0001100682false00011006822024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 7, 2024

Date of Report (Date of earliest event reported)

CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 001-15943 | 06-1397316 |

(State or Other

Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

251 Ballardvale Street

Wilmington, Massachusetts 01887

(Address of Principal Executive Offices) (Zip Code)

781-222-6000

(Registrant’s Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | CRL | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. Results of Operations and Financial Condition

The following information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On August 7, 2024, Charles River Laboratories International, Inc. issued a press release providing financial results for the second quarter ended June 29, 2024.

The press release, attached as an exhibit to this report, includes "safe harbor" language pursuant to the Private Securities Litigation Reform Act of 1995, as amended, indicating that certain statements contained in the press release are "forward-looking" rather than historic. The press release also states that these and other risks relating to Charles River are set forth in the documents filed by Charles River with the Securities and Exchange Commission.

ITEM 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

| | | |

| Date: | August 7, 2024 | By: | /s/ Matthew L. Daniel |

| | | Matthew L. Daniel, Corporate Senior Vice President, |

| | | General Counsel, Corporate Secretary & Chief Compliance Officer |

NEWS RELEASE

CHARLES RIVER LABORATORIES ANNOUNCES

SECOND-QUARTER 2024 RESULTS

– Second-Quarter Revenue of $1.03 Billion –

– Second-Quarter GAAP Earnings per Share of $1.74

and Non-GAAP Earnings per Share of $2.80 –

– Board Approves New Stock Repurchase Authorization of $1.0 Billion –

– Revises 2024 Guidance –

WILMINGTON, MA, August 7, 2024 – Charles River Laboratories International, Inc. (NYSE: CRL) today reported its results for the second quarter of 2024. For the quarter, revenue was $1.03 billion, a decrease of 3.2% from $1.06 billion in the second quarter of 2023.

The impact of foreign currency translation reduced reported revenue by 0.3%, a divestiture reduced reported revenue by 0.2%, and an acquisition contributed 0.5% to consolidated second-quarter revenue. Excluding the effect of these items, revenue also declined 3.2% on an organic basis. On a segment basis, organic revenue growth in the Manufacturing Solutions (Manufacturing) segment was more than offset by lower revenue in the Discovery and Safety Assessment (DSA) and Research Models and Services (RMS) segments.

In the second quarter of 2024, the GAAP operating margin decreased to 14.8% from 15.6% in the second quarter of 2023. This GAAP decrease was primarily driven by lower operating margins in the RMS and DSA segments, due in part to costs associated with the Company’s restructuring initiatives. On a non-GAAP basis, the second-quarter operating margin increased to 21.3% from 20.4%, driven primarily by lower performance-based compensation accruals, as well as operating margin improvement in the Manufacturing segment.

On a GAAP basis, second-quarter net income attributable to common shareholders was $90.0 million, a decrease of 7.2% from $97.0 million for the same period in 2023. Second-quarter diluted earnings per share on a GAAP basis were $1.74, a decrease of 7.9% from $1.89 for the second quarter of 2023. The GAAP net income and earnings per share decreases were driven primarily by lower revenue and operating income, which included higher costs associated with the Company’s restructuring initiatives. On a non-GAAP basis, net income was $144.9 million for the second quarter of 2024, an increase of 4.8% from $138.3 million for the same period in 2023. Second-quarter diluted earnings per share on a non-GAAP basis were $2.80, an increase of 4.1% from $2.69 per share for the second quarter of 2024. The increases in non-GAAP net

income and earnings per share were driven primarily by lower performance-based compensation accruals, as well as higher revenue and operating income in the Manufacturing segment.

James C. Foster, Chair, President and Chief Executive Officer, said, “Our financial performance through the first half of this year has been largely in line with our initial outlook; however, forward-looking DSA trends suggest that demand will not improve during the second half of the year as we had previously anticipated, and in fact, will decline for global biopharmaceutical clients. This has caused us to take a much more negative view of our growth prospects for the second half of the year. We believe that our clients are currently more focused on reassessing their budgets and reprioritizing their pipelines, but continue to view strategic outsourcing as a compelling solution to improve their cost efficiency and speed to market, presenting a longer-term opportunity for us.”

“Therefore, it is imperative for us to navigate through this period of softer demand by aggressively managing our cost structure, initiating new and innovative ways to transform our business, being disciplined with our investments, and enhancing our commercial efforts to win new business. We firmly believe that our clients will continue to seek life-saving treatments for rare diseases and other unmet medical needs, which drives us to take further steps to position Charles River for the future. These steps will enable us to emerge as a stronger, leaner partner to help our clients achieve their goals by utilizing our scientific expertise and flexible solutions,” Mr. Foster concluded.

Second-Quarter Segment Results

Research Models and Services (RMS)

Revenue for the RMS segment was $206.4 million in the second quarter of 2024, a decrease of 1.7% from $209.9 million in the second quarter of 2023. The Noveprim acquisition in November 2023 contributed 2.7% to second-quarter RMS reported revenue, and the impact of foreign currency translation reduced revenue by 0.5%. Organic revenue decreased by 3.9%, due primarily to lower revenue for non-human primates (NHPs) in China. In addition, lower revenue for research model services and the Cell Solutions business also contributed to the decline. The decline was partially offset by higher sales of small research models, particularly in Europe and China.

In the second quarter of 2024, the RMS segment’s GAAP operating margin decreased to 14.5% from 23.3% in the second quarter of 2023. On a non-GAAP basis, the operating margin decreased to 23.1% from 26.4%. The GAAP and non-GAAP operating margin declines were driven primarily by lower NHP revenue. On a GAAP basis, the lower operating margin also reflects higher costs associated with the Company’s restructuring initiatives, including site consolidation costs related to the Company’s CRADL operations in California.

Discovery and Safety Assessment (DSA)

Revenue for the DSA segment was $627.4 million in the second quarter of 2024, a decrease of 5.4% from $663.5 million in the second quarter of 2023. A divestiture of a small Safety Assessment site reduced reported revenue by 0.3% and the impact of foreign currency translation

reduced DSA revenue by 0.1%. Organic revenue decreased by 5.0%, driven by lower revenue in the Discovery Services and Safety Assessment businesses.

In the second quarter of 2024, the DSA segment’s GAAP operating margin decreased to 22.1% from 24.3% in the second quarter of 2023. On a non-GAAP basis, the operating margin decreased to 27.1% from 27.6% in the second quarter of 2023. The GAAP and non-GAAP operating margin decreases were driven primarily by the impact of lower sales volume, partially offset by lower performance-based compensation accruals. On a GAAP basis, the lower operating margin also reflects higher costs associated with the Company’s restructuring initiatives, as well as higher acquisition-related adjustments associated with Noveprim.

Manufacturing Solutions (Manufacturing)

Revenue for the Manufacturing segment was $192.3 million in the second quarter of 2024, an increase of 3.1% from $186.5 million in the second quarter of 2023. The impact of foreign currency translation reduced Manufacturing revenue by 0.6%. Organic revenue growth of 3.7% reflected higher revenue across all of the segment’s businesses.

In the second quarter of 2024, the Manufacturing segment’s GAAP operating margin increased to 19.4% from 13.1% in the second quarter of 2023, and on a non-GAAP basis, the operating margin increased to 26.6%, from 22.9% in the second quarter of 2023. The GAAP and non-GAAP operating margin increases were driven primarily by improved profitability for each of segment’s businesses. On a GAAP basis, lower third-party legal costs related to the Microbial Solutions business and lower acquisition-related adjustments also contributed to the increase.

New Stock Repurchase Authorization

The Company’s Board of Directors has approved a new stock repurchase authorization of $1.0 billion. This new authorization replaces a prior stock repurchase authorization of $1.3 billion that had $129.1 million remaining on the plan when it was terminated.

Revises 2024 Guidance

The Company is revising its financial guidance for 2024, which was previously updated on May 9, 2024. The reduced guidance primarily reflects the lack of a recovery in demand from our small and mid-sized biotechnology clients in the second half of the year, as well as softer demand trends from global biopharmaceutical clients whose deterioration has become increasingly evident in the past couple of months. As a result, the Company no longer expects that overall demand trends will improve during the second half of the year. In particular, these trends will have a meaningful impact on the outlook for the DSA segment. The Company is implementing restructuring initiatives that are expected to result in annualized cost savings of over $150 million (inclusive of actions implemented last year through the third quarter of 2024), of which approximately $100 million will be realized in 2024.

The Company’s 2024 guidance for revenue growth and earnings per share is as follows:

| | | | | | | | |

| 2024 GUIDANCE | CURRENT | PRIOR |

| Revenue growth/(decrease), reported | (4.5)% – (2.5)% | 1.0% – 4.0% |

| Impact of divestitures/(acquisitions), net | ~(0.5)% | ~(0.5)% |

| (Favorable)/unfavorable impact of foreign exchange | -- | ~(0.5)% |

Revenue growth/(decrease), organic (1) | (5.0)% – (3.0)% | 0.0% – 3.0% |

| GAAP EPS estimate | $5.65 – $5.95 | $7.60 – $8.10 |

| Acquisition-related amortization (2) | ~$2.75 | ~$2.50 |

| Acquisition and integration-related adjustments (3) | ~$0.20 | ~$0.10 |

| Costs associated with restructuring actions (4) | ~$1.00 | ~$0.35 |

| Certain venture capital and other strategic investment losses/(gains), net (5) | ($0.14) | ($0.08) |

| Incremental dividends related to Noveprim (6) | ~$0.25 | ~$0.25 |

| Other items (7) | ~$0.20 | ~$0.20 |

| Non-GAAP EPS estimate | $9.90 – $10.20 | $10.90 – $11.40 |

Footnotes to Guidance Table:

(1) Organic revenue growth is defined as reported revenue growth adjusted for completed acquisitions and divestitures, as well as foreign currency translation.

(2) These adjustments include amortization related to intangible assets, as well as the purchase accounting step-up on inventory and certain long-term biological assets.

(3) These adjustments are related to the evaluation and integration of acquisitions and divestitures, and primarily include transaction, advisory, certain third-party integration, and related costs; as well as fair value adjustments associated with contingent consideration arrangements.

(4) These adjustments primarily include site consolidation, severance, impairment, and other costs related to the Company’s restructuring actions.

(5) Certain venture capital and other strategic investment performance only includes recognized gains or losses on certain investments. The Company does not forecast the future performance of these investments.

(6) This item primarily relates to incremental dividends attributable to Noveprim noncontrolling interest holders who may receive preferential dividends for fiscal year 2024.

(7) These items primarily relate to (i) certain third-party legal costs related to investigations by the U.S. government into the NHP supply chain related to our Safety Assessment business; and (ii) charges associated with U.S. and international tax legislation that necessitated changes to the Company’s international financing structure.

Webcast

Charles River has scheduled a live webcast on Wednesday, August 7th, at 9:00 a.m. ET to discuss matters relating to this press release. To participate, please go to ir.criver.com and select the webcast link. You can also find the associated slide presentation and reconciliations of GAAP financial measures to non-GAAP financial measures on the website.

Non-GAAP Reconciliations

The Company reports non-GAAP results in this press release, which exclude often-one-time charges and other items that are outside of normal operations. A reconciliation of GAAP to non-GAAP results is provided in the schedules at the end of this press release.

Use of Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, such as non-GAAP earnings per diluted share, non-GAAP operating income, non-GAAP operating margin, and non-GAAP net income. Non-GAAP financial measures exclude, but are not limited to, the amortization of intangible assets and the purchase accounting step-up adjustment on inventory and certain long term biological assets, and other charges and adjustments related to our acquisitions and divestitures, including incremental dividends attributable to Noveprim noncontrolling interest holders and the gain on our sale of our Avian Vaccine business; expenses associated with evaluating and integrating acquisitions and divestitures, including advisory fees and certain other transaction-related costs, as well as fair value adjustments associated with contingent consideration; charges, gains, and losses attributable to businesses or properties we plan to close, consolidate, or divest; severance and other costs associated with our restructuring initiatives; the write-off of deferred financing costs and fees related to debt financing; investment gains or losses associated with our venture capital and other strategic equity investments; certain legal costs in our Microbial Solutions business related to environmental litigation and in our Safety Assessment business related to U.S. government investigations into the NHP supply chain; tax effect of all of the aforementioned matters; and adjustments related to the recognition of deferred tax assets expected to be utilized as a result of changes to the our international financing structure and the revaluation of deferred tax liabilities as a result of foreign tax legislation. This press release also refers to our revenue on both a GAAP and non-GAAP basis: “organic revenue growth,” which we define as reported revenue growth adjusted for foreign currency translation, acquisitions, and divestitures. We exclude these items from the non-GAAP financial measures because they are outside our normal operations. There are limitations in using non-GAAP financial measures, as they are not presented in accordance with generally accepted accounting principles, and may be different than non-GAAP financial measures used by other companies. In particular, we believe that the inclusion of supplementary non-GAAP financial measures in this press release helps investors to gain a meaningful understanding of our core operating results and future prospects without the effect of these often-one-time charges, and is consistent with how management measures and forecasts the Company's performance, especially when comparing such results to prior periods or forecasts. We believe that the financial impact of our acquisitions and divestitures (and in certain cases, the evaluation of such acquisitions and divestitures, whether or not ultimately consummated) is often large relative to our overall financial performance, which can adversely affect the comparability of our results on a period-to-period basis. In addition, certain activities and their underlying associated costs, such as business acquisitions, generally occur periodically but on an unpredictable basis. We calculate non-GAAP integration costs to include third-party integration costs incurred post-acquisition. Presenting revenue on an organic basis allows investors to measure our revenue growth exclusive of acquisitions, divestitures, and foreign currency exchange fluctuations more clearly. Non-GAAP results also allow investors to compare the Company’s operations against the financial results of other companies in the industry who similarly provide non-GAAP results. The non-GAAP financial measures included in this press release are not meant to be considered superior to or a substitute for results of operations presented in accordance with GAAP. The Company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules and regulations. Reconciliations of the non-GAAP financial measures used in

this press release to the most directly comparable GAAP financial measures are set forth in this press release, and can also be found on the Company’s website at ir.criver.com.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “will,” “would,” “may,” “estimate,” “plan,” “outlook,” and “project,” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements also include statements regarding Charles River’s expectations regarding the availability of Cambodia-sourced NHPs; the impact of the investigations by the U.S. government into the Cambodia NHP supply chain, including but not limited to Charles River’s ability to cooperate fully with the U.S. government; Charles River’s ability to effectively manage any Cambodia NHP supply impact; the projected future financial performance of Charles River and our specific businesses, including our expectations with respect to the impact of NHP supply constraints and our ability to gain market share; earnings per share; operating margin; client demand, particularly the future demand for drug discovery and development products and services, including our expectations for future revenue trends; our expectations with respect to pricing of our products and services; our expectations with respect to future tax rates and the impact of such tax rates on our business; our expectations with respect to the impact of acquisitions and divestitures completed in 2021, 2022, and 2023, including the Noveprim acquisition, on the Company, our service offerings, client perception, strategic relationships, revenue, revenue growth rates, revenue growth drivers, and earnings; the development and performance of our services and products, including our investments in our portfolio; market and industry conditions including the outsourcing of services and identification of spending trends by our clients and funding available to them; ability to gain market share and capitalize on business opportunities; the impact of our restructuring initiatives, including annualized savings; the impact of our stock repurchase authorization; and Charles River’s future performance as delineated in our forward-looking guidance, and particularly our expectations with respect to revenue, the impact of foreign exchange, interest rates, enhanced efficiency initiatives. Forward-looking statements are based on Charles River’s current expectations and beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: NHP supply constraints and the investigations by the U.S. Department of Justice, including the impact on our projected future financial performance, the timing of the resumption of Cambodia NHP imports into the U.S., our ability to manage supply impact, and potential study delays in our Safety Assessment business attributable to NHP supply constraints; changes and uncertainties in the global economy and financial markets; the ability to successfully integrate businesses we acquire, including Noveprim; the timing and magnitude of our share repurchases; negative trends in research and development spending, negative trends in the level of outsourced services, or other cost reduction actions by our clients; the ability to convert backlog to revenue; special interest groups; contaminations; industry trends; new displacement technologies; USDA and FDA regulations; changes in law; continued availability of products and supplies; loss of key personnel; interest rate and foreign currency exchange rate fluctuations; changes in tax regulation and laws; changes in generally accepted accounting

principles; disruptions in the global economy caused by geopolitical conflicts; and any changes in business, political, or economic conditions due to the threat of future terrorist activity in the U.S. and other parts of the world, and related U.S. military action overseas. A further description of these risks, uncertainties, and other matters can be found in the Risk Factors detailed in Charles River's Annual Report on Form 10-K as filed on February 14, 2024, as well as other filings we make with the Securities and Exchange Commission. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River, and Charles River assumes no obligation and expressly disclaims any duty to update information contained in this press release except as required by law.

About Charles River

Charles River provides essential products and services to help pharmaceutical and biotechnology companies, government agencies and leading academic institutions around the globe accelerate their research and drug development efforts. Our dedicated employees are focused on providing clients with exactly what they need to improve and expedite the discovery, early-stage development and safe manufacture of new therapies for the patients who need them. To learn more about our unique portfolio and breadth of services, visit www.criver.com.

# # #

Investor Contact: Media Contact:

Todd Spencer Amy Cianciaruso

Corporate Vice President, Corporate Vice President,

Investor Relations Chief Communications Officer

781.222.6455 781.222.6168

todd.spencer@crl.com amy.cianciaruso@crl.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

| | | | | | | | |

| SCHEDULE 1 |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) |

| (in thousands, except for per share data) |

| | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| | | | | | | | |

| Service revenue | $ | 842,900 | | | $ | 874,891 | | | $ | 1,659,762 | | | $ | 1,732,257 | |

| Product revenue | 183,217 | | | 185,046 | | | 377,915 | | | 357,053 | |

| Total revenue | 1,026,117 | | | 1,059,937 | | | 2,037,677 | | | 2,089,310 | |

| Costs and expenses: | | | | | | | |

| Cost of services provided (excluding amortization of intangible assets) | 577,383 | | | 578,099 | | | 1,155,547 | | | 1,143,576 | |

| Cost of products sold (excluding amortization of intangible assets) | 95,021 | | | 82,861 | | | 183,574 | | | 169,103 | |

| Selling, general and administrative | 169,791 | | | 199,758 | | | 356,082 | | | 374,604 | |

| Amortization of intangible assets | 32,270 | | | 34,274 | | | 64,845 | | | 69,190 | |

| Operating income | 151,652 | | | 164,945 | | | 277,629 | | | 332,837 | |

| Other income (expense): | | | | | | | |

| Interest income | 3,010 | | | 1,426 | | | 5,212 | | | 2,232 | |

| Interest expense | (32,769) | | | (35,044) | | | (67,770) | | | (69,424) | |

| Other income (expense), net | (2,240) | | | (2,663) | | | 3,593 | | | (5,940) | |

| Income before income taxes | 119,653 | | | 128,664 | | | 218,664 | | | 259,705 | |

| Provision for income taxes | 25,392 | | | 29,221 | | | 49,921 | | | 56,308 | |

| Net income | 94,261 | | | 99,443 | | | 168,743 | | | 203,397 | |

| Less: Net income attributable to noncontrolling interests | 180 | | | 2,423 | | | 1,702 | | | 3,246 | |

| Net income available to Charles River Laboratories International, Inc. | $ | 94,081 | | | $ | 97,020 | | | $ | 167,041 | | | $ | 200,151 | |

| | | | | | | |

| Calculation of net income per share attributable to common shareholders of Charles River Laboratories International, Inc. | | | | | | | |

| Net income available to Charles River Laboratories International, Inc. | $ | 94,081 | | | $ | 97,020 | | | $ | 167,041 | | | $ | 200,151 | |

| Less: Adjustment of redeemable noncontrolling interest | 301 | | | — | | | 702 | | | — | |

| Less: Incremental dividends attributable to noncontrolling interest holders | 3,792 | | | — | | | 9,022 | | | — | |

| Net income available to Charles River Laboratories International, Inc. common shareholders | $ | 89,988 | | | $ | 97,020 | | | $ | 157,317 | | | $ | 200,151 | |

| | | | | | | |

| | | | | | | | |

| Earnings per common share | | | | | | | |

| Net income attributable to common shareholders: | | | | | | | |

| Basic | $ | 1.75 | | | $ | 1.89 | | | $ | 3.06 | | | $ | 3.91 | |

| Diluted | $ | 1.74 | | | $ | 1.89 | | | $ | 3.04 | | | $ | 3.90 | |

| | | | | | | | |

| Weighted-average number of common shares outstanding: | | | | | | | |

| Basic | 51,551 | | | 51,216 | | | 51,494 | | | 51,157 | |

| Diluted | 51,846 | | | 51,467 | | | 51,810 | | | 51,382 | |

| | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

|

| SCHEDULE 2 |

| CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| (in thousands, except per share amounts) |

| | | |

| | | |

| June 29, 2024 | | December 30, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 179,213 | | | $ | 276,771 | |

| Trade receivables and contract assets, net of allowances for credit losses of $24,951 and $25,722, respectively | 762,221 | | | 780,375 | |

| Inventories | 349,111 | | | 380,259 | |

| Prepaid assets | 97,892 | | | 87,879 | |

| Other current assets | 110,836 | | | 83,378 | |

| Total current assets | 1,499,273 | | | 1,608,662 | |

| Property, plant and equipment, net | 1,613,895 | | | 1,639,741 | |

| Venture capital and strategic equity investments | 231,859 | | | 243,811 | |

| Operating lease right-of-use assets, net | 386,147 | | | 394,029 | |

| Goodwill | 3,079,693 | | | 3,095,045 | |

| Intangible assets, net | 800,129 | | | 864,051 | |

| Deferred tax assets | 36,109 | | | 40,279 | |

| Other assets | 301,178 | | | 309,383 | |

| Total assets | $ | 7,948,283 | | | $ | 8,195,001 | |

| | | |

| Liabilities, Redeemable Noncontrolling Interests and Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 133,101 | | | $ | 168,937 | |

| Accrued compensation | 176,667 | | | 213,290 | |

| Deferred revenue | 247,177 | | | 241,820 | |

| Accrued liabilities | 192,156 | | | 227,825 | |

| Other current liabilities | 198,418 | | | 203,210 | |

| Total current liabilities | 947,519 | | | 1,055,082 | |

| Long-term debt, net and finance leases | 2,409,380 | | | 2,647,147 | |

| Operating lease right-of-use liabilities | 428,587 | | | 419,234 | |

| Deferred tax liabilities | 165,183 | | | 191,349 | |

| Other long-term liabilities | 224,520 | | | 223,191 | |

| Total liabilities | 4,175,189 | | | 4,536,003 | |

| Redeemable noncontrolling interest | 46,076 | | | 56,722 | |

| Equity: | | | |

| Preferred stock, $0.01 par value; 20,000 shares authorized; no shares issued and outstanding | — | | | — | |

| Common stock, $0.01 par value; 120,000 shares authorized; 51,696 shares issued and 51,613 shares outstanding as of June 29, 2024, and 51,338 shares issued and outstanding as of December 30, 2023 | 517 | | | 513 | |

| Additional paid-in capital | 1,956,629 | | | 1,905,578 | |

| Retained earnings | 2,053,557 | | | 1,887,218 | |

| Treasury stock, at cost, 83 and zero shares, as of June 29, 2024 and December 30, 2023, respectively | (18,265) | | | — | |

| Accumulated other comprehensive loss | (269,709) | | | (196,427) | |

| Total Charles River Laboratories International, Inc. equity | 3,722,729 | | | 3,596,882 | |

| Nonredeemable noncontrolling interests | 4,289 | | | 5,394 | |

| Total equity | 3,727,018 | | | 3,602,276 | |

| Total liabilities, equity and noncontrolling interests | $ | 7,948,283 | | | $ | 8,195,001 | |

| | | | | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

| |

| SCHEDULE 3 |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| (in thousands) |

| | | | |

| | Six Months Ended |

| | June 29, 2024 | | July 1, 2023 |

| Cash flows relating to operating activities | | | |

| Net income | $ | 168,743 | | | $ | 203,397 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 171,439 | | | 154,740 | |

| Stock-based compensation | 33,325 | | | 29,730 | |

| | | | |

| Deferred income taxes | (13,073) | | | (16,555) | |

| Long-lived asset impairment charges | 14,250 | | | 10,453 | |

| (Gain) loss on venture capital & strategic equity investments, net | (6,305) | | | 5,176 | |

| Provision for credit losses | 4,719 | | | 9,849 | |

| Loss on divestitures, net | 659 | | | 563 | |

| | | | |

| Other, net | 9,090 | | | 3,229 | |

| Changes in assets and liabilities: | | | |

| Trade receivables and contract assets, net | 1,072 | | | (48,249) | |

| Inventories | 9,750 | | | (32,671) | |

| Accounts payable | (6,436) | | | (24,985) | |

| Accrued compensation | (33,153) | | | (7,648) | |

| Deferred revenue | 8,151 | | | (6,796) | |

| Customer contract deposits | 7,849 | | | (17,519) | |

| Other assets and liabilities, net | (46,657) | | | (5,209) | |

| Net cash provided by operating activities | 323,423 | | | 257,505 | |

| Cash flows relating to investing activities | | | |

| Acquisition of businesses and assets, net of cash acquired | (5,479) | | | (50,166) | |

| Capital expenditures | (118,630) | | | (174,258) | |

| Purchases of investments and contributions to venture capital investments | (35,538) | | | (22,689) | |

| Proceeds from sale of investments | 12,359 | | | 2,943 | |

| | | | |

| Other, net | (370) | | | (1,057) | |

| Net cash used in investing activities | (147,658) | | | (245,227) | |

| Cash flows relating to financing activities | | | |

| Proceeds from long-term debt and revolving credit facility | 741,200 | | | 281,796 | |

| Proceeds from exercises of stock options | 22,331 | | | 15,719 | |

| Payments on long-term debt, revolving credit facility, and finance lease obligations | (987,344) | | | (317,049) | |

| Purchase of treasury stock | (18,265) | | | (23,978) | |

| | | | |

| Payments of contingent consideration | — | | | (2,711) | |

| Purchases of additional equity interests, net | (12,000) | | | — | |

| Other, net | (13,434) | | | — | |

| Net cash provided by financing activities | (267,512) | | | (46,223) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (11,729) | | | 1,508 | |

| Net change in cash, cash equivalents, and restricted cash | (103,476) | | | (32,437) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 284,480 | | | 241,214 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 181,004 | | | $ | 208,777 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

| | | | | | | | | |

| SCHEDULE 4 |

| RECONCILIATION OF GAAP TO NON-GAAP |

SELECTED BUSINESS SEGMENT INFORMATION (UNAUDITED)(1) |

| (in thousands, except percentages) |

| | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| Research Models and Services | | | | | | | | |

| Revenue | | $ | 206,389 | | | $ | 209,948 | | | $ | 427,296 | | | $ | 409,714 | |

| Operating income | | 29,948 | | | 48,918 | | | 73,097 | | | 89,327 | |

| Operating income as a % of revenue | | 14.5 | % | | 23.3 | % | | 17.1 | % | | 21.8 | % |

| Add back: | | | | | | | | |

| Amortization related to acquisitions | | 7,357 | | | 5,491 | | | 17,645 | | | 10,985 | |

| Acquisition related adjustments (2) | | 174 | | | 997 | | | 337 | | | 1,827 | |

| Severance | | 494 | | | — | | | 1,034 | | | — | |

| Site consolidation and impairment charges | | 9,728 | | | — | | | 16,574 | | | — | |

| | | | | | | | | |

| Total non-GAAP adjustments to operating income | | $ | 17,753 | | | $ | 6,488 | | | $ | 35,590 | | | $ | 12,812 | |

| Operating income, excluding non-GAAP adjustments | | $ | 47,701 | | | $ | 55,406 | | | $ | 108,687 | | | $ | 102,139 | |

| Non-GAAP operating income as a % of revenue | | 23.1 | % | | 26.4 | % | | 25.4 | % | | 24.9 | % |

| | | | | | | | | |

| Depreciation and amortization | | $ | 16,538 | | | $ | 13,949 | | | $ | 34,661 | | | $ | 27,438 | |

| Capital expenditures | | $ | 9,313 | | | $ | 7,493 | | | $ | 29,357 | | | $ | 26,577 | |

| | | | | | | | | |

| Discovery and Safety Assessment | | | | | | | | |

| Revenue | | $ | 627,419 | | | $ | 663,457 | | | $ | 1,232,871 | | | $ | 1,325,810 | |

| Operating income | | 138,376 | | | 161,538 | | | 253,215 | | | 332,969 | |

| Operating income as a % of revenue | | 22.1 | % | | 24.3 | % | | 20.5 | % | | 25.1 | % |

| Add back: | | | | | | | | |

| Amortization related to acquisitions | | 20,298 | | | 17,744 | | | 38,894 | | | 35,231 | |

| Acquisition related adjustments (2) | | 5,591 | | | 2,359 | | | 5,783 | | | 2,603 | |

| Severance | | 2,429 | | | — | | | 7,913 | | | — | |

| Site consolidation and impairment charges | | 1,337 | | | — | | | 2,344 | | | — | |

| Third-party legal costs (3) | | 2,110 | | | 1,492 | | | 4,301 | | | 4,297 | |

| Total non-GAAP adjustments to operating income | | $ | 31,765 | | | $ | 21,595 | | | $ | 59,235 | | | $ | 42,131 | |

| Operating income, excluding non-GAAP adjustments | | $ | 170,141 | | | $ | 183,133 | | | $ | 312,450 | | | $ | 375,100 | |

| Non-GAAP operating income as a % of revenue | | 27.1 | % | | 27.6 | % | | 25.3 | % | | 28.3 | % |

| | | | | | | | | |

| Depreciation and amortization | | $ | 47,729 | | | $ | 43,124 | | | $ | 93,518 | | | $ | 85,574 | |

| Capital expenditures | | $ | 19,444 | | | $ | 48,326 | | | $ | 68,403 | | | $ | 113,510 | |

| | | | | | | | | |

| Manufacturing Solutions | | | | | | | | |

| Revenue | | $ | 192,309 | | | $ | 186,532 | | | $ | 377,510 | | | $ | 353,786 | |

| Operating income | | 37,230 | | | 24,403 | | | 70,911 | | | 26,509 | |

| Operating income as a % of revenue | | 19.4 | % | | 13.1 | % | | 18.8 | % | | 7.5 | % |

| Add back: | | | | | | | | |

| Amortization related to acquisitions | | 10,768 | | | 11,125 | | | 21,561 | | | 23,146 | |

| Acquisition related adjustments (2) | | 544 | | | 2,182 | | | 1,243 | | | 3,011 | |

| Severance | | 1,671 | | | 2,517 | | | 3,194 | | | 3,433 | |

| Site consolidation and impairment charges | | 990 | | | 182 | | | 1,090 | | | 2,754 | |

| Third-party legal costs (3) | | — | | | 2,368 | | | — | | | 6,858 | |

| Total non-GAAP adjustments to operating income | | $ | 13,973 | | | $ | 18,374 | | | $ | 27,088 | | | $ | 39,202 | |

| Operating income, excluding non-GAAP adjustments | | $ | 51,203 | | | $ | 42,777 | | | $ | 97,999 | | | $ | 65,711 | |

| Non-GAAP operating income as a % of revenue | | 26.6 | % | | 22.9 | % | | 26.0 | % | | 18.6 | % |

| | | | | | | | | |

| Depreciation and amortization | | $ | 20,073 | | | $ | 19,523 | | | $ | 39,878 | | | $ | 39,607 | |

| Capital expenditures | | $ | 10,583 | | | $ | 10,862 | | | $ | 19,445 | | | $ | 32,600 | |

| | | | | | | | | |

| Unallocated Corporate Overhead | | $ | (53,902) | | | $ | (69,914) | | | $ | (119,594) | | | $ | (115,968) | |

| Add back: | | | | | | | | |

| Acquisition related adjustments (2) | | 2,108 | | | 4,799 | | | 3,637 | | | 7,002 | |

| Severance | | 1,304 | | | — | | | 2,794 | | | — | |

| | | | | | | | | |

| Total non-GAAP adjustments to operating expense | | $ | 3,412 | | | $ | 4,799 | | | $ | 6,431 | | | $ | 7,002 | |

| Unallocated corporate overhead, excluding non-GAAP adjustments | | $ | (50,490) | | | $ | (65,115) | | | $ | (113,163) | | | $ | (108,966) | |

| | | | | | | | | |

| Total | | | | | | | | |

| Revenue | | $ | 1,026,117 | | | $ | 1,059,937 | | | $ | 2,037,677 | | | $ | 2,089,310 | |

| Operating income | | 151,652 | | | 164,945 | | | 277,629 | | | 332,837 | |

| Operating income as a % of revenue | | 14.8 | % | | 15.6 | % | | 13.6 | % | | 15.9 | % |

| Add back: | | | | | | | | |

| Amortization related to acquisitions | | 38,423 | | | 34,360 | | | 78,100 | | | 69,362 | |

| Acquisition related adjustments (2) | | 8,417 | | | 10,337 | | | 11,000 | | | 14,443 | |

| Severance | | 5,898 | | | 2,517 | | | 14,935 | | | 3,433 | |

| Site consolidation and impairment charges | | 12,055 | | | 182 | | | 20,008 | | | 2,754 | |

| Third-party legal costs (3) | | 2,110 | | | 3,860 | | | 4,301 | | | 11,155 | |

| Total non-GAAP adjustments to operating income | | $ | 66,903 | | | $ | 51,256 | | | $ | 128,344 | | | $ | 101,147 | |

| Operating income, excluding non-GAAP adjustments | | $ | 218,555 | | | $ | 216,201 | | | $ | 405,973 | | | $ | 433,984 | |

| Non-GAAP operating income as a % of revenue | | 21.3 | % | | 20.4 | % | | 19.9 | % | | 20.8 | % |

| | | | | | | | | |

| Depreciation and amortization | | $ | 86,082 | | | $ | 77,671 | | | $ | 171,439 | | | $ | 154,740 | |

| Capital expenditures | | $ | 39,486 | | | $ | 67,383 | | | $ | 118,630 | | | $ | 174,258 | |

| | | | | | | | | |

(1) | Charles River management believes that supplementary non-GAAP financial measures provide useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of often-one-time charges and other items which are outside our normal operations, consistent with the manner in which management measures and forecasts the Company’s performance. The supplementary non-GAAP financial measures included are not meant to be considered superior to, or a substitute for results of operations prepared in accordance with U.S. GAAP. The Company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules, regulations and guidance. |

(2) | These adjustments are related to the evaluation and integration of acquisitions, which primarily include transaction, third-party integration, and certain compensation costs, and fair value adjustments associated with contingent consideration arrangements. |

| |

(3) | Third-party legal costs are related to (a) an environmental litigation related to the Microbial Solutions business and (b) investigations by the U.S. government into the NHP supply chain applicable to our Safety Assessment business. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

|

| SCHEDULE 5 |

RECONCILIATION OF GAAP EARNINGS TO NON-GAAP EARNINGS (UNAUDITED)(1) |

| (in thousands, except per share data) |

| | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| | | | | | | | |

| Net income available to Charles River Laboratories International, Inc. common shareholders | $ | 89,988 | | | $ | 97,020 | | | $ | 157,317 | | | $ | 200,151 | |

| Add back: | | | | | | | |

Adjustment of redeemable noncontrolling interest (2) | 301 | | | — | | | 702 | | | — | |

Incremental dividends attributable to noncontrolling interest holders (3) | 3,792 | | | — | | | 9,022 | | | — | |

Non-GAAP adjustments to operating income (4) | 65,576 | | | 51,256 | | | 127,017 | | | 101,147 | |

| | | | | | | |

| Venture capital and strategic equity investment (gains) losses, net | (902) | | | 1,873 | | | (6,664) | | | 5,155 | |

(Gain) loss on divestitures (5) | — | | | 1,003 | | | 658 | | | 562 | |

Other (6) | — | | | 596 | | | — | | | 495 | |

| Tax effect of non-GAAP adjustments: | | | | | | | |

Non-cash tax provision related to international financing structure (7) | 871 | | | 1,296 | | | 1,212 | | | 2,420 | |

| | | | | | | |

| Tax effect of the remaining non-GAAP adjustments | (14,687) | | | (14,759) | | | (26,715) | | | (28,658) | |

| Net income attributable to Charles River Laboratories International, Inc. common shareholders, excluding non-GAAP adjustments | $ | 144,939 | | | $ | 138,285 | | | $ | 262,549 | | | $ | 281,272 | |

| | | | | | | | |

| Weighted average shares outstanding - Basic | 51,551 | | | 51,216 | | | 51,494 | | | 51,157 | |

| Effect of dilutive securities: | | | | | | | |

| Stock options, restricted stock units and performance share units | 295 | | | 251 | | | 316 | | | 225 | |

| Weighted average shares outstanding - Diluted | 51,846 | | | 51,467 | | | 51,810 | | | 51,382 | |

| | | | | | | | |

| Earnings per share attributable to common shareholders: | | | | | | | |

| Basic | $ | 1.75 | | | $ | 1.89 | | | $ | 3.06 | | | $ | 3.91 | |

| Diluted | $ | 1.74 | | | $ | 1.89 | | | $ | 3.04 | | | $ | 3.90 | |

| | | | | | | | |

| Basic, excluding non-GAAP adjustments | $ | 2.81 | | | $ | 2.70 | | | $ | 5.10 | | | $ | 5.50 | |

| Diluted, excluding non-GAAP adjustments | $ | 2.80 | | | $ | 2.69 | | | $ | 5.07 | | | $ | 5.47 | |

| | | | | | | | |

(1) | Charles River management believes that supplementary non-GAAP financial measures provide useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of often-one-time charges and other items which are outside our normal operations, consistent with the manner in which management measures and forecasts the Company’s performance. The supplementary non-GAAP financial measures included are not meant to be considered superior to, or a substitute for results of operations prepared in accordance with U.S. GAAP. The Company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules, regulations and guidance. |

(2) | This amount represents accretion adjustments of the Noveprim redeemable noncontrolling interest. |

(3) | This amount represents incremental undeclared dividends attributable to Noveprim noncontrolling interest holders who receive preferential dividends for fiscal year 2024. |

(4) | This amount excludes Non-GAAP adjustments attributable to noncontrolling interest holders. |

(5) | The amount included in 2024 relates to a loss on the sale of a Safety Assessment site. Adjustments included in 2023 relate to the gain on the sale of our Avian Vaccine business, which was divested in 2022. |

(6) | Amounts included in 2023 relate to a final adjustment on the termination of a Canadian pension plan. |

(7) | This amount relates to the recognition of deferred tax assets expected to be utilized as a result of changes to the Company's international financing structure. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CHARLES RIVER LABORATORIES INTERNATIONAL, INC. |

| | | | | | | | | |

| SCHEDULE 6 |

| RECONCILIATION OF GAAP REVENUE GROWTH |

| TO NON-GAAP REVENUE GROWTH, ORGANIC (UNAUDITED) (1) |

| | | | | | | | | |

| | | | | | | | | |

| Three Months Ended June 29, 2024 | | Total CRL | | RMS Segment | | DSA Segment | | MS Segment |

| | | | | | | | | |

| Revenue growth, reported | | (3.2) | % | | (1.7) | % | | (5.4) | % | | 3.1 | % |

| (Increase) decrease due to foreign exchange | | 0.3 | % | | 0.5 | % | | 0.1 | % | | 0.6 | % |

Contribution from acquisitions (2) | | (0.5) | % | | (2.7) | % | | — | % | | — | % |

Impact of divestitures (3) | | 0.2 | % | | — | % | | 0.3 | % | | — | % |

| | | | | | | | |

Non-GAAP revenue growth, organic (4) | | (3.2) | % | | (3.9) | % | | (5.0) | % | | 3.7 | % |

| | | | | | | | | |

| Six Months Ended June 29, 2024 | | Total CRL | | RMS Segment | | DSA Segment | | MS Segment |

| | | | | | | | | |

| Revenue growth, reported | | (2.5) | % | | 4.3 | % | | (7.0) | % | | 6.7 | % |

| (Increase) decrease due to foreign exchange | | — | % | | 0.4 | % | | (0.3) | % | | 0.2 | % |

Contribution from acquisitions (2) | | (1.0) | % | | (5.1) | % | | — | % | | — | % |

Impact of divestitures (3) | | 0.3 | % | | — | % | | 0.4 | % | | — | % |

| | | | | | | | |

Non-GAAP revenue growth, organic (4) | | (3.2) | % | | (0.4) | % | | (6.9) | % | | 6.9 | % |

| | | | | | | | | |

(1) | Charles River management believes that supplementary non-GAAP financial measures provide useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of often-one-time charges and other items which are outside our normal operations, consistent with the manner in which management measures and forecasts the Company’s performance. The supplementary non-GAAP financial measures included are not meant to be considered superior to, or a substitute for results of operations prepared in accordance with U.S. GAAP. The Company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules, regulations and guidance. |

(2) | The contribution from acquisitions reflects only completed acquisitions. |

(3) | Impact of divestitures relates to the sale of a site within our Safety Assessment business. |

(4) | Organic revenue growth is defined as reported revenue growth adjusted for acquisitions, divestitures, and foreign exchange. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

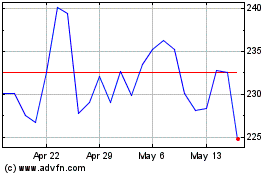

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jan 2024 to Jan 2025