Energy Transfer Signs Agreement to Supply Chevron 2.0 Million Tonnes of LNG Per Annum From Its Lake Charles LNG Export Facility

December 19 2024 - 3:02PM

Business Wire

Energy Transfer LP (NYSE: ET) today announced its

subsidiary, Energy Transfer LNG Export, LLC (Energy Transfer LNG),

has entered into a 20-year LNG Sale and Purchase Agreement (SPA)

with Chevron U.S.A. Inc. (Chevron) related to its Lake Charles LNG

project. Under the SPA, Energy Transfer LNG will supply 2.0 million

tonnes of LNG per annum (mtpa) to Chevron. The LNG will be supplied

on a free-on-board (FOB) basis and the purchase price will consist

of a fixed liquefaction charge and a gas supply component indexed

to the Henry Hub benchmark. The obligations of Energy Transfer LNG

under the SPA are subject to Energy Transfer LNG taking a final

investment decision (FID) as well as the satisfaction of other

conditions precedent.

“We are pleased that one of the most prominent LNG industry

participants has selected Lake Charles LNG as a supplier,” said Tom

Mason, President of Energy Transfer LNG. “We believe that Lake

Charles is the most compelling LNG project on the Gulf Coast and we

continue to make significant progress towards full

commercialization of this project.”

“Chevron believes LNG plays an important role in meeting the

world’s need for energy while helping advance lower carbon

ambitions,” said Freeman Shaheen, President, Chevron Global Gas.

“This new long-term agreement demonstrates our focus on increasing

access to affordable, reliable, ever-cleaner energy supplies to

meet growing global demand.”

The Lake Charles LNG export facility would be constructed on the

existing brownfield regasification facility site and will

capitalize on four existing LNG storage tanks, two deep water

berths and other LNG infrastructure. Lake Charles LNG would also

benefit from its direct connection to Energy Transfer's existing

Trunkline pipeline system that in turn provides connections to

multiple intrastate and interstate pipelines. These pipelines allow

access to multiple natural gas producing basins, including the

Haynesville, the Permian and the Marcellus Shale. Energy Transfer

is one of the largest and most diversified midstream energy

companies in North America, with a strategic footprint in all of

the major U.S. production basins.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the

largest and most diversified portfolios of energy assets in the

United States, with more than 130,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 21% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

39% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Forward-Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control, including the following factors: securing

long-term contractual arrangements for the offtake on terms

sufficient to support the financial viability of the Lake Charles

LNG project; global supply, demand and price fluctuations of oil,

gas and petrochemicals, including LNG; costs to construct the

liquefaction facility, the terms and conditions of the financing

for the construction of the liquefaction facility, the cost of the

natural gas supply, the costs to transport natural gas to the

liquefaction facility, the costs to operate the liquefaction

facility and the costs to transport LNG from the liquefaction

facility to customers in foreign markets (particularly Europe and

Asia); global economic conditions; competition in the industries in

which Energy Transfer operates; operational risk and hazards common

in the oil, gas and petrochemicals industries; the cyclical nature

of the oil, gas and petrochemicals industries; regulatory approval

of the Lake Charles LNG project, some of which may be subject to

further conditions, review and/or revocation; risks related to

operating in a regulated industry and changes to oil, gas,

environmental or other regulations that impact the industries in

which Energy Transfer operates; legal proceedings and other

disputes; and other risks and uncertainties that could cause actual

results to differ from the forward-looking statements in this press

release. An extensive list of factors that can affect future

results are discussed in the Partnership’s Annual Report on Form

10-K and other documents filed from time to time with the

Securities and Exchange Commission. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

The information contained in this press release is available on

our website at www.energytransfer.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219500228/en/

Media Relations Vicki Granado or

Jeff Tieszen 214-840-5820 media@energytransfer.com Investor Relations Bill Baerg, Brent Ratliff or

Lyndsay Hannah 214-981-0795

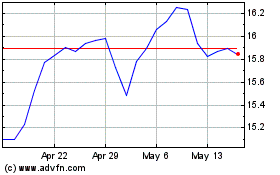

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Jan 2025 to Feb 2025

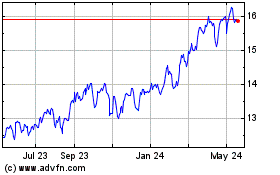

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Feb 2024 to Feb 2025