Achieved Revenue, Net Income, Gross Margin and

Adjusted EBITDA Growth

Achieves Record Quarterly Adjusted EBITDA of

$22.8 Million and Adjusted EBITDA Margin of 18.8%

Expects Full-Year 2023 Net Sales of $427 to

$484 Million and Raises 2023 Full-Year Adjusted EBITDA Range to $80

to $84 Million

Cadre Holdings, Inc. (NYSE: CDRE) ("Cadre" or "the Company"), a

global leader in the manufacturing and distribution of safety and

survivability equipment for first responders, announced today its

consolidated operating results for the three and six months ended

June 30, 2023.

- Net sales of $121.1 million for the second quarter; net sales

of $232.8 million for the six months ended June 30, 2023

- Gross profit margin of 41.9% for the second quarter; gross

profit margin of 41.8% for the six months ended June 30, 2023

- Net income of $11.0 million, or $0.29 per diluted share, for

the second quarter; net income of $18.0 million, or $0.48 per

diluted share, for the six months ended June 30, 2023

- Adjusted EBITDA of $22.8 million for the second quarter;

Adjusted EBITDA of $41.4 million for the six months ended June 30,

2023

- Adjusted EBITDA margin of 18.8% for the second quarter;

Adjusted EBITDA margin of 17.8% for the six months ended June 30,

2023

- Declared quarterly cash dividend of $0.08 per share in July

2023

“Our significant momentum continued in the second quarter, as we

generated improvements in quarterly net sales, adjusted EBITDA, and

net income both sequentially and year-over-year,” said Warren

Kanders, CEO and Chairman. “Based on outstanding strategic

execution and strong and recurring demand for our best-in-class

mission-critical safety and survivability equipment, we are pleased

to increase our full year 2023 adjusted EBITDA outlook. We

continued to make progress expanding margins in the second quarter,

driven by further implementation of our resilient and proven

operating model. Our Q2 adjusted EBITDA margin of 18.8% was our

highest since going public, with gross margins increasing 530 basis

points compared to last year.”

Mr. Kanders added, “The consistency and strength of our

financial results are a testament to Cadre’s innovative product

offering, premium brands, and superior execution, underpinned by

leading positions in law enforcement, first responder and military

markets. We remain on track to deliver record full year net sales

in 2023 and are ideally positioned to capitalize on organic and

inorganic opportunities ahead to further enhance our market

leadership over the long-term. As we continue to actively evaluate

a robust pipeline of potential M&A transactions, we are

steadfast in our patient and disciplined approach and focus on high

margin companies with leading market positions and strong recurring

revenues and cash flows.”

Second Quarter and Six-Month 2023 Operating Results

For the quarter ended June 30, 2023, Cadre generated net sales

of $121.1 million, as compared to $118.2 million for the quarter

ended June 30, 2022. The increase was primarily the result of the

Cyalume acquisition, armor and holster volume, and agency demand

for hard goods, partially offset by timing for our EOD

products.

For the six months ended June 30, 2023, Cadre generated net

sales of $232.8 million, as compared to $222.6 million for the six

months ended June 30, 2022, mainly driven by recent acquisitions,

armor and holster volume, and agency demand for hard goods,

partially offset by timing for our EOD products.

For the quarter ended June 30, 2023, Cadre generated gross

profit of $50.7 million, as compared to $43.2 million for the

quarter ended June 30, 2022. For the six months ended June 30,

2023, Cadre generated gross profit of $97.4 million, as compared to

$83.4 million for the prior year period.

Gross profit margin was 41.9% for the quarter ended June 30,

2023, as compared to 36.6% for the quarter ended June 30, 2022,

mainly driven by favorable pricing, favorable product mix, prior

year amortization of inventory step up related to acquisitions and

productivity net of inflation. Gross profit margin was 41.8% for

the six months ended June 30, 2023, as compared to 37.5% for the

prior year period.

Net income was $11.0 million for the quarter ended June 30,

2023, as compared to $4.4 million for the three months ended June

30, 2022. The increase resulted primarily from the change in

year-over-year revenue and the increase in gross profit margin.

Net income was $18.0 million for the six months ended June 30,

2023, as compared to a net loss of $5.7 million for the prior year

period, primarily due to the change in year-over-year revenue, the

increase in gross profit margin, and a decrease in stock-based

compensation expense.

Cadre generated $22.8 million of Adjusted EBITDA for the quarter

ended June 30, 2023, as compared to $18.4 million for the quarter

ended June 30, 2022. Adjusted EBITDA margin was 18.8% for the

quarter ended June 30, 2023, as compared to 15.6% for the prior

year period.

Cadre generated $41.4 million of Adjusted EBITDA for the six

months ended June 30, 2023, as compared to $32.6 million for the

prior period. Adjusted EBITDA margin was 17.8% for the six months

ended June 30, 2023, as compared to 14.6% for the prior year

period.

Product segment gross margin was 43.7% and 43.6% for the second

quarter and first half of 2023, respectively, compared to 39.0% and

39.5% for the prior year periods.

Distribution segment gross margin was 23.1% and 23.6% for the

second quarter and first half of 2023, respectively, compared to

18.2% and 21.4% for the prior year periods.

Liquidity, Cash Flows and Capital Allocation

- Cash and cash equivalents increased by $10.5 million from $45.3

million as of December 31, 2022 to $55.8 million as of June 30,

2023.

- Total debt decreased by $7.0 million from $149.7 million as of

December 31, 2022, to $142.7 million as of June 30, 2023.

- Net Debt (total debt net of cash and cash equivalents)

decreased by $17.4 million from $104.4 million as of December 31,

2022, to $87.0 million as of June 30, 2023.

- Capital expenditures totaled $1.5 million for the second

quarter and $2.5 million for the six months ended June 30, 2023,

compared with $1.4 million for the second quarter and $2.5 million

for the six months ended June 30, 2022.

Dividend

On July 25, 2023, the Company announced that its Board of

Directors declared a quarterly cash dividend of $0.08 per share, or

$0.32 per share on an annualized basis. Cadre's dividend payment

will be made on August 18, 2023, to shareholders of record as of

the close of business on the record date of August 4, 2023. The

declaration of any future dividend is subject to the discretion of

the Company's Board of Directors.

2023 Outlook Update

As a result of the Company's second-quarter performance and

management's outlook for the remainder of the year, Cadre increased

its full-year Adjusted EBITDA guidance. For the full year 2023,

Cadre expects to generate net sales in the range of $472 million to

$484 million and Adjusted EBITDA in the range of $80 million to $84

million. We expect capital expenditures to be in the range of $8.0

million to $9.0 million.

Conference Call

Cadre management will host a conference call on Tuesday, August

8, 2023, at 5:00 PM EST to discuss the latest corporate

developments and financial results. The dial-in number for callers

in the US is (888)-510-2553 and the dial-in number for

international callers is (646)-960-0473. The access code for all

callers is 1410384. A live webcast will also be available on the

Company’s website at https://www.cadre-holdings.com/.

A replay of the call will be available through August 22, 2023.

To access the replay, please dial (800)-770-2030 in the U.S. or

+1-647-362-9199 if outside the U.S., and then enter the access code

1410384.

About Cadre

Headquartered in Jacksonville, Florida, Cadre is a global leader

in the manufacturing and distribution of safety and survivability

products for first responders. Cadre's equipment provides critical

protection to allow users to safely and securely perform their

duties and protect those around them in hazardous or

life-threatening situations. The Company's core products include

body armor, explosive ordnance disposal equipment, and duty gear.

Our highly engineered products are utilized in over 100 countries

by federal, state and local law enforcement, fire and rescue

professionals, explosive ordnance disposal teams, and emergency

medical technicians. Our key brands include Safariland® and

Med-Eng®, amongst others.

Use of Non-GAAP Measures

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”). The press

release contains the non-GAAP measures: (i) earnings before

interest, taxes, other income or expense, depreciation and

amortization (“EBITDA”), (ii) adjusted EBITDA and (iii) adjusted

EBITDA margin. The Company believes the presentation of these

non-GAAP measures provides useful information for the understanding

of its ongoing operations and enables investors to focus on

period-over-period operating performance, and thereby enhances the

user’s overall understanding of the Company’s current financial

performance relative to past performance and provides, along with

the nearest GAAP measures, a baseline for modeling future earnings

expectations. Non-GAAP measures are reconciled to comparable GAAP

financial measures within this press release. The Company cautions

that non-GAAP measures should be considered in addition to, but not

as a substitute for, the Company’s reported GAAP results.

Additionally, the Company notes that there can be no assurance that

the above referenced non-GAAP financial measures are comparable to

similarly titled financial measures used by other publicly traded

companies.

Forward-Looking Statements

Except for historical information, certain matters discussed in

this press release may be forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include but are not limited to all

projections and anticipated levels of future performance.

Forward-looking statements involve risks, uncertainties and other

factors that may cause our actual results to differ materially from

those discussed herein. Any number of factors could cause actual

results to differ materially from projections or forward-looking

statements in this press release, including, but not limited to,

those risks and uncertainties more fully described from time to

time in the Company’s public reports filed with the Securities and

Exchange Commission, including under the section titled “Risk

Factors” in the Company's Annual Report on Form 10-K, and/or

Quarterly Reports on Form 10-Q, as well as in the Company’s Current

Reports on Form 8-K. All forward-looking statements included in

this press release are based upon information available to the

Company as of the date of this press release and speak only as of

the date hereof. We assume no obligation to update any

forward-looking statements to reflect events or circumstances after

the date of this press release.

CADRE HOLDINGS, INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except share

and per share amounts)

June 30, 2023

December 31, 2022

Assets

Current assets

Cash and cash equivalents

$

55,782

$

45,286

Accounts receivable, net of allowance for

doubtful accounts of $800 and $924, respectively

57,361

64,557

Inventories

82,777

70,273

Prepaid expenses

10,009

10,091

Other current assets

6,406

6,811

Total current assets

212,335

197,018

Property and equipment, net of accumulated

depreciation and amortization of $47,046 and $42,694,

respectively

44,531

45,285

Operating lease assets

6,657

8,489

Deferred tax assets, net

2,351

2,255

Intangible assets, net

46,919

50,695

Goodwill

81,560

81,576

Other assets

5,566

6,634

Total assets

$

399,919

$

391,952

Liabilities, Mezzanine Equity and

Shareholders' Equity

Current liabilities

Accounts payable

$

29,640

$

23,406

Accrued liabilities

34,480

38,720

Income tax payable

4,279

4,584

Liabilities held for sale

—

—

Current portion of long-term debt

10,022

12,211

Total current liabilities

78,421

78,921

Long-term debt

132,712

137,476

Long-term operating lease liabilities

3,211

4,965

Deferred tax liabilities

3,759

3,508

Other liabilities

1,314

1,192

Total liabilities

219,417

226,062

Mezzanine equity

Preferred stock ($0.0001 par value,

10,000,000 shares authorized, no shares issued and outstanding as

of June 30, 2023 and December 31, 2022)

—

—

Shareholders' equity

Common stock ($0.0001 par value,

190,000,000 shares authorized, 37,586,031 and 37,332,271 shares

issued and outstanding as of June 30, 2023 and December 31, 2022,

respectively)

4

4

Additional paid-in capital

208,492

206,540

Accumulated other comprehensive income

2,746

2,087

Accumulated deficit

(30,740

)

(42,741

)

Total shareholders’ equity

180,502

165,890

Total liabilities, mezzanine equity and

shareholders' equity

$

399,919

$

391,952

CADRE HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(In thousands, except share

and per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net sales

$

121,087

$

118,232

$

232,835

$

222,638

Cost of goods sold

70,340

75,011

135,470

139,228

Gross profit

50,747

43,221

97,365

83,410

Operating expenses

Selling, general and administrative

34,051

32,749

69,301

86,699

Restructuring and transaction costs

693

1,203

693

1,802

Related party expense

115

1,112

263

1,234

Total operating expenses

34,859

35,064

70,257

89,735

Operating income (loss)

15,888

8,157

27,108

(6,325

)

Other expense

Interest expense

(1,013

)

(1,439

)

(2,654

)

(2,929

)

Other income (expense), net

346

(756

)

710

(961

)

Total other expense, net

(667

)

(2,195

)

(1,944

)

(3,890

)

Income (loss) before provision for income

taxes

15,221

5,962

25,164

(10,215

)

(Provision) benefit for income taxes

(4,229

)

(1,517

)

(7,170

)

4,495

Net income (loss)

$

10,992

$

4,445

$

17,994

$

(5,720

)

Net income (loss) per share:

Basic

$

0.29

$

0.13

$

0.48

$

(0.16

)

Diluted

$

0.29

$

0.12

$

0.48

$

(0.16

)

Weighted average shares

outstanding:

Basic

37,586,031

35,320,314

37,480,367

34,888,703

Diluted

37,850,708

35,688,620

37,758,998

34,888,703

CADRE HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(In thousands)

Six Months Ended June

30,

2023

2022

Cash Flows From Operating

Activities:

Net income (loss)

$

17,994

$

(5,720

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

8,220

7,380

Amortization of original issue discount

and debt issue costs

374

367

Amortization of inventory step-up

—

1,344

Deferred income taxes

14

(4,594

)

Stock-based compensation

4,852

26,327

Gain on sale of fixed assets

(108

)

—

(Recoveries from) provision for losses on

accounts receivable

(21

)

240

Foreign exchange (gain) loss

(776

)

1,107

Other

(325

)

—

Changes in operating assets and

liabilities, net of impact of acquisitions:

Accounts receivable

7,605

(3,243

)

Inventories

(11,986

)

(1,461

)

Prepaid expenses and other assets

3,397

3,616

Accounts payable and other liabilities

(971

)

(345

)

Net cash provided by operating

activities

28,269

25,018

Cash Flows From Investing

Activities:

Purchase of property and equipment

(2,404

)

(2,473

)

Proceeds from disposition of property and

equipment

206

—

Business acquisitions, net of cash

acquired

—

(55,039

)

Net cash used in investing activities

(2,198

)

(57,512

)

Cash Flows From Financing

Activities:

Proceeds from revolving credit

facilities

—

48,000

Principal payments on revolving credit

facilities

—

(48,000

)

Principal payments on term loans

(5,000

)

(5,009

)

Principal payments on insurance premium

financing

(2,189

)

(2,853

)

Payment of capital leases

—

(22

)

Taxes paid in connection with employee

stock transactions

(2,725

)

(6,216

)

Proceeds from secondary offering, net of

underwriter discounts

—

49,703

Deferred offering costs

—

(2,715

)

Dividends distributed

(5,993

)

(5,533

)

Net cash (used in) provided by financing

activities

(15,907

)

27,355

Effect of foreign exchange rates on cash

and cash equivalents

332

144

Change in cash and cash equivalents

10,496

(4,995

)

Cash and cash equivalents, beginning of

period

45,286

33,857

Cash and cash equivalents, end of

period

$

55,782

$

28,862

Supplemental Disclosure of Cash Flows

Information:

Cash paid for income taxes, net

$

7,288

$

241

Cash paid for interest

$

4,859

$

2,330

Supplemental Disclosure of Non-Cash

Investing and Financing Activities:

Accruals and accounts payable for capital

expenditures

$

129

$

17

CADRE HOLDINGS, INC.

SEGMENT INFORMATION

(Unaudited)

(In thousands)

Three Months Ended June 30,

2023

Reconciling

Product

Distribution

Items(1)

Total

Net sales

$

103,368

$

25,726

$

(8,007

)

$

121,087

Cost of goods sold

58,216

19,779

(7,655

)

70,340

Gross profit

$

45,152

$

5,947

$

(352

)

$

50,747

Three Months Ended June 30,

2022

Reconciling

Product

Distribution

Items(1)

Total

Net sales

$

99,837

$

23,728

$

(5,333

)

$

118,232

Cost of goods sold

60,947

19,406

(5,342

)

75,011

Gross profit

$

38,890

$

4,322

$

9

$

43,221

Six Months Ended June 30,

2023

Reconciling

Product

Distribution

Items(1)

Total

Net sales

$

196,562

$

50,386

$

(14,113

)

$

232,835

Cost of goods sold

110,824

38,476

(13,830

)

135,470

Gross profit

$

85,738

$

11,910

$

(283

)

$

97,365

Six Months Ended June 30,

2022

Reconciling

Product

Distribution

Items(1)

Total

Net sales

$

185,223

$

47,824

$

(10,409

)

$

222,638

Cost of goods sold

112,067

37,578

(10,417

)

139,228

Gross profit

$

73,156

$

10,246

$

8

$

83,410

_______________________________

(1)

Reconciling items consist

primarily of intercompany eliminations and items not directly

attributable to operating segments.

CADRE HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited)

(In thousands)

Year ended

Three Months

Three Months Ended

Six Months Ended

Last Twelve

December 31,

Ended March 31,

June 30,

June 30,

Months

2022

2023

2023

2022

2023

2022

June 30, 2023

Net income (loss)

$

5,820

$

7,002

$

10,992

$

4,445

$

17,994

$

(5,720

)

$

29,534

Add back:

Depreciation and amortization

15,651

4,261

3,959

3,836

8,220

7,380

16,491

Interest expense

6,206

1,641

1,013

1,439

2,654

2,929

5,931

Provision (benefit) for income taxes

3,553

2,941

4,229

1,517

7,170

(4,495

)

15,218

EBITDA

$

31,230

$

15,845

$

20,193

$

11,237

$

36,038

$

94

$

67,174

Add back:

Restructuring and transaction costs(1)

5,355

—

693

2,203

693

2,802

3,246

Other general income(2)

(159

)

—

—

—

—

—

(159

)

Other expense (income), net(3)

1,137

(364

)

(346

)

756

(710

)

961

(534

)

Stock-based compensation expense(4)

32,239

2,747

2,105

2,818

4,852

26,541

10,550

Stock-based compensation payroll tax

expense(5)

305

220

—

7

220

305

220

LTIP bonus(6)

1,369

144

160

174

304

558

1,115

Amortization of inventory step-up(7)

4,255

—

—

1,191

—

1,344

2,911

Adjusted EBITDA

$

75,731

$

18,592

$

22,805

$

18,386

$

41,397

$

32,605

$

84,523

Adjusted EBITDA margin(8)

16.5

%

16.6

%

18.8

%

15.6

%

17.8

%

14.6

%

________________________

(1)

Reflects the “Restructuring and

transaction costs” line item on our consolidated statement of

operations, which primarily includes transaction costs composed of

legal and consulting fees, and $1.0 million paid to Kanders &

Company, Inc., a company controlled by our Chief Executive Officer,

for services related to the acquisition of Cyalume, which is

included in related party expense in the Company’s consolidated

statements of operations for the year ended December 31, 2022.

(2)

Reflects the “Other general

income” line item on our consolidated statement of operations and

includes a gain from a long-lived asset sale.

(3)

Reflects the “Other (income)

expense, net” line item on our consolidated statement of operations

and primarily includes gains and losses on foreign currency

transactions.

(4)

Reflects compensation expense

related to equity and liability classified stock-based compensation

plans.

(5)

Reflects payroll taxes associated

with vested stock-based compensation awards.

(6)

Reflects the cost of a cash-based

long-term incentive plan awarded to employees that vests over three

years.

(7)

Reflects amortization expense

related to the step-up inventory adjustment recorded as a result of

our recent acquisitions.

(8)

Reflects Adjusted EBITDA / Net

Sales for the relevant periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808946301/en/

Gray Hudkins Cadre Holdings, Inc. 203-550-7148

gray.hudkins@cadre-holdings.com Investor Relations: The IGB

Group Leon Berman / Matt Berkowitz 212-477-8438 / 212-227-7098

lberman@igbir.com / mberkowitz@igbir.com Media Contact:

Jonathan Keehner / Andrew Siegel Joele Frank, Wilkinson Brimmer

Katcher 212-355-4449

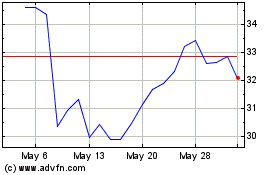

Cadre (NYSE:CDRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cadre (NYSE:CDRE)

Historical Stock Chart

From Jan 2024 to Jan 2025