UPDATE: ING Confirms It May Sell Car Leasing Unit

June 20 2011 - 6:22AM

Dow Jones News

ING Groep NV (INGA.AE), the Dutch financial-services company

that needed state aid to get through the financial crisis, Monday

confirmed reports that it may sell its European car leasing unit in

a move that will further reduce the scale of the financial

giant.

ING, the Netherlands' biggest financial company by assets, said

that it is reviewing strategic options for the business, which

includes talks with "third parties interested in a potential

acquisition." It will give more details in due course, it said in a

statement.

Dutch daily Het Financieele Dagblad reported Monday that a

transaction could total EUR4 billion, as a buyer would have to take

over EUR3 billion in debt and bolster the unit's capital buffer by

around EUR750 million.

ING wasn't immediately available to comment on these

figures.

ING Car Lease is not on the list of assets that ING was ordered

to sell by the European Commission as a condition for the EUR10

billion state aid it received during the financial crisis. However,

the unit can be added to over EUR5.5 billion in assets ING has sold

off under a restructuring program that aims to make the company

less complex.

Meanwhile, the Amsterdam-based group is also in the midst of a

restructuring ordered by the European Commission, in which it will

divest its insurance business and some bank assets. The divestments

will nearly halve ING's EUR1.3 trillion balance sheet and will

transform the global financial giant into a European-focused bank

that generates the bulk of its profit in Benelux countries.

ING last week kicked off the disposal program by announcing the

sale of Internet bank ING Direct USA to Capital One Financial Corp.

(COF) in a $9 billion deal. While the sale was welcomed by

investors, analysts said ING didn't get the best possible

price.

SNS Securities analyst Lemer Salah said he was "positively

surprised" that ING now plans to sell ING Car Lease, which has a

fleet of 240,000 cars and operates in eight European countries. He

said the timing may be right as the car leasing market is gradually

improving, after experiencing a slump in 2008 and 2009.

Potential bidders could be the car-leasing units of BMW AG

(BMW.XE), Volkswagen AG (VOW.XE) and General Electric Co. (GE), Het

Financieele Dagblad wrote. Other bidders may include Arval, a unit

of BNP Paribas SA (BNP.FR), and Athlon Car Lease, which is owned by

Dutch Rabobank Group.

At 1034 GMT, ING shares were 2.4% lower at EUR8.

-By Maarten van Tartwijk, Dow Jones Newswires; +31 20 571 5201;

maarten.vantartwijk@dowjones.com

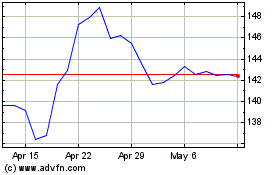

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

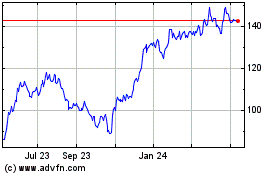

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024