Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 13 2024 - 6:33AM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated December

13, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: December 13, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly held company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

ANNOUNCEMENT OF RELATED

PARTY TRANSACTION

BRF S.A. ("BRF" or "Company")

(B3: BRFS3; NYSE: BRFS), in accordance with item XXXII of article 33 of CVM Resolution No. 80/2022, informs its shareholders and the market

in general of the following related party transactions:

| Related Party Names |

BRF and Sadia Uruguay S.A. ("Sadia Uruguay"); Marfrig Chile S.A., Quickfood S.A., Dicasold S.A., Pampeano Alimentos S.A. and Weston Importers Ltd. ("Marfrig Chile", "Quickfood", "Dicasold", "Pampeano" and “Weston”, respectively"). |

|

Relationship with

the Company

|

Marfrig Chile, Quickfood, Dicasold, Pampeano and Weston are subsidiaries of Marfrig Global Foods S.A. ("Marfrig"), which is the controlling shareholder of BRF. |

| Date of the Transactions |

Between September 1, 2024 and November 30, 2024; and as of this date. |

| Object, Main Terms and Conditions of the Transactions |

In addition to the Announcement

to the Market released on 09/06/2024, BRF announces that the total sale of meat products and raw materials to Marfrig Chile, Quickfood,

Dicasold and Pampeano; and the commercial services provided to Weston, totaled, between September 1, 2024 and November 30, 2024, the amount

of R$ 57,014,926.18 (fifty-seven million, fourteen thousand, nine hundred and twenty-six reais and eighteen cents).

Additionally, in continuity

with the operations usually carried out by the Company, BRF estimates that over the next 24 months:

(i)

will supply meat products and raw materials to Quickfood,

based on a supply contract and distribution contract in Argentina, in an amount of up to USD 45,000,000.00 (forty-five million dollars);

(ii)

will supply meat products to Marfrig Chile,

based on a supply contract, in an amount of up to USD 10,000,000.00 (ten million dollars); and

(iii)

will supply meat products to Dicasold, through

its subsidiary Sadia Uruguay, on the basis of a distribution contract, in an amount of up to USD 16,000,000.00 (sixteen million

dollars). |

|

With regard to purchase

orders, BRF reports that the total sales of meat products and raw materials from Weston and Pampeano amounted to R$ 16,127,524.85 (sixteen

million one hundred and twenty-seven thousand five hundred and twenty-four reais and eighty-five cents), between September 1, 2024 and

November 30, 2024.

Additionally, in continuity

with the operations normally carried out by the Company, BRF estimates that, over the next 24 months, it will purchase meat products and

raw materials from Weston, based on purchase orders, an amount of up to USD 100,000,000.00 (one hundred million dollars). |

| Reasons why the Company's management deems the transactions to be equitable |

The Company's management considers that the sale and distribution of meat products and/or raw materials carried out by BRF and Sadia Uruguay with the companies controlled by Marfrig are equitable and in the interest of BRF since they were carried out in accordance with market prices, adequate delivery times, quality and quantity that met BRF’s needs, as well as helped to reduce the cost of distributing BRF products in Chile, Argentina and Uruguay. |

| Eventual involvement of the counterparty, its partners or administrators in the Company's decision process regarding the Transaction or negotiation of the Transaction as representatives of the Company, describing these involvements |

There was no participation by Marfrig or its managers in BRF's and Sadia Uruguay decision-making process regarding the transactions carried out, nor did such persons participate in the negotiation of the above-mentioned transactions as representatives of BRF. |

São Paulo, December 13, 2024.

Fabio Luis Mendes Mariano

Chief Financial and Investor Relations Officer

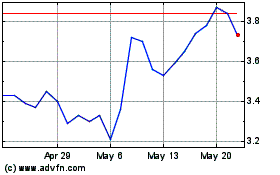

BRF (NYSE:BRFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

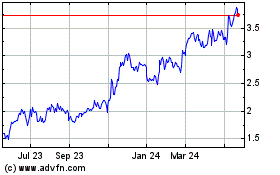

BRF (NYSE:BRFS)

Historical Stock Chart

From Jan 2024 to Jan 2025