Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 11 2024 - 7:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

| |

For the month of September, 2024 |

|

Commission File Number: 1-14678 |

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into

English)

CIBC Square, 81 Bay Street

Toronto, Ontario

Canada M5J 0E7

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Date: September 6, 2024 |

|

|

By: |

/s/ Geoff Dillon |

| |

|

|

|

Name: |

Geoff Dillon |

| |

|

|

|

Title: |

Vice-President |

Exhibits

Exhibit

99.1

CIBC Receives TSX Approval for Normal Course

Issuer Bid

TORONTO, Sept. 6, 2024 /CNW/ - CIBC (TSX: CM)

(NYSE: CM) announced today that the Toronto Stock Exchange (TSX) has accepted notice of CIBC's intention to make a normal course issuer

bid (NCIB). As previously announced on August 29, 2024, CIBC intends to purchase for cancellation up to 20 million common shares under

a new NCIB.

TSX approval permits CIBC to purchase for cancellation

from time to time up to 20 million common shares, representing approximately 2.1% of CIBC's 944,972,539 issued and outstanding common

shares as of August 31, 2024. The average daily trading volume for the six months ended August 31, 2024 and the maximum amount of

common shares that could be purchased each day, calculated pursuant to the rules of the TSX for the purposes of the NCIB, were 3,979,727

and 994,931 common shares, respectively.

CIBC's purchase of common shares under a NCIB is consistent

with the bank's priority of maintaining balance sheet strength, while generating shareholder value through a balanced capital deployment

strategy.

Purchases under the bid may commence through the TSX

on or after September 10, 2024 and may also be made through alternative Canadian trading systems, the NYSE and by other such means

as may be permitted by the Ontario Securities Commission or other applicable Canadian Securities Administrators. The bid will be completed upon

the earlier of (i) CIBC purchasing 20 million common shares, (ii) CIBC providing a notice of termination, or (iii) September 9, 2025.

CIBC Capital Markets has been retained to act as designated broker to repurchase CIBC shares pursuant to the bid. The price paid for the

common shares will be the market price at the time of the purchase. The common shares purchased under the NCIB will be cancelled.

CIBC has also entered into an automatic share purchase

plan (ASPP) with CIBC Capital Markets. Under the ASPP, CIBC Capital Markets may purchase common shares at times when CIBC ordinarily would

not be active in the market due to insider trading rules and its own internal trading blackout periods. Purchases will be made by CIBC

Capital Markets based upon parameters set by CIBC prior to the commencement of any such blackout period and in accordance with the terms

of the ASPP. The ASPP has been approved by the TSX.

CIBC's previous normal course issuer bid for

the purchase of up to 20 million common shares commenced on December 13, 2021 and expired on December 12, 2022. Over the term of the previous

bid, CIBC purchased 1.8 million of its common shares for cancellation at an average price of $74.43 per share.

A NOTE ABOUT FORWARD-LOOKING STATEMENTS: From time

to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including in this press release,

in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. These

statements include, but are not limited to, statements about our potential normal course issuer bid purchases and about our financial

condition, priorities, targets, ongoing objectives, strategies and outlook. Forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific. A variety of factors, many of which are beyond our control, could cause actual results

to differ materially from the expectations expressed in any of our forward-looking statements, including general business and economic

conditions worldwide; amendments to, and interpretations of, risk-based capital guidelines; and changes in monetary and economic policy.

We do not undertake to update any forward-looking statement except as required by law.

About CIBC

CIBC is a leading North American financial institution

with 14 million personal banking, business, public sector and institutional clients. Across Personal and Business Banking, Commercial

Banking and Wealth Management, and Capital Markets, CIBC offers a full range of advice, solutions and services through its leading digital

banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more

information about CIBC can be found at www.cibc.com/ca/media-centre.

SOURCE CIBC

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c7905.html

%CIK: 0001045520

For further information: For further information: Investor Relations:

Jason Patchett, 416-980-8691, jason.patchett@cibc.com; Investor & Financial Communications, Erica Belling, 416-594-7251, erica.belling@cibc.com

CO: CIBC

CNW 09:00e 06-SEP-24

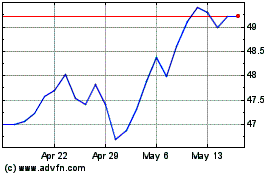

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Nov 2023 to Nov 2024