0000026324False00000263242025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2025

CURTISS-WRIGHT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 1-134 | 13-0612970 |

(State or Other

Jurisdiction of

Incorporation) | (Commission File

Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 130 Harbour Place Drive, Suite 300 | | |

| Davidson, | North Carolina | | 28036 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (704) 869-4600

--------------

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CW | New York Stock Exchange |

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). | |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Section 2 - Financial Information

Item 2.02. Results of Operations and Financial Condition

On Wednesday, February 12, 2025, the Company issued a press release announcing financial results for the year ended December 31, 2024. A webcast conference call will be held on Thursday, February 13, 2025 at 11:00 am ET for management to discuss the Company’s year ended 2024 financial performance as well as expectations for 2025 financial performance. Lynn M. Bamford, Chair and Chief Executive Officer, and K. Christopher Farkas, Vice President and Chief Financial Officer, will host the call. A copy of the press release and the webcast slide presentation are attached hereto as Exhibits 99.1 and 99.2.

The financial press release, access to the webcast, and the financial presentation will be posted in the Investor Relations section on Curtiss-Wright's website at www.curtisswright.com/investor-relations. In addition, the dial-in number for domestic callers is (800) 343-5172, while international callers can dial (203) 518-9856. The conference ID code is CWQ424. For those unable to join the live webcast, a replay will be available within the Investor Relations section on the Company’s website beginning one hour after the call takes place.

The information contained in this Current Report, including Exhibits 99.1 and 99.2, are being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this report shall not be incorporated by reference into any filing of the registrant with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Exhibits.

99.1 Press Release dated February 12, 2025

99.2 Presentation shown during investor and securities analyst webcast on February 13, 2025

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | CURTISS-WRIGHT CORPORATION |

| | By: /s/ K. Christopher Farkas |

| | K. Christopher Farkas |

| | Vice President and |

| | Chief Financial Officer |

| | |

Date: February 13, 2025 | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

Curtiss-Wright Corporation, Page 1

NEWS RELEASE

CURTISS-WRIGHT REPORTS FOURTH QUARTER AND FULL-YEAR 2024 FINANCIAL RESULTS; ISSUES FULL-YEAR 2025 GUIDANCE REFLECTING HIGHER SALES, OPERATING MARGIN EXPANSION AND DOUBLE-DIGIT EPS GROWTH

Company Delivers Record FY24 Sales, Profitability, EPS, Free Cash Flow and Orders

DAVIDSON, N.C. – February 12, 2025 – Curtiss-Wright Corporation (NYSE: CW) reports financial results for the fourth quarter and full-year ended December 31, 2024.

Fourth Quarter 2024 Highlights:

•Reported sales of $824 million, up 5%, operating income of $155 million, operating margin of 18.8%, and diluted earnings per share (EPS) of $3.09;

•Adjusted operating income of $163 million;

•Adjusted operating margin of 19.8%;

•Adjusted diluted EPS of $3.27, up 3%;

•Free cash flow (FCF) of $278 million, generating 223% Adjusted FCF conversion;

•Total share repurchases of $112 million; and

•New orders of $939 million, up 37%, generating a book-to-bill of 1.1x.

Full-Year 2024 Highlights:

•Reported sales of $3.1 billion, up 10%, operating income of $529 million, operating margin of 16.9%, and diluted EPS of $10.55;

•Adjusted operating income of $546 million, up 11%;

•Adjusted operating margin of 17.5%, up 10 basis points;

•Adjusted diluted EPS of $10.90, up 16%;

•FCF of $483 million, generating 116% Adjusted FCF conversion;

•Total share repurchases of $250 million;

•New orders of $3.7 billion, up 20%, reflecting strong demand in our Aerospace & Defense (A&D) markets, and book-to-bill of 1.2x; and

•Backlog of $3.4 billion, up 20%.

"Curtiss-Wright concluded the year with a strong, fourth quarter financial performance that reflected better-than-expected sales growth, record quarterly Adjusted diluted EPS of $3.27, strong free cash flow and robust order activity," said Lynn M. Bamford, Chair and CEO of Curtiss-Wright Corporation.

"We achieved numerous financial records in 2024, while maintaining our commitment to invest in innovative technologies, capacity expansion, talent and systems to support our future growth. Our performance was highlighted by double-digit growth in sales, operating income and diluted EPS, along with record free cash flow of $483 million, as we delivered profitable growth while reducing working capital. We also experienced strong demand across our Defense and Commercial Aerospace markets, driving record new orders of $3.7 billion. Our results this past year are a testament to our teams' strong execution and the momentum we are building in our Pivot to Growth strategy."

"Looking ahead, our strong backlog at the start of the year, combined with the alignment of our technologies to favorable secular growth trends in our end markets, reinforces our confidence in

Curtiss-Wright Corporation, Page 2

delivering another strong performance in 2025. We anticipate total sales growth of 7% to 8%, driven by strong organic growth in our A&D and Commercial Nuclear markets, and the contribution from our recently completed acquisition of Ultra Energy. We also expect to deliver operating margin expansion of 40 to 60 basis points while increasing our R&D investments, as well as double-digit EPS growth and strong free cash flow generation. As a result, we maintain line of sight to the three-year financial targets that we communicated at our 2024 Investor Day and remain well-positioned to drive long-term shareholder value."

Curtiss-Wright Corporation, Page 3

Fourth Quarter 2024 Operating Results

| | | | | | | | | | | |

| (In millions) | Q4-2024 | Q4-2023 | Change |

| Reported | | | |

| Sales | $ | 824 | | $ | 786 | | 5 | % |

| Operating income | $ | 155 | | $ | 161 | | (4 | %) |

| Operating margin | 18.8 | % | 20.4 | % | (160 bps) |

| | | |

Adjusted (1) | | | |

| Sales | $ | 824 | | $ | 786 | | 5 | % |

| Operating income | $ | 163 | | $ | 163 | | 0 | % |

| Operating margin | 19.8 | % | 20.8 | % | (100 bps) |

(1)Reconciliations of Reported to Adjusted operating results are available in the Appendix.

•Sales of $824 million increased 5% compared with the prior year period;

•Total A&D market sales increased 6%, while total Commercial market sales increased 3%;

•In our A&D markets, we experienced solid growth in the defense markets principally driven by increased submarine revenues in naval defense, as well as higher OEM sales in the commercial aerospace market;

•In our Commercial markets, we experienced solid growth in the power & process market, principally driven by higher sales of commercial nuclear products that were partially offset by lower industrial valve sales in the process market, in addition to lower sales in the general industrial market; and

•Adjusted operating income was $163 million, essentially flat compared with the prior year period, while Adjusted operating margin decreased 100 basis points to 19.8%, as favorable overhead absorption on overall higher revenues was partially offset by higher investments in research and development in all three segments, as well as unfavorable mix in both the Defense Electronics and Naval & Power segments.

Curtiss-Wright Corporation, Page 4

Fourth Quarter 2024 Segment Performance

Aerospace & Industrial

| | | | | | | | | | | |

| (In millions) | Q4-2024 | Q4-2023 | Change |

| Reported | | | |

| Sales | $ | 251 | | $ | 238 | | 5 | % |

| Operating income | $ | 48 | | $ | 44 | | 9 | % |

| Operating margin | 19.1 | % | 18.5 | % | 60 bps |

| | | |

Adjusted (1) | | | |

| Sales | $ | 251 | | $ | 238 | | 5 | % |

| Operating income | $ | 54 | | $ | 44 | | 22 | % |

| Operating margin | 21.3 | % | 18.5 | % | 280 bps |

(1)Reconciliations of Reported to Adjusted operating results are available in the Appendix.

•Sales of $251 million, up $13 million, or 5%;

•Higher revenue in the aerospace defense market reflected higher sales for our actuation equipment principally on the F-35 and other fighter jet programs;

•Commercial aerospace market revenue increases reflected increased demand and higher OEM sales of sensors products and surface treatment services on narrowbody and widebody platforms;

•Lower general industrial market revenue was principally driven by reduced sales of industrial vehicle products serving off-highway and specialty vehicle platforms; and

•Adjusted operating income was $54 million, up 22%, reflecting a strong Adjusted operating margin up 280 basis points to 21.3%, as favorable absorption on higher revenues and the benefits of our restructuring and cost containment initiatives were partially offset by higher investment in research and development.

Curtiss-Wright Corporation, Page 5

Defense Electronics

| | | | | | | | | | | |

| (In millions) | Q4-2024 | Q4-2023 | Change |

| Reported | | | |

| Sales | $ | 227 | | $ | 240 | | (5 | %) |

| Operating income | $ | 55 | | $ | 69 | | (21 | %) |

| Operating margin | 24.1 | % | 28.8 | % | (470 bps) |

| | | |

Adjusted (1) | | | |

| Sales | $ | 227 | | $ | 240 | | (5 | %) |

| Operating income | $ | 55 | | $ | 69 | | (20 | %) |

| Operating margin | 24.3 | % | 28.8 | % | (450 bps) |

(1)Reconciliations of Reported to Adjusted operating results are available in the Appendix.

•Sales of $227 million, down $12 million, or 5%;

•Higher revenue in the aerospace defense market was principally driven by increased sales of flight test instrumentation equipment;

•Ground defense market revenue declines principally reflected the timing of sales of embedded computing equipment on the Stryker ground combat vehicle;

•Lower revenue in the naval defense market reflected the timing of sales of embedded computing equipment supporting various domestic and international programs; and

•Adjusted operating income was $55 million, down 20% from the prior year period, while Adjusted operating margin decreased 450 basis points to 24.3%, primarily due to unfavorable absorption on lower defense revenues, unfavorable mix of products, and higher investment in research and development.

Curtiss-Wright Corporation, Page 6

Naval & Power

| | | | | | | | | | | |

| (In millions) | Q4-2024 | Q4-2023 | Change |

| Reported | | | |

| Sales | $ | 346 | | $ | 308 | | 12 | % |

| Operating income | $ | 65 | | $ | 57 | | 15 | % |

| Operating margin | 18.8 | % | 18.5 | % | 30 bps |

| | | |

Adjusted (1) | | | |

| Sales | $ | 346 | | $ | 308 | | 12 | % |

| Operating income | $ | 66 | | $ | 59 | | 11 | % |

| Operating margin | 19.1 | % | 19.3 | % | (20 bps) |

(1)Reconciliations of Reported to Adjusted operating results are available in the Appendix.

•Sales of $346 million, up $38 million, or 12%;

•Revenue growth in the naval defense market was stronger than anticipated principally driven by higher demand and timing of revenues on the Virginia-class and Columbia-class submarine programs, in addition to higher growth for aircraft handling systems to international customers;

•Lower revenue in the aerospace defense market principally reflected the timing of sales of arresting systems equipment supporting various international customers;

•Higher power & process market revenues mainly reflected increased commercial nuclear aftermarket sales supporting the maintenance of U.S. operating reactors. Those increases were partially offset by lower industrial valve sales in the process market; and

•Adjusted operating income was $66 million, up 11% from the prior year period, while Adjusted operating margin decreased 20 basis points to 19.1%, as favorable absorption on higher revenues was partially offset by unfavorable mix of products and higher investment in research and development.

Curtiss-Wright Corporation, Page 7

Free Cash Flow

| | | | | | | | | | | |

| (In millions) | Q4-2024 | Q4-2023 | Change |

| Net cash provided by operating activities | $ | 301 | | $ | 282 | | 7 | % |

| Capital expenditures | (23) | | (13) | | 84 | % |

| Reported free cash flow | $ | 278 | | $ | 270 | | 3 | % |

Adjusted free cash flow (1) | $ | 278 | | $ | 270 | | 3 | % |

(1)A reconciliation of Reported to Adjusted free cash flow is available in the Appendix.

•Reported free cash flow of $278 million increased $8 million, primarily due to the timing of customer advances driving improved working capital partially offset by higher capital investments;

•Adjusted free cash flow of $278 million increased $8 million; and

•Capital expenditures increased approximately $11 million compared with the prior year period, primarily due to higher growth investments within the Naval & Power segment.

New Orders and Backlog

•New orders of $939 million increased 37% in the fourth quarter, principally reflecting strong demand across our A&D markets;

•Full-year 2024 new orders of $3.7 billion increased 20% and generated an overall book-to-bill of approximately 1.2x, reflecting strong growth within our A&D markets as well as solid demand for commercial nuclear products within our Commercial markets; and

•Backlog of $3.4 billion, up 20% from December 31, 2023.

Share Repurchase and Dividends

•During the fourth quarter, the Company repurchased approximately 311,000 shares of its common stock for approximately $112 million;

•During full-year 2024, the Company repurchased approximately 766,000 shares for $250 million; and

•The Company also declared a quarterly dividend of $0.21 a share.

Curtiss-Wright Corporation, Page 8

Full-Year 2025 Guidance

The Company's full-year 2025 financial guidance(1) is as follows:

| | | | | | | | |

| ($ in millions, except EPS) | 2025 Guidance | % Chg vs 2024 Adjusted |

| Total Sales | $3,335 - $3,385 | 7 - 8% |

| Operating Income | $598 - $613 | 10 - 12% |

| Operating Margin | 17.9% - 18.1% | 40 - 60 bps |

| Diluted EPS | $12.10 - $12.40 | 11 - 14% |

Free Cash Flow(2) | $485 - $505 | 0 - 4% |

(1)Reconciliations of Reported to Adjusted 2024 operating results and 2025 financial guidance are available in the Appendix and exclude first-year purchase accounting costs associated with prior-year acquisitions.

(2)2025 Free Cash Flow guidance includes higher capital expenditures supporting growth and efficiency (reflecting a $14 to $24 million year-over-year increase compared with 2024 results) and the timing of prior year record customer advances.

**********

A more detailed breakdown of the Company’s 2025 financial guidance by segment and by market, as well as all reconciliations of Reported GAAP amounts to Adjusted non-GAAP amounts, can be found in the accompanying schedules. Historical financial results are available in the Investor Relations section of Curtiss-Wright’s website.

Conference Call & Webcast Information

The Company will host a conference call to discuss fourth quarter and full-year 2024 financial results and expectations for 2025 guidance at 11:00 a.m. ET on Thursday, February 13, 2025. A live webcast of the call and the accompanying financial presentation, as well as a webcast replay of the call, will be made available on the internet by visiting the Investor Relations section of the Company’s website at www.curtisswright.com.

(Tables to Follow)

Curtiss-Wright Corporation, Page 9

| | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED) |

| ($'s in thousands, except per share data) |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Product sales | $ | 698,626 | | | $ | 667,879 | | | $ | 2,639,953 | | | $ | 2,389,711 | |

| Service sales | 125,687 | | | 117,912 | | | 481,236 | | | 455,662 | |

| Total net sales | 824,313 | | | 785,791 | | | 3,121,189 | | | 2,845,373 | |

| | | | | | | |

| Cost of product sales | 437,801 | | | 414,010 | | | 1,690,574 | | | 1,507,480 | |

| Cost of service sales | 69,082 | | | 67,051 | | | 277,066 | | | 270,715 | |

| Total cost of sales | 506,883 | | | 481,061 | | | 1,967,640 | | | 1,778,195 | |

| | | | | | | |

| Gross profit | 317,430 | | | 304,730 | | | 1,153,549 | | | 1,067,178 | |

| | | | | | | |

| Research and development expenses | 25,781 | | | 20,066 | | | 91,647 | | | 85,764 | |

| Selling expenses | 36,158 | | | 36,306 | | | 145,360 | | | 137,088 | |

| General and administrative expenses | 92,405 | | | 87,664 | | | 373,497 | | | 359,724 | |

| Restructuring expenses | 8,250 | | | — | | | 14,448 | | | — | |

| | | | | | | |

| Operating income | 154,836 | | | 160,694 | | | 528,597 | | | 484,602 | |

| | | | | | | |

| Interest expense | 11,675 | | | 10,961 | | | 44,869 | | | 51,393 | |

| Other income, net | 10,034 | | | 7,117 | | | 38,328 | | | 29,861 | |

| | | | | | | |

| Earnings before income taxes | 153,195 | | | 156,850 | | | 522,056 | | | 463,070 | |

| Provision for income taxes | (35,343) | | | (36,963) | | | (117,078) | | | (108,561) | |

| Net earnings | $ | 117,852 | | | $ | 119,887 | | | $ | 404,978 | | | $ | 354,509 | |

| | | | | | | |

| Basic earnings per share | $ | 3.11 | | | $ | 3.14 | | | $ | 10.61 | | | $ | 9.26 | |

| Diluted earnings per share | $ | 3.09 | | | $ | 3.11 | | | $ | 10.55 | | | $ | 9.20 | |

| | | | | | | |

| Dividends per share | $ | 0.21 | | | $ | 0.20 | | | $ | 0.83 | | | $ | 0.79 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 37,874 | | | 38,232 | | | 38,153 | | | 38,283 | |

| Diluted | 38,137 | | | 38,505 | | | 38,373 | | | 38,529 | |

Curtiss-Wright Corporation, Page 10

| | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| ($'s in thousands, except par value) |

| | | |

| December 31, | | December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 385,042 | | | $ | 406,867 | |

| Receivables, net | 835,037 | | | 732,678 | |

| Inventories, net | 541,442 | | | 510,033 | |

| Other current assets | 88,073 | | | 67,502 | |

| Total current assets | 1,849,594 | | | 1,717,080 | |

| Property, plant, and equipment, net | 339,118 | | | 332,796 | |

| Goodwill | 1,675,718 | | | 1,558,826 | |

| Other intangible assets, net | 596,831 | | | 557,612 | |

| Operating lease right-of-use assets, net | 169,350 | | | 141,435 | |

| Prepaid pension asset | 299,130 | | | 261,869 | |

| Other assets | 55,963 | | | 51,351 | |

| Total assets | $ | 4,985,704 | | | $ | 4,620,969 | |

| | | |

| Liabilities | | | |

| Current liabilities: | | | |

| Current portion of long-term and short-term debt | $ | 90,000 | | | $ | — | |

| Accounts payable | 247,185 | | | 243,833 | |

| Accrued expenses | 219,054 | | | 188,039 | |

| Deferred revenue | 459,421 | | | 303,872 | |

| Other current liabilities | 80,288 | | | 70,800 | |

| Total current liabilities | 1,095,948 | | | 806,544 | |

| Long-term debt | 958,949 | | | 1,050,362 | |

| Deferred tax liabilities | 140,659 | | | 132,319 | |

| Accrued pension and other postretirement benefit costs | 67,413 | | | 66,875 | |

| Long-term operating lease liability | 148,175 | | | 118,611 | |

| Other liabilities | 124,761 | | | 117,845 | |

| Total liabilities | $ | 2,535,905 | | | $ | 2,292,556 | |

| | | |

| Stockholders' equity | | | |

| Common stock, $1 par value | $ | 49,187 | | | $ | 49,187 | |

| Additional paid in capital | 147,940 | | | 140,182 | |

| Retained earnings | 3,861,073 | | | 3,487,751 | |

| Accumulated other comprehensive loss | (243,225) | | | (213,223) | |

| Less: cost of treasury stock | (1,365,176) | | | (1,135,484) | |

| Total stockholders' equity | 2,449,799 | | | 2,328,413 | |

| | | |

| Total liabilities and stockholders' equity | $ | 4,985,704 | | | $ | 4,620,969 | |

Curtiss-Wright Corporation, Page 11

Use and Definitions of Non-GAAP Financial Information (Unaudited)

The Corporation supplements its financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial information. Curtiss-Wright believes that these Adjusted (non-GAAP) measures provide investors with improved transparency in order to better measure Curtiss-Wright’s ongoing operating and financial performance and better comparisons of our key financial metrics to our peers. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. Curtiss-Wright encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Reconciliations of “Reported” GAAP amounts to “Adjusted” non-GAAP amounts are furnished within this release.

The following definitions are provided:

Adjusted Operating Income, Operating Margin, Net Earnings and Diluted EPS

These Adjusted financials are defined as Reported Operating Income, Operating Margin, Net Earnings and Diluted Earnings per Share under GAAP excluding: (i) the impact of first year purchase accounting costs associated with acquisitions, specifically one-time inventory step-up, backlog amortization, deferred revenue adjustments and transaction costs; (ii) costs associated with the Company's 2024 Restructuring Program; and (iii) the sale or divestiture of a business or product line, as applicable.

Curtiss-Wright Corporation, Page 12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| RECONCILIATION OF AS REPORTED TO ADJUSTED (UNAUDITED) |

| ($'s in thousands) |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended | | | | |

| December 31, 2024 | | December 31, 2023 | | % Change |

| As Reported | | Adjustments | | Adjusted | | As Reported | | Adjustments | | Adjusted | | As Reported | | Adjusted |

| Sales: | | | | | | | | | | | | | | | |

| Aerospace & Industrial | $ | 250,917 | | | $ | — | | | $ | 250,917 | | | $ | 238,224 | | | $ | — | | | $ | 238,224 | | | 5 | % | | 5 | % |

Defense Electronics | 227,475 | | | — | | | 227,475 | | | 239,751 | | | — | | | 239,751 | | | (5) | % | | (5) | % |

| Naval & Power | 345,921 | | | — | | | 345,921 | | | 307,816 | | | — | | | 307,816 | | | 12 | % | | 12 | % |

| | | | | | | | | | | | | | | |

| Total sales | $ | 824,313 | | | $ | — | | | $ | 824,313 | | | $ | 785,791 | | | $ | — | | | $ | 785,791 | | | 5 | % | | 5 | % |

| | | | | | | | | | | | | | | |

| Operating income (expense): | | | | | | | | | | | | | | |

Aerospace & Industrial(3) | $ | 47,876 | | | $ | 5,694 | | | $ | 53,570 | | | $ | 44,054 | | | $ | — | | | $ | 44,054 | | | 9 | % | | 22 | % |

Defense Electronics(3) | 54,775 | | | 587 | | | 55,362 | | | 69,015 | | | — | | | 69,015 | | | (21) | % | | (20) | % |

Naval & Power(1)(2)(3) | 65,150 | | | 962 | | | 66,112 | | | 56,845 | | | 2,529 | | | 59,374 | | | 15 | % | | 11 | % |

| | | | | | | | | | | | | | | | |

| Total segments | $ | 167,801 | | | $ | 7,243 | | | $ | 175,044 | | | $ | 169,914 | | | $ | 2,529 | | | $ | 172,443 | | | (1) | % | | 2 | % |

Corporate and other(3) | (12,965) | | | 1,414 | | | (11,551) | | | (9,221) | | | — | | | (9,221) | | | (41) | % | | (25) | % |

| | | | | | | | | | | | | | | |

| Total operating income | $ | 154,836 | | | $ | 8,657 | | | $ | 163,493 | | | $ | 160,693 | | | $ | 2,529 | | | $ | 163,222 | | | (4) | % | | — | % |

| | | | | | | | | | | | | | | |

| Operating margins: | As Reported | | | | Adjusted | | As Reported | | | | Adjusted | | As Reported | | Adjusted |

| Aerospace & Industrial | 19.1 | % | | | | 21.3 | % | | 18.5 | % | | | | 18.5 | % | | 60 bps | | 280 bps |

| Defense Electronics | 24.1 | % | | | | 24.3 | % | | 28.8 | % | | | | 28.8 | % | | (470 bps) | | (450 bps) |

| Naval & Power | 18.8 | % | | | | 19.1 | % | | 18.5 | % | | | | 19.3 | % | | 30 bps | | (20 bps) |

| Total Curtiss-Wright | 18.8 | % | | | | 19.8 | % | | 20.4 | % | | | | 20.8 | % | | (160 bps) | | (100 bps) |

| | | | | | | | | | | | | | | |

| Segment margins | 20.4 | % | | | | 21.2 | % | | 21.6 | % | | | | 21.9 | % | | (120 bps) | | (70 bps) |

| | | | | | | | | | | | | | | |

(1) Excludes first year purchase accounting adjustments in both the current and prior year periods. |

(2) Excludes trailing costs in the prior year period associated with the divestiture of our German valves business. |

(3) Excludes costs associated with the Company's 2024 Restructuring Program in the current period. |

|

|

Curtiss-Wright Corporation, Page 13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| RECONCILIATION OF AS REPORTED TO ADJUSTED (UNAUDITED) |

| ($'s in thousands) |

| | | | | | | | | | | | | | | |

| Year Ended | | Year Ended | | | | |

| December 31, 2024 | | December 31, 2023 | | % Change |

| As Reported | | Adjustments | | Adjusted | | As Reported | | Adjustments | | Adjusted | | As Reported | | Adjusted |

| Sales: | | | | | | | | | | | | | | | |

| Aerospace & Industrial | $ | 932,133 | | | $ | — | | | $ | 932,133 | | | $ | 887,228 | | | $ | — | | | $ | 887,228 | | | 5 | % | | 5 | % |

| Defense Electronics | 910,706 | | | — | | | 910,706 | | | 815,912 | | | — | | | 815,912 | | | 12 | % | | 12 | % |

| Naval & Power | 1,278,350 | | | — | | | 1,278,350 | | | 1,142,233 | | | — | | | 1,142,233 | | | 12 | % | | 12 | % |

| | | | | | | | | | | | | | | |

| Total sales | $ | 3,121,189 | | | $ | — | | | $ | 3,121,189 | | | $ | 2,845,373 | | | $ | — | | | $ | 2,845,373 | | | 10 | % | | 10 | % |

| | | | | | | | | | | | | | | |

| Operating income (expense): | | | | | | | | | | | | | | |

Aerospace & Industrial(3) | $ | 148,023 | | | $ | 10,239 | | | $ | 158,262 | | | $ | 145,278 | | | $ | — | | | $ | 145,278 | | | 2 | % | | 9 | % |

Defense Electronics(3) | 224,739 | | | 1,929 | | | 226,668 | | | 191,775 | | | — | | | 191,775 | | | 17 | % | | 18 | % |

Naval & Power (1)(2)(3) | 199,663 | | | 2,063 | | | 201,726 | | | 189,227 | | | 9,198 | | | 198,425 | | | 6 | % | | 2 | % |

| | | | | | | | | | | | | | | | |

| Total segments | $ | 572,425 | | | $ | 14,231 | | | $ | 586,656 | | | $ | 526,280 | | | $ | 9,198 | | | $ | 535,478 | | | 9 | % | | 10 | % |

Corporate and other(3) | (43,828) | | | 3,038 | | | (40,790) | | | (41,678) | | | — | | | (41,678) | | | (5) | % | | 2 | % |

| | | | | | | | | | | | | | | |

| Total operating income | $ | 528,597 | | | $ | 17,269 | | | $ | 545,866 | | | $ | 484,602 | | | $ | 9,198 | | | $ | 493,800 | | | 9 | % | | 11 | % |

| | | | | | | | | | | | | | | |

| Operating margins: | As Reported | | | | Adjusted | | As Reported | | | | Adjusted | | As Reported | | Adjusted |

| Aerospace & Industrial | 15.9 | % | | | | 17.0 | % | | 16.4 | % | | | | 16.4 | % | | (50 bps) | | 60 bps |

| Defense Electronics | 24.7 | % | | | | 24.9 | % | | 23.5 | % | | | | 23.5 | % | | 120 bps | | 140 bps |

| Naval & Power | 15.6 | % | | | | 15.8 | % | | 16.6 | % | | | | 17.4 | % | | (100 bps) | | (160 bps) |

| Total Curtiss-Wright | 16.9 | % | | | | 17.5 | % | | 17.0 | % | | | | 17.4 | % | | (10 bps) | | 10 bps |

| | | | | | | | | | | | | | | |

| Segment margins | 18.3 | % | | | | 18.8 | % | | 18.5 | % | | | | 18.8 | % | | (20 bps) | | — bps |

| | | | | | | | | | | | | | | |

(1) Excludes first year purchase accounting adjustments in both the current and prior year periods. |

(2) Excludes trailing costs in the prior year period associated with the divestiture of our German valves business. |

(3) Excludes costs associated with the Company's 2024 Restructuring Program in the current period. |

Curtiss-Wright Corporation, Page 14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| RECONCILIATION OF AS REPORTED SALES TO ADJUSTED SALES BY END MARKET (UNAUDITED) |

| ($'s in thousands) |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | | |

| | December 31, 2024 | | December 31, 2023 | | % Change |

| | As Reported | | Adjustments | | Adjusted Sales | | As Reported | | Adjustments | | Adjusted Sales | | Change in As Reported Sales | Change in Adjusted Sales |

| Aerospace & Defense markets: | | | | | | | | | | | | | | | |

| Aerospace Defense | | $ | 171,432 | | | $ | — | | | $ | 171,432 | | | $ | 171,527 | | | $ | — | | | $ | 171,527 | | | 0 | % | 0 | % |

Ground Defense | | 84,654 | | | — | | | 84,654 | | | 87,691 | | | — | | | 87,691 | | | (3 | %) | (3 | %) |

| Naval Defense | | 216,894 | | | — | | | 216,894 | | | 187,240 | | | — | | | 187,240 | | | 16 | % | 16 | % |

Commercial Aerospace | | 98,318 | | | — | | | 98,318 | | | 92,723 | | | — | | | 92,723 | | | 6 | % | 6 | % |

| Total Aerospace & Defense | | $ | 571,298 | | | $ | — | | | $ | 571,298 | | | $ | 539,181 | | | $ | — | | | $ | 539,181 | | | 6 | % | 6 | % |

| | | | | | | | | | | | | | | |

| Commercial markets: | | | | | | | | | | | | | | | |

| Power & Process | | $ | 146,772 | | | $ | — | | | $ | 146,772 | | | $ | 136,541 | | | $ | — | | | $ | 136,541 | | | 7 | % | 7 | % |

| General Industrial | | 106,243 | | | — | | | 106,243 | | | 110,069 | | | — | | | 110,069 | | | (3 | %) | (3 | %) |

| Total Commercial | | $ | 253,015 | | | $ | — | | | $ | 253,015 | | | $ | 246,610 | | | $ | — | | | $ | 246,610 | | | 3 | % | 3 | % |

| | | | | | | | | | | | | | | |

| Total Curtiss-Wright | | $ | 824,313 | | | $ | — | | | $ | 824,313 | | | $ | 785,791 | | | $ | — | | | $ | 785,791 | | | 5 | % | 5 | % |

| | | | | | | | | | | | | | | |

| | Year Ended | | Year Ended | | | |

| | December 31, 2024 | | December 31, 2023 | | % Change |

| | As Reported | | Adjustments | | Adjusted Sales | | As Reported | | Adjustments | | Adjusted Sales | | Change in As Reported Sales | Change in Adjusted Sales |

| Aerospace & Defense markets: | | | | | | | | | | | | | | | |

| Aerospace Defense | | $ | 616,590 | | | $ | — | | | $ | 616,590 | | | $ | 551,622 | | | $ | — | | | $ | 551,622 | | | 12 | % | 12 | % |

Ground Defense | | 353,326 | | | — | | | 353,326 | | | 308,008 | | | — | | | 308,008 | | | 15 | % | 15 | % |

| Naval Defense | | 821,898 | | | — | | | 821,898 | | | 720,013 | | | — | | | 720,013 | | | 14 | % | 14 | % |

Commercial Aerospace | | 378,086 | | | — | | | 378,086 | | | 324,949 | | | — | | | 324,949 | | | 16 | % | 16 | % |

| Total Aerospace & Defense | | $ | 2,169,900 | | | $ | — | | | $ | 2,169,900 | | | $ | 1,904,592 | | | $ | — | | | $ | 1,904,592 | | | 14 | % | 14 | % |

| | | | | | | | | | | | | | | |

| Commercial markets: | | | | | | | | | | | | | | | |

Power & Process | | $ | 540,788 | | | $ | — | | | $ | 540,788 | | | $ | 509,998 | | | $ | — | | | $ | 509,998 | | | 6 | % | 6 | % |

| General Industrial | | 410,501 | | | — | | | 410,501 | | | 430,783 | | | — | | | 430,783 | | | (5 | %) | (5 | %) |

| Total Commercial | | $ | 951,289 | | | $ | — | | | $ | 951,289 | | | $ | 940,781 | | | $ | — | | | $ | 940,781 | | | 1 | % | 1 | % |

| | | | | | | | | | | | | | | |

| Total Curtiss-Wright | | $ | 3,121,189 | | | $ | — | | | $ | 3,121,189 | | | $ | 2,845,373 | | | $ | — | | | $ | 2,845,373 | | | 10 | % | 10 | % |

| | | | | | | | | | | | | | | |

|

|

Curtiss-Wright Corporation, Page 15

| | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| RECONCILIATION OF AS REPORTED TO ADJUSTED DILUTED EARNINGS PER SHARE (UNAUDITED) |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Diluted earnings per share - As Reported | $ | 3.09 | | | $ | 3.11 | | | $ | 10.55 | | | $ | 9.20 | |

| First year purchase accounting adjustments | 0.01 | | | 0.02 | | | 0.04 | | | 0.15 | |

| Divested German valves business | — | | | 0.03 | | | — | | | 0.03 | |

| Restructuring expenses | 0.17 | | | — | | | 0.31 | | | — | |

Diluted earnings per share - Adjusted (1) | $ | 3.27 | | | $ | 3.16 | | | $ | 10.90 | | | $ | 9.38 | |

| | | | | | | |

(1) All adjustments are presented net of income taxes. | | | | |

Curtiss-Wright Corporation, Page 16

Organic Sales and Organic Operating Income

The Corporation discloses organic sales and organic operating income because the Corporation believes it provides investors with insight as to the Company’s ongoing business performance. Organic sales and organic operating income are defined as sales and operating income, excluding contributions from acquisitions and results of operations from divested businesses or product lines during the last twelve months, costs associated with the Company's 2024 Restructuring Program, and foreign currency fluctuations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, |

| 2024 vs. 2023 |

| Aerospace & Industrial | | Defense Electronics | | Naval & Power | | Total Curtiss-Wright |

| Sales | | Operating income | | Sales | | Operating income | | Sales | | Operating income | | Sales | | Operating income |

| As Reported | 5% | | 9% | | (5%) | | (21%) | | 12% | | 15% | | 5% | | (4%) |

| Less: Acquisitions | 0% | | 0% | | 0% | | 0% | | 0% | | 1% | | 0% | | 0% |

| Restructuring | 0% | | 13% | | 0% | | 1% | | 0% | | (1%) | | 0% | | 5% |

| Foreign currency | 0% | | (2%) | | 0% | | 0% | | 0% | | (2%) | | 0% | | (1%) |

| Organic | 5% | | 20% | | (5%) | | (20%) | | 12% | | 13% | | 5% | | 0% |

| | | | | | | | | | | | | | | |

| Year Ended |

| December 31, |

| 2024 vs. 2023 |

| Aerospace & Industrial | | Defense Electronics | | Naval & Power | | Total Curtiss-Wright |

| Sales | | Operating income | | Sales | | Operating income | | Sales | | Operating income | | Sales | | Operating income |

| As Reported | 5% | | 2% | | 12% | | 17% | | 12% | | 6% | | 10% | | 9% |

| Less: Acquisitions | 0% | | 0% | | 0% | | 0% | | (1%) | | 0% | | 0% | | 0% |

| Restructuring | 0% | | 7% | | 0% | | 1% | | 0% | | 0% | | 0% | | 3% |

| Foreign currency | 0% | | (1%) | | 0% | | 0% | | 0% | | (1%) | | (1%) | | 0% |

| Organic | 5% | | 8% | | 12% | | 18% | | 11% | | 5% | | 9% | | 12% |

Curtiss-Wright Corporation, Page 17

Free Cash Flow and Free Cash Flow Conversion

The Corporation discloses free cash flow because it measures cash flow available for investing and financing activities. Free cash flow represents cash available to repay outstanding debt, invest in the business, acquire businesses, return capital to shareholders and make other strategic investments. Free cash flow is defined as net cash provided by operating activities less capital expenditures. Adjusted free cash flow excludes payments associated with the Westinghouse legal settlement in the prior year period. The Corporation discloses adjusted free cash flow conversion because it measures the proportion of net earnings converted into free cash flow and is defined as adjusted free cash flow divided by adjusted net earnings.

| | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

| NON-GAAP FINANCIAL DATA (UNAUDITED) |

| ($'s in thousands) |

| | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 301,299 | | | $ | 282,372 | | | $ | 544,275 | | | $ | 448,089 | |

| Capital expenditures | (23,271) | | | (12,629) | | | (60,974) | | | (44,666) | |

| Free cash flow | $ | 278,028 | | | $ | 269,743 | | | $ | 483,301 | | | $ | 403,423 | |

| Westinghouse legal settlement | — | | | — | | | — | | | 10,000 | |

| Adjusted free cash flow | $ | 278,028 | | | $ | 269,743 | | | $ | 483,301 | | | $ | 413,423 | |

| Adjusted free cash flow conversion | 223 | % | | 221 | % | | 116 | % | | 114 | % |

Curtiss-Wright Corporation, Page 18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION |

| 2025 Guidance |

| As of February 12, 2025 |

| ($'s in millions, except per share data) |

| | | | | | | | | | | | | | | | | | | | | |

| 2024

Reported

(GAAP) | | 2024 Adjustments (Non-GAAP)(1) | | 2024 Adjusted (Non-GAAP)(1) | | 2025

Reported Guidance

(GAAP) | | 2025 Adjustments (Non-GAAP)(2) | | 2025 Adjusted Guidance (Non-GAAP)(2) |

| | | | | | | Low | High | | | | Low | High | | | | | | | | 2025 Chg

vs 2024

Adjusted |

| Sales: | | | | | | | | | | | | | | | | | | | | | |

| Aerospace & Industrial | $ | 932 | | | $ | — | | | $ | 932 | | | $ | 960 | | $ | 975 | | | $ | — | | | $ | 960 | | $ | 975 | | | | | | | | | 3 - 5% |

| Defense Electronics | 911 | | | — | | | 911 | | | 975 | | 990 | | | $ | — | | | 975 | | 990 | | | | | | | | | 7 - 9% |

| Naval & Power | 1,278 | | | — | | | 1,278 | | | 1,400 | | 1,420 | | | $ | — | | | 1,400 | | 1,420 | | | | | | | | | 10 - 11% |

| Total sales | $ | 3,121 | | | $ | — | | | $ | 3,121 | | | $ | 3,335 | | $ | 3,385 | | | $ | — | | | $ | 3,335 | | $ | 3,385 | | | | | | | | | 7 - 8% |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income: | | | | | | | | | | | | | | | | | | | | | |

| Aerospace & Industrial | $ | 148 | | | $ | 10 | | | $ | 158 | | | $ | 164 | | $ | 169 | | | $ | 3 | | | $ | 167 | | $ | 172 | | | | | | | | | 5 - 8% |

| Defense Electronics | 225 | | | 2 | | | 227 | | | 244 | | 250 | | | — | | | 244 | | 250 | | | | | | | | | 8 - 10% |

| Naval & Power | 200 | | | 2 | | | 202 | | | 217 | | 223 | | | 11 | | | 228 | | 234 | | | | | | | | | 13 - 16% |

| Total segments | 572 | | | 15 | | | 587 | | | 624 | | 641 | | | 14 | | | 638 | | 655 | | | | | | | | | |

| Corporate and other | (44) | | | 3 | | | (41) | | | (40) | | (42) | | | — | | | (40) | | (42) | | | | | | | | | |

| Total operating income | $ | 529 | | | $ | 17 | | | $ | 546 | | | $ | 584 | | $ | 599 | | | $ | 14 | | | $ | 598 | | $ | 613 | | | | | | | | | 10 - 12% |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | $ | (45) | | | $ | — | | | $ | (45) | | | $ | (42) | | $ | (43) | | | $ | — | | | $ | (42) | | $ | (43) | | | | | | | | | |

| Other income, net | 38 | | | — | | | 38 | | | 33 | | 34 | | | $ | — | | | 33 | | 34 | | | | | | | | | |

| Earnings before income taxes | 522 | | | 17 | | | 539 | | | 575 | | 590 | | | $ | 14 | | | 589 | | 603 | | | | | | | | | |

| Provision for income taxes | (117) | | | (4) | | | (121) | | | (127) | | (130) | | | (3) | | | (130) | | (133) | | | | | | | | | |

| Net earnings | $ | 405 | | | $ | 13 | | | $ | 418 | | | $ | 448 | | $ | 460 | | | $ | 11 | | | $ | 459 | | $ | 470 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share | $ | 10.55 | | | $ | 0.35 | | | $ | 10.90 | | | $ | 11.80 | | $ | 12.10 | | | $ | 0.30 | | | $ | 12.10 | | $ | 12.40 | | | | | | | | | 11 - 14% |

| Diluted shares outstanding | 38.4 | | | | | 38.4 | | | 37.9 | | 37.9 | | | | | 37.9 | | 37.9 | | | | | | | | | |

| Effective tax rate | 22.4 | % | | | | 22.4 | % | | 22.0 | % | 22.0 | % | | | | 22.0 | % | 22.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating margins: | | | | | | | | | | | | | | | | | | | | | |

| Aerospace & Industrial | 15.9 | % | | | | 17.0 | % | | 17.1 | % | 17.3 | % | | | | 17.4 | % | 17.6 | % | | | | | | | | 40 - 60 bps |

| Defense Electronics | 24.7 | % | | | | 24.9 | % | | 25.0 | % | 25.2 | % | | | | 25.0 | % | 25.2 | % | | | | | | | | 10 - 30 bps |

| Naval & Power | 15.6 | % | | | | 15.8 | % | | 15.5 | % | 15.7 | % | | | | 16.3 | % | 16.5 | % | | | | | | | | 50 - 70 bps |

| Total operating margin | 16.9 | % | | | | 17.5 | % | | 17.5 | % | 17.7 | % | | | | 17.9 | % | 18.1 | % | | | | | | | | 40 - 60 bps |

| | | | | | | | | | | | | | | | | | | | | |

Free cash flow(3) | $ | 483 | | | $— | | $ | 483 | | | $ | 485 | | $ | 505 | | | $— | | $ | 485 | | $ | 505 | | | | | | | | | 0 - 4% |

| | | | | | | | | | | | | | | | | | | | | |

| Notes: Amounts may not add due to rounding. |

(1) 2024 Adjusted financials are defined as Reported Operating Income, Operating Margin, Net Income and Diluted EPS under GAAP excluding costs associated with the Company's 2024 Restructuring Program and the impact of first year purchase accounting adjustments. |

(2) 2025 Adjusted financials are defined as Reported Operating Income, Operating Margin, Net Income and Diluted EPS under GAAP excluding costs associated with the Company's 2024 Restructuring Program and the impact of first year purchase accounting adjustments. |

(3) Free Cash Flow is defined as cash flow from operations less capital expenditures. 2025 Free Cash Flow guidance includes higher capital expenditures supporting growth and efficiency (reflecting a $14 to $24 million year-over-year increase compared with 2024 results) and the timing of prior year record customer advances. |

Curtiss-Wright Corporation, Page 19

| | | | | | | | | | | |

| CURTISS-WRIGHT CORPORATION |

| 2025 Sales Growth Guidance by End Market |

As of February 12, 2025 |

| | | |

| | | |

| | |

| 2025 % Change vs. 2024 Adjusted | | % Total Sales |

| | | |

| Aerospace & Defense Markets | | | |

| Aerospace Defense | 6 - 8% | | 20% |

| Ground Defense | 3 - 5% | | 11% |

| Naval Defense | 3 - 5% | | 25% |

| Commercial Aerospace | 10 - 12% | | 13% |

| Total Aerospace & Defense | 5 - 7% | | 69% |

| | | |

| Commercial Markets | | | |

| Power & Process | 16 - 18% | | 19% |

| General Industrial | Flat | | 12% |

| Total Commercial | 9 - 11% | | 31% |

| | | |

| Total Curtiss-Wright Sales | 7 - 8% | | 100% |

| | | |

| | |

Curtiss-Wright Corporation, Page 20

About Curtiss-Wright Corporation

Curtiss-Wright Corporation (NYSE:CW) is a global integrated business that provides highly engineered products, solutions and services mainly to Aerospace & Defense markets, as well as critical technologies in demanding Commercial Power, Process and Industrial markets. We leverage a workforce of approximately 8,800 highly skilled employees who develop, design and build what we believe are the best engineered solutions to the markets we serve. Building on the heritage of Glenn Curtiss and the Wright brothers, Curtiss-Wright has a long tradition of providing innovative solutions through trusted customer relationships. For more information, visit www.curtisswright.com.

###

Certain statements made in this press release, including statements about future revenue, financial performance guidance, quarterly and annual revenue, net income, operating income growth, future business opportunities, cost saving initiatives, the successful integration of the Company’s acquisitions, and future cash flow from operations, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements present management's expectations, beliefs, plans and objectives regarding future financial performance, and assumptions or judgments concerning such performance. Any discussions contained in this press release, except to the extent that they contain historical facts, are forward-looking and accordingly involve estimates, assumptions, judgments and uncertainties. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Such risks and uncertainties include, but are not limited to: a reduction in anticipated orders; an economic downturn; changes in the competitive marketplace and/or customer requirements; a change in government spending; an inability to perform customer contracts at anticipated cost levels; and other factors that generally affect the business of aerospace, defense contracting, electronics, marine, and industrial companies. Such factors are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and subsequent reports filed with the Securities and Exchange Commission.

This press release and additional information are available at www.curtisswright.com.

Contact: Jim Ryan

(704) 869-4621

Jim.Ryan@curtisswright.com

Q4 2024 Earnings Presentation February 13, 2025 Q4 2024 EARNINGS CONFERENCE CALL Webcast Login: curtisswright.com/investor-relations/ Conference Call Dial-in numbers: (800) 343-5172 (domestic) (203) 518-9856 (international) Conference code: CWQ424

Q4 2024 Earnings Presentation SAFE HARBOR STATEMENT Please note that the information provided in this presentation is accurate as of the date of the original presentation. The presentation will remain posted on this website from one to twelve months following the initial presentation, but content will not be updated to reflect new information that may become available after the original presentation posting. The presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act"), Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"), and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this report and Curtiss-Wright Corporation assumes no obligation to update the information included in this report. Such forward-looking statements include, among other things, management's estimates of future performance, revenue and earnings, our management's growth objectives, our management’s ability to integrate our acquisition, and our management's ability to produce consistent operating improvements. These forward-looking statements are based on expectations as of the time the statements were made only, and are subject to a number of risks and uncertainties which could cause us to fail to achieve our then-current financial projections and other expectations, including the impact of a global pandemic or national epidemic. This presentation also includes certain non-GAAP financial measures with reconciliations to GAAP financial measures being made available in the earnings release and this presentation that are posted to our website and furnished with the SEC. We undertake no duty to update this information. More information about potential factors that could affect our business and financial results is included in our filings with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, including, among other sections, under the captions, "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," which is on file with the SEC and available at the SEC's website at www.sec.gov. 2

Q4 2024 Earnings Presentation CURTISS-WRIGHT DELIVERED STRONG Q4 RESULTS & RECORD 2024 PERFORMANCE ▪ Sales of $824M, up 5% ▪ Operating Income of $163M; Strong Operating Margin of 19.8% ▪ Diluted EPS of $3.27, up 3% ▪ Strong FCF of $278M; 223% conversion ▪ New Orders of $939M, up 37% – ~1.1x Book-to-Bill Note: Fourth quarter and Full-year 2024 results and comparisons to 2023, as well as Full-year 2025 guidance and comparisons to 2024, presented on an Adjusted (Non-GAAP) basis, unless noted ▪ Sales of $3.1B, up 10% ▪ Operating Income of $546M, up 11% ▪ Operating Margin of 17.5%, up 10 bps YOY – Continued growth in internal and customer-funded R&D investments ▪ Diluted EPS of $10.90, up 16% ▪ FCF of $483M; 116% conversion ▪ New Orders of $3.7B, up 20%; Backlog up 20% Full Year 2024 Highlights Fourth Quarter 2024 Highlights 3

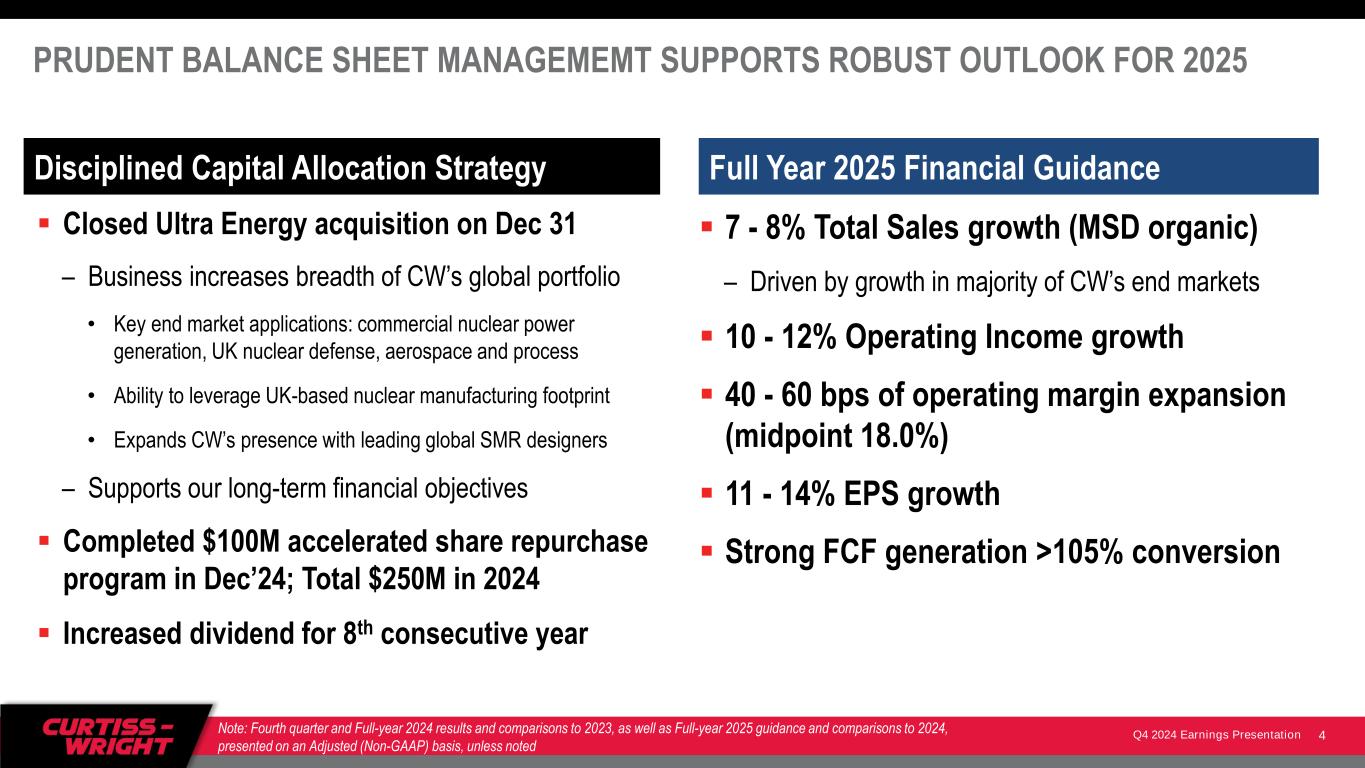

Q4 2024 Earnings Presentation PRUDENT BALANCE SHEET MANAGEMEMT SUPPORTS ROBUST OUTLOOK FOR 2025 ▪ Closed Ultra Energy acquisition on Dec 31 – Business increases breadth of CW’s global portfolio • Key end market applications: commercial nuclear power generation, UK nuclear defense, aerospace and process • Ability to leverage UK-based nuclear manufacturing footprint • Expands CW’s presence with leading global SMR designers – Supports our long-term financial objectives ▪ Completed $100M accelerated share repurchase program in Dec’24; Total $250M in 2024 ▪ Increased dividend for 8th consecutive year Note: Fourth quarter and Full-year 2024 results and comparisons to 2023, as well as Full-year 2025 guidance and comparisons to 2024, presented on an Adjusted (Non-GAAP) basis, unless noted ▪ 7 - 8% Total Sales growth (MSD organic) – Driven by growth in majority of CW’s end markets ▪ 10 - 12% Operating Income growth ▪ 40 - 60 bps of operating margin expansion (midpoint 18.0%) ▪ 11 - 14% EPS growth ▪ Strong FCF generation >105% conversion Full Year 2025 Financial GuidanceDisciplined Capital Allocation Strategy 4

Q4 2024 Earnings Presentation FOURTH QUARTER 2024 FINANCIAL REVIEW ($ in millions) Q4’24 Adjusted Q4’23 Adjusted Change Key Drivers of 2024 Performance Aerospace & Industrial $251 $238 5% ▪ Higher YOY sales across all Defense markets and strong growth in Commercial Aerospace (narrowbody and widebody OEM platforms); Partially offset by decline in General Industrial Defense Electronics $227 $240 (5%) ▪ Timing of embedded computing sales in Defense markets ▪ Growth and restructuring initiatives advancing ahead of schedule Naval & Power $346 $308 12% ▪ Stronger than anticipated growth in Naval Defense (higher demand and timing of submarine revenues) ▪ Solid growth in Power & Process market (strong growth in U.S. aftermarket revenues in Commercial Nuclear partially offset by lower industrial valves in Process) ▪ Timing in Aerospace Defense (lower international arresting systems equipment sales) Total Sales $824 $786 5% Strong sales growth driven by Naval Defense and Commercial Nuclear markets Aerospace & Industrial Margin $54 21.3% $44 18.5% 22% 280 bps ▪ Favorable absorption on higher sales growth; Benefit of restructuring and cost containment initiatives ▪ Profitability partially offset by higher investment in R&D Defense Electronics Margin $55 24.3% $69 28.8% (20%) (450 bps) ▪ Unfavorable absorption on lower defense revenues, unfavorable mix of products and higher investment in R&D Naval & Power Margin $66 19.1% $59 19.3% 11% (20 bps) ▪ Favorable absorption on strong revenue growth in defense and commercial nuclear markets ▪ Profitability offset by unfavorable mix and higher investment in R&D Corporate and Other ($12) ($9) (25%) ▪ Higher 401k and medical expenses Total Op. Income CW Margin $163 19.8% $163 20.8% Flat (100 bps) Maintaining consistent investment in R&D (up $6M YoY) to drive future organic growth 5Notes: Amounts may not add due to rounding.

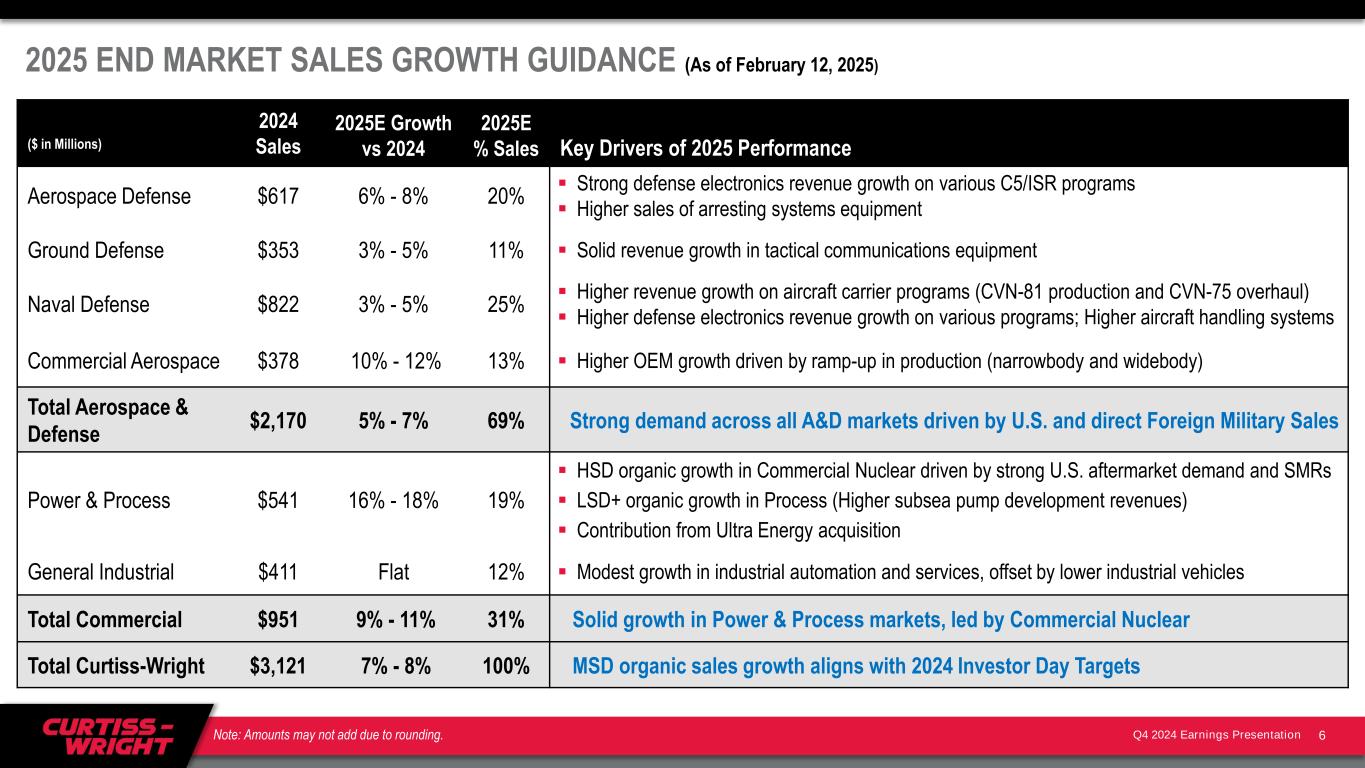

Q4 2024 Earnings Presentation 2025 END MARKET SALES GROWTH GUIDANCE (As of February 12, 2025) ($ in Millions) 2024 Sales 2025E Growth vs 2024 2025E % Sales Key Drivers of 2025 Performance Aerospace Defense $617 6% - 8% 20% ▪ Strong defense electronics revenue growth on various C5/ISR programs ▪ Higher sales of arresting systems equipment Ground Defense $353 3% - 5% 11% ▪ Solid revenue growth in tactical communications equipment Naval Defense $822 3% - 5% 25% ▪ Higher revenue growth on aircraft carrier programs (CVN-81 production and CVN-75 overhaul) ▪ Higher defense electronics revenue growth on various programs; Higher aircraft handling systems Commercial Aerospace $378 10% - 12% 13% ▪ Higher OEM growth driven by ramp-up in production (narrowbody and widebody) Total Aerospace & Defense $2,170 5% - 7% 69% Strong demand across all A&D markets driven by U.S. and direct Foreign Military Sales Power & Process $541 16% - 18% 19% ▪ HSD organic growth in Commercial Nuclear driven by strong U.S. aftermarket demand and SMRs ▪ LSD+ organic growth in Process (Higher subsea pump development revenues) ▪ Contribution from Ultra Energy acquisition General Industrial $411 Flat 12% ▪ Modest growth in industrial automation and services, offset by lower industrial vehicles Total Commercial $951 9% - 11% 31% Solid growth in Power & Process markets, led by Commercial Nuclear Total Curtiss-Wright $3,121 7% - 8% 100% MSD organic sales growth aligns with 2024 Investor Day Targets 6Note: Amounts may not add due to rounding.

Q4 2024 Earnings Presentation ($ in millions) 2025E Adjusted Change vs 2024 Adjusted Key Drivers of 2025 Performance Aerospace & Industrial $960 - $975 3% - 5% ▪ Strong growth in Commercial Aerospace and higher EM actuation sales in Defense markets ▪ Flat General Industrial sales Defense Electronics $975 - $990 7% - 9% ▪Defense market growth (U.S. DoD and FMS) driven by increased embedded computing and tactical communications revenues ▪ Increased sales of avionics and instrumentation in Commercial Aerospace Naval & Power $1,400 - $1,420 10% - 11% ▪ Strong growth in Power & Process reflects HSD organic growth in Commercial Nuclear and Ultra Energy acquisition ▪ Solid Naval Defense growth driven by aircraft carrier programs; Higher FMS (aircraft handling & arresting systems) Total Sales $3,335 - $3,385 7% - 8% Benefiting from continued growth in order book and strong backlog Aerospace & Industrial Margin $167 - $172 17.4% - 17.6% 5% - 8% 40 - 60 bps ▪ Favorable absorption on strong growth in A&D revenues and benefit of restructuring savings Defense Electronics Margin $244 - $250 25.0% - 25.2% 8% - 10% 10 - 30 bps ▪ Favorable absorption on strong growth in A&D revenues and benefit of restructuring savings ▪ Profitability partially offset by higher investments in R&D Naval & Power Margin $228 - $234 16.3% - 16.5% 13% - 16% 50 - 70 bps ▪ Favorable absorption on higher A&D and Power & Process revenues; PY naval contract adjustment ▪ Profitability partially offset by first-year dilution from acquisition and continued investment in development programs Corporate and Other ($40 - $42) (3%) - 2% Total Op. Income CW Margin $598 - $613 17.9% - 18.1% 10% - 12% 40 - 60 bps Accelerated Operating Margin expansion in 2025, including R&D investments and acquisition dilution 2025 FINANCIAL GUIDANCE (As of February 12, 2025) 7

Q4 2024 Earnings Presentation 2025 FINANCIAL GUIDANCE (As of February 12, 2025) ($ in millions, except EPS) 2024 Adjusted 2025E Adjusted Change vs 2024 Adjusted Key Drivers of 2025 Performance Total Sales $3,121 $3,335 - $3,385 7% - 8% Strategically focused on delivering profitable growth Total Operating Income $546 $598 - $613 10% - 12% Other Income $38 $33 - $34 ▪ Lower interest income offset by higher pension income Interest Expense ($45) ($42 - $43) ▪ Upcoming maturity: $90M 3.85% Sr. Notes due late Feb 2025 Tax Rate 22.4% 22.0% ▪ Continued tax optimization Diluted EPS $10.90 $12.10 - $12.40 11% - 14% Double-digit EPS growth in-line with Investor Day target Diluted Shares Outstanding 38.4 ~37.9 ▪ Benefit of $250M in total repurchases in 2024 ▪ Min. $60M share repurchase in 2025 Free Cash Flow $483 $485 - $505 0% - 4% Strong FCF generation, incl. Higher Growth CapEx and Timing of PY Advances FCF Conversion 116% >105% ▪ Continued solid FCF conversion in-line with Investor Day target Capital Expenditures $61 $75 - $85 ▪ Exceeding ~2% of Sales (LT target) to fuel growth investments in 2025 Depreciation & Amortization $108 $115 - $120 ▪ Primarily Ultra acquisition impact, excludes first year intangible amortization 8Note: Amounts may not add due to rounding.

Q4 2024 Earnings Presentation PIVOT TO GROWTH STRATEGY CONTINUES TO BUILD MOMENTUM 9 ▪ Well-positioned to deliver strong performance in 2025 – Sales growth of 7% - 8% (MSD organic) reflects increases in A&D and Power & Process markets • Building upon record 2024 order book and strong backlog – Accelerated Operating Margin expansion of 40 - 60 bps reflects focus on operational excellence – Expecting EPS growth of 11% - 14% while increasing R&D investments to drive future growth – Targeting FCF conversion >105%; Aligned with long-term view ▪ Advancing disciplined and strategic capital allocation with M&A as an accelerator – Balanced by consistent returns to shareholders through share repurchase and dividend growth ▪ Maintain strong confidence in achieving 2024 Investor Day targets – Focused strategy and alignment to secular growth trends provides clear path to capture future growth – On track to achieve >5% Organic Revenue CAGR, OI Growth > Revenue Growth, top quartile margin performance, double-digit EPS growth and >$1.3B in FCF generation – Building upon strong core, while continuing to offer significant upside optionality in Commercial Nuclear

Q4 2024 Earnings Presentation Appendix 10

Q4 2024 Earnings Presentation NON-GAAP FINANCIAL INFORMATION The Corporation supplements its financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial information. Curtiss-Wright believes that these Adjusted (non-GAAP) measures provide investors with improved transparency in order to better measure Curtiss-Wright’s ongoing operating and financial performance and better comparisons of our key financial metrics to our peers. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. Curtiss-Wright encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Reconciliations of “Reported” GAAP amounts to “Adjusted” non-GAAP amounts are furnished within the Company’s earnings press release. The following definitions are provided: Adjusted Operating Income, Operating Margin, Net Earnings and Diluted Earnings per Share (EPS) These Adjusted financials are defined as Reported Operating Income, Operating Margin, Net Earnings and Diluted Earnings per Share under GAAP excluding: (i) the impact of first year purchase accounting costs associated with acquisitions, specifically one-time inventory step-up, backlog amortization, and transaction costs; (ii) costs associated with the Company's 2024 Restructuring Program; and (iii) the sale or divestiture of a business or product line, as applicable. Organic Sales and Organic Operating Income The Corporation discloses organic sales and organic operating income because the Corporation believes it provides investors with insight as to the Company’s ongoing business performance. Organic sales and organic operating income are defined as sales and operating income, excluding contributions from acquisitions and results of operations from divested businesses or product lines during the last twelve months, costs associated with the Company's 2024 Restructuring Program, and foreign currency fluctuations. Free Cash Flow (FCF) and Free Cash Flow Conversion The Corporation discloses free cash flow because it measures cash flow available for investing and financing activities. Free cash flow represents cash available to repay outstanding debt, invest in the business, acquire businesses, return capital to shareholders and make other strategic investments. Free cash flow is defined as net cash provided by operating activities less capital expenditures. Adjusted free cash flow excludes payments associated with the Westinghouse legal settlement in the prior year period. The Corporation discloses adjusted free cash flow conversion because it measures the proportion of net earnings converted into free cash flow and is defined as adjusted free cash flow divided by adjusted net earnings. 11

Q4 2024 Earnings Presentation FOURTH QUARTER 2024: END MARKET SALES GROWTH ($ in millions) Q4’24 Q4’23 Change Key Drivers Aerospace Defense $171 $172 Flat ▪ Higher sales of actuation equipment on fighter jet programs ▪ Partially offset by timing of international sales of arresting systems equipment Ground Defense $85 $88 (3%) ▪ Timing of sales of embedded computing equipment on ground combat vehicles Naval Defense $217 $187 16% ▪ Higher demand and timing of revenues on Virginia-class and Columbia-class submarine programs ▪ Higher higher sales of aircraft handling systems Commercial Aerospace $98 $93 6% ▪ Strong OEM demand on narrowbody and widebody platforms Total Aerospace & Defense $571 $539 6% Power & Process $147 $137 7% ▪ Higher commercial nuclear aftermarket revenues ▪ Partially offset by lower industrial valve sales in the process market General Industrial $106 $110 (3%) ▪ Lower sales of industrial vehicle products to off-highway and specialty vehicle platforms Total Commercial $253 $247 3% Total Curtiss-Wright $824 $786 5% 12 Note: Amounts may not add down due to rounding.

Q4 2024 Earnings Presentation FULL YEAR 2024: END MARKET SALES GROWTH ($ in millions) FY’24 FY’23 Change Key Drivers Aerospace Defense $617 $552 12% ▪ Strong demand for embedded computing equipment principally on helicopter programs ▪ Higher sales of actuation and sensors equipment on fighter jet programs Ground Defense $353 $308 15% ▪ Higher tactical communications equipment revenues Naval Defense $822 $720 14% ▪ Higher demand and timing of submarines revenues (Columbia-class and Virginia-class production; SSN(X) development) and increased CVN-81 aircraft carrier revenues ▪ Higher sales of aircraft handling systems Commercial Aerospace $378 $325 16% ▪ Strong OEM demand on narrowbody and widebody platforms Total Aerospace & Defense $2,170 $1,905 14% Power & Process $541 $510 6% ▪ Solid growth principally driven by higher commercial nuclear aftermarket revenues General Industrial $411 $431 (5%) ▪ Lower sales of industrial vehicle products to off-highway and specialty vehicle platforms Total Commercial $951 $941 1% Total Curtiss-Wright $3,121 $2,845 10% 13 Note: Amounts may not add down due to rounding.

Q4 2024 Earnings Presentation 70% $2.17B 30% $0.95B Industrial Vehicles Tactical battlefield communications Principally Repair and Overhaul Aerospace & Defense Markets Commercial Markets 26% 12% 20% 11% ~90% ~10% Embedded computing, sensors, actuation, arresting systems 60% Narrowbody / 40% Widebody Linked to Boeing/Airbus production Aerospace OEM Total 2024 CW End Markets $3.121B General IndustrialNaval Commercial Aerospace Power & Process Pumps / Valves / Steam Turbines (Nuclear naval propulsion) Ground AM ~35% 17% 13% ~60% Severe-service valves and subsea pump applications ~65% Electromechanical actuation and Surface Treatment Services Aftermarket (Operating Reactors) & New Build (AP1000, SMRs) On/Off-Highway Commercial and Specialty Vehicles Commercial Nuclear Process Industrial Automation and Services ~40% 2024 END MARKET SALES WATERFALL FY’24: Overall UP 10% (9% Org.) A&D Markets UP 14% Comm’l Markets UP 1% Note: Amounts shown for % of Total Sales may not add due to rounding. ▪ Power & Process market sales concentrated in Naval & Power segment ▪ General Industrial sales concentrated in Aerospace & Industrial segment 14 Commercial Nuclear 90% Domestic & Int’l Aftermarket 10% New Build Gen III / Gen IV (Advanced SMRs)

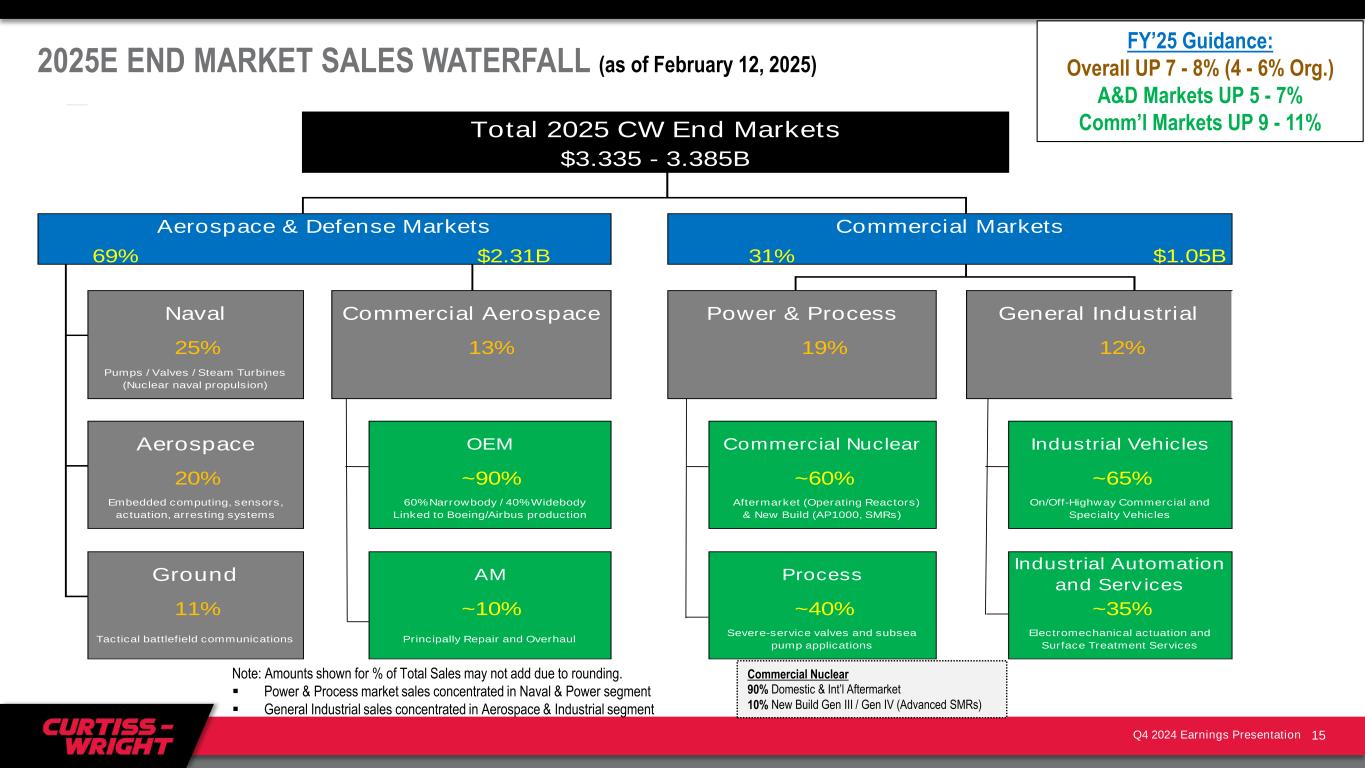

Q4 2024 Earnings Presentation 69% $2.31B 31% $1.05B Industrial Vehicles 19% 12% ~60% Severe-service valves and subsea pump applications ~65% Electromechanical actuation and Surface Treatment Services Aftermarket (Operating Reactors) & New Build (AP1000, SMRs) On/Off-Highway Commercial and Specialty Vehicles Commercial Nuclear Process Industrial Automation and Services ~40% Pumps / Valves / Steam Turbines (Nuclear naval propulsion) Ground AM ~35% Total 2025 CW End Markets $3.335 - 3.385B General IndustrialNaval Commercial Aerospace Power & Process Tactical battlefield communications Principally Repair and Overhaul Aerospace & Defense Markets Commercial Markets 25% 13% 20% 11% ~90% ~10% Embedded computing, sensors, actuation, arresting systems 60% Narrowbody / 40% Widebody Linked to Boeing/Airbus production Aerospace OEM 2025E END MARKET SALES WATERFALL (as of February 12, 2025) FY’25 Guidance: Overall UP 7 - 8% (4 - 6% Org.) A&D Markets UP 5 - 7% Comm’l Markets UP 9 - 11% Note: Amounts shown for % of Total Sales may not add due to rounding. ▪ Power & Process market sales concentrated in Naval & Power segment ▪ General Industrial sales concentrated in Aerospace & Industrial segment 15 Commercial Nuclear 90% Domestic & Int’l Aftermarket 10% New Build Gen III / Gen IV (Advanced SMRs)

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

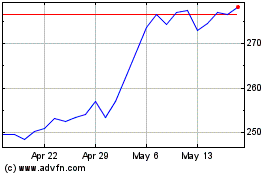

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Feb 2024 to Feb 2025