0001472787falseFirst American Financial Corp00014727872025-02-122025-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 12, 2025 |

FIRST AMERICAN FINANCIAL CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34580 |

26-1911571 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 First American Way |

|

Santa Ana, California |

|

92707-5913 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (714) 250-3000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.00001 par value |

|

FAF |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2025, First American Financial Corporation issued a press release announcing its financial results for the quarter and fiscal year ended December 31, 2024. The full text of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including Exhibit 99.1 hereto, is being “furnished” in accordance with General Instruction B.2 of Form 8-K. As such, this information is not deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filings with the SEC unless it shall be explicitly so incorporated in such filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

FIRST AMERICAN FINANCIAL CORPORATION |

|

|

|

|

Date: |

February 12, 2025 |

By: |

/s/ Lisa W. Cornehl |

|

|

|

Name: Lisa W. Cornehl

Title: Senior Vice President, Chief Legal Officer |

Exhibit 99.1

|

|

|

|

|

|

NEWS |

FOR IMMEDIATE RELEASE |

FIRST AMERICAN FINANCIAL REPORTS Results

for the fourth quarter and full year of 2024

SANTA ANA, Calif., Feb. 12, 2025 – First American Financial Corporation (NYSE: FAF), a premier provider of title, settlement and risk solutions for real estate transactions and the leader in the digital transformation of its industry, today announced financial results for the fourth quarter and year ended Dec. 31, 2024.

Current Quarter Highlights

•Earnings per diluted share of $0.69, or $1.35 per share on an adjusted basis

- Net investment losses of $86 million, or 61 cents per diluted share

•Total revenue of $1.7 billion, up 18 percent compared with last year

- Adjusted total revenue of $1.8 billion, up 20 percent compared with last year

•Title Insurance and Services segment investment income of $155 million, up 18 percent compared with last year

•Title Insurance and Services segment pretax margin of 7.9 percent, or 11.8 percent on an adjusted basis

•Commercial revenues of $252 million, up 47 percent compared with last year

•Home Warranty segment pretax margin of 18.1 percent, or 18.2 percent on an adjusted basis

•Debt-to-capital ratio of 30.8 percent, or 23.9 percent excluding secured financings payable of $644 million

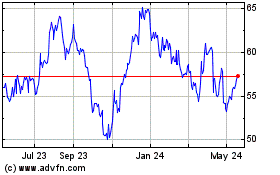

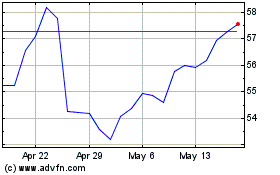

•Repurchased 124,000 shares for a total of $8 million at an average price of $65.80

- In 2025, through Feb. 11, repurchased 187,000 shares for a total of $11 million at an average price of $61.31

Full Year Highlights

•Earnings per diluted share of $1.26, or $4.40 per share on an adjusted basis

- Net investment losses of $402 million, or $2.91 per diluted share, primarily due to the strategic investment portfolio rebalancing project

•Total revenue of $6.1 billion, up 2 percent compared with last year

- Adjusted total revenue of $6.5 billion, up 5 percent compared with last year

•Title Insurance and Services segment investment income of $534 million, down 1 percent compared with last year

•Title Insurance and Services segment pretax margin of 4.3 percent, or 10.3 percent on an adjusted basis

•Commercial revenues of $761 million, up 16 percent compared with last year

•Home Warranty pretax margin of 15.1 percent, or 14.8 percent on an adjusted basis

•Repurchased 1.2 million shares for a total of $68 million at an average price of $55.76

•Raised the common stock dividend by 2 percent to an annual rate of $2.16 per share

•Cash flow from operations of $897 million compared with $354 million last year

•Named one of the 100 Best Companies to Work For by Great Places to Work® and Fortune Magazine for the ninth consecutive year

Selected Financial Information

($ in millions, except per share data)

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Full Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total revenue |

|

$ |

1,685.1 |

|

|

$ |

1,429.3 |

|

|

$ |

6,128.1 |

|

|

$ |

6,003.5 |

|

Income before taxes |

|

$ |

99.9 |

|

|

$ |

38.4 |

|

|

$ |

165.4 |

|

|

$ |

274.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

72.4 |

|

|

$ |

34.1 |

|

|

$ |

131.1 |

|

|

$ |

216.8 |

|

Net income per diluted share |

|

$ |

0.69 |

|

|

$ |

0.33 |

|

|

$ |

1.26 |

|

|

$ |

2.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income |

|

$ |

141.6 |

|

|

$ |

72.1 |

|

|

$ |

459.0 |

|

|

$ |

397.7 |

|

Adjusted net income per diluted share |

|

$ |

1.35 |

|

|

$ |

0.69 |

|

|

$ |

4.40 |

|

|

$ |

3.80 |

|

Total revenue for the fourth quarter of 2024 was $1.7 billion, up 18 percent compared with the fourth quarter of 2023. Net income in the current quarter was $72 million, or 69 cents per diluted share, compared with net income of $34 million, or 33 cents per diluted share, in the fourth quarter of 2023. Net investment losses in the current quarter were $86 million, or 61 cents per diluted share, compared with net investment losses of $42 million, or 30 cents per diluted share, in the fourth quarter of last year. The net investment losses in the current quarter were primarily due to asset impairments and recognized losses in the company's venture portfolio. Net investment losses in the same quarter of last year were due to the sale of fixed-income securities in connection with the company’s tax planning efforts, partly offset by a favorable change in the fair value of marketable equity securities.

Adjusted net income in the current quarter was $142 million, or $1.35 per diluted share, compared with $72 million, or 69 cents per diluted share, in the fourth quarter of last year. The effective tax rate in the current quarter of 27 percent was driven by a valuation reserve against deferred tax assets, partly offset by the recognition of research and development tax credits. This resulted in a reduction of 3 cents per diluted share when compared to the company's normalized tax rate of 24 percent.

Total revenue for the full year 2024 was $6.1 billion, up 2 percent compared with the prior year. Net income in 2024 was $131 million, or $1.26 per diluted share, compared with net income of $217 million, or $2.07 per diluted share in 2023. Adjusted net income in 2024 was $459 million, or $4.40 per diluted share, compared with $398 million, or $3.80 per diluted share in 2023.

"The company delivered excellent results in the fourth quarter, despite generally challenging market conditions,” said Ken DeGiorgio, chief executive officer at First American Financial Corporation. "Title premiums and escrow revenues were up double-digits across all key business lines, highlighted by 47% growth in our commercial revenue. Coupled with our continued focus on expense management, we achieved an adjusted pretax title margin of 11.8% for the quarter."

"Looking into 2025, we are planning for mortgage rates to remain elevated, however, we expect modest improvement in both the residential purchase and refinance businesses. We expect our commercial business will have a good year with continued revenue growth weighted to the first half of the

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 3

year, given the 33% increase experienced in the second half of last year. This will be another year of earnings improvement in what looks to be the early stages of the next real estate cycle.

"The widespread damage and devastation from the recent wildfires in the Los Angeles area unfortunately directly impacted several of our people and our customers. Our thoughts are with them and the many others who have suffered through this terrible event. The company’s roots in Southern California and the greater Los Angeles area trace back 135 years, so all of us at First American feel a responsibility to find ways to help our neighbors, friends and families cope with this tragedy. Our company, along with many of our employees, have responded to that call. I want to thank our people for all they have done to provide support and relief to those affected."

Title Insurance and Services

($ in millions, except average revenue per order)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Total revenues |

|

$ |

1,605.3 |

|

|

$ |

1,321.1 |

|

|

|

|

|

|

|

|

Income before taxes |

|

$ |

126.4 |

|

|

$ |

59.8 |

|

Pretax margin |

|

|

7.9 |

% |

|

|

4.5 |

% |

Adjusted pretax margin |

|

|

11.8 |

% |

|

|

7.5 |

% |

|

|

|

|

|

|

|

Title open orders(1) |

|

|

143,100 |

|

|

|

124,600 |

|

Title closed orders(1) |

|

|

119,800 |

|

|

|

100,600 |

|

|

|

|

|

|

|

|

U.S. Commercial |

|

|

|

|

|

|

Total revenues |

|

$ |

252.0 |

|

|

$ |

171.6 |

|

Open orders |

|

|

25,000 |

|

|

|

21,600 |

|

Closed orders |

|

|

16,500 |

|

|

|

15,600 |

|

Average revenue per order |

|

$ |

15,200 |

|

|

$ |

11,000 |

|

(1) U.S. direct title insurance orders only. |

|

|

|

|

|

|

Total revenues for the Title Insurance and Services segment during the fourth quarter were $1.6 billion, up 22 percent compared with the same quarter of 2023. Direct premiums and escrow fees were 31 percent higher compared with the fourth quarter of 2023, driven by a 19 percent increase in the number of direct title orders closed in our domestic operations and an 11 percent increase in the average revenue per order closed. The average revenue per direct title order rose to $4,343, due to the impact of a 39 percent increase in the average revenue per order for commercial transactions, partly offset by a shift in the closed order mix to lower-premium refinance transactions from higher-premium commercial transactions. Agent premiums, which are recorded on approximately a one-quarter lag relative to direct premiums, grew by 23 percent in the current quarter compared with last year.

Information and other revenues were $238 million during the quarter, up $27 million, or 13 percent, compared with last year. This increase was primarily due to revenue growth in Canada and in the commercial and data and analytics business units.

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 4

Investment income was $155 million in the fourth quarter, up $23 million, or 18 percent compared with the same quarter last year. This increase was primarily due to a higher average yield on the investment portfolio as a result of the company's recent strategic investment portfolio rebalancing project. In addition, investment income from the company's warehouse lending business and operating cash accounts increased. Net investment losses totaled $62 million in the current quarter, compared with net investment losses of $32 million in the fourth quarter of 2023. The net investment losses in the current quarter were primarily due to asset impairments, while net investment losses last year were primarily due to the sale of fixed-income securities in connection with the company’s tax planning efforts, partly offset by a favorable change in the fair value of marketable equity securities.

Personnel costs were $523 million in the fourth quarter, up $60 million, or 13 percent, compared with the same quarter of 2023. The increase in personnel costs was primarily due to higher incentive compensation expense as a result of improved financial performance.

Other operating expenses were $263 million in the fourth quarter, an increase of $36 million, or 16 percent, compared with the fourth quarter of 2023. The increase was primarily attributable to higher production expense across several business units due to higher transaction volumes and higher software expense.

The provision for policy losses and other claims was $38 million in the fourth quarter, or 3.0 percent of title premiums and escrow fees, unchanged from the prior year. The fourth quarter rate reflects an ultimate loss rate of 3.75 percent for the current policy year and a net decrease of $10 million in the loss reserve estimate for prior policy years.

Depreciation and amortization expense was $51 million in the fourth quarter, up $2 million, or 5 percent, compared with the same period last year, due to higher amortization of internally developed software.

Interest expense was $27 million in the current quarter, up $5 million, or 25 percent from last year primarily due to higher interest expense in the company's warehouse lending business.

Pretax income for the Title Insurance and Services segment was $126 million in the fourth quarter, compared with $60 million in the fourth quarter of 2023. Pretax margin was 7.9 percent in the current quarter, compared with 4.5 percent last year. Adjusted pretax margin was 11.8 percent in the current period, compared with 7.5 percent last year.

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 5

Home Warranty

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Total revenues |

|

$ |

102.8 |

|

|

$ |

98.8 |

|

|

|

|

|

|

|

|

Income before taxes |

|

$ |

18.6 |

|

|

$ |

14.7 |

|

Pretax margin |

|

|

18.1 |

% |

|

|

14.9 |

% |

Adjusted pretax margin |

|

|

18.2 |

% |

|

|

19.9 |

% |

Total revenues for the Home Warranty segment were $103 million in the fourth quarter, up $4 million compared with the fourth quarter of 2023. The segment posted pretax income of $19 million this quarter, compared with $15 million last year. The claim loss rate was 43.7 percent in the fourth quarter, compared with 43.6 percent last year, due to higher claim frequency, partly offset by lower claim severity. Home Warranty’s pretax margin was 18.1 percent this quarter, compared with 14.9 percent last year. Adjusted pretax margin was 18.2 percent this quarter, compared with 19.9 percent last year.

The current quarter results include a change in the estimate of earned premium revenues which negatively impacted both revenue and pretax income by approximately $6 million.

Corporate

The Corporate segment recorded a net pretax loss of $45 million this quarter compared with a loss of $36 million in the prior year. Excluding net investment losses, adjusted pretax loss was $22 million in the current quarter compared with $32 million last year. The $10 million improvement in net pretax loss primarily reflects the higher legal and personnel costs related to the cybersecurity event in the prior year period, partly offset by higher interest expense due to the company’s new debt issuance in the third quarter of this year.

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 6

Teleconference/Webcast

First American’s fourth quarter 2024 results will be discussed in more detail on Thursday, Feb. 13, 2024, at 11 a.m. EST, via teleconference. The toll-free dial-in number is +1-877-407-8293. Callers from outside the United States may dial +1-201-689-8349.

The live audio webcast of the call will be available on First American’s website at www.firstam.com/investor. An audio replay of the conference call will be available through Feb. 27, 2025, by dialing +1-201-612-7415 and using the conference ID 13751214. An audio archive of the call will also be available on First American’s investor website.

About First American

First American Financial Corporation (NYSE: FAF) is a premier provider of title, settlement and risk solutions for real estate transactions. With its combination of financial strength and stability built over more than 135 years, innovative proprietary technologies, and unmatched data assets, the company is leading the digital transformation of its industry. First American also provides data products to the title industry and other third parties; valuation products and services; mortgage subservicing; home warranty products; banking, trust and wealth management services; and other related products and services. With total revenue of $6.1 billion in 2024, the company offers its products and services directly and through its agents throughout the United States and abroad. In 2024, First American was named one of the 100 Best Companies to Work For by Great Place to Work® and Fortune Magazine for the ninth consecutive year and was named one of the 100 Best Workplaces for Innovators by Fast Company for the second consecutive year. More information about the company can be found at www.firstam.com.

Website Disclosure

First American posts information of interest to investors at www.firstam.com/investor. This includes opened and closed title insurance order counts for its U.S. direct title insurance operations, which are posted approximately 10 to 12 days after the end of each month.

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 7

Forward-Looking Statements

Certain statements made in this press release and the related management commentary contain, and responses to investor questions may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and may contain the words “believe,” “anticipate,” “expect,” “intend,” “plan,” “predict,” “estimate,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” or “could.” These forward-looking statements include, without limitation, statements regarding future operations, performance, financial condition, prospects, plans and strategies. These forward-looking statements are based on current expectations and assumptions that may prove to be incorrect. Risks and uncertainties exist that may cause results to differ materially from those set forth in these forward-looking statements. Factors that could cause the anticipated results to differ from those described in the forward-looking statements include, without limitation: interest rate fluctuations; changes in conditions of the real estate markets; volatility in the capital markets; unfavorable economic conditions; impairments in the company’s goodwill or other intangible assets; failures at financial institutions where the company deposits funds; regulatory oversight and changes in applicable laws and government regulations, including privacy and data protection laws; heightened scrutiny by legislators and regulators of the company’s title insurance and services segment and certain other of the company’s businesses; regulation of title insurance rates; limitations on access to public records and other data; severe weather conditions, health crises, terrorist attacks, and other catastrophe events; changes in relationships with large mortgage lenders and government-sponsored enterprises; changes in measures of the strength of the company’s title insurance underwriters, including ratings and statutory capital and surplus; losses in the company’s investment portfolio or venture investment portfolio; material variance between actual and expected claims experience; provision of capital to subsidiaries that could affect the company's liquidity position; defalcations, increased claims or other costs and expenses attributable to the company’s use of title agents; any inadequacy in the company’s risk management framework or use of models; systems damage, failures, interruptions, cyberattacks and intrusions, or unauthorized data disclosures; innovation efforts of the company and other industry participants and any related market disruption; errors and fraud involving the transfer of funds; failures to recruit and retain qualified employees; the company’s use of a global workforce; inability of the company to fulfill parent company obligations and/or pay dividends; inability to realize anticipated synergies or produce returns that justify investment in acquired businesses; a reduction in the deposits at the company’s federal savings bank subsidiary; claims of infringement or inability to adequately protect the company’s intellectual property; and other factors described in the company’s quarterly report on Form 10-Q for the quarter ended September 30, 2024, as filed with the Securities and Exchange Commission. The forward-looking statements speak only as of the date they are made. The company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

Use of Non-GAAP Financial Measures

This news release and related management commentary contain certain financial measures that are not presented in accordance with generally accepted accounting principles (GAAP), including an adjusted debt to capitalization ratio, personnel and other operating expense ratios, success ratios, net operating revenues; and adjusted revenues, adjusted pretax income, adjusted pretax margin, adjusted net income, and adjusted earnings per share. The company is presenting these non-GAAP financial measures because they provide the company’s management and investors with additional insight into the financial leverage, operational efficiency and performance of the company relative to earlier periods and relative to the company’s competitors. The company does not intend for these non-GAAP financial measures to be a substitute for any GAAP financial information. In this news release, these non-GAAP financial measures have been presented with, and reconciled to, the most directly comparable GAAP financial measures. Investors should use these non-GAAP financial measures only in conjunction with the comparable GAAP financial measures.

|

|

Media Contact: Marcus Ginnaty

Corporate Communications

First American Financial Corporation

714-250-3298 |

Investor Contact: Craig Barberio Investor Relations First American Financial Corporation 714-250-5214 |

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Summary of Consolidated Financial Results and Selected Information |

|

(in millions, except per share amounts and title orders, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total revenues |

|

$ |

1,685.1 |

|

|

$ |

1,429.3 |

|

|

$ |

6,128.1 |

|

|

$ |

6,003.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

99.9 |

|

|

$ |

38.4 |

|

|

$ |

165.4 |

|

|

$ |

274.4 |

|

Income tax expense |

|

|

27.0 |

|

|

|

4.1 |

|

|

|

32.8 |

|

|

|

58.9 |

|

Net income |

|

|

72.9 |

|

|

|

34.3 |

|

|

|

132.6 |

|

|

|

215.5 |

|

Less: Net income (loss) attributable to noncontrolling interests |

|

|

0.5 |

|

|

|

0.2 |

|

|

|

1.5 |

|

|

|

(1.3 |

) |

Net income attributable to the Company |

|

$ |

72.4 |

|

|

$ |

34.1 |

|

|

$ |

131.1 |

|

|

$ |

216.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share attributable to stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.70 |

|

|

$ |

0.33 |

|

|

$ |

1.26 |

|

|

$ |

2.08 |

|

Diluted |

|

$ |

0.69 |

|

|

$ |

0.33 |

|

|

$ |

1.26 |

|

|

$ |

2.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.54 |

|

|

$ |

0.53 |

|

|

$ |

2.14 |

|

|

$ |

2.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

103.7 |

|

|

|

104.0 |

|

|

|

103.9 |

|

|

|

104.3 |

|

Diluted |

|

|

104.2 |

|

|

|

104.4 |

|

|

|

104.3 |

|

|

|

104.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Title Insurance Segment Information |

|

|

|

|

|

|

|

|

|

|

|

|

Title orders opened(1) |

|

|

143,100 |

|

|

|

124,600 |

|

|

|

634,300 |

|

|

|

629,100 |

|

Title orders closed(1) |

|

|

119,800 |

|

|

|

100,600 |

|

|

|

468,800 |

|

|

|

455,500 |

|

Paid title claims |

|

$ |

53.2 |

|

|

$ |

44.4 |

|

|

$ |

204.0 |

|

|

$ |

169.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) U.S. direct title insurance orders only. |

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 9

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Selected Consolidated Balance Sheet Information |

|

(in millions, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash and cash equivalents |

|

$ |

1,718.1 |

|

|

$ |

3,605.3 |

|

Investments |

|

|

8,042.6 |

|

|

|

7,948.9 |

|

Goodwill and other intangible assets, net |

|

|

1,929.5 |

|

|

|

1,961.3 |

|

Total assets |

|

|

14,908.6 |

|

|

|

16,802.8 |

|

Reserve for claim losses |

|

|

1,193.4 |

|

|

|

1,282.4 |

|

Notes and contracts payable |

|

|

1,546.6 |

|

|

|

1,393.9 |

|

Total stockholders’ equity |

|

$ |

4,908.5 |

|

|

$ |

4,848.1 |

|

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Segment Information |

|

(in millions, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

Title |

|

|

Home |

|

|

Corporate |

|

December 31, 2024 |

|

Consolidated |

|

|

Insurance |

|

|

Warranty |

|

|

(incl. Elims.) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Direct premiums and escrow fees |

|

$ |

672.8 |

|

|

$ |

575.9 |

|

|

$ |

97.0 |

|

|

$ |

(0.1 |

) |

Agent premiums |

|

|

697.9 |

|

|

|

697.9 |

|

|

|

— |

|

|

|

— |

|

Information and other |

|

|

243.7 |

|

|

|

238.4 |

|

|

|

5.1 |

|

|

|

0.2 |

|

Net investment income |

|

|

156.6 |

|

|

|

155.4 |

|

|

|

0.8 |

|

|

|

0.4 |

|

Net investment losses |

|

|

(85.9 |

) |

|

|

(62.3 |

) |

|

|

(0.1 |

) |

|

|

(23.5 |

) |

|

|

|

1,685.1 |

|

|

|

1,605.3 |

|

|

|

102.8 |

|

|

|

(23.0 |

) |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs |

|

|

541.9 |

|

|

|

523.4 |

|

|

|

20.0 |

|

|

|

(1.5 |

) |

Premiums retained by agents |

|

|

557.9 |

|

|

|

557.9 |

|

|

|

— |

|

|

|

— |

|

Other operating expenses |

|

|

290.8 |

|

|

|

263.4 |

|

|

|

19.3 |

|

|

|

8.1 |

|

Provision for policy losses and other claims |

|

|

79.2 |

|

|

|

38.2 |

|

|

|

42.4 |

|

|

|

(1.4 |

) |

Depreciation and amortization |

|

|

52.0 |

|

|

|

50.6 |

|

|

|

1.4 |

|

|

|

0.0 |

|

Premium taxes |

|

|

19.7 |

|

|

|

18.7 |

|

|

|

1.1 |

|

|

|

(0.1 |

) |

Interest |

|

|

43.7 |

|

|

|

26.7 |

|

|

|

— |

|

|

|

17.0 |

|

|

|

|

1,585.2 |

|

|

|

1,478.9 |

|

|

|

84.2 |

|

|

|

22.1 |

|

Income (loss) before income taxes |

|

$ |

99.9 |

|

|

$ |

126.4 |

|

|

$ |

18.6 |

|

|

$ |

(45.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

Title |

|

|

Home |

|

|

Corporate |

|

December 31, 2023 |

|

Consolidated |

|

|

Insurance |

|

|

Warranty |

|

|

(incl. Elims.) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Direct premiums and escrow fees |

|

$ |

539.1 |

|

|

$ |

440.3 |

|

|

$ |

98.7 |

|

|

$ |

0.1 |

|

Agent premiums |

|

|

569.7 |

|

|

|

569.7 |

|

|

|

— |

|

|

|

— |

|

Information and other |

|

|

215.6 |

|

|

|

211.1 |

|

|

|

4.8 |

|

|

|

(0.3 |

) |

Net investment income |

|

|

146.6 |

|

|

|

132.0 |

|

|

|

1.5 |

|

|

|

13.1 |

|

Net investment losses |

|

|

(41.7 |

) |

|

|

(32.0 |

) |

|

|

(6.2 |

) |

|

|

(3.5 |

) |

|

|

|

1,429.3 |

|

|

|

1,321.1 |

|

|

|

98.8 |

|

|

|

9.4 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs |

|

|

501.2 |

|

|

|

463.7 |

|

|

|

18.5 |

|

|

|

19.0 |

|

Premiums retained by agents |

|

|

455.4 |

|

|

|

455.4 |

|

|

|

— |

|

|

|

— |

|

Other operating expenses |

|

|

262.2 |

|

|

|

227.3 |

|

|

|

20.4 |

|

|

|

14.5 |

|

Provision for policy losses and other claims |

|

|

73.4 |

|

|

|

30.3 |

|

|

|

43.0 |

|

|

|

0.1 |

|

Depreciation and amortization |

|

|

49.6 |

|

|

|

48.4 |

|

|

|

1.2 |

|

|

|

(0.0 |

) |

Premium taxes |

|

|

15.8 |

|

|

|

14.9 |

|

|

|

1.0 |

|

|

|

(0.1 |

) |

Interest |

|

|

33.3 |

|

|

|

21.3 |

|

|

|

— |

|

|

|

12.0 |

|

|

|

|

1,390.9 |

|

|

|

1,261.3 |

|

|

|

84.1 |

|

|

|

45.5 |

|

Income (loss) before income taxes |

|

$ |

38.4 |

|

|

$ |

59.8 |

|

|

$ |

14.7 |

|

|

$ |

(36.1 |

) |

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Segment Information |

|

(in millions, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

|

|

Title |

|

|

Home |

|

|

Corporate |

|

December 31, 2024 |

|

Consolidated |

|

|

Insurance |

|

|

Warranty |

|

|

(incl. Elims.) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Direct premiums and escrow fees |

|

$ |

2,446.0 |

|

|

$ |

2,048.3 |

|

|

$ |

397.8 |

|

|

$ |

(0.1 |

) |

Agent premiums |

|

|

2,561.9 |

|

|

|

2,561.9 |

|

|

|

— |

|

|

|

— |

|

Information and other |

|

|

960.8 |

|

|

|

938.2 |

|

|

|

22.5 |

|

|

|

0.1 |

|

Net investment income |

|

|

561.0 |

|

|

|

534.3 |

|

|

|

4.0 |

|

|

|

22.7 |

|

Net investment (losses) gains |

|

|

(401.6 |

) |

|

|

(345.4 |

) |

|

|

1.4 |

|

|

|

(57.6 |

) |

|

|

|

6,128.1 |

|

|

|

5,737.3 |

|

|

|

425.7 |

|

|

|

(34.9 |

) |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs |

|

|

2,059.4 |

|

|

|

1,953.2 |

|

|

|

81.2 |

|

|

|

25.0 |

|

Premiums retained by agents |

|

|

2,044.6 |

|

|

|

2,044.6 |

|

|

|

— |

|

|

|

— |

|

Other operating expenses |

|

|

1,113.4 |

|

|

|

992.5 |

|

|

|

86.0 |

|

|

|

34.9 |

|

Provision for policy losses and other claims |

|

|

320.0 |

|

|

|

138.3 |

|

|

|

184.4 |

|

|

|

(2.7 |

) |

Depreciation and amortization |

|

|

207.4 |

|

|

|

202.2 |

|

|

|

5.1 |

|

|

|

0.1 |

|

Premium taxes |

|

|

68.3 |

|

|

|

63.7 |

|

|

|

4.6 |

|

|

|

(0.0 |

) |

Interest |

|

|

149.6 |

|

|

|

96.6 |

|

|

|

— |

|

|

|

53.0 |

|

|

|

|

5,962.7 |

|

|

|

5,491.1 |

|

|

|

361.3 |

|

|

|

110.3 |

|

Income (loss) before income taxes |

|

$ |

165.4 |

|

|

$ |

246.2 |

|

|

$ |

64.4 |

|

|

$ |

(145.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

|

|

Title |

|

|

Home |

|

|

Corporate |

|

December 31, 2023 |

|

Consolidated |

|

|

Insurance |

|

|

Warranty |

|

|

(incl. Elims.) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Direct premiums and escrow fees |

|

$ |

2,252.1 |

|

|

$ |

1,856.4 |

|

|

$ |

395.6 |

|

|

$ |

0.1 |

|

Agent premiums |

|

|

2,449.3 |

|

|

|

2,449.3 |

|

|

|

— |

|

|

|

— |

|

Information and other |

|

|

938.5 |

|

|

|

917.1 |

|

|

|

21.7 |

|

|

|

(0.3 |

) |

Net investment income |

|

|

570.0 |

|

|

|

540.2 |

|

|

|

5.9 |

|

|

|

23.9 |

|

Net investment losses |

|

|

(206.4 |

) |

|

|

(38.2 |

) |

|

|

(6.0 |

) |

|

|

(162.2 |

) |

|

|

|

6,003.5 |

|

|

|

5,724.8 |

|

|

|

417.2 |

|

|

|

(138.5 |

) |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs |

|

|

1,989.1 |

|

|

|

1,876.0 |

|

|

|

77.8 |

|

|

|

35.3 |

|

Premiums retained by agents |

|

|

1,952.2 |

|

|

|

1,952.2 |

|

|

|

— |

|

|

|

— |

|

Other operating expenses |

|

|

1,067.0 |

|

|

|

937.7 |

|

|

|

82.8 |

|

|

|

46.5 |

|

Provision for policy losses and other claims |

|

|

336.3 |

|

|

|

139.9 |

|

|

|

193.1 |

|

|

|

3.3 |

|

Depreciation and amortization |

|

|

188.5 |

|

|

|

183.6 |

|

|

|

4.8 |

|

|

|

0.1 |

|

Premium taxes |

|

|

63.5 |

|

|

|

59.1 |

|

|

|

4.4 |

|

|

|

(0.0 |

) |

Interest |

|

|

132.5 |

|

|

|

82.3 |

|

|

|

— |

|

|

|

50.2 |

|

|

|

|

5,729.1 |

|

|

|

5,230.8 |

|

|

|

362.9 |

|

|

|

135.4 |

|

Income (loss) before income taxes |

|

$ |

274.4 |

|

|

$ |

494.0 |

|

|

$ |

54.3 |

|

|

$ |

(273.9 |

) |

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Reconciliation of Non-GAAP Financial Measures |

|

(in millions, except margin and per share amounts, unaudited) |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

1,685.1 |

|

|

$ |

1,429.3 |

|

|

$ |

6,128.1 |

|

|

$ |

6,003.5 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(85.9 |

) |

|

|

(41.7 |

) |

|

|

(401.6 |

) |

|

|

(206.4 |

) |

Adjusted total revenues |

|

$ |

1,771.0 |

|

|

$ |

1,471.0 |

|

|

$ |

6,529.7 |

|

|

$ |

6,209.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax income |

|

$ |

99.9 |

|

|

$ |

38.4 |

|

|

$ |

165.4 |

|

|

$ |

274.4 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(85.9 |

) |

|

|

(41.7 |

) |

|

|

(401.6 |

) |

|

|

(206.4 |

) |

Plus: Purchase-related intangible amortization |

|

|

7.3 |

|

|

|

9.6 |

|

|

|

32.7 |

|

|

|

38.4 |

|

Adjusted pretax income |

|

$ |

193.1 |

|

|

$ |

89.7 |

|

|

$ |

599.7 |

|

|

$ |

519.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax margin |

|

|

5.9 |

% |

|

|

2.7 |

% |

|

|

2.7 |

% |

|

|

4.6 |

% |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(4.6 |

)% |

|

|

(2.7 |

)% |

|

|

(6.0 |

)% |

|

|

(3.1 |

)% |

Plus: Purchase-related intangible amortization |

|

|

0.4 |

% |

|

|

0.7 |

% |

|

|

0.5 |

% |

|

|

0.7 |

% |

Adjusted pretax margin |

|

|

10.9 |

% |

|

|

6.1 |

% |

|

|

9.2 |

% |

|

|

8.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

72.4 |

|

|

$ |

34.1 |

|

|

$ |

131.1 |

|

|

$ |

216.8 |

|

Non-GAAP adjustments, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(63.8 |

) |

|

|

(30.9 |

) |

|

|

(303.2 |

) |

|

|

(152.5 |

) |

Plus: Purchase-related intangible amortization |

|

|

5.4 |

|

|

|

7.1 |

|

|

|

24.7 |

|

|

|

28.4 |

|

Adjusted net income |

|

$ |

141.6 |

|

|

$ |

72.1 |

|

|

$ |

459.0 |

|

|

$ |

397.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per diluted share (EPS) |

|

$ |

0.69 |

|

|

$ |

0.33 |

|

|

$ |

1.26 |

|

|

$ |

2.07 |

|

Non-GAAP adjustments, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(0.61 |

) |

|

|

(0.30 |

) |

|

|

(2.91 |

) |

|

|

(1.46 |

) |

Plus: Purchase-related intangible amortization |

|

|

0.05 |

|

|

|

0.07 |

|

|

|

0.24 |

|

|

|

0.27 |

|

Adjusted EPS |

|

$ |

1.35 |

|

|

$ |

0.69 |

|

|

$ |

4.40 |

|

|

$ |

3.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase-related intangible amortization includes amortization of noncompete agreements, |

|

customer relationships, and trademarks acquired in business combinations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals may not sum due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Reconciliation of Non-GAAP Financial Measures |

|

(in millions except margin, unaudited) |

|

By Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Title Insurance and Services Segment |

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

1,605.3 |

|

|

$ |

1,321.1 |

|

|

$ |

5,737.3 |

|

|

$ |

5,724.8 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(62.3 |

) |

|

|

(32.0 |

) |

|

|

(345.4 |

) |

|

|

(38.2 |

) |

Adjusted total revenues |

|

$ |

1,667.6 |

|

|

$ |

1,353.1 |

|

|

$ |

6,082.7 |

|

|

$ |

5,763.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax income |

|

$ |

126.4 |

|

|

$ |

59.8 |

|

|

$ |

246.2 |

|

|

$ |

494.0 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(62.3 |

) |

|

|

(32.0 |

) |

|

|

(345.4 |

) |

|

|

(38.2 |

) |

Plus: Purchase-related intangible amortization |

|

|

7.3 |

|

|

|

9.5 |

|

|

|

32.6 |

|

|

|

38.3 |

|

Adjusted pretax income |

|

$ |

196.0 |

|

|

$ |

101.3 |

|

|

$ |

624.2 |

|

|

$ |

570.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax margin |

|

|

7.9 |

% |

|

|

4.5 |

% |

|

|

4.3 |

% |

|

|

8.6 |

% |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment losses |

|

|

(3.4 |

)% |

|

|

(2.3 |

)% |

|

|

(5.4 |

)% |

|

|

(0.6 |

)% |

Plus: Purchase-related intangible amortization |

|

|

0.5 |

% |

|

|

0.7 |

% |

|

|

0.6 |

% |

|

|

0.7 |

% |

Adjusted pretax margin |

|

|

11.8 |

% |

|

|

7.5 |

% |

|

|

10.3 |

% |

|

|

9.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Warranty Segment |

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

102.8 |

|

|

$ |

98.8 |

|

|

$ |

425.7 |

|

|

$ |

417.2 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment (losses) gains |

|

|

(0.1 |

) |

|

|

(6.2 |

) |

|

|

1.4 |

|

|

|

(6.0 |

) |

Adjusted total revenues |

|

$ |

102.9 |

|

|

$ |

105.0 |

|

|

$ |

424.3 |

|

|

$ |

423.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax income |

|

$ |

18.6 |

|

|

$ |

14.7 |

|

|

$ |

64.4 |

|

|

$ |

54.3 |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment (losses) gains |

|

|

(0.1 |

) |

|

|

(6.2 |

) |

|

|

1.4 |

|

|

|

(6.0 |

) |

Adjusted pretax income |

|

$ |

18.7 |

|

|

$ |

20.9 |

|

|

$ |

63.0 |

|

|

$ |

60.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax margin |

|

|

18.1 |

% |

|

|

14.9 |

% |

|

|

15.1 |

% |

|

|

13.0 |

% |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net investment (losses) gains |

|

|

(0.1 |

)% |

|

|

(5.0 |

)% |

|

|

0.3 |

% |

|

|

(1.2 |

)% |

Adjusted pretax margin |

|

|

18.2 |

% |

|

|

19.9 |

% |

|

|

14.8 |

% |

|

|

14.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase-related intangible amortization includes amortization of noncompete agreements, |

|

customer relationships, and trademarks acquired in business combinations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals may not sum due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Expense and Success Ratio Reconciliation |

|

Title Insurance and Services Segment |

|

($ in millions, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total revenues |

|

$ |

1,605.3 |

|

|

$ |

1,321.1 |

|

|

$ |

5,737.3 |

|

|

$ |

5,724.8 |

|

Less: Net investment losses |

|

|

(62.3 |

) |

|

|

(32.0 |

) |

|

|

(345.4 |

) |

|

|

(38.2 |

) |

Net investment income |

|

|

155.4 |

|

|

|

132.0 |

|

|

|

534.3 |

|

|

|

540.2 |

|

Premiums retained by agents |

|

|

557.9 |

|

|

|

455.4 |

|

|

|

2,044.6 |

|

|

|

1,952.2 |

|

Net operating revenues |

|

$ |

954.3 |

|

|

$ |

765.7 |

|

|

$ |

3,503.8 |

|

|

$ |

3,270.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel and other operating expenses |

|

$ |

786.8 |

|

|

$ |

691.0 |

|

|

$ |

2,945.7 |

|

|

$ |

2,813.7 |

|

Ratio (% net operating revenues) |

|

|

82.4 |

% |

|

|

90.2 |

% |

|

|

84.1 |

% |

|

|

86.0 |

% |

Ratio (% total revenues) |

|

|

49.0 |

% |

|

|

52.3 |

% |

|

|

51.3 |

% |

|

|

49.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in net operating revenues |

|

$ |

188.6 |

|

|

|

|

|

$ |

233.2 |

|

|

|

|

Change in personnel and other operating expenses |

|

|

95.8 |

|

|

|

|

|

|

132.0 |

|

|

|

|

Success Ratio(1) |

|

|

51 |

% |

|

|

|

|

|

57 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Change in personnel and other operating expenses divided by change in net operating revenues. |

|

First American Financial Reports Results for the Fourth Quarter and Full Year of 2024

Page 15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First American Financial Corporation |

|

Supplemental Direct Title Insurance Order Information(1) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q424 |

|

|

Q324 |

|

|

Q224 |

|

|

Q124 |

|

|

Q423 |

|

Open Orders per Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase |

|

|

1,178 |

|

|

|

1,428 |

|

|

|

1,592 |

|

|

|

1,498 |

|

|

|

1,105 |

|

Refinance |

|

|

452 |

|

|

|

502 |

|

|

|

378 |

|

|

|

332 |

|

|

|

325 |

|

Refinance as % of residential orders |

|

|

28 |

% |

|

|

26 |

% |

|

|

19 |

% |

|

|

18 |

% |

|

|

23 |

% |

Commercial |

|

|

397 |

|

|

|

398 |

|

|

|

395 |

|

|

|

416 |

|

|

|

349 |

|

Default and other |

|

|

244 |

|

|

|

267 |

|

|

|

286 |

|

|

|

263 |

|

|

|

231 |

|

Total open orders per day |

|

|

2,271 |

|

|

|

2,595 |

|

|

|

2,650 |

|

|

|

2,508 |

|

|

|

2,010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closed Orders per Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase |

|

|

1,030 |

|

|

|

1,120 |

|

|

|

1,177 |

|

|

|

939 |

|

|

|

930 |

|

Refinance |

|

|

372 |

|

|

|

314 |

|

|

|

265 |

|

|

|

240 |

|

|

|

221 |

|

Refinance as % of residential orders |

|

|

27 |

% |

|

|

22 |

% |

|

|

18 |

% |

|

|

20 |

% |

|

|

19 |

% |

Commercial |

|

|

263 |

|

|

|

225 |

|

|

|

236 |

|

|

|

231 |

|

|

|

252 |

|

Default and other |

|

|

237 |

|

|

|

241 |

|

|

|

271 |

|

|

|

247 |

|

|

|

219 |

|

Total closed orders per day |

|

|

1,902 |

|

|

|

1,900 |

|

|

|

1,948 |

|

|

|

1,656 |

|

|

|

1,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Revenue per Order (ARPO)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase |

|

$ |

3,578 |

|

|

$ |

3,572 |

|

|

$ |

3,605 |

|

|

$ |

3,360 |

|

|

$ |

3,421 |

|

Refinance |

|

|

1,317 |

|

|

|

1,291 |

|

|

|

1,206 |

|

|

|

1,151 |

|

|

|

1,284 |

|

Commercial |

|

|

15,239 |

|

|

|

13,194 |

|

|

|

11,720 |

|

|

|

9,989 |

|

|

|

11,001 |

|

Default and other |

|

|

344 |

|

|

|

355 |

|

|

|

433 |

|

|

|

363 |

|

|

|

421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total ARPO |

|

$ |

4,343 |

|

|

$ |

3,926 |

|

|

$ |

3,818 |

|

|

$ |

3,516 |

|

|

$ |

3,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Days |

|

|

63 |

|

|

|

64 |

|

|

|

64 |

|

|

|

62 |

|

|

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) U.S. operations only. |

|

(2) Average revenue per order (ARPO) defined as direct premiums and escrow fees divided by closed title orders. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals may not sum due to rounding. |

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |