Consolidated Fourth Quarter Revenue

Increases 8% to $84.1 Million compared with $78.0 Million in the

Prior Year

Fourth Quarter Net Income Increases 76% to

$12.0 Million compared with $6.8 Million in the Prior

Year--Adjusted EBITDA Increases 39% to $22.9 Million in the Fourth

Quarter compared with $16.5 Million in Fiscal 2023

Cash Flows From Operating Activities For

Fiscal 2024 Increase to $60.3 Million compared with $35.7 Million

in Fiscal 2023 and Free Cash Flow Increases to $48.9 Million From

$22.2 Million in the Prior Year

Liquidity Remains Strong at over $111

Million, with $48.7 Million of Cash and No Drawdowns on the

Company’s $62.5 Million Credit Facility, even after Purchasing

$30.7 Million of its Common Stock during Fiscal 2024

Company Announces Guidance for Fiscal

2025

Franklin Covey Co. (NYSE: FC), a leader in organizational

performance improvement that creates, and, on a subscription basis,

distributes world-class content, training, processes, and tools

that organizations and individuals use to achieve systemic changes

in human behavior to transform their results, today announced

financial results for the fourth quarter and full fiscal year ended

August 31, 2024.

Financial Highlights

The Company’s consolidated revenue for the quarter ended August

31, 2024 grew 8% to $84.1 million compared with $78.0 million in

the fourth quarter of the prior year. Revenue for the fiscal year

ended August 31, 2024 increased to $287.2 million compared with

$280.5 million in fiscal 2023. The Company’s financial performance

for the fourth quarter and full fiscal year ended August 31, 2024

included the following:

- Enterprise Division revenues for the fourth quarter of fiscal

2024 increased 12%, or $6.1 million, to $58.5 million compared with

$52.4 million in fiscal 2023. Increased revenue during the fourth

quarter was driven by increased All Access Pass (AAP) and legacy

services revenues. AAP subscription revenue grew 3% compared with

the fourth quarter of fiscal 2023 and AAP subscription plus

subscription services revenue grew 4% in the fourth quarter

compared with the prior year. Legacy revenues increased primarily

due to strong intellectual property license sales during the

quarter. Enterprise revenue for the fiscal year ended August 31,

2024 increased 2% to $208.8 million compared with $205.7 million in

fiscal 2023. During fiscal 2024, AAP subscription revenue retention

levels in the United States and Canada remained strong and were

greater than 90%.

- Education Division revenues for the fourth quarter were

consistent with the prior year at $24.1 million. For the fiscal

year ended August 31, 2024, Education Division revenue increased 5%

to $73.5 million compared with $69.7 million in fiscal 2023.

Education Division revenue growth for the year was driven by

increased revenues from classroom and training materials,

membership subscriptions, and coaching and consulting. Delivery of

training and coaching days remained strong during fiscal 2024, as

the Education Division delivered nearly 400 more training and

coaching days than the prior year. In fiscal 2024, the Education

Division added 728 new Leader in Me schools in the United States

and Canada.

- Total Company subscription and subscription services revenues

reached $65.8 million, a 2% increase over the fourth quarter of the

prior year. For the fiscal year ended August 31, 2024, subscription

and subscription service revenue reached $231.8 million, a $9.0

million, or 4% increase over fiscal 2023.

- For the fourth quarter of fiscal 2024, subscriptions invoiced

were $62.9 million compared with $64.0 million in the fourth

quarter of fiscal 2023. For fiscal 2024, total subscriptions

invoiced increased 5% to $156.8 million compared with $150.0

million in the prior year.

- Operating income for the quarter ended August 31, 2024

increased 70%, or $7.4 million, to $17.9 million compared with

$10.6 million in fiscal 2023. Net income for the fourth quarter

increased 76%, or $5.1 million, to $12.0 million, or $0.89 per

diluted share, compared with $6.8 million, or $0.49 per diluted

share, in the fourth quarter of the prior year. Full year net

income increased 32%, or $5.6 million, to $23.4 million, or $1.74

per diluted share, compared with $17.8 million, or $1.24 per

diluted share in fiscal 2023.

- Adjusted EBITDA for the fourth quarter of fiscal 2024 increased

39% to $22.9 million compared with $16.5 million in the prior year.

Adjusted EBITDA for the fiscal year ended August 31, 2024 increased

15%, or $7.2 million, to $55.3 million compared with $48.1 million

in fiscal 2023.

- Consolidated deferred subscription revenue at August 31, 2024

increased 9% to $107.9 million compared with $99.0 million at

August 31, 2023. Unbilled deferred subscription revenue at August

31, 2024, was $75.2 million compared with $87.4 million at August

31, 2023. At August 31, 2024, 56% of the Company’s AAP contracts in

North America are for at least two years, compared with 54% at

August 31, 2023, and the percentage of contracted amounts

represented by multi-year contracts at August 31, 2024 was

consistent with the prior year at 59%.

- Cash flows from operating activities for fiscal 2024 increased

69%, or $24.5 million, to $60.3 million compared with $35.7 million

in fiscal 2023. Free Cash Flow increased 121%, or $26.8 million, to

$48.9 million in fiscal 2024 from $22.2 million in fiscal 2023. The

increase in cash flows during fiscal 2024 was primarily due to

favorable changes in working capital and increased net income when

compared with fiscal 2023.

- The Company purchased 127,252 shares of its common stock on the

open market for $4.9 million during the fourth quarter of fiscal

2024. For the fiscal year ended August 31, 2024, the Company

purchased 776,234 shares of its common stock for $30.7

million.

Paul Walker, President and Chief Executive Officer said, “We

delivered strong performance in the fourth quarter and for the

fiscal year ended August 31, 2024, with full-year revenue of $287.2

million, Adjusted EBITDA of $55.3 million, and strong cash flows

from operations totaling $60.3 million. These results reflect what

we anticipated would be possible 9 years ago when we transitioned

to a technology-enabled content and services subscription business

model.”

Walker continued, “Having successfully converted to our

technology-enabled subscription business model and having made the

significant investments in technology and content to further

strengthen our strategic position, we are now ready to make the

necessary investments to accelerate our revenue growth from

mid-single digits to solid double digits. This increased growth

will be driven by investments in two areas: first, we are seeking

to further expand our presence within existing clients. Since our

conversion to a subscription model, our average revenue per client

has already increased from $39,000 to $85,000 with the majority of

our clients using our offerings for a relatively small percentage

of their employee base. We believe this low penetration provides

substantial headroom for future growth. Second, we intend to

significantly increase the number of new logo sales. Although we

have already won thousands of new contracts, we are only scratching

the surface of the large potential market which we serve.

Accordingly, we are making approximately $16 million of incremental

investments to: 1) add client-facing sales and support roles to

increase the penetration bandwidth of those responsible for client

expansion; and 2) to provide additional sales, marketing, and

closing resources to help those responsible for winning new logos.

In addition, we are making investments in central sales leadership

and operations functions, including hiring a new chief revenue

officer and a new head of revenue operations which will allow us to

scale our sales force even more rapidly in the future.”

Walker concluded, “We expect these investments to begin to

produce favorable results in the back half of fiscal 2025, and then

fundamentally shift our growth curve thereafter. We anticipate

revenue growth will accelerate from approximately 4.5%, or $13

million, in fiscal 2025 to 10%, or $30 million in fiscal 2026. We

are then targeting accelerated revenue growth to 12%, or $40

million in fiscal 2027 and 14% growth, or approximately $50 million

in fiscal 2028. Following an initial anticipated decrease in

Adjusted EBITDA to between $40 million and $44 million in fiscal

2025, we expect the impact of these investments to produce

approximately $48 million of Adjusted EBITDA in fiscal 2026, then

$60 million in fiscal 2027, and $75 million in fiscal 2028. We

believe these initiatives and investments will position Franklin

Covey to fully capitalize on our market opportunity and to deliver

growth with attractive returns to our shareholders for many years

to come.”

Fiscal 2025 Guidance

Based on the expected success of investments in its sales and

marketing efforts, the Company expects fiscal 2025 revenue to be in

the range of $295 million to $305 million. The Company expects

revenue to increase even though a significant amount of the

invoiced sales from these initiatives will be recorded as deferred

subscription revenue and recognized over the lives of the

underlying contracts. Consistent with previous messaging, the

Company believes strategic investments in projects and initiatives,

which are expected to result in long-term revenue growth and value

creation, are effective uses of available capital. Considering the

$16 million of expected investments in additional sales, sales

support, and marketing personnel, combined with anticipated

increases in revenue, the Company currently expects Adjusted EBITDA

for fiscal 2025 to be in the range of $40 million to $44 million.

As revenue growth from these initiatives accelerates, the impact of

these additional expenses is expected to decline and growth in

Adjusted EBITDA and cash flows are expected to resume and then

increase significantly in future years.

Earnings Conference Call

On Wednesday, November 6, 2024, at 5:00 p.m. Eastern (3:00 p.m.

Mountain) Franklin Covey will host a conference call to review its

fourth quarter and full fiscal 2024 financial results. Interested

persons may access a live audio webcast at

https://edge.media-server.com/mmc/p/djbumumn or may participate via

telephone by registering at

https://register.vevent.com/register/BI2c309c7ae5274c6e9ba8c8285922ffea.

Once registered, participants will have the option of 1) dialing

into the call from their phone (via a personalized PIN); or 2)

clicking the “Call Me” option to receive an automated call directly

to their phone. For either option, registration will be required to

access the call. A replay of the conference call webcast will be

archived on the Company’s website for at least 30 days.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

including those statements related to the Company’s future results

and profitability and other goals relating to the growth and

operations of the Company. Forward-looking statements are based

upon management’s current expectations and are subject to various

risks and uncertainties including, but not limited to: general

macroeconomic conditions; renewals of subscription contracts; the

impact of strategic projects and initiatives on future financial

results; growth in and client demand for add-on services; market

acceptance of new products or services, including new AAP portal

upgrades and content launches; the ability to achieve sustainable

double-digit revenue growth in future periods; impacts from

geopolitical conflicts; inflation; and other factors identified and

discussed in the Company’s most recent Annual Report on Form 10-K

and other periodic reports filed with the Securities and Exchange

Commission. Many of these conditions are beyond the Company’s

control or influence, any one of which may cause future results to

differ materially from the Company’s current expectations, and

there can be no assurance that the Company’s actual future

performance will meet management’s expectations. These

forward-looking statements are based on management’s current

expectations and the Company undertakes no obligation to update or

revise these forward-looking statements to reflect events or

circumstances subsequent to this press release.

Non-GAAP Financial

Information

This earnings release includes the concepts of Adjusted EBITDA

and Free Cash Flow, which are non-GAAP measures. The Company

defines Adjusted EBITDA as net income excluding the impact of

interest, income taxes, intangible asset amortization,

depreciation, stock-based compensation expense, and certain other

infrequently occurring items such as restructuring costs and

impaired assets. Free Cash Flow is defined as GAAP calculated cash

flows from operating activities less capitalized expenditures for

purchases of property and equipment, curriculum development, and

content rights. The Company references these non-GAAP financial

measures in its decision-making because they provide supplemental

information that facilitates consistent internal comparisons to the

historical operating performance of prior periods and the Company

believes they provide investors with greater transparency to

evaluate operational activities and financial results. Refer to the

attached tables for the reconciliation of the non-GAAP financial

measure, Adjusted EBITDA, to consolidated net income, a related

GAAP financial measure, and for the calculation of Free Cash

Flow.

The Company is unable to provide a reconciliation of the above

forward-looking estimate of non-GAAP Adjusted EBITDA to GAAP

measures because certain information needed to make a reasonable

forward-looking estimate is difficult to obtain and dependent on

future events which may be uncertain, or out of the Company’s

control, including the amount of AAP contracts invoiced, the number

of AAP contracts that are renewed, necessary costs to deliver the

Company’s offerings, such as unanticipated curriculum development

costs, and other potential variables. Accordingly, a reconciliation

is not available without unreasonable effort.

About Franklin Covey Co.

Franklin Covey Co. (NYSE: FC) is a global leadership company

with directly owned and licensee partner offices providing

professional services in 150 countries and territories around the

world. The Company transforms organizations by partnering with its

clients to build leaders, teams, and cultures that achieve

breakthrough results through collective action, which leads to a

more engaging work experience for their people. Available through

the Franklin Covey All Access Pass, the Company’s best-in-class

content and solutions, experts, technology, and metrics seamlessly

integrate to ensure lasting behavioral change at scale. Solutions

are available in multiple delivery modalities in more than 20

languages.

This approach to leadership and organizational change has been

tested and refined by working with tens of thousands of teams and

organizations over the past 30 years. Clients have included

organizations in the Fortune 100, Fortune 500, and thousands of

small- and mid-sized businesses, numerous governmental entities,

and educational institutions. To learn more, visit

www.franklincovey.com, and enjoy exclusive content from Franklin

Covey’s social media channels at: LinkedIn, Facebook, Twitter,

Instagram, and YouTube.

FRANKLIN COVEY CO.

Condensed Consolidated Income

Statements (in thousands, except per-share amounts, and

unaudited) Quarter Ended Fiscal Year Ended August 31,

August 31, August 31, August 31,

2024

2023

2024

2023

Revenue

$

84,124

$

77,955

$

287,233

$

280,521

Cost of revenue

18,387

18,650

66,161

67,031

Gross profit

65,737

59,305

221,072

213,490

Selling, general, and administrative

45,854

45,960

175,941

177,951

Restructuring costs

-

565

3,008

565

Impaired asset

-

-

928

-

Depreciation

910

1,141

3,905

4,271

Amortization

1,045

1,071

4,248

4,342

Income from operations

17,928

10,568

33,042

26,361

Interest income (expense), net

63

(122

)

4

(492

)

Income before income taxes

17,991

10,446

33,046

25,869

Income tax provision

(6,035

)

(3,634

)

(9,644

)

(8,088

)

Net income

$

11,956

$

6,812

$

23,402

$

17,781

Net income per common share: Basic

$

0.92

$

0.52

$

1.78

$

1.30

Diluted

0.89

0.49

1.74

1.24

Weighted average common shares: Basic

13,020

13,162

13,171

13,640

Diluted

13,387

13,886

13,472

14,299

Other data: Adjusted EBITDA(1)

$

22,933

$

16,508

$

55,273

$

48,066

(1)

The term Adjusted EBITDA

(earnings before interest, income taxes, depreciation,

amortization, stock-based compensation, and certain other items) is

a non-GAAP financial measure that the Company believes is useful to

investors in evaluating its results. For a reconciliation of this

non-GAAP measure to a GAAP measure, refer to the Reconciliation of

Net Income to Adjusted EBITDA as shown below.

FRANKLIN COVEY CO.

Reconciliation of Net Income to Adjusted

EBITDA (in thousands and unaudited) Quarter Ended

Fiscal Year Ended August 31, August 31, August 31, August 31,

2024

2023

2024

2023

Reconciliation of net income to Adjusted EBITDA: Net income

$

11,956

$

6,812

$

23,402

$

17,781

Adjustments: Interest expense (income), net

(63

)

122

(4

)

492

Income tax provision

6,035

3,634

9,644

8,088

Amortization

1,045

1,071

4,248

4,342

Depreciation

910

1,141

3,905

4,271

Stock-based compensation

3,050

3,163

10,142

12,520

Restructuring costs

-

565

3,008

565

Impaired asset

-

-

928

-

Increase in the fair value of contingent consideration liabilities

-

-

-

7

Adjusted EBITDA

$

22,933

$

16,508

$

55,273

$

48,066

Adjusted EBITDA margin

27.3

%

21.2

%

19.2

%

17.1

%

FRANKLIN COVEY

CO. Additional Financial

Information (in thousands and unaudited) Quarter

Ended Fiscal Year Ended August 31, August 31, August 31, August 31,

2024

2023

2024

2023

Revenue by Division/Segment: Enterprise Division: Direct

offices

$

56,100

$

49,827

$

197,610

$

194,021

International licensees

2,403

2,597

11,229

11,645

58,503

52,424

208,839

205,666

Education Division

24,117

24,105

73,519

69,736

Corporate and other

1,504

1,426

4,875

5,119

Consolidated

$

84,124

$

77,955

$

287,233

$

280,521

Gross Profit by Division/Segment: Enterprise

Division: Direct offices

$

47,243

$

40,715

$

162,430

$

156,915

International licensees

2,110

2,323

9,971

10,507

49,353

43,038

172,401

167,422

Education Division

15,992

15,921

47,149

44,418

Corporate and other

392

346

1,522

1,650

Consolidated

$

65,737

$

59,305

$

221,072

$

213,490

Adjusted EBITDA by Division/Segment: Enterprise

Division: Direct offices

$

17,399

$

11,986

$

50,376

$

44,198

International licensees

1,076

1,087

5,647

5,874

18,475

13,073

56,023

50,072

Education Division

6,930

6,118

9,522

7,426

Corporate and other

(2,472

)

(2,683

)

(10,272

)

(9,432

)

Consolidated

$

22,933

$

16,508

$

55,273

$

48,066

FRANKLIN COVEY CO.

Condensed Consolidated Balance

Sheets (in thousands and unaudited) August 31,

August 31,

2024

2023

Assets Current assets: Cash and cash

equivalents

$

48,663

$

38,230

Accounts receivable, less allowance for doubtful accounts of $3,015

and $3,790

86,002

81,935

Inventories

4,002

4,213

Prepaid expenses and other current assets

21,586

20,639

Total current assets

160,253

145,017

Property and equipment, net

8,736

10,039

Intangible assets, net

37,766

40,511

Goodwill

31,220

31,220

Deferred income tax assets

870

1,661

Other long-term assets

22,694

17,471

$

261,539

$

245,919

Liabilities and Shareholders'

Equity Current liabilities: Current portion of notes payable

$

835

$

5,835

Current portion of financing obligation

3,111

3,538

Accounts payable

7,863

6,501

Deferred subscription revenue

101,218

95,386

Customer deposits

16,972

12,137

Accrued liabilities

32,454

28,252

Total current liabilities

162,453

151,649

Notes payable, less current portion

775

1,535

Financing obligation, less current portion

1,312

4,424

Other liabilities

10,732

7,617

Deferred income tax liabilities

3,132

2,040

Total liabilities

178,404

167,265

Shareholders' equity: Common stock

1,353

1,353

Additional paid-in capital

231,813

232,373

Retained earnings

123,204

99,802

Accumulated other comprehensive loss

(768

)

(987

)

Treasury stock at cost, 14,084 and 13,974 shares

(272,467

)

(253,887

)

Total shareholders' equity

83,135

78,654

$

261,539

$

245,919

FRANKLIN COVEY CO.

Condensed Consolidated Free Cash

Flow (in thousands and unaudited) YEAR ENDED

AUGUST 31,

2024

2023

In thousands CASH FLOWS FROM OPERATING ACTIVITIES Net income $

23,402

$

17,781

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

8,153

8,613

Amortization of capitalized curriculum development costs

3,172

3,084

Deferred income taxes

1,885

4,748

Stock-based compensation expense

10,142

12,520

Impaired asset

928

-

Change in the fair value of contingent consideration liabilities

-

7

Amortization of right-of-use operating lease assets

760

834

Changes in working capital

11,815

(11,849

)

Net cash provided by operating activities

60,257

35,738

CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property

and equipment

(3,694

)

(4,515

)

Capitalized curriculum development costs

(6,866

)

(9,035

)

Acquisition of content rights

(750

)

-

Net cash used for investing activities

(11,310

)

(13,550

)

Free Cash Flow $

48,947

$

22,188

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106009928/en/

Investor Contact: Franklin Covey Boyd Roberts 801-817-5127

investor.relations@franklincovey.com

Media Contact: Franklin Covey Debra Lund 801-817-6440

Debra.Lund@franklincovey.com

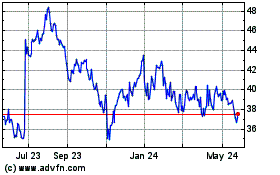

Franklin Covey (NYSE:FC)

Historical Stock Chart

From Nov 2024 to Dec 2024

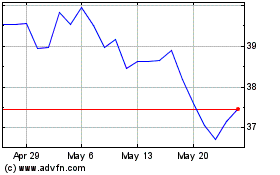

Franklin Covey (NYSE:FC)

Historical Stock Chart

From Dec 2023 to Dec 2024