Credit Giants Get Cautious Over U.S. Consumers -- WSJ

October 30 2018 - 2:02AM

Dow Jones News

By AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 30, 2018).

Two of the biggest credit-card issuers are tightening lending

standards, an unusual move in a strong economy that may signal

longer-term concerns about consumers' financial health.

Capital One Financial Corp. and Discover Financial Services said

last week they have become more cautious in how they're handling

credit limits. The two lenders said they don't currently see signs

of deterioration in consumers' ability to pay their debts but do

question how much longer the economic recovery will last.

"In so many ways, one can't help but be struck by...just how

good the economy [at] this point is," Capital One Chief Executive

Richard Fairbank said on the company's earnings call. "And in some

ways, it almost feels too good to be true."

Credit-card limits have long served as an indicator of lenders'

outlook. During the last financial downturn, card issuers slashed

credit limits to avoid incurring new losses. Around 2015, many

lenders began increasing limits as they courted more balances and

interest income.

Capital One and Discover are gauges of many Americans' ability

to handle debt. Discover generally doesn't market to affluent

customers, and Capital One has a large number of customers with

less-than-pristine credit scores, making both companies a window

into a part of the economy that is often the first to show cracks.

Some 33% of Capital One's domestic card balances, for example, are

owed by subprime borrowers, according to the bank.

The biggest banks have in recent years targeted affluent

customers with above-average credit. Banks like JPMorgan Chase

& Co. and Citigroup Inc. reported earnings earlier this month

that pointed to consumers' continued strength.

Capital One and Discover, on the other hand, signaled they are

paying more attention to how consumers use their cards' spending

limits. Mr. Fairbank said on the earnings call that the company had

"further dialed back" during the past year on spending limits for

newly issued credit cards and on raising existing cardholders'

spending limits.

Discover said it reduced the number of credit-card balance

transfer offers to a group of consumers it considers to be higher

risk. That was in part to avoid consumers who would likely transfer

a balance to a Discover credit card that would max out their

spending limits, CEO Roger Hochschild said in an interview. He said

the move is a "nuanced example of tightening."

Separately, Discover has shut down inactive credit cards

totaling nearly $30 billion in spending limits over the past two

years. The effort is in part aimed at lessening the chances that

credit cards that have been abandoned in sock drawers or elsewhere

will suddenly start being used by cardholders if they become

desperate for credit.

Discover also said it expects losses to increase on personal

loans, and it has cut back on originations there.

"It really is about reducing risk," Mr. Hochschild said. "By

traditional measures we're pretty late into an economic cycle."

The renewed caution comes in part because consumers have been

taking on record levels of debt. The total dollar amount

outstanding on credit cards, personal loans, student loans and auto

loans in the U.S. has never been higher.

Rising interest rates also play a role. The rates charged on

credit cards, for example, generally rise when the Federal Reserve

raises rates, leading to larger required payments for consumers.

The Fed has raised short-term rates three times this year.

One sign of a pullback is playing out in the subprime portion of

the credit-card market. Subprime borrowers who were approved for

new credit cards in the first quarter received an average spending

limit of $949, down 10% from a year earlier, according to the

latest data from credit-reporting firm TransUnion. That was the

sixth consecutive quarterly drop since a postrecession peak of

$1,155 in 2016.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

October 30, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

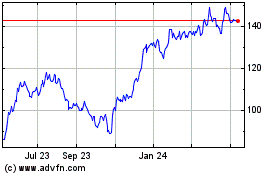

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

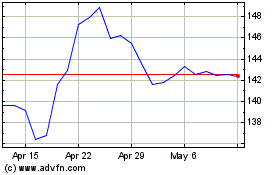

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024