Confirms 2024 Guidance

EPR Properties (NYSE:EPR) today announced operating results for

the first quarter ended March 31, 2024 (dollars in thousands,

except per share data):

Three Months Ended March

31,

2024

2023

Total revenue

$

167,232

$

171,396

Net income available to common

shareholders

56,677

51,624

Net income available to common

shareholders per diluted common share

0.75

0.69

Funds From Operations as adjusted

(FFOAA)(1)

85,723

96,006

FFOAA per diluted common share (1)

1.13

1.26

Adjusted Funds From Operations (AFFO)

(1)

85,675

98,734

AFFO per diluted common share (1)

1.12

1.30

Note: Each of the measures above

include deferred rent and interest collections from cash basis

customers that were recognized as revenue of $0.6 million and $6.5

million for the three months ended March 31, 2024 and 2023,

respectively.

(1) A non-GAAP financial

measure.

First Quarter Company Headlines

- Executes on Investment Pipeline - During the first

quarter of 2024, the Company's investment spending totaled $85.7

million, which included $33.4 million for the acquisition of an

attraction property in New York and $14.7 million for the

acquisition and financing of land for two build-to-suit eat &

play developments in Kansas and Illinois, respectively.

- Strong Liquidity Position - As of March 31, 2024, the

Company had cash on hand of $59.5 million, no borrowings on its

$1.0 billion unsecured revolving credit facility and a consolidated

debt profile that is all at fixed interest rates with only $136.6

million maturing in August 2024.

- Increases Monthly Dividend - As previously announced,

the Company increased its monthly dividend by 3.6% to $0.285 per

share starting with the dividend paid on April 15, 2024 to common

shareholders of record as of March 28, 2024.

- Confirms 2024 Guidance - The Company is confirming FFOAA

per diluted common share guidance for 2024 of $4.76 to $4.96,

representing an increase of 3.2% at the midpoint over 2023 after

excluding the impact from both years of out-of-period deferred rent

and interest collections from cash-basis customers included in

income. The Company is also confirming investment spending guidance

for 2024 of $200.0 million to $300.0 million and disposition

proceeds guidance of $50.0 million to $75.0 million.

“During the first quarter, we continued the positive momentum we

experienced last year, as we focus on driving long-term reliable

earnings growth,” stated Company Chairman and CEO Greg Silvers. “We

are pleased to continue to source attractive relationship-based

opportunities to deploy capital into experiential assets across our

target experiential property types. We remain disciplined in an

ongoing uncertain environment and with our progress to date and

supported by our strong liquidity position, we are confirming

investment spending guidance for the year.”

Investment Update

The Company's investment spending during the three months ended

March 31, 2024 totaled $85.7 million and included $33.4 million for

the acquisition of an attraction property in New York and $14.7

million for the acquisition and financing of land for two

build-to-suit eat & play developments in Kansas and Illinois,

respectively. Investment spending for the quarter also included

experiential build-to-suit development and redevelopment

projects.

As of March 31, 2024, the Company has committed an additional

approximately $220.0 million for experiential development and

redevelopment projects, which is expected to be funded over the

next two years. The Company will continue to be more selective in

making investments, utilizing cash on hand, excess cash flow,

disposition proceeds and borrowings under our line of credit, until

such time as the Company's cost of capital improves.

Strong Liquidity Position

The Company remains focused on maintaining strong liquidity and

financial flexibility. The Company had $59.5 million of cash on

hand at quarter-end, no borrowings on its $1.0 billion unsecured

revolving credit facility and a consolidated debt profile that is

all at fixed interest rates with only $136.6 million maturing in

August 2024.

Capital Recycling

During the first quarter of 2024, the Company completed the sale

of two cultural properties and one vacant theatre property for net

proceeds totaling $46.2 million and recognized a gain on sale of

$17.9 million.

Portfolio Update

The Company's total assets were $5.7 billion (after accumulated

depreciation of approximately $1.5 billion) and total investments

(a non-GAAP financial measure) were $6.9 billion at March 31, 2024,

with Experiential investments totaling $6.4 billion, or 93%, and

Education investments totaling $0.5 billion, or 7%.

The Company's Experiential portfolio (excluding property under

development and undeveloped land inventory) consisted of the

following property types (owned or financed) at March 31, 2024:

- 165 theatre properties;

- 58 eat & play properties (including seven theatres located

in entertainment districts);

- 24 attraction properties;

- 11 ski properties;

- seven experiential lodging properties;

- 21 fitness & wellness properties;

- one gaming property; and

- one cultural property.

As of March 31, 2024, the Company's owned Experiential portfolio

consisted of approximately 19.7 million square feet, which includes

0.5 million square feet of properties the Company intends to sell.

The Experiential portfolio, excluding the properties the Company

intends to sell, was 99% leased and included a total of $36.1

million in property under development and $20.2 million in

undeveloped land inventory.

The Company's Education portfolio consisted of the following

property types (owned or financed) at March 31, 2024:

- 61 early childhood education center properties; and

- nine private school properties.

As of March 31, 2024, the Company's owned Education portfolio

consisted of approximately 1.3 million square feet, which includes

39 thousand square feet of properties the Company intends to sell.

The Education portfolio, excluding the properties the Company

intends to sell, was 100% leased.

The combined owned portfolio consisted of 21.0 million square

feet and was 99% leased excluding the 0.5 million square feet of

properties the Company intends to sell.

Dividend Information

The Company's Board of Trustees declared its monthly cash

dividend to common shareholders of $0.285 per share, which was paid

on April 15, 2024 to shareholders of record as of March 28, 2024.

This dividend represents an annualized dividend of $3.42 per common

share, an increase of 3.6% over the prior year's annualized

dividend (based upon the monthly dividend at the end of the prior

year).

Additionally, the Board declared its regular quarterly dividends

to preferred shareholders of $0.359375 per share on both the

Company's 5.75% Series C cumulative convertible preferred shares

and Series G cumulative redeemable preferred shares and $0.5625 per

share on its 9.00% Series E cumulative convertible preferred

shares.

2024 Guidance

(Dollars in millions, except per share

data):

Measure

Net income available to common

shareholders per diluted common share

$

2.68

to

$

2.88

FFOAA per diluted common share

$

4.76

to

$

4.96

Investment spending

$

200.0

to

$

300.0

Disposition proceeds

$

50.0

to

$

75.0

The Company is confirming its 2024 earnings guidance for FFOAA

per diluted common share of $4.76 to $4.96, representing an

increase of 3.2% at the midpoint over 2023 after excluding the

impact from both years of out-of-period deferred rent and interest

collections from cash-basis customers included in income. The 2024

guidance for FFOAA per diluted common share is based on a FFO per

diluted common share range of $4.68 to $4.88 adjusted for

retirement and severance expense, transaction costs, provision

(benefit) for credit losses, net, and deferred income tax expense.

FFO per diluted common share for 2024 is based on a net income

available to common shareholders per diluted common share range of

$2.68 to $2.88 plus estimated real estate depreciation and

amortization of $2.16 and allocated share of joint venture

depreciation of $0.13, less estimated gain on sale of real estate

of $0.24 and the impact of Series C and Series E dilution of $0.05

(in accordance with the NAREIT definition of FFO).

Additional earnings guidance detail can be found in the

Company's supplemental information package available in the

Investor Center of the Company's website located at

https://investors.eprkc.com/earnings-supplementals.

Conference Call Information

Management will host a conference call to discuss the Company's

financial results on May 2, 2024 at 8:30 a.m. Eastern Time. The

call may also include discussion of Company developments and

forward-looking and other material information about business and

financial matters. The conference will be webcast and can be

accessed via the Webcasts page in the Investor Center on the

Company's website located at https://investors.eprkc.com/webcasts.

To access the audio-only call, visit the Webcasts page for the link

to register and receive dial-in information and a PIN providing

access to the live call. It is recommended that you join 10 minutes

prior to the start of the event (although you may register and

dial-in at any time during the call).

You may watch a replay of the webcast by visiting the Webcasts

page at https://investors.eprkc.com/webcasts.

Quarterly Supplemental

The Company's supplemental information package for the first

quarter ended March 31, 2024 is available in the Investor Center on

the Company's website located at

https://investors.eprkc.com/earnings-supplementals.

EPR Properties

Consolidated Statements of

Income

(Unaudited, dollars in

thousands except per share data)

Three Months Ended March

31,

2024

2023

Rental revenue

$

142,281

$

151,591

Other income

12,037

9,333

Mortgage and other financing income

12,914

10,472

Total revenue

167,232

171,396

Property operating expense

14,920

14,155

Other expense

12,976

8,950

General and administrative expense

13,908

13,965

Retirement and severance expense

1,836

—

Transaction costs

1

270

Provision (benefit) for credit losses,

net

2,737

587

Depreciation and amortization

40,469

41,204

Total operating expenses

86,847

79,131

Gain (loss) on sale of real estate

17,949

(560

)

Income from operations

98,334

91,705

Interest expense, net

31,651

31,722

Equity in loss from joint ventures

3,627

1,985

Income before income taxes

63,056

57,998

Income tax expense

347

341

Net income

$

62,709

$

57,657

Preferred dividend requirements

6,032

6,033

Net income available to common

shareholders of EPR Properties

$

56,677

$

51,624

Net income available to common

shareholders of EPR Properties per share:

Basic

$

0.75

$

0.69

Diluted

$

0.75

$

0.69

Shares used for computation (in

thousands):

Basic

75,398

75,084

Diluted

75,705

75,283

EPR Properties

Condensed Consolidated Balance

Sheets

(Unaudited, dollars in

thousands)

March 31, 2024

December 31, 2023

Assets

Real estate investments, net of

accumulated depreciation of $1,470,507 and $1,435,683 at March 31,

2024 and December 31, 2023, respectively

$

4,629,859

$

4,537,359

Land held for development

20,168

20,168

Property under development

36,138

131,265

Operating lease right-of-use assets

183,031

186,628

Mortgage notes and related accrued

interest receivable, net

578,915

569,768

Investment in joint ventures

46,127

49,754

Cash and cash equivalents

59,476

78,079

Restricted cash

2,929

2,902

Accounts receivable

69,414

63,655

Other assets

67,979

61,307

Total assets

$

5,694,036

$

5,700,885

Liabilities and Equity

Accounts payable and accrued

liabilities

$

84,153

$

94,927

Operating lease liabilities

223,077

226,961

Dividends payable

28,950

31,307

Unearned rents and interest

91,829

77,440

Debt

2,817,710

2,816,095

Total liabilities

3,245,719

3,246,730

Total equity

$

2,448,317

$

2,454,155

Total liabilities and equity

$

5,694,036

$

5,700,885

Non-GAAP Financial Measures

Funds From Operations (FFO), Funds From Operations As

Adjusted (FFOAA) and Adjusted Funds From Operations (AFFO)

The National Association of Real Estate Investment Trusts

(NAREIT) developed FFO as a relative non-GAAP financial measure of

performance of an equity REIT in order to recognize that

income-producing real estate historically has not depreciated on

the basis determined under GAAP. Pursuant to the definition of FFO

by the Board of Governors of NAREIT, the Company calculates FFO as

net income available to common shareholders, computed in accordance

with GAAP, excluding gains and losses from disposition of real

estate and impairment losses on real estate, plus real estate

related depreciation and amortization, and after adjustments for

unconsolidated partnerships, joint ventures and other affiliates.

Adjustments for unconsolidated partnerships, joint ventures and

other affiliates are calculated to reflect FFO on the same basis.

The Company has calculated FFO for all periods presented in

accordance with this definition.

In addition to FFO, the Company presents FFOAA and AFFO. FFOAA

is presented by adding to FFO retirement and severance expense,

transaction costs, provision (benefit) for credit losses, net,

costs associated with loan refinancing or payoff, preferred share

redemption costs and impairment of operating lease right-of-use

assets and subtracting sale participation income, gain on insurance

recovery and deferred income tax (benefit) expense. AFFO is

presented by adding to FFOAA non-real estate depreciation and

amortization, deferred financing fees amortization and share-based

compensation expense to management and Trustees; and subtracting

amortization of above and below market leases, net and tenant

allowances, maintenance capital expenditures (including second

generation tenant improvements and leasing commissions),

straight-lined rental revenue (removing the impact of

straight-lined ground sublease expense), and the non-cash portion

of mortgage and other financing income.

FFO, FFOAA and AFFO are widely used measures of the operating

performance of real estate companies and are provided here as

supplemental measures to GAAP net income available to common

shareholders and earnings per share, and management provides FFO,

FFOAA and AFFO herein because it believes this information is

useful to investors in this regard. FFO, FFOAA and AFFO are

non-GAAP financial measures. FFO, FFOAA and AFFO do not represent

cash flows from operations as defined by GAAP and are not

indicative that cash flows are adequate to fund all cash needs and

are not to be considered alternatives to net income or any other

GAAP measure as a measurement of the results of our operations or

our cash flows or liquidity as defined by GAAP. It should also be

noted that not all REITs calculate FFO, FFOAA and AFFO the same way

so comparisons with other REITs may not be meaningful.

The following table summarizes FFO, FFOAA and AFFO for the three

months ended March 31, 2024 and 2023 and reconciles such measures

to net income available to common shareholders, the most directly

comparable GAAP measure:

EPR Properties

Reconciliation of Non-GAAP

Financial Measures

(Unaudited, dollars in

thousands except per share data)

Three Months Ended March

31,

2024

2023

FFO:

Net income available to common

shareholders of EPR Properties

$

56,677

$

51,624

(Gain) loss on sale of real estate

(17,949

)

560

Real estate depreciation and

amortization

40,282

41,000

Allocated share of joint venture

depreciation

2,416

2,055

FFO available to common shareholders of

EPR Properties

$

81,426

$

95,239

FFO available to common shareholders of

EPR Properties

$

81,426

$

95,239

Add: Preferred dividends for Series C

preferred shares

1,938

1,938

Add: Preferred dividends for Series E

preferred shares

1,938

1,938

Diluted FFO available to common

shareholders of EPR Properties

$

85,302

$

99,115

FFOAA:

FFO available to common shareholders of

EPR Properties

$

81,426

$

95,239

Retirement and severance expense

1,836

—

Transaction costs

1

270

Provision (benefit) for credit losses,

net

2,737

587

Deferred income tax benefit

(277

)

(90

)

FFOAA available to common shareholders of

EPR Properties

$

85,723

$

96,006

FFOAA available to common shareholders of

EPR Properties

$

85,723

$

96,006

Add: Preferred dividends for Series C

preferred shares

1,938

1,938

Add: Preferred dividends for Series E

preferred shares

1,938

1,938

Diluted FFOAA available to common

shareholders of EPR Properties

$

89,599

$

99,882

AFFO:

FFOAA available to common shareholders of

EPR Properties

$

85,723

$

96,006

Non-real estate depreciation and

amortization

187

204

Deferred financing fees amortization

2,212

2,129

Share-based compensation expense to

management and trustees

3,692

4,322

Amortization of above and below market

leases, net and tenant allowances

(84

)

(89

)

Maintenance capital expenditures (1)

(1,555

)

(2,176

)

Straight-lined rental revenue

(3,670

)

(2,105

)

Straight-lined ground sublease expense

32

565

Non-cash portion of mortgage and other

financing income

(862

)

(122

)

AFFO available to common shareholders of

EPR Properties

$

85,675

$

98,734

AFFO available to common shareholders of

EPR Properties

$

85,675

$

98,734

Add: Preferred dividends for Series C

preferred shares

1,938

1,938

Add: Preferred dividends for Series E

preferred shares

1,938

1,938

Diluted AFFO available to common

shareholders of EPR Properties

$

89,551

$

102,610

FFO per common share:

Basic

$

1.08

$

1.27

Diluted

1.07

1.25

FFOAA per common share:

Basic

$

1.14

$

1.28

Diluted

1.13

1.26

AFFO per common share:

Basic

$

1.14

$

1.31

Diluted

1.12

1.30

Shares used for computation (in

thousands):

Basic

75,398

75,084

Diluted

75,705

75,283

Weighted average shares

outstanding-diluted EPS

75,705

75,283

Effect of dilutive Series C preferred

shares

2,301

2,272

Effect of dilutive Series E preferred

shares

1,663

1,663

Adjusted weighted average shares

outstanding-diluted Series C and Series E

79,669

79,218

Other financial information:

Dividends per common share

$

0.8350

$

0.8250

(1) Includes maintenance capital expenditures and certain second

generation tenant improvements and leasing commissions.

The conversion of the 5.75% Series C cumulative convertible

preferred shares and the 9.00% Series E cumulative convertible

preferred shares would be dilutive to FFO, FFOAA and AFFO per share

for the three months ended March 31, 2024 and 2023. Therefore, the

additional common shares that would result from the conversion and

the corresponding add-back of the preferred dividends declared on

those shares are included in the calculation of diluted FFO, FFOAA

and AFFO per share for those periods.

Net Debt

Net Debt represents debt (reported in accordance with GAAP)

adjusted to exclude deferred financing costs, net and reduced for

cash and cash equivalents. By excluding deferred financing costs,

net, and reducing debt for cash and cash equivalents on hand, the

result provides an estimate of the contractual amount of borrowed

capital to be repaid, net of cash available to repay it. The

Company believes this calculation constitutes a beneficial

supplemental non-GAAP financial disclosure to investors in

understanding our financial condition. The Company's method of

calculating Net Debt may be different from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

Gross Assets

Gross Assets represents total assets (reported in accordance

with GAAP) adjusted to exclude accumulated depreciation and reduced

for cash and cash equivalents. By excluding accumulated

depreciation and reducing cash and cash equivalents, the result

provides an estimate of the investment made by the Company. The

Company believes that investors commonly use versions of this

calculation in a similar manner. The Company's method of

calculating Gross Assets may be different from methods used by

other REITs and, accordingly, may not be comparable to such other

REITs.

Net Debt to Gross Assets Ratio

Net Debt to Gross Assets Ratio is a supplemental measure derived

from non-GAAP financial measures that the Company uses to evaluate

capital structure and the magnitude of debt to gross assets. The

Company believes that investors commonly use versions of this ratio

in a similar manner. The Company's method of calculating the Net

Debt to Gross Assets Ratio may be different from methods used by

other REITs and, accordingly, may not be comparable to such other

REITs.

EBITDAre

NAREIT developed EBITDAre as a relative non-GAAP financial

measure of REITs, independent of a company's capital structure, to

provide a uniform basis to measure the enterprise value of a

company. Pursuant to the definition of EBITDAre by the Board of

Governors of NAREIT, the Company calculates EBITDAre as net income,

computed in accordance with GAAP, excluding interest expense (net),

income tax (benefit) expense, depreciation and amortization, gains

and losses from dispositions of real estate, impairment losses on

real estate, costs associated with loan refinancing or payoff and

adjustments for unconsolidated partnerships, joint ventures and

other affiliates.

Management provides EBITDAre herein because it believes this

information is useful to investors as a supplemental performance

measure because it can help facilitate comparisons of operating

performance between periods and with other REITs. The Company's

method of calculating EBITDAre may be different from methods used

by other REITs and, accordingly, may not be comparable to such

other REITs. EBITDAre is not a measure of performance under GAAP,

does not represent cash generated from operations as defined by

GAAP and is not indicative of cash available to fund all cash

needs, including distributions. This measure should not be

considered an alternative to net income or any other GAAP measure

as a measurement of the results of the Company's operations or cash

flows or liquidity as defined by GAAP.

Adjusted EBITDAre

Management uses Adjusted EBITDAre in its analysis of the

performance of the business and operations of the Company.

Management believes Adjusted EBITDAre is useful to investors

because it excludes various items that management believes are not

indicative of operating performance, and because it is an

informative measure to use in computing various financial ratios to

evaluate the Company. The Company defines Adjusted EBITDAre as

EBITDAre (defined above) for the quarter excluding sale

participation income, gain on insurance recovery, retirement and

severance expense, transaction costs, provision (benefit) for

credit losses, net, impairment losses on operating lease

right-of-use assets and prepayment fees.

The Company's method of calculating Adjusted EBITDAre may be

different from methods used by other REITs and, accordingly, may

not be comparable to such other REITs. Adjusted EBITDAre is not a

measure of performance under GAAP, does not represent cash

generated from operations as defined by GAAP and is not indicative

of cash available to fund all cash needs, including distributions.

This measure should not be considered as an alternative to net

income or any other GAAP measure as a measurement of the results of

the Company's operations or cash flows or liquidity as defined by

GAAP.

Net Debt to Adjusted EBITDAre Ratio

Net Debt to Adjusted EBITDAre Ratio is a supplemental measure

derived from non-GAAP financial measures that the Company uses to

evaluate our capital structure and the magnitude of our debt

against our operating performance. The Company believes that

investors commonly use versions of this ratio in a similar manner.

In addition, financial institutions use versions of this ratio in

connection with debt agreements to set pricing and covenant

limitations. The Company's method of calculating the Net Debt to

Adjusted EBITDAre Ratio may be different from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

Reconciliations of debt, total assets and net income (all

reported in accordance with GAAP) to Net Debt, Gross Assets, Net

Debt to Gross Assets Ratio, EBITDAre, Adjusted EBITDAre and Net

Debt to Adjusted EBITDAre Ratio (each of which is a non-GAAP

financial measure), as applicable, are included in the following

tables (unaudited, in thousands except ratios):

March 31,

2024

2023

Net

Debt:

Debt

$

2,817,710

$

2,811,653

Deferred financing costs, net

23,519

29,576

Cash and cash equivalents

(59,476

)

(96,438

)

Net Debt

$

2,781,753

$

2,744,791

Gross

Assets:

Total Assets

$

5,694,036

$

5,756,615

Accumulated depreciation

1,470,507

1,341,527

Cash and cash equivalents

(59,476

)

(96,438

)

Gross Assets

$

7,105,067

$

7,001,704

Debt to Total Assets Ratio

49

%

49

%

Net Debt to Gross Assets Ratio

39

%

39

%

Three Months Ended March

31,

2024

2023

EBITDAre and

Adjusted EBITDAre:

Net income

$

62,709

$

57,657

Interest expense, net

31,651

31,722

Income tax expense

347

341

Depreciation and amortization

40,469

41,204

(Gain) loss on sale of real estate

(17,949

)

560

Allocated share of joint venture

depreciation

2,416

2,055

Allocated share of joint venture interest

expense

2,131

2,083

EBITDAre

$

121,774

$

135,622

Retirement and severance expense

1,836

—

Transaction costs

1

270

Provision (benefit) for credit losses,

net

2,737

587

Adjusted EBITDAre

$

126,348

$

136,479

Adjusted EBITDAre (annualized) (1)

$

505,392

$

545,916

Net Debt/Adjusted EBITDAre Ratio

5.5

5.0

(1) Adjusted EBITDA for the quarter is

multiplied by four to calculate an annualized amount but does not

include the annualization of investments put in service, acquired

or disposed of during the quarter, as well as the potential

earnings on property under development, the annualization of

percentage rent and participating interest and adjustments for

other items. See detailed calculation and reconciliation of

Annualized Adjusted EBITDAre and Net Debt/Annualized EBITDAre ratio

that includes these adjustments in the Company's Supplemental

Operating and Financial Data for the quarter ended March 31,

2024.

Total Investments

Total investments is a non-GAAP financial measure defined as the

sum of the carrying values of real estate investments (before

accumulated depreciation), land held for development, property

under development, mortgage notes receivable and related accrued

interest receivable, net, investment in joint ventures, intangible

assets, gross (before accumulated amortization and included in

other assets) and notes receivable and related accrued interest

receivable, net (included in other assets). Total investments is a

useful measure for management and investors as it illustrates

across which asset categories the Company's funds have been

invested. Our method of calculating total investments may be

different from methods used by other REITs and, accordingly, may

not be comparable to such other REITs. A reconciliation of total

assets (computed in accordance with GAAP) to total investments is

included in the following table (unaudited, in thousands):

March 31, 2024

December 31, 2023

Total assets

$

5,694,036

$

5,700,885

Operating lease right-of-use assets

(183,031

)

(186,628

)

Cash and cash equivalents

(59,476

)

(78,079

)

Restricted cash

(2,929

)

(2,902

)

Accounts receivable

(69,414

)

(63,655

)

Add: accumulated depreciation on real

estate investments

1,470,507

1,435,683

Add: accumulated amortization on

intangible assets (1)

30,934

30,589

Prepaid expenses and other current assets

(1)

(30,093

)

(22,718

)

Total investments

$

6,850,534

$

6,813,175

Total Investments:

Real estate investments, net of

accumulated depreciation

$

4,629,859

$

4,537,359

Add back accumulated depreciation on real

estate investments

1,470,507

1,435,683

Land held for development

20,168

20,168

Property under development

36,138

131,265

Mortgage notes and related accrued

interest receivable, net

578,915

569,768

Investment in joint ventures

46,127

49,754

Intangible assets, gross (1)

65,073

65,299

Notes receivable and related accrued

interest receivable, net (1)

3,747

3,879

Total investments

$

6,850,534

$

6,813,175

(1) Included in other assets in the

accompanying consolidated balance sheet. Other assets include the

following:

March 31, 2024

December 31, 2023

Intangible assets, gross

$

65,073

$

65,299

Less: accumulated amortization on

intangible assets

(30,934

)

(30,589

)

Notes receivable and related accrued

interest receivable, net

3,747

3,879

Prepaid expenses and other current

assets

30,093

22,718

Total other assets

$

67,979

$

61,307

About EPR Properties

EPR Properties (NYSE:EPR) is the leading diversified

experiential net lease real estate investment trust (REIT),

specializing in select enduring experiential properties in the real

estate industry. We focus on real estate venues that create value

by facilitating out of home leisure and recreation experiences

where consumers choose to spend their discretionary time and money.

We have total assets of approximately $5.7 billion (after

accumulated depreciation of approximately $1.5 billion) across 44

states. We adhere to rigorous underwriting and investing criteria

centered on key industry, property and tenant level cash flow

standards. We believe our focused approach provides a competitive

advantage and the potential for stable and attractive returns.

Further information is available at www.eprkc.com.

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

The financial results in this press release reflect preliminary,

unaudited results, which are not final until the Company’s

Quarterly Report on Form 10-Q is filed. With the exception of

historical information, certain statements contained or

incorporated by reference herein may contain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

such as those pertaining to our guidance, our capital resources and

liquidity, our pursuit of growth opportunities, the timing of

transaction closings and investment spending, our expected cash

flows, the performance of our customers, our expected cash

collections and our results of operations and financial condition.

The forward-looking statements presented herein are based on the

Company's current expectations. Forward-looking statements involve

numerous risks and uncertainties, and you should not rely on them

as predictions of actual events. There is no assurance that the

events or circumstances reflected in the forward-looking statements

will occur. You can identify forward-looking statements by use of

words such as “will be,” “intend,” “continue,” “believe,” “may,”

“expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,”

“estimates,” “offers,” “plans,” “would” or other similar

expressions or other comparable terms or discussions of strategy,

plans or intentions contained or incorporated by reference herein.

Forward-looking statements necessarily are dependent on

assumptions, data or methods that may be incorrect or imprecise.

These forward-looking statements represent our intentions, plans,

expectations and beliefs and are subject to numerous assumptions,

risks and uncertainties. Many of the factors that will determine

these items are beyond our ability to control or predict. For

further discussion of these factors see “Item 1A. Risk Factors” in

our most recent Annual Report on Form 10-K and, to the extent

applicable, our Quarterly Reports on Form 10-Q.

For these statements, we claim the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements, which speak only as of

the date hereof or the date of any document incorporated by

reference herein. All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. Except as

required by law, we do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances after the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501831702/en/

EPR Properties Brian Moriarty, 816-472-1700 www.eprkc.com

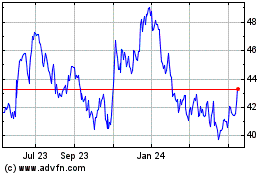

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

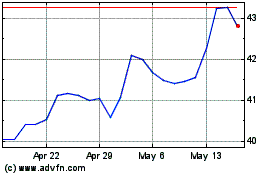

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Jan 2024 to Jan 2025