Delta Air Lines Takes Minority Stake in Private-Jet Operator Wheels Up

December 12 2019 - 6:29AM

Dow Jones News

By Doug Cameron

Delta Air Lines Inc. said it is buying a minority stake in

Wheels Up, a private-jet operator, that will extend the

Atlanta-based carrier's operations to more premium passengers.

Wheels Up and Delta's existing corporate aircraft unit will have

190 planes and a wider customer base, so planes will fly empty less

often, Delta Chief Executive Ed Bastian said in an interview. He

and Wheels Up wouldn't say how much Delta is investing in the New

York-based company.

He said that will help cut down on emissions in the private-jet

business--a focus for critics of the airline industry's efforts to

tackle climate change because of the larger per-passenger carbon

footprint. Mr. Bastian said he expects more pressure on the global

airline industry to limit and mitigate emissions.

"This is an existential threat to the growth of our industry,"

he said.

Airlines, notably in Europe, are facing mounting consumer

pressure to try to address these concerns by doing things such as

selling carbon offsets that passengers can purchase with their

tickets. Mr. Bastian said Delta hasn't done enough to publicize

similar efforts. Like Delta, other U.S. and overseas airlines are

focusing on reducing their carbon footprint through buying more

fuel-efficient aircraft, expanding use of biofuels and cutting

single-use plastics.

"We've got to get much more specific about the offsets, let the

passengers see what we are doing," he said.

The investment in Wheels Up continues a diversification strategy

at Delta that has included buying a jet-fuel refinery as well as

investing in overseas airlines and more-ancillary businesses such

as aircraft maintenance and credit cards.

The strategy has made it the most profitable of the three

network carriers. Its shares are up 10% this year, outperforming

American Airlines Group Inc. and United Airlines Holdings Inc.

Both those rivals have been hobbled by the grounding of their

Boeing Co. 737 MAX fleets after two fatal crashes. Delta didn't

operate any of the aircraft. Mr. Bastian said if global regulators

recertify the MAX to fly next year, its return could add enough

capacity across the industry to put downward pressure on ticket

prices.

Delta said ahead of an investor meeting with analysts on

Thursday that it expects capacity to grow by 4% and sales to grow

by 4% to 6% next year, with targeted earnings per share of $6.75 to

$7.75, in line with analysts expectations.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

December 12, 2019 07:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

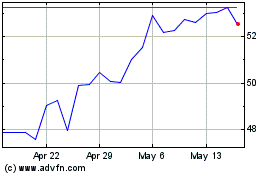

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

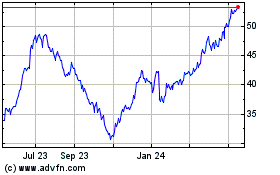

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jul 2023 to Jul 2024