BNY Mellon High Yield Strategies Fund

| |

SEMI-ANNUAL REPORT September 30, 2024 |

| |

|

| |

BNY Mellon High Yield Strategies Fund Protecting

Your Privacy

Our Pledge to You THE FUND IS COMMITTED TO YOUR PRIVACY.

On this page, you will find the fund’s policies and practices for collecting, disclosing, and safeguarding

“nonpublic personal information,” which may include financial or other customer information. These

policies apply to individuals who purchase fund shares for personal, family, or household purposes, or

have done so in the past. This notification replaces all previous statements of the fund’s consumer

privacy policy, and may be amended at any time. We’ll keep you informed of changes as required by law. YOUR ACCOUNT IS PROVIDED IN A SECURE ENVIRONMENT. The fund maintains

physical, electronic and procedural safeguards that comply with federal regulations to guard nonpublic

personal information. The fund’s agents and service providers have limited access to customer information

based on their role in servicing your account. THE FUND COLLECTS INFORMATION

IN ORDER TO SERVICE AND ADMINISTER YOUR ACCOUNT. The fund collects a variety of nonpublic

personal information, which may include: • Information

we receive from you, such as your name, address, and social security number. • Information about your transactions with us, such as the purchase

or sale of fund shares. • Information

we receive from agents and service providers, such as proxy voting information. THE

FUND DOES NOT SHARE NONPUBLIC PERSONAL INFORMATION WITH ANYONE, EXCEPT AS PERMITTED BY LAW. Thank you for this opportunity

to serve you. |

| |

The views expressed

in this report reflect those of the portfolio manager(s) only through the end of the period covered and

do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in

the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time

based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility

to update such views. These views may not be relied on as investment advice and, because investment decisions

for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an

indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F

O R M O R E I N F O R M AT I O N

Back Cover

| |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s

available. Log into www.bny.com/investments and sign up for eCommunications. It’s simple and only takes

a few minutes. |

DISCUSSION

OF FUND PERFORMANCE (Unaudited)

How did the Fund perform last six Months?

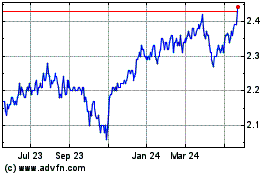

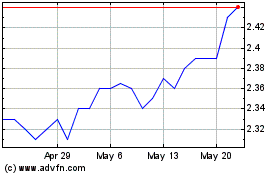

For the six month period ended September

30, 2024, BNY Mellon High Yield Strategies Fund (the “fund”) produced a total return of 7.83% on

a net-asset-value basis and a return of 15.99% on a market price basis. In comparison, the ICE BofA U.S.

High Yield Constrained Index (the “Index”), the fund’s benchmark, posted a total return of 6.42%.1

Over the same period, the fund provided aggregate income dividends of $0.105 per share, which reflects

an annualized distribution rate of 7.81%.2

1 Source: FactSet — The ICE BofA U.S. High Yield Constrained

Index contains all securities in the ICE B of A U.S. High Yield Index but caps issuer exposure at 2%.

Index constituents are capitalization weighted, based on their current amount outstanding, provided the

total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced

to 2%, and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face

values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. In

the event there are fewer than 50 issuers in the Index, each is equally weighted, and the face values

of their respective bonds are increased or decreased on a pro-rata basis. Investors cannot invest directly

in any index.

2 Total

return includes reinvestment of dividends and any capital gains paid, based upon net asset value per

share. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate

such that upon redemption, fund shares may be worth more or less than their original cost.

2

STATEMENT

OF INVESTMENTS

September 30, 2024 (Unaudited)

| | | | | | | | | | |

| |

Description | Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% | | | |

Advertising

- .7% | | | | | |

Clear Channel Outdoor Holdings, Inc., Sr. Scd. Notes | | 5.13 | | 8/15/2027 | | 967,000 | b,c | 951,361 | |

Clear Channel Outdoor Holdings, Inc., Sr. Scd. Notes | | 9.00 | | 9/15/2028 | | 495,000 | b,c | 526,630 | |

| | 1,477,991 | |

Aerospace & Defense - 2.8% | | | | | |

AAR

Escrow Issuer LLC, Gtd. Notes | | 6.75 | | 3/15/2029 | | 994,000 | b,c | 1,034,641 | |

Bombardier, Inc., Sr. Unscd. Notes | | 7.25 | | 7/1/2031 | | 283,000 | c | 299,537 | |

Bombardier, Inc., Sr. Unscd. Notes | | 7.50 | | 2/1/2029 | | 815,000 | b,c | 863,053 | |

TransDigm, Inc., Gtd. Notes | | 4.88 | | 5/1/2029 | | 842,000 | b | 820,587 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.38 | | 3/1/2029 | | 650,000 | c | 671,430 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.63 | | 3/1/2032 | | 264,000 | c | 275,244 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.75 | | 8/15/2028 | | 478,000 | b,c | 492,597 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.88 | | 12/15/2030 | | 870,000 | b,c | 911,861 | |

TransDigm, Inc., Sr. Scd. Notes | | 7.13 | | 12/1/2031 | | 220,000 | c | 232,961 | |

| | 5,601,911 | |

Airlines

- 1.6% | | | | | |

American Airlines, Inc./Aadvantage Loyalty IP Ltd., Sr. Scd.

Notes | | 5.75 | | 4/20/2029 | | 1,972,121 | b,c | 1,970,477 | |

JetBlue Airways Corp./JetBlue Loyalty LP, Sr. Scd. Notes | | 9.88 | | 9/20/2031 | | 1,284,000 | b,c | 1,353,708 | |

| | 3,324,185 | |

Automobiles & Components - 1.4% | | | | | |

IHO

Verwaltungs GmbH, Sr. Scd. Bonds | | 6.00 | | 5/15/2027 | | 1,450,000 | b,c,d | 1,426,012 | |

Phinia, Inc., Sr. Scd. Notes | | 6.75 | | 4/15/2029 | | 361,000 | b,c | 373,006 | |

Real Hero Merger Sub 2, Inc., Sr. Unscd. Notes | | 6.25 | | 2/1/2029 | | 1,200,000 | b,c | 1,044,844 | |

| | 2,843,862 | |

Banks - 1.1% | | | | | |

Citigroup,

Inc., Jr. Sub. Notes, Ser. X | | 3.88 | | 2/18/2026 | | 840,000 | e | 810,580 | |

3

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Banks

- 1.1% (continued) | | | | | |

Freedom Mortgage Corp., Sr.

Unscd. Notes | | 6.63 | | 1/15/2027 | | 1,468,000 | b,c | 1,472,565 | |

| | 2,283,145 | |

Beverage Products - .4% | | | | | |

Triton

Water Holdings, Inc., Sr. Unscd. Notes | | 6.25 | | 4/1/2029 | | 830,000 | b,c | 829,913 | |

Building Materials - 3.4% | | | | | |

Builders

FirstSource, Inc., Gtd. Notes | | 4.25 | | 2/1/2032 | | 931,000 | b,c | 861,339 | |

Camelot Return Merger Sub, Inc., Sr. Scd. Notes | | 8.75 | | 8/1/2028 | | 1,311,000 | b,c | 1,327,995 | |

Cornerstone Building Brands, Inc., Sr. Scd. Notes | | 9.50 | | 8/15/2029 | | 348,000 | c | 357,769 | |

Eco Material Technologies, Inc., Sr. Scd. Notes | | 7.88 | | 1/31/2027 | | 744,000 | b,c | 752,304 | |

Emrld Borrower LP/Emerald Co-Issuer, Inc., Sr. Scd. Notes | | 6.63 | | 12/15/2030 | | 2,018,000 | b,c | 2,083,272 | |

Miter Brands Acquisition Holdco, Inc./MIWD Borrower LLC, Sr.

Scd. Notes | | 6.75 | | 4/1/2032 | | 812,000 | b,c | 842,248 | |

Standard Building Solutions, Inc., Sr. Unscd. Notes | | 6.50 | | 8/15/2032 | | 222,000 | c | 230,058 | |

Standard Industries, Inc., Sr. Unscd. Notes | | 4.75 | | 1/15/2028 | | 497,000 | b,c | 487,237 | |

| | 6,942,222 | |

Chemicals

- 4.4% | | | | | |

Iris Holdings, Inc., Sr. Unscd. Notes | | 8.75 | | 2/15/2026 | | 1,396,000 | b,c,d | 1,308,355 | |

Italmatch Chemicals SpA, Sr. Scd. Notes | EUR | 10.00 | | 2/6/2028 | | 470,000 | c | 557,883 | |

Mativ Holdings, Inc., Gtd. Notes | | 6.88 | | 10/1/2026 | | 983,000 | b,c | 983,172 | |

Mativ Holdings, Inc., Sr. Unscd. Notes | | 8.00 | | 10/1/2029 | | 956,000 | c | 976,960 | |

NOVA Chemicals Corp., Sr. Unscd. Notes | | 9.00 | | 2/15/2030 | | 620,000 | c | 672,309 | |

Olympus Water US Holding Corp., Sr. Scd. Notes | | 7.25 | | 6/15/2031 | | 400,000 | c | 416,616 | |

Olympus Water US Holding Corp., Sr. Scd. Notes | | 9.75 | | 11/15/2028 | | 880,000 | b,c | 940,288 | |

Olympus Water US Holding Corp., Sr. Unscd. Notes | | 6.25 | | 10/1/2029 | | 440,000 | c | 426,283 | |

4

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Chemicals

- 4.4% (continued) | | | | | |

Rain Carbon, Inc., Sr.

Scd. Notes | | 12.25 | | 9/1/2029 | | 550,000 | c | 594,741 | |

SCIH Salt Holdings, Inc., Sr. Unscd. Notes | | 6.63 | | 5/1/2029 | | 1,030,000 | b,c | 991,390 | |

WR Grace Holdings LLC, Sr. Unscd. Notes | | 5.63 | | 8/15/2029 | | 1,207,000 | b,c | 1,135,049 | |

| | 9,003,046 | |

Collateralized

Loan Obligations Debt - 1.9% | | | | | |

Crown Point 8 Ltd.

CLO, Ser. 2019-8A, Cl. ER, (3 Month TSFR +7.39%) | | 12.67 | | 10/20/2034 | | 2,375,000 | c,f | 2,382,462 | |

Northwoods Capital 27 Ltd. CLO, Ser. 2021-27A, Cl. E, (3

Month TSFR +7.30%) | | 12.59 | | 10/17/2034 | | 1,150,000 | c,f | 1,080,308 | |

Rockford Tower Ltd. CLO, Ser. 2022-2A, Cl. ER, (3 Month

TSFR +8.12%) | | 13.40 | | 10/20/2035 | | 500,000 | c,f | 502,783 | |

| | 3,965,553 | |

Commercial & Professional Services - 6.3% | | | | | |

Adtalem

Global Education, Inc., Sr. Scd. Notes | | 5.50 | | 3/1/2028 | | 904,000 | b,c | 896,243 | |

Albion Financing 1 Sarl/Aggreko Holdings, Inc., Sr. Scd.

Notes | | 6.13 | | 10/15/2026 | | 330,000 | c | 331,355 | |

Albion Financing 2 Sarl, Sr. Unscd. Notes | | 8.75 | | 4/15/2027 | | 318,000 | b,c | 326,622 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp., Sr.

Unscd. Notes | | 6.00 | | 6/1/2029 | | 710,000 | b,c | 635,187 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas

Luxco 4 Sarl, Sr. Scd. Bonds, Ser. 144 | GBP | 4.88 | | 6/1/2028 | | 520,000 | c | 643,533 | |

BCP V Modular Services Finance PLC, Gtd. Notes | EUR | 6.75 | | 11/30/2029 | | 730,000 | c | 719,151 | |

Herc Holdings, Inc., Gtd. Notes | | 6.63 | | 6/15/2029 | | 606,000 | c | 628,183 | |

House of HR Group BV, Sr. Scd. Bonds | EUR | 9.00 | | 11/3/2029 | | 1,240,000 | c | 1,386,500 | |

Prime Security Services Borrower LLC/Prime Finance, Inc., Scd.

Notes | | 6.25 | | 1/15/2028 | | 1,429,000 | b,c | 1,430,463 | |

5

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Commercial

& Professional Services - 6.3% (continued) | | | | | |

Shift4

Payments LLC/Shift4 Payments Finance Sub, Inc., Gtd. Notes | | 6.75 | | 8/15/2032 | | 1,072,000 | b,c | 1,120,038 | |

United Rentals North America, Inc., Gtd. Notes | | 3.75 | | 1/15/2032 | | 998,000 | | 912,011 | |

Verisure Midholding

AB, Gtd. Notes | EUR | 5.25 | | 2/15/2029 | | 2,200,000 | c | 2,435,094 | |

Wand NewCo 3, Inc., Sr. Scd. Notes | | 7.63 | | 1/30/2032 | | 1,225,000 | b,c | 1,291,380 | |

| | 12,755,760 | |

Consumer

Discretionary - 7.4% | | | | | |

Allwyn Entertainment Financing UK PLC, Sr. Scd. Notes | | 7.88 | | 4/30/2029 | | 1,318,000 | b,c | 1,389,797 | |

Ashton Woods USA LLC/Ashton Woods Finance Co., Sr. Unscd.

Notes | | 4.63 | | 4/1/2030 | | 640,000 | b,c | 613,706 | |

Caesars Entertainment, Inc., Sr. Scd. Notes | | 7.00 | | 2/15/2030 | | 790,000 | b,c | 825,851 | |

Carnival Corp., Gtd. Notes | | 6.00 | | 5/1/2029 | | 1,920,000 | b,c | 1,946,543 | |

Churchill Downs, Inc., Gtd. Notes | | 4.75 | | 1/15/2028 | | 440,000 | b,c | 431,732 | |

Dealer Tire LLC/DT Issuer LLC, Sr. Unscd. Notes | | 8.00 | | 2/1/2028 | | 1,389,000 | b,c | 1,383,949 | |

Flutter Treasury Designated Activity Co., Sr. Scd. Notes | | 6.38 | | 4/29/2029 | | 250,000 | b,c | 259,051 | |

Hilton Domestic Operating Co., Inc., Gtd. Notes | | 4.00 | | 5/1/2031 | | 650,000 | b,c | 608,227 | |

International Game Technology PLC, Sr. Scd. Notes | | 5.25 | | 1/15/2029 | | 1,105,000 | b,c | 1,101,550 | |

Liberty TripAdvisor Holdings, Inc., Sr. Unscd. Debs. | | 0.50 | | 6/30/2051 | | 410,000 | c | 384,477 | |

Midwest Gaming Borrower LLC/Midwest Gaming Finance Corp., Sr.

Scd. Notes | | 4.88 | | 5/1/2029 | | 1,140,000 | b,c | 1,094,270 | |

Miller Homes Group Finco PLC, Sr. Scd. Bonds | GBP | 7.00 | | 5/15/2029 | | 610,000 | c | 795,873 | |

NCL Corp. Ltd., Gtd. Notes | | 5.88 | | 3/15/2026 | | 690,000 | b,c | 690,474 | |

NCL Corp. Ltd., Sr. Scd. Notes | | 5.88 | | 2/15/2027 | | 556,000 | b,c | 558,342 | |

Royal Caribbean Cruises Ltd., Sr. Unscd. Notes | | 4.25 | | 7/1/2026 | | 262,000 | c | 259,228 | |

6

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Consumer

Discretionary - 7.4% (continued) | | | | | |

Station

Casinos LLC, Gtd. Notes | | 4.63 | | 12/1/2031 | | 1,038,000 | c | 963,510 | |

Taylor Morrison Communities, Inc., Sr. Unscd. Notes | | 5.13 | | 8/1/2030 | | 538,000 | c | 534,957 | |

Verde Purchaser LLC, Sr. Scd. Notes | | 10.50 | | 11/30/2030 | | 617,000 | c | 670,363 | |

Windsor Holdings III LLC, Sr. Scd. Notes | | 8.50 | | 6/15/2030 | | 496,000 | b,c | 531,180 | |

| | 15,043,080 | |

Diversified

Financials - 6.4% | | | | | |

AG Issuer LLC, Sr. Scd. Notes | | 6.25 | | 3/1/2028 | | 978,000 | b,c | 956,981 | |

Encore Capital Group, Inc., Sr. Scd. Notes | GBP | 4.25 | | 6/1/2028 | | 1,570,000 | c | 1,931,674 | |

Freedom Mortgage Holdings LLC, Sr. Unscd. Notes | | 9.25 | | 2/1/2029 | | 312,000 | b,c | 324,566 | |

Garfunkelux Holdco 3 SA, Sr. Scd. Bonds | GBP | 7.75 | | 11/1/2025 | | 680,000 | c | 607,864 | |

Icahn Enterprises LP/Icahn Enterprises Finance Corp., Gtd.

Notes | | 5.25 | | 5/15/2027 | | 764,000 | | 732,719 | |

Icahn Enterprises LP/Icahn

Enterprises Finance Corp., Gtd. Notes | | 6.25 | | 5/15/2026 | | 465,000 | | 461,768 | |

Jane Street Group/JSG Finance, Inc., Sr. Scd. Notes | | 7.13 | | 4/30/2031 | | 1,345,000 | b,c | 1,426,225 | |

Nationstar Mortgage Holdings, Inc., Gtd. Notes | | 5.75 | | 11/15/2031 | | 840,000 | c | 823,776 | |

OneMain Finance Corp., Gtd. Notes | | 7.50 | | 5/15/2031 | | 256,000 | | 263,745 | |

OneMain Finance Corp., Gtd. Notes | | 7.88 | | 3/15/2030 | | 790,000 | b | 826,571 | |

Osaic Holdings, Inc., Sr. Unscd. Notes | | 10.75 | | 8/1/2027 | | 396,000 | c | 403,518 | |

PennyMac Financial Services, Inc., Gtd. Notes | | 7.13 | | 11/15/2030 | | 646,000 | c | 669,387 | |

PennyMac Financial Services, Inc., Gtd. Notes | | 7.88 | | 12/15/2029 | | 917,000 | b,c | 978,625 | |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., Gtd.

Notes | | 4.00 | | 10/15/2033 | | 451,000 | b,c | 403,253 | |

United Wholesale Mortgage LLC, Sr. Unscd. Notes | | 5.50 | | 4/15/2029 | | 958,000 | b,c | 933,941 | |

7

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Diversified

Financials - 6.4% (continued) | | | | | |

VFH

Parent LLC/Valor Co-Issuer, Inc., Sr. Scd. Bonds | | 7.50 | | 6/15/2031 | | 1,155,000 | b,c | 1,212,305 | |

| | 12,956,918 | |

Electronic

Components - .9% | | | | | |

Sensata Technologies BV, Gtd. Notes | | 5.88 | | 9/1/2030 | | 980,000 | b,c | 984,752 | |

WESCO Distribution, Inc., Gtd. Notes | | 6.63 | | 3/15/2032 | | 747,000 | b,c | 779,010 | |

| | 1,763,762 | |

Energy

- 16.3% | | | | | |

Aethon United BR LP/Aethon United Finance Corp., Sr. Unscd.

Notes | | 7.50 | | 10/1/2029 | | 2,008,000 | c | 2,036,031 | |

Aethon United BR LP/Aethon United Finance Corp., Sr. Unscd.

Notes | | 8.25 | | 2/15/2026 | | 1,505,000 | b,c | 1,523,724 | |

Antero Resources Corp., Gtd. Notes | | 5.38 | | 3/1/2030 | | 835,000 | b,c | 825,544 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp., Sr. Unscd.

Notes | | 7.00 | | 7/15/2029 | | 1,041,000 | b,c | 1,083,077 | |

CITGO Petroleum Corp., Sr. Scd. Notes | | 8.38 | | 1/15/2029 | | 780,000 | c | 812,254 | |

Comstock Resources, Inc., Gtd. Notes | | 6.75 | | 3/1/2029 | | 1,671,000 | b,c | 1,632,753 | |

CQP Holdco LP/Bip-V Chinook Holdco LLC, Sr. Scd. Notes | | 5.50 | | 6/15/2031 | | 1,450,000 | b,c | 1,423,104 | |

Encino Acquisition Partners Holdings LLC, Gtd. Notes | | 8.50 | | 5/1/2028 | | 870,000 | b,c | 886,231 | |

Encino Acquisition Partners Holdings LLC, Sr. Unscd. Notes | | 8.75 | | 5/1/2031 | | 789,000 | b,c | 830,450 | |

Energy Transfer LP, Jr. Sub. Bonds, Ser. B | | 6.63 | | 2/15/2028 | | 1,730,000 | b,e | 1,711,691 | |

EQM Midstream Partners LP, Sr. Unscd. Notes | | 5.50 | | 7/15/2028 | | 461,000 | b | 467,544 | |

Gulfport Energy Operating Corp., Gtd. Notes | | 6.75 | | 9/1/2029 | | 1,466,000 | b,c | 1,484,979 | |

Kraken Oil & Gas Partners LLC, Sr. Unscd. Notes | | 7.63 | | 8/15/2029 | | 866,000 | b,c | 865,620 | |

8

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Energy

- 16.3% (continued) | | | | | |

Matador Resources Co., Gtd.

Notes | | 6.50 | | 4/15/2032 | | 1,112,000 | b,c | 1,111,173 | |

Moss Creek Resources Holdings, Inc., Sr. Unscd. Notes | | 8.25 | | 9/1/2031 | | 410,000 | c | 405,120 | |

Noble Finance II LLC, Gtd. Notes | | 8.00 | | 4/15/2030 | | 1,017,000 | b,c | 1,050,107 | |

Northern Oil & Gas, Inc., Sr. Unscd. Notes | | 8.13 | | 3/1/2028 | | 604,000 | b,c | 608,883 | |

Northriver Midstream Finance LP, Sr. Scd. Notes | | 6.75 | | 7/15/2032 | | 1,073,000 | b,c | 1,108,336 | |

Rockies Express Pipeline LLC, Sr. Unscd. Notes | | 4.80 | | 5/15/2030 | | 1,396,000 | b,c | 1,316,453 | |

Sitio Royalties Operating Partnership LP/Sitio Finance Corp., Sr.

Unscd. Notes | | 7.88 | | 11/1/2028 | | 1,317,000 | b,c | 1,378,812 | |

SM Energy Co., Sr. Unscd. Notes | | 6.75 | | 8/1/2029 | | 520,000 | c | 522,560 | |

SM Energy Co., Sr. Unscd. Notes | | 7.00 | | 8/1/2032 | | 260,000 | c | 261,183 | |

Solaris Midstream Holdings LLC, Gtd. Notes | | 7.63 | | 4/1/2026 | | 592,000 | c | 596,950 | |

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp., Gtd.

Notes | | 5.50 | | 1/15/2028 | | 351,000 | c | 340,091 | |

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp., Gtd.

Notes | | 6.00 | | 12/31/2030 | | 440,000 | c | 418,283 | |

TGNR Intermediate Holdings LLC, Sr. Unscd. Notes | | 5.50 | | 10/15/2029 | | 2,105,000 | b,c | 2,001,462 | |

Venture Global Calcasieu Pass LLC, Sr. Scd. Notes | | 3.88 | | 11/1/2033 | | 1,301,000 | b,c | 1,167,848 | |

Venture Global LNG, Inc., Jr. Sub. Notes | | 9.00 | | 9/30/2029 | | 1,391,000 | c,e | 1,411,022 | |

Venture Global LNG, Inc., Sr. Scd. Notes | | 7.00 | | 1/15/2030 | | 747,000 | c | 763,704 | |

Venture Global LNG, Inc., Sr. Scd. Notes | | 8.13 | | 6/1/2028 | | 1,937,000 | b,c | 2,020,658 | |

Venture Global LNG, Inc., Sr. Scd. Notes | | 8.38 | | 6/1/2031 | | 1,025,000 | b,c | 1,083,021 | |

| | 33,148,668 | |

Environmental

Control - 1.2% | | | | | |

Madison IAQ LLC, Sr. Scd. Notes | | 4.13 | | 6/30/2028 | | 224,000 | c | 216,346 | |

9

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Environmental

Control - 1.2% (continued) | | | | | |

Madison

IAQ LLC, Sr. Unscd. Notes | | 5.88 | | 6/30/2029 | | 1,278,000 | b,c | 1,245,421 | |

Reworld Holding Corp., Gtd. Notes | | 5.00 | | 9/1/2030 | | 1,022,000 | | 960,792 | |

| | 2,422,559 | |

Food

Products - 4.4% | | | | | |

Bellis Acquisition Co. PLC, Sr. Scd. Bonds | GBP | 8.13 | | 5/14/2030 | | 630,000 | c | 834,790 | |

Boparan Finance PLC, Sr. Scd. Bonds | GBP | 7.63 | | 11/30/2025 | | 650,000 | c | 856,933 | |

Chobani LLC/Chobani Finance Corp., Inc., Sr. Scd. Notes | | 4.63 | | 11/15/2028 | | 580,000 | c | 565,414 | |

Fiesta Purchaser, Inc., Sr. Scd. Notes | | 7.88 | | 3/1/2031 | | 656,000 | b,c | 696,594 | |

Fiesta Purchaser, Inc., Sr. Unscd. Notes | | 9.63 | | 9/15/2032 | | 675,000 | c | 700,405 | |

Pilgrim's Pride Corp., Gtd. Notes | | 3.50 | | 3/1/2032 | | 1,064,000 | b | 945,591 | |

Post Holdings, Inc., Gtd. Notes | | 4.63 | | 4/15/2030 | | 1,350,000 | c | 1,292,928 | |

Post Holdings, Inc., Gtd. Notes | | 5.50 | | 12/15/2029 | | 760,000 | c | 755,117 | |

Simmons Foods, Inc./Simmons Prepared Foods, Inc./Simmons Pet

Food, Inc./Simmons Feed, Scd. Notes | | 4.63 | | 3/1/2029 | | 1,186,000 | c | 1,126,385 | |

US Foods, Inc., Gtd. Notes | | 6.88 | | 9/15/2028 | | 1,044,000 | b,c | 1,089,442 | |

| | 8,863,599 | |

Health

Care - 9.8% | | | | | |

Bausch Health Cos., Inc., Gtd. Notes | | 5.25 | | 2/15/2031 | | 397,000 | c | 218,034 | |

Bausch Health Cos., Inc., Sr. Scd. Notes | | 11.00 | | 9/30/2028 | | 1,277,000 | b,c | 1,193,995 | |

Charles River Laboratories International, Inc., Gtd. Notes | | 4.25 | | 5/1/2028 | | 402,000 | b,c | 391,311 | |

CHEPLAPHARM Arzneimittel GmbH, Sr. Scd. Notes | | 5.50 | | 1/15/2028 | | 560,000 | b,c | 543,646 | |

CHS/Community Health Systems, Inc., Scd. Notes | | 6.88 | | 4/15/2029 | | 1,046,000 | b,c | 949,469 | |

CHS/Community Health Systems, Inc., Sr. Scd. Notes | | 5.25 | | 5/15/2030 | | 829,000 | b,c | 763,613 | |

10

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Health

Care - 9.8% (continued) | | | | | |

CHS/Community

Health Systems, Inc., Sr. Scd. Notes | | 5.63 | | 3/15/2027 | | 934,000 | b,c | 919,816 | |

CHS/Community Health Systems, Inc., Sr. Scd. Notes | | 10.88 | | 1/15/2032 | | 952,000 | b,c | 1,050,280 | |

Cidron Aida Finco Sarl, Sr. Scd. Bonds | GBP | 6.25 | | 4/1/2028 | | 870,000 | c | 1,110,436 | |

Global Medical Response, Inc., Sr. Scd. Notes | | 10.00 | | 10/31/2028 | | 2,144,000 | b,c,d | 2,156,382 | |

HealthEquity, Inc., Gtd. Notes | | 4.50 | | 10/1/2029 | | 667,000 | b,c | 645,448 | |

Jazz Securities DAC, Sr. Scd. Notes | | 4.38 | | 1/15/2029 | | 550,000 | b,c | 532,356 | |

LifePoint Health, Inc., Sr. Scd. Notes | | 9.88 | | 8/15/2030 | | 1,035,000 | b,c | 1,140,833 | |

LifePoint Health, Inc., Sr. Unscd. Notes | | 10.00 | | 6/1/2032 | | 880,000 | b,c | 968,543 | |

Medline Borrower LP, Sr. Scd. Notes | | 3.88 | | 4/1/2029 | | 780,000 | b,c | 739,139 | |

Medline Borrower LP, Sr. Unscd. Notes | | 5.25 | | 10/1/2029 | | 414,000 | c | 406,516 | |

Option Care Health, Inc., Gtd. Notes | | 4.38 | | 10/31/2029 | | 1,503,000 | b,c | 1,429,260 | |

Organon & Co./Organon Foreign Debt Co-Issuer BV, Sr.

Scd. Notes | | 6.75 | | 5/15/2034 | | 1,194,000 | c | 1,234,620 | |

Radiology Partners, Inc., Sr. Scd. Notes | | 7.78 | | 1/31/2029 | | 444,834 | c,d | 442,054 | |

Ray Financing LLC, Sr. Scd. Bonds | EUR | 6.50 | | 7/15/2031 | | 710,000 | c | 813,157 | |

Sotera Health Holdings LLC, Sr. Scd. Notes | | 7.38 | | 6/1/2031 | | 664,000 | b,c | 690,400 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 4.25 | | 6/1/2029 | | 692,000 | b | 667,758 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 6.75 | | 5/15/2031 | | 890,000 | b | 928,436 | |

| | 19,935,502 | |

Industrial

- 3.9% | | | | | |

Arcosa, Inc., Gtd. Notes | | 6.88 | | 8/15/2032 | | 1,064,000 | b,c | 1,114,438 | |

Artera Services LLC, Sr. Scd. Notes | | 8.50 | | 2/15/2031 | | 637,029 | b,c | 631,234 | |

Assemblin Caverion Group AB, Sr. Scd. Bonds | EUR | 6.25 | | 7/1/2030 | | 360,000 | c | 411,796 | |

11

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Industrial

- 3.9% (continued) | | | | | |

Chart Industries, Inc., Sr.

Scd. Notes | | 7.50 | | 1/1/2030 | | 1,152,000 | b,c | 1,215,563 | |

Dycom Industries, Inc., Gtd. Notes | | 4.50 | | 4/15/2029 | | 554,000 | b,c | 535,305 | |

Dynamo Newco II GmbH, Sr. Scd. Bonds | EUR | 6.25 | | 10/15/2031 | | 431,000 | c | 483,366 | |

GrafTech Finance, Inc., Sr. Scd. Notes | | 4.63 | | 12/15/2028 | | 1,846,000 | b,c | 1,234,818 | |

Husky Injection Molding Systems Ltd./Titan Co-Borrower LLC, Sr.

Scd. Notes | | 9.00 | | 2/15/2029 | | 602,000 | b,c | 628,946 | |

Mangrove Luxco III Sarl, Sr. Scd. Bonds, (3 Month EURIBOR

+5.00%) | EUR | 8.67 | | 7/15/2029 | | 490,000 | c,f | 547,538 | |

Terex Corp., Gtd. Notes | | 6.25 | | 10/15/2032 | | 218,000 | | 218,000 | |

TK Elevator US Newco, Inc., Sr. Scd. Notes | | 5.25 | | 7/15/2027 | | 1,000,000 | b,c | 989,997 | |

| | 8,011,001 | |

Information

Technology - 4.0% | | | | | |

AthenaHealth Group, Inc., Sr. Unscd. Notes | | 6.50 | | 2/15/2030 | | 3,069,000 | b,c | 2,950,477 | |

Cloud Software Group, Inc., Scd. Bonds | | 9.00 | | 9/30/2029 | | 623,000 | b,c | 634,507 | |

Cloud Software Group, Inc., Sr. Scd. Notes | | 6.50 | | 3/31/2029 | | 748,000 | b,c | 744,867 | |

Cloud Software Group, Inc., Sr. Scd. Notes | | 8.25 | | 6/30/2032 | | 320,000 | c | 334,753 | |

Elastic NV, Sr. Unscd. Notes | | 4.13 | | 7/15/2029 | | 1,438,000 | b,c | 1,344,928 | |

SS&C Technologies, Inc., Gtd. Notes | | 5.50 | | 9/30/2027 | | 530,000 | b,c | 530,179 | |

SS&C Technologies, Inc., Gtd. Notes | | 6.50 | | 6/1/2032 | | 480,000 | c | 496,630 | |

UKG, Inc., Sr. Scd. Notes | | 6.88 | | 2/1/2031 | | 1,127,000 | b,c | 1,165,347 | |

| | 8,201,688 | |

Insurance

- 5.8% | | | | | |

Acrisure LLC/Acrisure Finance, Inc., Sr. Scd. Notes | | 4.25 | | 2/15/2029 | | 247,000 | c | 233,551 | |

Acrisure LLC/Acrisure Finance, Inc., Sr. Scd. Notes | | 7.50 | | 11/6/2030 | | 983,000 | c | 1,012,461 | |

Acrisure LLC/Acrisure Finance, Inc., Sr. Unscd. Notes | | 6.00 | | 8/1/2029 | | 610,000 | b,c | 588,877 | |

12

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Insurance

- 5.8% (continued) | | | | | |

Acrisure LLC/Acrisure

Finance, Inc., Sr. Unscd. Notes | | 8.25 | | 2/1/2029 | | 1,091,000 | b,c | 1,126,643 | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, Sr.

Scd. Notes | | 6.75 | | 4/15/2028 | | 666,000 | b,c | 677,281 | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, Sr.

Scd. Notes | | 7.00 | | 1/15/2031 | | 270,000 | b,c | 277,661 | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, Sr.

Unscd. Notes | | 7.38 | | 10/1/2032 | | 703,000 | c | 713,617 | |

Ardonagh Finco Ltd., Sr. Scd. Notes | | 7.75 | | 2/15/2031 | | 2,134,000 | b,c | 2,207,789 | |

Ardonagh Group Finance Ltd., Sr. Unscd. Notes | | 8.88 | | 2/15/2032 | | 800,000 | b,c | 827,476 | |

AssuredPartners, Inc., Sr. Unscd. Notes | | 5.63 | | 1/15/2029 | | 1,190,000 | b,c | 1,146,654 | |

Howden UK Refinance PLC/Howden UK Refinance 2 PLC/Howden US

Refinance LLC, Sr. Scd. Notes | | 7.25 | | 2/15/2031 | | 651,000 | c | 676,090 | |

Howden UK Refinance PLC/Howden UK Refinance 2 PLC/Howden US

Refinance LLC, Sr. Unscd. Notes | | 8.13 | | 2/15/2032 | | 818,000 | b,c | 841,588 | |

HUB International Ltd., Sr. Scd. Notes | | 7.25 | | 6/15/2030 | | 518,000 | c | 540,121 | |

Panther Escrow Issuer LLC, Sr. Scd. Notes | | 7.13 | | 6/1/2031 | | 800,000 | c | 839,755 | |

| | 11,709,564 | |

Internet

Software & Services - 1.9% | | | | | |

Arches Buyer, Inc., Sr.

Scd. Notes | | 4.25 | | 6/1/2028 | | 718,000 | c | 661,351 | |

Arches Buyer, Inc., Sr. Unscd. Notes | | 6.13 | | 12/1/2028 | | 1,337,000 | b,c | 1,145,953 | |

Cogent Communications Group LLC, Gtd. Notes | | 7.00 | | 6/15/2027 | | 581,000 | b,c | 591,716 | |

Match Group Holdings II LLC, Sr. Unscd. Notes | | 4.13 | | 8/1/2030 | | 1,050,000 | b,c | 984,434 | |

Newfold Digital Holdings Group, Inc., Sr. Scd. Notes | | 11.75 | | 10/15/2028 | | 390,000 | c | 384,848 | |

| | 3,768,302 | |

13

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Materials

- 4.4% | | | | | |

Clydesdale Acquisition Holdings, Inc., Gtd. Notes | | 8.75 | | 4/15/2030 | | 930,000 | b,c | 945,297 | |

Clydesdale Acquisition Holdings, Inc., Sr. Scd. Notes | | 6.88 | | 1/15/2030 | | 804,000 | c | 822,076 | |

LABL, Inc., Sr. Scd. Notes | | 6.75 | | 7/15/2026 | | 284,000 | b,c | 283,944 | |

LABL, Inc., Sr. Unscd. Notes | | 10.50 | | 7/15/2027 | | 1,314,000 | b,c | 1,317,565 | |

Mauser Packaging Solutions Holding Co., Scd. Notes | | 9.25 | | 4/15/2027 | | 383,000 | c | 393,076 | |

Mauser Packaging Solutions Holding Co., Sr. Scd. Bonds | | 7.88 | | 4/15/2027 | | 1,456,000 | b,c | 1,506,126 | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group

Issuer LLC, Sr. Scd. Notes | | 4.00 | | 10/15/2027 | | 1,130,000 | b,c | 1,087,594 | |

Sealed Air Corp., Gtd. Notes | | 5.00 | | 4/15/2029 | | 620,000 | b,c | 611,248 | |

Trivium Packaging Finance BV, Gtd. Notes | | 8.50 | | 8/15/2027 | | 400,000 | c | 401,355 | |

Trivium Packaging Finance BV, Sr. Scd. Notes | | 5.50 | | 8/15/2026 | | 1,638,000 | b,c | 1,633,060 | |

| | 9,001,341 | |

Media - 7.1% | | | | | |

CCO

Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 4.25 | | 1/15/2034 | | 793,000 | b,c | 651,168 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 4.50 | | 5/1/2032 | | 1,370,000 | b | 1,185,637 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 5.00 | | 2/1/2028 | | 880,000 | b,c | 856,682 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 5.38 | | 6/1/2029 | | 799,000 | b,c | 770,622 | |

Charter Communications Operating LLC/Charter Communications

Operating Capital, Sr. Scd. Notes | | 5.38 | | 5/1/2047 | | 568,000 | | 477,196 | |

CSC Holdings LLC, Gtd. Notes | | 4.13 | | 12/1/2030 | | 677,000 | c | 493,922 | |

CSC Holdings LLC, Gtd. Notes | | 5.50 | | 4/15/2027 | | 935,000 | b,c | 823,115 | |

CSC Holdings LLC, Gtd. Notes | | 11.25 | | 5/15/2028 | | 1,035,000 | b,c | 999,952 | |

DISH Network Corp., Sr. Scd. Notes | | 11.75 | | 11/15/2027 | | 1,528,000 | b,c | 1,604,928 | |

14

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Media

- 7.1% (continued) | | | | | |

DISH Network Corp., Sr.

Unscd. Notes | | 0.00 | | 12/15/2025 | | 643,000 | g | 560,253 | |

Gray Television, Inc., Sr. Scd. Notes | | 10.50 | | 7/15/2029 | | 510,000 | c | 533,178 | |

Paramount Global, Jr. Sub. Notes | | 6.38 | | 3/30/2062 | | 319,000 | | 295,319 | |

Paramount Global, Sr. Unscd. Notes | | 4.95 | | 1/15/2031 | | 2,308,000 | b | 2,177,586 | |

Scripps Escrow II, Inc., Sr. Unscd. Notes | | 5.38 | | 1/15/2031 | | 474,000 | | 273,548 | |

Scripps Escrow, Inc., Gtd. Notes | | 5.88 | | 7/15/2027 | | 511,000 | c | 445,107 | |

Sunrise Finco I BV, Sr. Scd. Notes | | 4.88 | | 7/15/2031 | | 770,000 | b,c | 729,213 | |

Virgin Media Finance PLC, Gtd. Notes | EUR | 3.75 | | 7/15/2030 | | 440,000 | c | 441,483 | |

Virgin Media Secured Finance PLC, Sr. Scd. Notes | | 5.50 | | 5/15/2029 | | 667,000 | c | 640,249 | |

Ziggo Bond Co. BV, Gtd. Notes | | 5.13 | | 2/28/2030 | | 559,000 | b,c | 515,906 | |

| | 14,475,064 | |

Metals

& Mining - 3.2% | | | | | |

Arsenal AIC Parent LLC, Sr. Scd. Notes | | 8.00 | | 10/1/2030 | | 1,140,000 | b,c | 1,224,740 | |

Cleveland-Cliffs, Inc., Gtd. Notes | | 6.75 | | 4/15/2030 | | 601,000 | b,c | 611,878 | |

Compass Minerals International, Inc., Gtd. Notes | | 6.75 | | 12/1/2027 | | 1,146,000 | c | 1,141,601 | |

First Quantum Minerals Ltd., Scd. Notes | | 9.38 | | 3/1/2029 | | 880,000 | b,c | 933,851 | |

FMG Resources August 2006 Pty Ltd., Sr. Unscd. Notes | | 6.13 | | 4/15/2032 | | 690,000 | b,c | 706,497 | |

Samarco Mineracao SA, Sr. Unscd. Notes | | 9.00 | | 6/30/2031 | | 601,165 | d | 563,620 | |

Samarco Mineracao SA, Sr. Unscd. Notes | | 9.00 | | 6/30/2031 | | 484,550 | c,d | 454,288 | |

Taseko Mines Ltd., Sr. Scd. Notes | | 8.25 | | 5/1/2030 | | 891,000 | b,c | 936,197 | |

| | 6,572,672 | |

Real

Estate - 4.9% | | | | | |

Anywhere Real Estate Group LLC/Anywhere Co-Issuer Corp., Scd.

Notes | | 7.00 | | 4/15/2030 | | 877,809 | c | 816,281 | |

Iron Mountain, Inc., Gtd. Notes | | 4.88 | | 9/15/2029 | | 1,240,000 | c | 1,215,421 | |

15

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Real

Estate - 4.9% (continued) | | | | | |

Ladder

Capital Finance Holdings LLLP/Ladder Capital Finance Corp., Gtd. Notes | | 4.25 | | 2/1/2027 | | 2,114,000 | b,c | 2,067,529 | |

Park Intermediate Holdings LLC/PK Domestic Property LLC/PK

Finance Co-Issuer, Sr. Scd. Notes | | 4.88 | | 5/15/2029 | | 742,000 | c | 720,631 | |

RHP Hotel Properties LP/RHP Finance Corp., Gtd. Notes | | 6.50 | | 4/1/2032 | | 943,000 | b,c | 975,237 | |

Rithm Capital Corp., Sr. Unscd. Notes | | 8.00 | | 4/1/2029 | | 1,751,000 | b,c | 1,773,399 | |

RLJ Lodging Trust LP, Sr. Scd. Notes | | 4.00 | | 9/15/2029 | | 779,000 | b,c | 717,746 | |

Starwood Property Trust, Inc., Sr. Unscd. Notes | | 7.25 | | 4/1/2029 | | 663,000 | c | 696,025 | |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, Sr.

Scd. Notes | | 10.50 | | 2/15/2028 | | 846,000 | c | 903,707 | |

| | 9,885,976 | |

Retailing - 4.3% | | | | | |

Beacon

Roofing Supply, Inc., Gtd. Notes | | 4.13 | | 5/15/2029 | | 641,000 | c | 604,510 | |

Carvana Co., Sr. Scd. Notes | | 12.00 | | 12/1/2028 | | 483,005 | c,d | 507,685 | |

Carvana Co., Sr. Scd. Notes | | 13.00 | | 6/1/2030 | | 809,400 | b,c,d | 880,798 | |

Fertitta Entertainment LLC/Fertitta Entertainment Finance Co.,

Inc., Gtd. Notes | | 6.75 | | 1/15/2030 | | 535,000 | b,c | 498,787 | |

Fertitta Entertainment LLC/Fertitta Entertainment Finance Co.,

Inc., Sr. Scd. Notes | | 4.63 | | 1/15/2029 | | 461,000 | b,c | 440,522 | |

Foundation Building Materials, Inc., Gtd. Notes | | 6.00 | | 3/1/2029 | | 1,805,000 | b,c | 1,591,218 | |

PetSmart, Inc./PetSmart Finance Corp., Sr. Scd. Notes | | 4.75 | | 2/15/2028 | | 990,000 | b,c | 950,052 | |

Specialty Building Products Holdings LLC/SBP Finance Corp., Sr.

Scd. Notes | | 6.38 | | 9/30/2026 | | 557,000 | c | 555,401 | |

Walgreens Boots Alliance, Inc., Sr. Unscd. Notes | | 8.13 | | 8/15/2029 | | 529,000 | | 528,522 | |

16

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Retailing

- 4.3% (continued) | | | | | |

White Cap Buyer LLC, Sr.

Unscd. Notes | | 6.88 | | 10/15/2028 | | 1,271,000 | b,c | 1,283,967 | |

White Cap Parent LLC, Sr. Unscd. Notes | | 8.25 | | 3/15/2026 | | 805,000 | c,d | 806,257 | |

| | 8,647,719 | |

Semiconductors

& Semiconductor Equipment - .7% | | | | | |

Entegris, Inc., Gtd.

Notes | | 5.95 | | 6/15/2030 | | 1,360,000 | b,c | 1,386,460 | |

Telecommunication

Services - 5.8% | | | | | |

Altice Financing SA, Sr. Scd. Bonds | | 5.75 | | 8/15/2029 | | 525,000 | b,c | 422,396 | |

Altice France SA, Sr. Scd. Notes | | 5.50 | | 1/15/2028 | | 1,145,000 | b,c | 833,602 | |

C&W Senior Finance Ltd., Sr. Unscd. Notes | | 6.88 | | 9/15/2027 | | 883,000 | b,c | 880,694 | |

Consolidated Communications, Inc., Sr. Scd. Notes | | 6.50 | | 10/1/2028 | | 989,000 | c | 936,293 | |

Frontier Communications Holdings LLC, Scd. Notes | | 5.88 | | 11/1/2029 | | 160,000 | | 158,982 | |

Frontier Communications

Holdings LLC, Scd. Notes | | 6.00 | | 1/15/2030 | | 159,000 | c | 158,871 | |

Frontier Communications Holdings LLC, Scd. Notes | | 6.75 | | 5/1/2029 | | 920,000 | b,c | 927,147 | |

Frontier Communications Holdings LLC, Sr. Scd. Notes | | 8.63 | | 3/15/2031 | | 322,000 | c | 347,420 | |

Frontier Communications Holdings LLC, Sr. Scd. Notes | | 8.75 | | 5/15/2030 | | 1,070,000 | b,c | 1,141,170 | |

Iliad Holding SASU, Sr. Scd. Bonds | | 8.50 | | 4/15/2031 | | 940,000 | b,c | 1,011,887 | |

Iliad Holding SASU, Sr. Scd. Notes | | 6.50 | | 10/15/2026 | | 531,000 | c | 537,197 | |

Level 3 Financing, Inc., Sr. Scd. Notes | | 10.50 | | 4/15/2029 | | 1,375,000 | b,c | 1,505,692 | |

Level 3 Financing, Inc., Sr. Scd. Notes | | 10.75 | | 12/15/2030 | | 319,000 | c | 351,684 | |

Lumen Technologies, Inc., Sr. Scd. Notes | | 4.13 | | 4/15/2029 | | 648,175 | c | 547,708 | |

Optics Bidco SpA, Sr. Scd. Notes | | 7.72 | | 6/4/2038 | | 805,000 | c | 891,707 | |

Windstream Escrow LLC/Windstream Escrow Finance Corp., Sr.

Scd. Notes | | 8.25 | | 10/1/2031 | | 816,000 | c | 830,637 | |

17

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description

| Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Bonds

and Notes - 120.7% (continued) | | | |

Telecommunication

Services - 5.8% (continued) | | | | | |

Zayo

Group Holdings, Inc., Sr. Unscd. Notes | | 6.13 | | 3/1/2028 | | 319,000 | c | 265,051 | |

| | 11,748,138 | |

Utilities

- 4.3% | | | | | |

Calpine Corp., Sr. Unscd. Notes | | 4.63 | | 2/1/2029 | | 845,000 | b,c | 816,838 | |

Calpine Corp., Sr. Unscd. Notes | | 5.00 | | 2/1/2031 | | 747,000 | b,c | 723,913 | |

NextEra Energy Operating Partners LP, Gtd. Notes | | 3.88 | | 10/15/2026 | | 827,000 | b,c | 806,261 | |

NextEra Energy Operating Partners LP, Sr. Unscd. Notes | | 7.25 | | 1/15/2029 | | 1,077,000 | b,c | 1,136,428 | |

NRG Energy, Inc., Gtd. Notes | | 3.88 | | 2/15/2032 | | 650,000 | b,c | 592,713 | |

NRG Energy, Inc., Jr. Sub. Bonds | | 10.25 | | 3/15/2028 | | 1,090,000 | b,c,e | 1,230,407 | |

PG&E Corp., Sr. Scd. Notes | | 5.00 | | 7/1/2028 | | 1,102,000 | b | 1,093,257 | |

Vistra Corp., Jr. Sub. Bonds | | 7.00 | | 12/15/2026 | | 447,000 | c,e | 456,679 | |

Vistra Operations Co. LLC, Gtd. Notes | | 4.38 | | 5/1/2029 | | 76,000 | c | 73,619 | |

Vistra Operations Co. LLC, Gtd. Notes | | 6.88 | | 4/15/2032 | | 474,000 | c | 499,003 | |

Vistra Operations Co. LLC, Gtd. Notes | | 7.75 | | 10/15/2031 | | 1,171,000 | b,c | 1,261,598 | |

| | 8,690,716 | |

Total Bonds

and Notes

(cost $234,540,502) | | 245,260,317 | |

| | | | | | | | | |

Floating

Rate Loan Interests - 15.4% | | | | | |

Advertising - .7% | | | | | |

Dotdash

Meredith, Inc., Term Loan B, (1 Month SOFR +4.10%) | | 9.30 | | 12/1/2028 | | 549,233 | f | 550,263 | |

Neptune BidCo US, Inc., Term Loan B, (3 Month SOFR +5.10%) | | 10.40 | | 4/11/2029 | | 865,234 | f | 814,558 | |

| | 1,364,821 | |

Automobiles & Components - .9% | | | | | |

First

Brands Group LLC, 2021 First Lien Term Loan, (3 Month SOFR +5.26%) | | 10.51 | | 3/30/2027 | | 267,231 | f | 264,851 | |

First Brands Group LLC, 2022 Incremental Term Loan, (3 Month

SOFR +5.26%) | | 10.51 | | 3/30/2027 | | 788,749 | f | 781,847 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Floating

Rate Loan Interests - 15.4% (continued) | | | | | |

Automobiles

& Components - .9% (continued) | | | | | |

IXS

Holdings, Inc., Initial Term Loan, (3 Month SOFR +4.35%) | | 8.95 | | 3/5/2027 | | 695,132 | f | 678,842 | |

| | 1,725,540 | |

Chemicals

- .3% | | | | | |

Hexion Holdings Corp., First Lien Initial Term Loan, (3

Month SOFR +4.65%) | | 9.77 | | 3/15/2029 | | 688,240 | f | 684,124 | |

Commercial

& Professional Services - 1.7% | | | | | |

Albion Financing 3

Sarl, 2024 New Amended USD Term Loan, (3 Month SOFR +4.51%) | | 9.83 | | 8/2/2029 | | 792,015 | f | 797,955 | |

American Auto Auction Group LLC, Tranche Term Loan B, (3

Month SOFR +5.15%) | | 9.75 | | 12/30/2027 | | 546,549 | f | 549,626 | |

Envalior Finance GmbH, USD Facility Term Loan B-1, (3 Month

SOFR +5.50%) | | 10.75 | | 4/3/2030 | | 521,034 | f | 497,978 | |

Modulaire Group Holdings Ltd., Term Loan B, (3 Month EURIBOR

+4.18%) | EUR | 7.52 | | 12/22/2028 | | 1,000,000 | f | 1,096,024 | |

Vaco Holdings LLC, Initial Term Loan, (1 Month SOFR +5.10%) | | 9.95 | | 1/22/2029 | | 538,615 | f | 530,033 | |

| | 3,471,616 | |

Consumer Discretionary - .5% | | | | | |

Bally's

Corp., Facility Term Loan B, (3 Month SOFR +3.51%) | | 8.79 | | 10/2/2028 | | 817,195 | f | 780,168 | |

Fitness International LLC, Term Loan B, (3 Month SOFR +5.25%) | | 10.51 | | 2/12/2029 | | 311,435 | f | 311,175 | |

| | 1,091,343 | |

Diversified Financials - 1.0% | | | | | |

Blackhawk

Network Holdings, Inc., Term Loan B, (1 Month SOFR +5.00%) | | 9.85 | | 3/12/2029 | | 927,675 | f | 932,893 | |

Nexus Buyer LLC, Refinancing Term Loan, (1 Month SOFR +4.00%) | | 8.85 | | 7/31/2031 | | 1,092,779 | f | 1,085,179 | |

| | 2,018,072 | |

19

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Floating

Rate Loan Interests - 15.4% (continued) | | | | | |

Energy

- .8% | | | | | |

WaterBridge Midstream Operating LLC, Term Loan B, (3 Month

SOFR +4.75%) | | 9.39 | | 6/27/2029 | | 817,742 | f | 791,750 | |

WaterBridge NDB Operating LLC, Initial Term Loan, (3 Month

SOFR +4.50%) | | 9.60 | | 5/10/2029 | | 812,768 | f | 812,390 | |

| | 1,604,140 | |

Financials - .5% | | | | | |

Jump

Financial LLC, Term Loan, (3 Month SOFR +4.76%) | | 9.37 | | 8/7/2028 | | 1,055,997 | f | 1,048,077 | |

Food Products - .5% | | | | | |

Max

US Bidco, Inc., Initial Term Loan, (1 Month SOFR +5.00%) | | 9.85 | | 10/2/2030 | | 1,114,400 | f | 1,059,003 | |

Health Care - 1.8% | | | | | |

Alvogen

Pharma US, Inc., 2022 New Extended June Term Loan, (1 Month SOFR +7.60%) | | 12.45 | | 6/30/2025 | | 244,853 | f | 221,592 | |

Auris Luxembourg III SA, Facility Term Loan B-4, (6 Month

SOFR +4.68%) | | 9.56 | | 2/8/2029 | | 528,675 | f | 529,502 | |

Bella Holding Co. LLC, First Lien Initial Term Loan, (1

Month SOFR +3.85%) | | 8.70 | | 5/10/2028 | | 619,404 | f | 620,178 | |

Radiology Partners, Inc., Term Loan C, (3 Month SOFR +3.76%) | | 8.88 | | 1/31/2029 | | 986,679 | d,f | 969,417 | |

Team Health Holdings, Inc., Extended Term Loan, (3 Month

SOFR +5.25%) | | 10.50 | | 3/2/2027 | | 568,365 | f | 545,187 | |

US Anesthesia Partners, Inc., Initial Term Loan, (1 Month

SOFR +4.36%) | | 9.57 | | 10/2/2028 | | 698,200 | f | 685,155 | |

| | 3,571,031 | |

Industrial - .4% | | | | | |

Swissport

Stratosphere USA LLC, USD Facility Term Loan B, (3 Month SOFR +4.25%) | | 9.57 | | 3/31/2031 | | 807,975 | f | 811,764 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Floating

Rate Loan Interests - 15.4% (continued) | | | | | |

Information

Technology - 1.1% | | | | | |

Ascend Learning LLC, Second Lien Initial Term Loan, (1 Month

TSFR +5.75%) | | 11.10 | | 12/10/2029 | | 699,996 | f | 679,433 | |

HS Purchaser LLC, First Lien 7th Amendment Refinancing Term

Loan, (1 Month SOFR +4.10%) | | 8.95 | | 11/30/2026 | | 458,799 | f | 438,727 | |

Polaris Newco LLC, First Lien Euro Term Loan, (3 Month EURIBOR

+4.00%) | EUR | 7.35 | | 6/5/2028 | | 997,429 | f | 1,058,321 | |

| | 2,176,481 | |

Insurance - .7% | | | | | |

Amynta

Agency Borrower, Inc., 2024 Refinancing Term Loan, (3 Month SOFR +3.75%) | | 9.00 | | 2/28/2028 | | 678,300 | f | 679,202 | |

OneDigital Borrower LLC, Second Lien Initial Term Loan,

(1 Month SOFR +5.25%) | | 10.10 | | 7/2/2032 | | 664,000 | f | 659,020 | |

| | 1,338,222 | |

Internet Software & Services - 1.1% | | | | | |

MH

Sub I LLC, 2023 May New Term Loan, (1 Month SOFR +4.25%) | | 9.10 | | 5/3/2028 | | 1,076,375 | f | 1,070,837 | |

MH Sub I LLC, Second Lien Term Loan, (3 Month SOFR +6.25%) | | 11.50 | | 2/23/2029 | | 570,000 | f | 560,840 | |

StubHub Holdco Sub LLC, Extended USD Term Loan B, (1 Month

SOFR +4.75%) | | 9.60 | | 3/15/2030 | | 670,246 | f | 670,802 | |

| | 2,302,479 | |

Materials - .5% | | | | | |

LABL,

Inc., Initial Euro Term Loan, (1 Month EURIBOR +5.00%) | EUR | 8.38 | | 10/30/2028 | | 994,885 | f | 1,047,238 | |

Media

- .5% | | | | | |

Vmed O2 UK Holdco 4 Ltd., Facility Term Loan Z, (1 Month

EURIBOR +3.43%) | EUR | 6.86 | | 10/15/2031 | | 1,000,000 | f | 1,109,883 | |

21

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate

(%) | | Maturity

Date | | Principal

Amount

($) | a | Value

($) | |

Floating

Rate Loan Interests - 15.4% (continued) | | | | | |

Real

Estate - .3% | | | | | |

CoreLogic, Inc., First Lien Initial Term Loan, (1 Month

SOFR +3.61%) | | 8.46 | | 6/2/2028 | | 706,359 | f | 701,125 | |

Retailing

- .1% | | | | | |

Staples, Inc., Closing Date Term Loan, (3 Month SOFR +5.75%) | | 10.69 | | 9/10/2029 | | 235,000 | f | 214,101 | |

Semiconductors

& Semiconductor Equipment - .2% | | | | | |

Icon Parent, Inc., Second

Lien Term Loan, (1 Month TSFR +5.00%) | | 5.00 | | 9/13/2032 | | 305,000 | f | 307,002 | |

Technology Hardware & Equipment - .6% | | | | | |

Indy

US Holdco LLC, Ninth Amended Dollar Term Loan, (1 Month SOFR +4.75%) | | 9.60 | | 3/6/2028 | | 1,189,909 | f | 1,187,928 | |

Telecommunication Services - .7% | | | | | |

Lumen

Technologies, Inc., Term Loan B-2, (1 Month SOFR +2.46%) | | 7.32 | | 4/15/2030 | | 693,247 | f | 602,695 | |

Zayo Group Holdings, Inc., Initial Dollar Term Loan, (1

Month SOFR +3.00%) | | 7.96 | | 3/9/2027 | | 870,000 | f | 797,229 | |

| | 1,399,924 | |

Transportation - .1% | | | | | |

PODS

LLC, Term Loan, (3 Month SOFR +3.26%) | | 8.51 | | 3/31/2028 | | 147,819 | f | 140,133 | |

Utilities - .4% | | | | | |

Nautilus

Power LLC, Term Loan B, (3 Month SOFR +5.51%) | | 10.85 | | 11/16/2026 | | 818,168 | f | 818,986 | |

Total Floating Rate Loan Interests

(cost

$30,836,707) | | 31,193,033 | |

| | | | | | Shares | | | |

Exchange-Traded

Funds - .4% | | | | | |

Registered

Investment Companies - .4% | | | | | |

iShares

iBoxx Investment Grade Corporate Bond ETF

(cost $803,661) | | | | | | 7,570 | | 855,259 | |

22

| | | | | | | | | | |

| |

Description | 1-Day

Yield

(%) | | | | Shares | | Value

($) | |

Investment

Companies - 2.5% | | | | | |

Registered

Investment Companies - 2.5% | | | | | |

Dreyfus Institutional Preferred Government

Plus Money Market Fund, Institutional Shares

(cost $5,011,439) | | 4.95 | | | | 5,011,439 | h | 5,011,439 | |

Total

Investments (cost $271,192,309) | | 139.0% | 282,320,048 | |

Liabilities, Less Cash and Receivables | | (39.0%) | (79,184,857) | |

Net Assets | | 100.0% | 203,135,191 | |

ETF—Exchange-Traded

Fund

EURIBOR—Euro Interbank Offered Rate

SOFR—Secured Overnight Financing Rate

TSFR—Term Secured Overnight Financing

Rate Reference Rates

EUR—Euro

GBP—British Pound

a Amount stated in U.S. Dollars unless otherwise noted above.

b Security,

or portion thereof, has been pledged as collateral for the fund’s Revolving Credit and Security Agreement.

c Security

exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may

be resold in transactions exempt from registration, normally to qualified institutional buyers. At September

30, 2024, these securities were valued at $227,218,604 or 111.86% of net assets.

d Payment-in-kind security and interest may be paid in additional

par.

e Security

is a perpetual bond with no specified maturity date. Maturity date shown is next reset date of the bond.

f Variable

rate security—interest rate resets periodically and rate shown is the interest rate in effect at period

end. Security description also includes the reference rate and spread if published and available.

g Security

issued with a zero coupon. Income is recognized through the accretion of discount.

h Investment in affiliated issuer. The investment objective

of this investment company is publicly available and can be found within the investment company’s prospectus.

See notes to financial statements.

23

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | |

Affiliated Issuers | | | |

Description | Value

($)

3/31/2024 | Purchases ($)† | Sales

($) | Value

($)

9/30/2024 | Dividends/

Distributions

($) | |

Registered Investment Companies - 2.5% | | |

Dreyfus Institutional Preferred Government Plus Money Market

Fund, Institutional Shares - 2.5% | 2,355,916 | 65,311,193 | (62,655,670) | 5,011,439 | 122,664 | |

† Includes reinvested dividends/distributions.

See notes to financial statements.

| | | | | | |

Forward Foreign Currency Exchange Contracts | |

Counterparty/ Purchased

Currency | Purchased

Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized

Appreciation (Depreciation) ($) |

Barclays Capital, Inc. |

United States Dollar | 1,004,158 | Euro | 900,000 | 10/23/2024 | 1,314 |

British Pound | 140,000 | United States Dollar | 187,908 | 10/23/2024 | (737) |

Goldman

Sachs & Co. LLC |

United States Dollar | 7,078,113 | British

Pound | 5,330,000 | 10/23/2024 | (47,753) |

United States Dollar | 10,223,875 | Euro | 9,140,000 | 10/23/2024 | 39,435 |

Gross Unrealized Appreciation | | | 40,749 |

Gross Unrealized Depreciation | | | (48,490) |

See notes to financial statements.

24

STATEMENT

OF ASSETS AND LIABILITIES

September 30, 2024 (Unaudited)

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | | | |

Unaffiliated issuers | 266,180,870 | | 277,308,609

| |

Affiliated issuers | | 5,011,439 | | 5,011,439

| |

Cash denominated in foreign

currency | | | 629,006 | | 627,241

| |

Receivable for investment

securities sold | | 5,821,966 | |

Interest receivable | | 4,332,700 | |

Unrealized

appreciation on forward foreign

currency exchange contracts—Note 4 | | 40,749 | |

Prepaid

expenses | | | | | 48,493 | |

| | | | |

293,191,197 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc.

and affiliates—Note 3(b) | | 176,660 | |

Cash overdraft due to Custodian | | | | | 983,335 | |

Loan

payable—Note 2 | | 74,000,000 | |

Payable for investment securities

purchased | | 14,366,384 | |

Interest payable—Note 2 | | 379,465 | |

Unrealized

depreciation on forward foreign

currency exchange contracts—Note 4 | | 48,490 | |

Trustees’

fees and expenses payable | | 11,843 | |

Other accrued expenses | | | | | 89,829 | |

| | | | |

90,056,006 | |

Net Assets ($) | | |

203,135,191 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 277,577,745 | |

Total distributable earnings

(loss) | | | | | (74,442,554) | |

Net

Assets ($) | | |

203,135,191 | |

| | | | | |

Shares

Outstanding | | |

(unlimited

number of $.001 par value

shares of Beneficial Interest authorized) | 72,736,534 | |

Net Asset Value Per Share ($) | | 2.79 | |

| | | | |

See notes to financial statements. | | | | |

25

STATEMENT

OF OPERATIONS

Six

Months Ended September 30, 2024 (Unaudited)

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest (net of $5,731 foreign taxes withheld

at source) | 11,086,115

| |

Dividends: | |

Unaffiliated issuers | | | 16,750 | |

Affiliated issuers | | | 122,664 | |

Total

Income | | |

11,225,529 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 1,024,522 | |

Interest

expense—Note 2 | | | 2,412,885 | |

Professional

fees | | | 106,853 | |

Registration

fees | | | 35,414 | |

Trustees’

fees and expenses—Note 3(c) | | | 31,548 | |

Shareholders’

reports | | | 27,387 | |

Shareholder

servicing costs | | | 9,676 | |

Chief

Compliance Officer fees—Note 3(b) | | | 7,243 | |

Custodian fees—Note 3(b) | | | 6,261 | |

Miscellaneous | | | 22,778 | |

Total

Expenses | | |

3,684,567 | |

Net Investment Income | | |

7,540,962 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4

($): | | |

Net realized gain (loss)

on investments

and foreign currency transactions | 1,391,463 | |

Net

realized gain (loss) on forward foreign

currency exchange contracts | (408,124) | |

Net Realized Gain (Loss) | | | 983,339 | |

Net

change in unrealized appreciation (depreciation) on

investments and foreign

currency transactions |

6,002,507 | |

Net

change in unrealized appreciation (depreciation) on

forward foreign currency

exchange contracts | (251,262) | |

Net Change in Unrealized Appreciation (Depreciation) | 5,751,245 | |

Net Realized and Unrealized Gain (Loss) on Investments | 6,734,584 | |

Net Increase in Net Assets Resulting from Operations | 14,275,546 | |

| | | | | | |

See

notes to financial statements. | | | | | |

26

STATEMENT

OF CASH FLOWS

Six

Months Ended September 30, 2024 (Unaudited)

| | | | | | | |

| | | | | |

| | | | | | |

Cash Flows from Operating Activities ($): | | | | | |

Purchases of portfolio securities | |

(150,010,631) | | | |

Proceeds from sales of portfolio securities | 154,214,510 | | | |

Net purchase (sales) of short-term securities | (2,393,023) | | | |

Dividends and interest income received | | 11,260,369 | | | |

Interest expense paid | | (2,462,971) | | | |

Expenses paid to BNY Mellon Investment

Adviser, Inc. and affiliates | | (1,042,743) | | | |

Operating expenses paid | | (182,581) | | | |

Net realized gain (loss) from forward foreign

currency

exchange contracts transactions | | (408,124) | | | |

Net Cash Provided (or Used) in Operating Activities | | 8,974,806 | |

Cash

Flows from Financing Activities ($): | | | | | |

Dividends paid to shareholders | | (8,910,377) | | | |

Decrease in loan outstanding | | (5,000,000) | | | |

Increase in Cash Overdraft due to Custodian | | 983,335 | | | |

Net Cash Provided (or Used) in Financing Activities | | (12,927,042) | |

Effect of Foreign Exchange Rate Changes on Cash | |

29,881 | |

Net Increase

(Decrease) in Cash | | (3,922,355) | |

Cash and cash denominated in foreign currency at beginning

of period | | 4,549,596 | |

Cash

and Cash Denominated in Foreign Currency at End of Period | | 627,241 | |

Reconciliation of Net Increase (Decrease) in

Net Assets

Resulting from Operations to Net Cash Provided

by Operating Activities ($): | | | |

Net Increase in Net Assets Resulting From Operations | |

14,275,546 | | | |

Adjustments

to Reconcile Net Increase (Decrease)

in Net Assets Resulting from Operations to

Net Cash

Provided (or Used) in Operating Activities ($): | | | |

Increase in investments in securities at cost | | (3,380,580) | | | |

Decrease in dividends and interest receivable

| | 34,840 | | | |

Increase in receivable for investment securities

sold | | (166,414) | | | |

Decrease in prepaid expenses | | 19,266 | | | |

Decrease in Due to BNY Mellon Investment

Adviser, Inc. and affiliates | |

(4,717) | | | |

Increase in payable for investment

securities purchased | | 3,966,387 | | | |

Decrease in interest payable | | (50,086) | | | |

Increase in Trustees' fees and expenses payable | | 9,622 | | | |

Increase in other accrued expenses | | 22,187 | | | |

Net change in unrealized (appreciation)

depreciation

on investments | |

(5,751,245) | | | |

Net

Cash Provided (or Used) in Operating Activities | | 8,974,806 | |

See notes to financial statements. | | | | | |

27

STATEMENT

OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | |

| | | | Six

Months Ended

September 30, 2024 (Unaudited) | | Year Ended

March 31, 2024 | |

Operations ($): | | | | | | | | |

Net investment income | | | 7,540,962 | | | | 15,758,548 | |

Net

realized gain (loss) on investments | | 983,339

| | | | (7,365,662) | |

Net

change in unrealized appreciation

(depreciation) on investments | | 5,751,245

| | | | 15,921,186 | |

Net Increase

(Decrease) in Net Assets

Resulting from Operations | 14,275,546 | | | | 24,314,072 | |

Distributions

($): | |

Distributions to shareholders |

(7,637,336) | | | |

(13,274,417) | |

Total Increase (Decrease) in Net Assets |

6,638,210 | | | |

11,039,655 | |

Net Assets

($): | |

Beginning of Period | | | 196,496,981 | | | | 185,457,326 | |

End

of Period | | | 203,135,191 | | | | 196,496,981 | |

| | | | | | | | | |

See notes to financial statements. | | | | | | | | |

28

FINANCIAL

HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated.

Market price total return is calculated assuming an initial investment made at the market price at the

beginning of the period, reinvestment of all dividends and distributions at market price during the period,

and sale at the market price on the last day of the period.

| | | | | | | |

Six Months Ended | | | | | |

September 30, 2024 | Year Ended March 31, |

| | (Unaudited) | 2024 | 2023 | 2022 | 2021 | 2020 |

Per Share Data ($): | | | | | | |

Net

asset value,

beginning of period | 2.70 | 2.55 | 3.05 | 3.30 | 2.59 | 3.32 |

Investment

Operations: | | | | | | |

Net

investment incomea | .10 | .22 | .20 | .24 | .24 | .25 |

Net

realized and unrealized

gain (loss) on investments | .10 | .11 | (.49) | (.24) | .73 | (.72) |

Total

from Investment Operations | .20 | .33 | (.29) | (.00)b | .97 | (.47) |

Distributions: | | | | | | |

Dividends from

net

investment income | (.11) | (.18) | (.21) | (.26) | (.26) | (.26) |

Net asset value, end of period | 2.79 | 2.70 | 2.55 | 3.05 | 3.30 | 2.59 |

Market value, end of

period | 2.69 | 2.42 | 2.17 | 2.78 | 3.09 | 2.27 |

Market Price Total Return (%) | 15.99c | 20.93 | (14.49) | (2.72) | 49.32 | (19.39) |

Ratios/Supplemental Data (%): | | | | | |

Ratio

of total expenses to

average net assets | 3.73d | 3.96 | 2.90 | 1.71 | 1.85 | 2.77 |

Ratio of interest expense and

loan

fees to average net assets | 2.44d | 2.65 | 1.60 | .42 | .58 | 1.48 |

Ratio of net investment income

to

average net assets | 7.63d | 8.37 | 7.48 | 7.27 | 7.87 | 7.49 |

Portfolio Turnover Rate | 54.30c | 111.68 | 119.01 | 78.09 | 85.59 | 70.93 |

Net Assets,

end of period ($ x 1,000) | 203,135 | 196,497 | 185,457 | 221,624 | 239,727 | 188,270 |

Average

borrowings

outstanding ($ x 1,000) | 75,257 | 79,000 | 79,847 | 96,000 | 92,800 | 110,784 |

Weighted average | | | | | |

number of fund shares

outstanding ($ x 1,000) | 72,737 | 72,737 | 72,737 | 72,724 | 72,708 | 72,708 |

Average

amount

of debt per share ($) | 1.03 | 1.09 | 1.10 | 1.32 | 1.28 | 1.52 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Not annualized.

d Annualized.

See

notes to financial statements.

29

NOTES

TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

BNY

Mellon High Yield Strategies Fund (the “fund”) is registered under the Investment Company Act of

1940, as amended (the “Act”), as a diversified, closed-end management investment company. The fund’s

primary investment objective is to seek high current income. Under normal market conditions, the fund

invests at least 65% of its total assets in income securities of U.S. issuers rated below investment

grade quality or unrated income securities that Alcentra NY, LLC, the fund’s sub-adviser (“Alcentra”

or the “Sub-Adviser”), determines to be of comparable quality. The fund’s investment adviser is

BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New

York Corporation (“BNY”). The fund’s shares of beneficial interest trades on the New York Stock

Exchange (the “NYSE”) under the ticker symbol DHF.

The Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference

of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to

be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange

Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC

registrants. The fund is an investment company and applies the accounting and reporting guidance of the

FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared

in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results

could differ from those estimates.

The fund enters into contracts

that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is

unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a)

Portfolio valuation: The fair value of a financial instrument is the amount that would be received

to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes

the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority

to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements)

and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly

and whether

30

such a decrease in activity results in transactions that are not orderly. GAAP

requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating

to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical

investments.

Level 2—other significant observable inputs

(including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

Changes in valuation techniques may result

in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used

to value the fund’s investments are as follows:

The fund’s Board of Trustees (the “Board”)

has designated the Adviser as the fund’s valuation designee to make all fair value determinations with

respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule

2a-5 under the Act.

Investments in debt securities and floating rate loan interests,

excluding short-term investments (other than U.S. Treasury Bills) and forward foreign currency exchange

contracts (“forward contracts”), are valued each business day by one or more independent pricing

services (each, a “Service”) approved by the Board. Investments for which quoted bid prices are readily

available and are representative of the bid side of the market in the judgment of a Service are valued

at the mean between the quoted bid prices (as obtained by a Service from dealers in such securities)

and asked prices (as calculated by a Service based upon its evaluation of the market for such securities).

Securities are valued as determined by a Service, based on methods which include consideration of the

following: yields or prices of securities of comparable quality, coupon, maturity and type; indications

as to values from dealers; and general market conditions. The Services are engaged under the general

supervision of the Board. These securities are generally categorized within Level 2 of the fair value

hierarchy.

31

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

Investments in equity securities and exchanged-traded funds are valued at the

last sales price on the securities exchange or national securities market on which such securities are

primarily traded. Securities listed on the National Market System for which market quotations are available

are valued at the official closing price or, if there is no official closing price that day, at the last

sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used

when no asked price is available. Registered investment companies that are not traded on an exchange

are valued at their net asset value. All of the preceding securities are generally categorized within

Level 1 of the fair value hierarchy.

Securities not listed on an exchange or

the national securities market, or securities for which there were no transactions, are valued at the

average of the most recent bid and asked prices. U.S. Treasury Bills are valued at the mean price between

quoted bid prices and asked prices by the Service. These securities are generally categorized within

Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined

with the assistance of a Service using calculations based on indices of domestic securities and other

appropriate indicators, such as prices of relevant American Depository Receipts and futures. Utilizing

these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or

are determined not to accurately reflect fair value, such as when the value of a security has been significantly

affected by events after the close of the exchange or market on which the security is principally traded,

but before the fund calculates its net asset value, the fund may value these investments at fair value

as determined in accordance with the procedures approved by the Board. Certain factors may be considered

when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions

on disposition, an evaluation of the forces that influence the market in which the securities are purchased

and sold, and public trading in similar securities of the issuer or comparable issuers. These securities

are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs

used.

For securities where observable inputs are limited, assumptions about market activity

and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at

the prevailing rates of exchange.

32

Forward contracts are valued at the forward rate and are generally categorized

within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of September

30, 2024 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level

2- Other Significant Observable Inputs | | Level 3-Significant Unobservable

Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Collateralized

Loan Obligations | - | 3,965,553 | | - | 3,965,553 | |

Corporate

Bonds and Notes | - | 241,294,764 | | - | 241,294,764 | |

Exchange-Traded

Funds | 855,259 | - | | - | 855,259 | |

Floating

Rate Loan Interests | - | 31,193,033 | | - | 31,193,033 | |

Investment

Companies | 5,011,439 | - | | - | 5,011,439 | |

Other

Financial Instruments: | | |

Forward Foreign Currency Exchange Contracts†† | - | 40,749 | | - | 40,749 | |

Liabilities

($) | | |

Other Financial Instruments: | | |

Forward

Foreign Currency Exchange Contracts†† | - | (48,490) | | - | (48,490) | |

† See Statement of Investments for additional detailed categorizations,

if any.

†† Amount

shown represents unrealized appreciation (depreciation) at period end, but only variation margin on exchange-traded

and centrally cleared derivatives, if any, are reported in the Statement of Assets and Liabilities.

(b)

Foreign currency transactions: The fund does not isolate that portion of the results of

operations resulting from changes in foreign exchange rates on investments from the fluctuations arising

from changes in the market prices of securities held. Such fluctuations are included with the net realized

and unrealized gain or loss on investments.

33

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

Net realized foreign exchange gains or losses arise from sales of foreign currencies,

currency gains or losses realized on securities transactions between trade and settlement date, and the

difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s

books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign

exchange gains and losses arise from changes in the value of assets and liabilities other than investments

resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions

are also included with net realized and unrealized gain or loss on investments.

Foreign taxes: The

fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends,

realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign

taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in

the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund

and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or

those subject to reclaims as of September 30, 2024, if any, are disclosed in the fund’s Statement of

Assets and Liabilities.

(c) Securities transactions

and investment income: Securities transactions are recorded on a trade date basis. Realized gains and

losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized

on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization

of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers:

Investments in other investment companies advised by the Adviser are considered “affiliated” under

the Act.

(e) Market Risk: The value of the securities in which the fund invests may

be affected by political, regulatory, economic and social developments, and developments that impact

specific economic sectors, industries or segments of the market. The value of a security may also decline

due to general market conditions that are not specifically related to a particular company or industry,

such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings,

changes in interest or currency rates, changes to inflation, adverse changes to credit markets or adverse

investor sentiment generally.

High Yield Risk: The fund invests primarily in high yield

debt securities. Below investment grade instruments are commonly referred to as “junk” or “high

yield” instruments and are regarded as predominantly speculative

34

with respect to the issuer’s capacity to pay interest and repay principal. Below