FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated August

23, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: August 23, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 1629-2

EXTRACT FROM THE MINUTES OF THE ORDINARY

MEETING OF THE BOARD OF DIRECTORS

HELD ON AUGUST 14, 2024

1.

Date, Time and Place: Held on August 14, 2024, at 2

p.m., at the office of BRF S.A. ("Company"), located at Avenida das Nações Unidas, nº 14.401, 25th floor,

Chácara Santo Antônio, CEP 04794-000, City of São Paulo, State of São Paulo, and by videoconference.

2.

Call and Attendance: Call duly carried out under the

terms of Article 21 of the Company's Bylaws, with the presence of the totality of the members of the Board of Directors, namely, Mr. Marcos

Antonio Molina dos Santos, Ms. Marcia Aparecida Pascoal Marçal dos Santos, Mr. Sergio Agapito Lires Rial, Mr. Marcos Fernando Marçal

dos Santos, Ms. Flávia Maria Bittencourt, Mr. Augusto Marques da Cruz Filho, Mr. Eduardo Augusto Rocha Pocetti, Mr. Márcio

Hamilton Ferreira and Mr. Pedro de Camargo Neto. Attending as guests, considering the topics on the Agenda, were Messrs. Miguel de Souza

Gularte, Global Chief Executive Officer of the Company and Fabio Luis Mendes Mariano, Vice President of Finance and Investor Relations,

in addition to Messrs. Octavio Zampirollo, Ricardo Akira and André Barbosa, partners of Grant Thornton Auditores Independentes

("Grant Thornton").

3.

Composition of the Board: Chairman: Mr. Marcos

Antonio Molina dos Santos. Secretary: Mr. Bruno Machado Ferla.

4.

Agenda: (i) Analysis and approval of the Company's Quarterly

Financial Information for the quarter ended June 30, 2024 ("2nd ITR/2024"); (ii) Analysis and approval of the Company's

current Amendment to the Share Buyback Program ("Share Buyback Program"); and (iii) Analysis and approval of the execution

of Indemnity Agreements to the Global President Director and Directors.

5.

Resolutions: The

members of the Company's Board of Directors, by unanimous vote and without any reservations, reservations or restrictions, approved the

drafting of these minutes in summary form and resolved, after examining and debating the matters contained in the Agenda, as follows:

5.1.

Regarding item "(i)" of the Agenda, the Board Members, by unanimous vote of those

present and without any reservations or restrictions, and in accordance with the recommendation of the Audit and Integrity Committee,

and also considering the knowledge of the Company's Fiscal Council, approved the 2nd ITR/2024, accompanied by the Management Report, the

explanatory notes and the opinion of the independent auditors.

Page 1 from 5 Extract from the Minutes of the Ordinary Meeting of the Board of Directors of BRF S.A. held on August 14, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE ORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON AUGUST 14, 2024 |

5.2.

Regarding item "(ii)" of the Agenda, the Board Members, by unanimous vote and without

any reservations, reservations or restrictions, subject to the provisions of CVM Resolution No. 77/2022, pursuant to item XI of article

23 of the Bylaws, approved the Amendment to the Share Buyback Program, the information of which is specified

in Exhibit I of these minutes, pursuant to Annex G of CVM Resolution No. 80/2022.

5.3.

With respect to item "(iii)" of the Agenda, the Board Members, considering the favorable

recommendation of the People, Governance, Organization and Culture Committee, approved the execution of Indemnity Agreements to the following

Statutory Officers who do not yet have celebrated it: Messrs. Miguel de Souza Gularte, Artemio Listoni, Fabio Duarte Stumpf, Fabio Luis

Mendes Mariano, Manoel Reinaldo Manzano Martins Junior and Igor Fonseca Marti.

6.

Documents Filed with the Company: Documents that supported

the resolutions taken by the members of the Board of Directors or that are related to the information provided during the meeting are

filed at the Company's headquarters.

7.

Adjournment: There being no further business to discuss,

the meeting was adjourned, and these Minutes were drawn up by means of electronic processing, which, after being read and approved, was

signed by all the Board Members present.

I certify that the above extract is a faithful

transcription of an excerpt from the minutes drawn up in the Book of Minutes of Ordinary and Extraordinary Meetings of the Company's Board

of Directors.

São Paulo, August 14, 2024.

_____________________________________

Bruno Machado Ferla

Secretary

Page 2 from 5 Extract from the Minutes of the Ordinary Meeting of the Board of Directors of BRF S.A. held on August 14, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE ORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON AUGUST 14, 2024 |

ANNEX I

TO THE MINUTES OF THE ORDINARY MEETING OF

THE

BOARD OF DIRECTORS OF BRF S.A.,

HELD ON AUGUST 14, 2024

ANNEX G TO CVM RESOLUTION NO. 80/22

1.

Justify in detail the objective and expected economic effects of the operation;

The Company's objective with the Buyback Program:

to maximize the generation of value for shareholders, promoting the efficient allocation of available resources and the Company's capital

structure. The Company may use the shares to be acquired to remain in treasury, and subsequent sale or cancellation, as well as to comply

with the obligations and commitments assumed under the Stock Option Grant Plan, approved at the Annual and Extraordinary Shareholders'

Meeting held on April 8, 2015 ("Call Option Grant Plan"), and the Restricted Share Grant Plan, approved at the Annual and Extraordinary

Shareholders' Meeting held on April 8, 2015 and amended at subsequent Shareholders' Meetings ("Restricted Share Grant Plan").

The Company, through the Board of Directors,

understands that the acquisition of shares issued by the Company will not impact its financial health.

2.

Inform the number of shares (i) outstanding and (ii) already held in treasury;

(i)

Number of shares outstanding in the market, as defined in article 1, sole paragraph, item I, of

CVM Resolution No. 77/2022: 804,203,900 common shares (based on the shareholding position as of July 31, 2024);

(ii)

Number of treasury shares as of this date: 27,380,171 common shares (based on the shareholding

position as of July 31, 2024).

3.

Inform the number of shares that may be acquired or sold;

Maximum number of shares to be acquired: up

to seventeen (17) million common shares.

4.

Describe the main characteristics of the derivative instruments that the company will use, if any;

The Company will not use derivative instruments.

Page 3 from 5 Extract from the Minutes of the Ordinary Meeting of the Board of Directors of BRF S.A. held on August 14, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE ORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON AUGUST 14, 2024 |

5.

Describe, if any, any agreements or voting guidelines between the company and the counterparty

of the operations;

Not applicable. The Company will carry out

the operations on the stock exchange, will not have knowledge of who the counterparties will be in the operations and does not have or

will have voting agreements or guidelines with such counterparties.

6.

In the event of operations carried out outside organized securities markets, inform:

a.

the maximum (minimum) price at which the shares will be acquired (disposed of); and

b.

if applicable, the reasons that justify carrying out the operation at prices more than 10% (ten

percent) higher, in the case of acquisition, or more than 10% (ten percent) lower, in the case of sale, than the average of the quotation,

weighted by volume, in the 10 (ten) previous trading sessions;

Not applicable, since all acquisitions will

be carried out on the stock exchange and at market price.

7.

Inform, if any, the impacts that the negotiation will have on the composition of the shareholding

control or the administrative structure of the company;

The Company, through the Board of Directors,

understands that the acquisition of shares issued by the Company will not impact its shareholding composition.

8.

Identify the counterparties, if known, and, in the case of a party related to the company, as defined

by the accounting rules that deal with this matter, also provide the information required by article 9 of CVM Resolution No. 81, of March

29, 2022;

As all operations will be carried out on the

stock exchange and at market price, the Company has no knowledge of who will be the counterparties of the operations.

9.

Indicate the destination of the funds earned, if applicable;

See item 1.

Page 4 from 5 Extract from the Minutes of the Ordinary Meeting of the Board of Directors of BRF S.A. held on August 14, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE ORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON AUGUST 14, 2024 |

10.

Indicate the maximum period for the settlement of authorised transactions;

Maximum term for the acquisition of shares

issued by the Company under the Buyback Program: the same period approved by the Board of Directors at a meeting held on May 7, 2024,

which began on May 8, 2024 and will end on October 7, 2025, and the Board of Executive Officers is responsible for defining the dates

on which the buybacks will be effectively executed.

11.

Identify institutions that will act as intermediaries, if any;

Financial institutions that will act as intermediaries:

XP INVESTIMENTOS CCTVM S/A., registered with the CNPJ/MF under No. 02.332.886/0001-04, Av. Chedid Jafet, 75, 30º andar, Torre Sul,

São Paulo/SP, CEP 04551-065, BRADESCO S.A CORRETORA DE TITULOS E VALORES MOBILIARIOS., registered with the CNPJ/MF under No. 061.855.045/0001-32,

Av. Presidente Juscelino Kubitscheck, 1309, 11th floor, São Paulo/SP, CEP 04543-011 or ITAÚ CORRETORA DE VALORES S.A., registered

with the CNPJ/MF under No. 61.194.353/0001-64, Avenida Brigadeiro Faria Lima, 3500, 3rd floor, São Paulo/SP, CEP 04538-132., AGORA

CORRETORA DE TÍTULOS E VALORES IMOBILIÁRIOS S/A., CNPJ: 74.014-747/0001-35 , AV PRESIDENTE Juscelino Kubitscheck 1309, -

4, 5 and 11 andar - VILA NOVA CONCEIÇÃO - São Paulo – SP.

12.

Specify the available resources to be used, pursuant to article 8, paragraph 1, of CVM Resolution

No. 77, of March 29, 2022;

The acquisitions made under the Buyback Program

will be supported by the Company's capital reserve, as determined in the financial statements for the quarter ended June 30, 2024, whose

amount corresponds to R$ 2,763,362,601.00.

13.

Specify the reasons why the members of the board of directors feel comfortable that the share buyback

will not affect the fulfillment of obligations assumed with creditors or the payment of mandatory, fixed or minimum dividends.

The Company, through the Board of Directors,

understands that the acquisition of shares issued by it will not impact its shareholding composition, nor its financial health.

Page 5 from 5 Extract from the Minutes of the Ordinary Meeting of the Board of Directors of BRF S.A. held on August 14, 2024. |

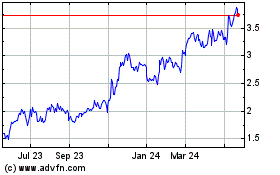

BRF (NYSE:BRFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

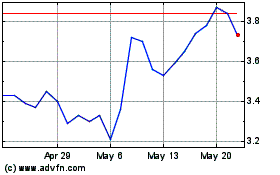

BRF (NYSE:BRFS)

Historical Stock Chart

From Jan 2024 to Jan 2025