CRH plc (NYSE: CRH) (LSE: CRH):

Key Highlights

Summary Financials

Q3 2024

Change

Q3 YTD 2024

Change

Total revenues

$10.5bn

+4%

$26.7bn

+2%

Net income

$1.4bn

+5%

$2.8bn

+13%

Net income margin

13.2%

+20bps

10.5%

+100bps

Adjusted EBITDA*

$2.5bn

+12%

$5.2bn

+12%

Adjusted EBITDA margin*

23.3%

+170bps

19.3%

+180bps

EPS

$1.99

+10%

$4.03

+20%

- Robust performance underpinned by differentiated solutions

strategy

- Strong double-digit growth in Adjusted EBITDA* & EPS

despite adverse weather

- Further margin expansion driven by positive pricing, cost

management & operational efficiency

- Significant portfolio activity YTD; $4.6bn invested in

value-accretive M&A; $1.2bn divested

- Integration of materials acquisitions in Texas & Australia

progressing well

- Ongoing share buyback; $1.2bn YTD; commencing new $0.3bn

quarterly tranche

- Declaring quarterly dividend of $0.35 per share (+5%

annualized)

- Reaffirming FY24 guidance midpoint; Net Income $3.78bn-$3.85bn;

Adjusted EBITDA* $6.87bn-$6.97bn

- Outlook positive with favorable dynamics across key markets

expected to continue into 2025

Albert Manifold, Chief Executive, said:

"Our third quarter results represent another strong performance

with further growth in sales, profits and margins. Despite

contending with adverse weather in the quarter, our differentiated

solutions strategy continues to deliver industry-leading

performance, while the strength of our balance sheet combined with

our disciplined approach to capital allocation leaves us well

positioned to capitalize on the growth and value creation

opportunities that lie ahead. We are pleased to reaffirm our

guidance midpoint for 2024 and looking ahead to 2025, we expect

favorable underlying demand, positive pricing momentum and another

year of progress for CRH."

Announced Thursday, November 7, 2024

____________________________________

* Represents non-GAAP measure. See

'Non-GAAP Reconciliation and Supplementary Information' on pages 13

to 14.

Q3 2024 Results

Performance Overview

Total revenues of $10.5 billion (Q3 2023: $10.1 billion) were 4%

ahead, while organic total revenues* were 1% behind the

corresponding period in 2023. Contributions from acquisitions and

strong commercial management more than offset the impact of

divestitures and lower activity levels due to adverse weather in

certain regions. Net income of $1.4 billion (Q3 2023: $1.3 billion)

was 5% ahead of the prior year reflecting strong operating

performance, gains on disposal of long-lived assets and a gain on

the European Lime divestiture. Adjusted EBITDA* of $2.5 billion (Q3

2023: $2.2 billion) was 12% ahead as a result of the continued

delivery of CRH's integrated solutions strategy, positive pricing,

ongoing cost control and further operational efficiencies. Organic

Adjusted EBITDA* was 8% ahead of Q3 2023. The Group's net income

margin of 13.2% (Q3 2023: 13.0%) and Adjusted EBITDA margin* of

23.3% (Q3 2023: 21.6%) were both ahead of the comparable prior year

period. Basic Earnings Per Share (EPS) for Q3 2024 was $1.99 (Q3

2023: $1.81).

- Americas Materials Solutions' total revenues were 4%

ahead of Q3 2023, driven by strong pricing across all lines of

business along with contributions from acquisitions which mitigated

the effects of lower activity in certain markets due to weather

disruption. Adjusted EBITDA was 16% ahead of the prior year period

driven by pricing improvements, operational efficiencies and good

cost management, along with gains on the disposal of certain land

assets.

- Americas Building Solutions' total revenues were 1%

ahead of Q3 2023 as contributions from acquisitions more than

offset the impact of lower activity levels due to challenging

weather and subdued new-build residential demand. Adjusted EBITDA

was 9% lower due to adverse weather and a strong prior year

comparative.

- Europe Materials Solutions' total revenues were 7% ahead

of Q3 2023, benefiting from the acquisition of Adbri Ltd (Adbri) in

July 2024 and partly offset by the divestiture of the European Lime

operations, as well as lower activity levels in certain markets.

Adjusted EBITDA was 24% ahead of the prior year driven by good

commercial management, lower energy costs, operational efficiencies

and contributions from acquisitions.

- Europe Building Solutions' total revenues were 4% behind

Q3 2023, amid continued subdued demand in new-build residential

markets. Adjusted EBITDA was 10% behind as the impact of lower

activity was only partially offset by ongoing cost saving

measures.

Acquisitions and Divestitures

During the three months ended September 30, 2024, CRH completed

12 acquisitions for a total consideration of $1.4 billion, compared

with $0.4 billion in the same period of 2023. Americas Materials

Solutions completed seven acquisitions, Americas Building Solutions

completed three acquisitions and Europe Materials Solutions

completed two acquisitions.

Overall, during the nine months ended September 30, 2024, CRH

completed 28 acquisitions for a total consideration of $3.9

billion, compared with $0.6 billion in the first nine months of the

prior year. On July 1, 2024, CRH completed the acquisition of a

majority stake in Adbri for a total consideration of $0.8 billion.

Adbri is an integrated materials business with high-quality assets

and leading market positions in Australia, complementing our core

competencies in cement, concrete and aggregates and creating

additional growth and development opportunities for our existing

Australian business.

During the three months ended September 30, 2024, cash proceeds

from divestitures and disposals of long-lived assets were $0.1

billion, including the third and final phase of the divestiture of

the European Lime operations, which was completed on August 30,

2024.

For the nine months ended September 30, 2024, the Company

realized cash proceeds from divestitures and disposals of

long-lived assets of $1.2 billion, primarily related to the

divestiture of the European Lime operations. No divestitures

occurred in the first nine months of the prior year.

Dividends and Share Buybacks

In line with the Company's policy of consistent long-term

dividend growth, the Board has declared a quarterly dividend of

$0.35 per share. This represents an annualized increase of 5% on

the prior year. The dividend will be paid wholly in cash on

December 18, 2024, to shareholders registered at the close of

business on November 22, 2024. The ex-dividend date will be

November 22, 2024.

On November 6, 2024, the latest tranche of the share buyback

program was completed, bringing the year-to-date repurchases to

$1.2 billion, including approximately four million shares

repurchased in Q3 2024 for a total consideration of $0.3 billion.

The Company is pleased to announce that it is commencing an

additional $0.3 billion tranche to be completed no later than

February 26, 2025.

Innovation and Sustainability

The transition to a more sustainable built environment

represents a significant commercial opportunity for CRH. Our

strategy focuses on transforming essential materials into

value-added and innovative solutions to address three global

challenges: water, circularity and decarbonization. We continue to

enhance our capabilities to meet these challenges through

investment in innovative technologies. Two recent examples include

our investment in FIDO AI, supporting the development of artificial

intelligence leak detection software to accelerate our water

infrastructure solutions in North America, as well as CRH’s

strategic investment partnership with Sublime Systems, a U.S. based

company operating in the field of sustainable cement production.

Through these efforts, we continue to develop and deliver

innovative solutions for our customers.

Outlook

We are pleased to reaffirm our guidance midpoint for 2024,

reflecting the continued strength of our financial performance, the

positive underlying momentum in our business as well as the

positive contribution from portfolio activity.

2024 Guidance

Updated Guidance Range

(i)

Previous Guidance Range

(ii)

(in $ billions, except per share

data)

Low

High

Low

High

Net income

3.78

3.85

3.70

3.85

Adjusted EBITDA*

6.87

6.97

6.82

7.02

EPS

$5.45

$5.55

$5.40

$5.60

Capital expenditure

2.4

2.6

2.2

2.4

(i) 2024 Net income and EPS under our

Updated Guidance Range are based on approximately $0.5 billion

interest expense, net and an effective tax rate of approximately

23%. 2024 EPS is based on a year-to-date average of approximately

686 million common shares outstanding. The above guidance does not

reflect the potential Q4 impairment in the range of $0.3-$0.4

billion.

(ii) 2024 Net income and EPS under our

Previous Guidance Range were based on approximately $0.5 billion

interest expense, net, effective tax rate of approximately 23% and

a year-to-date average of approximately 688 million common shares

outstanding.

Looking ahead to 2025 and notwithstanding some macroeconomic

uncertainties, we expect positive underlying demand across our key

end-use markets, underpinned by significant public investment in

infrastructure and re-industrialization activity. A lower interest

rate environment is expected to aid a gradual recovery in new-build

residential construction activity. Through a combination of

continued positive price momentum, favorable underlying demand and

the benefits of our integrated, value-based solutions strategy we

expect another year of progress in 2025.

Americas Materials Solutions

Analysis of Change

in $ millions

Q3 2023

Currency

Acquisitions

Divestitures

Organic

Q3 2024

% change

Total revenues

5,080

(7)

+232

(44)

+38

5,299

+4%

Adjusted EBITDA

1,284

(2)

+65

(14)

+151

1,484

+16%

Adjusted EBITDA margin

25.3%

28.0%

Americas Materials Solutions’ total revenues were 4% ahead of

the third quarter of 2023. Continued positive pricing across all

lines of business was partly offset by adverse weather impacting

volumes, resulting in organic total revenues* 1% ahead of the prior

year.

In Essential Materials, total revenues increased by 5% driven by

pricing growth in both aggregates and cement, ahead by 10% and 9%,

respectively. Cement volumes increased by 1%, as acquisition

activity offset the adverse impact of major hurricanes. Aggregates

volumes declined by 4%, negatively impacted by adverse weather.

In Road Solutions, total revenues increased by 4% driven by

improved pricing across all lines of business and continued funding

support relating to the Infrastructure Investment and Jobs Act more

than offsetting challenging weather in certain regions. Paving and

construction revenue increased by 3% with growth in the Northeast

and West regions. Construction backlogs were ahead of the prior

year supported by positive momentum in bidding activity. Asphalt

volumes decreased by 2% and pricing increased by 3%, while

readymixed concrete volumes and prices increased by 2% and 7%,

respectively.

Third quarter Adjusted EBITDA for Americas Materials Solutions

of $1.5 billion was 16% ahead of the prior year as pricing

initiatives, cost management and operational efficiencies along

with gains on certain land asset sales mitigated the impact of

higher labor and raw materials costs. Organic Adjusted EBITDA* was

12% ahead of the third quarter of 2023. Adjusted EBITDA margin

increased by 270bps.

Americas Building Solutions

Analysis of Change

in $ millions

Q3 2023

Currency

Acquisitions

Divestitures

Organic

Q3 2024

% change

Total revenues

1,738

(2)

+45

—

(24)

1,757

+1%

Adjusted EBITDA

391

—

+8

—

(44)

355

(9%)

Adjusted EBITDA margin

22.5%

20.2%

Americas Building Solutions' total revenues were 1% ahead of the

prior year period as contributions from acquisitions more than

offset the impact of lower activity levels due to challenging

weather and subdued new-build residential demand. Organic total

revenues* were 1% behind the third quarter of 2023.

In Building & Infrastructure Solutions, total revenues were

3% ahead of Q3 2023 driven by a strong performance from

acquisitions which offset weaker new-build residential demand and

challenging weather conditions in certain markets.

In Outdoor Living Solutions, total revenues were in line with

the prior year period as lower activity levels, impacted by adverse

weather in the period, were offset by positive contributions from

acquisitions.

Third quarter Adjusted EBITDA for Americas Building Solutions

was 9% behind a strong prior year comparative, 11% behind on an

organic* basis as adverse weather and subdued residential demand

impacted profitability. Adjusted EBITDA margin was 230bps behind

the third quarter of 2023.

Europe Materials Solutions

Analysis of Change

in $ millions

Q3 2023

Currency

Acquisitions

Divestitures

Organic

Q3 2024

% change

Total revenues

2,617

+42

+354

(131)

(87)

2,795

+7%

Adjusted EBITDA

446

+6

+51

(32)

+82

553

+24%

Adjusted EBITDA margin

17.0%

19.8%

Europe Materials Solutions' total revenues, including the

acquisition of a majority stake in Adbri which closed in July 2024,

were 7% ahead of the third quarter of 2023. Organic total revenues*

were 3% behind as continued pricing progress and growth in Central

and Eastern Europe were more than offset by subdued residential

activity in Western Europe.

In Essential Materials, total revenues increased by 6% compared

with the third quarter of 2023, supported by contributions from

acquisitions and positive pricing in both aggregates and cement,

ahead by 4% and 5%, respectively. Aggregates and cement volumes

were both ahead by 6%.

In Road Solutions, revenues increased by 8% with volumes and

prices ahead in the readymixed concrete business, benefiting from

acquisition activity in the quarter. Asphalt volumes and pricing

declined 5% and 1%, respectively, while paving and construction

revenues were impacted by lower activity levels in Western

Europe.

Adjusted EBITDA in Europe Materials Solutions was $0.6 billion,

24% ahead of the comparable period in 2023, and 18% ahead on an

organic* basis, primarily driven by increased pricing, lower energy

costs, operational efficiencies and contributions from

acquisitions. Adjusted EBITDA margin increased by 280bps compared

with the third quarter of 2023.

Europe Building Solutions

Analysis of Change

in $ millions

Q3 2023

Currency

Acquisitions

Divestitures

Organic

Q3 2024

% change

Total revenues

693

+11

+4

(4)

(40)

664

(4%)

Adjusted EBITDA

69

+1

+1

—

(9)

62

(10%)

Adjusted EBITDA margin

10.0%

9.3%

Total revenues in Europe Building Solutions declined by 4%

compared with the third quarter of 2023, amid continued subdued

new-build residential activity.

Within Building & Infrastructure Solutions, total revenues

were 6% behind the comparable period in 2023. Infrastructure

Products was ahead of the prior year, with contributions from

acquisitions more than offsetting lower activity levels. Revenues

in Precast and Construction Accessories were behind the comparable

period in 2023 amid continued lower demand in certain key

markets.

Revenues in Outdoor Living Solutions increased by 2% compared

with the third quarter of 2023 despite lower activity levels which

were impacted by adverse weather and continued subdued new-build

residential demand.

Adjusted EBITDA in Europe Building Solutions declined by 10%

compared with the third quarter of 2023.

Other Financial Items

Depreciation, depletion and amortization charges of $0.5 billion

were $0.1 billion higher than the third quarter of the prior year

(Q3 2023: $0.4 billion), primarily due to the impact of

acquisitions.

Gains on the disposal of long-lived assets of $89 million were

higher than the same period in the prior year (Q3 2023: $15

million), primarily due to the disposal of certain land assets.

Interest income of $33 million was lower than the third quarter

of the prior year (Q3 2023: $62 million) primarily due to a lower

level of cash deposits. Interest expense of $164 million was higher

than the comparable period in 2023 (Q3 2023: $131 million),

primarily due to an increase in gross debt balances.

Other nonoperating income, net was $62 million (Q3 2023: $1

million) primarily related to gains on divestitures.

Basic EPS was higher than Q3 2023 at $1.99 (Q3 2023: $1.81) due

to a positive operating performance, higher gains on disposals of

long-lived assets and divestitures as well as reduced share count

as a result of the ongoing share buyback program.

The results of the Company’s third quarter impairment assessment

indicated increased risk of impairments as a result of certain

recent challenging market conditions which may impact future growth

prospects, resulting in reduced headroom. Arising from the

Company’s ongoing sensitivity analysis, potential non-cash

impairment charges of $0.3-$0.4 billion, representing the range of

possible outcomes, may be recognized in its results for the quarter

and year ending December 31, 2024 based on reasonably possible

changes in key assumptions. These potential impairment charges

relate to the Company’s equity method investment in China and the

Architectural Products reporting unit in the Europe Building

Solutions segment.

Balance Sheet and Liquidity

Total short and long-term debt was $13.9 billion at September

30, 2024, compared to $11.6 billion at December 31, 2023, and $11.4

billion at September 30, 2023.

During the nine months ended September 30, 2024, a net $0.6

billion of commercial paper was issued across the U.S. Dollar and

Euro Commercial Paper Programs. In January 2024, €600 million of

euro-denominated notes were repaid on maturity. In May 2024, the

Company completed the issuance of $750 million in 5.20% notes due

in 2029 and $750 million in 5.40% notes due in 2034. In July 2024,

as part of the Adbri acquisition $0.5 billion of external debt was

acquired.

Net Debt* at September 30, 2024, was $11.2 billion, compared to

$5.4 billion at December 31, 2023, and $5.9 billion at September

30, 2023. The increase in Net Debt* compared to December 31, 2023

reflects acquisitions, cash returns to shareholders through

dividends and share buybacks, as well as the purchase of property,

plant and equipment, partially offset by inflows from operating

activities and proceeds from divestitures.

As of September 30, 2024 CRH had $3.1 billion of cash and cash

equivalents and restricted cash on hand (Q3 2023: $5.7 billion) and

$4.0 billion of undrawn committed facilities. At September 30,

2024, the weighted average maturity of the term debt (net of cash

and cash equivalents) was 7.5 years.

As of September 30, 2024, the Company had a $4.0 billion U.S.

Dollar Commercial Paper Program and a €1.5 billion Euro Commercial

Paper Program available. As of September 30, 2024 there was $1.3

billion of outstanding issued notes under the U.S. Dollar

Commercial Paper Program and $0.4 billion of outstanding issued

notes under the Euro Commercial Paper Program. CRH remains

committed to maintaining its robust balance sheet and expects to

maintain a strong investment-grade credit rating with a BBB+ or

equivalent rating with each of the three main rating agencies.

Segmental Reporting Structure

In light of the Company’s recent portfolio activity, the Europe

Materials Solutions and Europe Building Solutions segments have

been combined into an International Solutions segment reflecting

how the business is now managed. The change took effect in the

fourth quarter of 2024 and will be reflected in the financial

results for the quarter and year ending December 31, 2024.

Q3 2024 Conference Call

CRH will host a conference call and webcast presentation at 8:00

a.m. (New York)/1:00 p.m. (Dublin) today, Thursday, November 7,

2024, to discuss the Q3 2024 results and outlook. Registration

details are available on www.crh.com/investors. Upon registration a

link to join the call and dial-in details will be made available.

The accompanying investor presentation will be available on the

investor section of the CRH website in advance of the conference

call, while a recording of the conference call will be made

available afterwards.

Dividend Timetable

The timetable for payment of the quarterly dividend of $0.35 per

share is as follows:

Ex-dividend Date:

November 22, 2024

Record Date:

November 22, 2024

Payment Date:

December 18, 2024

The default payment currency is U.S. Dollar for shareholders who

hold their Ordinary Shares through a Depository Trust Company (DTC)

participant. It is also U.S. Dollar for shareholders holding their

Ordinary Shares in registered form, unless a currency election has

been registered with CRH’s Transfer Agent, Computershare Trust

Company N.A. by 5:00 p.m. (New York)/10:00 p.m. (Dublin) on

November 22, 2024.

The default payment currency for shareholders holding their

Ordinary Shares in the form of Depository Interests is euro. Such

shareholders can elect to receive the dividend in U.S. Dollar or

Pounds Sterling by providing their instructions to the Company’s

Depositary Interest provider, Computershare Investor Services plc,

by 12:00 p.m. (New York)/5:00 p.m. (Dublin) on November 26,

2024.

Appendices

Appendix 1 - Primary Statements

The following financial statements are an extract of the

Company’s Condensed Consolidated Financial Statements prepared in

accordance with U.S. GAAP for the three months and nine months

ended September 30, 2024, and do not present all necessary

information for a complete understanding of the Company's financial

condition as of September 30, 2024. The full Condensed Consolidated

Financial Statements prepared in accordance with U.S. GAAP for the

three months and nine months ended September 30, 2024, including

notes thereto, will be included as a part of the Company’s

Quarterly Report on Form 10-Q filed with the U.S. Securities and

Exchange Commission (SEC).

Condensed Consolidated Statements of

Income (Unaudited)

(in $ millions, except share and per share

data)

Three months ended

Nine months ended

September 30

September 30

2024

2023

2024

2023

Product revenues

7,482

7,157

20,158

19,926

Service revenues

3,033

2,971

6,544

6,338

Total revenues

10,515

10,128

26,702

26,264

Cost of product revenues

(3,674)

(3,609)

(11,010)

(11,285)

Cost of service revenues

(2,782)

(2,756)

(6,151)

(5,967)

Total cost of revenues

(6,456)

(6,365)

(17,161)

(17,252)

Gross profit

4,059

3,763

9,541

9,012

Selling, general and administrative

expenses

(2,184)

(1,990)

(5,919)

(5,647)

Gain on disposal of long-lived assets

89

15

199

38

Operating income

1,964

1,788

3,821

3,403

Interest income

33

62

112

138

Interest expense

(164)

(131)

(452)

(285)

Other nonoperating income, net

62

1

246

3

Income from operations before income

tax expense and income from equity method investments

1,895

1,720

3,727

3,259

Income tax expense

(531)

(416)

(942)

(781)

Income from equity method investments

25

14

27

21

Net income

1,389

1,318

2,812

2,499

Net (income) attributable to redeemable

noncontrolling interests

(9)

(9)

(21)

(21)

Net (income) attributable to

noncontrolling interests

(4)

(3)

(2)

(1)

Net income attributable to CRH

plc

1,376

1,306

2,789

2,477

Earnings per share attributable to CRH

plc

Basic

$1.99

$1.81

$4.03

$3.36

Diluted

$1.97

$1.80

$4.00

$3.34

Weighted average common shares

outstanding

Basic

681.6

718.2

685.0

731.8

Diluted

685.5

722.1

690.0

736.6

Condensed Consolidated Balance Sheets

(Unaudited)

(in $ millions, except share

data)

September 30

December 31

September 30

2024

2023

2023

Assets

Current assets:

Cash and cash equivalents

2,978

6,341

5,722

Restricted cash

102

–

–

Accounts receivable, net

6,422

4,507

5,972

Inventories

4,644

4,291

4,191

Assets held for sale

–

1,268

–

Other current assets

694

478

430

Total current assets

14,840

16,885

16,315

Property, plant and equipment, net

21,289

17,841

18,103

Equity method investments

929

620

665

Goodwill

10,906

9,158

9,545

Intangible assets, net

1,105

1,041

1,074

Operating lease right-of-use assets,

net

1,322

1,292

1,237

Other noncurrent assets

830

632

692

Total assets

51,221

47,469

47,631

Liabilities, redeemable noncontrolling

interests and shareholders’ equity

Current liabilities:

Accounts payable

2,963

3,149

2,954

Accrued expenses

2,513

2,296

2,457

Current portion of long-term debt

3,218

1,866

1,860

Operating lease liabilities

271

255

245

Liabilities held for sale

–

375

–

Other current liabilities

1,703

2,072

1,675

Total current liabilities

10,668

10,013

9,191

Long-term debt

10,672

9,776

9,535

Deferred income tax liabilities

3,168

2,738

3,050

Noncurrent operating lease liabilities

1,117

1,125

1,065

Other noncurrent liabilities

2,430

2,196

2,142

Total liabilities

28,055

25,848

24,983

Commitments and contingencies

Redeemable noncontrolling interests

361

333

320

Shareholders’ equity

Preferred stock, €1.27 par value, 150,000

shares authorized and 50,000 shares issued and outstanding for 5%

preferred stock and 872,000 shares authorized, issued and

outstanding for 7% 'A' preferred stock, as of September 30, 2024,

December 31, 2023, and September 30, 2023

1

1

1

Common stock, €0.32 par value,

1,250,000,000 shares authorized; 721,319,880, 734,519,598 and

750,725,468 issued and outstanding, as of September 30, 2024,

December 31, 2023, and September 30, 2023 respectively

291

296

302

Treasury stock, at cost (41,493,074,

42,419,281 and 41,554,960 shares as of September 30, 2024, December

31, 2023 and September 30, 2023 respectively)

(2,141)

(2,199)

(2,132)

Additional paid-in capital

392

454

423

Accumulated other comprehensive loss

(499)

(616)

(763)

Retained earnings

23,831

22,918

23,936

Total shareholders’ equity attributable

to CRH plc shareholders

21,875

20,854

21,767

Noncontrolling interests

930

434

561

Total equity

22,805

21,288

22,328

Total liabilities, redeemable

noncontrolling interests and equity

51,221

47,469

47,631

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in $ millions)

Nine months ended

September 30

2024

2023

Cash Flows from Operating

Activities:

Net income

2,812

2,499

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion and

amortization

1,288

1,187

Share-based compensation

96

92

Gains on disposals from businesses and

long-lived assets, net

(389)

(38)

Deferred tax expense

195

108

Income from equity method investments

(27)

(21)

Pension and other postretirement benefits

net periodic benefit cost

27

22

Non-cash operating lease costs

188

212

Other items, net

(17)

33

Changes in operating assets and

liabilities, net of effects of acquisitions and divestitures:

Accounts receivable, net

(1,527)

(1,643)

Inventories

(45)

62

Accounts payable

(276)

(30)

Operating lease liabilities

(218)

(204)

Other assets

(311)

(5)

Other liabilities

498

354

Pension and other postretirement benefits

contributions

(35)

(34)

Net cash provided by operating

activities

2,259

2,594

Cash Flows from Investing

Activities:

Purchases of property, plant and

equipment

(1,635)

(1,175)

Acquisitions, net of cash acquired

(3,853)

(561)

Proceeds from divestitures and disposals

of long-lived assets

1,180

64

Dividends received from equity method

investments

22

23

Settlements of derivatives

(21)

3

Deferred divestiture consideration

received

82

5

Other investing activities, net

(180)

(88)

Net cash used in investing

activities

(4,405)

(1,729)

Condensed Consolidated Statements of

Cash Flows (Unaudited)

(in $ millions)

Nine months ended

September 30

2024

2023

Cash Flows from Financing

Activities:

Proceeds from debt issuances

3,452

2,687

Payments on debt

(1,854)

(940)

Settlements of derivatives

34

5

Payments of finance lease obligations

(37)

(18)

Deferred and contingent acquisition

consideration paid

(16)

(8)

Dividends paid

(1,469)

(761)

Distributions to noncontrolling and

redeemable noncontrolling interests

(33)

(35)

Repurchases of common stock

(1,224)

(2,031)

Proceeds from exercise of stock

options

3

4

Net cash used in financing

activities

(1,144)

(1,097)

Effect of exchange rate changes on cash

and cash equivalents, including restricted cash

(20)

18

Decrease in cash and cash equivalents,

including restricted cash

(3,310)

(214)

Cash and cash equivalents and restricted

cash at the beginning of period

6,390

5,936

Cash and cash equivalents and

restricted cash at the end of period

3,080

5,722

Supplemental cash flow

information:

Cash paid for interest (including finance

leases)

372

244

Cash paid for income taxes

654

620

Reconciliation of cash and cash

equivalents and restricted cash

Cash and cash equivalents presented in the

Condensed Consolidated Balance Sheets

2,978

5,722

Restricted cash presented in the Condensed

Consolidated Balance Sheets

102

–

Total cash and cash equivalents and

restricted cash presented in the Condensed Consolidated Statements

of Cash Flows

3,080

5,722

Appendix 2 - Non-GAAP Reconciliation and Supplementary

Information

CRH uses a number of non-GAAP performance measures to monitor

financial performance. These measures are referred to throughout

the discussion of our reported financial position and operating

performance on a continuing operations basis unless otherwise

defined and are measures which are regularly reviewed by CRH

management. These performance measures may not be uniformly defined

by all companies and accordingly may not be directly comparable

with similarly titled measures and disclosures by other

companies.

Certain information presented is derived from amounts calculated

in accordance with U.S. GAAP but is not itself an expressly

permitted GAAP measure. The non-GAAP performance measures as

summarized below should not be viewed in isolation or as an

alternative to the equivalent GAAP measure.

Adjusted EBITDA: Adjusted EBITDA is defined as earnings

from continuing operations before interest, taxes, depreciation,

depletion, amortization, loss on impairments, gain/loss on

divestitures and unrealized gain/loss on investments, income/loss

from equity method investments, substantial acquisition-related

costs and pension expense/income excluding current service cost

component. It is quoted by management in conjunction with other

GAAP and non-GAAP financial measures to aid investors in their

analysis of the performance of the Company. Adjusted EBITDA by

segment is monitored by management in order to allocate resources

between segments and to assess performance. Adjusted EBITDA

margin is calculated by expressing Adjusted EBITDA as a

percentage of total revenues.

Reconciliation to its nearest GAAP measure is presented

below:

Three months ended

Nine months ended

September 30

September 30

in $ millions

2024

2023

2024

2023

Net income

1,389

1,318

2,812

2,499

Income from equity method investments

(25)

(14)

(27)

(21)

Income tax expense

531

416

942

781

Gain on divestitures and unrealized gains

on investments (i)

(59)

–

(242)

–

Pension income excluding current service

cost component (i)

(1)

(1)

(3)

(3)

Other interest, net (i)

(2)

–

(1)

–

Interest expense

164

131

452

285

Interest income

(33)

(62)

(112)

(138)

Depreciation, depletion and

amortization

467

402

1,288

1,187

Substantial acquisition-related costs

(ii)

23

–

45

–

Adjusted EBITDA

2,454

2,190

5,154

4,590

Total revenues

10,515

10,128

26,702

26,264

Net income margin

13.2%

13.0%

10.5%

9.5%

Adjusted EBITDA margin

23.3%

21.6%

19.3%

17.5%

(i) Gain on divestitures and unrealized

gains on investments, pension income excluding current service cost

component and other interest, net have been included in Other

nonoperating income, net in the Condensed Consolidated Statements

of Income.

(ii) Represents expenses associated with

non-routine substantial acquisitions, which meet the criteria for

being separately reported in Note 4 “Acquisitions” of the unaudited

financial statements in the Quarterly Report on Form 10-Q. Expenses

in the third quarter of 2024 primarily include legal and consulting

expenses related to these non-routine substantial acquisitions.

Adjusted EBITDA is not defined by GAAP and should not be

considered as an alternative to earnings measures defined by GAAP.

Reconciliation to its nearest GAAP measure for the mid-point of the

2024 Adjusted EBITDA guidance is presented below:

in $ billions

2024 Mid-Point

Net income

3.8

Income tax expense

1.1

Interest expense, net

0.5

Depreciation, depletion, amortization and

impairment

1.8

Other (i)

(0.3)

Adjusted EBITDA

6.9

(i) Other primarily relates to loss

(income) from equity method investments, loss (gain) on

divestitures and unrealized loss (gain) on investments and

substantial acquisition-related costs.

Net Debt: Net Debt is used by management as it gives

additional insight into the Company’s current debt position less

available cash. Net Debt is provided to enable investors to see the

economic effect of gross debt, related hedges and cash and cash

equivalents in total. Net Debt comprises short and long-term debt,

finance lease liabilities, cash and cash equivalents and current

and noncurrent derivative financial instruments (net).

Reconciliation to its nearest GAAP measure is presented

below:

September 30

December 31

September 30

in $ millions

2024

2023

2023

Short and long-term debt

(13,890)

(11,642)

(11,395)

Cash and cash equivalents (i)

2,978

6,390

5,722

Finance lease liabilities

(228)

(117)

(96)

Derivative financial instruments (net)

(35)

(37)

(118)

Net Debt

(11,175)

(5,406)

(5,887)

(i) Cash and cash equivalents includes

cash and cash equivalents reclassified as held for sale of $nil

million, $49 million, and $nil million at September 30, 2024,

December 31, 2023 and September 30, 2023 respectively.

Organic Revenue and Organic Adjusted EBITDA: Because of

the impact of acquisitions, divestitures, currency exchange

translation and other non-recurring items on reported results each

reporting period, CRH uses organic revenue and organic Adjusted

EBITDA as additional performance indicators to assess performance

of pre-existing (also referred to as underlying, like-for-like or

ongoing) operations each reporting period.

Organic revenue and organic Adjusted EBITDA are arrived at by

excluding the incremental revenue and Adjusted EBITDA contributions

from current and prior year acquisitions and divestitures, the

impact of exchange translation, and the impact of any one-off

items. Changes in organic revenue and organic Adjusted EBITDA are

presented as additional measures of revenue and Adjusted EBITDA to

provide a greater understanding of the performance of the Company.

Organic change % is calculated by expressing the organic movement

as a percentage of the prior year reporting period (adjusted for

currency exchange effects). A reconciliation of the changes in

organic revenue and organic Adjusted EBITDA to the changes in total

revenues and Adjusted EBITDA by segment is presented with the

discussion within each segment’s performance in tables contained in

the segment discussion commencing on page 4.

Appendix 3 - Disclaimer/Forward-Looking Statements

In order to utilize the “Safe Harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995, CRH is

providing the following cautionary statement.

This document contains statements that are, or may be deemed to

be, forward-looking statements with respect to the financial

condition, results of operations, business, viability and future

performance of CRH and certain of the plans and objectives of CRH.

These forward-looking statements may generally, but not always, be

identified by the use of words such as “will”, “anticipates”,

“should”, “could”, “would”, “targets”, “aims”, “may”, “continues”,

“expects”, “is expected to”, “estimates”, “believes”, “intends” or

similar expressions. These forward-looking statements include all

matters that are not historical facts or matters of fact at the

date of this document.

In particular, the following, among other statements, are all

forward looking in nature: plans and expectations regarding demand

outlook for 2024 and 2025; plans and expectations regarding

government funding initiatives and re-industrialization activity;

pricing, costs, trends in residential and non-residential markets;

macroeconomic and other market trends and dynamics in regions where

CRH operates; plans and expectations regarding investments in

innovation and sustainability and the enhancement of CRH's ability

to address global challenges; favorable trends in the interest rate

environment; plans and expectations regarding acquisitions and

divestitures and resulting synergies and growth opportunities;

plans and expectations regarding management succession; plans and

expectations regarding return of cash to shareholders, including

the timing and amount of share buybacks and dividends; expectations

regarding CRH's credit rating with each of the three main rating

agencies; plans with respect to changes in the Company’s reportable

segments; the existence of a potential impairment, including amount

and timing; and plans and expectations regarding CRH’s 2024 full

year performance, including net income, Adjusted EBITDA, earnings

per share and capital expenditure.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future and reflect

the Company’s current expectations and assumptions as to such

future events and circumstances that may not prove accurate. You

are cautioned not to place undue reliance on any forward-looking

statements. These forward-looking statements are made as of the

date of this document. The Company expressly disclaims any

obligation or undertaking to publicly update or revise these

forward-looking statements other than as required by applicable

law.

A number of material factors could cause actual results and

developments to differ materially from those expressed or implied

by these forward-looking statements, certain of which are beyond

our control, and which include, among other factors: economic and

financial conditions, including changes in interest rates,

inflation, price volatility and/or labor and materials shortages;

demand for infrastructure, residential and non-residential

construction and our products in geographic markets in which we

operate; increased competition and its impact on prices and market

position; increases in energy, labor and/or other raw materials

costs; adverse changes to laws and regulations, including in

relation to climate change; the impact of unfavorable weather;

investor and/or consumer sentiment regarding the importance of

sustainable practices and products; availability of public sector

funding for infrastructure programs; political uncertainty,

including as a result of political and social conditions in the

jurisdictions CRH operates in, or adverse political developments,

including the ongoing geopolitical conflicts in Ukraine and the

Middle East; failure to complete or successfully integrate

acquisitions or make timely divestments; cyber-attacks and exposure

of associates, contractors, customers, suppliers and other

individuals to health and safety risks, including due to product

failures. Additional factors, risks and uncertainties that could

cause actual outcomes and results to be materially different from

those expressed by the forward-looking statements in this report

include the risks and uncertainties described under “Risk Factors”

in Part 1, Item 1A of the Annual Report on Form 10-K “Risk Factors”

in CRH’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 as filed with the SEC and in CRH's other filings

with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106972036/en/

ir@crh.com

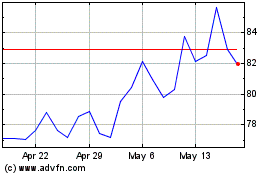

CRH (NYSE:CRH)

Historical Stock Chart

From Oct 2024 to Nov 2024

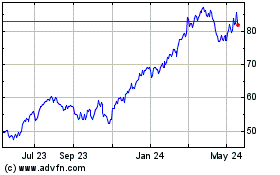

CRH (NYSE:CRH)

Historical Stock Chart

From Nov 2023 to Nov 2024