0000016732false00000167322024-03-122024-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of Earliest Event Reported):

March 12, 2024

CAMPBELL SOUP COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| New Jersey | | 1-3822 | | 21-0419870 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

One Campbell Place

Camden, New Jersey 08103-1799

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (856) 342-4800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Capital Stock, par value $.0375 | CPB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On March 12, 2024, Campbell Soup Company, a New Jersey corporation (the “Company”), filed a Current Report on Form 8-K (the “Original Form 8-K”) to announce the completion of its acquisition of Sovos Brands, Inc., a Delaware corporation (“Sovos”), pursuant to the Agreement and Plan of Merger, dated August 7, 2023, among the Company, Sovos and Premium Products Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (the “Transaction”).

This amendment amends and supplements the Original Form 8-K solely to provide the financial statements and pro forma financial information relating to the Transaction required under Item 9.01 of Form 8-K as set forth below, which are incorporated herein by reference, and which were excluded from the Original Form 8-K in reliance on the instructions to such item. This amendment reports no other updates or amendments to the Original Form 8-K. The pro forma financial information included in this amendment has been presented for informational purposes only, as required by Form 8-K. It does not purport to represent the actual results of operations that the Company and Sovos would have achieved had the companies been combined during the periods presented in the pro forma financial information and is not intended to project the future results of operations that the combined company may achieve after completion of the Transaction.

Item 9.01 – Financial Statements and Exhibits

(a) Financial Statements of Business Acquired

Audited consolidated balance sheets as of December 30, 2023 and December 31, 2022 and the related consolidated statements of operations, comprehensive income, stockholders’ equity, and cash flows for each of the fiscal years ended December 30, 2023, December 31, 2022 and December 25, 2021 of Sovos included in Item 8 of Sovos’s Annual Report on Form 10-K (File No. 001-40837) filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2024, are included in Exhibit 99.1 and incorporated herein by reference.

(b) Pro Forma Financial Information

The following unaudited pro forma financial information is attached as Exhibit 99.2 to this Form 8-K/A and incorporated herein by reference:

| | | | | |

| |

(i) | Unaudited Pro Forma Combined Statement of Earnings for the six months ended January 28, 2024; |

| |

(ii) | Unaudited Pro Forma Combined Statement of Earnings for the year ended July 30, 2023; |

| |

(iii) | Unaudited Pro Forma Combined Balance Sheet as of January 28, 2024; and |

| |

(iv) | Notes to Unaudited Pro Forma Combined Financial Statements. |

(d) Exhibits

The following exhibits are filed as a part of this Form 8-K/A:

| | | | | | | | |

| 23 | | |

| 99.1 | | Audited consolidated balance sheets as of December 30, 2023 and December 31, 2022 and the related consolidated statements of operations, comprehensive income, stockholders’ equity, and cash flows for each of the fiscal years ended December 30, 2023, December 31, 2022 and December 25, 2021 of Sovos are incorporated by reference to Item 8 of Sovos’s Annual Report on Form 10-K (File No. 001-40837) filed with the SEC on February 28, 2024. |

| 99.2 | | |

| 104 | | The cover page from this Current Report on Form 8-K/A formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CAMPBELL SOUP COMPANY | |

| | (Registrant) | |

| | | |

| | | |

| Date: May 21, 2024 | By: | /s/ Carrie L. Anderson | |

| | Carrie L. Anderson | |

| | Executive Vice President and Chief | |

| | Financial Officer | |

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-274048 on Form S-3 and Registration Statement Nos. 333-277843, 333-268604, 333-216582, 333-208441, 333-173583, 333-173582, 333-160381, 333-157850, 333-134675, 333-22803, 333-00729 and 033-59797 on Form S-8 of Campbell Soup Company of our report dated February 28, 2024, relating to the financial statements of Sovos Brands, Inc. incorporated by reference in this Current Report on Form 8-K/A dated May 21, 2024.

| | | | | | | | | | | | | | | | | |

|

| | | | | |

/s/ Deloitte & Touche LLP | | | |

| | | | | |

| Denver, Colorado | | | | | |

| | | | | | |

May 21, 2024 |

Exhibit 99.2

Unaudited Pro Forma Combined Financial Information

Introduction

On March 12, 2024 (the “Closing Date”), Campbell Soup Company (“Campbell” or the “Company”) consummated the previously announced transaction with Sovos Brands, Inc. (“Sovos”), pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of August 7, 2023, among the Company, Sovos and Premium Products Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”). Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), Merger Sub merged with and into Sovos, with Sovos surviving as a wholly owned subsidiary of the Company (the “Merger”).

Pursuant to the Merger Agreement, at the Effective Time, each share of common stock, par value $0.001 per share of Sovos (“Sovos Common Stock”) (other than shares of Sovos Common Stock (i) held by Sovos as treasury stock or owned by the Company or Merger Sub immediately prior to the Effective Time, (ii) held by any subsidiary of either Sovos or the Company (other than Merger Sub) immediately prior to the Effective Time and (iii) any dissenting Sovos Common Stock) was canceled and automatically converted into the right to receive an amount in cash equal to $23.00 per share of Sovos Common Stock, without interest (the “Merger Consideration”).

In addition, at the Effective Time:

•Each restricted share of Sovos Common Stock that was outstanding as of immediately prior to the Effective Time (each, “Sovos Restricted Stock”) was canceled in exchange for the Merger Consideration; provided that each share of Sovos Restricted Stock for which vesting was based solely on the achievement of a performance condition and for which the applicable performance condition remained unsatisfied (after giving effect to the Merger) was, in accordance with its existing terms, forfeited to the Sovos Limited Partnership as of immediately prior to the closing for no consideration to the applicable holder thereof and thereafter was converted into the Merger Consideration in accordance with, and subject to the terms of, the Merger Agreement; and

•Each outstanding award of restricted stock units in respect of shares of Sovos Common Stock, including awards of performance-based restricted stock units (each, a “Sovos RSU Award”), that was held by any non-employee director or former service provider of Sovos was canceled at the Effective Time in exchange for the Merger Consideration. All other Sovos RSU Awards were converted upon the Effective Time into time-vesting restricted stock unit awards in respect of common stock of Campbell, par value $0.0375 per share, having equivalent value and terms (including time-based vesting schedule). In the case of Sovos RSU Awards subject to a performance-based vesting condition, such performance conditions were deemed achieved at the target level (i.e., 100%), or if applicable under the existing terms of such awards, the actual level of performance calculated as of the Effective Time (if greater).

In connection with the Merger, Campbell entered into a delayed single draw term loan credit agreement (the “DDTL”) totaling up to $2 billion with a maturity date of October 8, 2024, and issued $860 million of commercial paper (the “Financing”). The proceeds from the DDTL and commercial paper were used for the payment of the Merger Consideration, repayment of Sovos’ existing indebtedness, and fees and expenses incurred in connection with the Merger.

The unaudited pro forma combined financial information has been prepared by Campbell in accordance with Regulation S–X Article 11, Pro Forma Financial Information, as amended by the final rule, Amendments to Financial Disclosures About Acquired and Disposed Businesses, as adopted by the Securities and Exchange Commission on May 20, 2020. The unaudited pro forma combined financial information presented herein has been derived as follows:

•Campbell’s historical financial information as of and for the six months ended January 28, 2024 has been derived from its unaudited consolidated financial statements included in its Quarterly Report on Form 10-Q for the six months ended January 28, 2024.

•Campbell’s historical financial information for the year ended July 30, 2023 has been derived from its consolidated financial statements included in its Annual Report on Form 10-K for the fiscal year ended July 30, 2023.

•The historical financial information of Sovos as of December 30, 2023 has been derived from its consolidated financial statements included in its Annual Report on Form 10-K for the fiscal year ended December 30, 2023 incorporated by reference herein. The Statement of Earnings for the 26 weeks ended December 30, 2023 has been derived from Sovos’ consolidated financial statements for the fiscal year ended December 30, 2023, adjusted to exclude the 26 weeks ended July 1, 2023 included in the unaudited condensed consolidated financial statements included in its Quarterly Report on Form 10-Q for the 26 weeks ended July 1, 2023 (which is not included or incorporated by reference herein).

•The historical financial information of Sovos for the year ended July 1, 2023 has been derived from its consolidated financial statements for the fiscal year ended December 31, 2022 included in its Annual Report on Form 10-K for the fiscal year ended December 30, 2023 and incorporated by reference herein, adjusted to include the 26 weeks ended July 1, 2023 included in the unaudited condensed consolidated financial statements included in its Quarterly Report on Form 10-Q for the 26 weeks ended July 1, 2023, and adjusted to exclude the 26 weeks ended June 25, 2022 included

in the unaudited condensed consolidated financial statements included in its Quarterly Report on Form 10-Q for the 26 weeks ended July 1, 2023 (which is not included or incorporated by reference herein).

The historical financial statements of Campbell and Sovos have been adjusted in the accompanying unaudited pro forma combined financial information to give effect to pro forma events which are necessary to account for the Merger and the Financing (together, the “Transactions”), in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The unaudited pro forma adjustments are based upon available information and certain assumptions that management believes are reasonable.

The acquisition of Sovos will be accounted for as a business combination using the acquisition method with Campbell as the accounting acquirer in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”). Under this method of accounting, the total consideration will be allocated to the assets acquired and liabilities assumed based upon estimated fair values at the Closing Date. Any differences between the fair value of the consideration transferred and the fair value of the assets acquired and liabilities assumed will be recorded as goodwill.

As a result of the foregoing, the unaudited pro forma combined financial information is based on the preliminary information available and management’s preliminary valuation of the fair value of tangible and intangible assets acquired and liabilities assumed. The actual purchase accounting assessment may vary based on final analyses of the valuation of assets acquired and liabilities assumed, and differences could be material. The Company will finalize the accounting for the Transactions as soon as practicable within the measurement period in accordance with ASC 805, but in no event later than one year from the Closing Date.

The unaudited pro forma combined financial information and related notes are provided for illustrative purposes only and do not purport to represent the combined results of operations or financial position had the Transactions been completed on the dates indicated, nor are they indicative of the future results of operations or financial position of the post-combination company.

The unaudited pro forma combined financial information does not give effect to any anticipated synergies, operating efficiencies or cost savings that may be associated with the Transactions. The unaudited pro forma combined financial information also does not include any integration costs the combined company may incur related to the Transactions as part of combining the operations of the companies.

CAMPBELL SOUP COMPANY

Unaudited Pro Forma Combined Statement of Earnings

For the Six Months Ended January 28, 2024

(millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Campbell Soup Company | | Sovos Brands, Inc. | | | | | | | | | | |

| | Six months ended January 28, 2024 | | Six months ended December 30, 2024 | | Transaction Accounting Adjustments | | | | Financing Adjustments | | | | Pro Forma Combined |

| Net sales | | $ | 4,974 | | $ | 550 | | $ | — | | | | $ | — | | | | $ | 5,524 |

| Costs and expenses | | | | | | | | | | | | | | |

| Cost of products sold | | 3,410 | | 386 | | 2 | | B | | — | | | | 3,798 |

| Marketing and selling expenses | | 439 | | 49 | | — | | | | — | | | | 488 |

| Administrative expenses | | 347 | | 57 | | — | | | | — | | | | 404 |

| Research and development expenses | | 49 | | 5 | | — | | | | — | | | | 54 |

| Other expenses / (income) | | 50 | | 11 | | (5) | | G | | — | | | | 56 |

| Restructuring charges | | 4 | | — | | — | | | | — | | | | 4 |

| Total costs and expenses | | 4,299 | | 508 | | (3) | | | | — | | | | 4,804 |

| Earnings before interest and taxes | | 675 | | 42 | | 3 | | | | — | | | | 720 |

| Interest expense | | 95 | | 22 | | (22) | | I | | 91 | | K | | 186 |

| Interest income | | 1 | | 5 | | — | | | | — | | | | 6 |

| Earnings before taxes | | 581 | | 25 | | 25 | | | | (91) | | | | 540 |

| Taxes on earnings | | 144 | | 8 | | 6 | | J | | (21) | | J | | 137 |

| Net earnings | | 437 | | 17 | | 19 | | | | (70) | | | | 403 |

| Less: Net earnings (loss) attributable to noncontrolling interests | | — | | — | | — | | | | — | | | | — |

| Net earnings attributable to Campbell Soup Company | | $ | 437 | | $ | 17 | | $ | 19 | | | | $ | (70) | | | | $ | 403 |

| Per Share — Basic | | | | | | | | | | | | | | |

| Net earnings attributable to Campbell Soup Company | | $ | 1.47 | | | | | | | | | | | | $ | 1.35 |

| Weighted average shares outstanding — basic | | 298 | | | | 1 | | Note 7 | | | | | | 299 |

| Per Share — Assuming Dilution | | | | | | | | | | | | | | |

| Net earnings attributable to Campbell Soup Company | | $ | 1.46 | | | | | | | | | | | | $ | 1.34 |

| Weighted average shares outstanding — assuming dilution | | 299 | | | | 1 | | Note 7 | | | | | | 300 |

See accompanying Notes to Unaudited Pro Forma Combined Financial Statements.

CAMPBELL SOUP COMPANY

Unaudited Pro Forma Combined Statement of Earnings

For the Year Ended July 30, 2023

(millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Campbell Soup Company | | Sovos Brands, Inc. | | | | | | | | | | |

| | | Year ended July 30, 2023 | | Year ended July 1, 2023 | | Transaction Accounting Adjustments | | | | Financing Adjustments | | | | Pro Forma Combined |

| Net sales | | $ | 9,357 | | $ | 941 | | $ | — | | | | $ | — | | | | $ | 10,298 |

| Costs and expenses | | | | | | | | | | | | | | |

| Cost of products sold | | 6,440 | | 662 | | 22 | | A,B,C | | — | | | | 7,124 |

| Marketing and selling expenses | | 811 | | 85 | | — | | | | — | | | | 896 |

| Administrative expenses | | 654 | | 90 | | 40 | | D,E | | — | | | | 784 |

| Research and development expenses | | 92 | | 8 | | — | | | | — | | | | 100 |

| Other expenses / (income) | | 32 | | 77 | | 5 | | F,G | | — | | | | 114 |

| Restructuring charges | | 16 | | — | | 17 | | H | | — | | | | 33 |

| Total costs and expenses | | 8,045 | | 922 | | 84 | | | | — | | | | 9,051 |

| Earnings before interest and taxes | | 1,312 | | 19 | | (84) | | | | — | | | | 1,247 |

| Interest expense | | 188 | | 37 | | (37) | | I | | 184 | | K | | 372 |

| Interest income | | 4 | | 4 | | — | | | | — | | | | 8 |

| Earnings (loss) before taxes | | 1,128 | | (14) | | (47) | | | | (184) | | | | 883 |

| Taxes on earnings | | 270 | | 1 | | (4) | | J | | (43) | | J | | 224 |

| Net earnings (loss) | | 858 | | (15) | | (43) | | | | (141) | | | | 659 |

| Less: Net earnings (loss) attributable to noncontrolling interests | | — | | — | | — | | | | — | | | | — |

| Net earnings (loss) attributable to Campbell Soup Company | | $ | 858 | | $ | (15) | | $ | (43) | | | | $ | (141) | | | | $ | 659 |

| Per Share — Basic | | | | | | | | | | | | | | |

| Net earnings attributable to Campbell Soup Company | | $ | 2.87 | | | | | | | | | | | | $ | 2.20 |

| Weighted average shares outstanding — basic | | 299 | | | | 1 | | Note 7 | | | | | | 300 |

| Per Share — Assuming Dilution | | | | | | | | | | | | | | |

| Net earnings attributable to Campbell Soup Company | | $ | 2.85 | | | | | | | | | | | | $ | 2.18 |

| Weighted average shares outstanding — assuming dilution | | 301 | | | | 1 | | Note 7 | | | | | | 302 |

See accompanying Notes to Unaudited Pro Forma Combined Financial Statements.

CAMPBELL SOUP COMPANY

Unaudited Pro Forma Combined Balance Sheet

As of January 28, 2024

(millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Campbell Soup Company | | Sovos Brands, Inc. (Note 4) | | | | | | | | | | |

| | | As of January 28, 2024 | | As of December 30, 2023 | | Transaction Accounting Adjustments | | | | Financing Adjustments | | | | Pro Forma Combined |

| Current assets | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 169 | | $ | 232 | | $ | (2,901) | | AA,BB, CC,DD,EE | | $ | 2,862 | | PP | | $ | 362 |

| Accounts receivable, net | | 635 | | 98 | | — | | | | — | | | | 733 |

| Inventories | | 1,188 | | 96 | | 16 | | FF | | — | | | | 1,300 |

| Other current assets | | 78 | | 8 | | — | | | | (2) | | PP | | 84 |

| Total current assets | | 2,070 | | 434 | | (2,885) | | | | 2,860 | | | | 2,479 |

| Plant assets, net of depreciation | | 2,470 | | 65 | | 35 | | GG,HH | | — | | | | 2,570 |

| Goodwill | | 3,963 | | 395 | | 742 | | II | | — | | | | 5,100 |

| Other intangible assets, net of amortization | | 3,108 | | 329 | | 1,454 | | JJ | | — | | | | 4,891 |

| Other assets | | 495 | | 12 | | 25 | | DD | | — | | | | 532 |

| Total assets | | $ | 12,106 | | $ | 1,235 | | $ | (629) | | | | $ | 2,860 | | | | $ | 15,572 |

| Current liabilities | | | | | | | | | | | | | | |

| Short-term borrowings | | $ | 14 | | | | $ | — | | | | $ | 2,860 | | PP | | $ | 2,874 |

| Accounts payable | | 1,305 | | 73 | | — | | | | — | | | | 1,378 |

| Accrued liabilities | | 615 | | 75 | | 31 | | BB,CC, EE,KK,LL | | — | | | | 721 |

| Dividends payable | | 113 | | | | — | | | | — | | | | 113 |

| Accrued income taxes | | 9 | | 1 | | (4) | | MM | | — | | | | 6 |

| Total current liabilities | | 2,056 | | 149 | | 27 | | | | 2,860 | | | | 5,092 |

| Long-term debt | | 4,506 | | 484 | | (477) | | CC | | — | | | | 4,513 |

| Deferred taxes | | 1,068 | | 60 | | 344 | | NN | | — | | | | 1,472 |

| Other liabilities | | 625 | | 12 | | 5 | | LL | | — | | | | 642 |

| Total liabilities | | 8,255 | | 705 | | (101) | | | | 2,860 | | | | 11,719 |

| Commitment and contingencies | | | | | | | | | | | | | | |

| Campbell Soup Company shareholders' equity | | | | | | | | | | | | | | |

| Preferred stock; authorized 40 shares; none issued | | — | | | | — | | | | — | | | | — |

| Capital stock, $.0375 par value; authorized 560 shares; issued 323 shares | | 12 | | | | — | | | | — | | | | 12 |

| Additional paid-in capital | | 407 | | 602 | | (534) | | AA,EE,OO | | — | | | | 475 |

| Earnings (loss) retained in the business | | 4,665 | | (73) | | 7 | | BB,EE,LL,MM,NN, OO | | — | | | | 4,599 |

| Capital stock in treasury, at cost | | (1,212) | | | | — | | | | — | | | | (1,212) |

| Accumulated other comprehensive income (loss) | | (23) | | 1 | | (1) | | OO | | — | | | | (23) |

| Total Campbell Soup Company shareholders' equity | | 3,849 | | 530 | | (528) | | | | — | | | | 3,851 |

| Noncontrolling interests | | 2 | | | | — | | | | — | | | | 2 |

| Total equity | | 3,851 | | 530 | | (528) | | | | — | | | | 3,853 |

| Total liabilities and equity | | $ | 12,106 | | $ | 1,235 | | $ | (629) | | | | $ | 2,860 | | | | $ | 15,572 |

See accompanying Notes to Unaudited Pro Forma Combined Financial Statements.

CAMPBELL SOUP COMPANY

Notes to Unaudited Pro Forma Combined Financial Statements

(millions, except per share amounts)

Note 1. Basis of Presentation

The unaudited pro forma combined financial information was based on and should be read in conjunction with the (i) unaudited historical consolidated financial statements of Campbell included in its Quarterly Report on Form 10-Q for the six months ended January 28, 2024, (ii) audited historical consolidated financial statements of Campbell included in its Annual Report on Form 10-K for the year ended July 30, 2023, (iii) audited historical consolidated financial statements of Sovos included in its Annual Report on Form 10-K for the years ended December 30, 2023 and December 31, 2022, (iv) unaudited historical condensed consolidated financial statements of Sovos included in its Form 10-Q for 26 weeks ended July 1, 2023, and (v) unaudited historical condensed consolidated financial statements of Sovos included in its Form 10-Q for 26 weeks ended June 25, 2022. The unaudited pro forma combined Statements of Earnings and Balance Sheet give effect to the Transactions as if they occurred on August 1, 2022 for Statement of Earnings purposes and on January 28, 2024 for Balance Sheet purposes.

Campbell’s fiscal year ended on July 30, 2023. Sovos’ fiscal year ended on December 30, 2023 and its second quarter of fiscal year 2023 ended on July 1, 2023. The unaudited pro forma combined Statement of Earnings for the year ended July 30, 2023 combines Campbell’s year ended July 30, 2023 with Sovos’ twelve months ended July 1, 2023. The unaudited pro forma combined Statement of Earnings for the six months ended January 28, 2024 combines Campbell’s six months ended January 28, 2024 with Sovos’ 26 weeks ended December 30, 2023. The unaudited pro forma combined Balance Sheet information combines Campbell’s January 28, 2024 unaudited Balance Sheet with Sovos’ year ended December 30, 2023 audited Balance Sheet.

Both Campbell’s and Sovos’ historical financial statements were prepared in accordance with U.S. GAAP and presented in U.S. dollars. As discussed in Note 4. Reclassification Adjustments, certain reclassification adjustments were made to conform Sovos’ financial statement presentation to that of Campbell’s. Additional reclassifications and adjustments may be required if changes are needed to conform Sovos’ financial statement presentation and accounting policies to those of Campbell.

The unaudited pro forma combined financial information was prepared using the acquisition method of accounting in accordance with ASC 805, Business Combinations, with Campbell as the accounting acquirer. Under ASC 805, assets acquired and liabilities assumed in a business combination are to be recognized and measured at their estimated acquisition date fair value.

The pro forma adjustments are based on preliminary estimates of the fair values of assets acquired and liabilities assumed and information available as of the date of this Current Report on Form 8-K/A. Certain valuations and assessments, including valuations of inventories, plant assets, leases and intangible assets as well as the assessment of tax positions and tax rates of the combined business, are in process.

Actual adjustments may differ from the amounts reflected in the unaudited pro forma combined financial statements, and the differences may be material.

Note 2. Transaction and Estimated Purchase Consideration

The unaudited pro forma combined financial information reflects the acquisition of Sovos for an estimated purchase price of $2,901, which was derived as follows:

| | | | | | | | | | | |

Cash consideration paid to Sovos' shareholders (a) | | | $ | 2,307 |

Cash paid for share-based awards (b) | | | 32 |

| Cash consideration paid directly to shareholders | | | 2,339 |

| Transaction costs of Sovos paid by Campbell | | | 32 |

| Repayment of Sovos' existing indebtedness and accrued interest | | | 488 |

| Total cash consideration | | | 2,859 |

Fair value of replacement share-based awards (c) | | | 42 |

| Total consideration | | | $ | 2,901 |

___________________________________________

(a) Merger Consideration paid to Sovos’ shareholders which reflects $23.00 per outstanding Sovos’ share as of March 12, 2024.

(b) Represents the cash paid to certain Sovos’ equity award holders based on outstanding shares of Sovos Restricted Stock and Sovos RSU Awards attributable to pre-combination service. This includes (i) restricted stock that vested and was settled in the Merger Consideration as part of the Transactions and (ii) restricted stock units and performance-based restricted stock units to non-employee directors and former service providers that were settled in the Merger Consideration as part of the Transactions. This excludes $3 of cash paid to settle shares that vest based on a multiple of

invested capital (“MOIC”) that were modified in connection with the Transaction, which is recognized as a post-combination expense.

(c) Represents the portion of fair value of Sovos RSU Awards attributable to pre-combination service. This includes restricted stock units and performance-based restricted stock units that were replaced with Campbell restricted stock units as part of the Transactions.

The estimated purchase price allocation is based on preliminary estimates of fair value as follows:

| | | | | | | | | | | |

| Cash and cash equivalents | | | $ | 232 |

| Accounts receivable | | | 98 |

| Inventories | | | 112 |

| Other current assets | | | 8 |

| Plant assets | | | 100 |

| Other intangible assets | | | 1,783 |

| Other assets | | | 12 |

| Total assets acquired | | | $ | 2,345 |

| Accounts payable | | | $ | 73 |

| Accrued liabilities | | | 77 |

| Accrued income taxes | | | 1 |

| Long-term debt | | | 7 |

| Deferred taxes | | | 411 |

| Other liabilities | | | 12 |

| Total liabilities assumed | | | $ | 581 |

| Net assets acquired | | | $ | 1,764 |

| Goodwill | | | 1,137 |

| Total consideration | | | $ | 2,901 |

Note 3. Derivation of Sovos Brands' Results

The Sovos results included in the unaudited pro forma combined Statements of Earnings reflect the results for the year ended July 1, 2023 and the 26 weeks ended December 30, 2023, were derived as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal year ended December 31, 2022 | | 26 weeks ended July 1, 2023 | | 26 weeks ended June 25, 2022 | | Year ended July 1, 2023 | | Fiscal year ended December 30, 2023 | | 26 weeks ended December 30, 2023 |

| | (audited) | | (unaudited) | | (unaudited) | | (unaudited) | | (audited) | | (unaudited) |

| | | (A) | | (B) | | (C) | | (D = A+B-C) | | (E) | | (F = E-B) |

| Net sales | | $ | 878 | | | $ | 470 | | | $ | 407 | | | $ | 941 | | | $ | 1,020 | | | $ | 550 | |

| Cost of sales | | 632 | | 329 | | 298 | | 663 | | 715 | | 386 |

| Gross profit | | 246 | | 141 | | 109 | | 278 | | 305 | | 164 |

| | | | | | | | | | | | |

| Selling, general and administrative expenses | | 163 | | 91 | | 73 | | 181 | | 201 | | 110 |

| Depreciation and amortization | | 29 | | 12 | | 14 | | 27 | | 24 | | 12 |

| Loss on sale of asset | | 51 | | — | | — | | 51 | | — | | — |

| Impairment of goodwill | | 42 | | — | | 42 | | — | | — | | — |

| Total operating expenses | | 285 | | 103 | | 129 | | 259 | | 225 | | 122 |

| Operating income (loss) | | (39) | | 38 | | (20) | | 19 | | 80 | | 42 |

| Interest expense, net | | 28 | | 17 | | 12 | | 33 | | 34 | | 17 |

| Income (loss) before income taxes | | (67) | | 21 | | (32) | | (14) | | 46 | | 25 |

| Income tax (expense) benefit | | 13 | | (8) | | 6 | | (1) | | (16) | | (8) |

| Net income (loss) | | $ | (54) | | $ | 13 | | $ | (26) | | $ | (15) | | $ | 30 | | $ | 17 |

Note 4. Reclassification Adjustments

Certain reclassifications have been made to conform Sovos' historical financial statement presentation to that of Campbell.

Sovos’ reclassifications reflected in the unaudited pro forma combined Statement of Earnings for the six months ended January 28, 2024 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended December 30, 2023 | |

| | | Before Reclassification (unaudited) | | Reclassifications | | Notes | | After Reclassification (unaudited) | |

| Net sales | | $ | 550 | | | — | | | | $ | 550 | | |

| Costs and expenses | | | | | | | | | |

| Cost of products sold | | 386 | | — | | | | 386 | |

| Selling, general and administrative expenses | | 110 | | (110) | | (i),(ii),(iii), (iv) | | — | |

| Marketing and selling expenses | | | | 49 | | (i) | | 49 | |

| Administrative expenses | | | | 57 | | (iii) | | 57 | |

| Depreciation and amortization | | 12 | | (12) | | (ii),(iii),(iv) | | — | |

| Research and development expenses | | | | 5 | | (ii) | | 5 | |

| Other expenses / (income) | | | | 11 | | (iv) | | 11 | |

| | | | | | | | | |

| Total costs and expenses | | 508 | | — | | | | 508 | | |

| Earnings before interest and taxes | | 42 | | — | | | | 42 | |

| Interest expense, net | | 17 | | (17) | | (v),(vi) | | — | |

| Interest expense | | | | 22 | | (v) | | 22 | |

| Interest income | | | | 5 | | (vi) | | 5 | |

| Earnings before taxes | | 25 | | | — | | | | | 25 | | |

| Income tax (expense) benefit | | (8) | | 8 | | (vii) | | — | |

| Taxes on earnings | | | | 8 | | (vii) | | 8 | |

| Net earnings | | 17 | | | — | | | | | 17 | | |

| Less: Net earnings (loss) attributable to noncontrolling interests | | | | | | | | — | |

| Net earnings attributable to Campbell Soup Company | | $ | 17 | | $ | — | | | | $ | 17 | |

_____________________________________

(i.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses to Marketing and selling expenses to conform to Campbell’s Statements of Earnings presentation.

(ii.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses and a portion of Depreciation and amortization expenses to Research and development expenses to conform to Campbell’s Statements of Earnings presentation.

(iii.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses, and a portion of Depreciation and amortization expenses to Administrative expenses to conform to Campbell’s Statements of Earnings presentation.

(iv.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses, and a portion of Depreciation and amortization expenses to Other expenses / (income) to conform to Campbell’s Statements of Earnings presentation.

(v.)Represents the reclassification of a portion of Sovos’ Interest expense, net to Interest expense to conform to Campbell’s Statements of Earnings presentation.

(vi.)Represents the reclassification of the interest income included within Sovos’ Interest expense, net to Interest income to conform to Campbell’s Statements of Earnings presentation.

(vii.)Represents the reclassification of tax expense included within Sovos’ Income tax (expense) benefit to Taxes on earnings to conform to Campbell’s Statements of Earnings presentation.

Sovos' reclassifications reflected in the unaudited pro forma combined Statement of Earnings for the year ended July 30, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended July 1, 2023 | |

| | | Before Reclassification (unaudited) | | Reclassifications | | Notes | | After Reclassification (unaudited) | |

| Net sales | | $ | 941 | | | — | | | | $ | 941 | | |

| Costs and expenses | | | | | | | | | |

| Cost of products sold | | 663 | | (1) | | (i) | | 662 | |

| Selling, general and administrative expenses | | 181 | | (181) | | (i),(ii),(iii),(iv),(v) | | — | |

| Marketing and selling expenses | | | | 85 | | (v) | | 85 | |

| Administrative expenses | | | | 90 | | (iii) | | 90 | |

| Depreciation and amortization | | 27 | | (27) | | (ii),(iii),(iv) | | — | |

| Loss on sale of asset | | 51 | | (51) | | (iv) | | — | |

| | | | | | | | | |

| Research and development expenses | | | | 8 | | (ii) | | 8 | |

| Other expenses / (income) | | | | 77 | | (iv) | | 77 | |

| | | | | | | | | |

| Total costs and expenses | | 922 | | — | | | | 922 | | |

| Earnings before interest and taxes | | 19 | | — | | | | 19 | |

| Interest expense, net | | 33 | | (33) | | (vi),(vii) | | — | |

| Interest expense | | | | 37 | | (vi) | | 37 | |

| Interest income | | | | 4 | | (vii) | | 4 | |

| Earnings (loss) before taxes | | (14) | | | — | | | | | (14) | | |

| Income tax (expense) benefit | | (1) | | 1 | | (viii) | | — | |

| Taxes on earnings | | | | 1 | | (viii) | | 1 | |

| Net earnings (loss) | | (15) | | | — | | | | | (15) | | |

| Less: Net earnings (loss) attributable to noncontrolling interests | | | | | | | | — | |

| Net earnings (loss) attributable to Campbell Soup Company | | $ | (15) | | $ | — | | | | $ | (15) | |

_____________________________________

(i.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses to Cost of products sold to conform to Campbell’s Statements of Earnings presentation.

(ii.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses, and a portion of Depreciation and amortization expenses to Research and development expenses to conform to Campbell’s Statements of Earnings presentation.

(iii.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses, and a portion of Depreciation and amortization expenses to Administrative expenses to conform to Campbell’s Statements of Earnings presentation.

(iv.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses, a portion of Depreciation and amortization expenses, and Loss on sale of asset to Other expenses / (income) to conform to Campbell’s Statements of Earnings presentation.

(v.)Represents the reclassification of a portion of Sovos’ Selling, general, and administrative expenses to Marketing and selling expenses to conform to Campbell’s Statements of Earnings presentation.

(vi.)Represents the reclassification of a portion of Sovos’ Interest expense, net to Interest expense to conform to Campbell’s Statements of Earnings presentation.

(vii.)Represents the reclassification of the interest income included within Sovos’ Interest expense, net to Interest income to conform to Campbell’s Statements of Earnings presentation.

(viii.)Represents the reclassification of tax expense included within Sovos’ Income tax (expense) benefit to Taxes on earnings to conform to Campbell’s Statements of Earnings presentation.

Sovos Brands' reclassifications reflected in the unaudited pro forma combined Balance Sheet as of January 28, 2024 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 30, 2023 |

| | | | | | | | |

| | Before Reclassifications | | Reclassification Adjustments | | Notes | | After Reclassifications |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 232 | | | $ | — | | | | | $ | 232 | |

| Accounts receivable, net | | 98 | | | — | | | | | 98 | |

| Inventories, net | | 96 | | | — | | | | | 96 | |

| Prepaid expenses and other current assets | | 8 | | | — | | | | | 8 | |

| Total current assets | | 434 | | | — | | | | | 434 | |

| Property and equipment, net | | 65 | | | — | | | | | 65 | |

| Operating lease right-of-use assets | | 11 | | | (11) | | | (i) | | — | |

| Goodwill | | 395 | | | — | | | | | 395 | |

| Intangible assets, net | | 329 | | | — | | | | | 329 | |

| Other long-term assets | | 1 | | | (1) | | | (i) | | — | |

| Other assets | | | | 12 | | (i) | | 12 |

| Total assets | | $ | 1,235 | | $ | — | | | | $ | 1,235 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 30, 2023 |

| | | | | | | | |

| | Before Reclassifications | | Reclassification Adjustments | | Notes | | After Reclassifications |

| Liabilities and Stockholders' Equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 64 | | | $ | 9 | | | (ii) | | $ | 73 | |

| Accrued expenses | | 82 | | | (82) | | | (ii),(iii),(iv) | | — | |

| | | | | | | | |

| Current portion of long-term operating lease liabilities | | 3 | | | (3) | | | (iii) | | — | |

| Short-term borrowings | | | | | | | | |

| Accrued liabilities | | | | 75 | | | (iii) | | 75 | |

| Dividends payable | | | | | | | | |

| Accrued income taxes | | | | 1 | | | (iv) | | 1 | |

| Total current liabilities | | 149 | | | — | | | | | 149 | |

| Long-term debt | | 484 | | | — | | | | | 484 | |

| Deferred taxes | | 60 | | | — | | | | | 60 | |

| Long-term operating lease liabilities | | 11 | | | (11) | | | (v) | | — | |

| Other liabilities | | 1 | | | 11 | | | (v) | | 12 | |

| Total liabilities | | 705 | | | — | | | | | 705 | |

| Commitments and Contingencies | | | | | | | | |

| Stockholders' equity: | | | | | | | | |

| Preferred stock | | | | | | | | |

| Capital stock | | | | | | | | |

| Additional paid-in capital | | 602 | | | — | | | | | 602 | |

| Retained earnings / (deficit) | | (73) | | | — | | | | | (73) | |

| Capital stock in treasury, at cost | | | | | | | | |

| Accumulated other comprehensive income (loss) | | 1 | | | — | | | | | 1 | |

| Total stockholders' equity | | 530 | | | — | | | | | 530 | |

| Noncontrolling interests | | | | | | | | |

| Total equity | | 530 | | | — | | | | | 530 | |

| Total liabilities and equity | | $ | 1,235 | | $ | — | | | | $ | 1,235 |

___________________________________________

(i.)Represents the reclassification of Sovos’ Operating lease right-of-use assets and Other long-term assets to Other assets to conform to Campbell’s Balance Sheet presentation.

(ii.)Represents the reclassification of Sovos’ Accrued expenses to Accounts Payable to conform to Campbell’s Balance Sheet presentation.

(iii.)Represents the reclassification of Sovos’ Current portion of long-term operating lease liabilities and a portion of Accrued expenses to Accrued liabilities to conform to Campbell’s Balance Sheet presentation.

(iv.)Represents the reclassification of a portion of Sovos’ Accrued expenses to Accrued income taxes to conform to Campbell’s Balance Sheet presentation.

(v.)Represents the reclassification of Sovos’ Long-term operating lease liabilities to Other liabilities to conform to Campbell’s Balance Sheet presentation.

Note 5. Transaction Accounting Adjustments to Unaudited Pro Forma Combined Statements of Earnings

The transaction accounting adjustments reflected in the unaudited pro forma combined Statements of Earnings for the six months ended January 28, 2024, and year ended July 30, 2023 are detailed below:

A. Represents the additional Cost of products sold of $16 for the year ended July 30, 2023 recognized in connection with the step-up of inventory to fair value. Campbell will recognize the increased value of inventory in Cost of products sold as the inventory is sold, which for purposes of this pro forma combined financial information is assumed to occur within approximately two months after the Closing Date, based on the average historical inventory turnover.

B. Reflects an adjustment of $2 and $4 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively, related to amortization of a supplier payment over its contract period. Refer to Note 6 (DD) for additional information related to the supplier payment.

C. Represents the change in depreciation expense between the historical depreciation expense of Sovos of $12 in the year ended July 30, 2023 and the estimated depreciation expense of $14 based on the estimated fair value, depreciated on a straight-line basis over the estimated useful lives, of the acquired property and equipment. The historical depreciation and the estimated depreciation expense were both $6 for the six months ended January 28, 2024.

D. The pro forma adjustment for the year ended July 30, 2023 includes a one-time stock-based compensation charge of $29 related to Sovos Restricted Stock and Sovos RSU Awards for which vesting was accelerated as part of the Merger, of which $3 was settled in cash and $26 was settled in fully vested Campbell restricted stock units.

E. Reflects one-time retention bonuses of $11 for the year ended July 30, 2023 which remain in accrued liabilities.

F. Represents non-recurring incremental transaction expenses of $18 that were estimated to be incurred by Campbell in connection with the Transactions on the Closing Date.

G. Represents a net adjustment of $(5) and $(13) for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively, which includes (a) the reversal of Sovos’ historical amortization of intangible assets of $11 and $25 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively, and (b) the recognition of $6 and $12 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively, of amortization expense based on the preliminary fair value of identified intangible assets and the respective assigned estimated useful lives as specified in Note 6 (JJ) below.

H. Reflects the estimated non-recurring severance expense of $17 for the year ended July 30, 2023 resulting from pre-existing employment agreements of certain Sovos executive officers and employees. This amount reflects the expected severance expense to be recorded by Campbell as a result of terminations that occurred in connection with or after completion of the Transactions.

I. Represents the reversal of Sovos’ historical interest of $22 and $37 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively.

J. Reflects the tax effects of pro forma pre-tax adjustments for the six months ended January 28, 2024 and the year ended July 30, 2023 based on historic statutory tax rates in effect when the transactions would have taken place. The tax effects include the impact on certain of the transaction accounting adjustments giving effect to i) certain amounts related to transaction costs that are nondeductible for U.S. tax purposes; and ii) amounts related to transaction-related compensation which may not result in a tax benefit due to the limitation under Internal Revenue Code (“IRC”) section 162(m) and IRC section 280G.

K. Represents the net adjustments for interest expense of $91 and $184 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively, on the DDTL and commercial paper to be incurred by Campbell, which includes amortization of debt issuance costs amounting to $2 for the year ended July 30, 2023. The adjustment for amortization of debt issuance costs anticipates the required repayment of the DDTL within one year of drawdown. The adjustment for interest expense assumes the debt is outstanding for the entire annual and interim income statement periods. The DDTL and commercial paper will have variable interest rates and an increase or decrease of 1/8th percent in the interest rate would increase or decrease interest expense by $2 and $4 for the six months ended January 28, 2024 and the year ended July 30, 2023, respectively. Subsequent to the Closing Date, the Company refinanced its outstanding borrowings, and as a result, actual interest rates for the refinanced borrowings will differ.

Note 6. Transaction Accounting Adjustments to Unaudited Pro Forma Combined Balance Sheet

The transaction accounting adjustments reflected in the unaudited pro forma combined Balance Sheet as of January 28, 2024 are detailed below:

AA. Reflects components of purchase consideration, including $2,307 of cash consideration to be paid to Sovos’ shareholders; $74 of the estimated fair value of Sovos’ equity awards attributable to pre-combination services, which consist of $32 of restricted stock units and performance stock units that were settled in cash as part of the Transactions, and $42 of

restricted stock units and performance stock units that were replaced with Campbell restricted stock units as part of the Transactions; and the $32 payment of transaction costs on behalf of Sovos.

BB. Represents payment of transaction-related costs of $14 as well as accrued expenses related to unpaid transaction-related costs of $4 for the year ended January 28, 2024, incurred concurrent with the Closing Date.

CC. Reflects the repayment of $488 of Sovos’ existing debt, including $7 of related accrued interest, and elimination of unamortized debt issuance costs of $4.

DD. Reflects a payment of $25 to a vendor to modify a supply contract in conjunction with the Transactions. This payment has been capitalized within Other assets on the Balance Sheet and will be amortized over the contract period of 7 years.

EE. Reflects $29 of share-based post-combination compensation cost of which $3 is settled in cash and $26 is settled in fully vested Campbell restricted stock units. In addition, this adjustment includes $2 of transaction bonuses and $11 of retention bonuses payable to certain Sovos employees after closing, which are included in Accrued liabilities.

FF. Reflects adjustment to record the fair value of acquired inventory of approximately $112, which is an increase of $16 over Sovos’ book value of inventory.

GG. Represents adjustments to record the preliminary estimated fair value of Plant assets of approximately $87, which is an increase of $29 above Sovos’ book value.

HH. Represents adjustments to record the preliminary estimated increase in fair value of right-of-use assets related to finance leases of $6.

II. Represents net adjustment of $742 which includes (a) goodwill of $1,137, representing the excess of the purchase consideration over the fair value of Sovos’ net assets acquired based on the estimated preliminary purchase price allocation and (b) the elimination of Sovos’ historical goodwill of $395.

JJ. Represents the net adjustment of $1,454 which includes (a) the reversal of historical intangible assets of $329 and (b) the fair value of intangible assets acquired to reflect their preliminary estimated fair values of $1,783. The preliminary fair value assigned to the acquired intangible assets and their expected useful lives are as follows:

| | | | | | | | | | | |

| Useful Life | | Fair Value |

| Amortizable intangible assets | | | |

| Customer relationships | 20-30 years | | $ | 222 |

| Trademarks | 20 years | | 81 |

| Non-amortizable intangible assets | | | |

| Trademarks | Indefinite | | 1,480 |

| Total net intangible assets | | | $ | 1,783 |

KK. Reflects the $9 million fair value of a liability triggered by a change in control provision in Sovos’ contractual arrangements with third parties.

LL. Reflects the accrual of estimated non-recurring severance expense of $17 as a result of terminations that occurred in connection with or after completion of the Transactions due to pre-existing employment agreements of certain Sovos executive officers and employees. The short and long-term portions were $12 and $5, respectively.

MM. Reflects the reduction in accrued income taxes of $4 to reflect the tax effect of pro forma adjustments for acquisition-related expenses, transaction-related compensation and payments for historical debt.

NN. Reflects a net increase in deferred tax liabilities of $344 primarily associated with (a) the preliminary adjustment to record deferred tax assets and liabilities in connection with the fair value adjustments to assets acquired and liabilities assumed and (b) the tax effect of transaction-related compensation costs such as accelerated vesting of stock-based compensation and accrued transaction-related bonuses. The historical statutory tax rates were applied, as appropriate, to each adjustment based on the jurisdiction to which the adjustment relates. Deferred tax liabilities associated with fair value adjustments were primarily determined based on the excess of the fair values of the acquired assets and liabilities assumed as compared to the tax basis of the assets acquired and liabilities assumed, excluding the amount attributable to goodwill. This estimate of deferred tax assets and liabilities is preliminary and is subject to change based upon the final determination of the fair value of assets acquired and liabilities assumed by jurisdiction.

OO. Reflects the elimination of Sovos’ historical equity of $530, including $602 of Additional paid-in capital, $1 of Accumulated other comprehensive income, and $73 of Loss retained in the business.

PP. Reflects the preliminary adjustment to cash in connection with the DDTL and commercial paper, as follows:

| | | | | | | | |

Proceeds from the DDTL and commercial paper (1) | | $ | 2,862 | |

Less: Payment of finance costs (2) | | 2 |

Pro forma adjustment | | $ | 2,860 | |

____________________________________

(1) The Company used the proceeds from the $2,000 DDTL and $860 of commercial paper to repay in full all indebtedness of Sovos, and pay fees and expenses incurred in connection with the Transactions. The interest rates assumed for the DDTL and commercial paper were 6.67% and 5.67%, respectively. The new debt was classified as Short-term borrowings based on the DDTL’s term of less than one year and the short-term nature of commercial paper. Subsequent to the Closing Date, the Company refinanced its outstanding borrowings, and as a result, actual interest rates for the refinanced borrowings will differ.

(2) Represents the payment of financing costs incurred related to the DDTL. DDTL financing costs were presented as a reduction to the total loan amount and amortized in the combined Statement of Earnings.

Note 7. Earnings Per Share

The following tables set forth the computation of pro forma basic and diluted earnings per share for the six months ended January 28, 2024 and for the year ended July 30, 2023:

| | | | | | | | | | | |

| For the Six Months Ended January 28, 2024 | | For the Year Ended July 30, 2023 |

| Numerator: | | | |

| Pro forma Net earnings attributable to Campbell Soup Company | $ | 403 | | $ | 659 |

| Denominator: | | | |

| Historical Campbell weighted average shares outstanding – basic | 298 | | 299 |

| Impact of vested Campbell stock awards issued to replace Sovos' restricted stock units and performance-based restricted stock units | 1 | | 1 |

| Pro forma Weighted average shares outstanding – basic | 299 | | 300 |

| | | |

| Historical Campbell weighted average shares outstanding – assuming dilution | 299 | | 301 |

| Basic and dilutive impact of Campbell’s restricted stock units issued to replace Sovos’ restricted stock units and performance-based restricted stock units | 1 | | 1 |

| Pro forma Weighted average shares outstanding – assuming dilution | 300 | | 302 |

| | | |

| Pro forma Net earnings per share: | | | |

| Basic | $ | 1.35 | | $ | 2.20 |

| Diluted | $ | 1.34 | | $ | 2.18 |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

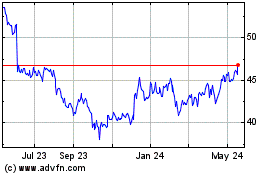

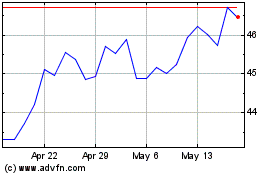

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From May 2024 to Jun 2024

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jun 2023 to Jun 2024