0001060822false00010608222025-02-252025-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2025

| | |

| Carter’s, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-31829 | | 13-3912933 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

Phipps Tower,

3438 Peachtree Road NE, Suite 1800

Atlanta, Georgia 30326

(Address of principal executive offices, including zip code)

(678) 791-1000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, par value $0.01 per share | | CRI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 ((§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 ((§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 25, 2025, Carter’s, Inc. issued a press release announcing its financial results for its fourth quarter and fiscal year ended December 28, 2024. A copy of that press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in the Current Report on Form 8-K is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

|

| | |

Exhibit

Number | Description |

| | |

| 99.1 | |

| 104 | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, Carter’s, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| February 25, 2025 | CARTER’S, INC. |

| | | |

| | By: | /s/ Antonio D. Robinson |

| | Name: | Antonio D. Robinson |

| | Title: | Senior Vice President, General Counsel, Corporate Secretary, CSR & Chief Compliance Officer |

| | |

Exhibit 99.1

| | | | | |

| |

| Contact: |

| Sean McHugh |

| Vice President & Treasurer |

| | (678) 791-7615 |

Carter’s, Inc. Reports Fourth Quarter and Fiscal Year 2024 Results

•Fourth quarter fiscal 2024 results

◦Net sales $860 million vs. $858 million in Q4 2023

◦Operating margin 9.7% vs. 15.9% in Q4 2023

◦Adjusted operating margin 13.4% vs. 15.9% in Q4 2023

◦Diluted EPS $1.71 (including non-cash charge of $0.63 related to impairment of the OshKosh tradename) vs. $2.90 in Q4 2023

◦Adjusted diluted EPS $2.39 vs. $2.76 in Q4 2023

•Fiscal year 2024 results

◦Net sales $2.844 billion vs. $2.946 billion in 2023

◦Operating margin 9.0% vs. 11.0% in 2023

◦Adjusted operating margin 10.1% vs. 11.1% in 2023

◦Diluted EPS $5.12 vs. $6.24 in 2023

◦Adjusted diluted EPS $5.81 vs. $6.19 in 2023

◦Operating cash flow $299 million

◦$167 million returned to shareholders through dividends and share repurchases

•Board of Directors declares quarterly dividend of $0.80 per share

•Fiscal year 2025 outlook1:

◦Net sales of $2.780 billion to $2.855 billion

◦Adjusted operating income of $180 million to $210 million

◦Adjusted diluted EPS of $3.20 to $3.80

ATLANTA, February 25, 2025 — Carter’s, Inc. (NYSE:CRI), the leading company in North America focused exclusively on apparel for babies and young children, today reported its fourth quarter and fiscal year 2024 results.

1 Refer to “Business Outlook” section of this release for additional information regarding reconciliations of forward-looking non-GAAP financial measures.

“Our product, pricing and promotional strategies in the fourth quarter drove a continued trend improvement in traffic, conversion and comparable sales in our U.S. Retail businesses,” said Richard F. Westenberger, Interim Chief Executive Officer, Senior Executive Vice President, Chief Financial Officer & Chief Operating Officer. “We also saw strong demand for our exclusive brands in the wholesale channel and continued momentum in our retail businesses in Mexico and Canada.

“We achieved a 13.4% adjusted operating margin in the fourth quarter. Our profitability reflected planned investments in pricing, marketing and stores which contributed to a mid-single-digit increase in comparable retail sales over the key Black Friday selling period as well as improved customer acquisition and retention.

“In 2024, our business generated nearly $300 million of operating cash flow and we ended the year with over $1 billion in total liquidity. Our balance sheet, substantial liquidity and strong cash flow represent significant advantages for Carter’s, providing us with the flexibility and resources to manage through periods of uneven consumer demand such as we’ve experienced in recent years and to invest in growth opportunities.

“Several factors are expected to weigh on our profitability in 2025, including some residual lower pricing in the first half of the year, higher product costs and the restoration of more normalized variable compensation provisions. In 2025, we intend to rely less on pricing action and lean more into planned improvements in our merchandise assortments and a stronger overall inventory position, particularly in the more significant second half of the year.

“Over the past several months, with the assistance of outside industry experts, we have been conducting a comprehensive assessment of our business. This review has highlighted many strengths, including our brand assets, significant equity with consumers and the unique reach of our multi-channel business model. It has also identified a number of opportunities to improve the focus and appeal of our product offerings to capture new customer segments and market share going forward. Our ultimate objectives are to return Carter’s to consistent, profitable growth and to create value for our shareholders, which have historically been hallmarks of this Company’s performance over a long period of time.

“As previously announced, our Board of Directors has initiated a comprehensive search to identify a permanent Chief Executive Officer. We look forward to introducing our new leader when the search process is completed.”

Adjustments to Reported GAAP Results

In addition to the results presented in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements, as presented below. The Company believes these adjustments provide a meaningful comparison of the Company’s results and afford investors a view of what management considers to be the Company’s underlying performance. These measures are presented for informational purposes only. See “Reconciliation of Adjusted Results to GAAP” section of this release for additional disclosures and reconciliations regarding these non-GAAP financial measures.

Fourth quarter fiscal 2024 results included a non-cash, pre-tax charge of $30.0 million related to the write down of the OshKosh tradename asset, reflecting lower projected sales and earnings for the OshKosh brand, and a pre-tax charge of $1.8 million related to organizational restructuring.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Fiscal Quarter |

| 2024 | | | 2023 |

| (In millions, except earnings per share) | Operating Income | | % Net Sales | | Net Income | | Diluted EPS | | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

| As reported (GAAP) | $ | 83.2 | | | 9.7 | % | | $ | 61.5 | | | $ | 1.71 | | | | $ | 136.1 | | | 15.9 | % | | $ | 106.5 | | | $ | 2.90 | |

| Organizational restructuring | 1.8 | | | | | 1.6 | | | 0.04 | | | | — | | | | | — | | | — | |

| Intangible asset impairment | 30.0 | | | | | 22.8 | | | 0.63 | | | | — | | | | | — | | | — | |

| Benefit from credit card settlement | — | | | | | — | | | — | | | | — | | | | | (5.3) | | | (0.14) | |

| | | | | | | | | | | | | | | | |

| As adjusted | $ | 115.0 | | | 13.4 | % | | $ | 85.9 | | | $ | 2.39 | | | | $ | 136.0 | | | 15.9 | % | | $ | 101.2 | | | $ | 2.76 | |

| | | | | | | | | | | | | | | | |

| Fiscal Year |

| 2024 | | | 2023 |

| (In millions, except earnings per share) | Operating Income | | % Net Sales | | Net Income | | Diluted EPS | | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

| As reported (GAAP) | $ | 254.7 | | | 9.0 | % | | $ | 185.5 | | | $ | 5.12 | | | | $ | 323.4 | | | 11.0 | % | | $ | 232.5 | | | $ | 6.24 | |

| Organizational restructuring | 1.8 | | | | | 1.6 | | | 0.04 | | | | 4.4 | | | | | 3.4 | | | 0.09 | |

| Intangible asset impairment | 30.0 | | | | | 22.8 | | | 0.63 | | | | — | | | | | — | | | — | |

| Partial pension plan settlement | — | | | | | 0.7 | | | 0.02 | | | | — | | | | | — | | | — | |

| Benefit from credit card settlement | — | | | | | — | | | — | | | | — | | | | | (5.3) | | | (0.14) | |

| As adjusted | $ | 286.6 | | | 10.1 | % | | $ | 210.7 | | | $ | 5.81 | | | | $ | 327.8 | | | 11.1 | % | | $ | 230.6 | | | $ | 6.19 | |

Note: Results may not be additive due to rounding.

Consolidated Results

The discussion of results below is presented on an adjusted (non-GAAP) basis where noted.

Fourth Quarter of Fiscal 2024 compared to Fourth Quarter of Fiscal 2023

Net sales increased $1.8 million, or 0.2%, to $859.7 million, compared to $857.9 million in the fourth quarter of fiscal 2023, reflecting growth in our U.S. Wholesale segment that was offset by declines in our U.S. Retail and International business segments. Macroeconomic factors, including inflation and elevated interest rates, continued to weigh on families with young children and demand for our brands in the fourth quarter of fiscal 2024. U.S. Wholesale net sales increased 7.3%, in part due to favorable changes in timing

of shipments to certain customers compared to the prior year period. U.S. Retail and International net sales declined 2.8% and 2.0%, respectively. U.S. Retail comparable net sales declined 3.4% which represented an improved trend from third quarter and first half results, in part due to targeted investments in price reductions and more compelling promotional events during the holiday shopping season. Changes in foreign currency exchange rates used for translation in the fourth quarter of fiscal 2024, as compared to the fourth quarter of fiscal 2023, had an unfavorable effect on consolidated net sales of approximately $5.9 million, or 0.7%.

Operating income decreased $52.9 million, or 38.9%, to $83.2 million, compared to $136.1 million in the fourth quarter of fiscal 2023. Operating margin decreased 620 basis points to 9.7%, reflecting the OshKosh tradename impairment, investments in pricing, marketing, and stores, higher inbound freight rates, and increased charitable contributions, partially offset by lower product costs and performance-based compensation expense.

Adjusted operating income (a non-GAAP measure) decreased $21.0 million, or 15.4%, to $115.0 million, compared to $136.0 million in the fourth quarter of fiscal 2023. Adjusted operating margin decreased 250 basis points to 13.4%, reflecting investments in pricing, marketing, and stores, higher inbound freight rates, and increased charitable contributions, partially offset by lower product costs and performance-based compensation expense.

Net income decreased $45.0 million, or 42.2%, to $61.5 million, compared to $106.5 million in the fourth quarter of fiscal 2023. Diluted earnings per share decreased 41.0% to $1.71, compared to $2.90 in the prior year period.

Adjusted net income (a non-GAAP measure) decreased $15.3 million, or 15.1%, to $85.9 million, compared to $101.2 million in the fourth quarter of fiscal 2023. Adjusted diluted earnings per share (a non-GAAP measure) decreased 13.4% to $2.39, compared to $2.76 in the fourth quarter of fiscal 2023.

Fiscal Year 2024 compared to Fiscal Year 2023

Consolidated net sales decreased $101.5 million, or 3.4%, to $2.84 billion, compared to $2.95 billion in fiscal 2023, reflecting declines in our U.S. Retail and International segments that were partially offset by growth in the U.S. Wholesale segment. Macroeconomic factors, including inflation and elevated interest rates, continued to weigh on families with young children and demand for our brands in 2024. U.S. Retail and International net sales declined 5.6%, and 5.5%, respectively, while U.S. Wholesale net sales grew 0.7%. U.S. Retail comparable net sales declined 6.9%. Changes in foreign currency exchange rates used for translation in fiscal 2024, as compared to fiscal 2023, had an unfavorable effect on consolidated net sales of approximately $7.4 million, or 0.3%.

Operating income in fiscal 2024 decreased $68.7 million, or 21.2%, to $254.7 million, compared to $323.4 million in fiscal 2023. Operating margin decreased 200 basis points to 9.0%, reflecting the OshKosh tradename impairment, fixed cost deleverage on lower sales, and investments in pricing, marketing, and retail stores, partially offset by lower inbound freight and product costs, lower performance-based compensation provisions, and lower consulting fees.

Adjusted operating income (a non-GAAP measure) decreased $41.3 million, or 12.6% to $286.6 million, compared to $327.8 million in fiscal 2023. Adjusted operating margin decreased 100 basis points to 10.1%, reflecting fixed cost deleverage on lower sales and investments in pricing, marketing, and retail stores, partially offset by lower inbound freight and product costs, lower performance-based compensation provisions, and lower consulting fees.

Net income in fiscal 2024 decreased $47.0 million, or 20.2%, to $185.5 million, compared to $232.5 million in fiscal 2023. Diluted earnings per share decreased 18.0% to $5.12, compared to $6.24 in fiscal 2023.

Adjusted net income (a non-GAAP measure) decreased $20.0 million, or 8.7%, to $210.7 million compared to $230.6 million in fiscal 2023. Adjusted earnings per diluted share (a non-GAAP measure) decreased 6.1% to $5.81, compared to $6.19 in fiscal 2023.

Net cash provided by operations in fiscal 2024 was $298.8 million compared to $529.1 million in fiscal 2023. The change in net cash provided by operating activities was primarily driven by lower net income and a more significant reduction in inventory in fiscal 2023 than in 2024.

See the “Reconciliation of Adjusted Results to GAAP” section of this release for additional disclosures regarding non-GAAP measures.

Liquidity and Financial Position

The Company’s total liquidity at the end of fiscal 2024 was $1.3 billion, comprised of cash and cash equivalents of $413 million and $845 million in unused borrowing capacity under the Company’s $850 million secured revolving credit facility.

Return of Capital

In the fourth quarter of fiscal 2024, the Company returned $28.8 million to shareholders through cash dividends. In fiscal 2024, the Company returned a total of $166.7 million to shareholders through cash dividends and share repurchases, as described below.

•Dividends: During the fourth quarter of fiscal 2024, the Company paid a cash dividend of $0.80 per common share totaling $28.8 million. In fiscal 2024, the Company paid quarterly cash dividends of $0.80 per common share each quarter totaling $116.2 million.

•Share repurchases: No shares were repurchased in the fourth quarter of fiscal 2024. During fiscal 2024, the Company repurchased and retired approximately 0.7 million shares for $50.5 million at an average price of $68.61 per share. Fiscal 2024 share repurchases represented approximately 2.0% of common shares outstanding as of the beginning of fiscal year 2024. All shares were repurchased in open market transactions pursuant to applicable regulations for such transactions. As of December 28, 2024, the total remaining capacity under the Company’s previously announced repurchase authorizations was approximately $599.0 million.

On February 21, 2025, the Company’s Board of Directors declared a quarterly cash dividend of $0.80 per share for payment on March 28, 2025, to shareholders of record at the close of business on March 10, 2025. The Company’s Board of Directors will evaluate future distributions of capital, including dividends and share repurchases, based on a number of factors, including business conditions, the Company’s financial performance, investment priorities, and other considerations.

Business Outlook

We do not reconcile forward-looking adjusted operating income or adjusted diluted earnings per share to their most directly comparable GAAP measures because we cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliations that are not within our control due to factors described above, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future operating income or diluted EPS, the most directly comparable GAAP metrics to adjusted operating income and adjusted diluted earnings per share, respectively.

The Company’s fiscal year ends on the Saturday in December or January nearest December 31. Every five or six years, our fiscal year includes an additional 53rd week of results. Fiscal years 2024 and 2023 contained 52 calendar weeks. Fiscal year 2025 contains 53 weeks.

For fiscal year 2025 (a 53 week fiscal year), the Company projects approximately:

•$2.780 billion to $2.855 billion in net sales ($2.844 billion in fiscal 2024);

•$180 million to $210 million in adjusted operating income ($287 million in fiscal 2024);

•$3.20 to $3.80 in adjusted diluted earnings per share ($5.81 in fiscal 2024);

•Operating cash flow of $200 million; and

•Capital expenditures of $65 million.

Our outlook for fiscal year 2025 assumes (comparisons vs. prior year unless otherwise noted):

•Comparable to a mid-single-digit decline in U.S. Retail sales, low single-digit growth to a low single-digit decline in U.S. Wholesale sales, and low single-digit growth to comparable International sales;

•Sales and earnings contributions weighted to the second half, driven by planned improvements in our product assortments and a better overall inventory position in the second half, and targeted pricing investments and freight costs to be less impactful in the second half;

•Lower gross margin rate, reflecting targeted retail pricing investments, changes in customer mix within wholesale, adverse currency exchange rate impacts, and higher product costs;

•Increased SG&A, principally reflecting higher variable compensation provisions and growth-related investments, partially offset by productivity initiatives;

•Higher net interest expense and effective tax rate; and

•Comparable average number of shares outstanding.

The above outlooks for adjusted operating income and adjusted diluted earnings per share for fiscal year 2025 exclude pre-tax expenses of approximately $8 million to $9 million related to the retirement of the Company’s previous CEO and $9 million to $10 million related to operating model improvement initiatives. The outlook for adjusted diluted earnings per share further excludes a non-cash pre-tax charge for termination of the OshKosh B’Gosh pension plan of up to $10 million.

For the first quarter of fiscal 2025, the Company projects approximately:

•$615 million to $625 million in net sales ($661 million in Q1 fiscal 2024);

•$30 million to $35 million in adjusted operating income ($55 million in Q1 fiscal 2024); and

•$0.45 to $0.55 in adjusted diluted earnings per share ($1.04 Q1 fiscal 2024).

Our outlook for the first quarter of fiscal 2025 assumes (comparisons vs. prior year):

•A mid-single-digit to high single-digit decline in U.S. Retail sales, a high single-digit decline in U.S. Wholesale sales, and a mid-single-digit decline in International sales;

•A later Easter holiday;

•Targeted pricing investments in U.S. Retail;

•Higher inbound freight rates;

•Lower SG&A;

•Higher net interest expense;

•Higher effective tax rate; and

•Comparable average number of shares outstanding.

The above outlooks for adjusted operating income and adjusted diluted earnings per share for the first quarter of fiscal year 2025 exclude pre-tax expenses of approximately $6 million related to the retirement of the Company’s previous CEO and $3 million related to operating model improvement initiatives.

Conference Call

The Company will hold a conference call with investors to discuss fourth quarter and fiscal 2024 results and its business outlook on February 25, 2025, at 8:30 a.m. Eastern Standard Time. To listen to a live webcast and view the accompanying presentation materials, please visit ir.carters.com and select links for “News & Events” followed by “Events.”

To access the call by phone, please preregister via the following link to receive your dial-in number and unique passcode: https://register.vevent.com/register/BI0c85063a140c4334a93a2bd6abfbbf3b.

A webcast replay will be available shortly after the conclusion of the call at ir.carters.com.

About Carter’s, Inc.

Carter’s, Inc. is the largest branded marketer in North America of apparel exclusively for babies and young children. The Company owns the Carter’s and OshKosh B’gosh brands, among the more recognized and trusted brands in the marketplace. These brands are sold through over 1,000 Company-operated stores in the United States, Canada, and Mexico and online at www.carters.com, www.oshkosh.com, www.cartersoshkosh.ca, and www.carters.com.mx. Carter’s also is the largest supplier of young children’s apparel to the largest retailers in North America. Its brands are sold in leading department stores, national chains, and specialty retailers domestically and internationally. The Company’s Child of Mine brand is available at Walmart, its Just One You brand is available at Target, and its Simple Joys brand is available on Amazon.com. The Company also owns Little Planet, a brand focused on organic fabrics and sustainable materials, and Skip Hop, a global lifestyle brand for families with young children. Carter’s is headquartered in Atlanta, Georgia. Additional information may be found at www.carters.com.

Forward Looking Statements

Statements in this press release that are not historical fact and use predictive words such as “estimates”, “outlook”, “guidance”, “expect”, “believe”, “intend”, “designed”, “target”, “plans”, “may”, “will”, “are confident” and similar words are forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These forward-looking statements and related assumptions involve risks and uncertainties that could cause actual results and outcomes to differ materially from any forward-looking statements or views expressed in this press release. These risks and uncertainties include,

but are not limited to, those discussed in the subsection entitled “Risk Factors” under Part I, Item 1A, of this Annual Report on 10-K, and otherwise in our reports and filings with the Securities and Exchange Commission, as well as the following factors: changes in global economic and financial conditions, and the resulting impact on consumer confidence and consumer spending, as well as other changes in consumer discretionary spending habits; risks related to public health crises; risks related to consumer tastes and preferences, as well as fashion trends; our ability to successfully launch new brands within the time frames we have previously disclosed; the failure to protect our intellectual property; the diminished value of our brands, potentially as a result of negative publicity or unsuccessful branding and marketing efforts; delays, product recalls, or loss of revenue due to a failure to meet our quality standards; risks related to uncertainty regarding the future of international trade agreements; increased competition in the marketplace; financial difficulties for one or more of our major customers; identification of locations and negotiation of appropriate lease terms for our retail stores; distinct risks facing our eCommerce business; failure to forecast demand for our products and our failure to manage our inventory; increased margin pressures, including increased cost of materials and labor and our inability to successfully increase prices to offset these increased costs; continued inflationary pressures with respect to labor and raw materials and global supply chain constraints that have, and could continue, to affect freight, transit, and other costs; fluctuations in foreign currency exchange rates; unseasonable or extreme weather conditions; risks associated with corporate responsibility issues; our foreign sourcing arrangements; a relatively small number of vendors supply a significant amount of our products; disruptions in our supply chain, including increased transportation and freight costs; our ability to effectively source and manage inventory; problems with our Braselton, Georgia distribution facility; pending and threatened lawsuits; a breach of our information technology systems and the loss of personal data or a failure to implement new information technology systems successfully; unsuccessful expansion into international markets; failure to comply with various laws and regulations; failure to properly manage strategic initiatives; retention of key individuals; acquisition and integration of other brands and businesses; failure to achieve sales growth plans and profitability objectives to support the carrying of our intangible assets; our continued ability to meet obligations related to our debt; changes in our tax obligations, including additional customs, duties or tariffs; our continued ability to declare and pay a dividend; volatility in the market price of our common stock; and the cost or effort required for our shareholders to bring certain claims or actions against us, as a result of our designation of the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings. Except for any ongoing obligations to disclose material information as required by federal securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. The inclusion of any statement in this press release does not constitute an admission

by the Company or any other person that the events or circumstances described in such statement are material.

CARTER’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands, except for share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal quarter ended | | For the fiscal year ended |

| | | December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

| | | | | | | | |

| | | | | | | | |

| Net sales | | $ | 859,712 | | | $ | 857,864 | | | $ | 2,844,102 | | | $ | 2,945,594 | |

| Cost of goods sold | | 448,687 | | | 439,689 | | | 1,478,936 | | | 1,549,659 | |

| | | | | | | | |

| Gross profit | | 411,025 | | | 418,175 | | | 1,365,166 | | | 1,395,935 | |

| Royalty income, net | | 4,292 | | | 4,837 | | | 19,251 | | | 21,410 | |

| Selling, general, and administrative expenses | | 302,117 | | | 286,952 | | | 1,099,689 | | | 1,093,940 | |

| | | | | | | | |

| Intangible asset impairment | | 30,000 | | | — | | | 30,000 | | | — | |

| Operating income | | 83,200 | | | 136,060 | | | 254,728 | | | 323,405 | |

| Interest expense | | 8,175 | | | 7,631 | | | 31,331 | | | 33,973 | |

| Interest income | | (2,395) | | | (2,007) | | | (11,039) | | | (4,776) | |

| Other expense (income), net | | 1,650 | | | (7,516) | | | 3,627 | | | (8,034) | |

| | | | | | | | |

| Income before income taxes | | 75,770 | | | 137,952 | | | 230,809 | | | 302,242 | |

| Income tax provision | | 14,253 | | | 31,441 | | | 45,300 | | | 69,742 | |

| Net income | | $ | 61,517 | | | $ | 106,511 | | | $ | 185,509 | | | $ | 232,500 | |

| | | | | | | | |

| Basic net income per common share | | $ | 1.71 | | | $ | 2.90 | | | $ | 5.12 | | | $ | 6.24 | |

| Diluted net income per common share | | $ | 1.71 | | | $ | 2.90 | | | $ | 5.12 | | | $ | 6.24 | |

| Dividend declared and paid per common share | | $ | 0.80 | | | $ | 0.75 | | | $ | 3.20 | | | $ | 3.00 | |

CARTER’S, INC.

CONDENSED BUSINESS SEGMENT RESULTS

(dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the fiscal quarter ended | | | For the fiscal year ended |

| December 28,

2024 | | % of

total sales | | December 30,

2023 | | % of

total sales | | | December 28, 2024 | | % of

total sales | | December 30,

2023 | | % of

total sales |

| Net sales: | | | | | | | | | | | | | | | | |

| U.S. Retail | $ | 466,231 | | | 54.2 | % | | $ | 479,798 | | | 56.0 | % | | | $ | 1,417,108 | | | 49.8 | % | | $ | 1,501,780 | | | 51.0 | % |

| U.S. Wholesale | 265,374 | | | 30.9 | % | | 247,389 | | | 28.8 | % | | | 1,021,396 | | | 35.9 | % | | 1,014,584 | | | 34.4 | % |

| International | 128,107 | | | 14.9 | % | | 130,677 | | | 15.2 | % | | | 405,598 | | | 14.3 | % | | 429,230 | | | 14.6 | % |

| Total consolidated net sales | $ | 859,712 | | | 100.0 | % | | $ | 857,864 | | | 100.0 | % | | | $ | 2,844,102 | | | 100.0 | % | | $ | 2,945,594 | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Segment operating income(1): | | | Segment operating margin | | | | Segment operating margin | | | | | Segment operating margin | | | | Segment operating margin |

| U.S. Retail | $ | 73,246 | | | 15.7 | % | | $ | 87,500 | | | 18.2 | % | | | $ | 132,926 | | | 9.4 | % | | $ | 190,642 | | | 12.7 | % |

| U.S. Wholesale | 54,318 | | | 20.5 | % | | 51,841 | | | 21.0 | % | | | 216,980 | | | 21.2 | % | | 198,945 | | | 19.6 | % |

| International | 20,988 | | | 16.4 | % | | 21,681 | | | 16.6 | % | | | 38,970 | | | 9.6 | % | | 45,131 | | | 10.5 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total segment operating income | $ | 148,552 | | | 17.3 | % | | $ | 161,022 | | | 18.8 | % | | | $ | 388,876 | | | 13.7 | % | | $ | 434,718 | | | 14.8 | % |

| | | | | | | | | | | | | | | | |

| Items not included in segment operating income: | | | Consolida-ted operating margin | | | | Consolida-ted operating margin | | | | | Consolida-ted operating margin | | | | Consolida-ted operating margin |

Unallocated corporate expenses (2) | $ | (33,530) | | | n/a | | $ | (24,962) | | | n/a | | | $ | (102,326) | | | n/a | | $ | (106,901) | | | n/a |

Organizational restructuring (3) | (1,822) | | | n/a | | — | | | n/a | | | (1,822) | | | n/a | | (4,412) | | | n/a |

Intangible asset impairment (4) | (30,000) | | | n/a | | — | | | n/a | | | (30,000) | | | n/a | | — | | | n/a |

| Consolidated operating income | $ | 83,200 | | | 9.7% | | $ | 136,060 | | | 15.9% | | | $ | 254,728 | | | 9.0% | | $ | 323,405 | | | 11.0% |

(1)In fiscal 2024, the Company changed its measure of segment profitability to segment operating income. Segment operating income includes net sales, royalty income, and related cost of goods sold and selling, general, and administrative expenses attributable to each segment. Segment operating income excludes unallocated corporate expenses as well as specific charges that are not directly attributable to segment operations, including restructuring costs and impairment charges related to goodwill and indefinite-lived intangible assets, which were included in our previous measure of segment profitability. Prior period segment operating income for the fiscal quarter and fiscal year ended December 30, 2023 has been recast to conform to the current presentation.

(2)Unallocated corporate expenses include corporate overhead expenses that are not directly attributable to one of our business segments and include unallocated accounting, finance, legal, human resources, and information technology expenses, occupancy costs for our corporate headquarters, and other benefit and compensation programs, including performance-based compensation.

(3)Net expenses related to organizational restructuring in fiscal 2024 and organizational restructuring and related corporate office lease amendment actions in fiscal 2023.

(4)Non-cash impairment charge on the OshKosh indefinite-lived tradename asset.

Note: Results may not be additive due to rounding.

CARTER’S, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except for share data)

(unaudited)

| | | | | | | | | | | |

| December 28, 2024 | | December 30, 2023 |

| ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 412,926 | | | $ | 351,213 | |

Accounts receivable, net of allowance for credit losses of $5,663 and $4,754, respectively | 194,834 | | | 183,774 | |

| Finished goods inventories | 502,332 | | | 537,125 | |

Prepaid expenses and other current assets | 32,580 | | | 29,131 | |

| | | |

Total current assets | 1,142,672 | | | 1,101,243 | |

Property, plant, and equipment, net | 180,956 | | | 183,111 | |

Operating lease assets | 577,133 | | | 528,407 | |

Tradenames, net | 268,008 | | | 298,186 | |

Goodwill | 206,875 | | | 210,537 | |

Customer relationships, net | 23,543 | | | 27,238 | |

Other assets | 33,980 | | | 29,891 | |

Total assets | $ | 2,433,167 | | | $ | 2,378,613 | |

| | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 248,200 | | | $ | 242,149 | |

Current operating lease liabilities | 130,564 | | | 135,369 | |

Other current liabilities | 130,052 | | | 134,344 | |

Total current liabilities | 508,816 | | | 511,862 | |

Long-term debt, net | 498,127 | | | 497,354 | |

Deferred income taxes | 38,210 | | | 41,470 | |

Long-term operating lease liabilities | 501,503 | | | 448,810 | |

Other long-term liabilities | 31,949 | | | 33,867 | |

Total liabilities | $ | 1,578,605 | | | $ | 1,533,363 | |

| | | |

| | | |

| | | |

Shareholders’ equity: | | | |

Preferred stock; par value $0.01 per share; 100,000 shares authorized; none issued or outstanding | $ | — | | | $ | — | |

Common stock, voting; par value $0.01 per share; 150,000,000 shares authorized; 36,041,995 and 36,551,221 shares issued and outstanding, respectively | 360 | | | 366 | |

Additional paid-in capital | 3,856 | | | — | |

Accumulated other comprehensive loss | (43,678) | | | (23,915) | |

Retained earnings | 894,024 | | | 868,799 | |

Total shareholders’ equity | 854,562 | | | 845,250 | |

Total liabilities and shareholders’ equity | $ | 2,433,167 | | | $ | 2,378,613 | |

CARTER’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(dollars in thousand)

(unaudited)

| | | | | | | | | | | | | | |

| | For the fiscal year ended |

| | December 28, 2024 | | December 30, 2023 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 185,509 | | | $ | 232,500 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation of property, plant, and equipment | | 54,233 | | | 60,407 | |

| Amortization of intangible assets | | 3,693 | | | 3,732 | |

| Recoveries of provisions for excess and obsolete inventory, net | | (348) | | | (10,439) | |

| | | | |

| Intangible asset impairments | | 30,000 | | | — | |

| Gain on partial termination of corporate lease | | — | | | (4,366) | |

| Other asset impairments and loss on disposal of property, plant and equipment, net of recoveries | | 865 | | | 3,078 | |

| Amortization of debt issuance costs | | 1,630 | | | 1,586 | |

| Stock-based compensation expense | | 17,841 | | | 19,463 | |

| Unrealized foreign currency exchange loss (gain), net | | 380 | | | (207) | |

| Provisions for doubtful accounts receivable from customers | | 1,086 | | | 471 | |

| | | | |

| Unrealized gain on investments | | (2,214) | | | (2,237) | |

| Partial pension plan settlement | | 949 | | | — | |

| Deferred income tax benefit | | (6,422) | | | (600) | |

| | | | |

| Effect of changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (13,743) | | | 15,453 | |

| Finished goods inventories | | 26,131 | | | 222,920 | |

| Prepaid expenses and other assets | | (2,962) | | | 4,317 | |

| Accounts payable and other liabilities | | 2,159 | | | (16,946) | |

| Net cash provided by operating activities | | $ | 298,787 | | | $ | 529,132 | |

| | | | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | $ | (56,165) | | | $ | (59,860) | |

| | | | |

| | | | |

| Net cash used in investing activities | | $ | (56,165) | | | $ | (59,860) | |

| | | | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Borrowings under secured revolving credit facility | | $ | — | | | $ | 70,000 | |

| Payments on secured revolving credit facility | | — | | | (190,000) | |

| Repurchase of common stock | | (50,526) | | | (100,034) | |

| Dividends paid | | (116,178) | | | (112,005) | |

| Withholdings from vesting of restricted stock | | (7,579) | | | (5,024) | |

| Proceeds from exercise of stock options | | 367 | | | 4,418 | |

| Other | | (900) | | | — | |

| | | | |

| Net cash used in financing activities | | $ | (174,816) | | | $ | (332,645) | |

| | | | |

| Net effect of exchange rate changes on cash | | (6,093) | | | 2,838 | |

| Net increase in cash and cash equivalents | | $ | 61,713 | | | $ | 139,465 | |

| Cash and cash equivalents, beginning of fiscal year | | 351,213 | | | 211,748 | |

| Cash and cash equivalents, end of fiscal year | | $ | 412,926 | | | $ | 351,213 | |

CARTER’S, INC.

RECONCILIATION OF ADJUSTED RESULTS TO GAAP

(dollars in millions, except earnings per share)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fiscal quarter ended December 28, 2024 |

| | | | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Income Taxes | | Net Income | | Diluted EPS |

| As reported (GAAP) | | | | | $ | 302.1 | | | 35.1 | % | | $ | 83.2 | | | 9.7 | % | | $ | 14.3 | | | $ | 61.5 | | | $ | 1.71 | |

Organizational restructuring (b) | | | | | (1.8) | | | | | 1.8 | | | | | 0.2 | | | 1.6 | | | 0.04 | |

Intangible asset impairment (c) | | | | | — | | | | | 30.0 | | | | | 7.2 | | | 22.8 | | | 0.63 | |

As adjusted (a) | | | | | $ | 300.3 | | | 34.9 | % | | $ | 115.0 | | | 13.4 | % | | $ | 21.7 | | | $ | 85.9 | | | $ | 2.39 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fiscal year ended December 28, 2024 |

| | | | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Income Taxes | | Net Income | | Diluted EPS |

| As reported (GAAP) | | | | | $ | 1,099.7 | | | 38.7 | % | | $ | 254.7 | | | 9.0 | % | | $ | 45.3 | | | $ | 185.5 | | | $ | 5.12 | |

Organizational restructuring (b) | | | | | (1.8) | | | | | 1.8 | | | | | 0.2 | | | 1.6 | | | 0.04 | |

Intangible asset impairment (c) | | | | | — | | | | | 30.0 | | | | | 7.2 | | | 22.8 | | | 0.63 | |

Pension plan settlement (d) | | | | | — | | | | | — | | | | | 0.2 | | | 0.7 | | | 0.02 | |

As adjusted (a) | | | | | $ | 1,097.9 | | | 38.6 | % | | $ | 286.6 | | | 10.1 | % | | $ | 52.9 | | | $ | 210.7 | | | $ | 5.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fiscal quarter ended December 30, 2023 |

| | | | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Income Taxes | | Net Income | | Diluted EPS |

| As reported (GAAP) | | | | | $ | 287.0 | | | 33.4 | % | | $ | 136.1 | | | 15.9 | % | | $ | 31.4 | | | $ | 106.5 | | | $ | 2.90 | |

| | | | | | | | | | | | | | | | | |

Benefit from credit card settlement (e) | | | | | — | | | | | — | | | | | (1.7) | | | (5.3) | | | (0.14) | |

As adjusted (a) | | | | | $ | 287.0 | | | 33.5 | % | | $ | 136.0 | | | 15.9 | % | | $ | 29.8 | | | $ | 101.2 | | | $ | 2.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fiscal year ended December 30, 2023 |

| | | | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Income Taxes | | Net Income | | Diluted EPS |

| As reported (GAAP) | | | | | $ | 1,093.9 | | | 37.1 | % | | $ | 323.4 | | | 11.0 | % | | $ | 69.7 | | | $ | 232.5 | | | $ | 6.24 | |

Organizational restructuring (b) | | | | | (4.4) | | | | | 4.4 | | | | | 1.0 | | | 3.4 | | | 0.09 | |

Benefit from credit card settlement (e) | | | | | — | | | | | — | | | | | (1.7) | | | (5.3) | | | (0.14) | |

| | | | | | | | | | | | | | | | | |

As adjusted (a) | | | | | $ | 1,089.5 | | | 37.0 | % | | $ | 327.8 | | | 11.1 | % | | $ | 69.1 | | | $ | 230.6 | | | $ | 6.19 | |

(a)In addition to the results provided in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements that present SG&A, operating income, income taxes, net income, and net income on a diluted share basis excluding the adjustments discussed above. The Company believes these adjustments provide a meaningful comparison of the Company’s results and afford investors a view of what management considers to be the Company's core performance. These measures are used by the Company's executive management to assess the Company's performance. The adjusted, non-GAAP financial measurements included in this earnings release should not be considered as an alternative to net income or as any other measurement of performance derived in accordance with GAAP. The adjusted, non-GAAP financial measurements are presented for informational purposes only and are not necessarily indicative of the Company’s future condition or results of operations.

(b)Net expenses related to organizational restructuring in fiscal 2024 and organizational restructuring and related corporate office lease amendment actions in fiscal 2023.

(c)Non-cash impairment charge on the OshKosh indefinite-lived tradename asset.

(d)Non-cash charge for partial settlement of the OshKosh B’Gosh Pension Plan.

(e)Gain resulting from a court-approved settlement related to payment card interchange fees.

Note: No adjustments were made to GAAP results in the first quarter of fiscal 2024. Results may not be additive due to rounding.

CARTER’S, INC.

RECONCILIATION OF NET INCOME ALLOCABLE TO COMMON SHAREHOLDERS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal quarter ended | | For the fiscal year ended |

| December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 |

| | | | | | | |

| Weighted-average number of common and common equivalent shares outstanding: | | | | | | | |

| Basic number of common shares outstanding | 35,246,887 | | | 35,992,362 | | | 35,524,378 | | | 36,589,922 | |

| Dilutive effect of equity awards | 1,130 | | | 3,172 | | | 1,238 | | | 3,344 | |

| Diluted number of common and common equivalent shares outstanding | 35,248,017 | | | 35,995,534 | | | 35,525,616 | | | 36,593,266 | |

| | | | | | | |

| As reported on a GAAP Basis: | | | | | | | |

| (dollars in thousands, except per share data) | | | | | | | |

| Basic net income per common share: | | | | | | | |

| Net income | $ | 61,517 | | | $ | 106,511 | | | $ | 185,509 | | | $ | 232,500 | |

| Income allocated to participating securities | (1,299) | | | (2,076) | | | (3,679) | | | (4,285) | |

| Net income available to common shareholders | $ | 60,218 | | | $ | 104,435 | | | $ | 181,830 | | | $ | 228,215 | |

| Basic net income per common share | $ | 1.71 | | | $ | 2.90 | | | $ | 5.12 | | | $ | 6.24 | |

| Diluted net income per common share: | | | | | | | |

| Net income | $ | 61,517 | | | $ | 106,511 | | | $ | 185,509 | | | $ | 232,500 | |

| Income allocated to participating securities | (1,299) | | | (2,076) | | | (3,679) | | | (4,285) | |

| Net income available to common shareholders | $ | 60,218 | | | $ | 104,435 | | | $ | 181,830 | | | $ | 228,215 | |

| Diluted net income per common share | $ | 1.71 | | | $ | 2.90 | | | $ | 5.12 | | | $ | 6.24 | |

| As adjusted (a): | | | | | | | |

| (dollars in thousands, except per share data) | | | | | | | |

| Basic net income per common share: | | | | | | | |

| Net income | $ | 85,938 | | | $ | 101,199 | | | $ | 210,652 | | | $ | 230,605 | |

| Income allocated to participating securities | (1,837) | | | (1,969) | | | (4,207) | | | (4,249) | |

| Net income available to common shareholders | $ | 84,101 | | | $ | 99,230 | | | $ | 206,445 | | | $ | 226,356 | |

| Basic net income per common share | $ | 2.39 | | | $ | 2.76 | | | $ | 5.81 | | | $ | 6.19 | |

| Diluted net income per common share: | | | | | | | |

| Net income | $ | 85,938 | | | $ | 101,199 | | | $ | 210,652 | | | $ | 230,605 | |

| Income allocated to participating securities | (1,837) | | | (1,969) | | | (4,207) | | | (4,248) | |

| Net income available to common shareholders | $ | 84,101 | | | $ | 99,230 | | | $ | 206,445 | | | $ | 226,357 | |

| Diluted net income per common share | $ | 2.39 | | | $ | 2.76 | | | $ | 5.81 | | | $ | 6.19 | |

(a) In addition to the results provided in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements that present per share data excluding the adjustments presented above. The Company excluded approximately $24.4 million and $25.1 million in after-tax expenses from these results for the quarter and fiscal year ended December 28, 2024, respectively. The Company excluded approximately $5.3 million and $1.9 million in after-tax benefits from these results for the quarter and fiscal year ended December 30, 2023, respectively.

CARTER’S, INC.

RECONCILIATION OF ADJUSTED RESULTS TO GAAP

(unaudited)

The following table provides a reconciliation of EBITDA and Adjusted EBITDA for the periods indicated to net income, which is the most directly comparable financial measure presented in accordance with GAAP:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal quarter ended | | Fiscal year ended | | |

| (dollars in millions) | | | | | December 28,

2024 | | December 30,

2023 | | December 28,

2024 | | December 30,

2023 | | |

| Net income | | | | | $ | 61.5 | | | $ | 106.5 | | | $ | 185.5 | | | $ | 232.5 | | | |

| Interest expense | | | | | 8.2 | | | 7.6 | | | 31.3 | | | 34.0 | | | |

| Interest income | | | | | (2.4) | | | (2.0) | | | (11.0) | | | (4.8) | | | |

| Tax expense | | | | | 14.3 | | | 31.4 | | | 45.3 | | | 69.7 | | | |

| Depreciation and amortization | | | | | 14.3 | | | 15.6 | | | 57.9 | | | 64.1 | | | |

| EBITDA | | | | | $ | 95.8 | | | $ | 159.1 | | | $ | 309.0 | | | $ | 395.6 | | | |

| | | | | | | | | | | | | |

| Adjustments to EBITDA | | | | | | | | | | | | | |

Organizational restructuring (a) | | | | | $ | 1.8 | | | $ | — | | | $ | 1.8 | | | $ | 4.4 | | | |

Intangible asset impairment (b) | | | | | 30.0 | | | — | | | 30.0 | | | — | | | |

Partial pension plan settlement (c) | | | | | — | | | — | | | 0.9 | | | — | | | |

Benefit from credit card settlement (d) | | | | | — | | | (6.9) | | | — | | | (6.9) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total adjustments | | | | | 31.8 | | | (6.9) | | | 32.8 | | | (2.5) | | | |

Adjusted EBITDA | | | | | $ | 127.6 | | | $ | 152.2 | | | $ | 341.8 | | | $ | 393.0 | | | |

(a)Net expenses related to organizational restructuring in fiscal 2024 and organizational restructuring and related corporate office lease amendment actions in fiscal 2023.

(b)Non-cash impairment charge on the OshKosh indefinite-lived tradename asset.

(c)Non-cash charge for partial settlement of the OshKosh B’Gosh Pension Plan.

(d)Gain resulting from a court-approved settlement related to payment card interchange fees.

Note: Results may not be additive due to rounding.

EBITDA and Adjusted EBITDA are supplemental financial measures that are not defined or prepared in accordance with GAAP. We define EBITDA as net income before interest, income taxes and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items described in the footnotes (a) - (d) to the table above.

We present EBITDA and Adjusted EBITDA because we consider them to be important supplemental measures of our performance and believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. These measures are used by the Company's executive management to assess the Company's performance.

The use of EBITDA and Adjusted EBITDA instead of net income or cash flows from operations has limitations as an analytical tool, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. EBITDA and Adjusted EBITDA do not represent net income or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. While EBITDA, Adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. EBITDA and Adjusted EBITDA do not reflect the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as discretionary cash available to us for working capital, debt service and other purposes.

CARTER’S, INC.

RECONCILIATION OF U.S. GAAP AND NON-GAAP INFORMATION

(dollars in millions)

(unaudited)

The tables below reflect the calculation of constant currency for total net sales of the International segment and consolidated net sales for the fiscal quarter and fiscal year ended December 28, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended |

| Reported Net Sales December 28, 2024 | | Impact of Foreign Currency Translation | | Constant-Currency Net Sales December 28, 2024 | | Reported Net Sales December 30, 2023 | | Reported Net Sales % Change | | Constant-Currency Net Sales % Change |

| | | | | |

| | | | | | | | | | | |

| Consolidated net sales | $ | 859.7 | | | $ | (5.9) | | | $ | 865.6 | | | $ | 857.9 | | | 0.2 | % | | 0.9 | % |

| International segment net sales | $ | 128.1 | | | $ | (5.9) | | | $ | 134.0 | | | $ | 130.7 | | | (2.0) | % | | 2.6 | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal year ended |

| Reported Net Sales December 28, 2024 | | Impact of Foreign Currency Translation | | Constant-Currency Net Sales December 28, 2024 | | Reported Net Sales December 30, 2023 | | Reported Net Sales % Change | | Constant-Currency Net Sales % Change |

| | | | | |

| | | | | | | | | | | |

| Consolidated net sales | $ | 2,844.1 | | | $ | (7.4) | | | $ | 2,851.5 | | | $ | 2,945.6 | | | (3.4) | % | | (3.2) | % |

| International segment net sales | $ | 405.6 | | | $ | (7.4) | | | $ | 413.0 | | | $ | 429.2 | | | (5.5) | % | | (3.8) | % |

| | | | | | | | | | | |

The Company evaluates its net sales on both an “as reported” and a “constant currency” basis. The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates that occurred between the comparative periods. Constant currency net sales results are calculated by translating current period net sales in local currency to the U.S. dollar amount by using the currency conversion rate for the prior comparative period. The Company consistently applies this approach to net sales for all countries where the functional currency is not the U.S. dollar. The Company believes that the presentation of net sales on a constant currency basis provides useful supplemental information regarding changes in our net sales that were not due to fluctuations in currency exchange rates and such information is consistent with how the Company assesses changes in its net sales between comparative periods.

Note: Results may not be additive due to rounding.

v3.25.0.1

Document and Entity Information Entity Information

|

Feb. 25, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 25, 2025

|

| Entity Registrant Name |

Carter’s, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31829

|

| Entity Tax Identification Number |

13-3912933

|

| Entity Address, Address Line One |

Phipps Tower

|

| Entity Address, Address Line Two |

3438 Peachtree Road NE

|

| Entity Address, Address Line Three |

Suite 1800

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

678

|

| Local Phone Number |

791-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

CRI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001060822

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

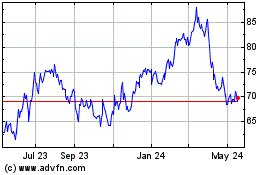

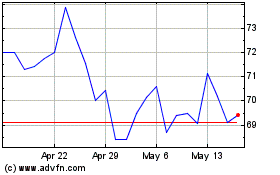

Carters (NYSE:CRI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Carters (NYSE:CRI)

Historical Stock Chart

From Feb 2024 to Feb 2025