Filed by Byline Bancorp, Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Byline Bancorp, Inc. (Commission File No. 001-38139)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 30, 2024

BYLINE BANCORP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

|

|

001-38139 |

|

36-3012593 |

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

180 North LaSalle Street, Suite 300 |

|

|

Chicago, Illinois |

|

60601 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(773) 244-7000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

BY |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 7.01. |

Regulation FD Disclosure. |

|

|

On September 30, 2024, Byline Bancorp, Inc., a Delaware corporation ("Byline"), issued a press release announcing the execution of an Agreement and Plan of Merger in connection with its proposed acquisition of First Security Bancorp, Inc., a Delaware corporation ("First Security Bancorp"), and First Security Bancorp's wholly owned bank subsidiary, First Security Trust and Savings Bank, an Illinois chartered bank. Byline has also provided supplemental information regarding the proposed transaction. A copy of the press release is attached to this report as Exhibit 99.1 and a copy of the supplemental materials is attached as Exhibit 99.2, both of which are incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2 hereto) is being furnished and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended (the “ Exchange Act ”), nor shall it be incorporated by reference into future filings by Byline under the Securities Act of 1933, as amended (the “ Securities Act ”), or under the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of information pursuant to this Item 7.01 will not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

|

|

Item 9.01. |

Financial Statements and Exhibits. |

|

|

(d) Exhibits.

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving Byline and First Security Bancorp. Byline intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement of First Security Bancorp and a prospectus of Byline, and Byline will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to First Security Bancorp stockholders seeking the required stockholder approval of the proposed transaction. Before making any voting or investment decision, investors and security holders of First Security Bancorp are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Byline with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Byline may be obtained free of charge at its website at http://www.bylinebancorp.com/Docs. Alternatively, these documents, when available, can be obtained free of charge from Byline upon written request to Byline Bancorp, Inc., Attn: Brooks Rennie, Head of Investor Relations, 180 North LaSalle Street, 3rd Floor, Chicago, Illinois 60601, or by calling (773) 244-7000.

Information regarding the interests of certain of First Security Bancorp’s directors and executive officers and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the registration statement on Form S-4 regarding the proposed transaction when it becomes available.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any statements about Byline’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives or assumptions of future events or performance are not historical facts and may be forward-looking. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of Byline and First Security Bancorp. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “expects,” “can,” “could,” “may,” “predicts,” “potential,” “opportunity,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “seeks,” “intends” and similar words or phrases. Accordingly, these statements involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual strategies, actions or results to differ materially from those expressed in them, and are not guarantees of timing, future results or other events or performance. Because forward-looking statements are necessarily only estimates of future strategies, actions or results, based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations, readers are cautioned not to place undue reliance on such statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees

and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with Byline’s and First Security Bancorp, Inc.’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which Byline and First Security Bancorp, Inc. operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks. Certain risks and important factors that could affect Byline’s future results are identified in its Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise.

Participants in this Transaction

Byline, First Security Bancorp, their respective directors and executive officers and certain of their other members of management and employees may be deemed to be participants in the solicitation of proxies from First Security Bancorp stockholders in connection with the proposed transaction. Information about the directors and executive officers of Byline may be found in Byline’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 4, 2024 and in Byline’s proxy statement for its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 22, 2024, copies of which can be obtained free of charge from Byline or from the SEC’s website as indicated above. To the extend the holdings of Byline’s securities by its directors and executive officers have changed since the amounts set forth in Byline’s proxy statement for its 2024 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. In addition, information about the directors and executive officers of Byline and First Security Bancorp and other persons who may be deemed participants in the transaction will be included in the proxy statement/prospectus and other relevant materials when filed with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BYLINE BANCORP, INC. |

|

|

|

|

Date: September 30, 2024 |

|

|

|

By: |

/s/ Roberto R. Herencia |

|

|

|

|

Name: |

Roberto R. Herencia |

|

|

|

|

Title: |

Executive Chairman and Chief Executive Officer |

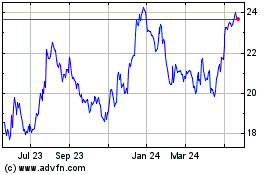

Byline Bancorp (NYSE:BY)

Historical Stock Chart

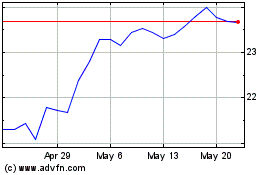

From Jan 2025 to Feb 2025

Byline Bancorp (NYSE:BY)

Historical Stock Chart

From Feb 2024 to Feb 2025