Fed OK's Capital One-ING Direct Deal - Analyst Blog

February 15 2012 - 9:55AM

Zacks

It’s a ‘YES’ for Capital One Financial

Corporation’s (COF) plan to acquire ING Direct USA, the

online banking unit of Amsterdam-based ING Groep

NV (ING). On Tuesday, the Federal Reserve finally approved

the deal. The consent removes the doubt that the acquisition would

create the next ‘too-big-to fail’ banking institution.

In June 2011, COF had announced that it would acquire ING Direct

in a stock-cum-cash transaction. As per the terms of the deal, the

company would pay $6.2 billion in cash and $2.8 billion in stock to

ING Groep. For this, the company will offer 55.9 million shares to

ING Groep at $50.07 per share, making ING Groep the largest single

shareholder in COF. Now, the company is expected to close the deal

over the next few days.

This deal will enable COF to move to the fifth position from the

present eighth, in terms of deposits in the U.S. Additionally, ING

Direct, with about 7.7 million customers in its kitty, would

further enhance the company’s market share in the online banking

sector.

Reasons for the Delay in Approval

Following the announcement of the agreement in June 2011,

serious concerns were raised by Congressman Barney Frank and the

National Community Reinvestment Coalition (NCRC) against COF-ING

Direct deal. According to them, the deal would limit the consumer

access to banking and credit services as well as would heighten the

risks to the financial system of a new ‘too-big-to-fail’

institution.

The COF-ING Direct deal became the first acquisition agreement

that was reviewed by the Fed under the provisions of the Dodd-Frank

Act. The Fed, under the Dodd-Frank Act, was required to weigh the

systematic risks of the deal before giving it the regulatory

nod.

Hence, the Fed held three public hearings on the proposed

acquisition during September-October 2011. The Fed had also

extended the period for public comment on the abovementioned

agreement.

Reasons for the ‘YES’

The Fed thoroughly analyzed the COF-ING Direct deal and

scrutinized whether the proposed agreement would benefit the public

at large with better efficiency, increased competition as well as

greater convenience. These benefits should outweigh the adverse

affects that include unfair competition, unstable banking

practices, conflicts of interest and risk to the stability of the

U.S. financial system.

The Fed also took into consideration various factors including

complexity and size of both the companies, their regulatory capital

ratios before and after the completion of the agreement, asset

quality and inter-relation between the companies and the economy as

a whole. Furthermore, the Fed also considered the other pending COF

agreement relating to the acquisition of HSBC Holdings

Plc’s (HBC) U.S. credit card unit.

The Fed stated that COF has a record of successfully integrating

large companies with its business operations. Since 2005, the

company has integrated three banks – Hibernia Corporation in 2005,

North Fork Bancorporation in 2006, and Chevy Chase Bank in

2009.

Moreover, while building the case in its favor, COF guaranteed

$180 billion in community loans and investments over the next 10

years. This includes $28.5 billion worth of home lending to

borrowers, who are characterized as low-and moderate-income group.

In addition to all these, the company announced its plans to hire

workers in Delaware.

However, the approval came with a set of conditions. The Fed has

asked COF to restructure its risk-management framework and lending,

and debt-collection practices. The company has 90 days to fulfill

these conditions.

In Conclusion

Following the completion of COF-ING Direct deal, COF’s

shareholders and clients will benefit over the long term. The

combined entity will create a valuable banking franchise to take

advantage of a large number of branch banking in attractive

high-growth markets and to gain from an online banking franchise

with a national reach.

Additionally, COF’s credit lending business would further get a

boost from nearly $80 billion of deposits that the company is about

to receive with the closure of the ING Direct deal. Moreover, given

the sound capital position and stable balance sheet, the company

will be able to further de-risk its balance sheet, and provide its

customers with better access to banking services.

Currently, Capital One retains a Zacks #3 Rank, which translates

into a short-term Hold rating. However, considering the

fundamentals, we maintain a long-term Neutral recommendation on the

stock.

CAPITAL ONE FIN (COF): Free Stock Analysis Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

ING GROEP-ADR (ING): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

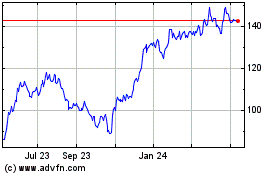

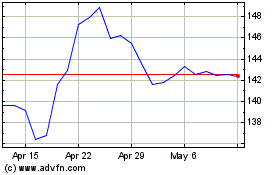

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2024 to Aug 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Aug 2023 to Aug 2024