both

December 31, 2024 and September 30, 2024.

Net Interest Income

Net interest income for the quarter ended December 31, 2024 was

$239.3 million, compared to $234.1 million for the immediately

preceding quarter ended September 30, 2024, and $217.2 million for

the quarter ended December 31, 2023. Interest income decreased by

$24.4 million for the quarter ended December 31, 2024, compared to

the immediately preceding quarter, while interest expense decreased

by $29.5 million.

The Company’s net interest margin, calculated on a

tax-equivalent basis, increased by 0.06% to 2.84% for the quarter

ended December 31, 2024, from 2.78% for the immediately preceding

quarter ended September 30, 2024. Factors impacting the net

interest margin for the quarter ended December 31, 2024 were:

- The average rate paid on interest bearing deposits declined to

3.75% for the quarter ended December 31, 2024, from 4.20% for the

quarter ended September 30, 2024. This decline reflected

initiatives taken to lower rates paid on deposits in response to

declines in the Fed Funds rate and the re-pricing of term

deposits.

- The average rate paid on FHLB advances declined to 3.82% for

the quarter ended December 31, 2024, from 4.27% for the quarter

ended September 30, 2024, reflecting the repayment or repricing of

predominantly shorter term high rate advances.

- The tax-equivalent yield on loans declined to 5.60% for the

quarter ended December 31, 2024, from 5.87% for the quarter ended

September 30, 2024 reflecting the impact of declining market rates

on the predominantly floating rate commercial portfolio.

- The tax-equivalent yield on investments declined to 5.31% for

the quarter ended December 31, 2024, from 5.62% for the quarter

ended September 30, 2024. This decrease resulted primarily from the

reset of coupon rates on variable rate securities.

Overall, the reduction in cost of interest bearing liabilities

outpaced the decline in the yield on interest earning assets.

Non-interest income and Non-interest

expense

Lease financing: Declines in both lease financing income and

depreciation of operating lease equipment for the year ended

December 31, 2024 compared to the year ended December 31, 2023

corresponded with the reduction in the portfolio of operating lease

equipment. Quarterly fluctuations in lease financing income may be

caused by variability in residual income.

Other non-interest income: Year-over-year increases in other

non-interest income include increases in loan related and

syndication fees, commercial card revenue and income related to

bank owned life insurance.

Employee compensation and benefits: Year-over-year increases in

compensation relate to investments we are making in people to

support future growth of the commercial business, regular merit

increases, and increased variable compensation cost, related in

part to an increase in the Company's stock price.

As discussed above, non-interest expense for the year and three

months ended December 31, 2023 included a $35.4 million FDIC

special assessment.

Railcar refurbishment costs of approximately $8 million that we

had expected to incur in the fourth quarter of 2024 did not

materialize, and are expected instead to occur in 2025.

Earnings Conference Call and

Presentation

A conference call to discuss quarterly results will be held at

9:00 a.m. ET on Wednesday, January 22, 2025 with Chairman,

President and Chief Executive Officer Rajinder P. Singh, Chief

Financial Officer Leslie N. Lunak and Chief Operating Officer

Thomas M. Cornish.

The earnings release and slides with supplemental information

relating to the release will be available on the Investor Relations

page under About Us on www.bankunited.com prior to the call. Due to

recent demand for conference call services, participants are

encouraged to listen to the call via a live Internet webcast at

https://ir.bankunited.com. To participate by telephone,

participants will receive dial-in information and a unique PIN

number upon completion of registration at

https://register.vevent.com/register/BI3806d72590724f8daf0fcb6899fb73f4.

For those unable to join the live event, an archived webcast will

be available on the Investor Relations page at

https://ir.bankunited.com approximately two hours following the

live webcast.

About BankUnited, Inc.

BankUnited, Inc., with total assets of $35.2 billion at December

31, 2024, is the bank holding company of BankUnited, N.A., a

national bank headquartered in Miami Lakes, Florida that provides a

full range of banking and related services to individual and

corporate customers through banking centers located in the state of

Florida, the New York metropolitan area and Dallas, Texas, and a

comprehensive suite of wholesale products to customers through an

Atlanta office focused on the Southeast region. BankUnited also

offers certain commercial lending and deposit products through

national platforms. For additional information, call (877) 779-2265

or visit www.BankUnited.com. BankUnited can be found on Facebook at

facebook.com/BankUnited.official, LinkedIn @BankUnited and on X

@BankUnited.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that reflect the Company’s current views with respect to, among

other things, future events and financial performance. The Company

generally identifies forward-looking statements by terminology such

as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “could,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates,”

"forecasts" or the negative version of those words or other

comparable words. Any forward-looking statements contained in this

press release are based on the historical performance of the

Company and its subsidiaries or on the Company’s current plans,

estimates and expectations. The inclusion of this forward-looking

information should not be regarded as a representation by the

Company that the future plans, estimates or expectations

contemplated by the Company will be achieved. Such forward-looking

statements are subject to various risks and uncertainties and

assumptions, including (without limitation) those relating to the

Company’s operations, financial results, financial condition,

business prospects, growth strategy and liquidity, including as

impacted by external circumstances outside the Company's direct

control, such as but not limited to adverse events or conditions

impacting the financial services industry. If one or more of these

or other risks or uncertainties materialize, or if the Company’s

underlying assumptions prove to be incorrect, the Company’s actual

results may vary materially from those indicated in these

statements. These factors should not be construed as exhaustive.

The Company does not undertake any obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise. A number of

important factors could cause actual results to differ materially

from those indicated by the forward-looking statements. Information

on these factors can be found in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023, and any subsequent

Quarterly Report on Form 10-Q or Current Report on Form 8-K, which

are available at the SEC’s website (www.sec.gov).

BANKUNITED, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS -

UNAUDITED

(In thousands, except share

and per share data)

December 31,

2024

September 30,

2024

December 31,

2023

ASSETS

Cash and due from banks:

Non-interest bearing

$

12,078

$

14,746

$

14,945

Interest bearing

479,038

875,122

573,338

Cash and cash equivalents

491,116

889,868

588,283

Investment securities (including

securities reported at fair value of $9,130,244, $9,109,860 and

$8,867,354)

9,130,244

9,119,860

8,877,354

Non-marketable equity securities

206,297

237,172

310,084

Loans

24,297,980

24,398,703

24,633,684

Allowance for credit losses

(223,153

)

(228,249

)

(202,689

)

Loans, net

24,074,827

24,170,454

24,430,995

Bank owned life insurance

284,570

306,313

318,459

Operating lease equipment, net

223,844

241,625

371,909

Goodwill

77,637

77,637

77,637

Other assets

753,207

741,816

786,886

Total assets

$

35,241,742

$

35,784,745

$

35,761,607

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities:

Demand deposits:

Non-interest bearing

$

7,616,182

$

7,635,427

$

6,835,236

Interest bearing

4,892,814

5,171,865

3,403,539

Savings and money market

11,055,418

10,324,697

11,135,708

Time

4,301,289

4,724,236

5,163,995

Total deposits

27,865,703

27,856,225

26,538,478

FHLB advances

2,930,000

3,580,000

5,115,000

Notes and other borrowings

708,553

708,694

708,973

Other liabilities

923,168

832,022

821,235

Total liabilities

32,427,424

32,976,941

33,183,686

Commitments and contingencies

Stockholders' equity:

Common stock, par value $0.01 per share,

400,000,000 shares authorized; 74,748,370, 74,749,012 and

74,372,505 shares issued and outstanding

747

747

744

Paid-in capital

301,672

296,107

283,642

Retained earnings

2,796,440

2,749,314

2,650,956

Accumulated other comprehensive loss

(284,541

)

(238,364

)

(357,421

)

Total stockholders' equity

2,814,318

2,807,804

2,577,921

Total liabilities and stockholders'

equity

$

35,241,742

$

35,784,745

$

35,761,607

BANKUNITED, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME - UNAUDITED

(In thousands, except per

share data)

Three Months Ended

Years Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Interest income:

Loans

$

336,816

$

355,220

$

346,255

$

1,389,897

$

1,318,217

Investment securities

121,872

127,907

125,993

497,666

488,212

Other

9,300

9,229

10,957

37,553

51,152

Total interest income

467,988

492,356

483,205

1,925,116

1,857,581

Interest expense:

Deposits

188,853

208,630

192,833

815,572

660,305

Borrowings

39,876

49,598

73,162

195,278

323,472

Total interest expense

228,729

258,228

265,995

1,010,850

983,777

Net interest income before provision for

credit losses

239,259

234,128

217,210

914,266

873,804

Provision for credit losses

11,001

9,248

19,253

55,072

87,607

Net interest income after provision for

credit losses

228,258

224,880

197,957

859,194

786,197

Non-interest income:

Deposit service charges and fees

4,988

5,016

5,201

20,226

20,906

Gain (loss) on investment securities,

net

804

127

617

2,127

(10,052

)

Lease financing

7,162

6,368

3,723

30,610

45,882

Other non-interest income

12,251

11,377

7,551

46,192

30,102

Total non-interest income

25,205

22,888

17,092

99,155

86,838

Non-interest expense:

Employee compensation and benefits

82,315

81,781

73,454

315,604

280,744

Occupancy and equipment

11,776

12,242

10,610

45,560

43,345

Deposit insurance expense

6,662

7,421

43,453

36,143

66,747

Professional fees

5,150

4,953

5,052

17,110

14,184

Technology

21,002

21,094

18,628

82,978

79,984

Depreciation of operating lease

equipment

4,352

4,666

10,476

26,127

44,446

Other non-interest expense

29,215

32,425

29,190

118,478

106,501

Total non-interest expense

160,472

164,582

190,863

642,000

635,951

Income before income taxes

92,991

83,186

24,186

316,349

237,084

Provision for income taxes

23,689

21,734

3,374

83,882

58,413

Net income

$

69,302

$

61,452

$

20,812

$

232,467

$

178,671

Earnings per common share, basic

$

0.92

$

0.82

$

0.27

$

3.10

$

2.39

Earnings per common share, diluted

$

0.91

$

0.81

$

0.27

$

3.08

$

2.38

BANKUNITED, INC. AND

SUBSIDIARIES

AVERAGE BALANCES AND

YIELDS

(Dollars in thousands)

Three Months Ended December

31,

Three Months Ended September

30,

Three Months Ended December

31,

2024

2024

2023

Average Balance

Interest (1)

Yield/ Rate

(1)(2)

Average Balance

Interest (1)

Yield/ Rate

(1)(2)

Average Balance

Interest (1)

Yield/ Rate

(1)(2)

Assets:

Interest earning assets:

Loans

$

24,152,602

$

339,725

5.60

%

$

24,299,898

$

358,259

5.87

%

$

24,416,013

$

349,603

5.69

%

Investment securities (3)

9,236,863

122,648

5.31

%

9,171,185

128,762

5.62

%

8,850,397

126,870

5.73

%

Other interest earning assets

785,947

9,300

4.71

%

722,366

9,229

5.08

%

801,833

10,957

5.42

%

Total interest earning assets

34,175,412

471,673

5.50

%

34,193,449

496,250

5.79

%

34,068,243

487,430

5.70

%

Allowance for credit losses

(235,211

)

(231,383

)

(198,984

)

Non-interest earning assets

1,405,129

1,444,410

1,715,795

Total assets

$

35,345,330

$

35,406,476

$

35,585,054

Liabilities and Stockholders'

Equity:

Interest bearing liabilities:

Interest bearing demand deposits

$

5,045,860

$

46,759

3.69

%

$

3,930,101

$

37,294

3.78

%

$

3,433,216

$

31,978

3.70

%

Savings and money market deposits

10,462,295

93,912

3.57

%

11,304,999

119,856

4.22

%

10,287,945

104,188

4.02

%

Time deposits

4,529,737

48,182

4.23

%

4,524,215

51,480

4.53

%

5,225,756

56,667

4.30

%

Total interest bearing deposits

20,037,892

188,853

3.75

%

19,759,315

208,630

4.20

%

18,946,917

192,833

4.04

%

FHLB advances

3,200,652

30,750

3.82

%

3,766,630

40,471

4.27

%

5,545,978

64,034

4.58

%

Notes and other borrowings

708,689

9,126

5.15

%

708,829

9,127

5.15

%

711,073

9,128

5.13

%

Total interest bearing liabilities

23,947,233

228,729

3.80

%

24,234,774

258,228

4.24

%

25,203,968

265,995

4.19

%

Non-interest bearing demand deposits

7,557,267

7,384,721

6,909,027

Other non-interest bearing liabilities

995,789

1,009,157

903,099

Total liabilities

32,500,289

32,628,652

33,016,094

Stockholders' equity

2,845,041

2,777,824

2,568,960

Total liabilities and stockholders'

equity

$

35,345,330

$

35,406,476

$

35,585,054

Net interest income

$

242,944

$

238,022

$

221,435

Interest rate spread

1.70

%

1.55

%

1.51

%

Net interest margin

2.84

%

2.78

%

2.60

%

___________________________ (1

)

On a tax-equivalent basis where

applicable

(2

)

Annualized

(3

)

At fair value except for securities held

to maturity

BANKUNITED, INC. AND

SUBSIDIARIES

AVERAGE BALANCES AND

YIELDS

(Dollars in thousands)

Years Ended December

31,

2024

2023

Average

Balance

Interest (1)

Yield/

Rate (1)

Average

Balance

Interest (1)

Yield/

Rate (1)

Assets:

Interest earning assets:

Loans

$

24,269,787

$

1,402,132

5.78

%

$

24,558,430

$

1,331,578

5.42

%

Investment securities (2)

9,064,521

501,006

5.53

%

9,228,718

491,851

5.33

%

Other interest earning assets

745,885

37,553

5.03

%

986,186

51,152

5.19

%

Total interest earning assets

34,080,193

1,940,691

5.69

%

34,773,334

1,874,581

5.39

%

Allowance for credit losses

(224,673

)

(171,618

)

Non-interest earning assets

1,502,205

1,749,981

Total assets

$

35,357,725

$

36,351,697

Liabilities and Stockholders'

Equity:

Interest bearing liabilities:

Interest bearing demand deposits

$

4,077,852

$

152,809

3.75

%

$

2,905,968

$

86,759

2.99

%

Savings and money market deposits

11,043,510

451,352

4.09

%

10,704,470

382,432

3.57

%

Time deposits

4,757,675

211,411

4.44

%

5,169,458

191,114

3.70

%

Total interest bearing deposits

19,879,037

815,572

4.10

%

18,779,896

660,305

3.52

%

FHLB advances

3,823,579

158,750

4.15

%

6,331,685

285,026

4.50

%

Notes and other borrowings

709,422

36,528

5.15

%

752,036

38,446

5.11

%

Total interest bearing liabilities

24,412,038

1,010,850

4.14

%

25,863,617

983,777

3.80

%

Non-interest bearing demand deposits

7,239,161

7,091,029

Other non-interest bearing liabilities

968,163

848,023

Total liabilities

32,619,362

33,802,669

Stockholders' equity

2,738,363

2,549,028

Total liabilities and stockholders'

equity

$

35,357,725

$

36,351,697

Net interest income

$

929,841

$

890,804

Interest rate spread

1.55

%

1.59

%

Net interest margin

2.73

%

2.56

%

___________________________

(1)

On a tax-equivalent basis where

applicable

(2)

At fair value except for securities held

to maturity

BANKUNITED, INC. AND

SUBSIDIARIES

EARNINGS PER COMMON

SHARE

(In thousands except share and

per share amounts)

Three Months Ended

Years Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Basic earnings per common

share:

Numerator:

Net income

$

69,302

$

61,452

$

20,812

$

232,467

$

178,671

Distributed and undistributed earnings

allocated to participating securities

(1,598

)

(850

)

(930

)

(4,113

)

(3,565

)

Income allocated to common stockholders

for basic earnings per common share

$

67,704

$

60,602

$

19,882

$

228,354

$

175,106

Denominator:

Weighted average common shares

outstanding

74,750,961

74,753,372

74,384,185

74,694,303

74,493,898

Less average unvested stock awards

(1,075,384

)

(1,079,182

)

(1,130,715

)

(1,098,045

)

(1,168,004

)

Weighted average shares for basic earnings

per common share

73,675,577

73,674,190

73,253,470

73,596,258

73,325,894

Basic earnings per common share

$

0.92

$

0.82

$

0.27

$

3.10

$

2.39

Diluted earnings per common

share:

Numerator:

Income allocated to common stockholders

for basic earnings per common share

$

67,704

$

60,602

$

19,882

$

228,354

$

175,106

Adjustment for earnings reallocated from

participating securities

(198

)

6

—

(402

)

(275

)

Income used in calculating diluted

earnings per common share

$

67,506

$

60,608

$

19,882

$

227,952

$

174,831

Denominator:

Weighted average shares for basic earnings

per common share

73,675,577

73,674,190

73,253,470

73,596,258

73,325,894

Dilutive effect of certain share-based

awards

616,913

817,866

203,123

382,043

197,441

Weighted average shares for diluted

earnings per common share

74,292,490

74,492,056

73,456,593

73,978,301

73,523,335

Diluted earnings per common

share

$

0.91

$

0.81

$

0.27

$

3.08

$

2.38

BANKUNITED, INC. AND

SUBSIDIARIES

SELECTED RATIOS

At or for the Three Months

Ended

At or for the Years Ended

December 31,

December 31, 2024

September 30, 2024

December 31, 2023

2024

2023

Financial ratios (4)

Return on average assets

0.78

%

0.69

%

0.23

%

0.66

%

0.49

%

Return on average stockholders’ equity

9.7

%

8.8

%

3.2

%

8.5

%

7.0

%

Net interest margin (3)

2.84

%

2.78

%

2.60

%

2.73

%

2.56

%

Loans to deposits

87.2

%

87.6

%

92.8

%

87.2

%

92.8

%

Tangible book value per common share

$

36.61

$

36.52

$

33.62

$

36.61

$

33.62

December 31, 2024

September 30, 2024

December 31, 2023

Asset quality ratios

Non-performing loans to total loans

(1)(5)

1.03

%

0.92

%

0.52

%

Non-performing assets to total assets

(2)(5)

0.73

%

0.64

%

0.37

%

Allowance for credit losses to total

loans

0.92

%

0.94

%

0.82

%

Allowance for credit losses to commercial

loans (6)

1.37

%

1.41

%

1.29

%

Allowance for credit losses to

non-performing loans (1)(5)

89.01

%

101.68

%

159.54

%

Net charge-offs to average loans(7)

0.16

%

0.12

%

0.09

%

___________________________

(1)

We define non-performing loans to include

non-accrual loans and loans other than purchased credit

deteriorated and government insured residential loans that are past

due 90 days or more and still accruing. Contractually delinquent

purchased credit deteriorated and government insured residential

loans on which interest continues to be accrued are excluded from

non-performing loans.

(2)

Non-performing assets include

non-performing loans, OREO and other repossessed assets.

(3)

On a tax-equivalent basis.

(4)

Annualized for the three months ended

December 31, 2024, September 30, 2024 and December 31, 2023.

(5)

Non-performing loans and assets include

the guaranteed portion of non-accrual SBA loans totaling $34.3

million or 0.14% of total loans and 0.10% of total assets at

December 31, 2024, $35.1 million or 0.14% of total loans and 0.10%

of total assets at September 30, 2024, and $41.8 million or 0.17%

of total loans and 0.12% of total assets at December 31, 2023.

(6)

For purposes of this ratio, commercial

loans includes the C&I and CRE sub-segments, as well as

franchise and equipment finance. Due to their unique risk profiles,

MWL and municipal finance are excluded from this ratio.

(7)

Annualized for the nine months ended

September 30, 2024; ratios for December 31, 2024 and 2023 are

annual net charge-off rates.

December 31, 2024

September 30, 2024

December 31, 2023

Required to be Considered Well

Capitalized

BankUnited, Inc.

BankUnited, N.A.

BankUnited, Inc.

BankUnited, N.A.

BankUnited, Inc.

BankUnited, N.A.

Capital ratios

Tier 1 leverage

8.5

%

9.7

%

8.3

%

9.6

%

7.9

%

9.1

%

5.0

%

Common Equity Tier 1 ("CET1") risk-based

capital

12.0

%

13.7

%

11.8

%

13.6

%

11.4

%

13.1

%

6.5

%

Total risk-based capital

14.1

%

14.6

%

13.9

%

14.6

%

13.4

%

13.9

%

10.0

%

Tangible Common Equity/Tangible Assets

7.8

%

N/A

7.6

%

N/A

7.0

%

N/A

N/A

Non-GAAP Financial

Measures

Tangible book value per common share is a non-GAAP financial

measure. Management believes this measure is relevant to

understanding the capital position and performance of the Company.

Disclosure of this non-GAAP financial measure also provides a

meaningful basis for comparison to other financial institutions as

it is a metric commonly used in the banking industry. The following

table reconciles the non-GAAP financial measurement of tangible

book value per common share to the comparable GAAP financial

measurement of book value per common share at the dates indicated

(in thousands except share and per share data):

December 31, 2024

September 30, 2024

December 31, 2023

Total stockholders’ equity

$

2,814,318

$

2,807,804

$

2,577,921

Less: goodwill and other intangible

assets

77,637

77,637

77,637

Tangible stockholders’ equity

$

2,736,681

$

2,730,167

$

2,500,284

Common shares issued and outstanding

74,748,370

74,749,012

74,372,505

Book value per common share

$

37.65

$

37.56

$

34.66

Tangible book value per common share

$

36.61

$

36.52

$

33.62

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122051331/en/

BankUnited, Inc. Investor Relations: Leslie N. Lunak,

786-313-1698

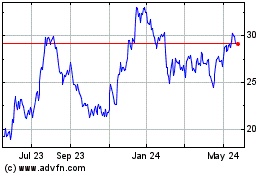

BankUnited (NYSE:BKU)

Historical Stock Chart

From Dec 2024 to Jan 2025

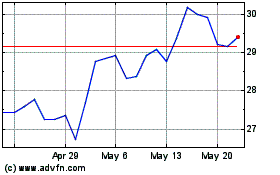

BankUnited (NYSE:BKU)

Historical Stock Chart

From Jan 2024 to Jan 2025