UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT

OF 1934

For the month of March 2025

Commission File Number: 001-38590

CANGO INC.

8F, New Bund Oriental Plaza II

556 West Haiyang Road, Pudong

New Area

Shanghai 200124

People’s Republic of China

(Address of principal executive

offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

EXHIBIT INDEX

Exhibit 99.1

— Cango Inc. Reports Fourth Quarter and Full Year 2024 Unaudited Financial Results

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CANGO INC. |

| |

|

| |

By: |

/s/ Yongyi Zhang |

| |

Name: |

Yongyi Zhang |

| |

Title: |

Chief Financial Officer |

Date: March 6, 2025

Exhibit 99.1

Cango Inc. Reports Fourth Quarter and Full

Year 2024 Unaudited Financial Results

SHANGHAI, March 7, 2025 /PRNewswire/ -- Cango

Inc. (NYSE: CANG) ("Cango" or the "Company"), a leading Bitcoin mining company with an automotive transaction service

in China, today announced its unaudited financial results for the fourth quarter and full year of 2024.

Fourth Quarter 2024 Financial and Operational

Highlights

| · | Total revenues were RMB668.0 million (US$91.5

million), a substantial increase from RMB130.2 million in the same period of 2023. This surge was primarily attributable to the launch

of our Bitcoin mining business in November 2024, which generated RMB653.0 million (US$89.5 million) in the quarter. |

| · | A total of 933.8 Bitcoins were mined during the

quarter. The average cost to mine Bitcoin, excluding depreciation of mining machines, was US$67,769.9 per Bitcoin in the quarter. |

| · | Net income was RMB55.9 million (US$7.7 million)

in the quarter compared with net loss of RMB103.8 million in the same period of 2023. |

| · | Total balance of cash and cash equivalents and

short-term investments were RMB2.5 billion (US$345.3 million) as of December 31, 2024. |

| · | The total outstanding balance of financing transactions

the Company facilitated was RMB3.9 billion (US$533.0 million) as of December 31, 2024. Our credit risk exposure has decreased, with

only RMB1.1 billion (US$ 148.2 million) of outstanding loan balances where the Company bears credit risks that have not been provided

with full bad debt allowance or full risk assurance liabilities. M1+ and M3+ overdue ratios for all outstanding financing transactions

facilitated by the Company that have not been provided with full bad debt allowance or full risk assurance liabilities were 3.24% and

1.78%, respectively, as of December 31, 2024, compared with 3.17% and 1.76%, respectively, as of September 30, 2024. |

Full Year 2024 Financial and Operational Highlights

| · | Total revenues were RMB804.5 million (US$110.2

million) compared with RMB1.7 billion in the full year of 2023. |

| · | Revenue from the Bitcoin mining business was

RMB653.0 million (US$89.5 million), despite the business’s very recent launch in November 2024. |

| · | Net income was RMB299.8 million (US$41.1 million)

compared with a net loss of RMB37.9 million in the full year of 2023. |

Mr. Jiayuan

Lin, Chief Executive Officer of Cango, commented, “2024 was a milestone year for Cango, marking another pivotal transformation and

growth phase for the Company. While we continued to develop our traditional automotive business, we also capitalized on the growing opportunities

in the cryptocurrencies sector and strategically expanded into Bitcoin mining. In early November 2024, we announced our acquisition

of on-rack Bitcoin mining machines with an aggregate hashrate of 50 exahashes (EH) for a total purchase price of US$400 million. By November 15,

we had taken delivery of 32 EH of mining power, making us the third-largest Bitcoin miner globally. In just two months, our Bitcoin mining

business generated revenues of RMB653.0 million, with a total of 933.8 Bitcoins mined as of the end of 2024.”

“Driven

by the Bitcoin mining business’ initial success, Cango recorded total revenues of RMB668 million in the fourth quarter of 2024,

representing a year-over-year surge of over 400%. Given this field’s immense growth potential, we have refined our transformation

efforts and placed "Energy + Computing Power" at the core of our future development strategy. Meanwhile, we will maintain a

strong focus on our used car exporting business, aiming to become a leading asset-light gateway for China’s used car exports. Looking

ahead to 2025, leveraging our solid foundation in the cryptocurrencies sector, we are strategically positioning ourselves for further

expansion across the digital economy value chain, creating sustainable value for all our stakeholders,” concluded Mr. Lin.

Mr. Yongyi

Zhang, Chief Financial Officer of Cango, stated, “We are pleased to close 2024 with strong financial performance, driven by our

strategic entry into the Bitcoin mining business. In 2024, we achieved a net income of RMB 299.8 million, marking a turnaround from the

net loss recorded in 2023. Building on the solid foundation we have established in the Bitcoin mining business, we will continue to assess

and pursue new opportunities to expand our capacity while prioritizing cost-effective and environmentally sustainable energy solutions

to optimize our cost structure. As we move into 2025, we are confident that Cango is well-positioned to embark on its next phase of growth.”

Fourth Quarter 2024 Financial Results

REVENUES

Total revenues in

the fourth quarter of 2024 were RMB668.0 million (US$91.5 million) compared with RMB130.2 million in the same period of 2023. The significant

year-over-year increase was primarily driven by the Bitcoin mining business launched in November 2024.

Revenue from the

Bitcoin mining business was RMB653.0 million (US$89.5 million), with a total of 933.8 Bitcoins mined as of the end of 2024.

Revenue from automotive trading related income1

was RMB15.0 million (US$2.1 million), compared with RMB130.2 million in the same period of 2023.

1 Revenue from automotive trading related income consists

revenues generated from loan facilitation income and other related income, guarantee income, leasing income, after-market services income,

automotive trading income and others.

OPERATING COST AND EXPENSES

Total operating cost and expenses in the fourth

quarter of 2024 were RMB645.5 million (US$88.4 million) compared with RMB159.1 million in the same period of 2023.

| · | Cost of revenue in the fourth quarter of 2024

increased to RMB550.5 million (US$75.4 million) from RMB110.9 million in the same period of 2023. The year-over-year increase was primarily

driven by the cost of the Bitcoin mining business. As a percentage of total revenues, cost of revenue in the fourth quarter of 2024 was

82.4% compared with 85.1% in the same period of 2023. |

| · | Sales and marketing expenses in the fourth quarter

of 2024 decreased to RMB2.2 million (US$0.3 million) from RMB4.4 million in the same period of 2023. As a percentage of total revenues,

sales and marketing expenses in the fourth quarter of 2024 were 0.3% compared with 3.4% in the same period of 2023. |

| · | General and administrative expenses in the fourth

quarter of 2024 increased to RMB127.9 million (US$17.5 million) from RMB45.6 million in the same period of 2023. As a percentage of total

revenues, general and administrative expenses in the fourth quarter of 2024 were 19.1% compared with 35.0% in the same period of 2023. |

| · | Research and development expenses in the fourth

quarter of 2024 decreased to RMB1.3 million (US$0.2 million) from RMB7.3 million in the same period of 2023. As a percentage of total

revenues, research and development expenses in the fourth quarter of 2024 were 0.2% compared with 5.6% in the same period of 2023. |

| · | Net loss on contingent risk assurance liabilities

in the fourth quarter of 2024 was RMB4.6 million (US$0.6 million), compared with RMB22.2 million in the same period of 2023. |

| · | Net recovery on provision for credit losses in

the fourth quarter of 2024 was RMB66.1 million (US$9.1 million), compared with RMB31.2 million in the same period of 2023. |

INCOME FROM OPERATIONS

Income from operations in the fourth quarter of

2024 was RMB22.5 million (US$3.1 million) compared with loss from operations of RMB28.9 million in the same period of 2023.

NET INCOME

Net income in the fourth quarter of 2024 was RMB55.9

million (US$7.7 million) compared with net loss of RMB103.8 million in the same period of 2023. Non-GAAP adjusted net income in the fourth

quarter of 2024 was RMB59.2 million (US$8.1 million) compared with non-GAAP adjusted net loss of RMB99.2 million in the same period of

2023. Non-GAAP adjusted net loss excludes the impact of share-based compensation expenses. For further information, see "Use of Non-GAAP

Financial Measure."

NET INCOME PER ADS

Basic and diluted net income per American Depositary

Share (the “ADS”) in the fourth quarter of 2024 were RMB0.54 (US$0.07) and RMB0.48 (US$0.07), respectively. Non-GAAP adjusted

basic and diluted net income per ADS in the fourth quarter of 2024 were RMB0.57 (US$0.08) and RMB0.51 (US$0.07), respectively. Each ADS

represents two Class A ordinary shares of the Company.

Full Year 2024 Financial Results

REVENUES

Total revenues in the full year of 2024 were RMB804.5

million (US$110.2 million) compared with RMB1.7 billion in the full year of 2023. The year-over-year decrease was primarily due to decreased

automotive trading related income1, partially offset by the revenue contribution from the Bitcoin mining business launched

in November 2024.

Revenue from the

Bitcoin mining business was RMB653.0 million (US$89.5 million) with a total of 933.8 Bitcoins mined as of the end of 2024.

Revenues from automotive trading related income1

was RMB151.5 million (US$20.8 million) compared with RMB1.7 billion in the full year of 2023.

OPERATING

COST AND EXPENSES

Total operating cost and expenses in the full

year of 2024 were RMB625.6 million (US$85.7 million) compared with RMB1.8 billion in the full year of 2023.

| · | Cost of revenue in the full year of 2024 decreased

to RMB629.4 million (US$86.2 million) from RMB1.5 billion in the full year of 2023. The year-over-year decline was primarily due to the

reduced business scale of the automotive trading related business, partially offset by rising costs associated with the Bitcoin mining

business. As a percentage of total revenues, cost of revenue in the full year of 2024 was 78.2% compared with 88.8% in the full year of

2023. |

| · | Sales and marketing expenses in the full year

of 2024 decreased to RMB13.1 million (US$1.8 million) from RMB38.9 million in the full year of 2023. As a percentage of total revenues,

sales and marketing expenses in the full year of 2024 were 1.6% compared with 2.3% in the full year of 2023. |

| · | General and administrative expenses in the full

year of 2024 increased to RMB250.2 million (US$34.3 million) from RMB157.0 million in the full year of 2023. As a percentage of total

revenues, general and administrative expenses in the full year of 2024 were 31.1% compared with 9.2% in the full year of 2023. |

| · | Research and development expenses in the full

year of 2024 decreased to RMB5.5 million (US$0.7 million) from RMB30.1 million in the full year of 2023. As a percentage of total revenues,

research and development expenses in the full year of 2024 were 0.7% compared with 1.8% in the full year of 2023. |

| · | Net gain on contingent risk assurance liabilities

in the full year of 2024 was RMB27.8 million (US$3.8 million), compared with net loss of RMB25.6 million in the full year of 2023. |

| · | Net recovery on provision for credit losses in

the full year of 2024 was RMB269.9 million (US$37.0 million), compared with RMB136.5 million in the full year of 2023. |

INCOME FROM OPERATIONS

Income from operations

in the full year of 2024 was RMB178.9 million (US$24.5 million) compared with loss from operations of RMB73.8 million in the full

year of 2023.

NET INCOME

Net income

in the full year of 2024 was RMB299.8 million (US$41.1 million) compared with net loss of RMB37.9 million in the full year of 2023. Non-GAAP

adjusted net income in the full year of 2024 was RMB316.9 million (US$43.4 million) compared with Non-GAAP adjusted net income of RMB0.6

million in the full year of 2023. Non-GAAP adjusted net income excludes the impact of share-based compensation expenses. For further information,

see “Use of Non-GAAP Financial Measure.”

NET INCOME PER ADS

Basic and diluted net income per American Depositary

Share (the “ADS”) in the full year of 2024 were RMB2.88 (US$0.39) and RMB2.57 (US$0.35), respectively. Non-GAAP adjusted basic

and diluted net income per ADS in the full year of 2024 were RMB3.04 (US$0.42) and RMB2.72 (US$0.37), respectively. Each ADS represents

two Class A ordinary shares of the Company.

BALANCE SHEET

| · | As of December 31, 2024, the Company had

cash and cash equivalents of RMB1.3 billion (US$176.7 million) compared with RMB691.8 million as of September 30, 2024. |

| · | As of December 31, 2024, the Company had

short-term investments of RMB1.2 billion (US$168.7 million) compared with RMB3.1 billion as of September 30, 2024. |

Business Outlook

We currently maintain a deployed hashrate of 32

EH, demonstrating our operational resilience. As part of our continued commitment to growth and scaling our capabilities, we are targeting

a substantial increase in our hashrate over the coming months. We are on track to grow our deployed hashrate to approximately 50 EH before

the end of this quarter. This increase is expected to be driven by the closing of our share-settled acquisition of Bitcoin mining assets,

positioning us to strengthen our competitive advantage and increase operational efficiency.

Share Repurchase Program

Pursuant to the share repurchase program announced

on April 23, 2024, the Company had repurchased 996,640 ADSs with cash in the aggregate amount of approximately US$1.7 million up

to December 31, 2024.

Conference Call Information

The Company's management will hold a conference

call on Thursday, March 6, 2025, at 8:00 P.M. Eastern Time or Friday, March 7, 2025, at 9:00 A.M. Beijing Time to

discuss the financial results. Listeners may access the call by dialing the following numbers:

| International: |

+1-412-902-4272 |

| United States Toll Free: |

+1-888-346-8982 |

| Mainland China Toll Free: |

4001-201-203 |

| Hong Kong, China Toll Free: |

800-905-945 |

| Conference ID: |

Cango Inc. |

The replay will be accessible through March 13,

2025, by dialing the following numbers:

| International: |

+1-412-317-0088 |

| United States Toll Free: |

+1-877-344-7529 |

| Access Code: |

6316125 |

A live and archived

webcast of the conference call will also be available at the Company's investor relations website at http://ir.cangoonline.com.

About Cango Inc.

Cango Inc. (NYSE:

CANG) primarily operates a leading Bitcoin mining business. Headquartered in Shanghai, China, Cango has deployed its mining operation

across strategic locations including North America, Middle East, South America, and East Africa. Cango expanded into the crypto assets

market in November 2024, driven by the development in blockchain technology, increasing prevalence of crypto assets and its endeavor

to diversify its business. Meanwhile, Cango has continued to operate the automotive transaction service in China since 2010, aiming to

make car purchases simple and enjoyable. For more information, please visit: www.cangoonline.com.

Definition of Overdue Ratios

The Company defines "M1+ overdue ratio"

as (i) exposure at risk relating to financing transactions for which any installment payment is 30 to 179 calendar days past due

as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such

date, excluding amounts of outstanding principal that are 180 calendar days or more past due.

The Company defines "M3+ overdue ratio"

as (i) exposure at risk relating to financing transactions for which any installment payment is 90 to 179 calendar days past due

as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such

date, excluding amounts of outstanding principal that are 180 calendar days or more past due.

Use of Non-GAAP Financial Measure

In evaluating the business, the Company considers

and uses Non-GAAP adjusted net income (loss), a Non-GAAP measure, as a supplemental measure to review and assess its operating performance.

The presentation of the Non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with U.S. GAAP. The Company defines Non-GAAP adjusted net income (loss) as net income

(loss) excluding share-based compensation expenses. The Company presents the Non-GAAP financial measure because it is used by the management

to evaluate the operating performance and formulate business plans. Non-GAAP adjusted net income (loss) enables the management to assess

the Company's operating results without considering the impact of share-based compensation expenses, which are non-cash charges. The Company

also believes that the use of the Non-GAAP measure facilitates investors' assessment of its operating performance.

Non-GAAP adjusted net income (loss) is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools.

One of the key limitations of using Non-GAAP adjusted net income (loss) is that it does not reflect all items of expense that affect the

Company's operations. Share-based compensation expenses have been and may continue to be incurred in the business and are not reflected

in the presentation of Non-GAAP adjusted net income (loss). Further, the Non-GAAP measure may differ from the Non-GAAP information used

by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations

by reconciling the Non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating

the Company's performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial

measure.

Reconciliations of Cango's Non-GAAP financial

measure to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain

RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to US$ were made at the rate of RMB7.2993 to US$1.00, the noon buying rate in effect on December 31, 2024,

in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred

could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" and similar statements. Among

other things, the "Business Outlook" section and quotations from management in this announcement, contain forward-looking statements.

Cango may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Cango's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: Cango's goal and strategies; Cango's expansion plans; Cango's

future business development, financial condition and results of operations; Cango's expectations regarding demand for, and market acceptance

of, its solutions and services; Cango's expectations regarding keeping and strengthening its relationships with dealers, financial institutions,

car buyers and other platform participants; general economic and business conditions; and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks is included in Cango's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and Cango does not undertake any obligation to update

any forward-looking statement, except as required under applicable law.

Investor Relations Contact

Yihe Liu

Cango Inc.

Tel: +86 21 3183 5088 ext.5581

Email: ir@cangoonline.com

Helen Wu

Piacente Financial Communications

Tel: +86 10 6508 0677

Email: ir@cangoonline.com

CANGO INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEET

(Amounts in Renminbi ("RMB") and US dollar ("US$"), except for number of shares and per share data)

| | |

As of December 31, 2023 | | |

As of December 31, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS: | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,020,604,191 | | |

| 1,289,629,981 | | |

| 176,678,583 | |

| Restricted cash - current - bank deposits held for short-term investments | |

| 1,670,006,785 | | |

| - | | |

| - | |

| Restricted cash - current - others | |

| 14,334,937 | | |

| 10,813,746 | | |

| 1,481,477 | |

| Short-term investments | |

| 635,070,394 | | |

| 1,231,171,751 | | |

| 168,669,838 | |

| Accounts receivable, net | |

| 64,791,709 | | |

| 22,991,951 | | |

| 3,149,884 | |

| Finance lease receivables - current, net | |

| 200,459,435 | | |

| 20,685,475 | | |

| 2,833,898 | |

| Financing receivables, net | |

| 29,522,035 | | |

| 5,685,096 | | |

| 778,855 | |

| Short-term contract asset | |

| 170,623,200 | | |

| 33,719,944 | | |

| 4,619,613 | |

| Prepayments and other current assets | |

| 78,606,808 | | |

| 226,352,004 | | |

| 31,010,097 | |

| Receivable for bitcoin collateral | |

| - | | |

| 617,057,765 | | |

| 84,536,567 | |

| Total current assets | |

| 3,884,019,494 | | |

| 3,458,107,713 | | |

| 473,758,812 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Restricted cash - non-current | |

| 583,380,417 | | |

| 287,425,602 | | |

| 39,377,146 | |

| Mining machines | |

| - | | |

| 1,772,319,041 | | |

| 242,806,713 | |

| Property and equipment, net | |

| 8,239,037 | | |

| 6,634,509 | | |

| 908,924 | |

| Intangible assets | |

| 48,373,192 | | |

| 47,425,617 | | |

| 6,497,283 | |

| Long-term contract asset | |

| 36,310,769 | | |

| 17,551,040 | | |

| 2,404,483 | |

| Finance lease receivables - non-current, net | |

| 36,426,617 | | |

| 9,309,227 | | |

| 1,275,359 | |

| Operating lease right-of-use assets | |

| 47,154,944 | | |

| 40,788,977 | | |

| 5,588,067 | |

| Other non-current assets | |

| 4,705,544 | | |

| 329,761,833 | | |

| 45,177,186 | |

| Total non-current assets | |

| 764,590,520 | | |

| 2,511,215,846 | | |

| 344,035,161 | |

| TOTAL ASSETS | |

| 4,648,610,014 | | |

| 5,969,323,559 | | |

| 817,793,973 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term debts | |

| 39,071,500 | | |

| 124,584,293 | | |

| 17,067,978 | |

| Long-term debts—current | |

| 926,237 | | |

| - | | |

| - | |

| Short-term lease liabilities | |

| 7,603,380 | | |

| 7,912,420 | | |

| 1,083,997 | |

| Accrued expenses and other current liabilities | |

| 206,877,626 | | |

| 1,348,300,779 | | |

| 184,716,449 | |

| Deferred guarantee income | |

| 86,218,888 | | |

| 11,787,712 | | |

| 1,614,910 | |

| Contingent risk assurance liabilities | |

| 125,140,991 | | |

| 31,190,425 | | |

| 4,273,071 | |

| Income tax payable | |

| 311,904,279 | | |

| 311,130,341 | | |

| 42,624,682 | |

| Total current liabilities | |

| 777,742,901 | | |

| 1,834,905,970 | | |

| 251,381,087 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Long-term debts | |

| 712,023 | | |

| - | | |

| - | |

| Deferred tax liability | |

| 10,724,133 | | |

| 10,724,133 | | |

| 1,469,200 | |

| Long-term operating lease liabilities | |

| 42,228,435 | | |

| 37,044,466 | | |

| 5,075,071 | |

| Other non-current liabilities | |

| 226,035 | | |

| 19,118 | | |

| 2,619 | |

| Total non-current liabilities | |

| 53,890,626 | | |

| 47,787,717 | | |

| 6,546,890 | |

| Total liabilities | |

| 831,633,527 | | |

| 1,882,693,687 | | |

| 257,927,977 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 204,260 | | |

| 199,087 | | |

| 27,274 | |

| Treasury shares | |

| (773,130,748 | ) | |

| (756,517,941 | ) | |

| (103,642,533 | ) |

| Additional paid-in capital | |

| 4,813,679,585 | | |

| 4,725,877,432 | | |

| 647,442,554 | |

| Accumulated other comprehensive income | |

| 111,849,166 | | |

| 152,882,024 | | |

| 20,944,751 | |

| Accumulated deficit | |

| (335,625,776 | ) | |

| (35,810,730 | ) | |

| (4,906,050 | ) |

| Total Cango Inc.’s equity | |

| 3,816,976,487 | | |

| 4,086,629,872 | | |

| 559,865,996 | |

| Total shareholders' equity | |

| 3,816,976,487 | | |

| 4,086,629,872 | | |

| 559,865,996 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| 4,648,610,014 | | |

| 5,969,323,559 | | |

| 817,793,973 | |

CANGO INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(Amounts in Renminbi (“RMB”) and US dollar (“US$”), except for number of shares and per share data)

| | |

For the three months ended | | |

For the years ended | |

| | |

December 31, 2023 | | |

December 31, 2024 | | |

December 31, 2023 | | |

December 31, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

| 130,237,183 | | |

| 668,032,884 | | |

| 91,520,130 | | |

| 1,701,918,741 | | |

| 804,488,547 | | |

| 110,214,479 | |

| Revenue from bitcoin mining | |

| - | | |

| 652,986,472 | | |

| 89,458,780 | | |

| - | | |

| 652,986,472 | | |

| 89,458,780 | |

| Loan facilitation income and other related income | |

| (7,656,161 | ) | |

| (534,163 | ) | |

| (73,180 | ) | |

| 19,962,063 | | |

| 15,776,386 | | |

| 2,161,356 | |

| Guarantee income | |

| 42,110,239 | | |

| 8,849,830 | | |

| 1,212,422 | | |

| 212,121,156 | | |

| 74,431,177 | | |

| 10,197,029 | |

| Leasing income | |

| 7,272,645 | | |

| 1,196,019 | | |

| 163,854 | | |

| 57,430,571 | | |

| 11,534,923 | | |

| 1,580,278 | |

| After-market services income | |

| 24,023,492 | | |

| 5,116,611 | | |

| 700,973 | | |

| 65,388,466 | | |

| 41,227,512 | | |

| 5,648,146 | |

| Automobile trading income | |

| 53,203,912 | | |

| 168,774 | | |

| 23,122 | | |

| 1,309,633,693 | | |

| 6,285,166 | | |

| 861,064 | |

| Others | |

| 11,283,056 | | |

| 249,341 | | |

| 34,159 | | |

| 37,382,792 | | |

| 2,246,911 | | |

| 307,826 | |

| Operating cost and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 110,877,885 | | |

| 550,534,892 | | |

| 75,422,971 | | |

| 1,511,863,115 | | |

| 629,379,550 | | |

| 86,224,645 | |

| Sales and marketing | |

| 4,375,457 | | |

| 2,189,957 | | |

| 300,023 | | |

| 38,921,589 | | |

| 13,099,320 | | |

| 1,794,599 | |

| General and administrative | |

| 45,646,503 | | |

| 127,873,306 | | |

| 17,518,571 | | |

| 156,966,463 | | |

| 250,164,109 | | |

| 34,272,342 | |

| Research and development | |

| 7,272,969 | | |

| 1,274,152 | | |

| 174,558 | | |

| 30,114,175 | | |

| 5,467,033 | | |

| 748,980 | |

| Net loss (gain) on contingent risk assurance liabilities | |

| 22,156,496 | | |

| 4,584,862 | | |

| 628,124 | | |

| 25,631,610 | | |

| (27,801,042 | ) | |

| (3,808,727 | ) |

| Net recovery on provision for credit losses | |

| (31,224,666 | ) | |

| (66,105,573 | ) | |

| (9,056,426 | ) | |

| (136,485,155 | ) | |

| (269,865,102 | ) | |

| (36,971,367 | ) |

| Impairment loss from goodwill | |

| - | | |

| - | | |

| - | | |

| 148,657,971 | | |

| - | | |

| - | |

| Loss from change in fair value of receivable for bitcoin collateral | |

| - | | |

| 25,150,893 | | |

| 3,445,658 | | |

| - | | |

| 25,150,893 | | |

| 3,445,658 | |

| Total operation cost and expenses | |

| 159,104,644 | | |

| 645,502,489 | | |

| 88,433,479 | | |

| 1,775,669,768 | | |

| 625,594,761 | | |

| 85,706,130 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Loss) income from operations | |

| (28,867,461 | ) | |

| 22,530,395 | | |

| 3,086,651 | | |

| (73,751,027 | ) | |

| 178,893,786 | | |

| 24,508,349 | |

| Interest income, net | |

| 20,183,627 | | |

| 30,316,565 | | |

| 4,153,352 | | |

| 79,164,929 | | |

| 106,317,885 | | |

| 14,565,491 | |

| Net gain on equity securities | |

| 8,653,285 | | |

| 1,570,825 | | |

| 215,202 | | |

| 24,093,019 | | |

| 8,788,576 | | |

| 1,204,030 | |

| Interest expense | |

| - | | |

| (659,217 | ) | |

| (90,312 | ) | |

| (4,099,783 | ) | |

| (659,217 | ) | |

| (90,312 | ) |

| Foreign exchange (loss) gain, net | |

| (1,247,296 | ) | |

| 2,571,854 | | |

| 352,343 | | |

| 1,099,229 | | |

| 1,650,777 | | |

| 226,156 | |

| Other income | |

| 1,297,133 | | |

| (209,124 | ) | |

| (28,650 | ) | |

| 30,701,851 | | |

| 8,261,705 | | |

| 1,131,849 | |

| Other expenses | |

| (1,256,297 | ) | |

| (65,035 | ) | |

| (8,910 | ) | |

| (1,624,789 | ) | |

| (2,116,893 | ) | |

| (290,013 | ) |

| Net (loss) income before income taxes | |

| (1,237,009 | ) | |

| 56,056,263 | | |

| 7,679,676 | | |

| 55,583,429 | | |

| 301,136,619 | | |

| 41,255,550 | |

| Income tax expenses | |

| (102,541,409 | ) | |

| (169,965 | ) | |

| (23,285 | ) | |

| (93,456,703 | ) | |

| (1,321,573 | ) | |

| (181,055 | ) |

| Net (loss) income | |

| (103,778,418 | ) | |

| 55,886,298 | | |

| 7,656,391 | | |

| (37,873,274 | ) | |

| 299,815,046 | | |

| 41,074,495 | |

| Net (loss) income attributable to Cango Inc.’s shareholders | |

| (103,778,418 | ) | |

| 55,886,298 | | |

| 7,656,391 | | |

| (37,873,274 | ) | |

| 299,815,046 | | |

| 41,074,495 | |

| (Loss) income per ADS attributable to ordinary shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.95 | ) | |

| 0.54 | | |

| 0.07 | | |

| (0.31 | ) | |

| 2.88 | | |

| 0.39 | |

| Diluted | |

| (0.95 | ) | |

| 0.48 | | |

| 0.07 | | |

| (0.31 | ) | |

| 2.57 | | |

| 0.35 | |

| Weighted average ADS used to compute earnings per ADS attributable to ordinary shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 109,101,164 | | |

| 103,360,485 | | |

| 103,360,485 | | |

| 121,524,393 | | |

| 104,098,809 | | |

| 104,098,809 | |

| Diluted | |

| 109,101,164 | | |

| 116,491,043 | | |

| 116,491,043 | | |

| 121,524,393 | | |

| 116,516,361 | | |

| 116,516,361 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive (loss) income, net of tax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (34,347,812 | ) | |

| 54,079,188 | | |

| 7,408,818 | | |

| 45,489,264 | | |

| 41,032,858 | | |

| 5,621,478 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive (loss) income | |

| (138,126,230 | ) | |

| 109,965,486 | | |

| 15,065,209 | | |

| 7,615,990 | | |

| 340,847,904 | | |

| 46,695,973 | |

| Total comprehensive (loss) income attributable to Cango Inc.’s shareholders | |

| (138,126,230 | ) | |

| 109,965,486 | | |

| 15,065,209 | | |

| 7,615,990 | | |

| 340,847,904 | | |

| 46,695,973 | |

CANGO INC.

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(Amounts in Renminbi ("RMB") and US dollar ("US$"), except for number of shares and per share data

| | |

For the three months ended | | |

For the years ended | |

| | |

December 31, 2023 | | |

December 31, 2024 | | |

December 31, 2023 | | |

December 31, 2024 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net (loss) income | |

| (103,778,418 | ) | |

| 55,886,298 | | |

| 7,656,391 | | |

| (37,873,274 | ) | |

| 299,815,046 | | |

| 41,074,495 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Add: Share-based compensation expenses | |

| 4,592,933 | | |

| 3,300,621 | | |

| 452,183 | | |

| 38,490,513 | | |

| 17,114,743 | | |

| 2,344,710 | |

| Cost of revenue | |

| 266,712 | | |

| 1,082,252 | | |

| 148,268 | | |

| 2,187,338 | | |

| 1,719,572 | | |

| 235,580 | |

| Sales and marketing | |

| 968,854 | | |

| 352,887 | | |

| 48,345 | | |

| 7,715,989 | | |

| 2,903,897 | | |

| 397,832 | |

| General and administrative | |

| 3,120,759 | | |

| 1,865,482 | | |

| 255,570 | | |

| 26,831,755 | | |

| 12,234,590 | | |

| 1,676,132 | |

| Research and development | |

| 236,608 | | |

| - | | |

| - | | |

| 1,755,431 | | |

| 256,684 | | |

| 35,166 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net (loss) income | |

| (99,185,485 | ) | |

| 59,186,919 | | |

| 8,108,574 | | |

| 617,239 | | |

| 316,929,789 | | |

| 43,419,205 | |

| Net (loss) income attributable to Cango Inc.’s shareholders | |

| (99,185,485 | ) | |

| 59,186,919 | | |

| 8,108,574 | | |

| 617,239 | | |

| 316,929,789 | | |

| 43,419,205 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net (loss) income per ADS-basic | |

| (0.91 | ) | |

| 0.57 | | |

| 0.08 | | |

| 0.01 | | |

| 3.04 | | |

| 0.42 | |

| Non-GAAP adjusted net (loss) income per ADS-diluted | |

| (0.91 | ) | |

| 0.51 | | |

| 0.07 | | |

| 0.00 | | |

| 2.72 | | |

| 0.37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average ADS outstanding—basic | |

| 109,101,164 | | |

| 103,360,485 | | |

| 103,360,485 | | |

| 121,524,393 | | |

| 104,098,809 | | |

| 104,098,809 | |

| Weighted average ADS outstanding—diluted | |

| 109,101,164 | | |

| 116,491,043 | | |

| 116,491,043 | | |

| 126,940,244 | | |

| 116,516,361 | | |

| 116,516,361 | |

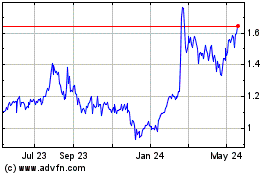

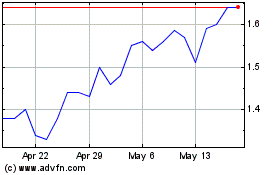

Cango (NYSE:CANG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cango (NYSE:CANG)

Historical Stock Chart

From Mar 2024 to Mar 2025