Form SC 13G/A - Statement of Beneficial Ownership by Certain Investors: [Amend]

November 06 2024 - 2:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULES 13d-1(b),(c) AND (d) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2

(Amendment No. 3)*

First Trust

Senior Floating Rate Income Fund II

(Name of Issuer)

Common Stock, $0.01 par value

(Title of Class of Securities)

33733U108

(CUSIP Number)

September 30, 2024

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this schedule is filed:

☒ Rule 13d-1(b)

☐ Rule 13d-1(c)

☐ Rule 13d-1(d)

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed

to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

CUSIP No. 33733U108

|

|

|

|

|

|

|

| 1. |

|

NAME OF REPORTING PERSON

LPL Financial LLC |

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP* (a) ☐ (b) ☐ |

| 3. |

|

SEC USE ONLY

|

| 4. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

California |

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5. |

|

SOLE VOTING POWER

0 |

| |

6. |

|

SHARED VOTING POWER

0 |

| |

7. |

|

SOLE DISPOSITIVE POWER

0 |

| |

8. |

|

SHARED DISPOSITIVE POWER

896,576 |

|

|

|

|

|

|

|

| 9. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 896,576 |

| 10. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(9) EXCLUDES CERTAIN SHARES ☐ |

| 11. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN

ROW (9) 3.5% * |

| 12. |

|

TYPE OF

REPORTING PERSON BD, IA |

| * |

Based on 25,983,388 shares of Common Stock outstanding as of May 31, 2024, as reported in the

Issuer’s Report on Form N-CSR for the fiscal year ended May 31, 2024 filed with the Securities and Exchange Commission on August 8, 2024. |

2

CUSIP No. 33733U108

AMENDMENT NO. 3 TO SCHEDULE 13G (FINAL AMENDMENT)

Reference is hereby made to the statement on Schedule 13G filed with the Securities and Exchange Commission by the Reporting Person with respect to the Common

Stock of the Issuer on February 14, 2022, Amendment No. 1 thereto filed on January 17, 2023 and Amendment No. 2 thereto filed on February 9, 2024 (as so amended, the “Schedule 13G”). Terms defined in the Schedule

13G are used herein as so defined.

The following Items of the Schedule 13G are hereby amended and restated as follows:

Item 4. Ownership

The information requested by this

paragraph is incorporated herein by reference to the cover page to this Amendment No. 3 to Schedule 13G. LPL, in its capacity as investment adviser, may be deemed to beneficially own the Common Stock reported herein, which are held by clients

who have granted discretionary authority to dispose of or direct the disposition of the shares to an independent contractor of LPL.

Item 5.

Ownership of Five Percent or Less of the Class

If this statement is being filed to report the fact that the Reporting Person has ceased to be the

beneficial owner of more than five percent of the Common Stock, check the following: ☒

3

CUSIP No. 33733U108

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete, and

correct.

Dated: November 6, 2024

|

|

|

| LPL FINANCIAL LLC |

|

|

| By: |

|

/s/ Jim McHale |

|

|

Name: Jim McHale |

|

|

Title: EVP, Chief Compliance Officer |

4

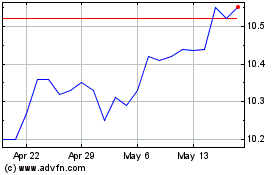

First Trust Senior Float... (NYSE:FCT)

Historical Stock Chart

From Feb 2025 to Mar 2025

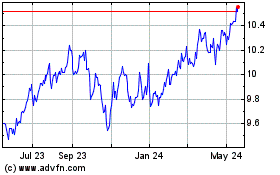

First Trust Senior Float... (NYSE:FCT)

Historical Stock Chart

From Mar 2024 to Mar 2025