Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 04 2020 - 4:11PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433(d)

Registration No. 333-230087

Pricing Supplement

March 4, 2020

Delta

Air Lines, Inc. (“Delta”)

(NYSE Symbol: DAL)

2020-1 Pass Through Trusts

Class AA and Class A Pass Through Certificates, Series 2020-1

Pricing Supplement dated March 4, 2020 to the preliminary prospectus supplement dated March 4, 2020 (the “Preliminary

Prospectus Supplement”) relating to the Class AA Certificates and the Class A Certificates referred to below of Delta.

The

information in this Pricing Supplement amends and supplements the Preliminary Prospectus Supplement to provide for the concurrent offerings of the Class AA Certificates and the Class A Certificates pursuant to, and on the terms and

conditions described in, the Preliminary Prospectus Supplement. The information in this Pricing Supplement supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary

Prospectus Supplement.

Terms used but not defined herein shall have the meanings set forth in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

|

Securities:

|

|

Class AA Pass Through

Certificates,

Series 2020-1AA (“Class

AA Certificates”)

|

|

Class A Pass Through

Certificates,

Series 2020-1A (“Class A

Certificates”)

|

|

Amount:

|

|

$795,894,000

|

|

$204,106,000

|

|

Public Offering Price:

|

|

100%

|

|

100%

|

|

CUSIP:

|

|

247361 ZV3

|

|

247361 ZW1

|

|

ISIN:

|

|

US247361ZV38

|

|

US247361ZW11

|

|

Coupon/Stated Interest Rate:

|

|

2.000%

|

|

2.500%

|

|

Regular Distribution Dates:

|

|

June 10 and December 10 of each year, commencing on June 10, 2020

|

|

Make-Whole Spread Over Treasuries:

|

|

0.200%

|

|

0.300%

|

|

Liquidity Provider Rating:

|

|

The Liquidity Provider currently meets the Liquidity Threshold Rating requirement.

|

|

Initial “Maximum Commitment” under the Liquidity Facilities:

|

|

$23,876,820

|

|

$7,653,975

|

|

Underwriters:

|

|

|

|

|

|

Morgan Stanley & Co. LLC

|

|

$129,333,000

|

|

$33,167,000

|

|

Credit Suisse Securities (USA) LLC

|

|

$129,333,000

|

|

$33,167,000

|

|

BofA Securities, Inc.

|

|

$129,333,000

|

|

$33,167,000

|

|

Goldman Sachs & Co. LLC

|

|

$129,333,000

|

|

$33,167,000

|

|

Banco Bilbao Vizcaya Argentaria, S.A.

|

|

$67,651,000

|

|

$17,349,000

|

|

|

|

|

|

|

|

Deutsche Bank Securities Inc.

|

|

$67,651,000

|

|

$17,349,000

|

|

PNC Capital Markets LLC

|

|

$67,651,000

|

|

$17,349,000

|

|

Standard Chartered Bank

|

|

$67,651,000

|

|

$17,349,000

|

|

AmeriVet Securities, Inc.

|

|

$3,979,000

|

|

$1,021,000

|

|

Natixis Securities Americas LLC

|

|

$3,979,000

|

|

$1,021,000

|

|

Aggregate Underwriting Commission:

|

|

$10,000,000

|

|

Concession to Selling Group Members:

|

|

0.50%

|

|

0.50%

|

|

Discount to Brokers/Dealers:

|

|

0.25%

|

|

0.25%

|

|

Settlement:

|

|

March 12, 2020 (T+6) closing date, the 6th business day following the date hereof.

|

Delta has filed a registration statement (No. 333-230087) (including a prospectus)

and a related prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents Delta has filed

with the SEC for more complete information about Delta and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating in the offering will

arrange to send you the prospectus and prospectus supplement if you request them by calling Morgan Stanley & Co. LLC toll-free at

1-800-718-1649 or Credit Suisse Securities (USA) LLC toll-free at

1-800-221-1037.

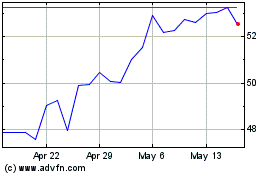

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

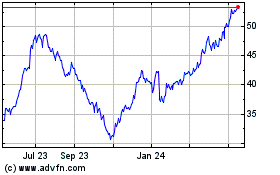

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jul 2023 to Jul 2024