Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

February 26 2024 - 3:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

On February 26, 2024, The Walt Disney Company issued the following press release:

FEBRUARY 26, 2024

Disney Board Of Directors Sends Letter To Shareholders

Highlighting Clear Progress Made And Promises Kept As It

Executes Strategic Transformation

Board and Management continue to deliver on strategic priorities outlined last year

Encourages shareholders to vote the WHITE proxy card FOR only

Disney’s 12 nominees and to visit VoteDisney.com for more information

BURBANK, Calif., February 26, 2024 – The Walt Disney Company (NYSE:DIS) Board of Directors today sent a letter to shareholders detailing the progress it has made and continues to make on its strategic priorities,

delivering on the promises it made just over one year ago.

The Board has been laser-focused on a strategy that will drive shareholder value. The Company has restored its cash dividend and subsequently increased the dividend payment declared for July 2024 by 50%. Disney is

also targeting $3 billion in share buybacks for FY24. As shared in its first quarter earnings, the Company has also made great strides in reigning in costs and is on track to meet or exceed its cost cutting target of $7.5 billion by the end of

FY24. Disney also reaffirmed it is on track to deliver $8 billion in free cash flow¹, and to reach profitability in its combined DTC streaming businesses² in Q4 FY24. Disney’s creative engines continue to be recognized with numerous nominations

across the TV and film industry.

Disney’s Board of Directors believes all of its 12 nominees are uniquely qualified to continue this important progress and create long-term shareholder value. The Board urges

shareholders to protect their investment and the future of the Company by voting the WHITE proxy card FOR only Disney’s 12 nominees NOW and not the Trian Group or Blackwells nominees. The 2024 Annual Meeting of Shareholders

will be held on April 3, 2024.

The Disney Board of Directors does not endorse the Trian Group nominees, Nelson Peltz and Jay Rasulo, or the Blackwells nominees, Craig Hatkoff, Jessica Schell and Leah Solivan, and believes that they are unqualified

to serve on Disney’s Board and preserve value creation for shareholders in this increasingly complex global landscape.

The Company’s proxy statement and other important information related to the Annual Meeting can be found at VoteDisney.com.

The Walt Disney Company PROMISES MADE: PROMISES KEPT Protect the Value of Your Disney Investment Vote the WHITE Proxy Card Today FOR Only Disney’s 12 Highly Qualified Director Nominees Dear Fellow

Shareholder, February 26, 2024 When Bob Iger returned as CEO in November 2022, he and the Board committed to an ambitious plan to restore long-term shareholder value. Just over a year later, they have delivered on that commitment, and the Company is

moving forward on a number of significant growth priorities. In spite of your Board’s record of success and the Company’s renewed growth strategy, two activist hedge funds could replace five current directors with their nominees, who we believe have

no meaningful plan to create shareholder value, do not have the qualifications or experience needed to be effective Disney directors, and could disrupt the Company’s significant progress. Protect the value of your Disney investment by voting TODAY on

the WHITE proxy card FOR only our 12 nominees. Please note that voting FOR more than 12 nominees will invalidate your vote on the election of directors. PROMISES MADE: PROMISES KEPT Since November 2022, your Board and management team: Restored the

cash dividend (paid in January 2024 and dividend payment declared for July 2024 was increased 50% over January 2024 payment) Announced a stock buyback program with $3B target in FY24 Are on track to meet or exceed $7.5B cost-cutting target by the end

of FY24, a $2B increase over our initial target Are on track to generate $8B in annual free cash flow in FY241, a 60% year-over-year increase Improved entertainment streaming operating income in Q1 FY24 by 86% year-over-year Expect to reach

PROFITABILITY in our DTC combined streaming businesses 2 in Q4 FY24 and deliver DOUBLE-DIGIT profit margins in the future Initiated a $60B, 10-year program to invest in and expand our parks and cruise line Reorganized Disney to put more

decision-making and authority with our CREATIVE TEAMS Oversaw a creative juggernaut that earned 20 ACADEMY AWARD NOMINATIONS, more than any other company, and had SIX OF THE TOP TEN most streamed movies across all streaming platforms in the U.S. in

2023 1 Free cash flow is a non-GAAP financial measure. The most comparable GAAP measure is cash provided by operations. See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the

most comparable GAAP measure at the end of this letter. 2 DTC streaming businesses operating income is a non-GAAP financial measure. The most comparable GAAP measures are segment operating income for the entertainment segment and the sports segment.

See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measures at the end of this letter. For more information, visit VoteDisney.com

Disney believes its 12 Board nominees are best qualified to provide diligent oversight of management and create sustainable shareholder value. The Board has been constructed with a diverse set of

skills and experiences in mind, all of which are critical to ensuring Disney’s success in an evolving and increasingly complex global landscape. Disney has continued to refresh its board with new, relevant skills to maintain pace with the changing

industry in which it operates, having added five new independent directors within the last three years. As a result, your Board of Directors is uniquely qualified to oversee the company as it continues to deliver on its transformation. In Contrast to

Our Highly Qualified Nominees and Their Successful Track Record, in our view, the Dissident Nominees Are Unqualified and Have No Meaningful Plan to Deliver Superior Shareholder Value One of the dissidents, the Trian Group, seeks to replace two

uniquely qualified directors, Michael B.G. Froman and Maria Elena Lagomasino, with Nelson Peltz, Trian’s CEO and Founder, and Jay Rasulo, a former Disney CFO who left the company eight years ago, before the dramatic industry-wide changes that have

affected our businesses. The Board believes both Ms. Lagomasino and Mr. Froman are far better qualified than either Mr. Peltz or Mr. Rasulo to help drive value for shareholders. Ms. Lagomasino is a seasoned financial leader and governance expert who

brings a strong shareholder perspective to the Board as a founder of the Institute for the Fiduciary Standard, a think tank committed to promoting the vital importance of the fiduciary standard in investment and financial advice, and the manager of

approximately $14B in assets as CEO of WE Family Offices. Mr. Peltz, by contrast, manages roughly half that amount at Trian, and Trian actually sold approximately 2.3M Disney shares since December 2022, including approximately 534,000 shares in the

fourth quarter of 2023, causing his clients to miss out on the recent appreciation of Disney’s stock price. Trian’s other nominee, Mr. Rasulo, has a track record of value destruction – during his tenure on the Board of Directors of iHeartMedia, the

stock price declined by 85%. Mr. Froman, President of the Council on Foreign Relations and former US Trade Representative, provides invaluable insights on complex geopolitical issues and associated risks and opportunities with our international

parks, distribution licenses and international markets and other key issues surrounding our global operations. Neither of Trian’s nominees have any such experience or qualifications in this vitally important area. “It’s odd to see a company and/or an

investment manager sell shares during a proxy fight. […] why, why would you do that if you’re in a proxy fight [...] It is rare, following these things to see that, unless they had redemptions that they had to sell some stock for.”–David Faber, CNBC:

Squawk on the Street: Trian Decreases Disney Stake, 2/15/24 “[Peltz] wants to be on the coattails of greatness. He can see that this thing [Disney] is about to take a big upswing and that Iger knows exactly what he is doing.”–Jeffrey A. Sonnenfeld,

Senior Associate Dean for Leadership Studies & Lester Crown Professor in the Practice of Management, Yale School of Management, The Compound, 2/5/24 For more information, visit VoteDisney.com

Blackwells Capital, a recent investor in Disney which beneficially owns just 157,131 shares, has not designated any specific Disney nominees for replacement. Its nominees are also unqualified for

election to Disney’s Board. Its financial engineering “program” largely consists of spinning off our land and hotels into a separate real estate investment trust and breaking up the remainder of the company into separate entities, demonstrating a

complete misunderstanding of Disney’s strengths derived from the synergies across our businesses. We urge shareholders to protect their investment and the future of the Company by voting the WHITE proxy card FOR only Disney’s 12 nominees and not the

Trian Group or Blackwells nominees. Thank you again for your investment in and commitment to The Walt Disney Company. Sincerely, The Walt Disney Company Board of Directors REMEMBER, VOTE “FOR” ONLY THE 12 DISNEY NOMINEES! Voting by Internet is quick

and easy—just follow the instructions on the WHITE proxy card. However, if voting by telephone or mail is more convenient for you, please keep careful track of your “FOR” votes and vote “FOR” only the twelve Disney nominees. X COMPANY NOMINEES

Recommended by your board Mary T. Barra Safra A. Catz Amy L. Chang D. Jeremy Darroch Carolyn N. Everson Michael B.G. Froman James P. Gorman Robert A . Iger Maria Elena Lagomasino Calvin R. McDonald Mark G. Parker Derica W. Rice FOR WITHHOLD WHITE

CARD TRIAN GROUP NOMINEES Opposed by the company Nelson Peltz James Rasulo BLACKWELLS NOMINEES Opposed by the company Craig Hatkoff Jessica Schell Leah Solivan If you have any questions about how to vote your shares, please call the firm assisting us

with the solicitation of proxies: INNISFREE M&A INCORPORATED Shareholders may call: 1 (877) 456-3463 (toll-free from the U.S. and Canada) or +1 (412) 232-3651 (from other countries) Remember, please do not use any blue Trian or green Blackwells

proxy card. If you inadvertently vote using a blue or green proxy card, you may cancel that vote simply by voting again TODAY using the Company’s WHITE proxy card. Only your latest-dated vote will count! For more information, visit VoteDisney.com

Forward-Looking Statements Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements

regarding the Company’s expectations; beliefs; plans; strategies; business or financial prospects or outlook; future shareholder value; expected growth and value creation; earnings expectations; expected drivers and guidance; profitability;

investments, including free cash flow and funding sources; expected benefits of new initiatives; cost reductions and efficiencies; capital allocation, including dividends or share repurchases; content offerings; priorities or performance; and other

statements that are not historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not

undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied.

Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations),

our execution of our business plans (including the content we create and intellectual property we invest in, our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost

rationalization while preserving revenue, the discovery of additional information or other business decisions, as well as from developments beyond the Company’s control, including: the occurrence of subsequent events; deterioration in domestic or

global economic conditions or failure of conditions to improve as anticipated, including heightened inflation, capital market volatility, interest rate and currency rate fluctuations and economic slowdown or recession; deterioration in or pressures

from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising revenue, consumer preferences and acceptance of our content and offerings, pricing model and price increases,

and corresponding subscriber additions and churn, and the market for advertising and sales on our direct-to-consumer services and linear networks; health concerns and their impact on our businesses and productions; international, political or

military developments; regulatory or legal developments; technological developments; labor markets and activities, including work stoppages; adverse weather conditions or natural disasters; and availability of content. Such developments may further

affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our operations, business plans or profitability, including direct-to-consumer profitability; our expected benefits

of the composition of the Board; demand for our products and services; the performance of the Company’s content; our ability to create or obtain desirable content at or under the value we assign the content; the advertising market for programming;

income tax expense; and performance of some or all Company businesses either directly or through their impact on those who distribute our products. Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended

September 30, 2023, including under the captions “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, and subsequent filings with the Securities and Exchange Commission (the “SEC”),

including, among others, quarterly reports on Form 10-Q. Additional Information and Where to Find It Disney has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its

solicitation of proxies for Disney’s 2024 Annual Meeting of Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY DISNEY AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Disney

free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Disney are also available free of charge by accessing Disney’s website at www.disney.com/investors. Participants Disney, its directors and

executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Disney. Information about Disney’s executive officers and directors is available in Disney’s

definitive proxy statement for its 2024 Annual Meeting, which was filed with the SEC on February 1, 2024. To the extent holdings by our directors and executive officers of Disney securities reported in the proxy statement for the 2024 Annual

Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov. Non-GAAP

Financial Measures This presentation includes the presentation and discussion of certain financial information that differs from what is reported under U.S. GAAP, including free cash flow and DTC streaming businesses operating income. These

measures should be reviewed in conjunction with the most comparable GAAP financial measures and should not be considered substitutes for, or superior to, those GAAP financial measures. “Free cash flow” is a non-GAAP financial measure calculated as

cash provided by continuing operations less investments in parks, resorts and other property. Disney’s management believes that information about free cash flow provides investors with an important perspective on the cash available to service debt

obligations, make strategic acquisitions and investments and pay dividends or repurchase shares. Disney is not providing forward-looking measures for cash provided by continuing operations, which is the most directly comparable GAAP measure, or a

quantitative reconciliation of the forward-looking free cash flow to that most directly comparable GAAP measure. Disney is unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the GAAP measure

without unreasonable effort. Information about other adjusting items that is currently not available to Disney could have a potentially unpredictable and significant impact on its future GAAP financial results. “DTC streaming businesses operating

income” is a non-GAAP financial measure calculated as entertainment segment direct-to-consumer operating income plus ESPN+ operating income from the sports segment. Disney’s management believes that information about DTC streaming businesses

operating income provides investors with the performance of its portfolio of streaming businesses and progress against Disney’s goal of reaching profitability in its combined streaming businesses. Disney is not providing forward-looking measures

for operating income for the entertainment and sports segments, which are the most directly comparable GAAP measures, or a quantitative reconciliation of the forward-looking DTC streaming businesses operating income to those most directly

comparable GAAP measures. Disney is unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the GAAP measures without unreasonable effort. Information about

other adjusting items that is currently not available to Disney could have a potentially unpredictable and significant impact on its future GAAP financial results. For more information, visit VoteDisney.com

Media Contacts:

David Jefferson

The Walt Disney Company

Corporate Communications

(818) 560-4832

david.j.jefferson@disney.com

Mike Long

The Walt Disney Company

Corporate Communications

(818) 560-4588

mike.p.long@disney.com

Steve Lipin

Gladstone Place

(212) 230-5930

slipin@gladstoneplace.com

[1] Free cash flow is a non-GAAP financial measure. The most comparable GAAP measure is cash provided by operations. See how we define and calculate this measure and

why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measure at the end of the attached shareholder letter.

[2] DTC streaming businesses operating income is a non-GAAP financial measure. The most comparable GAAP measures are segment operating income for the entertainment

segment and the sports segment. See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measures at the end of the attached shareholder letter.

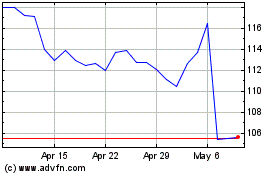

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

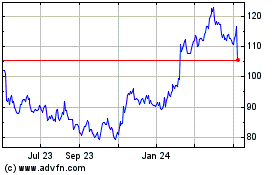

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Jul 2023 to Jul 2024