UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of December 2024

Commission File Number: 001-40459

Ero Copper Corp.

(Translation of registrant's name into English)

625 Howe Street, Suite 1050

Vancouver, British Columbia V6C 2T6

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [ X ]

Exhibit 99.1 of this Form 6-K is incorporated by reference as an additional exhibit to the registrant’s Registration Statement on Form S-8 (File NO. 333-264821) and Registration Statement on Form F-10 (File NO. 333-274097).

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Ero Copper Corp. |

| | | |

| Date: December 3, 2024 | By: | /s/ Deepk Hundal |

| | | Name: Deepk Hundal |

| | | Title: SVP, General Counsel and Corporate Secretary |

| | | |

EXHIBIT 99.1

Ero Copper Announces Updated Mineral Reserve and Resource Estimates

for the Xavantina Operations

VANCOUVER, British Columbia, Dec. 03, 2024 (GLOBE NEWSWIRE) -- Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the

“Company”) is pleased to announce an update of its National Instrument 43-101 (“NI 43-101”) compliant mineral

reserve and resource estimates for its Xavantina Operations, located in Mato Grosso State, Brazil. The updated mineral reserve and mineral

resource estimates incorporate drilling activities and mining depletion on the properties through June 30, 2024.

HIGHLIGHTS

- 19% increase in proven and probable mineral reserves as compared to the 2023 estimate, including a 24%

increase at the Santo Antônio Vein.

- Proven and probable mineral reserve compound annual growth rate ("CAGR") of approximately 62% from 2018

to 2024.

- 26% increase in measured and indicated mineral resources, inclusive of mineral reserves, as compared to

the 2023 estimate, including a 31% increase at the Santo Antônio Vein.

- Excess mill capacity of approximately 25% continues to offer further expansion potential in the near-

and medium-term.

"Our ongoing exploration program at the Xavantina Operations continues to deliver exceptional results," stated

David Strang, Chief Executive Officer. "When we acquired this asset in 2016, it had no mineral reserves, no mine life, and annual

production of just 25,000 ounces. We have since transformed it into a robust operation with nearly 600,000 ounces of measured and indicated

resources, including 459,000 ounces of proven and probable reserves. The successful completion of our NX 60 Initiative in 2023, highlighted

by first production from the Matinha Vein, was a major milestone, positioning Xavantina to sustain annual production of approximately

55,000 to 60,000 ounces in the years ahead.

"We are equally excited about Xavantina's untapped potential, both near the mine and regionally. Our dual strategy

remains focused on extending mine life and discovering new vein structures to expand mine and mill feed, enabling us to fully utilize

the mill’s installed capacity of up to 300,000 tonnes per annum."

Xavantina Operations Proven & Probable Mineral Reserve Evolution Since IPO

Note: Mineral reserve estimates were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum

(“CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “CIM

Standards”), and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on

November 29, 2019 (the “CIM Guidelines”), using geostatistical and/or classical methods, plus economic and mining parameters

appropriate for the deposit. Please refer to the Notes on Mineral Reserves and Mineral Resources section of this press release for a discussion

on the assumptions, parameters and methods used to estimate the mineral reserves for 2024. 2024 mineral reserve estimate effective date

of June 30, 2024. Please see the 2018 Xavantina Technical Report, the 2019 Xavantina Technical Report, the 2020 Xavantina Technical Report,

the January 2022 Press Release, the 2022 Xavantina Technical Report and the 2023 AIF, as applicable and as defined below, for a discussion

on the assumptions, parameters and methods used to estimate the mineral reserves for 2018, 2019, 2020, 2021, 2022 and 2023, respectively.

All figures have been rounded to the relative accuracy of the estimates.

2024 MINERAL RESERVE AND RESOURCE ESTIMATE

| |

2023

Mineral Reserves &

Resources

|

2024

Mineral Reserves &

Resources

|

Change |

| |

Tonnes |

|

Grade |

|

Contained |

|

Tonnes |

|

Grade |

|

Contained |

|

Contained

|

|

% |

| (kt) |

|

(Au gpt) |

|

Au (koz) |

|

(kt) |

|

(Au gpt) |

|

Au (koz) |

|

Au

(koz)

|

|

|

| Santo Antônio

Vein |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven Reserves |

290 |

|

8.57 |

|

80.0 |

|

223 |

|

9.68 |

|

69.4 |

|

(10.5) |

|

|

(13) |

|

| Probable Reserves |

1,072 |

|

7.80 |

|

268.7 |

|

1,155 |

|

9.76 |

|

362.3 |

|

93.6 |

|

|

35 |

|

| Proven & Probable Reserves |

1,362 |

|

7.96 |

|

348.7 |

|

1,378 |

|

9.75 |

|

431.8 |

|

83.1 |

|

|

24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Measured Resources |

277 |

|

10.54 |

|

93.7 |

|

333 |

|

9.57 |

|

102.3 |

|

8.7 |

|

|

9 |

|

| Indicated Resources |

1,042 |

|

9.92 |

|

332.2 |

|

1,222 |

|

11.57 |

|

454.6 |

|

122.3 |

|

|

37 |

|

| Measured & Indicated |

1,318 |

|

10.05 |

|

425.9 |

|

1,554 |

|

11.15 |

|

556.9 |

|

131.0 |

|

|

31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inferred Resources |

154 |

|

9.05 |

|

45.0 |

|

259 |

|

13.49 |

|

112.2 |

|

67.2 |

|

|

150 |

|

| Matinha Vein |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven Reserves |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

| Probable Reserves |

144 |

|

7.81 |

|

36.1 |

|

93 |

|

9.20 |

|

27.5 |

|

(8.6) |

|

|

(24) |

|

| Proven & Probable Reserves |

144 |

|

7.81 |

|

36.1 |

|

93 |

|

9.20 |

|

27.5 |

|

(8.6) |

|

|

(24) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Measured Resources |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

| Indicated Resources |

150 |

|

9.90 |

|

47.6 |

|

130 |

|

9.59 |

|

40.1 |

|

(7.5) |

|

|

(16) |

|

| Measured & Indicated |

150 |

|

9.90 |

|

47.6 |

|

130 |

|

9.59 |

|

40.1 |

|

(7.5) |

|

|

(16) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inferred Resources |

202 |

|

11.94 |

|

77.5 |

|

216 |

|

11.54 |

|

80.3 |

|

2.7 |

|

|

4 |

|

| Brás & Buracão Veins |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Measured Resources |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

| Indicated Resources |

7 |

|

3.36 |

|

0.7 |

|

7 |

|

3.36 |

|

0.7 |

|

— |

|

|

— |

|

| Measured & Indicated |

7 |

|

3.36 |

|

0.7 |

|

7 |

|

3.36 |

|

0.7 |

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inferred Resources |

157 |

|

4.71 |

|

23.8 |

|

157 |

|

4.71 |

|

23.8 |

|

— |

|

|

— |

|

| Total Xavantina Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven Reserves |

290 |

|

8.57 |

|

80.0 |

|

223 |

|

9.68 |

|

69.4 |

|

(10.5) |

|

|

(13) |

|

| Probable Reserves |

1,215 |

|

7.80 |

|

304.8 |

|

1,248 |

|

9.72 |

|

389.8 |

|

85.1 |

|

|

28 |

|

| Proven & Probable Reserves |

1,505 |

|

7.95 |

|

384.7 |

|

1,471 |

|

9.71 |

|

459.2 |

|

74.5 |

|

|

19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Measured Resources |

277 |

|

10.54 |

|

93.7 |

|

333 |

|

9.57 |

|

102.3 |

|

8.7 |

|

|

9 |

|

| Indicated Resources |

1,198 |

|

9.88 |

|

380.6 |

|

1,359 |

|

11.34 |

|

495.4 |

|

114.9 |

|

|

30 |

|

| Measured & Indicated Resources |

1,474 |

|

10.00 |

|

474.2 |

|

1,691 |

|

10.99 |

|

597.8 |

|

123.5 |

|

|

26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inferred Resources |

513 |

|

8.86 |

|

146.2 |

|

632 |

|

10.64 |

|

216.2 |

|

70.0 |

|

|

48 |

|

Note: 2024 mineral reserve and resource estimates are effective as at June 30, 2024. 2023 mineral reserve and

resource estimates are effective as at December 31, 2023. Presented mineral resources are inclusive of mineral reserves. All figures have

been rounded to reflect the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are

not mineral reserves do not have a demonstrated economic viability. See below notes on mineral reserve and resource estimates for additional

technical and scientific information.

NOTES ON MINERAL RESERVES AND RESOURCES

The 2024 mineral reserve and mineral resource estimates are effective as at June 30, 2024. Mineral resources are presented,

including mineral reserves. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to

rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

The 2024 mineral reserve and resource estimates for the Xavantina Operations are prepared under the supervision of

and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) and Resource Manager of

the Company who is a “qualified person” within the meanings of NI 43-101.

Reference herein of $ or USD is to United States dollars and BRL is to Brazilian reais. Mineral Reserves for the Xavantina

Operations have been estimated using a gold price of $1,900/oz, and the exchange rate used for mineral reserve and resource estimates

was USD/BRL 5.10.

Grade shells using a value of 1.20 gpt gold were used to generate a 3D mineralization model of the Xavantina Operations.

Within the grade shells, mineral resources were estimated using ordinary kriging within 10 meter by 10 meter by 2 meter block size, with

a minimum sub- block size of 1.0 meter by 1.0 meter by 0.5 meter, and the mineral resource estimate was constrained using a minimum stope

dimension of 2.0 meters by 2.0 meters by 1.5 meters, a cut-off of 1.20 gpt based on underground mining and processing costs of US$72 per

tonne and a gold price of US$1,900 per ounce.

The 2024 mineral reserve estimates were prepared in accordance with the CIM Standards and the CIM Guidelines, using

geostatistical and/or classical methods, plus economic and mining parameters appropriate for the deposit. Mineral reserves are the economic

portion of the measured and indicated mineral resources. Mineral reserve estimates include operational dilution of 17.4% plus planned

dilution of approximately 8.5% within each stope for room- and-pillar mining areas and operational dilution of 3.2% plus planned dilution

of 21.2% for cut-and-fill mining areas. Mining recovery of 92.5% and 94.7% assumed for room-and-pillar and cut-and-fill areas, respectively.

Practical mining shapes (wireframes) were designed using geological wireframes / mineral resource block models as a guide.

Where applicable, for scientific and technical information on historic mineral resource and reserve estimates on the

Xavantina Operations, please refer to the following reports:

- The “Xavantina Operations – Update Information with respect to the Xavantina Operations”

section within the Company's 2023 Annual Information Form dated March 7, 2024, prepared under the supervision of and verified by Mr. Cid

Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) and Resource Manager of the Company (the “2023

AIF”) for technical information and assumptions related to the 2023 mineral reserve and mineral resource estimate, with an effective

date of December 31, 2023.

- The NI 43-101 technical report entitled "Technical Report on the Xavantina Operations, Mato Grosso, Brazil"

dated May 12, 2023 with an effective date of October 31, 2022, prepared by Porfirio Cabaleiro Rodrigues, FAIG, Leonardo de Moraes Soares,

MAIG and Guilherme Gomides Ferreira, MAIG, all of GE21 Consultoria Mineral Ltda. (“GE21”) for technical information and assumptions

related to the 2022 mineral reserve and mineral resource estimate (the “2022 Xavantina Technical Report”).

- The Company's Press Release dated January 6, 2022, for technical information and assumptions related to

the 2021 mineral reserve and mineral resource estimate, with an effective date of September 30, 2021 prepared by or under the supervision

of and verified by Mr. Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission)

and Resource Manager of the Company as at the date of the press release, who was a Qualified Person as such term is defined under NI 43-101

(the “January 2022 Press Release”).

- The NI 43-101 technical report entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated January 8, 2021, with an effective date of September 30, 2020, prepared by Porfirio Cabaleiro Rodriguez,

MAIG, Leonardo de Moraes Soares, MAIG, Bernardo Horta Cerqueira Viana, MAIG, Paulo Roberto Bergmann, FAusIMM, all of GE21 for technical

information and assumptions related to the 2020 mineral reserve and mineral resource estimate (the “2020 Xavantina Technical Report”).

- The NI 43-101 technical report entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated February 3, 2020 with an effective date of September 30, 2019, prepared by Porfirio Cabaleiro Rodrigues,

FAIG, Leonardo de Moraes Soares, MAIG and Paulo Roberto Bergmann, all of GE21 for technical information and assumptions related to the

2019 mineral reserve and mineral resource estimate (the “2019 Xavantina Technical Report”).

- The NI 43-101 technical report entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated January 21, 2019 with an effective date of August 31, 2018, prepared by Porfirio Cabaleiro Rodrigues,

FAIG, Leonardo Apparicio da Silva, MAIG and Leonardo de Moraes Soares, MAIG, all of GE21 for technical information and assumptions related

to the 2018 mineral reserve and mineral resource estimate (the “2018 Xavantina Technical Report”).

QUALIFIED PERSONS

Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) has reviewed, verified

and approved the scientific and technical information contained in this press release, including the sampling, analytical and test data

underlying the information contained in this press release. Mr. Monteiro is Resource Manager of the Company and is a “qualified

person” within the meanings of NI 43-101.

QUALITY ASSURANCE & QUALITY CONTROL

Current QA/QC Program

At the Xavantina Operations, the Company is currently drilling underground with third-party contracted core drill rigs.

During the period from October 2022 to June 2024, third party drill rigs were operated by Trust Drilling Solutions and Servitec Foraco

Sondagem S.A. who are independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at our

secure core logging and storage facilities. Half of the drill core is retained on site and the other half-core is used for analysis, with

samples collected on a minimum of 0.2 meters and a maximum of 2.0 meters with an average length of 0.5 meters. Sampling commences at least

1.0 meter before the start of the mineralized zone and continues at least 1.0 meter beyond the limit of the mineralized zone. Sample collection

is performed at our core logging facilities with all sample preparation performed at ALS Brasil Ltda.'s laboratory or SGS Geosol - Laboratórios

Ltda's laboratory, both of which are located in Goiânia, Brazil. Samples are analyzed by the certified laboratories of ALS Peru S.A.

or SGS Geosol - Laboratórios Ltda, both of whom are independent of the Company. Gold content is preferentially determined using screen

fire assay. If the sample isn't sufficiently weighted, fire assay is used. All sample results used in the preparation of the 2024 updated

mineral resource and reserve estimate have been monitored through a quality assurance and quality control ("QA/QC") program that includes

the insertion of certified standards, blanks and field duplicates at a rate of one standard, one blank, and one field duplicate sample

per every 20 samples for a blended rate of approximately 5%.

QA/QC Validation

The QA/QC validation process undertaken for the 2024 updated mineral resource and reserve estimates for the Xavantina

Operations is consistent with the process set out in the 2022 Xavantina Technical Report.

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper producer with operations in Brazil and corporate headquarters in Vancouver,

B.C. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, Mineração Caraíba S.A. ("MCSA"),

100% owner of the Company's Caraíba Operations, which are located in the Curaçá Valley, Bahia State, Brazil, and the Tucumã

Operation, an open pit copper mine located in Pará State, Brazil. The Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns

the Xavantina Operations, an operating gold and silver mine located in Mato Grosso State, Brazil. In July 2024, the Company signed a definitive

earn-in agreement with Vale Base Metals for a 60% interest in the Furnas Copper-Gold Project, located in the Carajás Mineral Province

in Pará State, Brazil. For more information on the earn-in agreement, please see the Company's press releases dated October 30, 2023

and July 22, 2024. Additional information on the Company and its operations, including technical reports on the Caraíba Operations,

Xavantina Operations, Tucumã Operation and the Furnas Copper-Gold Project, can be found on the Company’s website (www.erocopper.com),

on SEDAR+ (www.sedarplus.ca/landingpage/) and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock

Exchange and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Corporate Development, Investor Relations & Sustainability (604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities

legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking

terminology such as “may”, “could”, “would”, “will”, “should”, “intend”,

“target”, “plan”, “expect”, “budget”, “estimate”, “forecast”,

“schedule”, “anticipate”, “believe”, “continue”, “potential”, “view”

or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may

include, but are not limited to, statements with respect to the Company's expected production at the Xavantina Operations; the estimation

of mineral reserves and mineral resources; the discovery of additional mineralized veins and the associated positive impact on throughput

rates; the significance of any particular exploration program or result and the Company’s expectations for current and future exploration

plans including, but not limited to, planned areas of additional exploration and the potential to convert any portion of the inferred

mineral resource base to economically viable mineral reserves; and any other statement that may predict, forecast, indicate or imply future

plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Forward-looking statements involve statements about the future and are inherently uncertain, and the Company’s actual results, achievements

or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors, including, without limitation, those referred to herein and in the Company's most recent Annual

Information Form under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of

management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection

with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among

other things: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to

advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other

metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates;

the geology of the Caraíba Operations, the Xavantina Operations, the Tucumã Operation and the Furnas Copper-Gold Project being

as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development

and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates;

operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing

to remain healthy in the face of prevailing epidemics, pandemics or other health risks, political and regulatory stability; the receipt

of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing

approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial

and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its

obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements.

Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press

release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and

uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements

to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions

is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and

expressed in, or implied by, the forward-looking statements contained in this press release. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims

any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or

otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and resource estimates included in this press release and the documents incorporated

by reference herein have been prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI

43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral

Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed

by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United

States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable

to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this press release

and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and

“inferred resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules”)

are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”)

which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional

disclosure system (the “MJDS”), Ero is not required to provide disclosure on its mineral properties under the U.S. Rules and

will continue to provide disclosure under NI 43-101 and the CIM Standards. If Ero ceases to be a foreign private issuer or loses its eligibility

to file its annual report on Form 40-F pursuant to the MJDS, then Ero will be subject to the U.S. Rules, which differ from the requirements

of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources.” In addition, the definitions of “proven mineral reserves”

and “probable mineral reserves” under the U.S. Rules are now “substantially similar” to the corresponding standards

under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than

mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral

resources, indicated mineral resources, or inferred mineral resources that Ero reports are or will be economically or legally mineable.

Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can

be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the

basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially

similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM

Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Ero may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred

mineral resources” under NI 43-101 would be the same had Ero prepared the reserve or resource estimates under the standards adopted

under the U.S. Rules.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e58950c7-9d23-4393-8b31-68d25a1628f6

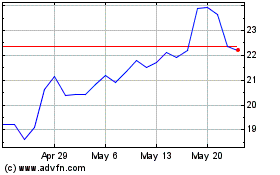

Ero Copper (NYSE:ERO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ero Copper (NYSE:ERO)

Historical Stock Chart

From Feb 2024 to Feb 2025